Mar'20

The IUP Journal of Case Folio

Archives

ExxonMobil: Challenges and Opportunities

Barnali Chakraborty

Freelancer, Hyderabad, IBS Hyderabad, Telangana, India. E-mail: research@icmrindia.org.

Sanjib Dutta

Research Lead, IBS Case Research Center, IBS Hyderabad, Telangana, India.

E-mail: sanjibdutta@icmrindia.org

The case examines the problems faced by ExxonMobil, the world's largest publicly traded Oil and Gas Company. Despite generating some of the best returns on capital and assets in the energy sector, the company became embroiled in several issues since the early 2010s. While its stocks were not generating good returns for investors, its output was also declining. The case discusses the challenges faced by the company and analyzes the opportunities present for the company. It also evaluates ExxonMobil's strategies to tackle the challenges and ends with the initiatives announced for aggressive growth in the future.

We've got the best portfolio of high-quality, high return investment opportunities that we've seen in two decades. Our plan takes full advantage of the company's unique strengths and financial capabilities, using innovation, technology and integration to drive long-term shareholder value and industry-leading returns.1

- Darren W Woods, Chairman and CEO,

ExxonMobil, March 2018

Exxon can't seem to conceive of a future without fossil fuels, or even far fewer fossil fuels. That failure of vision puts them at risk of being left with stranded assets, a loss of market share to innovation, and becoming irrelevant. Investors need to look at the risks, and there may be new products that are better investments.2

- Danielle Fugere, President of As You Sow, a Corporate Social

Responsibility Organization, April 2014

On January 31, 2019, ExxonMobil Corporation (ExxonMobil), the world's largest publicly traded Oil and Gas Company, announced that it would streamline its upstream3 organization and centralize project delivery across the company to support its growth plans announced in March 2018. Effective April 1, 2019, three new upstream companies would be created-ExxonMobil Upstream Oil & Gas Co., ExxonMobil Upstream Business Development Co., and ExxonMobil Upstream Integrated Solutions Co. Moreover, the company would also create the ExxonMobil Global Projects Company to enhance its project delivery capability and centralize major capital project planning and execution expertise to support all three business segments-upstream, downstream, and chemical. "We're simplifying and integrating our upstream organization to better capitalize on the industry-leading portfolio we've assembled through acquisitions and exploration success in the US Permian Basin, Guyana, Mozambique, Papua New Guinea and Brazil. Our focus is on increasing overall value by strengthening our upstream business and further integrating it with the downstream and chemical segments to take advantage of our unique capabilities across the value chain. A clear example is what we're doing in the Permian, which includes upstream, midstream and downstream investments, enabling us to maximize value unlike any of our competitors," said Neil Chapman, Senior Vice-President, ExxonMobil.

In the past, ExxonMobil had generated some of the best returns on capital and assets in the energy sector. Despite the huge potential, since early 2010s, ExxonMobil had been embroiled in several issues. While its stocks were not performing well, its output was also declining. Industry experts were growing increasingly concerned that ExxonMobil was falling behind its peers. Moreover, analysts were worried that the company was continuing to rely on oil and natural gas, instead of focusing on renewable energy. ExxonMobil was also severely criticized for shrugging off its responsibilities related to climate change.2

To overcome the challenges, in March 2018, ExxonMobil outlined a growth strategy to double operating cash flow and earnings by 2025. The company was confident that it would be able to achieve its ambitious growth target. "We are committed to sharing the company's success with our shareholders. Higher earnings and increased cash flow from our investments are a good means to accomplish this. We are equally committed to helping society reduce global emissions while supporting growth and prosperity for communities around the world-effectively addressing the dual challenge,"4 said Darren Woods (Woods), Chief Executive Officer, ExxonMobil.

About ExxonMobil

The history of ExxonMobil dated back to 1870 when John D Rockefeller (Rockefeller) and his associates founded Standard Oil. In 1879, Standard Oil purchased 75% interest in Vacuum Oil Company (Vacuum Oil) for $200,000. Over the next 40 years, Standard Oil became one of the largest integrated oil producing, refining, and marketing organizations in the world. At that time, Rockefeller was also the richest man in the world.

In 1882, Rockefeller and his partners formed the Standard Oil Trust to centralize their holdings in different US oil companies. However, Standard Oil Trust was accused by regulators of monopolistic practices and in 1911, a US Supreme Court ruling led to the dissolution of Standard Oil Trust into 34 separate companies. Jersey Standard (Standard) and Socony, two of the 34 companies formed after the disintegration of Standard Oil Trust, went on to become Exxon and Mobil respectively. Over the next few decades, both companies consolidated their positions with acquisitions.

Exxon Corporation

John Archbold became the first president of Standard in 1911. Under his guidance, Standard started oil exploration. In 1919, Standard acquired a 50% interest in Humble Oil & Refining Company (Humble Oil) of Texas. In 1919, Humble Oil, led by its pioneering Chief Geologist Wallace Pratt, used micropaleontology, the study of microscopic fossils contained in cuttings and core samples from drilling, as an aid to find oil. In 1920, Standard researchers produced rubbing alcohol, or isopropyl alcohol, the first commercial petrochemical.

In 1942, four researchers at Standard developed the world's first fluid catalytic cracker. The process, known as the 'four horsemen', improved on the Houdry method for cat cracking and eventually became the industry standard for producing gasoline. Fortune magazine in its October-November 1951 issue described it as "the most revolutionary chemical-engineering achievement of the last 50 years."

By the early 1950s, Standard had become the world's largest oil company with major oil exploration operations in the Middle East. In 1952, it introduced Uniflo motor oil, the first multigrade motor oil recommended for both summer and winter use.

By 1960, Standard had consolidated most of its oil exploration divisions in the US into one subsidiary, the Humble Oil and Refining Company. In 1960, the then CEO of Standard, Monroe J Rathbone, announced an important strategic decision-to start oil exploration projects outside the Middle East. In 1963, Humble invented 3-D seismic technology, which went on to become a breakthrough technology. 3-D seismic technology along with the use of massive parallel computers in seismic imaging, helped to reduce the finding costs for oil and natural gas.

During 1964-67, the company spent nearly $700 mn on exploration in non-OPEC countries and by 1977, it had more reserves outside the Middle East than any other company.

In 1972, Standard changed its name to Exxon Corporation (Exxon). In the 1970s and 1980s, Exxon faced a major setback in its attempt to diversify into other forms of energy. In 1982, it celebrated 100 years since the formation of the Standard Oil Trust in 1882.

On March 24, 1989, Exxon Valdez, an oil tanker owned by Exxon Shipping Company bound for Long Beach, California, ran aground in Prince William Sound's Bligh Reef, spilling 10.8 million US gallons of crude oil over the next few days. This was considered to be one of the most devastating human-caused environmental disasters.

In the 1990s, Exxon focused on the Asia-Pacific region anticipating a boom in the market for Liquified Natural Gas (LNG). It also aggressively invested in refinery expansion and new oil exploration projects in Asia. By the late 1990s, Exxon had established itself as a diversified company engaged in exploration, development, production, and sale of oil and natural gas; refining and sale of petroleum products; development, production, and sale of various chemical products; production and sale of coal and minerals, as well as power generation.

Mobil Oil Corporation

In 1906, Socony captured the market for kerosene in China by developing small lamps that burned kerosene efficiently. The lamps came to be known as Mei-Foo, from the Chinese symbols for Socony, meaning "beautiful confidence".

In the early 20th century, the demand for gasoline had increased and in 1920, Socony had registered its product trademark, MobilOil. In 1931, Socony merged with Vacuum Oil to form Socony-Vacuum. Over the next two decades, the company expanded its business. To start with, it acquired a 45% stake in Magnolia Petroleum Company, a major refiner, marketer, and pipeline transporter in the US.

In 1955, Socony-Vacuum was renamed Mobil Oil Company, Inc. In 1963, it changed its trade name from "MobilOil" to simply "Mobil". In 1966, the company celebrated 100 years since the founding of the Vacuum Oil Company and changed its name to Mobil Oil Corporation (Mobil).

In 1974, Mobil introduced a synthetic automotive engine lubricant-Mobil 1-which went on to become the world's leading synthetic motor oil. In 1997, it introduced Speedpass, an electronic system which automatically activated the oil pump and charged purchases to a credit card. Speedpass was similar to the electronic toll technology used successfully on subway, bus, and highway systems the world over.

ExxonMobil

On November 30, 1999, Exxon and Mobil merged to form Exxon Mobil Corporation (ExxonMobil). The $250 bn merger, one of the largest in history, brought back together two major companies of the former Standard Oil Co.

In 2002, ExxonMobil, along with other sponsors, kicked off the Global Climate and Energy Project (GCEP) at Stanford University, to identify technologies that could meet energy demand with lower greenhouse gas emissions.

In 2005, ExxonMobil and Qatar Petroleum, with other joint-venture partners, expanded development of the giant North Gas Field offshore Qatar. The North Gas Field offshore Qatar was discovered in 1971. It had a total recoverable resource of more than 900 trillion standard cubic feet of gas and was considered the world's largest single non associated gas field.5

In 2007, Exxon Neftegas Limited (a subsidiary of Exxon Mobil) completed the drilling of the Z-11 well, the longest measured depth Extended-Reach Drilling (ERD) well in the world. Located on Sakhalin Island offshore eastern Russia, the record-setting Z-11 achieved a total measured depth of 37,016 feet (more than seven miles).

In 2011, ExxonMobil announced two major oil discoveries and a gas discovery in the deep-water Gulf of Mexico after drilling the company's first post-moratorium

deep-water exploration well. This was one of the largest discoveries in the Gulf of Mexico in that decade.

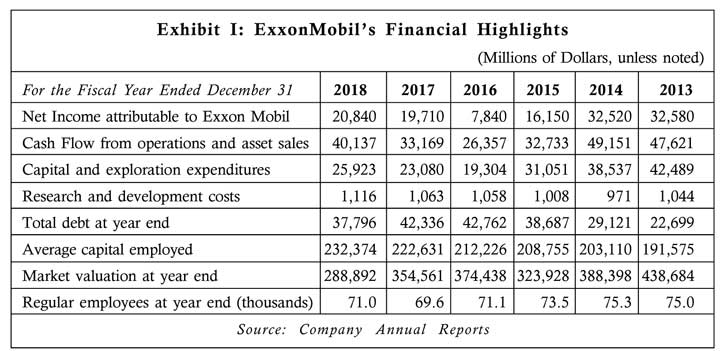

Over the years, ExxonMobil evolved from a domestic refiner and distributor of kerosene to a large multinational corporation involved in every level of oil and gas exploration, production, refining, and marketing and in petrochemicals manufacturing (Refer Exhibit I for Exxon Mobil's Financial Highlights).

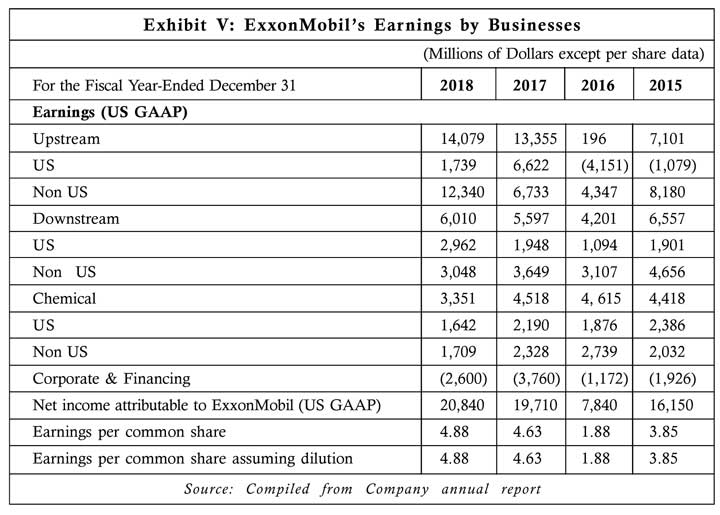

While ExxonMobil was the most profitable US oil company in the early 2000s, it suffered its worst year in 2016. In 2016, the company reported a net income of $7.8 bn compared to $16.2 bn in 2015 and $32.3 bn in 2013. The cash flow from operations and asset sales was $26.4 bn in 2016 compared to $47.6 bn in 2013.

Challenges for ExxonMobil

On February 2, 2018, the share price of ExxonMobil fell by 5.1%, its worst single day fall since 2011. The drop in share price was triggered by the release of the company's 2017 fourth quarter earnings. The company not only missed the earnings expectation, but also reported a decline of 3.2% in oil production.6 Production in the US fell to 244,000 barrels per day. In the fourth quarter of 2017, ExxonMobil reported a net income of $8.4 bn compared to $1.7 bn in the same quarter in 2016-an increase of $6.7 bn.7 However, the increase in earnings in Q4 2017 was driven by a gain of $5.9 bn due to US tax reforms and impairments. So, excluding that gain, the increase in net income was only $800 mn. Although increasing oil prices helped ExxonMobil's upstream business, the company's downstream and chemical business did not do well in the fourth quarter of 2017. The downstream earnings excluding the US tax reforms and impairments declined by $289 mn to $952 mn. Similarly, excluding the $335 mn due to US tax reforms, ExxonMobil's earnings from the chemical business increased by only $63 mn in the fourth quarter of 2017.

However, ExxonMobil's US upstream business affected the company's financials in the previous couple of years. In the fourth quarter of 2017, ExxonMobil's upstream business in the US finally generated earnings of $7.1 bn after reporting consecutive quarterly losses in the previous 12 quarters, while its competitors seemed to be doing much better. Excluding the benefits of the US tax reforms, ExxonMobil's upstream business in the US in the fourth quarter of 2017 lost $60 mn.8 Chevron, in contrast, made a profit of $358 mn in its US upstream business in the fourth quarter of 2017 and was profitable for the year overall and ConocoPhillips also reported solid results and speeded up its buyback program.9 In 2017, ExxonMobil's upstream business in the US generated earnings of $6.6 bn compared to a loss of $4.2 bn in 2016.10 Analysts also pointed out that ExxonMobil's upstream activities were heavily dependent on offshore resources. However, drilling in those areas had become excessively expensive, which affected the company's cash flow. The company could have made more profit if it had focused more on onshore operations in domestic shale resources.

In 2017, the company also lost its leading position in annual cash generation to Royal Dutch Shell (Shell), the world's second-largest oil company. In 2017, Shell reported a cash flow of $35.65 bn from operations-about 6% more than Exxon Mobil's $33.2 bn.11

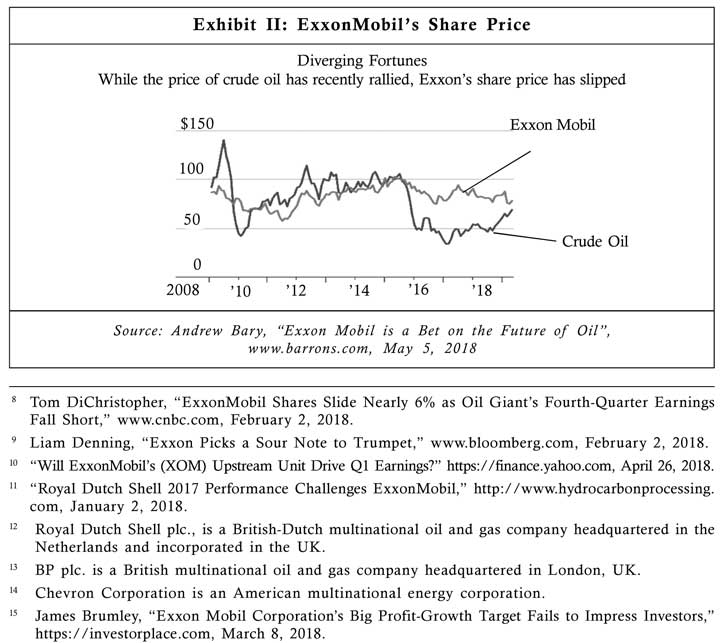

Between May 2017 and 2018, the share price of ExxonMobil declined by 7%. Other oil majors like Royal Dutch Shell,12 BP,13 and Chevron14 had an average share price gain of 25% in the same period. While major oil stocks were near their 52-week high, Exxon Mobil was close to its 52-week low. As of 2018, the stock price of ExxonMobil was $77, down by 25% compared to $104 in 201415 (Refer Exhibit II).

In the first quarter of 2018, ExxonMobil reported earnings of $4.7 bn compared to $4 bn in the same quarter in 2017, an increase of 16%. The company also announced positive US upstream earnings of $429 mn and the highest quarterly cash flow from operations and assets sales since 2014. But, production levels were still a concern as oil-equivalent production was 3.9 million barrels per day, a decline of 6% from the first quarter of 2017.16

Although the company's earnings increased from a year earlier, it fell short of expectations on per share basis. The company's stock price declined by 3.5% over the last year, compared to a 9% gain for the S&P 500 energy sector.17

While ExxonMobil's revenue in the first quarter of 2018 was $68.21 bn, an increase of 16% from a year earlier, profits in the downstream business decreased by 16% compared to the same period the previous year. The company's chemicals business also took a hit, with profits declining by 14% compared to the first quarter of 2017.18

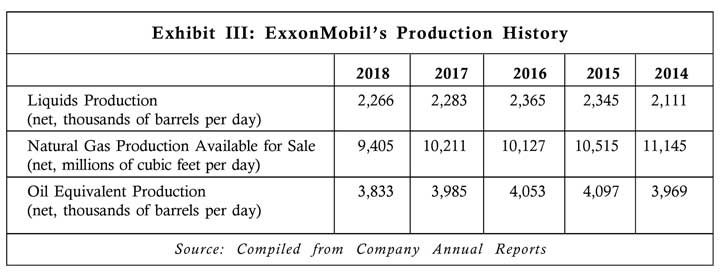

Industry experts cited several reasons for ExxonMobil's decline in performance. Over the previous few years, ExxonMobil had started missing production goals. In spite of its efforts to increase its energy output, it remained more or less the same for a decade-around four million oil-equivalent barrels per day (Refer Exhibit III). Due to its large base, achieving growth in oil and natural gas production had become a major challenge for the company over time.

In February 2018, ExxonMobil announced a $50 bn five-year investment plan in the US prompted by tax reforms. "We're planning to invest over $50 bn in the US over the next five years to increase production of profitable volumes and enhance our integrated portfolio, which is supported by the improved business climate created by tax reform,"19 said Woods, in a press release. The company intended to invest billions of dollars on expanding its existing operations, increasing oil production in the Permian Basin in West Texas and New Mexico, improving infrastructure, and building new manufacturing sites. The company expected these investments to benefit the economy by creating thousands of jobs and developing energy security while creating value for its shareholders. In 2017 also, the company had announced growth plans in the Gulf Coast and Permian regions. It aimed to triple its Permian shale production to about 600,000 barrels of oil equivalent per day by 2025. "The impact of tax reform on our earnings reflects the magnitude of our historic investment in the US and strengthens our commitment to further grow our business here," commented Woods.20

Over the last decade, the company's return on capital had declined drastically. While in 2005, it was 31%, it fell to 16% in 2014 and then to 7% in 2017.21 Analysts were of the view that some of the financial decisions taken by the company had contributed to its declining return on capital. More specifically, some investments directed by former CEO Rex Tillerson (Tillerson) had resulted in billions of dollars in write-downs in the midst of a fall in production and stock price. Some of these investments ended up costing the company more money. For instance, in 2010, the company acquired US natural-gas company XTO Energy for $35 bn. While in 2010, gas price was about $5 per million BTU, in 2018, it had fallen to $2.75 per million BTU, pushing back the expected payoff from the deal. The Kearl oil sands project developed by Imperial Oil Ltd, the Canadian affiliate of ExxonMobil, ended up costing much more than had been originally estimated. Tillerson himself admitted, "The XTO merger had an effect because gas prices had not yet bottomed out. While we anticipated at the time of the merger that it would be non-accretive in the near-term, because we expected that natural gas prices had not yet bottomed out, they stayed low much longer than we expected. Maybe we were off a year or two...... If you look at those capital expenditure numbers over the last five years compared to any other period of time...they are at extraordinarily high levels. You have a lot of capital on the books that's not performing."22 In February 2018, the company announced a $200-mn write down on abandoned ventures in Russia-once touted as its next big frontier. In 2018, it planned capital spending of $25 bn in expanding capacity in the Permian by drilling a three-mile lateral before the end of 2018, on its new discovery offshore Guyana, and on purchasing an aromatics plant in Singapore. This would again affect its return on capital as the company would have to wait for a payoff from new exploration.

Opportunities for ExxonMobil

While many analysts were worried about ExxonMobil's future growth potential considering its not so impressive financials and declining share price, some were of the view that the company still had the ability to find and develop enormous energy deposits profitably.

The global demand for oil increased by 1.6 million barrels per day in 2017 to reach 98 million barrels for the whole year. Over the decade, the average increase in daily global demand for oil was one million barrels. ExxonMobil had projected that by 2040, the global oil demand would increase by 20% to touch 118 million barrels per day.23

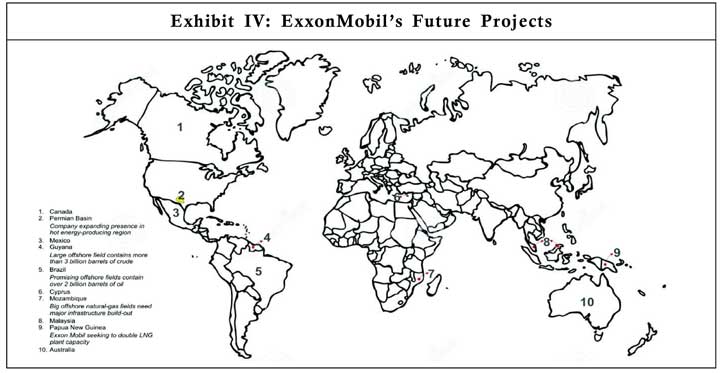

Industry experts said there were some major opportunities for the company to bounce back in the market. These included deepwater oil projects off the coasts of Guyana and Brazil, huge natural-gas fields and associated liquified-natural-gas plants in Mozambique and Papua New Guinea, and oil and natural gas in the Permian Basin of Texas and New Mexico (Refer Exhibit IV for ExxonMobil's Future Projects). The deepwater oil project off the coast of Guyana, in which ExxonMobil held nearly a 45% stake, was expected to be completed by 2020. The Guyana field was estimated to hold more than three billion barrels of oil equivalent. By 2025, the output was expected to reach about 500,000 barrels a day, which would make Guyana the second-biggest oil producer in Latin America behind only Brazil, within the next decade. "Exxon is a high-quality, disciplined and focused company that thinks in terms of decades, not years," commented John Herrlin, an energy analyst with Societe Generale S.A.24

Analysts opined that ExxonMobil was an 'integrated oil' company which owned onshore (Permian) and offshore (Guyana, Brazil, and Cyprus) projects which would guarantee steady upstream earnings for years to come. The other two segments, the downstream and chemical, were quite active as well. The company also had an incredibly strong vertically-integrated business. They were of the opinion that through close integration of its energy production (upstream), refining (downstream), and chemical businesses, ExxonMobil could maximize its profits. "We have long argued, and the historical returns support it, that Exxon is the highest quality integrated [oil company] overall and that its downstream and chemicals segments are key differentiators,"25 said Allen Good, Analyst at Morningstar.26

While the company generated the majority of its revenue from its robust downstream operations,27 it needed to rely on its upstream business for profitability and for returning value to its shareholders. However, the commodity down cycle that began in mid-2014 reversed this trend. Most of the integrated companies, including ExxonMobil, had to rely on their downstream operations to sustain their margins at that time. In an effort to make the downstream division more efficient and provide additional cash flow to counter the volatility in its upstream business, ExxonMobil announced in December 2017 that it would merge two separate business units-ExxonMobil Refining and Supply Company and ExxonMobil Fuels, Lubricants & Specialties Marketing Company. Effective January 1, 2018, these two units would merge into a new division known as ExxonMobil Fuels & Lubricants Company.

Analysts believed that ExxonMobil's profitable downstream and chemical businesses, which accounted for more than 50% of its earnings, could provide a cushion for the company's energy production business when oil prices were low (Refer Exhibit V for Exxon Mobil's Earnings by Businesses). An example of ExxonMobil's integrated model was the pipelines connecting oil and natural-gas fields in the Permian Basin to the company's refining and chemical plants on the Texas Gulf Coast. "The whole of ExxonMobil is worth more than the sum of our parts,"28 said Woods while commenting on ExxonMobil's integrated businesses.

Tackling the Challenges

In March 2018, ExxonMobil outlined an aggressive growth plan that would double its earnings and cash flow by 2025. It aimed to achieve that target by increasing its spending to a total of $230 bn over the eight-year period between 2018 and 2025. The company expected to generate more than $60 bn in annual operating cash flow by 2025, assuming oil price was $50 a barrel.29 ExxonMobil's earnings were projected to increase by more than 100% to $31 bn by 2025 at constant 2017 prices from 2017's adjusted earnings of $15.3 bn excluding US tax reforms and impairments. The company also aimed to increase its return on capital employed to about 15% by 2025. "Our existing business and plans for growth are robust to a wide range of price environments, allowing us to maintain a growing dividend and a strong balance sheet while returning excess cash to our shareholders,"30 said Woods.

ExxonMobil also aimed to increase its output worldwide. The company intended to increase tight-oil production five times from the US Permian Basin and also to start 25 new projects worldwide. These new projects were expected to add volumes of more than one million oil-equivalent barrels per day. In 2017, the company had already added 10 million oil-equivalent barrels to its resource base in different locations including the Permian, Guyana, Mozambique, PNG (Papua New Guinea), and Brazil. In 2017, ExxonMobil had already increased the size of its resource in the Permian Basin from less than 3 billion of oil-equivalent to 9.5 billion. In Guyana, the company successfully added 3.2 billion gross oil-equivalent barrels of recoverable resource. "We are in a solid position to maximize the value of the increased Permian production as it moves from the well head to our Gulf Coast refining and chemical operations, where we are focusing on manufacturing higher-demand, higher-value products,"31 commented Woods.

To increase its earnings from its downstream and chemical businesses, ExxonMobil invested in refineries at Baytown and Beaumont in Texas and Baton Rouge, Louisiana, Rotterdam, Antwerp, Singapore, and Fawley in the UK. These projects were expected to increase production of higher-value products, such as ultra-low sulfur diesel, chemical feedstocks, and basestocks for lubricants. In its chemical business, ExxonMobil aimed to grow manufacturing capacity in North America and the Asia Pacific by about 40%. That would enable the company to meet increasing demand in Asia and other growing markets. "We are uniquely positioned to take advantage of the global demand growth for higher-value products in the downstream and chemical. Our combined strengths in innovative technology, resource and market access, marketing product leadership and integration improve profitability and create significant shareholder value,"32 said Woods.

As ExxonMobil prepared itself to take on the challenges, it paid attention to its public image as well. For decades, the company had been the target of environmentalists for refusing to take responsibility for the adverse changes in the global environment as a result of its operations. It had been facing lawsuits dating back to the 1970s and 1980s, which alleged that the company had hidden knowledge about the fact that its products were contributing to climate change. The energy giant had always refuted these claims. Lee Raymond, ExxonMobil's former CEO and Chairman (1999-2005), called global warming a hoax and the 1997 Kyoto pact 'unworkable, unfair and ineffective.' In 2009, Tillerson, the then CEO of ExxonMobil, advocated the imposition of a carbon tax to curb greenhouse gas emissions.

Nonetheless, the company has started initiatives during Woods's tenure, to clean up its act. "We understand the risk and that it needs to be addressed. We're sincere in that. We believe that,"33 said Woods while commenting on global climate change. When Woods became the CEO of the company in January 2017, he urged the US President Donald Trump to support the Paris Climate Accords.34 "[Paris agreement] the agreement is an important step forward by world governments in addressing the serious risks of climate change,"35 said the company in a statement.

ExxonMobil had invested in innovations that met the four criteria of being 'affordable, scalable, reliable, and sustainable'. In collaboration with FuelCell Energy Inc.,36 it was developing a system which could capture carbon dioxide and other emissions from a power plant's emissions before they reached the atmosphere, while generating power. The system would divert the emissions from power plants, mix them with methane, and pipe them into a series of fuel cells that would electrochemically transform the gases into electricity plus a concentrated stream of 90% carbon dioxide ready to be pressurized and injected deep into the earth.

However, analysts were skeptical about ExxonMobil's initiatives to check climate change considering its history. In 1978, ExxonMobil's climate researcher James Black (Black) wrote a report titled "The Greenhouse Effect," warning of the effects of carbon emissions on global temperatures. "It is premature to limit use of fossil fuels but they should not be encouraged,"37 wrote Black. In the 1970s, ExxonMobil's scientists invented the lithium-ion battery. However, the company did not commercialize it and continued investing in fossil fuel and chose to ignore the suggestions made by its own researchers.

In an effort to change the strong bureaucratic culture at the company, Woods announced to join earnings conference calls38 from 2019. Until then, the company planned to have a senior executive participate in these calls. "It's important for him [Woods] to come out of his comfort zone and to hear criticism, whether it's fair or not. He may not like everything he hears and may think some of the comments are ludicrous, but you have a group of well-educated people doing analysis of the company on the call. At a minimum, he should listen,"39 said Paul Cheng, an analyst with Barclays.

At the 2017 annual meeting, activists passed a resolution, with 62% of the vote, seeking disclosure of ExxonMobil's plan for coping with rising temperatures and an assessment of the "viability of its assets as a result of the transition to a low-carbon economy." "It's a start but the world is changing even faster than Exxon,"40 said Andrew Logan at investment consultant at Ceres, while commenting on ExxonMobil's climate and governance issues.

In February 2019, ExxonMobil announced 2018 earnings of $20.8 bn, compared to $19.7 bn a year earlier. In 2018, ExxonMobil's full year cash flow from operating activities was $36 bn, its highest since 2014.41 The stock price of the company was also up 2.7%, at nearly $76 a share, following its earnings announcement.42

The company reported an increase in production in the fourth quarter of 2018, finally reversing a trend of falling output. Total production in the fourth quarter of 2018 increased to 4.01 million barrels of oil equivalent per day, up 4% from the 3.9 million barrels reported in the fourth quarter of 2017, driven by growth in the Permian Basin. In the Permian Basin, the size of the company's net resource was 10 billion oil-equivalent barrels per day and this was expected to exceed 1 million barrels per day by 2024.

Moreover, the company made its tenth discovery offshore Guyana and also increased its estimate of the discovered recoverable resource for the Stabroek Block to more than 5 billion oil equivalent barrels. "Strong results during a period of commodity price volatility demonstrate ExxonMobil's ability to deliver superior cash flow in different market environments. Our continued focus on long-term fundamentals and portfolio improvements position us well to grow shareholder value. ExxonMobil's 2018 results further demonstrate our advantages in technology, scale and integration, providing a strong foundation to successfully compete across commodity price cycles,"43 said Woods.

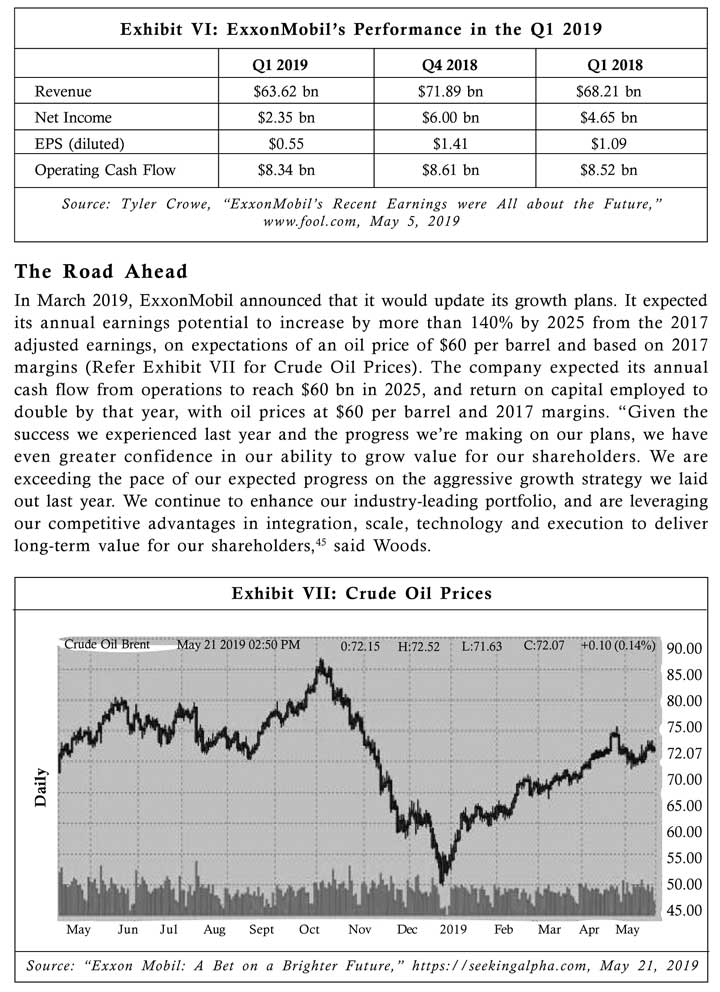

However, after two consecutive quarters that showed ExxonMobil was on track to achieve the growth target announced in March 2018, the company reported surprisingly weak results in the first quarter of 2019. Unlike the previous few years where the production level had been a concern, the poor performance in the first quarter of 2019 was due to its downstream and chemical businesses. While in the first quarter of 2019, ExxonMobil's production level increased driven by growth in the Permian Basin in West Texas and New Mexico, the company reported a loss in both its downstream and chemical businesses in the quarter (Refer Exhibit VI for ExxonMobil's Performance in the Q1 2019). "ExxonMobil's poor first-quarter earnings report revealed diminished profits, weak revenues, unproven cost reduction strategies, meager asset sales and the need to borrow US$3 bn to make ends meet,"44 commented the Institute for Energy Economics and Financial Analysis (IEEFA).

In an effort to return to its earlier splendor, the company continued its focus on fossil fuel. However, analysts wondered whether ExxonMobil was right in its view of a bright future for fossil fuels. "Darren Woods is turning the Exxon Mobil supertanker, but the scale of the challenge is giant,"46 said Paul Sankey, an analyst at Mizuho Energy. Analysts were skeptical about the future of ExxonMobil which was relying on oil and natural gas production at a time when the demand for renewable energy was on the rise. While ExxonMobil increased its production of oil and natural gas, its competitors were focusing on capital investment and returning cash to shareholders. "If you look back historically there have been a lot of industries that have disappeared because change has swallowed them up..... I can't imagine oil and gas going away completely, but it's evolving,"47 says Brian Rice, a Portfolio Manager at California State Teachers' Retirement System, which managed $225 bn shares including those of ExxonMobil.

- "ExxonMobil Outlines Aggressive Growth Plans to More Than Double Earnings," http://news. exxonmobil.com, March 7, 2018.

- Ben Adler, "ExxonMobil: Carbon Caps? Fat Chance. We'll Just Keep on Drilling," https://grist.org, April 1, 2014.

- ExxonMobil had three business segments: Upstream, Downstream, and Chemical. In the Upstream business, the company explored and produced crude oil and natural gas. In the Downstream business, the company manufactured and sold different petroleum products including gasoline, jet fuel, heating oil, diesel, and propane. In the Chemical business, the company offered a broad portfolio of petrochemical and polymer products.

- "ExxonMobil is on Track to More Than Double Earnings by 2025", http://www.oilreviewmiddle east.com, May 30, 2019.

- Associated gas fields refer to the natural gas found in association with oil within the reservoir. There are also reservoirs that contain only natural gas and no oil. This gas field is called a non-associated gas field.

- Jason Hall, "Exxon Mobil Corporation Stock Just Had Its Worst Day Since 2011: Here's a Better Stock to Buy," www.fool.com, February 3, 2018.

- "ExxonMobil Profit Misses Street on Refining, Chemical Weakness," www.rigzone.com, February 2, 2018.

- Tom DiChristopher, "ExxonMobil Shares Slide Nearly 6% as Oil Giant's Fourth-Quarter Earnings Fall Short," www.cnbc.com, February 2, 2018.

- Liam Denning, "Exxon Picks a Sour Note to Trumpet," www.bloomberg.com, February 2, 2018.

- "Will ExxonMobil's (XOM) Upstream Unit Drive Q1 Earnings?" https://finance.yahoo.com, April 26, 2018.

- "Royal Dutch Shell 2017 Performance Challenges ExxonMobil," http://www.hydrocarbonprocessing. com, January 2, 2018.

- Royal Dutch Shell plc., is a British-Dutch multinational oil and gas company headquartered in the Netherlands and incorporated in the UK.

- BP plc. is a British multinational oil and gas company headquartered in London, UK.

- Chevron Corporation is an American multinational energy corporation.

- James Brumley, "Exxon Mobil Corporation's Big Profit-Growth Target Fails to Impress Investors," https://investorplace.com, March 8, 2018.

- "ExxonMobil Earnings Increase 16 percent to $4.7Billion in First Quarter 2018," http://news. exxonmobil.com, April 27, 2018.

- Tom DiChristopher, "Exxon Mobil Shares Fall 3.5% on Earnings Miss Fueled by Weak Refining and Chemicals Profits," www.cnbc.com, April 27, 2018.

- Ibid.

- Jim Crumly, "What Happened in the Stock Market Today," www.fool.com, February 2, 2018.

- "ExxonMobil Profit Misses Street on Refining, Chemical Weakness," www.rigzone.com, February 2, 2018.

- Andrew Bary, "Exxon Mobil is a Bet on the Future of Oil," www.barrons.com, May 5, 2018.

- Conway Irwin, "Timing was Off for XTO Deal, Says Exxon CEO," https://breakingenergy.com, May 30, 2013.

- Andrew Bary, "Exxon Mobil is a Bet on the Future of Oil," www.barrons.com, May 5, 2018.

- Societe Generale S.A. is a French multinational banking and financial services company.

- Wayne Duggan, "What to Expect from Exxon Mobil Earnings," https://money.usnews.com, April 24, 2018.

- Morningstar, Inc. is an investment research and investment management firm headquartered in Chicago, Illinois, United States.

- Downstream refers to refining crude and purifying natural gas, as well as marketing and distribution of products made from oil and gas.

- Andrew Bary, "Exxon Mobil is a Bet on the Future of Oil," www.barrons.com, May 5, 2018.

- Mathew DiLallo, "ExxonMobil Corporation is Playing the Long Game for a Bigger Win," www.fool. com, March 22, 2018.

- "ExxonMobil Outlines Aggressive Growth Plans to More Than Double Earnings," http://news. exxonmobil.com, March 7, 2018.

- Ibid.

- Ibid.

- Christopher Helman, "Over a Barrel: ExxonMobil Preps for the Low-Carbon Future," www.forbes.com, February 13, 2018.

- The Paris Climate Accord is an agreement within the United Nations Framework Convention on Climate Change (UNFCCC), dealing with greenhouse-gas-emissions mitigation, adaptation, and finance, starting in the year 2020. The agreement's long-term goal is to keep the increase in global average temperature to well below 2 0C above pre-industrial levels; and to limit the increase to 1.5 0C, since this would substantially reduce the risks and effects of climate change.

- https://corporate.exxonmobil.com/en/energy-and-environment/environmental-protection/climate-change/statements-on-paris-climate-agreement

- Fuel Cell Energy, Inc. is a global fuel cell power company which designs, manufactures, operates, and services Direct Fuel Cell power plants to electrochemically produce electricity and heat from a range of basic fuels including natural gas and biogas.

- Christopher Helman, "Over a Barrel: ExxonMobil Preps for the Low-Carbon Future," www.forbes.com, February 13, 2018.

- The earnings conference call is a way for companies to relay information to all interested parties, including institutional and individual investors, as well as buy- and sell-side analysts (Source: https://www.investopedia.com).

- Andrew Bary, "Exxon Mobil is a Bet on the Future of Oil," www.barrons.com, May 5, 2018.

- Christopher Helman, "Over a Barrel: ExxonMobil Preps for the Low-Carbon Future," www.forbes.com, February 13, 2018.

- "ExxonMobil Earns $20.8 Billion in 2018; $6 Billion in Fourth Quarter," https://corporate.exxonmobil.com, February 1, 2019.

- Kevin Crowley, "ExxonMobil Shares Bounce Back as Permian Output Soars," www.worldoil.com, February 1, 2019.

- "ExxonMobil Earns $20.8 Billion in 2018; $6 Billion in Fourth Quarter," https://corporate.exxonmobil.com, February 1, 2019.

- Nick Cunningham, "Oil Majors Post Poor First Quarter," http://energyfuse.org, May 9, 2019.

- "ExxonMobil Updates Growth Plans, Significant Additional Upside Possible," https://corporate. exxonmobil.com, March 6, 2019.