Mar'20

The IUP Journal of Case Folio

Archives

From the Skies to the Ground: A Case Study on the Trajectories of Jet Airways

Emil Mathew

Assistant Professor, School of Maritime Management, Indian Maritime University, Chennai Campus, Chennai, Tamil Nadu, India. E-mail: memil@imu.ac.in

The case intends to teach students of business management the intricacies related to emergence, evolution and expulsion of a private airline company in the Indian aviation market. It introduces to them how the first private Indian airlines, Jet Airways, set standards for domestic and international air transportation when Air India was the sole player dominating the sector. The paper helps to familiarize the students of Transport Economics on different business models of the aviation industry, that is, low-cost carriers, full-service carriers and hybrid carriers. The case study on Jet Airways brings forth how practical considerations of survival compel the airline to change its business models and also teaches them that the Indian aviation industry is subjected to transformations similar to that of the changes being taken place in the rest of the world. The factors that contributed to the failure of Jet Airways discussed in the case study provide ample opportunity for the students to gain adequate knowledge on the constraints of Jet Airways while operating in the aviation sector.

On October 16, 2008, Thursday morning, former chairman and founder, Jet Airways, Naresh Goyal called for a press meet to share his views on the decision of the management of Jet Airways to terminate 1,900 employees within a span of two-day time without prior notice. He started with an apology note, ?I apologize for the agony that you all went through. I was not there when this decision was taken. I came to know about it later. I have not been able to sleep all night. I request all of you to start work from tomorrow morning?. Goyal went on to state that his conscience did not permit him to ignore the suffering of the employees whom he considered to be his family members. ?When I saw the tears rolling down from some of the workers? faces, I was moved. I cannot see you all unhappy. My workers are like my family members?. He added, ?it is my personal decision as a father of the family?.1

Ten years down the line, on May 25, 2019, at 3: 35 p.m., Dubai-bound Emirates flight EK 507 with 351 passengers and 17 crew members on board, returned from taxiway due to some immigration issues, which later turned out as an enquiry related to a look-out circular issued against one of the passengers of the flight.2 On the direction of Immigration Officials, airline officials offloaded two passengers from the flight. To the surprise of many, they were former chairman, Jet Airways, Naresh Goyal and his wife, Anita Goyal. Immigration agency can stop citizens from traveling abroad based on a look-out circular from law enforcement agencies such as the Enforcement Directorate (ED), the Central Bureau of Investigation (CBI), the Serious Fraud Investigation Office (SFIO) and the local police. In the case of Jet Airways, CBI had not registered any case and ED and Ministry of Corporate Affairs (MCA) were examining the books for any alleged fund diversion.3 The latest action against the Goyals came after Officers and Staff Association President, Jet Airways, Kiran Pawaskar approached Mumbai Police in April as a precaution to stop the top officials of the company from leaving India.4

History of Jet Airways

The founder and former chairman, Jet Airways, Naresh Goyal was born in Punjab in 1949. After his graduation in Commerce, Goyal started his career as a marketing executive at the General Sales Agent (GSA) with Lebanese International Airlines in Delhi with a salary of 300/pm. He worked with a couple of international airlines holding responsible positions: Public Relations Officer with Iraqi Airways (1969), Regional Manager for ALIA, Royal Jordanian Airlines (1971) and also with Indian offices of Middle Eastern Airline (MEA) in various areas including ticketing, reservations, and sales.5 Intending to provide sales and marketing representation to foreign airlines such as Air France, Australian Airlines and Cathay Pacific in India, Goyal started JetAir (Private) Limited in 1974 with an initial investment of 500 pounds borrowed from his mother. This gave him adequate experience in fields of development of traffic patterns, route structures, operational economies, and flight schedules. In 1975, he was appointed as Regional Manager of Philippine Airlines to handle commercial operations in India.

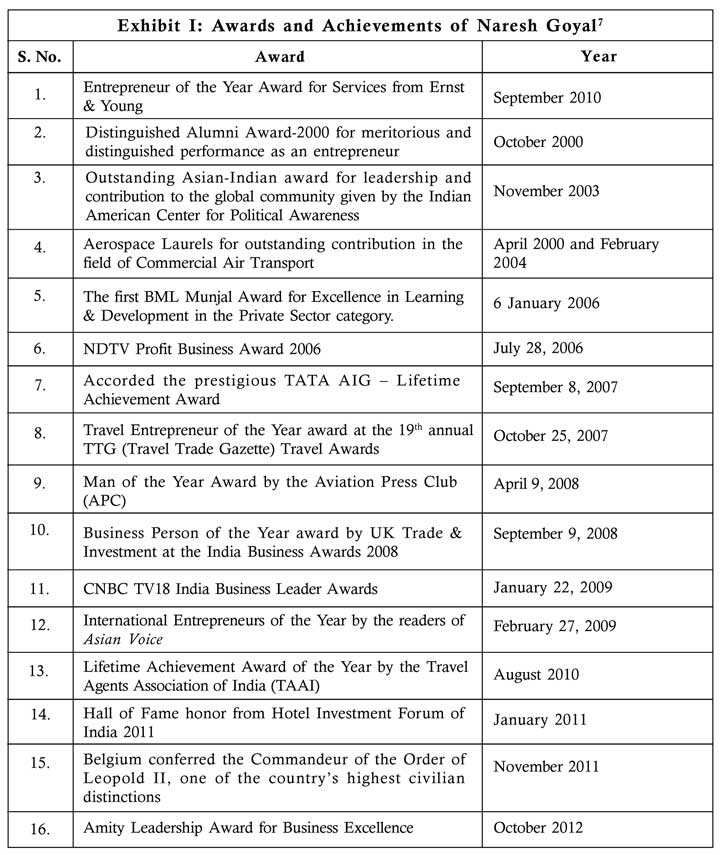

In 1991, the liberalization policy adopted by the Government of India fascinated Goyal to start Jet Airways as a private air taxi service in India.6 On April 1, 1992, Jet Airways was incorporated as an air taxi operator. On May 5, 1993, Jet Airways commenced its commercial operations from Bombay to Ahmedabad in flight 9W 321. The awards and achievements received by Goyal for his contributions to the aviation sector are given in Exhibit I. The long experience of working in the aviation sector helped Goyal to establish close contact with investors to support his initiative. Middle East Investors including Gulf Air and Kuwaiti Air supported Jet. During the initial years, Airways depended on leased aircraft and onboard talents from other airlines. However, in the first year of operations, Jet Airways turn out to be successful to carry 730,000 passengers.

A change in the Indian law enabled Jet Airways to apply for scheduled airline status on January 14, 1995. Jet Airways was the first airline from South East Asia to order Boeing 737-800. In the financial year 1996-97, the airline carried 2.4 million passengers with a market share of 20%, second highest after the state-owned Indian Airlines. In 2001, the fleet had grown to 30 aircraft and was operating 195 flights to 37 destinations within India.8 An increase in operational cost along with a slowdown in the demand made them undergo some losses in the FY 2001-02. Jet earned a unique status of being the first private Indian airline to operate an international flight from Chennai to Colombo in March 2004.9 Later, in December 2004, the lifting of foreign ownership limits on Indian airlines by the Government of India from 40% to 49% helped the Jet to generate additional funds through IPO. By 2005, Jet extended its operations beyond the Middle East and South East Asian countries with the introduction of the first international long haul flight to London in May 2005.

In 2006, Naresh Goyal expressed his interest to acquire Air Sahara for the $500 mn and on April 12, 200710 deal was completed with Jet Airways agreeing to pay $210 mn. Within four days, on April 16, 2007, Jet renamed Air Sahara as JetLite converting it into a subsidiary of Jet Airways11 and marketed as a Low-Cost Carrier (LCC). In October 2008, Jet was brought to news through the controversial retrenchment of 1,900 employees and later on, he was forced to reinstate sacked employees due to compulsions from several quarters.12 On May 8, 2009, Jet Airways launched another LCC, JetKonnect and its operations were limited to profitable short-haul routes with high passenger load factors. In the third quarter of 2010, Jet Airways become the largest airline in India with a 22.6% market share of the passengers.13 On March 25, 2012, Jet Airways merged JetLite with JetKonnect14 and started offering business class seats after the collapse of Kingfisher Airlines.

Based on the revised FDI policy of the Government of India, Goyal ventured into a partnership deal with Etihad Airways on November 12, 2013 giving a 24% equity stake in Jet Airways for $379 mn.15 Naresh Goyal retained 51% ownership of the stock.16 It was expected to provide wide-ranging revenue growth and cost synergy opportunities for both the airlines in the areas of operational synergies and cost savings including fleet acquisition, maintenance, product development, and training. Due to falling passenger demand, in 2013, the airline entered into a fare war with LCC like IndiGo and SpiceJet. On December 1, 2014, JetKonnect was merged with Jet Airways as a marketing strategy to operate as a uniform Full Service Carrier (FSC). In October 2017, Jet Airways attained the second position in market share and also in passengers carried by Indian airlines. It operates over 1,000 flights to 76 destinations worldwide. In November 2018, Jet Airways underwent a severe financial crisis and indicated negative figures in the balance sheet. It recorded a net loss of 1,323 cr and raised concerns regarding its financial capability to continue operations beyond 60 days.17

The next six months remained to be an ordeal for Jet Airways and by March 2019 nearly fourth of its aircraft were grounded due to breach of lease agreement.18 On March 25, 2019, Naresh Goyal and his wife Anita Goyal stepped down from the Board of Directors.19 On the same day, it grounded more than two-thirds of 119 aircraft operated on its fleet. The company had amassed a debt of more than $1 bn deferred payment to leasing companies and also salaries to employees. On April 5, 2019, Indian Oil Corporation stopped its supply of fuel to the airlines20 and on April 10 due to non-payment of dues, a European cargo service provider seized an aircraft at Amsterdam airport.21

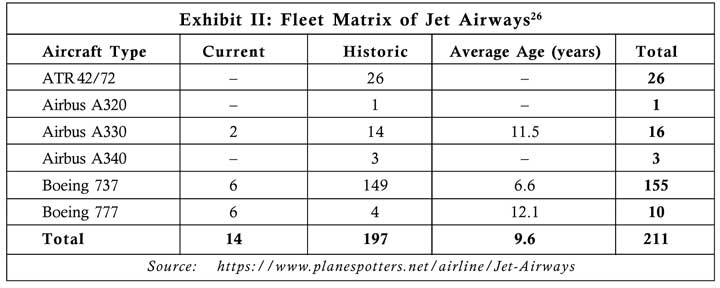

On April 17, 2019, Jet Airways official account tweeted, ?With deep sadness and a heavy heart we would like to share that, effective immediately, we will be suspending all our domestic and international operations?.22 Jet Airways temporarily shut its operations down on April 17 with the last flight operated from Amritsar to Mumbai. Further to this, membership in IATA was suspended.23 Jet Airways Ltd known for over 20% of the domestic market share operated in 76 destinations daily was forced to close down the operations due to financial crunch. According to a news report by Livemint on May 25, 2019, the slots given to Jet Airways had been temporarily reallocated to other airlines. Indigo and SpiceJet have been allotted 130 slots each, Vistara 110, GoAir 52, Air Asia 42 and Air India 24 for domestic operations.24 On June 18, 2019, the consortium of 26 banks led by State Bank approached National Company Law Tribunal to recover their dues of over 8,500 cr. The airline also owes over 10,000 cr to its hundreds of vendors, primarily, aircraft lessors and over 3,000 cr salaries to around 23,000 employees. The airline has a negative net worth for long and has run a loss of over 13,000 cr in the past few years.25 Thus, the total dues calculated was over 36,500 cr. On the airplane asset side Jet had only 14 on its book which valued around 5,000 cr as per media reports (Exhibit II). The rest of the 123 fleets were on lease and most of them have been deregistered or taken away by the foreign lessors already.

On June 18, 2019, the consortium of 26 banks led by State Bank approached National Company Law Tribunal to recover their dues of over 8,500 cr. The airline also owes over 10,000 cr to its hundreds of vendors, primarily, aircraft lessors and over 3,000 cr salaries to around 23,000 employees. The airline has a negative net worth for long and has run a loss of over 13,000 cr in the past few years.25 Thus, the total dues calculated was over 36,500 cr. On the airplane asset side Jet had only 14 on its book which valued around 5,000 cr as per media reports (Exhibit II). The rest of the 123 fleets were on lease and most of them have been deregistered or taken away by the foreign lessors already.

Jet Airways does not own all its aircraft but leases a large part of them and one of the reasons for the grounding of the aircraft was nonpayment of the lease amount.27 Similarly, some of the leasing companies have taken back their aircraft leading to a reduction in the asset base of Jet Airways after its closure. If there is an immediate resurrection of Jet soon, then it is difficult to get back the planes taken back by the lessors. Moreover, passengers doubt the reliability of Jet to sustain its operations in the future. The slots belonged to Jet earlier got absorbed by other airlines and it is difficult for Jet to get back as time passes. According to The Economic Times, June 18, 2019, the past five sessions alone, the shares of Jet Airways lost over 73% of their value.28 This is shocking as it happened to an airline that operated around 600 domestic and 380 international routes daily.

The Success of Jet Airways: A Unique Model

Jet Airways started its commercial operations in 1993 when the domestic market was dominated by Air India. Being the first private Indian airline to operate domestically and internationally, it introduced many innovative and progressive onboard changes in the flight. It redefined the entire flying experience and earned many loyal customers. The slogan ?Joy of Flying? promulgated by Jet is a catchy phrase and it earned wide recognition from both the business class and economy class passengers alike.

Jet Airways was introduced when Air India was single-handedly monopolizing the airline industry in India. However, the entry of Jet Airways into the aviation sector introduced several service standards, onboard culinary services, etiquette and manners of the staff, the hospitality of the crew, and comforts of seats which created a brand value unknown to domestic air travelers in India. Over time, the standards set by Jet turned out to be the norm of the entire industry which later on became a trendsetter for other domestic airlines too.29 Jet Airways was welcomed by travelers because of its friendlier approach and introduction of a set of a new generation of cleaner planes. The on-time performance made them reliable to business class travelers who found it convenient to keep their promises with the customers.

Jet Airways started its operations with fuel-efficient and cheaper to maintain new Boeing 737-300 aircraft and not the older Boeing 737-200 aircraft. This ensured maintenance and flight crew training simpler. The operational cost of Jet Airways was comparatively less due to the lean structure adopted which brought down the number of employees to 163 for Jet Airways compared to 397 employees per aircraft by Air India.30 Jet Airways established itself as a leading player in India through its outstanding inflight excellence. Jet Airways fleet was much younger and the average daily flying time was greater than Indian Airlines. Greater utilization of the flights ensured enhanced revenue per passenger. By 2008, Jet Airways became the second-largest airline that organizes long-term flies after Singapore Airlines. The company was appreciated for the most developed system of catering and earned the status of the most popular airline in India. It became the seventh most popular airline in the world. Thus, the quality of the aircraft, efficient manpower utilization and the delivery of the services enabled them to create an imprint on the minds of domestic passengers within a short period which remained to be intact until the grounding of the last aircraft.

Being the second-largest airline of India with almost 15% of passengers of the Indian aviation market, Jet Airways occupied a significant position.31 Its absence is likely to create a huge gap in the aviation sector, as India is the second-most populous country of the world. The existing airline operators could manage to increase the capacity over three to four months, however, the unique services and the passenger-friendly legacy environment which the Jet has created as a first private player in the field can never be ignored.

Airline Business Models: FSC and LCC

The LCC concept was developed in the USA in the 70s of the last century and later on by the 1990s, it received acceptance in Europe.32 The business model of LCC is claimed to achieve 50% lower operating cost compared to FSC. The advantages of the model persuaded the rest of the world to emulate the same, although there are controversies on total cost reductions practically achievable under them. LCC is a dominant business strategy widely accepted and adopted by various airlines internationally for short destinations of less than three hours of travel in the domestic territory of the nations. LCC is said to achieve lower costs through usage of younger homogeneous medium-sized fleet requiring lower fuel, maintenance, and personnel costs, lower fixed costs per passenger through high seating capacity, less delays by using smaller and uncongested airports, focus on point to point flights without connections, direct selling of ticket online, higher density seating, eliminating all forms of free inflight services such as catering, entertainment during the flight, magazines, etc. LCC generates additional revenues by selling products and services during the flights and on their websites. According to Doganis (2007), the operating costs of LCC can be reduced by 50% of that of FSC (Exhibit III). Meanwhile, the FSC found it difficult to survive in the market due to increased fuel prices, increased costs of airport services and the intense competition in the aviation market that brought their savings down through higher operating costs (Hamzathul, 2012).33 Over time, the third category called hybrid business model encompassing the best from LCC and FSC models developed.

During periods of high operational costs due to soaring fuel costs, and airport charges, FSCs are finding it difficult to survive and some of them have understood the need for moving on to LCC models. According to the International Civil Aviation Organization, the LCCs are increasing year after year and their share is increasing both in advanced and emerging economies alike.35 In 2018, LCC carried an estimated 1.3 billion passengers, around 31% of the world's total passengers on scheduled flights.36 Though there is a justifiable reason for the difference in the ticket fare of FSC and LCC on account of the value-added services provided by FSC, in recent years, because of the airfare reduction policy followed by FSC to capture the market, the airlines of both the models charge similar fares. It is a contradictory fact that though there is an increase in the number of passengers, the airfare is getting reduced year after year. It is reported that 50% of the seats of FSCs are charged below the costs of operations and hence it is unprofitable for the airlines. Since the tickets of FSCs are charged equivalent to that of LCCs, the intensity of loss experienced by them are severe compared to that of LCC.

-From-the-Skies-to-the-Ground-9.jpg)

LCC earned popularity in India during the liberalization period with the entry of various private airlines into the aviation market. The entry of Air Deccan in the first decade of the 21st century popularized air transport among common man for domestic destinations.37 It led to a major revolution in the Indian aviation industry that adopted measures to improve connectivity to new airports in various urban locations and introduced the aviation market to many new passengers who considered it to be unattainable. Followed by this, many airlines entered the aviation sector in India and some of them have failed to survive for long. Currently, Indigo, SpiceJet and GoAir operate in the LCC category, whereas the Air India, Vistara and the recently closed Jet Airways belong to FSC.38 Jet Airways was introduced as FSC which in due course established two LCC subsidiaries. Later on, during periods of survival, they were subsumed by the parent company. Though the LCC constitutes 63% of the domestic market share in India, the fares of FSC are very low, that is, technically the airline market is 100% a low fare market39 (Exhibit IV). In the Indian aviation market, there is little to distinguish between LCC and FSC, as the most important requirements expected by the passengers such as reliability, on time performance, consistency, ground product, cabin crew service standards are comparable even to that of an FSC. The most important limitation of FSC to improve its profitability is the unused seats in business class. The average load factor of the business class is 50% and hence unused space demarcated for the business class passengers remain unutilized and hence leads to lower revenue generation.40

-From-the-Skies-to-the-Ground-10.jpg)

Jet Airways: An FSC

Jet Airways was introduced into the market as an additional FSC when Air India was the sole airline operating on the model of FSC. The acquisition of an FSC airline Air Sahara by Jet Airways in 2007 and converting it into an LCC, JetLite, adversely affected Jet in the long run. These decisions undertaken during the period of economic crisis contributed to tremendous financial loss due to an increase in cost and reduction in the revenue. The financial crisis-induced fewer passenger turnout in the aviation market was addressed by Jet through a reduction in the fare. During the same period, the fuel costs increased which constitutes about 30-40% of the operational costs that pushed up the ticket price. The cutting down of the operational expenses was carried out irrationally by sacking 1,900 employees in two days. In 2009, Jet Airways launched one more LCC subsidiary, JetKonnect. The decision to operate two separate LCC subsidiaries under a single entity did not enable Jet Airways to achieve expected results. In 2012, Jet Airways merged two LCCs under JetKonnect.41 However, in 2014, when Jet Airways was merged with JetKonnect, JetKonnect lost its identity.42

Excluding those periods where Jet Airways experimented with LCC and FSC simultaneously, Jet Airways focused basically on the corporates by offering FSCs though it contributed to an increase in operational costs. Due to the continued financial crunch experienced by Jet Airways in the last two years, the company had diluted its business model from December 2008. Jet stopped providing free meals to most domestic economy class passengers from January 2019 excluding business class passengers of international and domestic flights.43 As FSC, Jet is known for making a standard in the Indian airline industry with business class seats, plush lounges, seats with ample legroom, frequent flyer miles, inflight entertainment and tickets inclusive of meals. Jet interpreted such moves as ways to address the freedom and flexibility that the passengers are looking forward to while making their travel choices. Jet did not have other choices to survive in the aviation sector. Jet closed down some of the routes which did not fetch adequate returns, especially the Gulf market. It has suspended complimentary lounge access for JetPrivilege, Platinum and Gold members traveling in economy class. Jet has also tried to increase the number of seats equivalent to that of LCC by reducing the number of business class seats.44 Analysts expressed their concerns that such interventions might dilute the uniqueness of the brand.

The closure of Kingfisher in 2012 brought forth more opportunities for the then competing airlines including Jet Airways. Similarly, the closing down of Jet Airways in 2019 gave opportunities by way of additional slots to other airlines to continue to be successful in the industry until some other disturbance emerges. It is very difficult for Jet Airways to get back to the air as the flights are already grounded, staff are hired by other airlines and the planes taken on lease have been taken over by the lessees. Three domestic LCC, IndiGo, SpiceJet and GoAir are expected to report a profit in FY 2020. It appeared as a bitter truth that the only way out for an LCC to be successful is the removal of competing airlines from the scenario, as it has been the case for a long time.

Indian Aviation Industry

The Indian aviation industry has prospects and growth potentials due to the high presence of the middle-class population, favorable demographic patterns, and higher disposable income along with higher spending patterns among the masses. According to IBEF 2014,45 the air traffic density in India is just 72 as compared to 282 in China and 2,896 in the US. India has 565 commercial aircraft for a population of 1.3 billion, whereas the US has 7,309 commercial aircraft for a population of just 328 million. Airports in India are underdeveloped with just a single operational runway whereas developed countries like the US have 5 to 6 runways on their major airports. According to World Tourism Organization (UNWTO) between 2010 and 2030, arrivals in emerging economies (+4.4% a year) are expected to increase at twice the rate of those in advanced economies (+2.2% a year). As an emerging economy, the growth prospect of the airlines operating in India in the immediate future is exorbitant. According to forecasts by the Center for Asia Pacific Aviation (CAPA), domestic air traffic in India is expected to grow at around 14 to 16% in the FY 2019-20.46

According to IATA (2018),47 the number of passengers flown by Indian airlines has more than doubled and reached up to 158 million passengers from 79 million journeys undertaken in 2010. On the other hand, an increase in the number of railway passengers during the same period is just 6%. More than 158 million airline passengers in India in 2017 represented an increase of almost 15% growth over 2016 and it is the third consecutive year of growth in the order of 15 to 20%. An increase in the air passenger demand is likely to make India, the third-largest air passenger market within the next 10 years. IATA forecasts that air traffic is estimated to increase by more than 414 million over the next 20 years period, an increase above 570 million journeys by 2037. The air transport market in India employs more than 400,000 employees and supports around 940,000 more engaged in supply chain operations. The air transport industry contributed about $35 bn to India's GDP in 2017. India's two airports, New Delhi and Bangalore are among the top 10 airports in the world in handling passengers in 2017.

Globally, LCC receives wide popularity and acceptance compared to FSC48 and India is not an exception. In 2004, over 5 million LCC seats were offered. It had grown to 135 million seats in 2018, which represents 27 times increment in the 14 years. Globally, around 55% of the seats of domestic and international markets are offered by LCC.49 Its share in the domestic Indian market is around 70%, whereas it is just 25% for international routes. The immediate competitor to LCC in India is the railways which offer better connectivity to interiors for short-distance travel. It is reported that the airline industry is expected to succumb to a loss even though the sector is likely to yield growth in traffic. The intensity of the loss of FSC is expected to be severe. The domestic FSCs are likely to undergo a loss of $1.5 bn during the same period, while LCCs are expected a loss of $200 mn. It points towards the present crisis experienced by airline service providers, where the ticket cost of most of these airlines are not higher enough to cover the actual expenses incurred. Since diverse quality services are offered by FSCs, the loss experienced by them are significant compared to LCC.

The Indian aviation sector is highly price-sensitive and airlines are aggressively competing to capture the market share. It forces the airlines to offer tickets below their operational costs and hence, they face issues of survival even if the industry passes through flourishing periods. Indian carriers including Air India and 2012 grounded Kingfisher Airlines lost more than $10 bn due to ticket fares below the operational expenses and overambitious expansion undertaken. Before the collapse of Jet Airways, many airlines of Indian origin like Kingfisher Airlines (2012), Air Deccan, Air India Cargo, Indian Airlines and Sahara Airlines had shut their operations down. The common factor connecting all these airlines is that they all were at some point in time merged with other airlines.50 Similarly, following the developments in the market, the competing operators may raise the fare on account of augmented market demand. An increase in operational expenses could be looked upon as an important justification behind an increase in the fare.51 But an increase in fare may ultimately bring the overall satisfaction of the passengers down.

The geographical location of airports in places far off from the urban centers leads to unutilization or underutilization of some of the recently constructed airports of India. More than $50 mn was spent by the government in recent years on eight such airports that do not receive scheduled flights and hence remained unutilized. One such was the case of Jaisalmer airport for which after spending $17 mn for construction it was closed between 2015 and 2017.52 The airlines which run their operations to such airports undertake heavy risks due to unpredictable future traffic demand.

The growing demand for air transportation indicates that the aviation sector in India has huge potentials of growth. The aviation industry in India is mainly catering to the price-conscious middle-class and if the costs are brought down, then the fare reduction is justifiable. The major component of the high operating costs of Indian airlines emerges from airport charges to fuel bills. Rising incomes and younger populations that want to be mobile, the rapid urbanization are contributing to the increased demand for air transportation. Connecting tier-2 and tier-3 cities in a subsidized manner led to an increase in the number of airports with an expanding base of the aviation market.

Current Crisis at Jet Airways

Jet Airways had been undergoing continuous loss since 2017. Subsequently, in August 2018, they deferred the second quarter of payments of the year. It posted a quarterly loss of 1,045 cr from January to March 2018, then for the period April to June, a loss of 1,323 cr was reported and from July to September, Jet Airways encountered a loss of 1,297.5 cr.53 The airline failed to pay several months of salary to its staff including senior pilots and external vendors. Unable to make salary commitments coupled with the inability of Jet Airways to make payments to vendors and lessors forced them to close down the operations. The suspension of the operations by Jet Airways badly affected about 22,000 employees directly and much more indirectly. Towards the end of FY 2018-19, banks had agreed to provide support of 1,500 cr to Jet, provided Goyal and family, holding 51% of the equity, give up the directorship of the company. Even after their resignation on March 25, 2019, banks did not provide financial support which created a deadlock. On April 17, 2019, the operations of Jet Airways were stopped completely.

A consortium of 26 bankers led by State Bank approached National Company Law Tribunal (NCLT) to recover dues of over 8,500 cr from Jet Airways.54 The lenders have been trying to sell the airline for the past few months but failed due to various reasons. Besides banks, the airline also owes over 10,000 cr to its hundreds of vendors, primarily aircraft lessors and over 3,000 cr to its employees. The airline has been having negative net worth for long and has run a loss of over 13,000 cr in the past few years. Thus, it has over 36,500 cr of dues.55 The Mumbai bench of NCLT had taken up the case of Jet Airways on 20 June 2019 for bankruptcy proceedings under the Insolvency and Bankruptcy Code (IBC). The court also approved an Insolvency Resolution Professional (IRP) to oversee the insolvency proceedings.56

Past Challenges

Jet Airways was not always floating on the same current all the time. Rather, it had gone through several ups and downs since its inception. During the global economic crisis of 2008, like any other market, the Indian aviation market too was very badly hit with a reduction in the number of passengers. This was followed by a reduction in fare to make it attractive for the passengers. However, a reduced fare could not sustain for long, as airlines were forced to increase the fare due to higher operating costs which had arisen mainly from escalated fuel prices.

Individually, each airline wished to make their fare attractive to capture the market to be competitive in the airline industry, despite the spiraling operational costs. The leaner business model was adopted by the management of Jet Airways to reduce the costs. In 2008, there was a mass retrenchment of employees without following proper procedure and subsequently, they were reinstated within a day that created commotion in the aviation industry and turmoil among the employees. This incident created in building up a negative image of Jet Airways and the airline ultimately succumbed to the pressure from the government, political parties and regulatory bodies to take back the sacked staff.

Another incident to indicate the inability of the management of Jet Airways to handle the labor issues is related to the strike of pilots. Being the contract employees having unsecured jobs, pilots may be laid off during periods of financial difficulty. During periods of the financial crisis, employees' salaries constituting 30 per cent of the expenses are the first to be cut. On July 24, 2009, National Aviators Guild (NAG) was registered by Regional Labor Commissioner to protect the interests of the pilots. The office-bearers of NAG were dismissed by Jet Airways and later on terminated from service without communicating the proper reason for dismissal. This agitated the pilots who went on a strike without negotiations with the management leading to the disruption of the operations and loss of Jet Airways. The four-day strike led to the inoculation of nearly 700 flights, costing hardships to over 28,000 passengers. The stalemate continued and the meetings conducted on behalf of the Chief Labor Commissioner did not produce any desired result and remained inconclusive. There were also rumors that the centre was planning to invoke the Essential Services Maintenance Act (ESMA), a law used in an extremely rare situation to compel pilots to fly or else face criminal prosecution. Goyal had gone to the extent of calling pilots as terrorists and he announced that he would bring foreign pilots to meet the situation. The management decision to refuse to reinstate the sacked pilots cost the company almost 15 cr a day.57 Finally, the deadlock ended with the reinstatement of the pilots with a remark, to dissolve the union and form an association. Pilots did not agree to this and later on, the management agreed that it would reconsider the wisdom of having a union.

These two incidents of straining relationships with the employees, the manpower of the organization, reflect on the inability of the management to have a proper internal grievance redressal mechanism. Despite resorting to leaner business models by sacking employees, other cost-cutting measures should have been embraced. Straining the relationship with pilots resulted in a huge loss of revenue for Jet Airways. Even the interests of the passengers were compromised as they could not provide an immediate solution to their concern. Ultimately, passengers were affected badly, man-days were lost, productivity suffered, revenues lost, and the image was tarnished.

Factors That Led to the Failure of Jet Airways

Acquisition, Rebranding, and Repositioning of Air Sahara: In 2007, Goyal acquired Air Sahara, despite criticisms from professional experts on acquiring a brand which does not fall within the culture of Jet Airways. Acquiring Sahara resulted in the drain of both managerial and financial resources. The aging fleet acquired by Jet and the unsuitability of corporate culture practiced by Air Sahara brought down the market appeal of Jet. It was a decision taken by Jet to expand its operations internationally when it was struggling to compete with LCC in the domestic market. According to Devesh Agarwal, Editor, Bangalore Aviation website, "The acquisition is still a millstone around the company's neck".58 Air Sahara was rebranded as JetLite and introduced as an LCC under the same management, but it brought down the legacy brand image of Jet Airways created for a long time. Two LCC subsidiaries JetLite and JetKonnect were later merged with Jet.

Poor Management Under a Single Head: Goyal's decision to have a single management team, headed by himself, to manage two diverse categories of services would have backfired him. The company's decision to single-handedly manage both LCC and FSC meant for two diverse categories of customers under the same management would have confused the passengers and the investors alike. For managing a company that has acquired another company targeted towards a different set of customers need at least two separate management teams.

The Personality Trait of Goyal: Many times, Goyal was criticized for his impulsive decisions taken emotionally and single-handedly without consulting with the top management of Jet Airways, and this personality trait has attracted the attention of many critics.59 Often hasty decisions are taken without proper thought out on future results in failure. He considered himself to be an entrepreneur ready to take risks, unlike CEOs who consult with a group for decisions. Goyal's decision to order Boeing 777 at Paris airshow in 2005 was one such decision taken by him when India did not have trained pilots or engineers to manage them.60 The decision was taken to procure widebody aircraft 13 years ago single-handedly produced long-lasting repercussions in the balance sheet of the company. Lack of leadership skills and the self-motivation to deal with the employee retrenchment exposed him in front of the public. He projected himself as a savior to the retrenched employees of his organization against whom the decision was taken by his management. It was reported that such a decision was taken out of pressure from different quarters, and he lost his face. According to Devesh Agarwal, Editor, Bangalore aviation website, Goyal was also accused of making bad investments and failed to address the company's deteriorating financial predicament while borrowing heavily.61 Goyal's failure to find an attractive investor to pump money into Jet during the last few years led to the present predicament and one of the pertinent reasons sighted for the loss of interest of the investors was Goyal's personality to head the company by himself.

Corporate Misgovernance: The decisions taken by the top management lacks transparency and they are accused of making bad investments. Jet Airways paid the price enormously for aggressive expansionary strategies adopted while procuring 22 wide-bodied aircraft in 2005 and also during the acquisition of an aging fleet of Sahara in 2007 that do not fit the culture of the Jet.

FSCs Compete with the LCCs Model: Jet Airways was started at a time when air travel was looked upon as a luxury and travel was limited to the upper and middle classes. Cost control was not on the agenda and Jet too won the hearts of the passengers due to their extremely dignified and elegant service. Over time, LCC increased in number and Jet found it hard to compete with the cost structures of these airlines. Without having a farsighted view on positioning the aircraft on a different plane, the management continued to provide services of an FSC without adopting cost-cutting measures. Now, the Indian market became highly price-sensitive and the airlines have to compete with several LCC and hence tended to quote a lower fare, even if it does not cover operational expenses. Capacity addition through lower fares without reducing operational expenses added to the cost. Had they kept the operating costs low equivalent to that of the competing airlines, without offering any additional services, they could have managed to give justification for a low fare. LCC popularized air travel among the middle-income group which led to the growth of the aviation industry in a highly populated country like India. We have seen that the conventional distinction between LCC and FSC are getting diluted as FSCs are moving to the areas of LCCs, as they presume that the overall revenue could be enhanced by exploring the potentials of the other segment.

Increase in Price of Crude Oil: The most important factor contributing to the operational costs of the airlines is the fuel costs which come around 35 to 40%.62 Central and state taxes of 30-40% is added to the fuel cost. An increase in fuel price will lead to a further increase in fuel cost and the tax charges imposed on it. Logically, the increase in the fuel charges is to be transferred on to the passengers through a higher ticket fare. Generally, the addition of taxes makes the fuel 30-35% expensive compared to other nations. To be competitive in the aviation sector, the airlines bear the brunt and are less likely to transfer the burden on to the passengers in the same proportion. This erodes the competitiveness of the airlines and often offer fares below operational expenses.

Unfavorable Government Policies and Aviation Regulation: Route Dispersal Guidelines followed in India mandates a certain percentage of flights operate on unprofitable routes and it is likely to bring down the profitability63 of the airlines. Another factor contributing to an increase in the operational cost is the value-added tax imposed on Aviation Turbine Fuel (ATF) and it remains outside goods and services tax. Different tax rates followed by each state do not provide clarity on refueling costs. This single-component alone accounts for 35-40% of the operational expenses making airline business unsustainable in India. The civil aviation ministry is considering the inclusion of fuel under GST.

Failure to Adopt Cost-Cutting Measures: Jet Airways offered three different types of services, first-class, business class, and economy class. The removal of first-class and upgradation of business and economy classes can reduce costs and improve customer satisfaction. The change of destinations to profit earning locations is one of the strategies they can adopt. Acquisition of wide-body aircraft such as Airbus A330s and Boeing 777 proved economically unviable.64 The cost of fuel may be reduced by induction of 737 which could reduce the fuel consumption by 15% and its maintenance costs are less. A proper restructuring of the routes by redirecting to revenue-generating routes and cutting down the cost inducing routes can enhance revenue per available seat kilometer and reduce the cost per available seat kilometer.

Depreciation of Indian Rupees: The depreciation of rupees against the dollar is another factor contributing to the crisis, as almost 25-30% of their costs such as aircraft lease rents, maintenance costs, ground handling, and parking charges abroad are dollar-denominated. One of the major hurdles experienced in 2018 is the loss in the value of Indian currency by 20% along with an increase in the price of crude oil which broke the backbone of the airlines.

Undue Support Received from the Government: It was reported that the political parties have given undue support to Goyal which had gone to the extent of changing the aviation policies and rules in favor of him. In 2001, Arun Shourie, then Minister in the NDA government had revealed the details of the Intelligence Bureau report which raised serious doubts about the source of funding of Goyal which later on was not taken up by any political parties for discussions. Tail Winds, one of Goyals' companies having a share in Jet, is based in Isle of Man, a tax-haven country.65 There were also doubts on Goyal's interests as he is considered to be a nonresident Indian living in England.

Conclusion

This case study gives a detailed description of the trajectories of a business company in the transport sector, since inception until its extinction. Jet Airways was the first private airline company introduced in India to cater to the corporate sector and it offered a set of service standards to the aviation industry to be emulated by its competitors. The slogan "Joy of Flying", created an appeal to acquire 15-20% of the market share of the Indian airline passengers. However, overdue in payments to vendors, lenders, and staff questioned the credibility of Jet Airways to continue operations and it ended the legacy after 25 years.

- "Jet Airways Reinstates All Sacked Employees", India Today, available at https://www.indiatoday. in/latest-headlines/story/jet-airways-reinstates-all-sacked-employees-31754-2008-10-16. Accessed on October 16, 20018.

- "Flight Returned from Taxiway to Offload Naresh Goyal: Sources", The Economic Times, available at https://economictimes.indiatimes.com/news/politics-and-nation/flight-returned-from-taxiwayoffload-naresh-goyal-sources/articleshow/69507780.cms?from=mdr. Accessed on May 27, 2019.

- Rajput Rashmi, "MCA Orders Probe into Jet Airways Over Alleged Mismanagement, Including Siphoning of Funds", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/mca-orders-probe-into-jet-airways-over-alleged-mismanagement-including-siphoning-of-funds/articleshow/70077599.cms?from=mdr. Accessed on July 4, 2019.

- PTI, "MHA Look Out Notice Against Goyal Stops him from Leaving India", Business Standard, available at https://www.business-standard.com/article/pti-stories/mha-look-out-notice-against-goyal-stops-him-from-leaving-india-119052501017_1.html. Accessed on May 25, 2019.

- Wikipedia, the Free Encyclopedia, https://en.wikipedia.org/wiki/Naresh_Goyal. Accessed on June 21, 2019.

- "Naresh Goyal Before his Step Down: The Man Who Aimed High", The Telegraph, available at https://www.telegraphindia.com/india/naresh-goyal-before-his-stepdown-the-man-who-aimed-high/cid/1687510. Accessed on March 25, 2019.

- Pop Flock, "Naresh Goyal", available at http://www.popflock.com/learn?s=Naresh_Goyal. Accessed on June 20, 2019.

- Wikipedia, the Free Encyclopedia, available at https://en.wikipedia.org/wiki/Jet_Airways. Accessed on July 3, 2019.

- Chowdhury Anirban and Mihir Mishra, "The Rise and Fall of India's Oldest Private Airline", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/jet-airways-naresh-goyals-folly-how-to-crash-a-business/articleshow/68930916.cms?from=mdr. Accessed on April 22, 2019.

- Timmons Heather, "Jet Airways Agrees to Take Over Air Sahara", The New York Times, available at https://www.nytimes.com/2007/04/12/business/worldbusiness/12iht-sahara.4.5258307.html. Accessed on April 12, 2007.

- P Manoj, "Jet Plans to Turn Air Sahara into Jetlite: Renegotiate Boeing Leases", Live Mint, available at https://www.livemint.com/Companies/qkXpce3xZBoHp7ad6XR0TP/Jet-plans-to-turn-Air-Sahara-into-Jetlite-renegotiate-Boein.html. Accessed on April 17, 2007.

- "Jet Reinstates All Sacked Employees", Rediff.com, available at https://www.rediff.com/money/2008/oct/17jet.htm

- Wikipedia, the Free Encyclopedia, available at https://en.wikipedia.org/wiki/Jet_Airways. Accessed on October 17, 2008.

- PTI, "Jet Airways Merges JetLite with Jet Konnect", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/jet-airways-merges-jetlite-with-jetkonnect/articleshow/12330847.cms?from=mdr. Accessed on March 20, 2012.

- Phadnis Aneesh, "All You Need to Know About Jet Etihad Deal", Business Standard, available at https://www.business-standard.com/article/companies/all-you-need-to-know-about-jet-etihad-deal-113112000302_1.html. Accessed on November 20, 2013.

- Rai Nayantara, "Lenders May Invoke Naresh Goyal's 51% Stake in Jet Airways", The Economic Times, available at https://economictimes.indiatimes.com/markets/stocks/news/lenders-may-discuss-invoking-naresh-goyals-51-stake-in-jet-airways/articleshow/68482134.cms?from=mdr. Accessed on March 19, 2019.

- India Today Web Desk, "Trouble Mounts for Jet Airways: Here are Key Factors that Led to Airlines Financial Crisis", India Today, available at https://www.indiatoday.in/business/story/jet-airways-financial-crunch-key-points-to-know-about-financial-crisis-1402161-2018-12-04. Accessed on December 4, 2018.

- "Jet Airways Share Price Falls After Four More Aircrafts Grounded Due to Non-Payment of Dues", Business Today, available at https://www.businesstoday.in/markets/company-stock/jet-airways-share-price-falls-aircraft-grounded-non-payment-dues/story/327173.html. Accessed on March 13, 2019.

- "Naresh Goyal, Wife Anita Goyal to Step Down from Jet Airways Board Today", Business Today, available at https://www.businesstoday.in/current/corporate/naresh-goyal-wife-anita-goyal-to-step-down-from-jet-airways-board-today/story/330658.html. Accessed on March 25, 2019.

- "Indian Oil Corporation Resumes Fuel Supply to Jet Airways", Times of India, available at https://timesofindia.indiatimes.com/business/india-business/indian-oil-corporation-resumes-fuel-supply-to-jet-airways/articleshow/68740641.cms. Accessed on April 05, 2019.

- PTI, "Cargo Agent Seizes Jet Plane in Amsterdam for Dues", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/cargo-agent-seizes-jet-plane-in-amsterdam-for-dues/articleshow/68813441.cms?from=mdr. Accessed on April 10, 2019.

- Twitter.com/Jet Airways, available at https://twitter.com/jetairways/status/11185495623801 77410?lang=en. Accessed on July 15, 2019.

- "Airlines Body IATA Suspends Jet from Clearing House Membership", Live Mint, available at https://www.livemint.com/companies/news/airlines-body-iata-suspends-jet-from-clearing-house-membership-1555601616042.html. Accessed on April 18, 2019.

- "Spice Jet, Vistara Add Planes to Make the Most of Jet Airways Slots", Live Mint, available at https://www.livemint.com/companies/news/spicejet-vistara-add-planes-to-make-the-most-of-jet-airways-slots-1558724526536.html. Accessed on May 25, 2019.

- Balachandran Manu, "Naresh Goyal, 'Sad', 'Deeply Distressed' Ahead of Jet Airways Bankruptcy Hearing", Forbes India, available at http://www.forbesindia.com/printcontent/54003. Accessed on June 18, 2019.

- "Jet Airways Fleet Details and History, Planes Plotters", available at https://www.planespotters.net/airline/Jet-Airways. Accessed on June 30, 2019.

- "Why India's Jet Airways Lost Its Wings", Knowledge at Wharton, available at https://knowledge.wharton.upenn.edu/article/jet-airways-shuts/. Accessed on April 25, 2019.

- PTI, "Lenders File for Jet Airways Bankruptcy: Hearing from Wednesday", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/lenders-file-for-jet-airways-bankruptcy-hearing-from-wednesday/articleshow/69843582.cms? from=mdr. Accessed on June 18, 2019.

- Goyal Sandeep, "Opinion, Jet Airways Crisis: As Winds of Change Blow, It is No More Jet Set Go", Live Mint, available at https://www.livemint.com/opinion/online-views/opinion-jet-airways-crisis-as-winds-of-change-blow-it-is-no-more-jet-set-go-1555635423736.html. Accessed on April 19, 2019.

- Sanjib Dutta (2002), "Jet Airways Story", Case Ref no 302-158-1, ICMR Publications, Case Centre, https://www.thecasecentre.org/main/products/view?id=21514

- Anirban Chowdhury and Mihir Mishra, "What's Ailing the Indian Aviation Industry?", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/whats-ailing-the-indian-aviation-industry/articleshow/68970564.cms? from=mdr. Accessed on April 21, 2019.

- Vidovic Andrija, Igor Stimac and Damir Vince (2013), International Journal of Traffic and Transport Engineering, Vol. 3, No. 1, pp. 69-81, available at http://ijtte.com/uploads/2013-03-25/5d57e65e-a0a9-482fIJTTE_Vol%203(1)_7.pdf

- H K Hamzathul (2012), Airline Management Critical Review of LCC VS Legacy Carrier.

- R Doganis (2007), The Airline Business, p. 304, Second Edition, Routledge, USA.

- "ICAO 2018 Review - Record Profits, LCC Market Share Increasing, Air Transport Carrying Over One Third of World Trade, But a Bad Year for Accidents", The Blue Swan Daily, available at https://blueswandaily.com/icao-2018-review-record-profits-lcc-market-share-increasing-air-transport-carrying-over-one-third-of-world-trade-but-a-bad-year-for-accidents/. Accessed on January 4, 2019.

- "ICAO Global Air Passenger Growth 'Solid' in 2018", GTP Headlines, available at https://news. gtp.gr/2019/01/09/icao-global-air-passenger-growth-solid-2018/. Accessed on January 9, 2019.

- Balachandran Manu, "The Pioneer of Low Cost Flights in India is Making a Comeback to Connect Its Small Towns", Quartz India, available at https://qz.com/india/947914/captain-gopinath-of-air-deccan-the-pioneer-of-low-cost-flights-in-india-is-making-a-comeback-to-connect-its-small-towns/. Accessed on April 6, 2017.

- 38 Awtaney Ajay, "Jet Airways Crisis Benefits Indigo, SpiceJet and Vistara: Intensifies Three Way Battle Between Airlines", First Post, available at https://www.firstpost.com/business/jet-airways-crisis-benefits-indigo-spicejet-and-vistara-intensifies-three-way-battle-between-airlines-6724821.html. Accessed on May 30, 2019.

- "India's Airlines, LCC and FSC Must Review their Business Models May Be Creating Space for Air Asia", Centre for Aviation, available at https://centreforaviation.com/analysis/reports/indias-airlines-lcc-and-fsc-must-review-their-business-models-maybe-creating-space-for-airasiaia-128482. Accessed on July 18, 2019.

- PTI, "Air India Likely to Offer Laptops to Business Class Passengers", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/air-india-likely-to-offer-laptops-to-business-class-passengers/articleshow/62417100.cms?from=mdr. Accessed on January 8, 2018.

- PTI, "Jet Airways Merges JetLite with JetKonnect", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/jet-airways-merges-jetlite-with-jetkonnect/articleshow/12330847.cms?from=mdr. Accessed on March 20, 2012.

- Ranjan Saharsh, "An Emergency Landing: Jet Airways Crisis", The Mit Post, available at https://themitpost.com/emergency-landing-jet-airways-crisis/. Accessed on July 11, 2019.

- PTI, "Jet Airways to Stop Free Meals to Most Economy Passengers", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/jet-airways-to-stop-free-meals-for-most-domestic-economy-passengers/articleshow/66923328.cms? from=mdr. Accessed on December 3, 2018.

- PTI, "Jet Airways Withdraws Lounge Access for Economy Class Fliers", Live Mint, available at https://www.livemint.com/Companies/d2WYBqUwI1Rcr16e4odfiI/Jet-Airways-cuts-down-on-lounge-services-to-reduce-costs.html. Accessed on November 24, 2018.

- "India Brand Equity Foundation", available at https://www.ibef.org/industry/tourism-hospitality-india.aspx. Accessed on July 17, 2019.

- "Full Service Carriers Likely to Post Loss of 15 Bn", Business Line, available at https://www.thehindubusinessline.com/companies/full-service-carriers-likely-to-post-loss-of-15-bn/article26245502.ece. Accessed on February 12, 2019.

- IATA, available at https://www.iata.org/publications/economics/Reports/India-aviation-summit-Aug18.pdf. Accessed on June 15, 2019.

- Bitzan John and James Peoples, "A Comparative Analysis of Cost Changes for Low Cost, Full Service, and Other Carriers in the US Airline Industry", ComparisonofFSCandLCCandTheirMarketSharein Aviation.pdf

- "Around 55% of Seats in India Market are Offered by Low Cost Carriers", Tourism Breaking News, available at https://tourismbreakingnews.com/around-55-of-all-seats-in-india-market-are-offered-by-low-cost-carriers/. Accessed on February 1, 2019.

- "Grounding of Jet Airways, Kingfisher Casts Doubts on India Aviation Boom", Live Mint, available at https://www.livemint.com/companies/news/grounding-of-jet-airways-kingfisher-casts-doubt-on-india-aviation-boom-1555652386045.html. Accessed on April 19, 2019.

- Prabhakar Binoy, "Why India's Airlines No Longer Looking at Profits or Loss But at Survival or Extinction?", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/why-indias-airlines-no-longer-looking-at-profit-or-loss-but-at-survival-or-extinction/articleshow/10622726.cms?from=mdr. Accessed on November 6, 2011.

- Wilkes Tommy, "Ghosts Airports Highlight Risks as Modi Spends to Grow", Reuters, available at https://in.reuters.com/article/india-airport/ghost-airports-highlight-risks-as-modi-spends-to-grow-idINKCN0QN2BV20150819. Accessed on August 19, 2015.

- India Today, "Trouble Mounts for Jet Airways: Here are Key Factors that Led to Airline's Financial Crisis", available at https://www.indiatoday.in/business/story/jet-airways-financial-crunch-key-points-to-know-about-financial-crisis-1402161-2018-12-04. Accessed on December 4, 2018.

- PTI, "Dutch Bankruptcy Administrator Moves NCLAT on Jet Airways Matter", The Economic Times, available at https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/dutch-bankruptcy-administrator-moves-nclat-on-jet-airways-matter/articleshow/7018 9058.cms?from=mdr. Accessed on July 12, 2019.

- "Its Official: Jet Airways to Go Under Insolvency", India Today, available at https://www.indiatoday.in/business/story/jet-airways-bankruptcy-nclt-order-1552953-2019-06-20. Accessed on June 20, 2019

- Kundu Rhik, "NCLT to Next Hear Jet Airways Case on 23 July", Live Mint, available at https://www.livemint.com/companies/news/nclt-to-hear-jet-airways-case-next-on-23-july-1562328123 406.html. Accessed on July 5, 2019.

- S Makesh Kumar (2016), https://shodhganga.inflibnet.ac.in/bitstream/10603/132841/9/09_ chapter3.pdf

- Tiwari Vaibhav, "Jet Airways Crisis Explained in 10 Points", NDTV, available at https://www.ndtv.com/india-news/jet-airways-crisis-explained-in-10-points-2024637. Accessed on April 17, 2019.

- Quora.Com, https://www.quora.com/What-has-gone-wrong-with-Jetairways. Accessed on July 3, 2019.

- Bandrawala Simone (2013), "Jet Airways Retrenchment Case Study", available at https://www.scribd.com/doc/161888890/jet-airways-retrenchment-case-study

- AFP, "5 Things That Went Wrong for Jet Airways", Live Mint, available at https://www.livemint.com/companies/news/5-things-that-went-wrong-for-jet-airways-1555488148493.html. Accessed on April 17, 2019.

- The Wire, "India's Airlines are in Trouble Again. What will the Modi Government Do?", Daily Hunt, available at https://m.dailyhunt.in/news/nepal/english/the+wire+english-epaper-wireng/india+s+airlines+are+in+trouble+again+what+will+the+modi+government+do-newsid-1020 51192. Accessed on November 22.

- Anirban Chowdhury and Mihir Mishra, "What's Ailing the Indian Aviation Industry?", The Economic Times, https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/whats-ailing-the-indian-aviation-industry/articleshow/68970564.cms?from=mdr. Accessed on April 21, 2019.

- "Jet Airways Crisis, 18 April 2019", Forum IAS, available at https://blog.forumias.com/article/7-pm-jet-airways-crisis-18-april-2019. Accessed on April 18, 2019.

- Wikipedia, The Free Encyclopedia, available at https://en.wikipedia.org/wiki/Jet_Airways. Accessed on July 20, 2019.