Mar '21

The IUP Journal of Case Folio

Archives

The Reset Button Pushed by Forever 21

Faria Zafar

Associate Consultant, IBS Case Research Center, IBS Hyderabad (Under IFHE - A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: faria@icmrindia.org

Indu Perepu

Research Faculty, IBS Case Research Center, IBS Hyderabad (Under IFHE - A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: indup@icmrindia.org

Forever 21, a US-based fashion retail brand headquartered in Los Angeles, California, was started by a South Korean immigrant couple, Jin Sook and Do Won Chang, in 1984. Forever 21 was a forerunner in the fast fashion industry and, spurred by its initial success, it started opening new stores at frequent intervals. But on September 29, 2019, Forever 21 filed for Chapter 11 bankruptcy protection to restructure its business. The company said, "We do however expect a significant number of these stores will remain open and operate as usual, and we do not expect to exit any major markets in the US." The company had 549 stores in the US and 251 stores in other countries at the time of filing bankruptcy. The company said it planned to "exit most international locations in Asia and Europe" but would continue to operate in Mexico and Latin America. It was expected to close up to 350 stores worldwide, including 178 stores in the US. A Forever 21 spokesperson said the retailer expected to have between 450 and 500 stores globally after this process. The case discusses the origin and growth of Forever 21, and the factors that led to its downfall-rapid expansion, global recession, retail apocalypse, and changing consumer preferences.

Forever 21 gives hope and inspiration to people who come here with almost nothing.1

- Don Won, Founder, Forever 21

This was an important and necessary step to secure the future of our company, which will enable us to reorganize our business and reposition Forever 21.2

- Linda Chang, Executive Vice-President, Forever 21

Bankruptcy may be the only way to salvage the brand, where they can basically follow the shrink to grow strategy.3

- Craig Johnson, Founder, Customer Growth Partners

Introduction

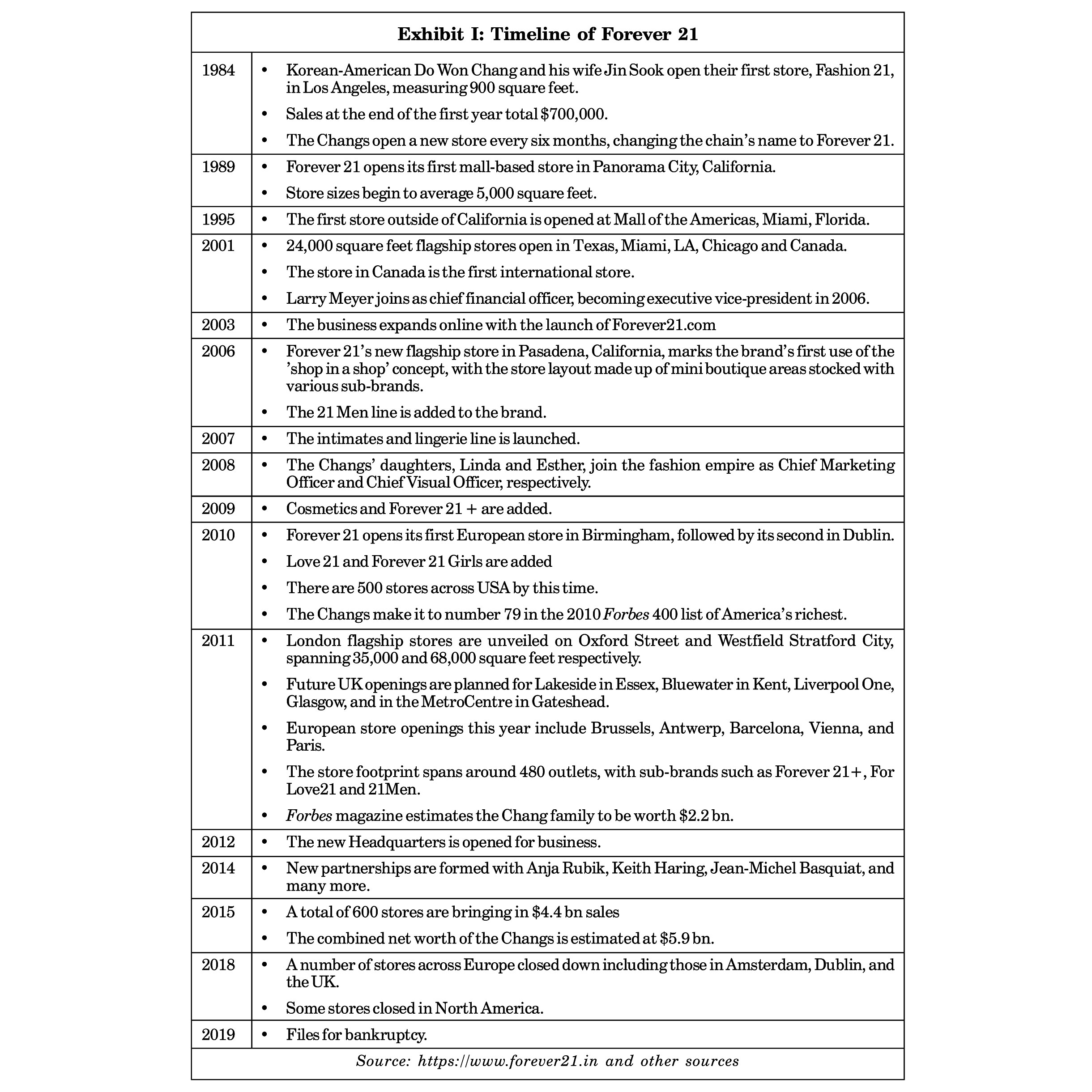

Initially, the business was named Fashion 21 and was marketed to Korean American women. The couple started the business with $11,000 and opened its first 900 square feet store on April 21, 1984, at Figueroa Street, LA. The company recorded sales to the tune of $700,000 in its first year of operations.11 In 1987, it changed its name to Forever 21 after the founders felt "young adults saw 21-year-olds as having the independence they so desired and older adults fondly remembered being 21 and unburdened by life's obligations and responsibilities."12

At the beginning, Fashion 21 was popular mostly among the Korean community of LA. Spurred by the success they tasted in its initial year of business, the company started opening a new outlet every six months. This helped it to broaden its customer base even more. By the end of 2000, Forever 21 had 100 stores across the USA.13 Its first international store was opened in Canada in 2001. By 2015, Forever 21 had become a well-known brand with more than 600 stores across the globe and $4.4 bn in global sales. The same year, the founders of Forever 21-the Changs-became one of the wealthiest American couples with a combined net worth of $5.9 bn.14

Forever 21 operated on a "fast-fashion" business model wherein a very strict turnaround time was adhered to. While it took traditional fashion houses six months to bring new styles to stores, for Forever 21, it took just a few weeks. The process from raw material to finished clothing was based on Forever 21's strategy of placing new products in stores every day. Forever 21 managed a high turnover rate because it "carried a healthy mix of private label goods as well as those from other suppliers."15 Forever 21 managed such short cycle times as it chose suppliers close to the market of their operations.

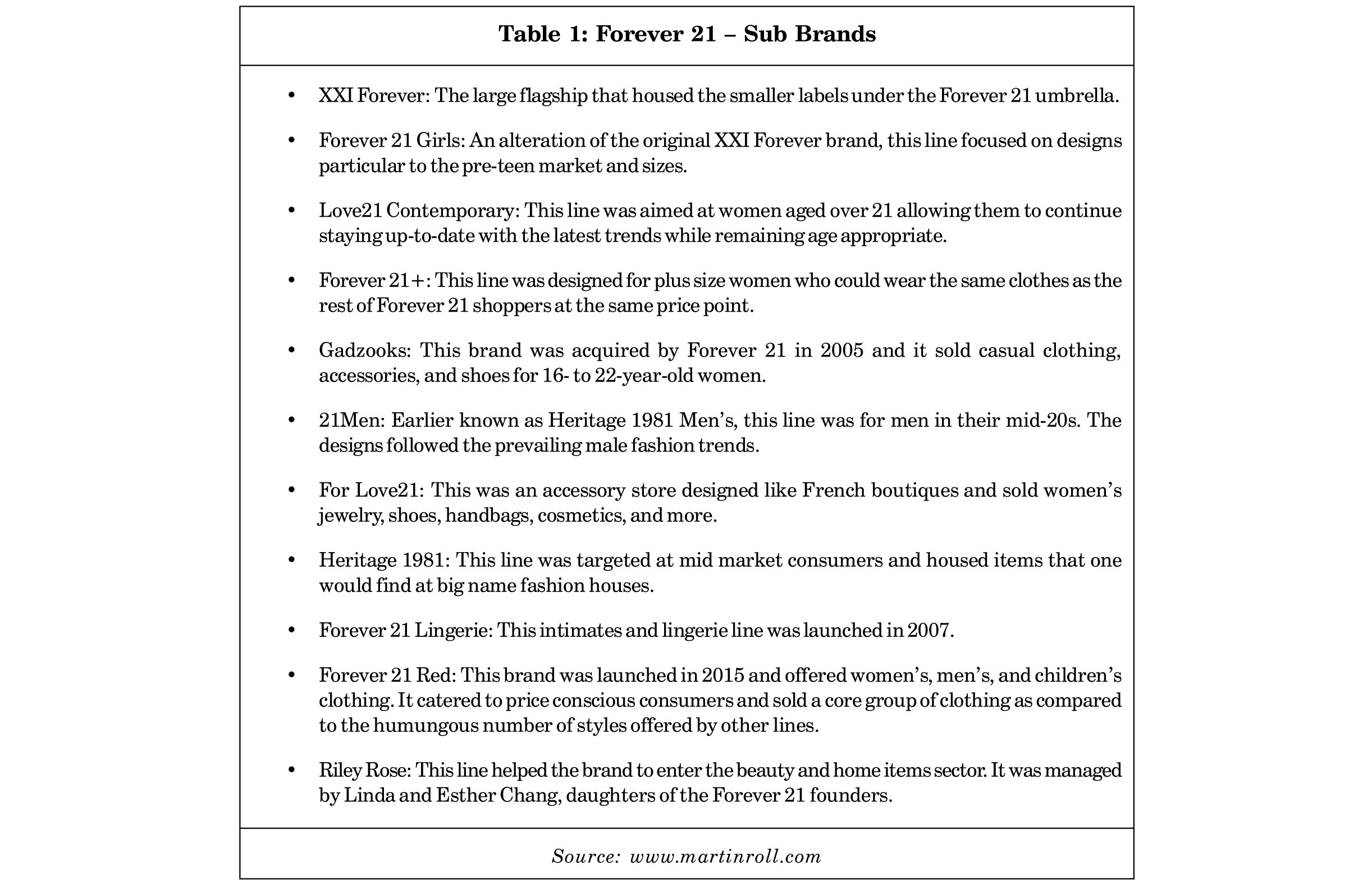

Forever 21 became the most favored destination for "fast fashion".16 Its fast fashion business model provided quick turnaround designs and mass produced products that were reasonably priced. This became popular with young customers as they wanted to go in for the latest looks but could not afford expensive fashion trends. Though the Forever 21 products were mass produced, they carried a feeling of uniqueness because their stores sold select styles and for only a limited period. A store manager said in 2001, "We get new merchandise in every day. With most mall stores, it's usually one or two days a week. We always have the newest styles."17 (Refer Table 1 for sub brands of Forever 21).

Store Expansion

Forever 21 opened its first 900 square foot store on April 21, 1984 at Figueroa Street, LA. In 1989, the company opened its first mall store in Panorama City, California (Refer Exhibit I for the timeline of Forever 21). At that time, store sizes were beginning to average 5,000 square feet. In 1995, the first store outside of California was opened at Mall of the Americas, Miami, Florida. 24,000 square feet flagship stores were opened in Texas, Miami, LA, Chicago, and Canada in 2001.

The year 2006 saw another innovation in the Forever 21 stores. Its new flagship store in Pasadena, California, marked the brand's first use of the 'shop in a shop' concept, with the store layout made up of mini boutique areas stocked with various sub-brands.

Since its inception in 1984, Forever 21 had opened a new store every six months. The company had ambitions of becoming a department store where the entire family could shop. Therefore, the company targeted giant, multi-level spaces. In the 2000s, it was at its peak of success and went in for aggressive expansion globally. Within a span on six years, it went from 7 countries to 47 countries.18 Linda Chang, Executive Vice-President, Forever 21, said, "We went from seven countries to 47 countries within a less-than-six-year time frame and with that came a lot of complexity."19

Forever 21 stores were huge, with the average size being 38,000 sq. ft.20 Some of the largest Forever 21 stores were the ones at Las Vegas (127,000 sq. ft), Times Square (90,000 sq. ft), and San Bernardino, CA (94,000 sq. ft).21 The largest store, which held multiple stories, was claimed to occupy 162,000 sq. ft.22

The Retail Apocalypse

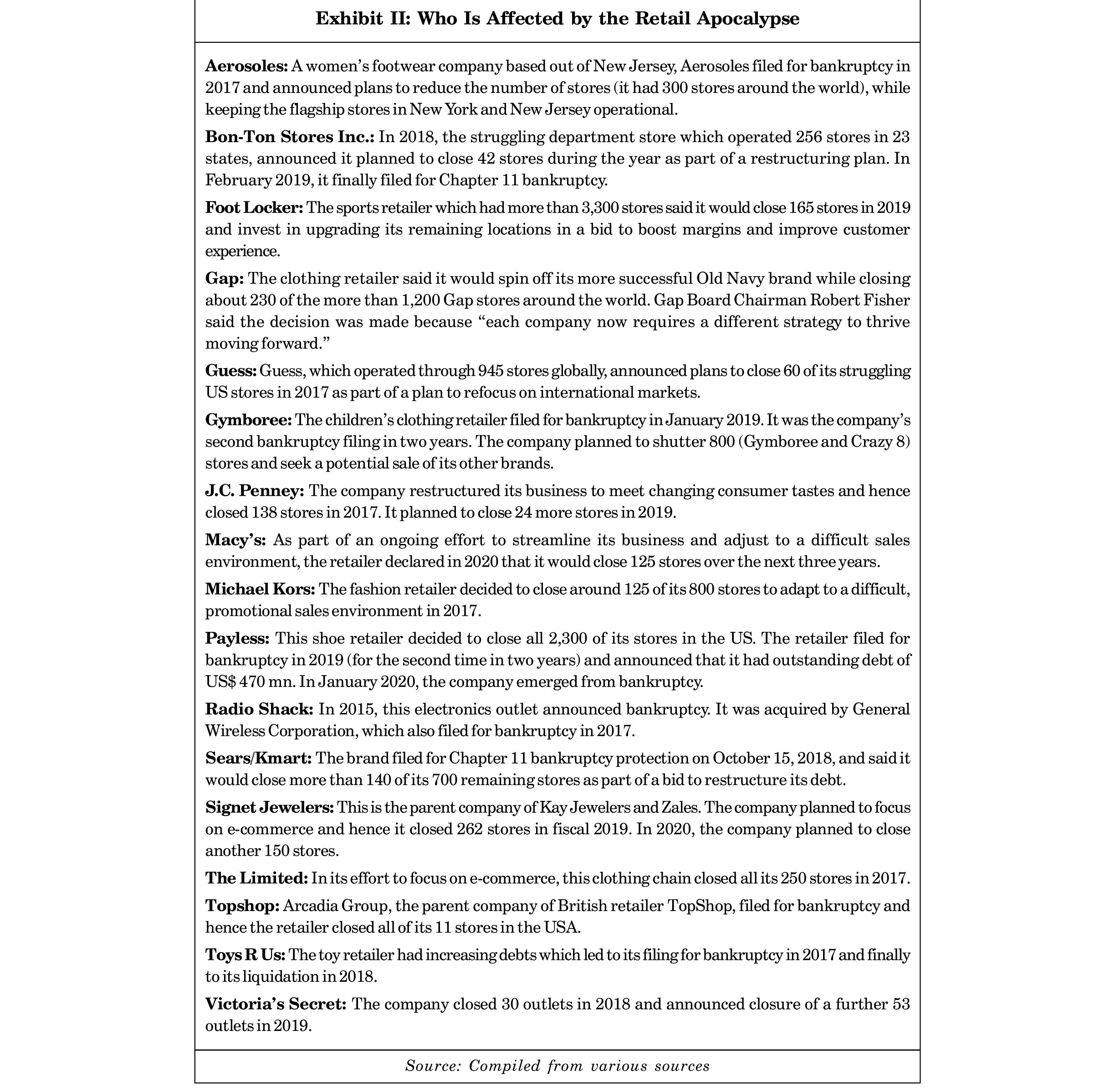

The retail industry in the US was affected drastically during The Great Recession. The Great Recession was a period of economic decline observed in world markets during the late 2000s and early 2010s.23 The scale and timing of the recession varied from country to country. The International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression and it was regarded as the second-worst downturn of all time. When the economy collapsed during this time, people stopped shopping. Retail sales dropped to a 35-year low.24 In response, retailers deeply discounted items to save their bottom lines. Many retailers suffered financial losses. Even when things started to improve, some retailers had to kick hard to stay afloat. These retailers had to take the help of private equity firms to bail themselves out of the crisis. The private equity firms began buying out these retailers and transitioned them away from publicly traded companies (Refer Exhibit II for the Role of Private Equity in Retail Apocalypse).

The retail industry in the US had thrived earlier from the 1990s due to high consumer spending. Low interest rates and easily available credit had encouraged consumers to splurge on shopping. To cater to the growing demand, retailers had added hundreds of new stores and many of them had launched online versions of their stores. The retailers also expanded globally. While the US economy grew 5% annually from 1996 to 2006 the retail sector grew at 12%.25 The retailers' revenues rose strongly, profits increased, and share prices soared.

But then came the Great Recession. The Great Recession was the economic downturn from 2007 to 2009 after the bursting of the US housing bubble and the global financial crisis. After the Great Depression in 1930, The Great Recession was the most challenging economic phase for the United States.

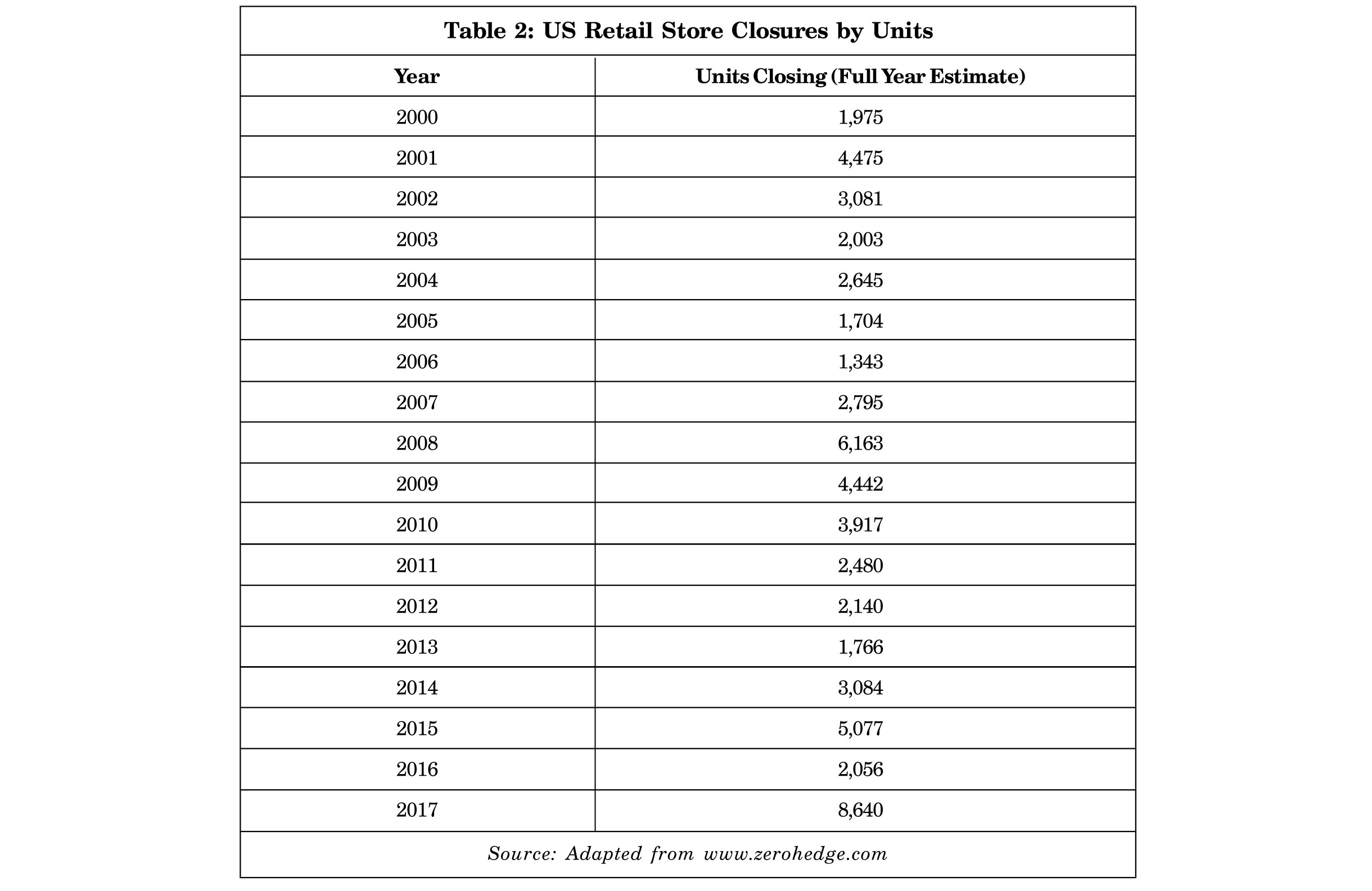

The retailing boom faced a downturn after 2008 due to the recession,26 in the aftermath of the US housing bubble burst followed by a global financial crisis. The recession

set the stage for the dreaded 'Retail Apocalypse'. Retailers had to heavily discount their products to stay afloat and meet their bottom lines. Unable to face the increasing losses, several retailers closed down their businesses. There were also frequent cases of retailers filing for bankruptcy since 2017. Observers dubbed this as the Retail Apocalypse.

To overcome the retail apocalypse, some retailers had to turn to private equity for help. The closure of Toys 'R' Us was one such tragedy due to private equity debt. Toys 'R' Us faced problems in business due to competition from Target and Walmart and the penetration of smaller chains. To turn the business around, the company went in for a joint $6.6 bn leveraged buyout by Bain Capital, Kohlberg Kravis Roberts, and Vornado Realty Trust. But the deal left the company with a debt of $5 bn. Toys 'R' Us was unable to pay the debt over a span of 10 years and finally had to bring down the shutters.

Chains like Sears, Gymboree (closed 805 stores in 2019), Nine West, PaylessShoe Source (closed 2,500 stores in 2019), Shopko discount stores (closed 251 stores in 2019), Charlotte Russe fashion boutiques (closed 500 stores in 2019), Performance Bicycle shops (closed 102 stores in 2019), and Mattress Firm had all walked the same path (Refer Table 2 for the number of stores closed in the US).

Retailers focusing on affordable fashion products had also filed for bankruptcy like Claire's, Charlotte Russe, and PacSun. In 2019, close to 8,200 retailers stores brought their shutters down as compared to 5,589 stores in 2018 (Refer Exhibit III for the Retailers affected by the Apocalypse).

With the advent of e-commerce giants like Amazon, online shipping became the in thing. People preferred to shop from the comfort of their homes rather than go to physical stores (Exhibit IV for the role of e-commerce in Retail Apocalypse). Between 2010 and 2016, Amazon's sales in North America went from $16 bn to $80 bn. e-Commerce was also very competitive in terms of price and promotion. Hassle-free

shopping and easy return policies made online shopping cheap, easy, and risk-free for consumers in apparel-the largest e-commerce category.27 The success of start-ups with an online business model like Casper, Bonobos, and Warby Parker forced physical stores to rethink their strategy. e-Commerce experienced an increase in sales by

11-20% during the holidays in 2018 compared to retail stores which only experienced an increase of 1.6%.28

According to a 2018 report from Quantis,29 apparel and footwear production accounted for 8% of global greenhouse gas emissions. Sustainability took center stage among shoppers, especially young shoppers who had once been core customers of fast fashion. According to eMarketer,30 shoppers considered sustainability when making purchases as 68% of US internet users deemed product sustainability an important factor in making a purchase decision. This shift in the buying preferences of shoppers affected the retail business, specially the fast fashion industry (Refer Exhibit V for Sustainability over Fashion).

According to financial services firm Cowen, the US had an estimated 23.5 sq. ft of retail for every citizen, as compared to 16.4 sq. ft in Canada, 4.6 sq. ft in the UK, and 3.8 sq. ft in France. Analysts at Cowen suggest that "the sector remains in the early innings of reduction in unproductive physical retail."31

Signet, which operated stores like Kay, Zales, and Jared Jewelers, closed 262 stores in 2018 and 150 stores in 2019. In 2019, Roberto Cavalli (Italian luxury fashion brand) filed for bankruptcy and closed all its 12 stores in the US. Home furnishing brand Z Gallerie filed for bankruptcy so as to restructure its business, and ended up closing 17 stores out of 76 in 2019.

Large retail brands were equally affected by the apocalypse. Victoria's Secret closed 30 stores in 2018 and 53 stores in 2019. Other large brands that resized include Dollar Tree (closed 390 Family Dollar Store in 2019), Beauty Brands (closed 25 stores in 2019), J. C. Penny (closed 18 stores in 2019), and Macy's (closed 8 stores in 2019).

Some brands decided to close stores that were less productive and open new stores in new locations. Abercrombie & Fitch closed 29 stores in 2018 and 40 stores in 2019. At the same time, the company opened 40 new stores in new locations. Gap closed 50 stores in 2019 and announced closure of 250 more over the next two years. GAP CEO Art Peck said, "GAP would continue to open new locations, explaining the closures reflect the wrong stores in the wrong locations."32

John D Morris, senior brand apparel analyst for financial services firm D.A. Davidson, said, "This is a healthy cleansing for the retail industry. We're in the middle of a multiyear retail purge. Companies are finding that when it comes to stores, less is more. Retailers have been hanging on too long to their bricks-and-mortar stores. The trend is toward more streamlined stores: Less chaos, less inventory, less choice. If a customer wants something in a different color or size, they can find that online."33

In 2019, in the US, 9,302 stores were closed and around 14,000 closures were projected for 2020. Jay Sole and Michael Lasser, analysts at UBS, said, "Store rationalization needs to accelerate meaningfully as online penetration continues to rise. Assuming online sales' share of total retail sales in the US grows to 25% by 2026, from 16% in 2019, roughly 75,000 more retail doors, excluding restaurants, need to close." This would mean that approximately 8,000-8,500 stores would close for every 1% increase in online penetration.34 This growth in online sales was fueled mostly by Amazon, which was expected to account for almost half of the e-commerce market in the US.

As per the prediction of UBS, clothing retail stores would be hit hardest, with almost 21,000 stores closing in 2020, which would be a drop of 25% from the 82,200 stores existing in the US in 2019. Consumer electronics retailers were expected to see a drop of 25% by 10,000 stores from 39,000 in 2019. Home furnishings were projected to witness a drop of 35%, closing 8,000 stores from 25,300 stores 2019. And the number of grocery stores was expected to come down by 7,000, or 8%, from 89,500 in 2019, where online penetration was 2% in 2019.35

Natalie Kotlyar, retail and consumer products practice leader, said in 2019, "Industry dynamics will inevitably favor those who are thinking long-term. What worked to keep businesses afloat in 2018 may not be enough. Retailers that are just surviving today could find themselves in trouble tomorrow."36

Forever 21 Lands in Trouble

In the years after 2010, many retailers wanted to shrink their mall presence whereas Forever 21 cracked leases for big spaces vacated by struggling department stores like the bankrupt Sears, Mervyn's, and Borders. Its store count bloated from 480 stores in 2010 to 600 stores in 2014 to 800 stores in 2018. Gabriella Santaniello, Founder of A Line Partners, a retail research firm, said that Forever 21 "went in big when everyone else was closing stores and downsizing".37 The company was very confident of its success and it typically signed ten-year leases for these new stores. The company had gigantic stores like its four-story, 90,000-sq-ft flagship store with 151 fitting rooms in New York's Times Square.

Alexander Goldfarb, an Analyst at Sandler O'Neill who covered a lot of the big mall companies, said, "It was certainly a more popular tenant out of the credit crisis and took a lot of space. Now they're in basically every mall."38

Forever 21 was among the top tenants in malls across the nation. It happened to be the single-largest tenant at Taubman,39 where it occupied 4.3% of the landlord's total square footage with just 17 stores, each of which averaged 30,200 sq. ft. It left behind many apparel companies which occupied smaller stores such as H&M (20 stores), which averaged 20,700 sq. ft) and Gap (47 stores, which averaged 8,500, sq. ft) at Taubman.40 It was also one of the largest tenants at mall companies like Brookfield Property Partners, Simon Property Group, and Macerich, according to regulatory filings.41

The expansion was motivated by a pursuit for growth by the Changs. In 2014, CEO Do Won proclaimed that he wanted to double the company's brick-and-mortar footprint to 1,200 stores over the next three years.42 The assumption was that bigger sales and profits would inevitably follow. "The only arrow they had in their quiver was to add more stores",43 says one former employee, who worked at corporate headquarters in Los Angeles.

As Forever 21 increased the size of its stores, it filled them with a wide range of products, expanding into children's, men's, plus sizes, intimates, and athleisure. In 2018, Forever 21 announced plans for a 12,000-sq-ft store at the Columbia Center Mall in Kennewick, Washington, an 11,000-sq-ft store at Grove City Premium Outlets in Grove City, Pennsylvania, and a 19,000-sq-ft store at Carriage Crossing in Collierville, Tennessee. "It's kind of like The Gap, where they overbuilt the stores, too," said Wharton marketing Professor Barbara Kahn, who also hosted "Marketing Matters" on Sirius XM. "They weren't seeing the trends, and instead of slowing down on physical space, they were building up physical space. That was a tactical mistake."44

As the number of stores was rising, so were complaints on websites like Yelp.45 Customers complained that there weren't enough employees on the floor to help. Customers, time and again, found sections of dressing rooms closed off and cash registers shut down. Clothes were often down on floor or sometimes on the wrong racks. Some stores were more than just messy. There were complaints that dust bunnies littered the floor, spills weren't cleaned up, and trash lay in plain sight on the floor. All this suggested that the company was unable to manage the increased number of stores.

In 2019, Business Insider Analyst Bethany Biron visited both Forever 21 and H&M stores in New York's Westfield World Trade Center mall and noticed that H&M attracted more customers with its organized and well lit store.46 "We shopped at a Forever 21 and H&M store, and saw that Forever 21's in-store experience paled in comparison to H&M. Forever 21 left much to be desired."47

No More Fast-Fashion

Forever 21 directed all its focus on expansion and ignored its supply chain. Because of neglecting the supply chain, it took Forever 21 more time to get fresh styles of clothes to market. At the same time, fast fashion was picking up and shoppers were asking for freshness in stocks. Sales of Forever 21 tumbled as the company faced increased competition from rivals such as H&M and Zara,48 which had agile supply chains, and unveiled new styles and fashion more often.

Initially, Forever 21 was popular among Los Angeles' Korean American crowd. Later its low cost trendy apparel caught up with a wider community of American youth. But the moment it started focusing on aggressive expansion, the styles became more "cookie-cutter".49 This brought down its fan following among core customers and customer preference shifted to competitors H&M and Zara.

Mark A Cohen, Director of retail studies at Columbia Business School, credited Zara's success to the popularity of fast fashion. However, according to him, Forever 21 had lost its appeal in fast fashion because the company was more focused on expansion "without regard to a reasonable outlook. It's a self-inflicted catastrophe. This is a bonanza for the competition that Forever 21 has and it's another death knell for the malls they're in that have already lost a Sears, Macy's, Penney's, and are struggling with footsteps diminishing every day."50

The preferences of young people, who were the core customers of Forever 21 was changing. They preferred sustainable products as they were becoming more conscious about protecting the environment. The fast fashion products of Forever 21 had a high environmental cost which young customers were not comfortable with. Fast-fashion was seen as causing "environmental havoc", as 85% of textiles produced each year ended up in landfills.51 "A couple of years ago, I became very conscious of how much I was consuming. I would buy seven shirts and I would give them all away after a few wears," Meredith, a young customer, said. "Now I buy something that's higher-quality, that's not just a little Band-Aid that causes so much environmental destruction."52

Not Enough Online Presence

Since its inception, Forever 21 had targeted young shoppers. But it lost its target customers after failing to strengthen its e-commerce strategy. Linda Chang, Executive Vice-President, Forever 21, said, "The retail industry is changing-there has been a softening of mall traffic and sales are shifting more to online."53 Forever 21 had a challenge in competing with other fast fashion retailers with a strong social media presence and also those that were based solely online, such as Fashion Nova, Misguided, and ASOS. In 2019, 16% of its sales were through e-commerce.

In 2015, Forever 21 was praised for its social media strategy that won it many young customers.54 The key to success, the company had realized, was to win over the millennial crowd through social media. Mario Moreno, global social media manager for Forever 21, stated at the 2014 WWD Digital Forum, "[Millennials] are looking for brands that provide them with content for their social feeds, and to recognize their content and appreciate it through social currency: likes, comments, retweets, and reposts."55 By 2015, the company had 8.8 million Instagram followers. According to WWD, Forever 21 was the fourth most followed brand on the social media. In 2019, it had more than 16 million followers on Instagram.56 Forever 21 had a user-friendly site with excellent customer interaction. It reposted quite a good number of content from customers who showcased the products at the store.

The company, however, did not further strengthen its e-commerce platform, even though its core customers-the young people-preferred shopping online. Nor did it turn to Influencer marketing to win over customers. However, it was well-known that millennial shoppers were more attracted to products on YouTube and Instagram via influencer content.

A digital presence formed a crucial component of businesses, especially for brands that targeted young customers. The decline of traditional brick-and-mortar shops was believed to be a result of consumers shifting online, stimulated by the rise of e-commerce giants like Amazon. The growth of e-commerce and the slow sales in physical stores threatened the traditional retailing model. According to Marketingdive.com, 75% of the combined population of Gen Z and millennials enjoyed online shopping more than moving around stores.57 It also meant fewer bags to carry around. Of the combined population, 90% moved to internet shopping and preferred online fashion retailers like Lazada, Shopee, and Zalora. Unfortunately, Forever 21 lost a huge set of customers here. This shift to e-commerce also triggered the "retail apocalypse".

According to Wharton marketing professor Barbara Kahn and marketing professor at Lehigh University,58 Ludovica Cesareo, Forever 21 had a very weak online presence. It did not strengthen its e-commerce platform, even though its primary customers were digital-savvy young millennials. They said, "It's fascinating that they couldn't predict that shift, so now they're forced to restructure their entire company and really put pressure on their online commerce platform to try to make up for the lost sales."59

Downsizing

In 2018, Forever 21 started to downsize and close some European stores in Amsterdam, Dublin, and the UK. In the UK, the company had seen the potential to open 100 stores. But by 2019, it was operating in only three stores, down from 8 stores earlier. According to the filings submitted to Companies House In 2017, the company reported a loss of £61 mn in the UK.

A few stores in North America were affected too. In 2018, Forever 21 swapped a 66,000-sq-ft store for a space a third of the size at the Riverchase Galleria outside of Birmingham, Alabama. In early 2019, the Forever 21 store at the Destiny USA mall in Syracuse, New York, which had expanded from one floor to two floors in 2012, reverted to one floor. In 2011, Forever 21 moved into an 110,000-sq-ft, two-level store previously occupied by Dillard's at the Mall St. Matthews in Louisville, Kentucky. That store was now down to just 30,000 sq. fet and the extra space was given to Dave and Busters and Ulta Beauty.

The company had been stepping back on some international expansions as well. It was reportedly planning to close down operations in 40 countries including Canada, China, and Japan, as part of its global restructuring strategy.60 It stopped operations in China in 2019 after entering the market less than a decade earlier. In March 2019, the company closed a two-story location in Toronto and asked shoppers to visit its closest store-located one block away.61 The company had announced that it would pull out of Japan by October 2019 due to "continued sluggish sales" and close all of its 14 stores.

While trying to plan a turnaround, the company took a $500 mn loan from JPMorgan Chase in 2017. Early in 2019 the company sold its headquarters building for $166 mn.62

Bankruptcy Filing

On September 29, 2019, Forever 21 filed for bankruptcy protection under Chapter 11 to restructure its business. The company said, "We do however expect a significant number of these stores will remain open and operate as usual, and we do not expect to exit any major markets in the US." The company had 549 US stores and 251 stores in other countries at the time of filing for bankruptcy.63 The company said it planned to "exit most international locations in Asia and Europe" but would continue to operate in Mexico and Latin America. It was expected to close up to 350 stores worldwide, including 178 US stores. A Forever 21 spokesperson said the retailer was expected to have between 450 and 500 stores globally after this process.64

In 2018, e-commerce constituted 16% of the total sales of Forever 21. Its total revenue was $3.3 bn in 2018, which was a slide from $4.4 bn in 2016. The restructured company was expected to bring $2.5 bn in annual sales. By 2019, the company had 32,800 employees, down from 43,000 in 2016.65

Forever 21 did not pay rent on its stores in September 2019 so as to save capital. Jon Goulding, an executive at the consultancy Alvarez & Marsal who was Forever 21's Chief Restructuring Officer during the proceedings, said, "Forever 21 planned to renegotiate leases on some of its United States stores after the filing."66 He said that liquidations would begin by October 31, 2019, for the stores that were closing. He anticipated the final count to be below 178. Talking about the landlords of leased spaces, he said, "A number of these folks don't want boxes back of the size we have with what's going on in the mall space."67 Goulding said that underperforming stores were likely to be located in lower-quality malls and stores of bankrupt retailers like Sears.

In the bankruptcy filing, Forever 21 stated that it owed $1 bn to $10 bn to more than 100,000 creditors, including Simon Property Group (owed $8.1 mn), Brookfield Properties (owed $5.3 mn), and FedEx (owed $3.4 mn).

As part of the Chapter 11 proceedings, Forever 21 said it had obtained $275 mn in financing from JPMorgan Chase, as well as $75 mn in new capital from TPG Sixth Street Partners that would allow it to operate in a "business as usual" manner during the restructuring. Its Canadian subsidiary also received protection from creditors.

Neil Saunders, Managing Director of GlobalData Retail, said: "The entry of Forever 21 into Chapter 11 bankruptcy is a consequence of both changing trends and tastes within the apparel market and of missteps by the company. As well as facing competition from the likes of H&M there was also a lack of clarity and differentiation at Forever 21. Over the past few years, the brand has lost much of the excitement and oomph which is critical to driving footfall and sales and is now something of an also-ran which is too easily overlooked. Store standards have also been sliding and consumer ratings for the quality of displays, merchandise, and the amount of inspiration in shops have dipped considerably over the past year. Bankruptcy would result in a much leaner US business, but most, if not all, stores in Europe would be expected to close."68

- James Lee, "Forever 21: An American Dream Come True," Tharawat Magazine, August 2017.

- Kim Bellware, "Forever 21 is Filing for Bankruptcy. But Its Employees Aren't Going Down Without a Fight," The Washington Post, October 2019.

- Lauren Debter and Elana Lyn Gross, "Forever 21 Hits Rough Patch, Knocking Founders Out of Billionaire Ranks," Forbes, July 2019.

- Chapter 11 is a form of bankruptcy that involves a reorganization of the debtor's business affairs, debts, and assets.

- Nathaniel Meyersohn and Chris Isidore, "Forever 21 Files for Bankruptcy and will Close Up to 178 US Stores," CNN Business, September 2019.

- Ibid.

- "Forever 21 Files for Chapter 11 Bankruptcy Protection," BBC, September 2019.

- Sears, an American chain of department stores, was founded by Richard Warren Sears and Alvah Curtis Roebuck in 1893. It filed for Chapter 11 Bankruptcy on October 15, 2018.

- Macy's, an upscale American department store chain, was founded in 1858 by Rowland Hussey Macy. It filed for Chapter 11 Bankruptcy in 1992 and was restructured. For the year ending February 2019, Macy's revenue was US$25.7 bn.

- The retail apocalypse is the closing of numerous North American brick-and-mortar retail stores, especially those of large chains, starting around 2010 and continuing onward.

- Shoshy Ciment, "How Forever 21 went from a Fast-Fashion Powerhouse to a Brand Reportedly Eyeing Bankruptcy and a Troublesome Future," Business Insider, September 2019.

- Sade Dayangku, "5 Inspirational Facts You're Dismissing About the Forever 21 Founders' Story," Vulcan Post, October 2019.

- "Forever 21 Inc.," Encyclopaedia, January 2020.

- Kaitlyn Wang and Irene Kim, "At Its Peak, Forever 21 Made $4.4 Billion in Revenue. Here's What Lead to the Brand's Downfall and Near Bankruptcy," Business Insider, September 2019.

- Lydia Dishman, "Forever 21 Expands: Big in Japan and the Plus-Size Market," CBS News, January 2010.

- "Fast Fashion" is a segment of clothes which are trendy and come in affordable prices.

- Nathaniel Meyersohn and Chris Isidore, "Forever 21 Files for Bankruptcy and Will Close Up to 178 US Stores," CNN Business, September 2019.

- Sapna Maheshwari, "Forever 21 Bankruptcy Signals a Shift in Consumer Tastes," The New York Times, Spetember 2019.

- Ibid.

- "About Us", Forever 21, https://www.forever21.in/content/about_us

- Erika Adams, "Forever 21 Reportedly Wants to Scale Back Its Massive Stores," Racked, September 2015.

- "About Us", Forever 21, https://www.forever21.in/content/about_us

- "Great Recession," Wikipedia.

- Tommy Andres, "Divided Decade: How the Financial Crisis Changed Retail," Marketplace, December 2018.

- Ken Favaro, Tim Romberger and David Meer, "Five Rules for Retailing in a Recession," Harvard Business Review, April 2009.

- The recession was termed as the most challenging phase in the US after the recession (depression?) during the 1930s.

- Derek Thompson, "What in the World Is Causing the Retail Meltdown of 2017?" The Atlantic, April 2017.

- Dias Marendra, "What is Retail Apocalypse and Its Impact to the Retail Industry," Businesstech, October 2019.

- Quantis is a company that guides organizations to define, shape, and implement intelligent environmental sustainability solutions.

- eMarketer is an independent research company.

- Hayley Peterson, "The Retail Apocalypse is Still in Its 'Early Innings' - And Thousands More Stores will Close Before It Ends," Business Insider, October 2018.

- Pamela N Danziger, "Retail Downsizing will Accelerate, With UBS Predicting 75,000 Stores Will Be Forced to Close by 2026," www.forbes.com, April 10, 2019.

- Abha Bhattarai, "'Retail Apocalypse' Now: Analysts Say 75,000 More U.S. Stores Could Be Doomed," Washington Post, April 2019.

- Lauren Thomas, "75,000 More Stores Need to Close Across the US, UBS Estimates, as Online Sales and Amazon Grow," CNBC, April 2019.

- Pamela N Danzinger, "Retail Downsizing Will Accelerate, With UBS Predicting 75,000 Stores Will Be Forced to Close By 2026," Forbes, April 2019.

- Ibid.

- Lauren Debter and Elana Lyn Gross, "Forever 21 Hits Rough Patch, Knocking Founders Out of Billionaire Ranks," Forbes, July 2019.

- Ibid.

- Taubman owns, manages and/or leases outlet shopping centers in the US and Asia.

- "Taubman Centers, Inc. Form 10-K," www.annualreports.com, December 2018.

- Lauren Debter and Elana Lyn Gross, "Forever 21 Hits Rough Patch, Knocking Founders Out of Billionaire Ranks," Forbes, July 2019.

- Ibid.

- Ibid.

- Barbara Kahn and Ludovica Cesareo, "Fashion Fail: Where Did Forever 21 Go Wrong?" Knowledge@Wharton, October 2019.

- Yelp is a business directory service and crowd-sourced review forum, and a public company of the same name that is headquartered in San Francisco, California.

- "How Forever 21 Went from a Fast-Fashion Powerhouse to a Brand Reportedly Eyeing Bankruptcy and a Troublesome Future," Business Insider, September 2019.

- Bethany Biron, "We Shopped at Forever 21 and H&M and Saw Firsthand Why One Store is Clearly Outperforming the Other," www.businessinsider.in, June 07, 2019.

- Lauren Thomas, "It's the Last Christmas for Some Forever 21 Stores. Here's Why the Retailer went Bankrupt," CNBC, December 2019.

- Kaitlyn Wang and Irene Kim, "At Its Peak, Forever 21 Made $4.4 Billion in Revenue. Here's What Lead to the Brand's Downfall and Near Bankruptcy," Business Insider, September 2019.

- Sapna Maheshwari, "Forever 21 Bankruptcy Signals a Shift in Consumer Tastes," The New York Times, Spetember 2019.

- Made Lapuerta, "How E-Commerce Killed Forever 21," Medium, October 2019.

- Abha Bhattarai and Taylor Telford, "Forever 21 Files for Bankruptcy, will Close 350 Stores Worldwide Amid Restructuring," The Washington Post, September 2019.

- Sapna Maheshwari, "Forever 21 Bankruptcy Signals a Shift in Consumer Tastes," The New York Times, Spetember 2019.

- Sara Ethers, "Forever 21 Drives Millennial Engagement Through Social Media," Fashion United, November 2015.

- Marcy Medina, "Forever 21's Social Strategy: Millennials Create Content, Drive Sales," www.wwd.com, November 2015.

- Terry Nguyen, "Forever 21 Is Filing For Bankruptcy. What Does This Actually Mean?" Vox, September 2019.

- "How Forever 21 Was Crushed by eCommerce," iManila, October 2019.

- Barbara Kahn and Ludovica Cesareo, "Fashion Fail: Where Did Forever 21 Go Wrong?" Knowledge@ Wharton, October 2019.

- Ibid.

- Sapna Maheshwari, "Forever 21 Bankruptcy Signals a Shift in Consumer Tastes," The New York Times, Spetember 2019.

- Lauren Debter and Elana Lyn Gross, "Forever 21 Hits Rough Patch, Knocking Founders Out of Billionaire Ranks," Forbes, July 2019.

- Hannah Madans, "Forever 21 HQ Sells for $166M", Los Angeles Business Journal, February 2019.

- Nathaniel Meyersohn and Chris Isidore, "Forever 21 Files for Bankruptcy and will Close Up to 178 US Stores," CNN Business, September 2019.

- "Forever 21 Files for Chapter 11 Bankruptcy Protection," BBC, September 2019.

- Sapna Maheshwari, "Forever 21 Bankruptcy Signals a Shift in Consumer Tastes," The New York Times, Spetember 2019.

- Ibid.

- Ibid.

- "Forever 21 Files for Chapter 11 Bankruptcy Protection," BBC, September 2019.

- Abha Bhattarai and Taylor Telford (2019), "Forever 21 Files for Bankruptcy, will Close 350 Stores Worldwide Amid Restructuring," The Washington Post, September.

- Abha Bhattarai (2019), "'Retail Apocalypse' Now: Analysts Say 75,000 More U.S. Stores Could Be Doomed," Washington Post, April.

- "About Us", Forever 21, https://www.forever21.in/content/about_us

- Arthur Villasanta (2019), "Forever 21 Files for Bankruptcy: Layoffs, Store Closures to Follow", International Business Times, September.

- Barbara Kahn and Ludovica Cesareo (2019), "Fashion Fail: Where Did Forever 21 Go Wrong?" Knowledge@Wharton, October.

- Barbara Kahn and Ludovica Cesareo (2019), "Fashion Fail: Where Did Forever 21 Go Wrong?" Knowledge@Wharton, October.

- Bethany Biron (2019), "The Last Decade was Devastating for the Retail Industry. Here's How the Retail Apocalypse Played Out," Business Insider, December.

- Derek Thompson (2017), "What in the World Is Causing the Retail Meltdown of 2017?" The Atlantic, April.

- Dias Marendra (2019), "What is Retail Apocalypse and Its Impact to the Retail Industry," Businesstech, October.

- Erika Adams (2015), "Forever 21 Reportedly Wants to Scale Back Its Massive Stores," Racked, September.

- "Forever 21 Files for Chapter 11 Bankruptcy Protection", BBC, September 2019.

- "Forever 21 Inc.", Encyclopedia, January 2020.

- "Great Recession", Wikipedia.

- Hannah Madans (2019), "Forever 21 HQ Sells for $166M", Los Angeles Business Journal, February.

- Hayley Peterson (2018), "The Retail Apocalypse is Still in Its 'Early Innings' - And Thousands More Stores will Close Before It Ends," Business Insider, October.

- "How Forever 21 Was Crushed by eCommerce", iManila, October 2019.

- "How Forever 21 Went from a Fast-Fashion Powerhouse to a Brand Reportedly Eyeing Bankruptcy and a Troublesome Future", Business Insider, September 2019.

- James Lee (2017), "Forever 21: An American Dream Come True," Tharawat Magazine, August.

- Kaitlyn Wang and Irene Kim (2019), "At Its Peak, Forever 21 Made $4.4 Billion in Revenue. Here's What Lead to the Brand's Downfall and Near Bankruptcy," Business Insider, September.

- Ken Favaro, Tim Romberger and David Meer (2009), "Five Rules for Retailing in a Recession," Harvard Business Review, April.

- Kim Bellware (2019), "Forever 21 Is Filing for Bankruptcy. But Its Employees Aren't Going Down Without a Fight," The Washington Post, October.

- Lauren Debter and Elana Lyn Gross (2019), "Forever 21 Hits Rough Patch, Knocking Founders Out Of Billionaire Ranks," Forbes, July.

- Lauren Thomas (2019), "75,000 More Stores Need to Close Across the US, UBS Estimates, as Online Sales and Amazon Grow," CNBC, April.

- Lauren Thomas (2019), "It's the Last Christmas for Some Forever 21 Stores. Here's Why the Retailer Went Bankrupt," CNBC, December.

- Lydia Dishman (2010), "Forever 21 Expands: Big in Japan and the Plus-Size Market," CBS News, January.

- Made Lapuerta (2019), "How E-Commerce Killed Forever 21," Medium, October.

- Martin Roll (2018), "Forever 21 - Fast Fashion Retail Brand With an Edge," www.martinroll.com, March.

- MaryLou Costa (2011), "Forever 21 Timeline," Marketing Week, September.

- Megan Bernard (2010), "Supply Chain: Fashion Experts Forever 21," University of British Columbia Blogs, November.

- Nathaniel Meyersohn and Chris Isidore (2109), "Forever 21 Files for Bankruptcy and will Close Up to 178 US Stores," CNN Business, September.

- Pamela N Danzinger (2019), "Retail Downsizing Will Accelerate, With UBS Predicting 75,000 Stores Will Be Forced To Close By 2026," Forbes, April.

- "Private-Equity Buyouts, Economic Downturn, and e-Commerce: How the 2010s Became the Defining Decade of the Retail Apocalypse", Business Insider, December 2019.

- "Private-Equity Buyouts, Economic Downturn, and e-Commerce: How the 2010s Became the Defining Decade of the Retail Apocalypse", Business Insider, December 2019.

- Sade Dayangku (2019), "5 Inspirational Facts You're Dismissing About The Forever 21 Founders' Story," Vulcan Post, October.

- Sapna Maheshwari (2019), "Forever 21 Bankruptcy Signals a Shift in Consumer Tastes," The New York Times, September.

- Sara Ethers (2015), "Forever 21 Drives Millennial Engagement Through Social Media," Fashion United, November.

- Scott Davis (2019), "Not Forever 21...Why Zara and H&M Still Dominate in the Fast Fashion Relevance War," Forbes, October.

- Shoshy Ciment (2019), "How Forever 21 went from a Fast-Fashion Powerhouse to a Brand Reportedly Eyeing Bankruptcy and a Troublesome Future," Business Insider, September.

- "Taubman Centers, Inc. Form 10-K", www.annualreports.com, December 2018.

- Terry Nguyen (2019), "Forever 21 Is Filing for Bankruptcy. What Does This Actually Mean?" Vox, September 2019.

- Thomas Barrabi (2019), "Retail Apocalypse: These Big Retailers Closing Stores, Filing for Bankruptcy," Fox Business, September.

- Thomas Barrabi (2019), "Retail Apocalypse: These Big Retailers Closing Stores, Filing for Bankruptcy," Fox News, September.

- Tommy Andres (2018), "Divided Decade: How the Financial Crisis Changed Retail," Marketplace, December.