July '2023

|

|

The Global Analyst

The Global ANALYST is one of India's leading business & finance magazines. The Global ANALYST, a monthly magazine, contains intellectually stimulating articles on cutting-edge and contemporary topics. Besides, it also features interviews with as well as articles written by eminent national and international experts from industry, academia (including IIMs and IITs), as well as regulatory bodies (like RBI), etc., encompassing areas such as financial markets, economics, strategy, international trade, banking, technology, start-ups, e-commerce, industries, to name a few.

First Cut

The merger of HDFC Bank and Housing Development Finance Corp (HDFC) has created Asia's largest and the world's fourth most valued lender, after JPMorgan Chase & Co., Industrial and Commercial Bank of China and Bank of America Corp., as of June 30, Bloomberg data showed. The HDFC Bank-HDFC juggernaut is valued at about $180 bn. JP Morgan Chase & Co. currently has m-cap of over $419 bn.

HDFC also zoomed past international rivals such as HSBC Holdings Plc and Citigroup Inc, while also leaving behind Indian peers like the state-owned SBI and private sector lender ICICI Bank, with market capitalizations of about $62 bn and $79 bn, respectively, as of June 22. It also has entered the league of top 100 companies globally, in terms of m-cap, with a ranking of 63.

After ChatGPT, it's time now for IndexGPT.

America's largest bank, JPMorgan Chase, has filed for a patent for a new financial service based on Artificial Intelligence (AI), named IndexGPT. According to reports, IndexGPT will help investors take informed decisions regarding how and where to invest their money in a better way. The AI-based service is likely to be launched somewhere during 2026-27, subject to the grant of the trademark. As per the New York-headquartered bank, IndexGPT will simplify "financial investment in the field of securities; funds investment; financial affairs and monetary affairs, namely, financial information and analysis services for securities investing".

Marking the new era of transforming Indian financial landscape, the NSE International Exchange, or NSE IX, has announced full-scale transition of SGX Nifty to GIFT Nifty, besides also unveiling a new logo. The new identity comes into effect from July 3, 2023. As a result of the move, derivative contracts worth $7.5 bn, which were earlier traded in Singapore, will now shift to India. According to a Moneycontrol. com report, the Singapore Exchange had an agreement with the NSE that allowed it to trade in Nifty futures and options in Singapore.

BUSINESS ENVIRONMENT

India's GCC Boom

A $110 bn Opportunity

The Indian market for Global Capability Centers (GCCs)-strategic units established by multinational corporations in different regions worldwide-is forecast to grow to a whopping $110 bn by 2030, presenting a huge opportunity to the country.

- By Surbhi Singhal, (CA, CS), Independent Senior Research Analyst, New Delhi

If you've been keeping your eye on

the global business landscape, you

might have noticed a seismic shift occurring in India. A shift that's creating a wealth of opportunities for corporations worldwide. What I'm talking about here is the explosive growth of the Global Capability Center (GCC) market in India, forecasted to reach an eye-watering $110 bn by 2030. Before I delve into the intricacies of this boom, let's start from the basics. What exactly is a GCC and how did it all begin in India?

Genesis of GCCs

If you've ever appeared for a global financial professional exam such as CFA, or FRM, you might have used a computing device (as handy as a calculator) most likely manufactured by Texas Instruments. It's a US corporation for whom such devices are only a small segment. They're a technology company manufacturing semiconductor chips.

Technology

Wireless Communications

What Does the Advent of AI, Chatbot and 5G Mean?

As long as Apple, Google and Samsung are not resting on their laurels, they can keep pushing the envelope and innovating. However, there is always an opportunity for smaller competitors to do something to break out.

- By Jeff Kagan, Wireless and Technology Industry Analyst, Atlanta, Georgia, US

How will new technologies like

5G and artificial intelligence

(AI) with Chatbot impact the wireless smartphone marketplace? While Apple iPhone, Google Android and Samsung Galaxy are the leaders in the wireless space, these new technologies could either help or hurt other competitors like Sony, LG, Motorola, Nokia and others. Let's take a closer look at what could happen next. Ever since iPhone, Android and Galaxy were launched about a decade and a half ago, the smartphone world has significantly changed. And in fact, it continues on its rapid change wave, further transforming the industry and the lives of people and business. Today, with new technology like 5G, AI and Chatbots, things are continuing to change. This is both an increasing challenge and growth opportunity to all competitors.

INDUSTRY

Sodium-ion BatteriesThe Future of EVs?

Sodium-ion batteries could be a viable alternative to the much-in-demand lithium-ion batteries, credited to have revolutionized the global EV industry, but whose shortage threatens to play spoilsport.

- By Rajat Kapoor, Managing Director, Synergy Consulting, Inc., New Delhi

Critical minerals, such as

lithium, cobalt, nickel, and

rare earth elements, are essential components of batteries, solar panels, and wind turbines. The global demand for these minerals has increased significantly in recent years due to the growing popularity of renewable energy and Electric Vehicles (EVs). However, the supply of critical minerals is limited, and their extraction and processing are often associated with environmental and social impacts.

Lithium, the hidden spark that powers the electric revolution

Lithium is an essential mineral that has become increasingly important for the development of renewable energy and EVs. It is a soft, silver-white metal that is highly reactive and lightweight, making it ideal for use in batteries. Lithium-Ion Batteries (LIB)s have become the standard for portable electronics and are rapidly gaining popularity in the transportation and energy storage sectors.

VIEW POINT

Mint Street

What is Behind RBI's 'Second' Pause?

The goal for the Reserve Bank of India now is to achieve the 4% inflation target, however, estimates show that this could remain elusive in FY24. That means the central bank will have to take a long pause and hence any chance of a reduction in the policy interest rate just shifts to FY25, possibly in the April-June 2024 period.

- By Indranil Pan, Chief Economist, Yes Bank Ltd., Mumbai

The Reserve Bank of India (RBI) paused in its rate hiking cycle in April and maintained a pause in the subsequent meeting in June. Before we go further and analyze the current happenings in the globe as also in India, it would be worthwhile to understand why there was a pause in April, as this could also provide cues for the future of rate cycle in India. But the pause-as explained by RBI-is not a 'pivot'. This means that the pause from the RBI should not be read as a reversal in policy and only allows the monetary authorities to assess the impact of past rate increases.

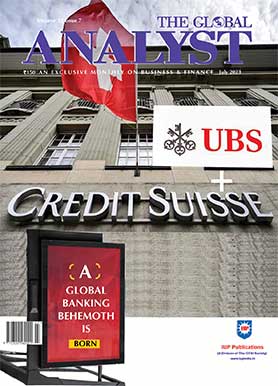

COVER STORY

UBS + Credit Suisse

A Behemoth is Born

Arch rivals UBS and Credit Suisse combine to form a global wealth management behemoth.

This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue.

- Colm Kelleher, Chairman, UBS

It was a 'merger-in-the-making' for long, yet

no one saw it coming. Sounds strange, yet it's

true. So, when in March, after dilly-dallying for a long time and amid hectic parleys, involving key stakeholders, UBS Group AG, the Swiss wealth management giant, finally announced its decision to acquire arch rival and compatriot investment bank Credit Suisse, it took both the industry experts as well as onlookers by surprise. For, the two firms are as different as chalk and cheese. While UBS has prided itself on its risk aversion (though it drumbeats about being risk aware), Credit Suisse, on the other hand, has been a risk-loving beast.

CORPORATE

Back in EU Anti-Trust Crosshairs

- By Rob Enderle, President and Principal Analyst, The Enderle Group, Bend, Oregon, US

Google has for long feared a forced break-up (read:split) might be coming its way, thanks to miffed regulators in some of its key markets, especially the European Union. Interestingly, it was this anticipation that led to an ambitious company reorganization and it renaming itself from Google to Alphabet, though the company is still mostly known as Google.

The decision to separate the company into components that could be split off might have been a mistake because it sent the message that Google thought it needed to be broken up. It's like an accused criminal planning for how to survive a jail sentence as if they believe they will be found guilty because they are probably guilty. That aside, Google's near monopoly on online advertising has been connected to the fall or weakening of competitors and news publications.

LEADERSHIP

Employability Quotient

The Skill Gap Conundrum

We are migrating from an 'age of production' to an 'age of innovation', and a new set of skills that focus on soft skills, creativity, and emotional intelligence need to be developed to keep the workforce on the bedrock of innovative practices.

- K Murlidar, Executive Director, LIC of India, Mumbai

In the ever-evolving and rapidly changing environment impacted by new technologies and pandemic-driven innovations, companies the world over are facing the challenge of the skill development of their employees. The skills that were considered essential when an employee joined an organization are fast becoming irrelevant, and unless he adapts himself to the new demands of time, it will be difficult to enhance levels of productivity. We are migrating from 'an age of production to an age of innovation' and a new set of skills that focus on soft skills, creativity, and emotional intelligence need to be developed to keep the workforce on the bedrock of innovative practices. To a question, 'How are we going to prepare our people?' raised in a PwC Workshop, 87% of the executives felt they were experiencing 'skill gaps' and emphasized the need to put in place strategies to overcome the same through structured skill development initiatives.

MACRO MATTERS

across the world

UK's Consumer Inflation Fails to Fall, Rises in May

Giving no respite to average Britons, the United Kingdom consumer prices continued its upward march in May as well, with the headline inflation surging by an annual 8.7%, although it remained unchanged from the preceding month, i.e., April 2023, data from Office for National Statistics (ONS) showed. A Reuters' poll had forecast the annual Consumer Prices Index (CPI) rate to fall to 8.4%. As far as the country's headline inflation (which includes food and energy prices) is concerned, it also rose-albeit by a marginal 0.7% in May 2023, on a month-over-month basis. It is to be mentioned that the UK consumer price inflation had hit a 41-year high of 11.1% in October last year before reversing its direction, although it continues to remain at elevated levels, much to the chagrin of the nation's central bank.

BANKING

First Loss Default Guarantee

Good Tidings for Digital Lending?

In a major boost to digital lending, RBI has said Loan Service Providers (LSPs) or fintechs can allocate 5% of their loan portfolio to regulated entities such as banks and NBFCs, which will help safeguard against losses if a customer defaults on payments.

- By Raiba Spurgeon, Research Officer, State Bank Staff College, Hyderabad

In India, the fintech adoption rate is

87%, significantly higher than the

global average adoption rate of 64%. Additionally, over 20% of the country's unicorns are part of the fintech ecosystem. This is testament to the massive growth of fintech in the country, which is estimated to attain a market size of $1.3 tn by 2025 (India Invest). The digital lending market alone is expected to reach $350 bn by 2023 and is also expected to account for 60% of the total Indian fintech market by 2030. Not surprisingly, fintech lending in the country has witnessed a growth of compound annual growth rate (CAGR) 39.5% over the last 10 years, and is expected to grow 5 times in the next 10 years (IIFL FinTech).

LEADERSHIP

Thought Leadership

Is Leadership 'A Contact Sport?'

Can executive leadership be called a 'contact sport'?

By Michael Walton, Business Psychologist and Visiting Professor, UK

The purpose of this article is to consider whether 'Leadership' can be viewed as an emotionally demanding and competitive 'contact sport'. If so, then such a perspective departs from conventional descriptions of leadership, which cast leadership as primarily an emotionally-neutral, logically-rational, and task-focused activity. For, leadership is an intensely emotion-rich entity as interpersonal interactions trigger multiple emotional responses and reactions in both the leader and others. Consequently, deciding to become an executive leader would arguably appear to be ill-suited to those with a fixation on logical and rational analysis as the sole cornerstone and determinant of successful leadership. Of course, logic and analysis matter a great deal, and much will revolve around (i) how such analytic computations and analyses are made and (ii) how the resultant executive decisions are presented and introduced.

INTERNATIONAL

EurozoneRecession Blues

The Eurozone is officially in a 'technical recession', i.e., two consecutive quarterly falls in real GDP.

- By Michael Robert, Economist, London

The Eurozone economy unexpectedly shrank 0.1% on quarter in the first three months of 2023, compared to early estimates of a modest 0.1% rise. Figures for the final quarter of 2022 were also revised to show a 0.1% fall, instead of a flat reading, which means the eurozone has now entered a recession.

The rest of the major advanced economies have also slowed down in 2023, but have not yet entered a recession, defined as a contraction of real Gross Domestic Product (GDP). The reason that the Eurozone has is due to the very high energy costs and rising food prices that have battered the Eurozone economies since 2022.

INTERNATIONAL

China

On a Strong Footing

Predictions about the so-called "China collapse" have long been a favorite Western sport. Obviously, they have all turned out to be exaggerated. The truth is that China still has much room to grow and prosper in the years ahead.

- By Andrew K P Leung, SBS, FRSA, International, and Independent China Strategist

CNBC News on June 6 flagged up China's exports plunge in May pby an unexpectedly high 7.5% from a year ago, while imports dropped by 4.5%, less than the 8% drop forecast by Reuters. China's factory output has slumped to its weakest level since the end of its Zero-Covid policy in December as its economic recovery continues to lose steam, according to CNN Business News on May 31. China's official manufacturing Purchasing Managers' Index (PMI) dropped to 48.8 this month, down from 49.2 in April, according to data released by the National Bureau of Statistics. It was the second contraction in as many months; a reading above 50 indicates expansion, while anything below that level shows contraction. Meanwhile, the official non-manufacturing PMI, which measures sentiment in the services and construction sectors, decreased to 54.5 in May from April's 56.4, also the weakest level in four months.

CLEANTECH

Flex Fuel

An EV Alternative?

India's pursuit of flex fuels represents a significant shift in its approach to fuel consumption and environmental responsibility.

- By Manish Vaid, Junior Fellow, Observer Research Foundation, New Delhi

Anil, a passionate car enthusiast, stumbles upon E20 fuel- a promising blend of 20% ethanol and 80% petrol-expected to be introduced in India by 2025. Intrigued by its potential to reduce reliance on fossil fuels and curb emissions, he decides to give it a try. To his delight, Anil discovers that E20 fuel not only proves to be cost-effective but also environmentally-friendly. Impressed by its benefits, he becomes an advocate, spreading awareness among others. Anil joins the growing movement of Indians who support E20 fuel as an alternative to Electric Vehicles (EVs), aligning with India's target of achieving 20% ethanol blending by 2025.

| Click here to upload your Articles |

Journals

Magazines

- HRM Review

- Marketing Mastermind

- Global CEO

- The IUPs World of IOT

Articles of the Month

ISBN: 978-81-314-2793-4

ISBN: 978-81-314-2793-4Price: ₹250

Payment by D.D. favouring

"ICFAI A/c IUP", Hyderabad

Reach us at

info@iupindia.in

Tel: +91 8498843633