Mar '21

The IUP Journal of Case Folio

Archives

Pinduoduo Inc.: Turning the Covid-19 Crisis into an Opportunity

Hadiya Faheem

Former Senior Research Associate, IBS Case Research Center, IBS Hyderabad (Under IFHE -

A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India.

E-mail: research@icmrindia.org

Debapratim Purkayastha

Director, IBS Case Research Center, IBS Hyderabad (Under IFHE - A Deemed to be University

u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: debapratim@ibsindia.org

The case is about Chinese e-commerce company Pinduoduo Inc.'s (PDD) strategy before and during the Covid-19 pandemic. Founder Colin Huang Zheng (Colin) described PDD as a combination of Costco and Disney, i.e., the company combined bargain products with entertainment. China, being the epicenter of the Covid-19 pandemic, witnessed a disruption in businesses and supply chains across the country through factory closures, roadblocks and mandatory quarantines. Farmers in China too faced difficulties selling their farm produce as large agricultural wholesale markets were closed down in a bid to contain the spread of Covid-19. PDD took this as an opportunity and leveraged its strength of being one of the largest e-commerce online platforms for agricultural products in China. In February 2020, the company launched a ?Help the Farmers' campaign wherein it collected information about surplus agricultural products and connected farmers with consumers through its online platform, live-streaming the perishable stock. While PDD supported farmers, merchants, employees and consumers during the outbreak of Covid-19, it also offered business subsidies and medical supplies, and donated funds. Going forward, PDD aimed to digitize agriculture in a bid to capitalize on the rising demand from consumers for safe and reliable produce in the wake of the pandemic. The senior management team at PDD had the onerous task of tapping this opportunity to fuel post-Covid-19 growth. .

Pinduoduo was perfectly positioned for people being stuck at home.i

- Tom Ronk, CEO, Century Pacific Investments,1 in July 2020.

Introduction

In October 2020, Chinese e-commerce company Pinduoduo Inc. (PDD) announced

that it aimed to take digital technology into the agricultural fields in a bid to

capitalize on the rising demand from consumers for safe and reliable produce in the wake of the Covid-19 pandemic. David Liu (David), Vice-President of Strategy, PDD, said, "We think we are heading in the right direction, not only through our own effort but because the industry is becoming more acceptive of e-commerce in agriculture. Specifically for agriculture and fresh produce, I think people's acceptance for the convenience has increased, and this is particularly true with the younger generation, people born after the 1990s."ii

Founded in 2015 by serial entrepreneur Colin Huang Zheng (Colin), PDD leveraged its strength of being one of the largest e-commerce online platforms for agricultural products in China to come out of the pandemic stronger. China being the epicenter of the Covid-19 pandemic, several businesses were affected, supply chains across the country were disrupted and people had to contend with factory closures, roadblocks and mandatory residential quarantines. Farmers in China too faced difficulties selling their farm produce as large agricultural wholesale markets were closed down in a bid to contain the spread of Covid-19. It was PDD that came to their rescue.

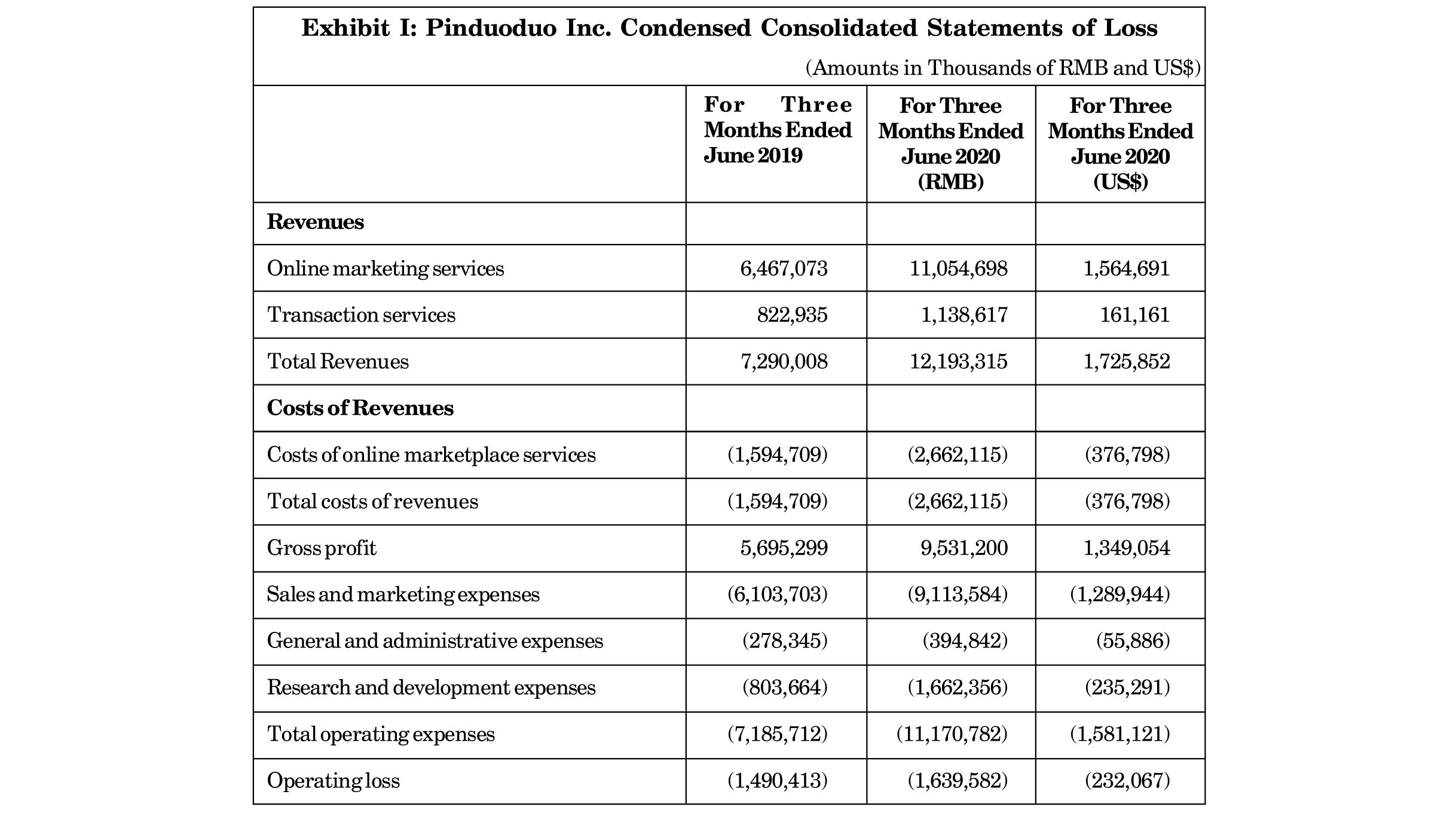

In February 2020, PDD launched a campaign called ?Help the Farmers' wherein it collected information about surplus agricultural products and connected farmers with consumers through its online platform and livestreamed the perishable stock. From its launch on February 10, 2020 to March 18, 2020, the campaign helped fulfill 27.5 million orders involving 120,000 metric tons of agricultural produce.iii The campaign not only saw sales rise, but also the valuation of PDD in the subsequent months. In August 2020, PDD reported that for the second quarter (Q2) ended June 30, 2020, its revenues had increased by 67% to $1.73 bn (See Exhibit I).iv In addition to this, for the twelve months ended June 2020, PDD's active buyers stood at 683.2 million, an increase of 41% from 483.2 million for the twelve months ended June 2019.v

However, PDD's decision to focus on digitizing agriculture led to mixed reactions from industry observers. While some analysts felt that the timing for such an initiative was right as more and more consumers were becoming conscious about the safety of traditional food markets and wet markets following the pandemic, others like Sofya

Bakhta of Daxue Consulting2 believed that though PDD might be a technology-enabled provider of fresh agricultural produce, the e-commerce company might not succeed in digitizing agriculture as many e-commerce players in China were adopting a similar model. In this context, David and the senior management team at PDD had their task cut out for them. How would they leverage PDD's strengths to drive post-Covid-19 growth?

About Pinduoduo

Pindoudou means "Together, More Savings, More Fun". Colin Huang Zheng (Colin), the founder of PDD, was born in 1980 in the eastern city of Hangzhou, capital of China's Zhejiang province. His father and mother worked in a factory. Colin excelled in mathematics and at the age of 12 he was invited to the Hangzhou Foreign Language School, a grade 7 to 12 public school, located in Zhejiang, China.vi

At school, Colin participated in a Mathematics Olympiad and won a gold medal and a scholarship to study at the Zhejiang University, where he graduated in computer science. While he was in college, Colin was selected as a fellow at the Melton Foundation, founded by Verifone founder Bill Melton. The Foundation selected young students from emerging nations. Each fellow was given a personal computer with internet data and was also allowed to travel to a member country each year. Colin believed that this experience had given him a more international mindset than most people in China.

Colin then secured an internship at American multinational technology company Microsoft Corporation (Microsoft) in Beijing with a stipend of $900 per month. He was later transferred to the US headquarters of Microsoft Corporation where he earned over $6000 per month.vii

In 2002, Colin went to the University of Wisconsin for a Master's in Computer Science. After completing his education in 2004, he joined American search engine giant Google Inc. (Google) as a software engineer and worked on early e-commerce-related search algorithms. He went on to become a product manager at Google before quitting in 2007 to return to China.

In 2007, Colin started his first company, an e-commerce website called Ouku.com, which sold mobile phones and other consumer electronics, but sold the business in 2010. He then launched another company called Leqi, which helped companies market their services on other e-commerce websites such as Alibaba.com's online shopping website Taobao or Beijing-based e-commerce company JD.com. This was followed by Colin setting up Xunmeng, a gaming firm that let users play games on WeChat.3 All his three ventures were successful, but Colin fell ill in 2013 and had to briefly retire at the age of 33.

Colin came up with the idea of starting Pinduoduo after seeing the success of Chinese internet giants such as Alibaba.com (e-commerce) and Tencent (social, games). Pinduoduo, according to Colin, would fall between these two companies?a social gamified

e-commerce company that would help manufacturers cut out middlemen by directly selling products to lower-income consumers and monetizing largely through advertising.

Pinduoduo was founded as yqphh.com or Pinhaohuo (PHH, meaning ?piece together good goods') in early 2015. PHH's business model focused on buying fruit in bulk from farmers and selling directly to the consumers. PHH's business grew through WeChat. In April 2015, PHH ran an advertisement on the official Hangzhou WeChat Account that was displayed on users' feeds. On May 1, 2015, the company fulfilled 5,000 orders. Soon after, its daily order volume surpassed 10,000 orders.

By September 2015, PHH had become China's number one free app and it was receiving 100,000 orders per day. Just when PHH was experiencing huge growth, it hit a roadblock. The company faced some delivery challenges in 2015 when selling a batch of lychee fruits. Its single fulfilment center, which had the capacity to handle 70,000 orders per day, broke down when the demand suddenly increased to 200,000 orders. The e-commerce company's delivery partner SF Express was not equipped to handle such demand and struggled to cope. Meanwhile, the orders kept piling up. The team missed a majority of the deliveries that week and most of the inventory went rotten. Consequently, PHH's daily order volume dropped 80% to 20,000. The following month it witnessed a drop in customer retention to 25%.viii

Irate customers complained that the lychee fruits they had received were rotten. PHH gave them refunds. It also recruited 100 new operations employees and opened six new warehouses. PHH automated its warehouses for sorting, packaging and distributing inventory to trucks for being shipped out. Thus, the time taken from farm to table was no more than two to three days. Business increased with PHH delivering 300,000 fruit orders per day. This soon doubled to 600,000. By the end of 2015, the company had 10 million registered users who were placing 1 million orders per day, with 77% being repeat customers. This again challenged the shipping capacity of SF Express and PHH, prompting them to hire more delivery partners.

In 2016, PHH was merged with a game-like e-commerce platform Pinduoduo. The merger banked on PHH's logistic expertise and PDD's understanding of the end consumer with 70 million users playing 30 different social games. Colin likened PDD to a combination of Costco4 and Disney, i.e., the company combined bargain products with entertainment. PDD offered consumers cash rewards for playing games that involved inviting their friends to the platform. This approach brought in mass buyers and, in turn, sellers who paid PDD for advertising, which was key to the company's business model and generated more revenue than sales.

In 2016, Colin received investments of US$110 mn from leading Chinese companies such as Tencent, Gaochun, and Xintianyu.ix On July 26, 2018, PDD listed on stock market index NASDAQ with an initial public offering of $1.63 bn.x

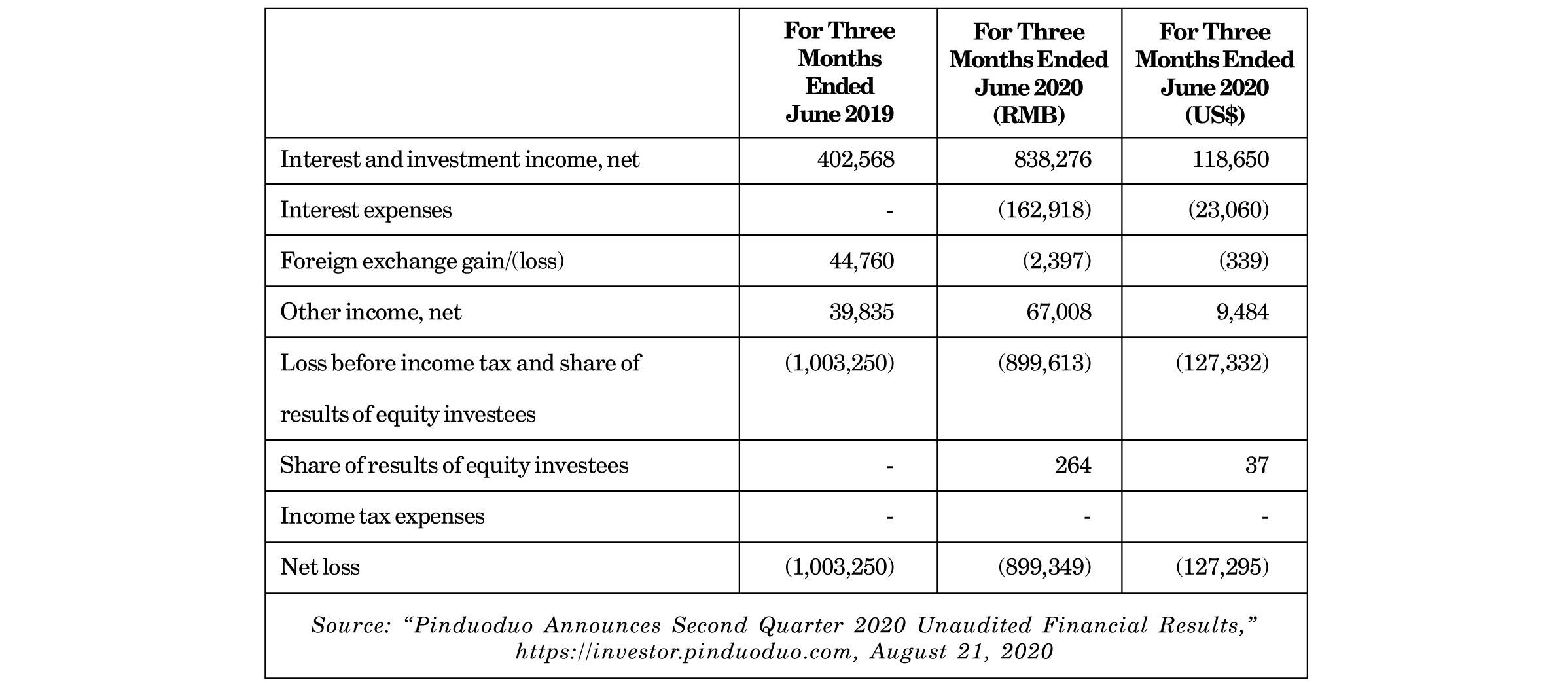

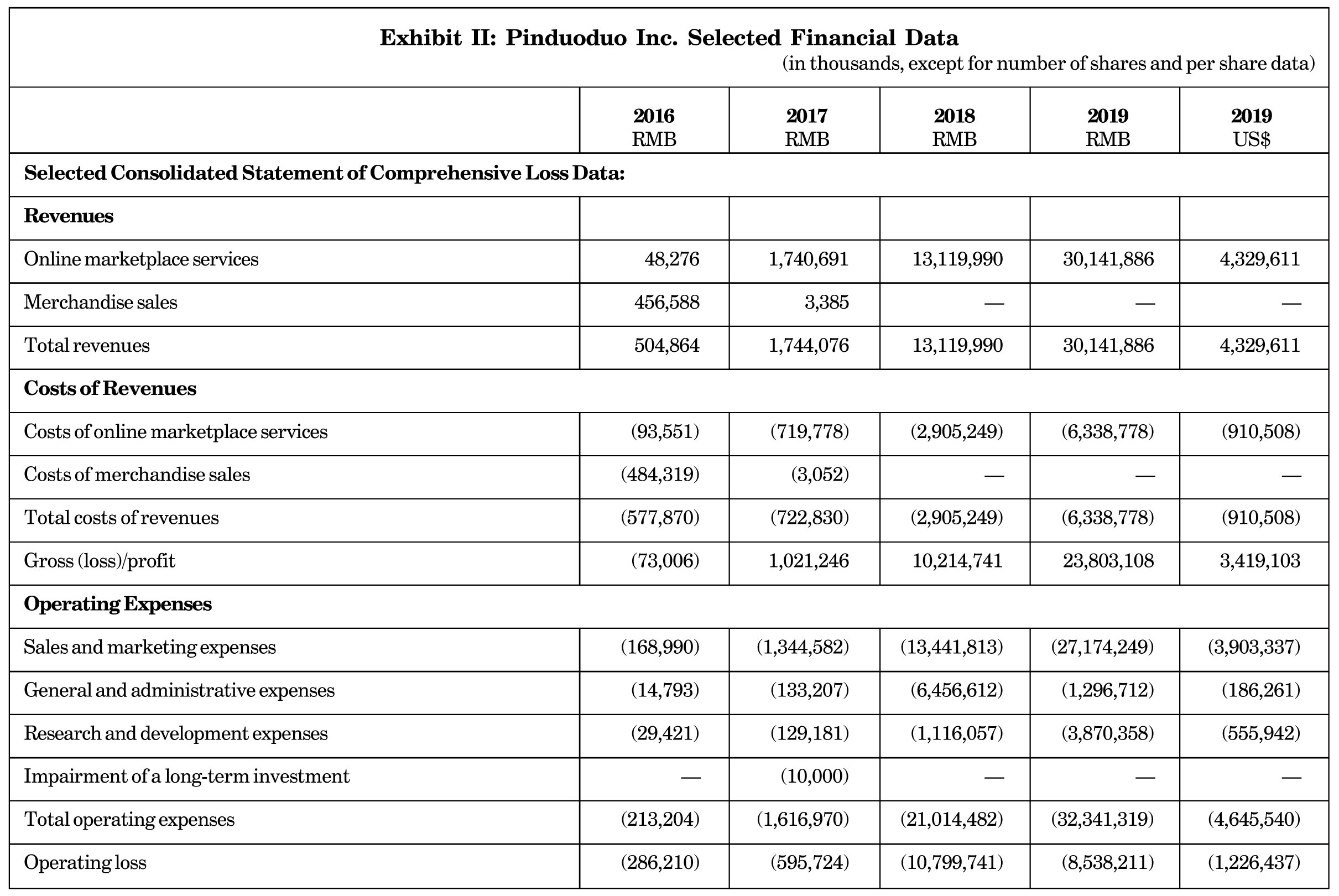

For the FY2019, PDD recorded revenues of $4.329 bn (See Exhibit II).xi

Deep Discounts

Unlike Alibaba.com and JD.com who catered primarily to higher income consumers, PDD started catering to young consumers in smaller cities and rural communities in China. According to Colin, "People living in the five rings of Beijing wouldn't understand our purpose. The new consumer economy isn't about giving Shanghainese the life of Parisians. It's about providing paper towels and good fruit to people in the Anhui province."xii

PDD's e-commerce platform focused on providing a social and interactive online shopping experience to consumers. As shopping in the physical world was seen as being "interactive and fun", PDD aimed to digitally mimic offline shopping. According to Miranda Shek, Head of international corporate affairs at PDD, "We created the feeling of being in a mall with your friends and enjoying the sensation of window shopping and sharing goods by replicating it online."xiii In other words, PDD created an interface that allowed users to share their purchases with friends for building networks and communities. Consumers could also host sales events to which they could invite those who wished to buy the same product. When the number of buyers reached a target, the whole group received a discount on the price of the product. The more the number of people who joined the group, the higher the discount obtained on the purchased product. Each item required a minimum number of buyers for the purchase to be completed. If that minimum number was not reached within 24 hours, group buying was canceled and the money committed by members in the group was refunded. The item could also be bought directly but the price was higher than if buying in a group. In return, PDD received a small commission and charged sellers for promoting their products on its app.

PDD allowed its shoppers to share products on WeChat to qualify for more discounts. For instance, if consumers found the product they were looking for on PDD, they could invite friends on WeChat to form a purchase group and get discounts of up to 90%. The products ranged from $1 T-shirts to $80 smartphones.xiv PDD also offered cash back incentives and free products to its loyal customers in a bid to encourage sharing on social media.

According to analysts, the majority of PDD's growth was driven by WeChat, which had over a billion users. This led to lower customer acquisition costs for PDD. According to Shanghai-based Guotai Junan Securities, "Direct buyer traffic to PDD is primarily generated from word-of-mouth referrals by its existing buyers as well as the effect of its marketing

campaigns. A portion of the Company's buyer traffic comes from its user recommendation or product introduction feature which buyers can share with friends or contacts through social networks such as WeChat and QQ."xv

PDD was also famous for its "gamified" shopping. For instance, a user who watered a virtual mango tree through the app for several consecutive days was gifted a free box of mangoes. Through these games, PDD encouraged daily visits to its app and enhanced user engagement.

Consumer to Manufacturer Model

Traditionally, agricultural produce went through many layers of distribution before it reached the consumers. In a bid to eliminate the unnecessary costs incurred due to intermediaries, PDD launched its ?Consumer-to-Manufacturer' (C2M) model in 2018.

Under the C2M model, PDD used Artificial Intelligence (AI) algorithms and its massive pools of data to help Chinese manufacturers predict the preferences of consumers and develop brands especially for domestic consumers. PDD instructed its manufacturers on how to customize their products, redesign their packaging, set their prices, and market their goods online. This helped the manufacturers to improve the efficiency of their production, thus making the products cheaper. PDD could monetize new users with advertising. This helped both PDD and the manufacturers to tap into the rapidly growing middle-class consumer base.

Since the manufacturers had a direct relationship with the consumers, they were able to gain an insight into consumer behavior. This helped them tweak clothing styles, accelerate product development timelines, cut costs by reducing demand mismatches, redesign food packaging, launch new products and also integrate PDD's data directly into their lines of manufacturing. Chinese suppliers could use keywords to predict demand.

In the case of farm produce, the C2M model offered guaranteed demand to farmers and farmers paid for that demand. The suppliers had the ability to bid on in-app feed placement, links, banners, logos, and keywords in search results. The suppliers could control group sizes, prices, and how many orders they could fulfill. Thus, they could predict their input costs and volume ahead of time. This led to small producers gaining the benefits of economy of scale. Initially, in a bid to guard against fraud, the suppliers were asked to pay PDD an upfront fee when they first listed their product on its platform. In case any supplier was caught selling a counterfeit product, they were fined 10 times the value of the fake product. Payments from customers were collected when any product was sold, which gave PDD float or a negative cash conversion cycle that collected cash before delivering any product or service.

Duo Duo Farm and Duo Duo University

Since PDD focused on encouraging farmers to sell their produce online, it launched the Duo Duo Farm in 2019. Here, farmers received training in the skill of selling directly on PDD rather than relying on intermediaries of the traditional supply chain. This initiative used AI to help aggregate demand for agricultural products and connected farmers directly with the consumers. David, an MA from Princeton University who had joined PDD in December 2017 and became its VP for Corporate Strategy in April 2019, said, "Agriculture is one of the hallmarks of our platform, and the Duo Duo Farms initiative aims to improve the entire agriculture supply chain from the moment the farmers decided what to sell to the moment the produce reaches our users' hands."xvi

To help farmers learn how to sell on PDD directly, the Duo Duo Farm program launched Duo Duo University as a local program in Yunnan province. The program equipped farmers with important skills, including giving them an understanding of e-commerce, business operations, finance, and online marketing. The program taught farmers how to build their digital business.

The lack of job opportunities in rural areas had been driving many young and educated people to cities in search of better jobs. However, with the launch of Duo Duo Farms, many youngsters were coming back as they found a multitude of jobs opening up for them, ranging from farming to delivery and e-commerce store operations.

Explaining PDD's focus on the agricultural products market, David pointed out the following facts:

? 25% of China's workers were in agriculture, but agriculture accounted for 10% of GDP.

? 98% of China's farms were less than two hectares, making them inefficient from an economies-of-scale perspective.

? Less than 7% of agricultural sales happened online in 2019 in China, versus 23% of all physical goods.

? On an average, agricultural products had to go through five layers before reaching the customer, adding 105% in costs and leading to 37% spoilage for vegetables.xvii

Covid-19 Pandemic and PDD

Like many other businesses, PDD had to grapple with the Covid-19 pandemic in 2020. The Covid-19 outbreak started in a wet market in Wuhan, which sold fish, birds and both live and dead animals. While 80% of the people infected with Covid-19 showed mild symptoms such as cold and flu, around 14% displayed symptoms of pneumonia and shortness of breath. Around 5% of the patients suffered from septic shock, respiratory failure, and multiple organ failure, according to data released by the Chinese authorities.xviii The virus soon spread to other provinces of China and throughout the world. On March 11, 2020, the World Health Organization declared it a pandemic.xix

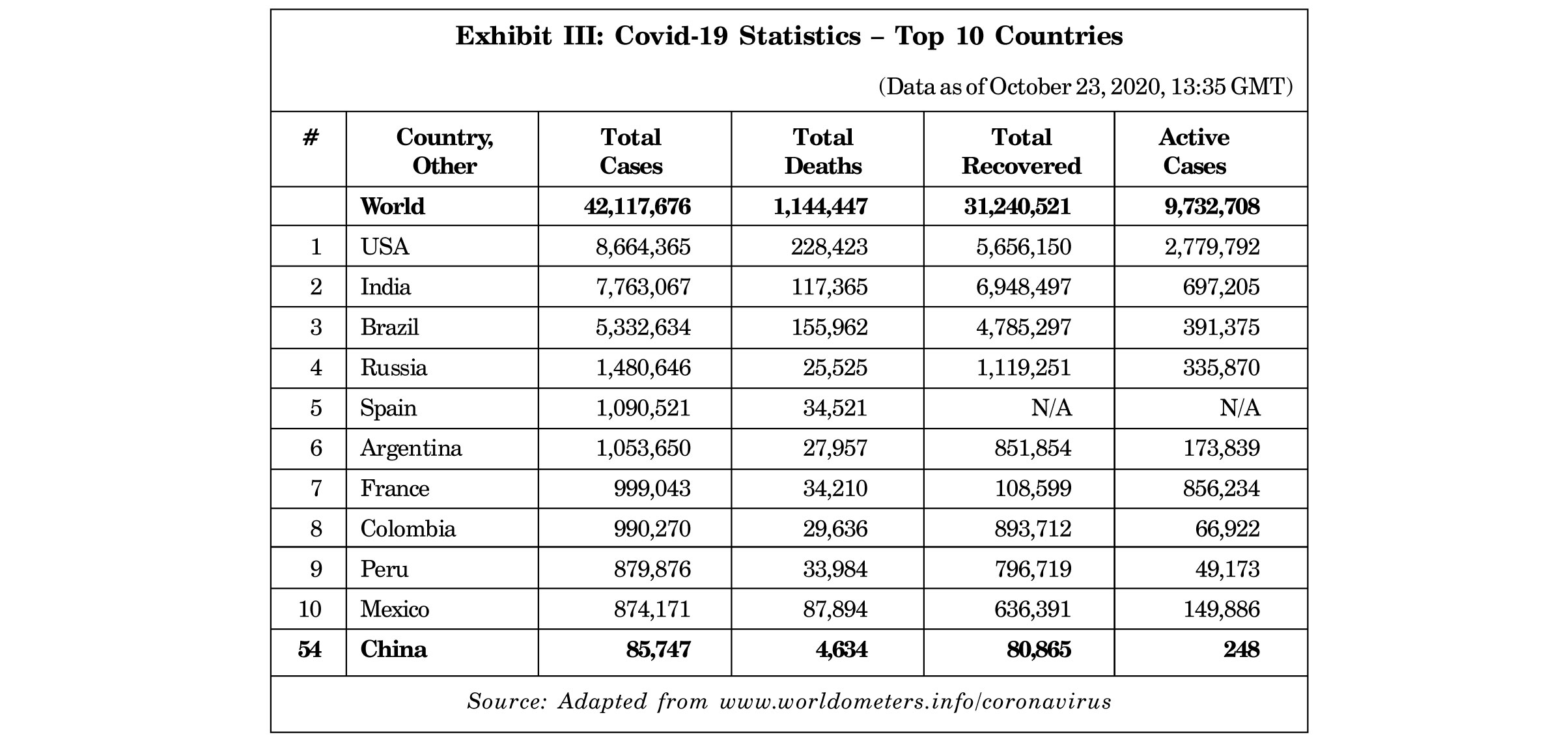

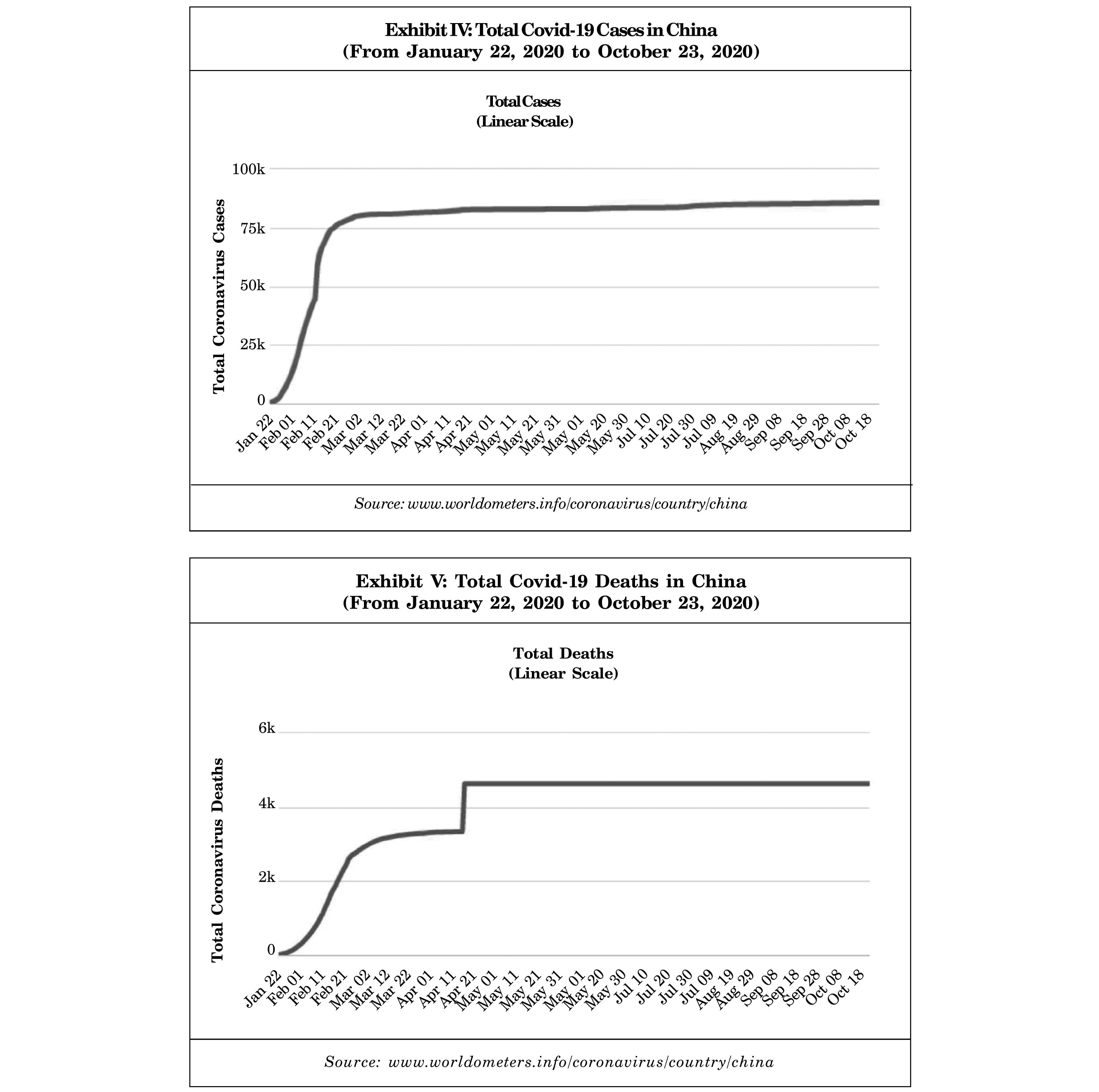

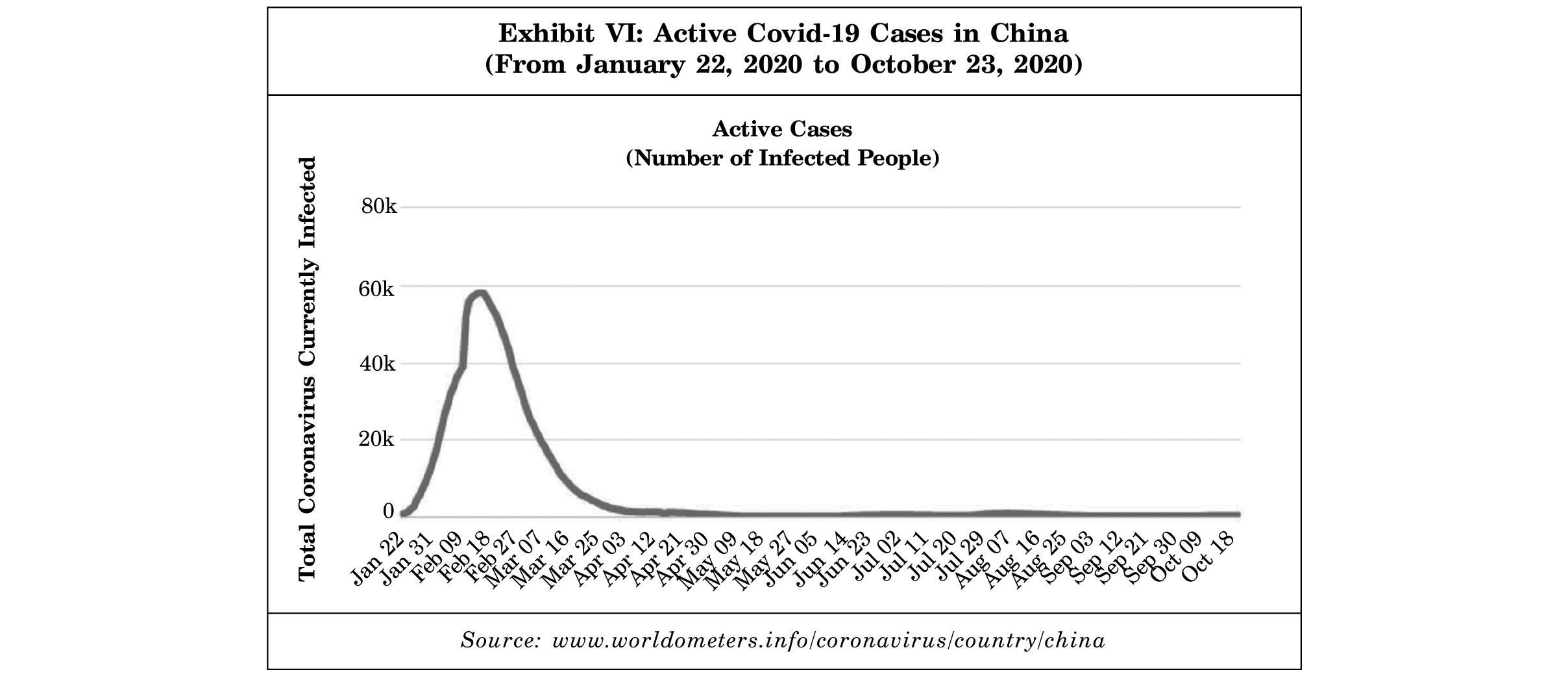

Since there was no specific treatment for Covid-19, doctors were trialling existing drugs for other conditions. In mid-April 2020, the WHO said that development of a vaccine for the Covid-19 might take 12 months or longer. In the meantime, the afflictions and fatalities linked to the contagion continued to increase. According to reference website Worldometer, as of October 23, 2020, there were more than 42 million confirmed Covid-19 cases worldwide with 1,144,513 deaths (See Exhibit III).xx In China, as of October 23, 2020, the total number of Covid-19 cases stood at 85,747 with 4,634 deaths, and 248 active cases (See Exhibits IV to VI).

Governments across the world were relying mostly on social distancing to arrest the spread of the disease. Many governments had imposed lockdowns, only allowing essential businesses to operate. This had led to massive disruptions in business. Analysts expected many businesses to be hit hard by the pandemic, as consumers did not buy non-essentials during this time. Thus, many departmental store chains and other "non-essential" retailers were forced to close down due to the pandemic.

After the Covid-19 pandemic hit China in early 2020, many farmers came close to facing

catastrophic losses as large agricultural markets were shut down in a bid to contain the spread of the coronavirus. According to Deputy Director of PDD's Agricultural Research Institute, Lake Di, "Excess supply in agricultural products has always been a problem and the coronavirus outbreak has made it extra difficult for farmers to sell, given the closure of the wholesale markets. At this special time, we are helping farmers to mitigate the impact from the coronavirus outbreak."xxi

PDD'S Strategy for Pandemic

On February 10, 2020, PDD started a channel known as ?Help the Farmers' to supply from over 12 million agricultural products to more than half a billion users. PDD's recommendation model and logistics data identified potential consumers so that the produce could be delivered to the consumers. This was crucial because agricultural products had limited shelf life. Through the ?Help the Farmers' initiative, consumers could directly buy fresh produce from 180,000 farmers in 400 agricultural areas, comprising 230 poverty stricken areas. Around 280,000 agricultural products were included on PDD's online platform.xxii,xxiii

PDD had committed RMB500 mn in subsidies, which came in the form of discounts or coupons, to encourage consumers to buy more farm produce. PDD also gave logistics subsidies of RMB2 to RMB3 per order to farmers selling on its platform.xxiv The company partnered with SF Express, China Post Group Corporation (the official postal service of China), and other logistics partners to quickly deliver the agricultural products to consumers.

To support its merchants during the pandemic, PDD extended the delivery time to February 12, 2020, for orders placed during the period January 17, 2020 to February 10, 2020. In addition to this, parcel delivery pick-up time from the sellers after confirmation of order was increased from 24 hours to 96 hours. Advertising rates were also slashed. According to David, "We supported our merchants, in particular small and medium-sized enterprises, by offering them lower effective advertising rates. We also directed traffic that we could have otherwise monetized to dedicated channels for medical supplies, household staples and other necessities in high demand."xxv The

e-commerce company allocated RMB1 bn ($140 mn) toward subsidies for the initiative, adding that it was "not setting upper limits on the support."xxvi

PDD encouraged merchants to sell more products through the new livestreaming platform it had launched in November 2019 to counter competition from Taobao Live. By August 2020, PDD had helped 67,000 farmers learn how to livestream events.xxvii It associated itself with local governments in the Guangdong, Fujian, Zhejiang and Shandong provinces where the country's key production centers were located for promoting locally produced specialties through livestreaming events. According to David, "As of April 30, total order number originating from these events reached 49 million. We have signed strategic cooperation agreements with these local governments to continue our support for high-quality local manufacturers and merchants, who we believe can become strong partners for our C2M initiatives over the long term."xxviii

PDD also took care of its employees during the pandemic by providing them with face masks and disinfectants, and also put in place safety procedures, measures and necessary equipment to support these procedures. To support its customers during the pandemic, PDD tweaked its app to enable people living in the same gated community to pool individual orders into a group purchase. The consolidated order was then delivered to the gate of the community and was received by volunteers designated by the building and then distributed to individual customers.

Other Initiatives

While PDD supported farmers, merchants, employees and consumers during the outbreak of Covid-19, it also offered business subsidies, and medical supplies and donated funds.

On January 23, 2020, PDD officially launched the "anti-epidemic special channel" to fight against Covid-19. This initiative covered medical and health supplies and drugs to ensure that emergency goods such as masks and thermometers were sold at low prices and sufficient supply was maintained.

On January 29, PDD and Zhejiang University set up a special fund with an investment of RMB100 mn for the prevention and control of viral infections and respiratory infectious diseases, especially providing support to Covid-19 and scientific research.xxix

On January 31, PDD announced its plans to supply 1 million medical masks, 200,000 medical gloves, 20,000 protective suits and 30 tons of disinfectant from Germany to Wuhan and other cities of Hubei province for alleviating shortages in medical supplies. It also supplied fruits and vegetables to hospital canteens in Wuhan to cater to the needs of 4,600 medical staff for a month.xxx

In April, PDD in association with the Shenzhen-based genome sequencing company BGI Group, started a testing service for Covid-19 in more than 50 cities. The e-commerce company provided subsidies of more than RMB10 bn with a test fee as low as RMB179 in 10 cities. According to Zong Hui, PDD's Project Manager, "Pinduoduo pays 10 yuan for each tester to help ease their economic pressure. Although the pandemic feels no emotions, we humans do."xxxi

PDD Gains

The ?Help the Farmers' initiative led to PDD witnessing an increase of nearly 1000% in sales of farming products including fertilizers, seeds, and sprinklers, in February 2020 compared to February 2019.xxxii According to a PDD spokesperson, more than 4.3 million agricultural producers bought farming essentials from PDD in February 2020. The spokesperson added, "We have observed a significant trend that farmers are now relying on their smartphones to buy their equipment online."xxxiii

Sensing a huge potential in online sales, in March, PDD provided $42.9 mn in discounts on farm supplies for putting 15,000 of the company's subsidized products on sale on its online platform.

In March 2020, PDD reported that 1.5 billion physical goods were ordered from the company's platform. Commenting on its sales, David said, "We think the coronavirus pandemic has created conditions that are conducive for C2M to take off in a big way."xxxiv

PDD raised $1.1 bn in a private share placement for funding its expansion despite market volatility due to the pandemic in March. Investors would purchase the company's newly issued Class A ordinary shares. This formed 2.8% of the company's total outstanding shares.xxxv According to David, "The extra funding gives us the strategic flexibility to capture opportunities to further benefit our users as we bring interactive experiences, such as our new live-streaming features and wider variety of value-for-money products to them."xxxvi

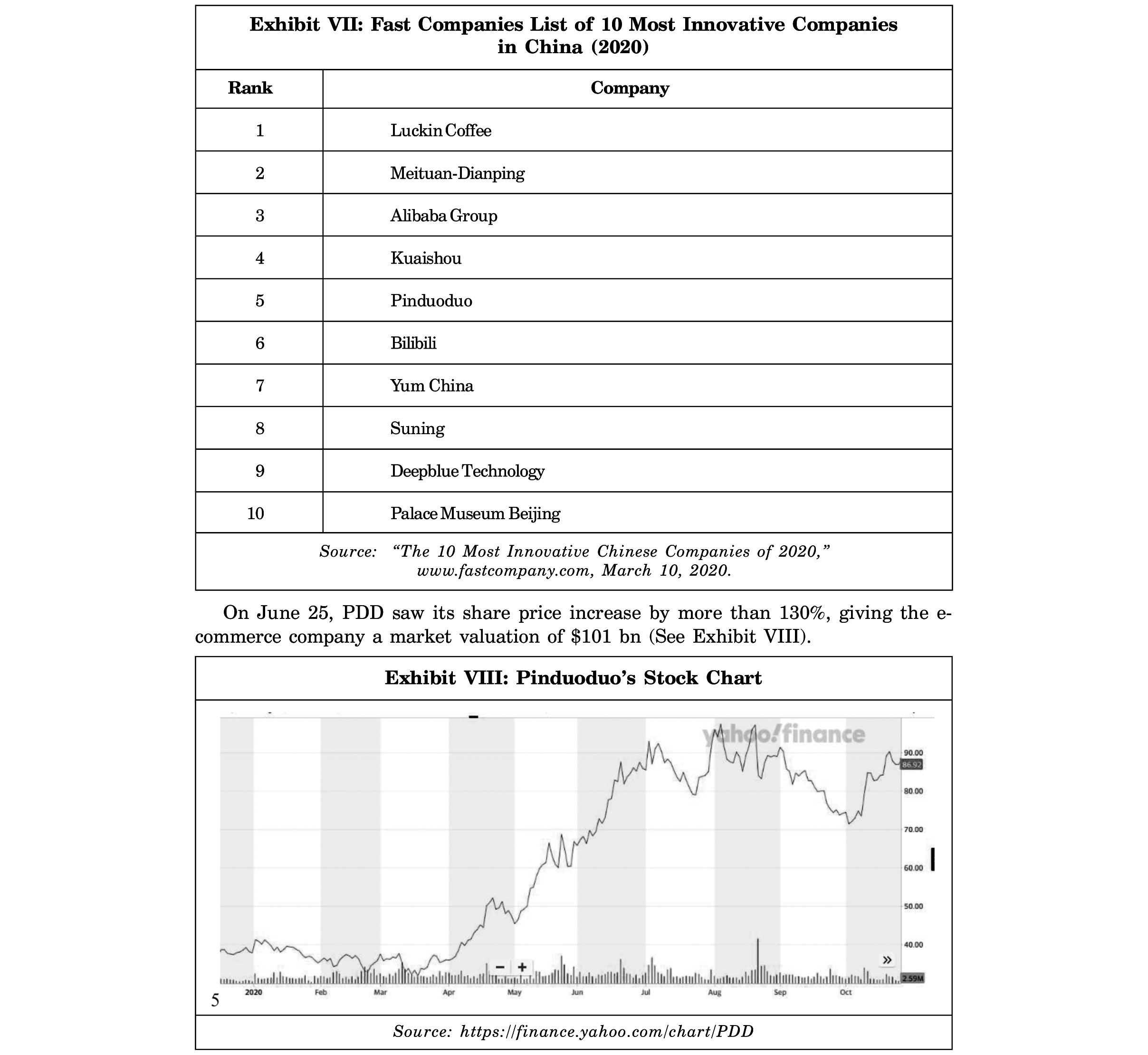

In March 2020, American business magazine The Fast Company reported that PDD ranked fifth in its 2020 list of 10 most innovative Chinese companies, for alleviating rural poverty by connecting farmers to more than 500 million buyers (See Exhibit VII).xxxvii

By May 2020, PDD's daily orders had increased to 65 million from 50 million per day in January 2020.xxxviii American multinational business magazine Fortune reported that from March 2020 to May 2020, Colin's personal fortune had witnessed a surge of $18 bn,which took his net worth to US$35.6 bn and made him the third wealthiest person in China after Pony Ma, founder of Tencent, and Jack Ma, founder of Alibaba.com.xxxix

PDD also recorded a 67% increase in revenues to $1.73 bn for the Q2 of 2020. The company's Gross Merchandise Volume5 (GMV) for the twelve months ended June 2020 stood at $179.6 bn, an increase of 79% from the same period of 2019.xl For the twelve months ended June 2020, PDD's active buyers stood at 683.2 million from 483.2 million for the twelve months ended June 2019.xli

On June 25, PDD saw its share price increase by more than 130%, giving the e-commerce company a market valuation of $101 bn (See Exhibit VIII).

The Challenges

PDD's rapid rise was accompanied by questions from several quarters on how it reported its order volumes, its corporate governance, and whether it would be a sustainable business model in the long run as the company was spending huge amounts of cash as subsidies to attract consumers. According to local broker Wu Fan at Chinese financial services company Guosheng Securities, "The current Pinduoduo is the biggest bubble in Chinese internet history."xlii

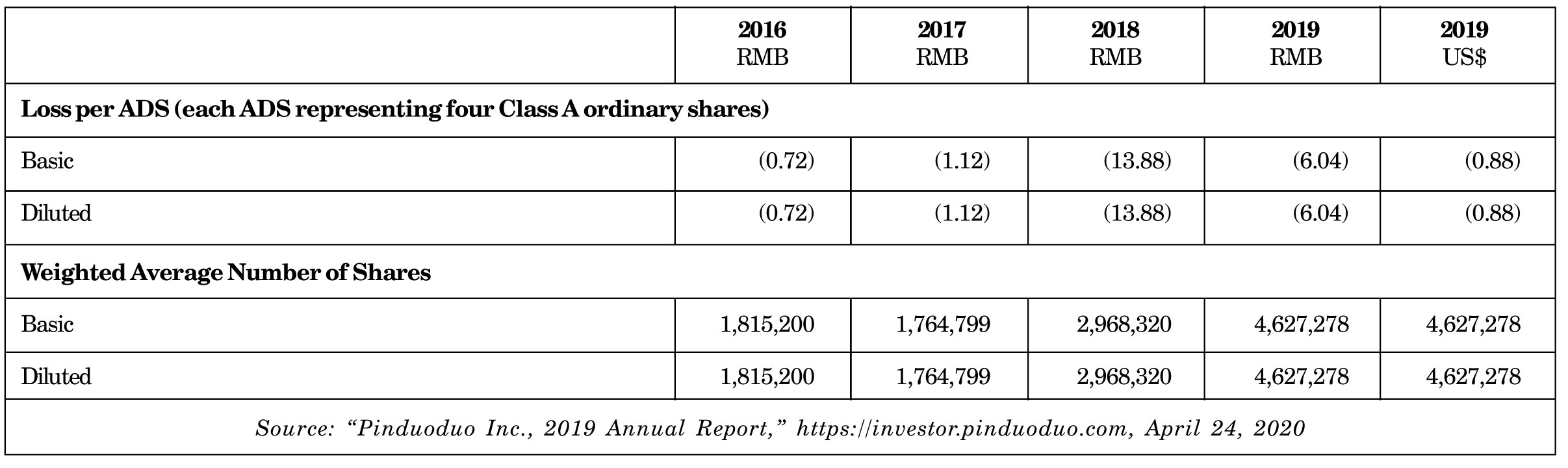

Analysts reported that PDD had recorded losses of RMB4.1 bn for the first quarter of 2020 and this was attributable to the deep discounts and promotions the company offered to attract consumers.xliii It was reported that some of Apple's iPhones and computers on PDD's online platform were cheaper than in Apple-owned stores during the company's "10 Bn RMB Subsidies" marketing campaign in May 2019.

Despite suffering huge losses, PDD continued to offer huge discounts to merchants to encourage them to sell their products on its online platform while it subsidized the difference from its own pocket. The e-commerce company adopted this strategy in a bid to counter competition from Alibaba.com and JD.com as both the companies were penetrating the lower tier cities. In July 2020, Alibaba.com and JD.com reported that around 70% of their new customers were coming from lower-tier cities in China.xliv

Analysts at China Renaissance Securities in Hong Kong, Charlie Chen and Veronica Shen, opined that PDD's aggressive price reduction strategies had helped it win a majority of consumers with lower incomes, but stifled its efforts to attract wealthier consumers. According to them, "PDD's users are largely bargain hunters reluctant to buy large-ticket items. We believe PDD is working to change its low-price brand image?but this could be costly."xlv

Many critics reported that in tier 1 markets such as Shanghai and Beijing, PDD had a poor reputation of selling low quality or fake goods. In a bid to change its reputation and restore consumers' confidence in the quality of goods sold on PDD, the company livestreamed a video in May 2020 providing a virtual tour of a warehouse which sourced the majority of the products sold at the company. The video attracted 1 million viewers.xlvi

While PDD was making efforts to target consumers in the higher tiers by offering premium products such as Apple iPhones and Tesla cars, Xiaofeng Wang, a Singapore-based analyst with market research company Forrester Research, wrote: "The group-buying model will work in the long term. But to go long, Pinduoduo needs to earn consumers' trust with quality products and deliver a good shopping experience. Pinduoduo still has work to do, deep discounting is not enough. That's why Pinduoduo is trying to upgrade itself to sell more premium items and attract more premium consumers."xlvii

Some analysts suggested that PDD would have to do heavy marketing to attract consumers in the top-tier segments and this would further hurt its margins.

PDD's corporate governance was also questioned by critics as Colin had held 43.3% of the shares with a voting power of 88% in the company. In June 2020, he reduced his controlling stake to 29.4% with his net worth standing at $30 bn.xlviii Colin also had the power to certify PDD's results as its principal financial officer as well as its chief executive and chairman of its board.xlix In response to this, a PDD spokesperson said that the company had a strong accounting team and the e-commerce company's Vice-President for strategy carried out some of the functions of a CFO and that the company was also actively looking for a CFO.

Looking Ahead

While PDD was grappling with several challenges, in July 2020, Colin announced his plans to step down as CEO in favor of Chen Lei, Chief Technology Officer of PDD. Colin would, however, remain Chairman of the company. "Covid-19 motivated us to think about a few things, including management transition. During the pandemic, we saw many young leaders in the company voluntarily taking up more responsibility. So the timing is ripe for the next generation to take the lead, and we feel more secure to hand over more responsibilities,"l said Colin.

Commenting on the management change, Shawn Yang, an Analyst at equity research, financial advisory and principal investment company Blue Lotus Capital Advisors, said, "PDD is still facing some high-level challenges in product supply, relationship with brand merchants, logistics and payments. Colin may want to focus more on these issues."li

Chen, a trained data scientist and a publisher on data mining, was keen to take PDD forward by connecting with more consumers and groups. He stated that PDD had plans to explore the best use of technology and transform the agriculture industry and further improve its efficiency. The e-commerce company felt that digitizing the agricultural supply chain would help tackle the challenges related to labor shortages and poor productivity that China's fragmented agricultural sector was facing. In June 2020, PDD organized a Duoduo Smart Agriculture competition in association with China Agricultural University in the Yunnan Province for growing strawberries through AI technologies or horticultural know-how.lii With this, the company aimed to encourage young farmers to develop solutions that could lower costs and digitize agriculture.

By making investments in related technology and operations such as developing of agricultural analytics system and logistics service in a bid to help farmers with decision-making and delivery, PDD aimed to become the number one online agricultural platform in China. In addition to this, PDD would invest in food safety, precision farming, and warehouse control. According to Chen, "Agriculture is a sector that touches the largest number of people and yet had the least amount of digitization in the past decades. Any technology that can improve productivity and efficiency along the agriculture value chain would have a huge impact."liii

Going forward, PDD planned to sell $145 bn of farm produce by 2025.liv David said that though PDD saw RMB136.4 bn, or 13.6% of its GMV from agriculture produce in 2019, the management team envisioned that figure would hit RMB1 tn, or seven times its 2019 GMV, within five years.lv Critics raised doubts over PDD's ability to achieve its target in digitizing agriculture as most of the e-commerce players were coming out with similar models. However, Chen remained optimistic: "In the future, there won't be a distinction between online and offline as no business can do without technology. So how do we become a pioneer and leader in this new world is something that we ponder a lot on."lvi

End Notes

- Venus Feng, Berber Jin, Blake Schmidt and Zheping Huang, "His Wealth Surged by $25 Billion. Then Jack Ma's Rival Quit," https://theprint.in, July 3, 2020.

- CK Tan, "China's Pinduoduo Turns to Smart Farming for Post-Covid Growth," https://asia.nikkei.com, October 5, 2020.

- "Pinduoduo (Nasdaq: PDD) Injecting Tech into Agriculture," https://olc.worldbank.org, May 2020.

- "China's Pinduoduo Beats Quarterly Revenue Estimates," https://in.reuters.com, August 21, 2020.

- "Pinduoduo Announces Second Quarter 2020 Unaudited Financial Results," https://investor.pinduoduo.com, August 21, 2020.

- Lu-Hai Liang, "Meet Colin Huang, Who Just Stepped Down as CEO of $100 Billion Pinduoduo and Whose Wealth Exploded by $25 billion in 2020," www.msn.com, July 3, 2020.

- Turner Novak, "Pinduoduo and Vertically Integrated Social Commerce," https://turner.substack.com, August 6, 2020.

- Turner Novak, "Pinduoduo and Vertically Integrated Social Commerce," https://turner.substack.com, August 6, 2020.

- Yashica Vashishtha, "Colin Huang: From Son of a Factory Worker to the CEO of a Billion Dollar Company ?Pinduoduo'," www.yourtechstory.com, March 16, 2019.

- "China's Pinduoduo Prices US IPO at Top of Range, Raises $1.6 Billion: Sources," www.reuters.com, July 26, 2018.

- "Annual Report 2019," https://investor.pinduoduo.com, April 24, 2020.

- Josh Horwitz, "China's Next Internet Giants are Getting Big by Serving the Country's Poor," www.qz.com, July 20, 2018.

- "What Can Luxury Learn from Group Buying?" www.forwardpmx.com, August 27, 2020.

- Yue Wang, "Pinduoduo: The $1.5B Startup Challenging E-Commerce Giant Alibaba in China's Towns and Villages," www.forbes.com, April 6, 2018.

- Arjun Kharpal, "Everything You Need to Know About Pinduoduo, the Fast-Growing Rival to Alibaba and JD in China," www.cnbc.com, April 22, 2020.

- Zen Soo, "China's Farmers Get Help Selling Produce Online as Beijing Steps Up Poverty Alleviation Efforts," www.scmp.com, January 13, 2020.

- Billy Duberstein, "Pinduoduo is Looking to Disrupt This Giant Industry Next," www.fool.com, August 24, 2020.

- Sarah Newey and Anne Gulland, "What is Coronavirus, How Did It Start and How Big Could It Get?" www.telegraph.co.uk, April 10, 2020.

- Jamie Ducharme, "World Health Organization Declares Covid-19 a ?Pandemic.' Here's What That Means," https://time.com, March 11, 2020.

- "Covid-19 Coronavirus Pandemic," www.worldometers.info, October 15, 2020.

- "How e-Commerce is Helping Farmers in China Deal with the Covid-19 Coronavirus Outbreak and Reshaping Consumer Behavior," https://medium.com, February 17, 2020.

- "Pinduoduo (Nasdaq: PDD) Injecting Tech into Agriculture," https://olc.worldbank.org, May 2020.

- "Pinduoduo Inc (PDD) Q4 2019 Earnings Call Transcript," www.fool.com, March 11, 2020.

- Caiwei Chen, "Pinduoduo Launch ?Help the Farmers' Initiative Amid Covid-19 Outbreak," https://pandaily.com, February 19, 2020.

- Isabel Wang, "Pinduoduo Posts Revenue Growth in Q1, Shows Support for Small Merchants During Covid-19," https://pandaily.com, May 25, 2020.

- Emma Lee, "Pinduoduo Boosts Support for Smaller Merchants During Crisis," https://technode.com, February 10, 2020.

- A J Cortese, "The Challenges of Transitioning China's Rural Economy to Livestreaming," https://kr-asia.com, August 8, 2020.

- Isabel Wang, "Pinduoduo Posts Revenue Growth in Q1, Shows Support for Small Merchants During Covid-19," https://pandaily.com, May 25, 2020.

- "Pinduoduo Inc (PDD) Q4 2019 Earnings Call Transcript," www.fool.com, March 11, 2020.

- "Pinduoduo Offers 1 Billion Yuans to Encourage Businesses to Fight with the Coronavirus," www.marketingtochina.com, February 20, 2020.

- Yupu Li, "China's E-commerce Giants Rush to Provide Covid-19 Tests as Economic Operation Restarts at Home," https://pandaily.com, April 23, 2020.

- Emily Chow, "Chinese Farmers Dodge Coronavirus and Go Online for Spring Seeds and Supplies," www.reuters.com, March 10, 2020.

- Benjamin Cooper, "The Covid-19 Pandemic ? Navigating the Rapidly Evolving Terrain of China's New Consumer Landscape," www.hkstrategies.com, April 17, 2020.

- "Pinduoduo Invests $200 Million in Electronics Retailer Gome as Covid-19 Forces Sector Consolidation," www.intellasia.net, April 21, 2020.

- "China's Pinduoduo Raises $1.1B in Private Placement," www.pymnts.com, March 31, 2020.

- Che Pan, "Pinduoduo Raises US$1.1 Billion in Private Placement to Fund New Services Such as Live-Streaming," www.scmp.com, March 31, 2020.

- "The 10 Most Innovative Chinese Companies of 2020," www.fastcompany.com, March 10, 2020.

- "Pinduoduo Beats Revenue Estimates as Online Shopping Demand Soars," www.reuters.com, May 22, 2020.

- Grady McRegor, "How the Pandemic Boosted the Net Worth of China's Fastest-Rising Billionaire," www.fortune.com, May 27, 2020.

- Ben Mahaney, "Pinduoduo Sinks 14% After 2Q Revenues Miss Estimates," https://finance.yahoo.com, August 24, 2020.

- "Pinduoduo Announces Second Quarter 2020 Unaudited Financial Results," https://investor.pinduoduo.com, August 21, 2020.

- James Kynge and Ryan McMorrow, "Pinduoduo Defies Gravity with Spending Spree," www.ft.com, June 25, 2020.

- "Revenue Grows But Losses Blow Out for US-Listed Pinduoduo," www.caixinglobal.com, May 23, 2020.

- Leo Sun, "4 Tough Tasks for Pinduoduo's New CEO," www.fool.com, July 7, 2020.

- Venus Feng, Berber Jin, Blake Schmidt and Zhephing Huang, "His Wealth Surged by $25 Billion. Then Jack Ma's Rival Quit," www.bloomberg.com, July 3, 2020.

- Grady McRegor, "How the Pandemic Boosted the Net Worth of China's Fastest-Rising Billionaire," www.fortune.com, May 27, 2020.

- Mark Sweney, "A Bubble? The Stellar Growth of China's e-Commerce Upstart Pinduoduo," www.theguardian.com, August 22, 2020.

- Venus Feng, Berber Jin, Blake Schmidt and Zheping Huang, "His Wealth Surged by $25 Billion. Then Jack Ma's Rival Quit," https://theprint.in, July 3, 2020.

- James Kynge and Ryan McMorrow, "Pinduoduo Defies Gravity with Spending Spree," www.ft.com, June 25, 2020.

- Russell Flannery, "Badger Successes in China: Pinduoduo's Chairman, New CEO Share US Connections," www.forbes.com, July 2, 2020.

- Venus Feng, Berber Jin, Blake Schmidt and Zheping Huang, "His Wealth Surged by $25 Billion. Then Jack Ma's Rival Quit," https://theprint.in, July 3, 2020.

- "Duoduo Smart Agriculture Competition Launched," www.fao.org, June 16, 2020.

- Yujie Xue, "PDD Doubles Down on Investment in Online Agriculture, Ramping Up Rivalry with JD, Alibaba," www.scmp.com, August 24, 2020.

- Rita Liao, "Pinduoduo's Latest Aim: Sell $145 Billion of Farm Produce in 2025," https://techcrunch.com, August 24, 2020.

- Billy Duberstein, "Pinduoduo is Looking to Disrupt This Giant Industry Next," www.fool.com, August 24, 2020.

- "Pinduoduo CEO on What's Next for Chinese e-Commerce in the Wake of the Coronavirus Pandemic," www.globenewswire.com, September 11, 2020.