Mar '21

The IUP Journal of Case Folio

Archives

The P&G-Merck KGaA Consumer Health Business Merger

Manish Agarwal

Faculty Associate, IBS Case Research Center, IBS Hyderabad (Under IFHE - A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: manish@icmrindia.org

Sanjib Dutta

Research Lead, IBS Case Research Center, IBS Hyderabad (Under IFHE - A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: sanjibdutta@icmrindia.org

The case discusses the M&A deal between the Germany-based global pharmaceutical company Merck KGaA and the US-based, multinational FMCG company P&G. In this deal, P&G acquired a 100% stake in the consumer health business of Merck KGaA for $4.2 bn. The case helps the students understand the various aspects of an M&A deal. It explores the rationale behind the merger deal, from both P&G's and Merck KGaA's perspective. It discusses the various developments that took place before and after the merger was announced. It provides sufficient scope to debate the various possible synergies and various challenges related to this deal. The case ends with a debate on whether the merger would be successful or not.

This acquisition helps us continue to drive sales and profit growth for P&G by providing the capabilities and portfolio scale we need to operate a winning global OTC business on our own, without the aid of a healthcare partner.1

- Tom Finn, President, P&G Global Personal Healthcare, April 2018

Introduction

On April 18, 2018, US multinational FMCG major Procter & Gamble Company (P&G) acquired a 100% stake in the Consumer Health Business (CHB) of Merck KGaA (Merck), a global pharmaceutical company headquartered in Germany. David Taylor, Chairman of the Board, President and Chief Executive Officer of P&G, said, "We like the steady, broad-based growth of the OTC Healthcare market and are pleased to add the consumer health portfolio and people of Merck KGaA, Darmstadt, Germany, to the P&G family."2 Stefan Oschmann, Chairman of the Executive Board and CEO of Merck, said, "Consumer Health is a strong business that deserves the best possible opportunities for its future development. With P&G we have found a strong, highly recognized player who has the necessary scale to successfully drive the business going forward."3

Industry experts believed that the acquisition of Merck's CHB by P&G would generate the expected synergies and help P&G gain the much-needed growth in revenue, which had gone southward due to the product portfolio restructuring the company had started in 2014.

However, some analysts were skeptical about the outcome of the merger as the culture of both the companies was different, P&G being one of the oldest US-based companies and Merck one of the oldest companies based in Germany. Experts believed that the merger could also fail to generate synergies as in the case of the failed merger between the two automobile giants-Chrysler from the US and Daimler from Germany.4

A Note on Procter & Gamble

P&G was founded in 1837 at Ohio, US, by two brothers-in-law-William Procter, a migrant from England, and James Gamble, a migrant from Ireland. Over a period of time, the company became one of the leading FMCG companies in the world.

The company dealt with baby, feminine and family care, fabric and home care, hair care, grooming, skin and personal care, and healthcare products. It owned some renowned global brands such as Ambi Pur, Ariel, Always, Charmin, Fusion, Gillette, Head & Shoulders, Mach3, Olay, Old Spice, Oral-B, Pampers, Pantene, Tide, and Vicks.5 The company produced its wide range of products in 24 manufacturing units in the US and 89 units in 38 other countries around the world.6 Its products were sold in departmental stores and grocery stores and through distributors, wholesalers, drug stores, e-commerce companies, etc.

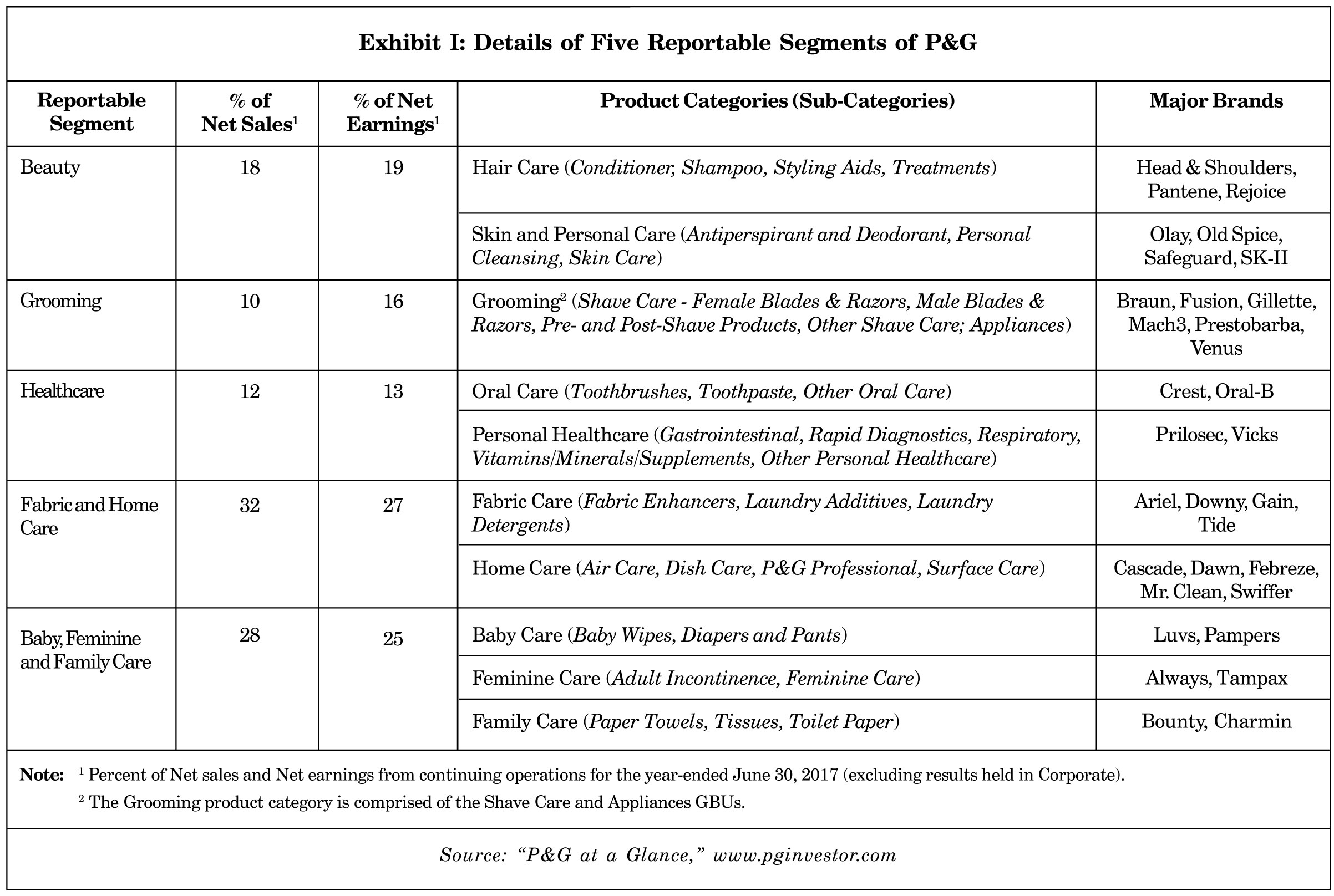

P&G had five business reporting segments-Beauty; Grooming; Health Care; Fabric and Home Care; and Baby, Feminine and Family Care. Fabric and Home Care was the largest segment with a 32% contribution to net sales in 2017. This segment was followed by Baby, Feminine, and Family Care (28%), Beauty (18%), Healthcare (12%), and Grooming (10%). These five reporting segments were further divided into 10 product categories (Refer Exhibit I for five reportable segments of P&G).

Product Portfolio Restructuring at P&G

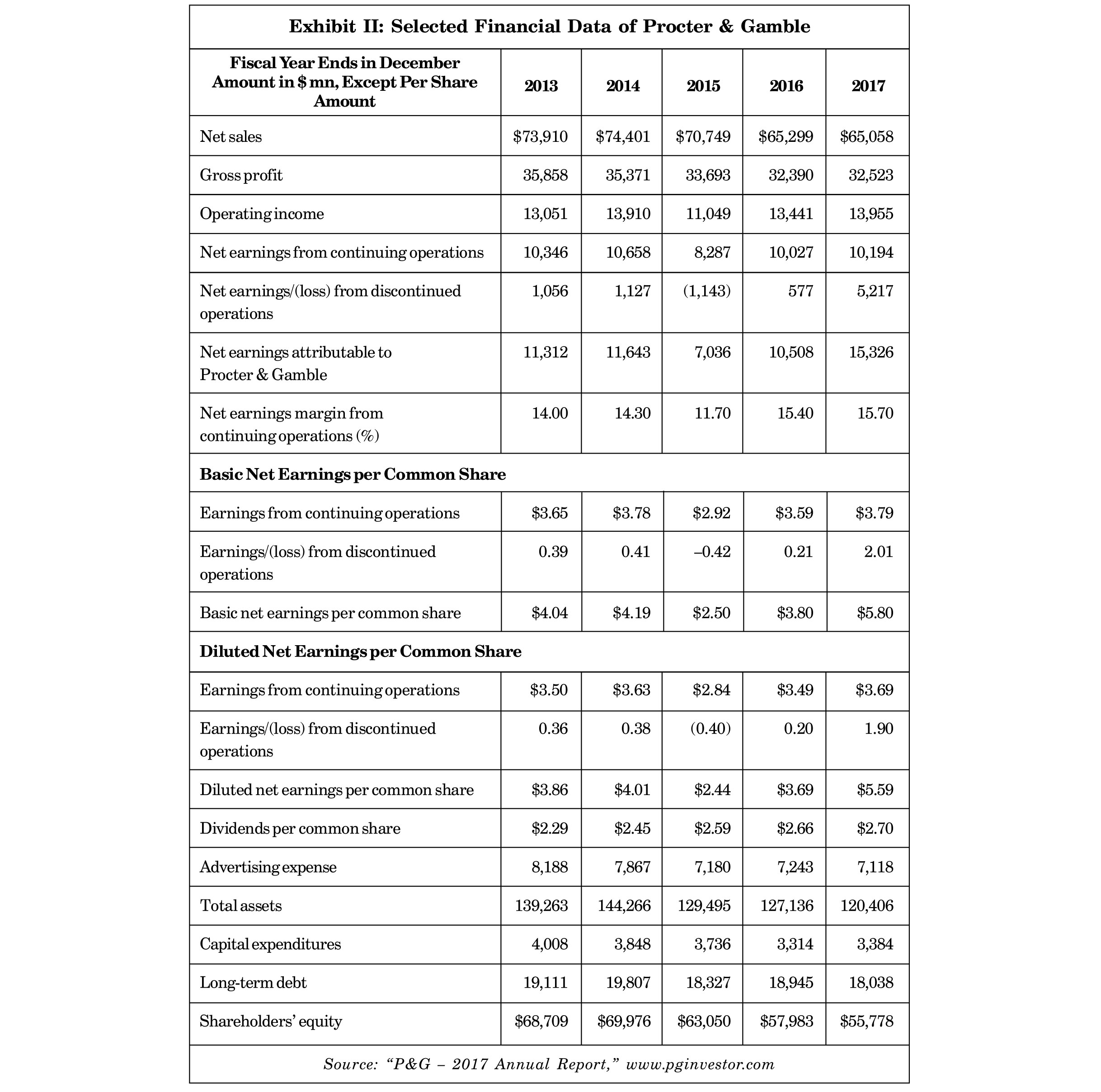

At the end of FY14, P&G reported net sales of $74.4 bn compared to $73.9 bn sales in FY13 and $73.1 bn net sales in FY12. Net earnings also grew at a slower pace from $10.8 bn in FY12 to $11.3 in FY13 and then $11.6 bn in FY14.7 Analysts opined that the cut-throat competition, slow sales growth, strengthening of the US dollar, and poor growth in the developed markets could be major reasons for the slow growth in P&G's net sales and net profit.

In August 2014, P&G had announced a product portfolio restructuring plan to divest itself of non-core and low growth brands. P&G planned to reduce its brand's portfolio and the number of employees to reduce cut costs and speed up the growth of the company. A.G. Lafley, the then Chief Executive of P&G, said, "Less will be much more."8

Following its product portfolio restructure plan, P&G sold, consolidated, and discontinued around 100 brands that had not performed well and did not match with the strategy of the company. In 2014, P&G completed the disinvestment of its Pet Care business to Mars Inc. (Mars) and Spectrum Brands.9 The same year, it sold its Duracell batteries business to Berkshire Hathaway.10 In July 2015, P&G announced a deal with Coty Inc. to divest itself of four of its product categories including more than 40 beauty brands, fine fragrance, hair care, and color, cosmetics businesses, etc. According to P&G's 2015 annual report, after the sale of various non-core businesses, it was left with around 65 brands which contributed 85% toward sales and 95% of the profit before tax.11

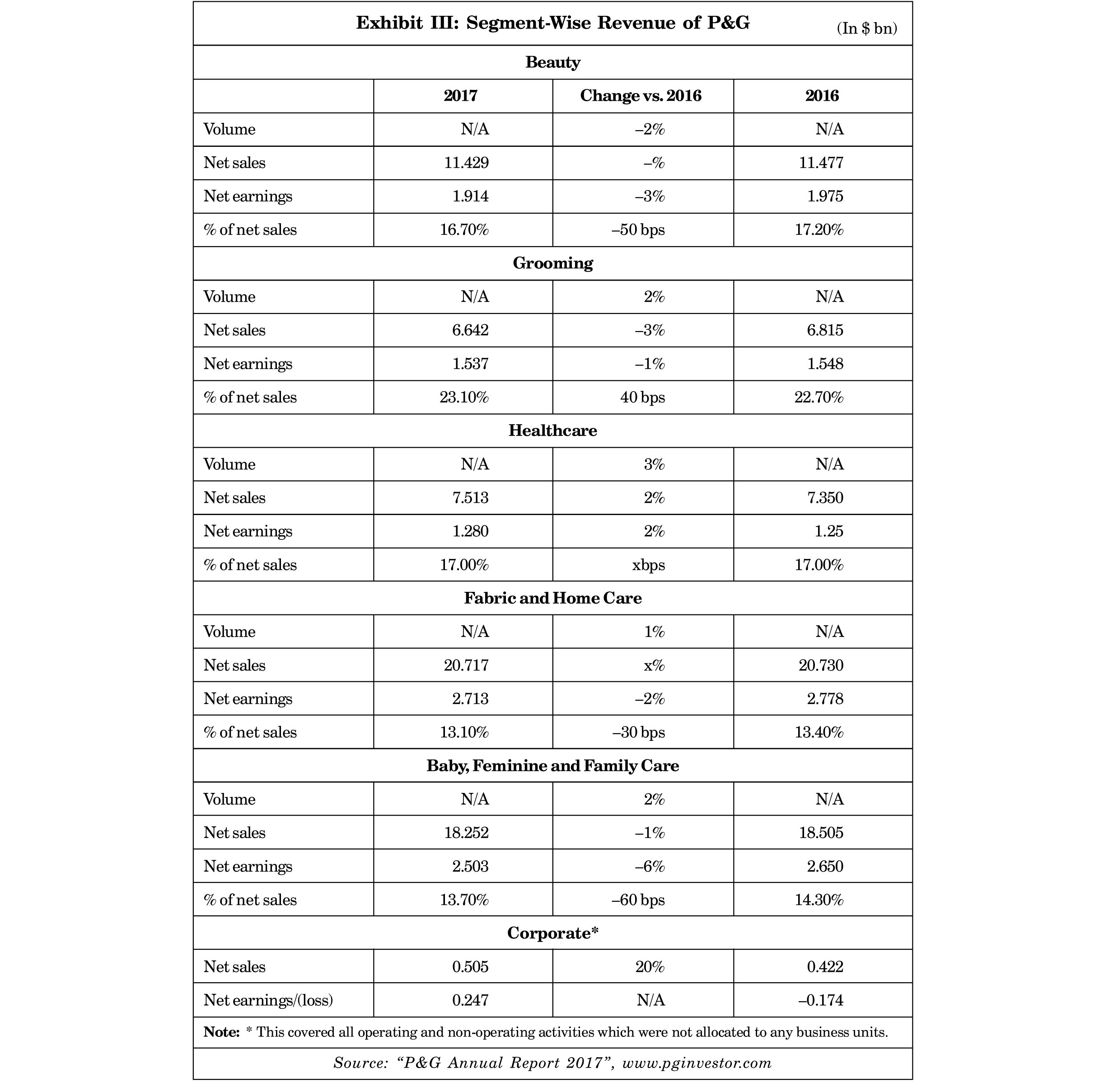

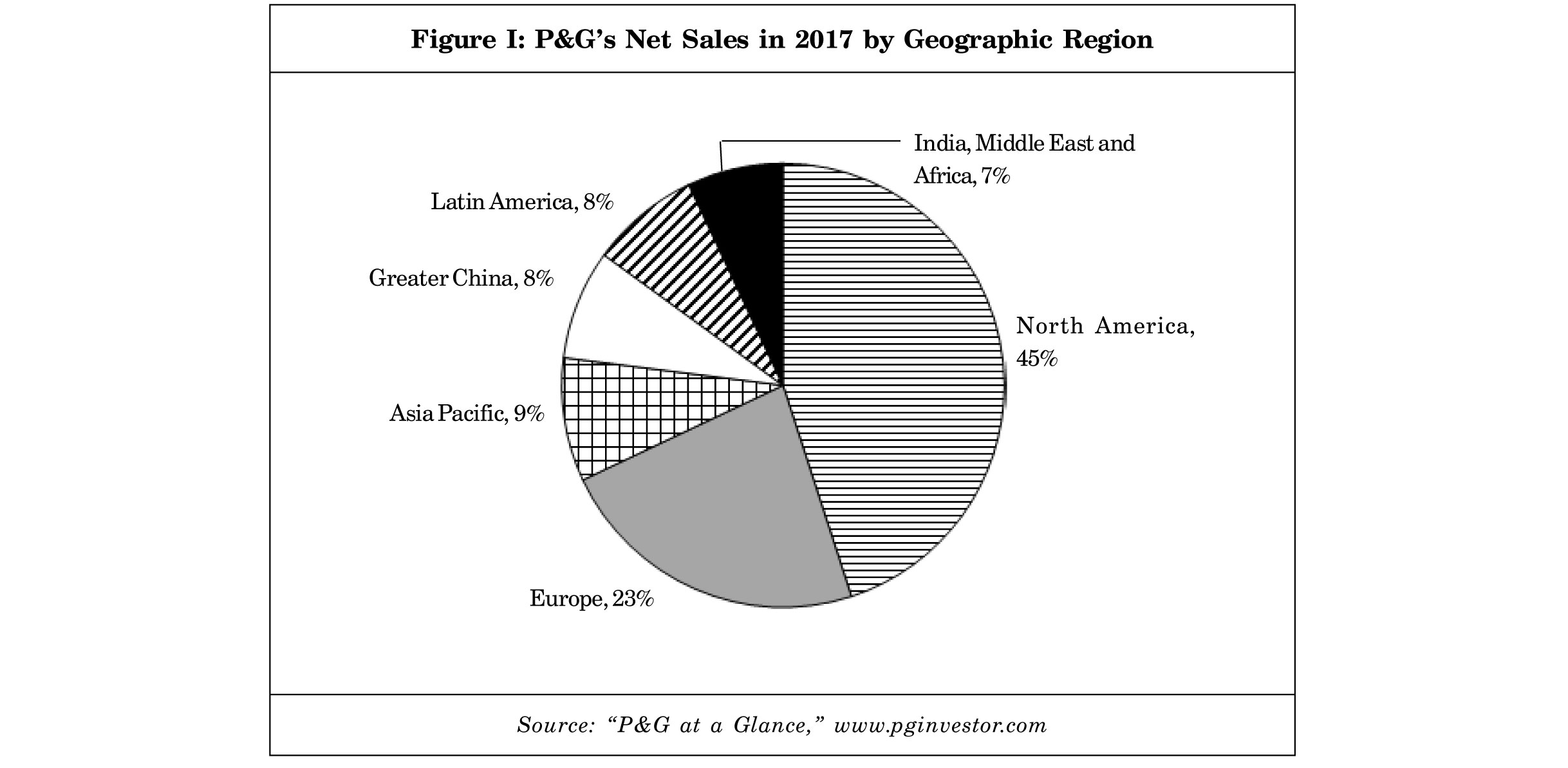

According to experts, the impact of restructuring soon started showing up in the financials of the company. On the one side, net sales dropped and on the other, net profit increased due to reduced costs. In 2017, P&G generated $65.1 bn net sales, lower than the net sales of $65.3 bn in 2016 and $70.7 bn in 2015. However, net earnings increased from $7.1 bn in 2015 to $10.5 bn in 2016 and $15.3 bn in 2017 (Refer Exhibit II for selected financial data of P&G).12 Healthcare was the only segment of the company where net sales, as well as the net earnings grew in 2017 over 2016 (Refer Exhibit III segment-wise revenue of P&G). In 2017, P&G generated a major part of its net sales from North America (45%) followed by Europe (23%), and the Asia Pacific (9%) (Refer Figure I).13

A Board Seat for Nelson Peltz

In February 2017, Nelson Peltz (Peltz), a veteran American billionaire, activist investor, and one of the founding partners of Trian Fund Management, purchased a 1.5% stake in P&G for $3.5 bn.14 Peltz then asked for a seat on the board of P&G, but initially the company did not agree. Peltz criticized the company for its corporate structure, poor returns to shareholders, slow growth rate, and narrow-minded culture. He criticized the company for its sluggish changes, given the rapidity with which consumer demand was changing.

In October 2017, Peltz lost by a small margin the chance to win a directorship in P&G through direct shareholders voting at the annual meeting. However, later, an independent election inspector-IVS Associates-confirmed that the shareholders of P&G had elected Peltz.

In December 2017, the company decided to give a seat to Peltz on its board from March 1, 2018. Experts stated that this decision had ended one of the costliest battles in the corporate history of the US. Peltz said, "P&G is a great company with tremendous potential. I am looking forward to working closely with David Taylor and the board toward our shared goals of driving market share growth and improved margins to create more value for all P&G shareholders."15

Peltz wanted P&G to make radical changes in the company. He asked the company to reduce the number of corporate employees and global business units to three from five. He believed P&G should build more businesses were it able to sell products directly to customers. Additionally, he wanted P&G to reduce its business to a business model where it sold its goods to retailers instead of to customers.16 According to P&G's 2017 annual report, the top 10 customers of P&G contributed about 35% of its total sales in 2017. Walmart was the largest customer of P&G with a 16% contribution in the total sales of 2017 and a 15% contribution in the total sales of 2016 and 2015.17

Peltz also pushed P&G for acquisition to increase its market share, profit, and growth rate. He asked P&G to acquire small brands and reduce dependence on old legacy brands such as Gillette, Tide, etc. Although P&G had restructured its product portfolio through divestiture, discontinuation, and consolidation, the company had not made any acquisition between FY14 and FY17, experts pointed out.

At last, on March 3, 2018, Peltz formally joined the board. It was at that time that Merck was trying to sell off its CHB.

A Note on Merck KGaA

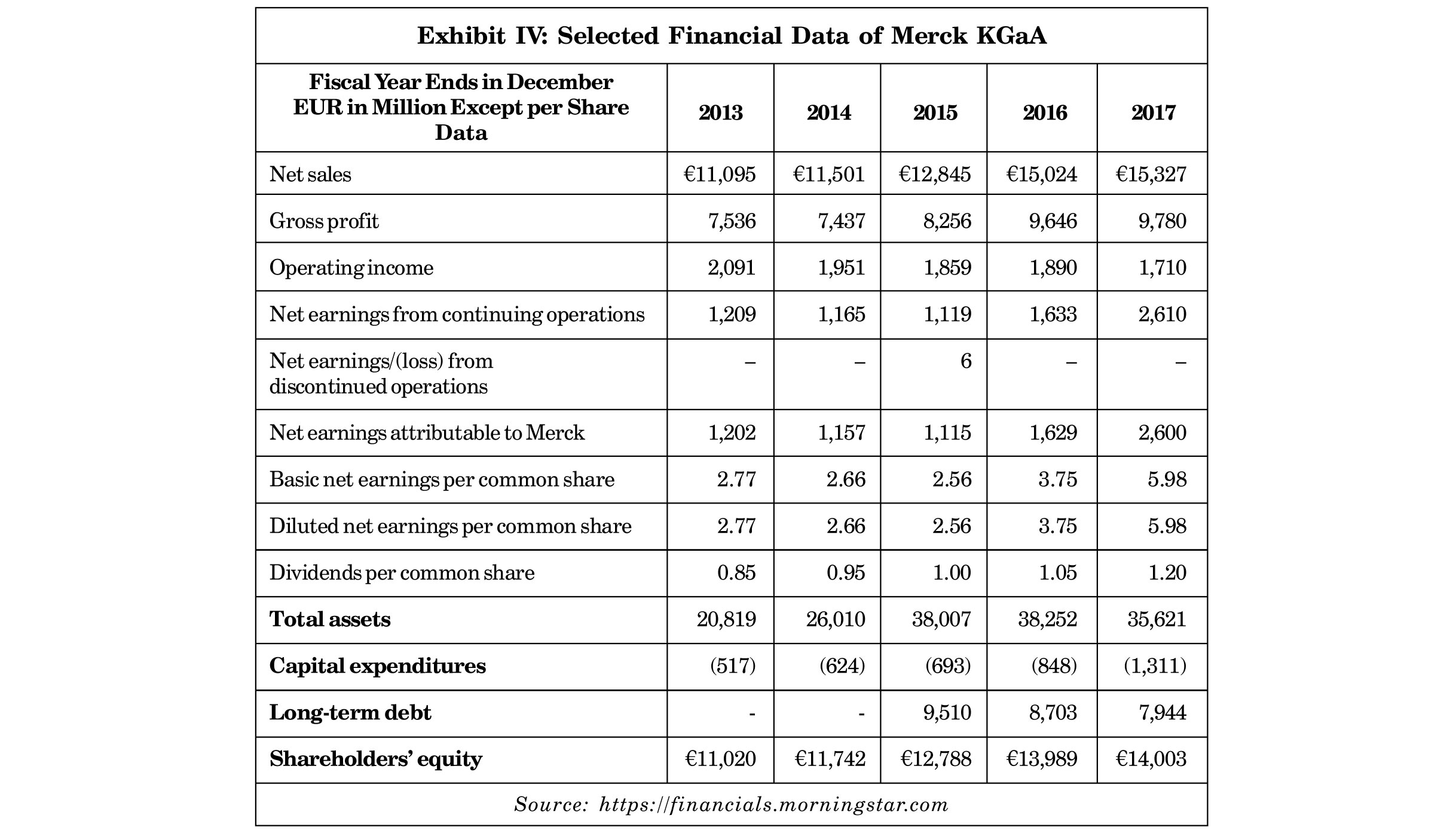

Merck, a global pharmaceutical company, was started in 1668 by Friedrich Jacob Merck in Darmstadt, Germany. The majority of the stake in the company was owned by the Merck family through E Merck KG.18 The company had generated ¤15.3 bn in net sales in 2017, which was ¤303 mn higher than the net sales of 2016. However, during the same period, the company's net profit increased from ¤1.6 bn in 2016 to ¤2.6 bn in 2017 (Refer Exhibit IV Selected Financial Data of Merck KGaA).

Merck ran its business under three groups-Healthcare, Life Science, and Performance Materials-and had 53,000 employees in 66 countries.19 Healthcare was the largest business group and contributed 46% of Merck's total revenue. This segment researched, developed, and manufactured prescription medicines for various treatments, Over the Counter (OTC) products, and food supplement products.20 The healthcare segment was further divided into three businesses-Allergopharma, Biopharma, and Consumer Health. Merck's CHB developed and sold OTC and food supplements products.

As per Merck's annual report 2017, the CHB was one of the top 15 brands around the world in the OTC market. The CHB had more than 900 products and included 10 strategic brands and covered 44 markets around the world.21,22,23 The major part of the revenue of this segment came from developing countries such as Brazil, Greece, India, Indonesia, South Africa, etc. Merck's CHB business included various brands including Nasivin, a nasal decongestant; Femibion, a pregnancy supplement; and Neurobion, a combination of B vitamins.

The CHB had generated ¤860 mn in sales in 2016 and ¤911 mn in 2017.24 Between 2013 and 2017, CHB had registered an organic CAGR of ~6% with a healthy margin. The segment had generated ¤99 mn profit after tax by the end of 2017 with the help of ~3,300 employees around the world. This segment had assets of ¤647 mn and liabilities of ¤192 mn as on December 31, 2017. It had two production facilities-one in Spittal, Austria, and the other in Goa in western India.25, 26

Merck Puts Consumer Health Business on the Block

On September 5, 2017, Merck announced that the company was analyzing various options for its consumer health business to focus on the Biopharma segment. Merck was considering selling off the CHB partially or completely or even entering into a strategic partnership. The high margin liquid crystals business, which generated 15% of Merck's total revenue in 2016 and had declined due to competition from Chinese companies, was one of the reasons for Merck to divert its CHB business.27

Merck stated that CHB was a profitable business unit and was operated in a growing market with a positive market condition. However, Merck had internal funding limits to fund the CHB, and divestment could help CHB to could grow to its full potential. In a statement, Belen Garijo, CEO of Merck's healthcare business, said, "We expect increasing internal constraints to fund the [Consumer Health] business to reach the required scale Any possible proceeds from a potential transaction would be used to deliver on the company's overall financial targets."28

CHB was the second business that Merck planned to divert in 2017. Merck had sold its Biosimilars business to Fresenius Kabi29 in April 2017 for ¤670 mn30 and royalty on future sales of products.

Merck had appointed JPMorgan31 as financial adviser and Freshfields Bruckhaus Deringer LLP32 as legal adviser to sell off its CHB. The company and its financial adviser approached prospective candidates and requested them to submit their non-binding proposal by December 15, 2017. It planned to shortlist bidders by the end of December 2017. JPMorgan valued Merck's CHB at ¤4 bn ($4.8 bn).33 Merck offered to allow potential buyers to view confidential financial and other information on CHB. Experts pointed out that GlaxoSmithKline, Reckitt Benckiser, Johnson & Johnson, P&G, Sanofi S.A., Bayer AG, and even Nestle S.A. (Nestle) could be potential buyers of Merck's CHB.

Bidding Process Starts for Merck's CHB

In November 2017, Nestle showed an interest in buying Merck's CHB to expand its consumer health business. Nestle had also shown an interest in Merck's rival Pfizer's CHB, which was also on sale. Pfizer's CHB was bigger than Merck's CHB with an extensive product portfolio, and it generated revenue of US$3.4 bn in 2016.34

Stada Arzneimittel AG (Stada), a German-based pharmaceutical company owned by a private equity firm, had also bid for Merck's CHB, as had the Reckitt Benckiser Group PLC (RB) and Mylan NV (Mylan). On December 14, 2017, Perrigo Company PLC (Perrigo), a US-based international drugmaker, jumped into the fray as well for the CHB unit. Perrigo felt that its generic and OTC product portfolio fitted in well with the vitamins and supplements business of Merck.35

On January 10, 2018, Bloomberg reported that Nestle was the front-runner for Merck's CHB as it had offered the highest bid price.36 Perrigo and Stada had decided to drop out of the bidding process. However, RB and Mylan were still in the race for Merck's CHB.

In the first week of February 2018, Nestle too dropped out of the race to buy Merck's CHB as the buyer and seller were unable to arrive at a mutually acceptable price. RB also exited the race, as it showed an interest in Pfizer's CHB.

On February 22, 2018, Frankfurter Allgemeine Zeitung, a German daily newspaper, reported that after the end of the first round of bidding, Merck was expecting a lower price that earlier for CHB. On April 13, 2018, Reuters37 reported that Mylan NN (Mylan), a global pharmaceutical company, was in an advanced stage of discussions with Merck for the CHB. However, Mylan stated that the Reuters report was untrue.

The Deal

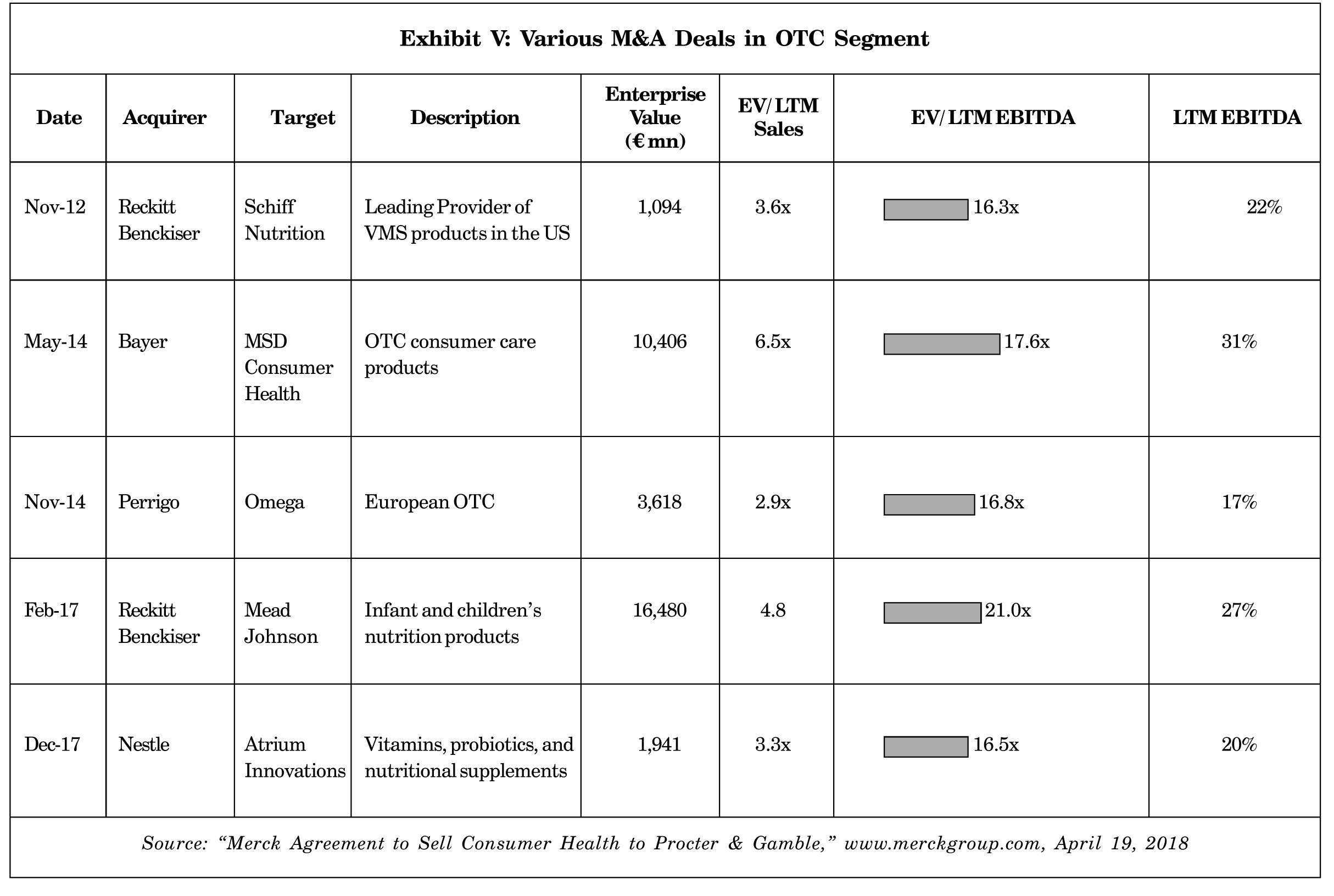

On April 18, 2018, P&G surprised everyone when it announced the acquisition of the whole consumer health business of Merck (CHB) in a debt-free and cash-free deal of ¤3.4 bn ($4.2 bn). Belen Garijo, Head of Healthcare at Merck, said, "We have found an ideal partner for consumer health and we have achieved a very attractive valuation."38 According to experts, the deal price was above the other M&A deals within the industry (Refer Exhibit V for various M&A deals in the OTC segment). The deal value was ~3.7 times of the Enterprise Value (EV) to sales and ~21.8 times of the EV to EBITDA.39 Analysts opined that the deal had gone through after Peltz joined the P&G board in March 2018.

Vincent Meunier, analyst at Morgan Stanley, said, "This will help (Merck) focus on its pharma unit and refurbish its pipeline."40 The sale proceeds helped Merck to increase the speed of repayment of debt.41 Merck planned to use the cash flow from the deal to deleverage itself and expected that the 'Net financial debt42 to EBITDA pre' would fall to below 2x (<2x) in 2018 from 2.5x on June 30, 2017.43 Additionally, Merck planned to use the cash flow to provide financial support to other business units, to fund small size acquisitions (

<500 mn), and to fund R&D activities in higher-margin prescription drugs.

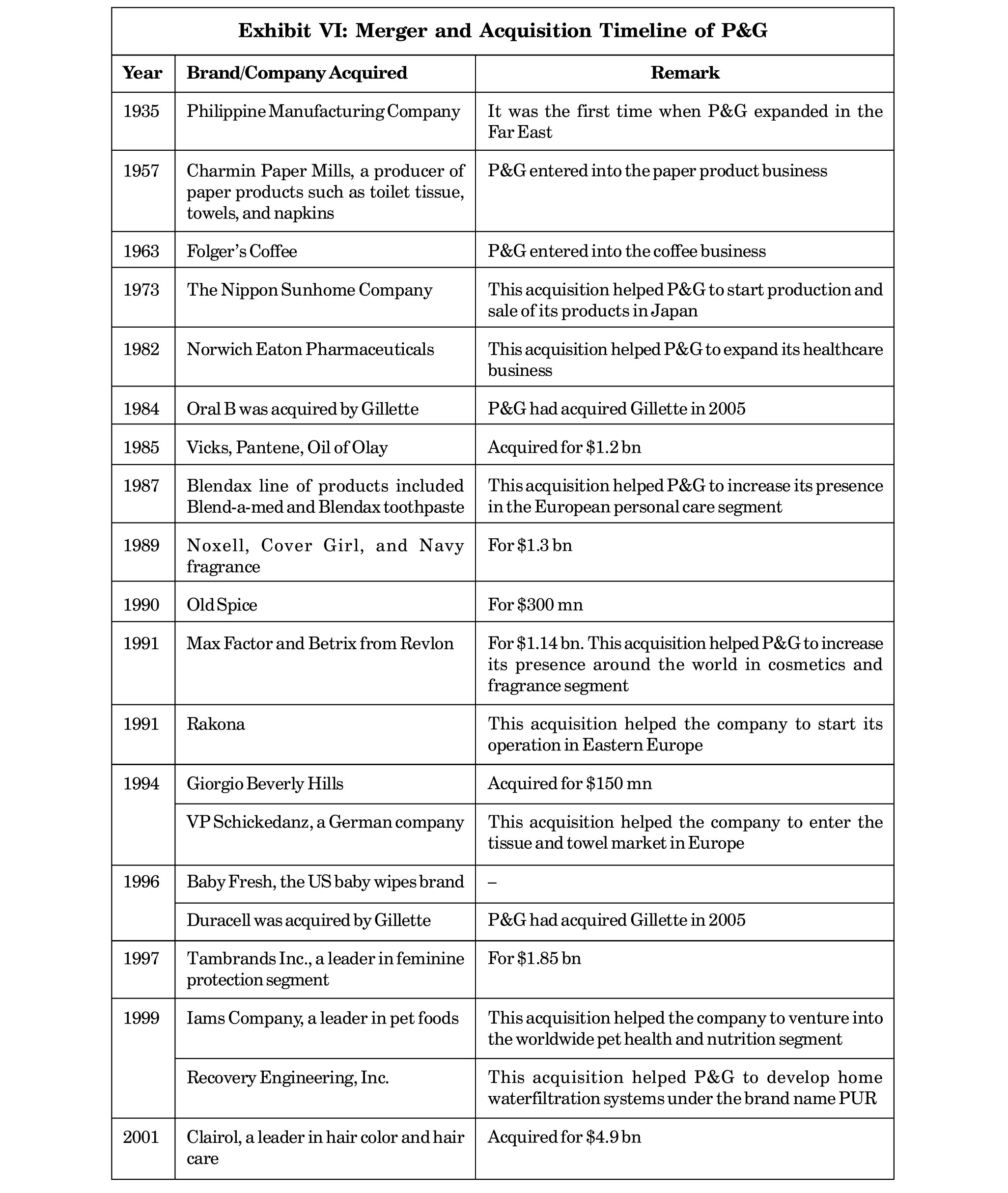

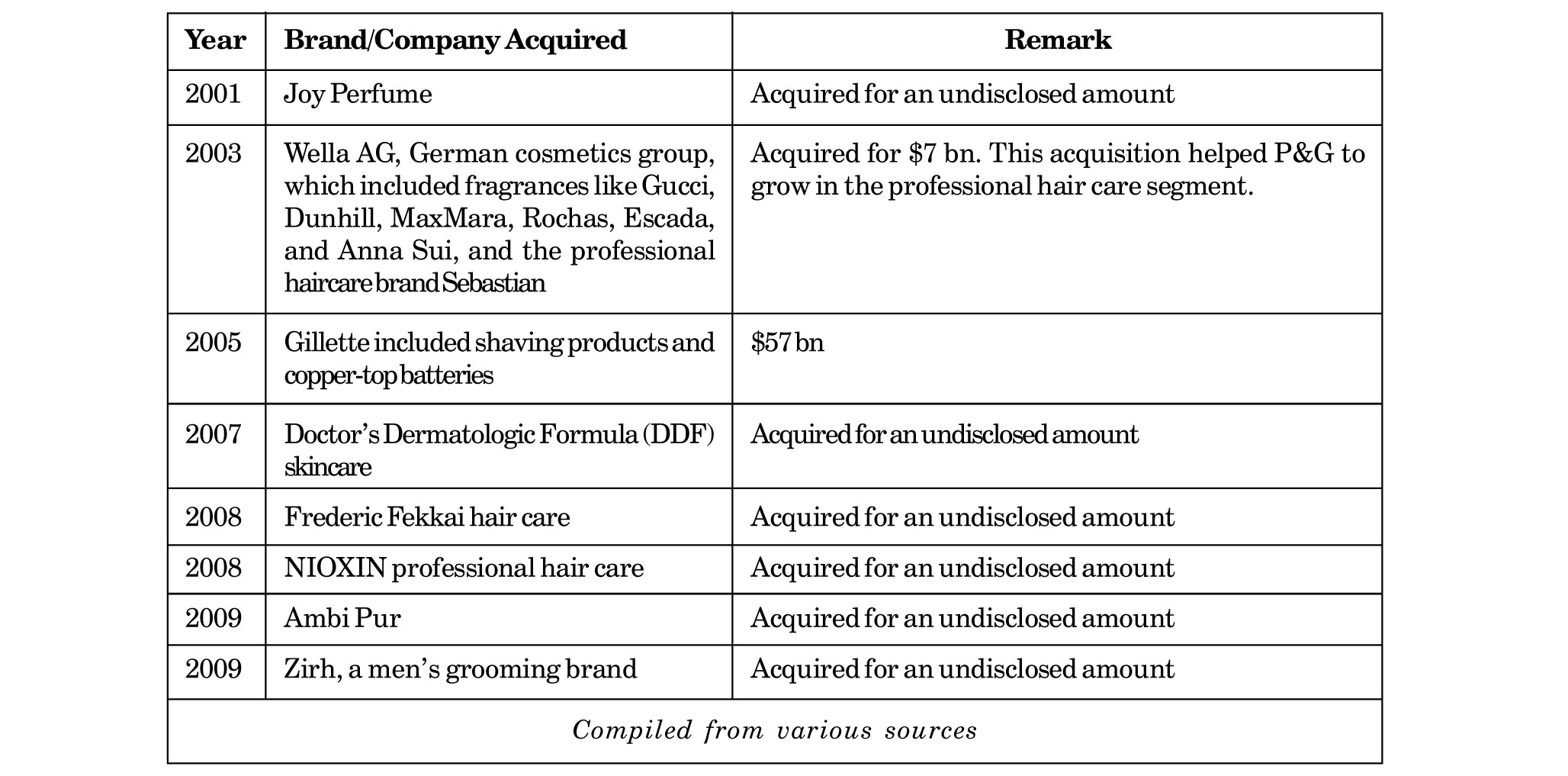

Merck's CHB was P&G's largest acquisition since 2005 when it had acquired Gillette for $57 bn (Refer Exhibit VI for Merger and Acquisition Timeline of P&G). In an interview, Velvet Gogol Bennett, Global Health Care Communications Director at P&G, said, "The acquisition of Merck KGaA Consumer Healthcare enables P&G to improve our PHC geographic scale, brand portfolio, and category footprint in all of our regions and in the vast majority of the world's top 15 OTC markets by adding a fast-growing portfolio of differentiated, physician-supported, multi-region brands. It also provides us with strong healthcare commercial and supply capabilities, deep technical mastery, and proven consumer healthcare leadership that will complement our own OTC capabilities, brands, and leadership."44

By acquiring Merck's CHB, P&G gained control over Merck's vitamin brands, which were growing at a faster pace than the household products of the company. Jon Moeller, Chief Financial Officer at P&G, said, "Branded goods business [of Merck] which carries higher than average company margins. So, it should be a very good strengthening move to the overall portfolio."45

As a part of the deal, P&G also bought a majority stake of 51.8% (8.59 million shares) in Merck's listed Indian CHB at the price of 1,500 per share. Afterward, P&G made a compulsory offer for acquiring 26% shares in Merck's Indian subsidiary.46

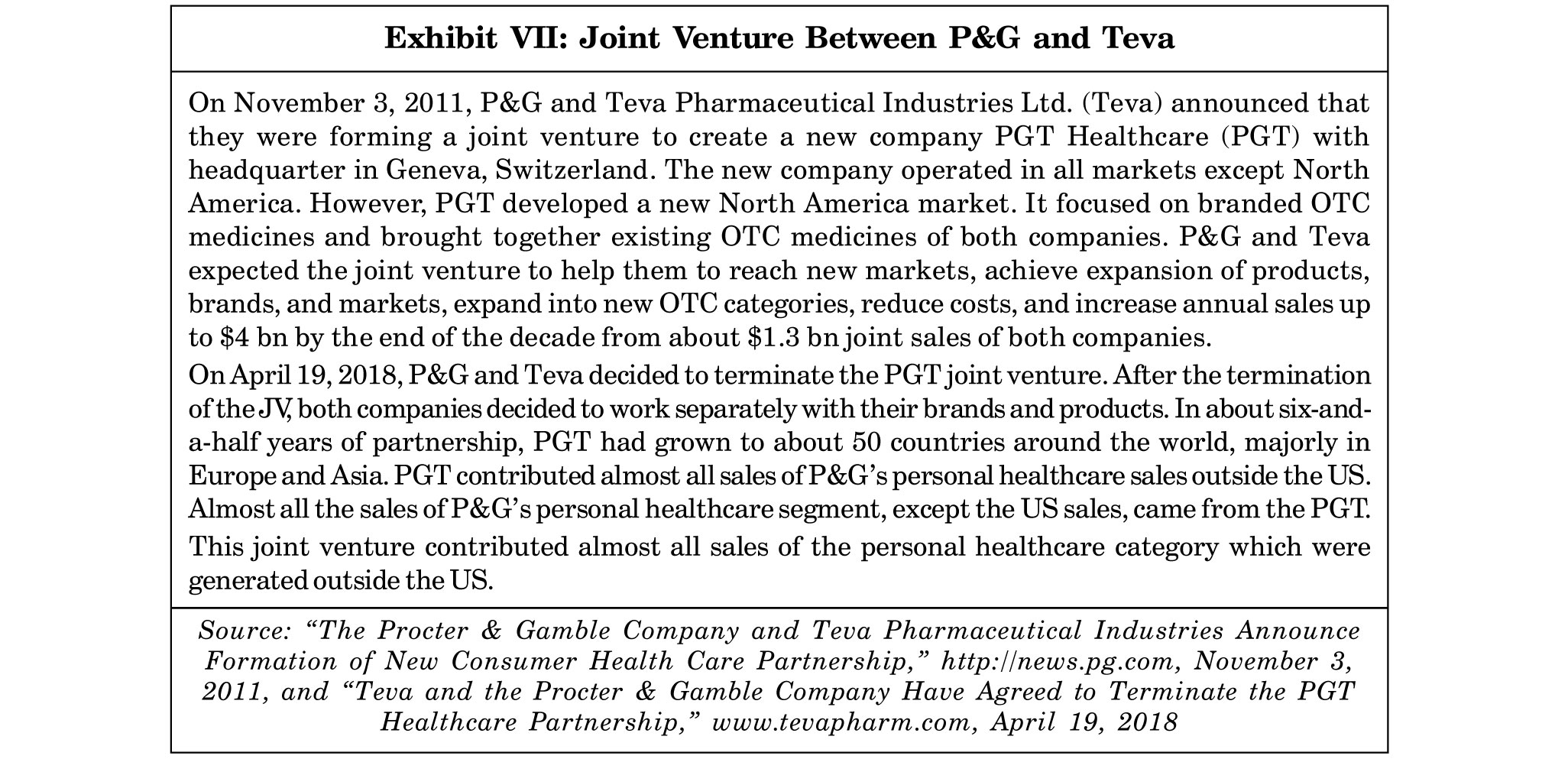

P&G also announced the end of its joint venture with Teva Pharmaceutical Industries Ltd.47 (Teva) from July 1, 2018, saying the strategies of the two companies were no longer aligned (Refer Exhibit VII for Joint Venture between P&G and Teva).48

Analysts opined that the P&G-Merck CHB deal would be beneficial to both companies. However, the success of the deal would depend on how P&G overcame the differences in the American and German cultures and other HR-related issues. It would be interesting to see how the management of P&G tackles the various issues and ensured revenue, cost, financial, and other synergies.

- "P&G Acquires the Consumer Health Business of Merck KGaA, Darmstadt, Germany," http://news.pg.com, April 19, 2018.

- Amany Zaher, "P&G to Acquire German Merck's Consumer Health Unit for $4.2 Billion," www.forbesmiddleeast.com, April 19, 2018.

- Teena Thacker, "P&G to Acquire Merck India Business for Rs. 1,300 Crore," https://www.livemint.com, April 20, 2018.

- Daimler and Chrysler merged in 1998. However, merger failed to realize synergies due to culture mismatch. Later, Daimler sold out Chrysler to Cerberus Capital Management, L.P. in 2007 and which renamed as Chrysler LLC.

- "P&G at a Glance," www.pginvestor.com, 2017.

- "P&G - 2017 Annual Report," www.pginvestor.com

- Ibid.

- "Update 4-P&G to Sell Up to 100 Brands to Revive Sales, Cut Costs," www.reuters.com, August 1, 2014.

- "P&G - 2014 Annual Report," www.pginvestor.com

- "Berkshire Hathaway to Acquire Duracell Battery from Procter & Gamble in $4.7 Billion Stock Deal," https://economictimes.indiatimes.com, November 14, 2014.

- "P&G - 2015 Annual Report," www.pginvestor.com

- "P&G - 2017 Annual Report," www.pginvestor.com

- "P&G at a Glance," www.pginvestor.com, 2017.

- Mamta Badkar, "Nelson Peltz Secures Board Seat at P&G," www.ft.com, December 16, 2017.

- Becky Bargh, "P&G Announces Nelson Peltz has Joined Its Board of Directors," www.cosmetics business.com/, December 19, 2017.

- Barrett J Brunsman, "P&G Board Reportedly Considering Peltz Shake-Up Plan," www.bizjournals.com, June 7, 2018.

- "P&G Annual Report 2017," www.pginvestor.com

- E Merck KG operates as a general partner of Merck and holds about 70% in Merck. Merck family holds around 99.9% in E Merck KG and the rest is held by the executive board of Merck. E Merck KG does not participate in management of Merck.

- "We are Merck," www.merckgroup.com

- "Merck Annual Report 2017," www.merckgroup.com, March 8, 2018.

- "Consumer Health," www.merckgroup.com.

- "Merck Agreement to Sell Consumer Health to Procter & Gamble," www.merckgroup.com, April 19, 2018.

- www.fiercepharma.com

- "Consumer Health," www.merckgroup.com

- "Merck Annual Report 2017," www.merckgroup.com, March 8, 2018.

- "Merck Agreement to Sell Consumer Health to Procter & Gamble," www.merckgroup.com, April 19, 2018.

- Georgina Prodhan and Ludwig Burger, "Germany's Merck Considers Sale of Consumer Health Business," www.reuters.com, September 5, 2017.

- Carly Helfand, "Merck KGaA Mulls Sale of Undersized Consumer Health Unit," www.fiercepharma.com, September 5, 2017.

- Fresenius Kabi is the multinational healthcare company from Germany.

- €170 mn upfront payment and ¤500 mn milestone payment.

- JPMorgan is a global investment banker and financial services provider from the US.

- Freshfields Bruckhaus Deringer LLP is the global law firm based in UK.

- Pamela Barbaglia, Ludwig Burger, Patricia Weiss, "Nestle, Stada Prepare Rival Bids for Germany's Merck Consumer Health: Sources," www.reuters.com, December 2, 2017.

- Pamela Barbaglia, Martinne Geller, Ben Hirschler, "Exclusive: Pfizer to Launch Consumer Health Sale in November - Sources," www.reuters.com, October 26, 2017.

- Pamela Barbaglia, Ludwig Burger, "Perrigo Lines Up Bid for Merck's Consumer Health Unit: Sources," www.reuters.com, December 14, 2017.

- Manuel Baigorri, Sarah Syed and Ruth David, "Nestle Takes Lead in Bids for Merck's Consumer Unit," www.bloomberg.com, January 10, 2018.

- Reuters is the global news agency based in London, UK.

- K Oanh Ha and Jeff Sutherland, "P&G to Buy German Merck's Consumer Unit for $4.2 Billion," www.bloomberg.com, April 19, 2018.

- "Merck Agreement to Sell Consumer Health to Procter & Gamble," www.merckgroup.com, April 19, 2018.

- "P&G to Acquire German Merck's Consumer Health Business for About $4.21 Billion," www.cnbc.com

- Merck's financial debt was ¤10.8 bn at the end of March 31, 2018.

- Net Finance debt did not included pensions.

- "Merck Agreement to Sell Consumer Health to Procter & Gamble," www.merckgroup.com, April 19, 2018.

- "Procter & Gamble Looks Ahead to Merck KGaA Acquisition," www.pharmacytimes.com, May 3, 2018.

- Camilla Hodgson and Anna Nicolaou, "P&G to Buy Merck's Consumer Health Business for ¤3.4 bn," www.ft.com, April 19, 2018.

- "Merck Zooms 19% on Open Offer by Procter & Gamble Overseas India," www.business-standard.com, April 19, 2018.

Bibliography

- Andrew Sherman (2010), Mergers and Acquisitions from A to Z Hardcover, (AMACOM, 2010).

- Camilla Hodgson and Anna Nicolaou (2018), "P&G to Buy Merck's Consumer Health Business for ¤3.4 bn," www.ft.com, April 19, 2018.

- Hassan M, Patro D K, Tuckman H and Wang X (2007), "Do Mergers and Acquisitions Create Shareholder Wealth in the Pharmaceutical Industry?", International Journal of Pharmaceutical and Healthcare Marketing, Vol. 1, No. 1, pp. 58-78.

- Jerilyn Castillo and Peter McAniff (1900), The Practitioner's Guide to Investment Banking, Mergers & Acquisitions, Corporate Finance, Circinus Business Press.

- Manuel Baigorri, Sarah Syed and Ruth David (2018), "Nestle Takes Lead in Bids for Merck's Consumer Unit," www.bloomberg.com, January 10, 2018.

- "Merck Agreement to Sell Consumer Health to Procter & Gamble", www.merckgroup.com, April 19, 2018.

- "Merck Zooms 19% on Open Offer by Procter & Gamble Overseas India", www.business-standard.com, April 19, 2018.

- Morck R, Shleifer A and Vishny R W (1990), "Do Managerial Objectives Drive Bad Acquisitions?", The Journal of Finance, Vol. 45, No. 1, pp. 31-48.

- Nielsen J F and Melicher R W (1973), "A Financial Analysis of Acquisition and Merger Premiums", Journal of Financial and Quantitative Analysis, Vol. 8, No. 2, pp. 139-148.

- Oanh Ha K and Jeff Sutherland (2018), "P&G to Buy German Merck's Consumer Unit for $4.2 Billion," www.bloomberg.com, April 19, 2018.

- "P&G to Acquire German Merck's Consumer Health Business for About $4.21 Billion", www.cnbc.com, April 9, 2018.

- Pamela Barbaglia and Ludwig Burger (2017), "Perrigo Lines Up Bid for Merck's Consumer Health Unit: Sources," www.reuters.com, December 14, 2017.

- "Procter & Gamble Looks Ahead to Merck KGaA Acquisition", www.pharma cytimes.com, May 3, 2018.

- Sarah Neville and Scheherazade Daneshkhu (2017), "Consumer Drugs Do Not Always Work for Big Pharma," www.ft.com, October 6, 2017.

- Scott C Whitaker (2016), Cross-Border Mergers and Acquisitions, Wiley, 2016.