June 2023

The Analyst Magazine

The Global ANALYST is one of India?s leading business & finance magazines.?The Global ANALYST, a monthly magazine, contains intellectually stimulating articles on cutting-edge and contemporary topics. Besides, it also features interviews with as well as articles written by eminent national and international experts from industry, academia (including IIMs and IITs), as well as regulatory bodies (like RBI), etc., encompassing areas such as financial markets, economics, strategy, international trade, banking, technology, start-ups, e-commerce, industries, to name a few.

First Cut

President Joe Biden, just moments after the Senate passed the debt limit bill, praised Congress for its efforts. "I look forward to signing this bill into law as soon as possible," he said in a statement. The legislation, which was passed by a vote of 63-36, lifts the government's $31.4 tn debt ceiling and caps government spending for two years. The failure to get the bill passed could have caused major embarrassment for the Biden Administration, besides it could also have had serious economic repercussions for the rest of the world, would have rattled global financial markets, and led to massive job losses, while also depriving millions of Americans of government benefit programs.

"Suspending the debt limit through 2025 takes the threat of default off the table until after the presidential election," CNN said.

French auto major Renault's India unit recently crossed the nine lakh units milestone in cumulative sales in the last 11 years. The company, which began selling its Made-in-India vehicles in 2012, currently sells some of the popular models that include the entry-level car Kwid, compact SUV Kiger, and multiutility vehicle Triber. "India is a strategic and among the top five markets for Groupe Renault and we have a clear long-term strategy in mind for the country. Renault India Operations Country CEO & Managing Director Venkatram Mamillapalle said in a statement. He added, "We have formulated a strong product-offensive plan for India, with a heavy emphasis on localization in future range of products," He told the French car major has a long-term commitment to the Indian market and is planning to bring several innovations in products and services to meet the evolving needs and preferences of customers. According to him, Renault's commitment to the Indian government's 'Make in India' vision is unwavering and Renault aims to attain 90% localization for its upcoming products."

Currently, Renault manufactures its vehicles at the Renault-Nissan alliance plant in Chennai, which has a capacity of 4.8 lakh units per annum. The auto major has close to 500 sales and 530 service touchpoints across the country.

Pixxel was founded in 2019 by the duo Awaish Ahmed and Kshitij Khandelwal. The startup is building a constellation of satellites that will have the ability to identify mineral deposits or the productivity of crops by analyzing the spectral signature of an image. According to the founders, the firm aims to build an AI model that could use satellite data to predict crop yields, detect illegal mining and track natural disasters. In an interview, the duo said they launched Pixxel when they concluded existing commercial satellite images did not provide enough detail. Speaking to Businessworld, Ahmed said he was inspired to launch a space startup from a visit to Elon Musk's SpaceX as part of a student competition to build a demonstration "hyperloop" transport pod. Pixxel's satellites take in and analyze a broad spectrum of light instead of just assigning primary colors to each pixel, a technology known as hyperspectral imaging.

"With this round of funding, we are even closer now to realizing our mission of building a health monitor for the planet, and empowering people around the world to make informed decisions about our collective well-being," said Ahmed, who also assumes the role of CEO at Pixxel, whose mission is: 'Seeing the unseen'. According to the startup's official website, "Pixxel is on a mission to build a health monitor for the planet through a constellation of cutting edge hyperspectral small satellites. This unique hyperspectral capability will be the key to unearth underlying, unseen problems that are invisible to satellites in orbit today." Pixxel's first hyperspectral imaging satellite named 'Shakuntala' is now on its space journey.

The startup will use the capital raised during the latest funding round to advance its mission to build the world's first and highest-resolution hyperspectral satellite constellation, delivering actionable climate insights on a planetary scale. Besides, it will also help further the development of 'Aurora', Pixxel's AI-powered analytics platform to make hyperspectral analysis accessible for everyone, Pixxel said in a statement. This apart, there are also plans to use a part of the proceeds to launch six satellites in 2024 and another 18 by 2025, according to the firm.

Data from Pixxel's satellites will be critical in helping global organizations closely monitor emissions, water pollution, gas leaks, oil spills, soil composition, forest biodiversity, and crop health in unprecedented detail and at faster speeds, Pixxel said. "We are incredibly grateful to our world-class investors for their unwavering support and belief in our vision and are excited to work together to create a meaningful positive impact on the future of our planet," PTI quoted Ahmed as saying further.

Pixxel's hyperspectral satellites can capture images at hundreds of wavelengths in the electromagnetic spectrum and reveal key data about the health of the planet. Both the hyperspectral constellation and advanced data analytics platform are likely to provide up to 10 times more information compared to today's multispectral satellites in space and increase the spectral resolution available by 50 times. Pixxel launched three pathfinder missions last year and added new customers for its hyperspectral imaging products. The company also announced a five-year contract with the NRO Commercial Systems Program Office (CSPO) for the Strategic Commercial Enhancements for Commercial Hyperspectral Capabilities program. The startup takes pride in the fact that "From realizing India's first Hyperloop pod to building some of the world's most advanced satellites and missiles to building landers and rovers for the moon, the team at Pixxel has constantly strived to push the boundaries of human exploration."

Besides, Vision Pro, Apple also showcased its newest operating system, visonOS, a spatial operating system. Built on the foundation of macOS, iOS, and iPadOS, visionOS enables powerful spatial experiences. The tech behemoth also introduced a slew of new products such as Macbook Air, a 15-inch Macbook Air with M2, Mac Studio with M2 Max and M2 Ultra, and Mac Pro with M2 Ultra (Apple's most powerful and capable chip ever). Besides, there were also previews of iOS 17, iPadOS 17, macOS Sonoma, and watchOS 10, and audio and video updates.

PREMIER

India

GDP Growth Beats Estimates

Asia's third-largest economy beats estimates, grows at a better-than-expected 6.1% in Q4, while FY23 growth

data too springs a positive surprise.

Asia's third-largest economy

sprang a surprise as it posted

better-than-expected gross domestic

product (GDP) growth of 6.1% in

the just-concluded January-March

quarter of 2022-23. It not only beats

analysts' estimates of 5.5%, but is also

a much improved performance compared

to the preceding December quarter

when it clocked a growth rate of

4.4%. For the whole of FY2023, the GDP

growth came in at 7.2%, compared to

9.1% in the previous fiscal year, provisional

national income data released

by the National Statistical Office

(NSO) showed. It is to be recalled that

the Reserve Bank of India (RBI) had in

an earlier forecast projected Q4FY23

real GDP growth to be at 5.1%, while SBI Research had forecast the GDP to

grow at a much better 5.5%.

BANKING

Withdrawal of 2,000 Currency

Demonetization 2.0?

The RBI's move to withdraw 2,000 notes has come more as a shake than a shock.

- ByAjay Chandra Pandey,AGM, and Faculty, State Bank of India, State Bank Academy, Gurugram

Memories of long queues in

front of ATMs and banks

during the 2016 demonetization

came alive in the minds of the

common people the moment Reserve

Bank of India (RBI) announced the

withdrawal of India's highest denomination

2,000 currency note, and this

painful memory was accentuated by

the alarm raised in the media. But the

facts and the truth are much different,

as there is no commonality between the

two. This withdrawal cannot be

equated with the demonetization of

2016, as the current exercise is different

not only in nature but in size too. It

is a withdrawal of 2,000 note, not an

outright ban as was done through the

exercise of demonetization in 2016, whereby 500 and 1,000 notes lost

their legal tender status. Even if we

compare the size only, the 2016 exercise

involved the exchange of 86% of the currency

in circulation, whereas the current

one involves only 10.8% of the currency

in circulation and that will be affected

over 130 days. Further, this is an RBI

decision, while the demonetization of

2016 was a Government of India decision.

INTERNATIONAL

USOf Debt Default, Perils and Pitfalls

A default by the US, which looks more likely than ever before, could imperil the domestic economy, jeopardize

global growth, roil global financial markets, and create chaos.

- ByMichael Robert, Economist, London

As I write, the impasse between

the Democrats and Republicans

over the so-called United

States debt ceiling is yet to be resolved.

Chances are, it may be by the time you

read this. But if not, then it will mean

that the US economy is facing paralysis,

and that will hit many other countries

too.

What is this 'debt ceiling'? The debt

ceiling is a legal limit on the total

amount of federal debt the US government

can accrue. The limit applies to

almost all federal debt, including the

roughly $24.5 tn of debt held by the public

and the roughly $6.9 tn the government

owes itself as a result of borrow-ing from various government accounts,

like the Social Security and Medicare

trust funds.

TECHNOLOGY

Google I/O 2023 AI, Bard Steal the Show

The annual developer conference has always given Google the chance to let the world get a clear vision and

better understanding of the company and the direction they, and we are heading. Alphabet did not let us down

this year.

- ByJeff Kagan,Wireless and Technology Industry Analyst Atlanta, Georgia, USA

This year at the annual Google I/O

Developer Conference, everyone

was watching with one thing on

their mind, Artificial Intelligence (AI)

and chatbot technology. This brand-new

area has quickly become the fastestgrowing

new tech trend of all time. And

even though AI has been around for decades,

chatbot is just beginning. So,

let's take a closer look at the event and

how AI and their chatbot called Bard

will impact our world.

BUSINESS ENVIRONMENT

IndiaNew Factory of the World?

The Indian manufacturing sector is gaining momentum, with many major players eyeing the country as a

potential hub for production and innovation. Amidst uncertainty in the global markets, there is an opportunity for

India to grab more of the manufacturing share.

Leveraging a strong, stable

economy, access to a large labor

supply, and policy reforms,

India aims to topple China and emerge

as the new factory of the world. Such

efforts are boosted further by new recognition

and accolades. For example, the

Economist Intelligence Unit (EIU) predicts

major improvements in areas like

infrastructure, taxation, and trade

regulation, which will reduce the risks

associated with manufacturing investment

in the country. It is also accelerated

by the geopolitical tensions between

the United States and China, the

Russia-Ukraine war, the rapid adoption

of e-commerce, and the Covid-19

pandemic, which have led to a rethinking

of strategies for re-shoring sourcing, the diversification of supply routes, and

the localization of manufacturing. In its

wake, many foreign manufacturing giants

have increasingly become wary of

their supply-chain overdependence on

China, the de facto factory of the world.

Most Western companies are implementing

or considering 'China plus one'

(also known simply as Plus One or C+1,

the business strategy to avoid investing

only in China and diversify the business

into other countries) strategies aimed

at building manufacturing across multiple

markets.

Germany

Recession Blues

Germany becomes the first major economy to officially slip into recession, hit hard by runaway prices caused

primarily by Russia's invasion of Ukraine.

Germany, the world's fourthlargest

and Europe's largest

economy, slipped into recession

as the country's GDP recorded its

second quarterly contraction in the

January-March quarter, hit hard by

high energy and food prices. Households

decreased their spending in the first

quarter as the persistence of high price

increases continued to be a burden on

the economy. Besides, factory orders,

retail sales, and exports also suffered

significant declines. Europe's largest

economy's GDP from January to March

quarter fell by 0.3%, the second consecutive

drop from the last quarter of

2022, which showed a GDP fall of 0.5%.

COVER STORY

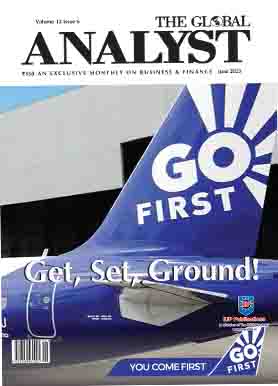

Go First Get, Set, Ground!

Go First, one of India's leading ultra-low-cost air carriers, which recently filed for voluntary

insolvency proceedings, taking its stakeholders, notably creditors, by surprise, blames faulty

P&W engine spare part shortages for facing what appears to be an existential crisis. Can it

bounce back?

The company has been crippled by the recurring Pratt & Whitney engine troubles. Pratt & Whitney's

defiance in not supplying spare engines as instructed by the Emergency Arbitrator has ground your

company to a halt.

- Kaushik Khona,CEO, Go First wrote in a note to employees

Flyers of Go First voke up to a rude shock as

the Wadias-owned (of Britannia fame) air

car-rier, in a communique dated May 2,

announced that owing to operational reasons, its

flights scheduled for May 3, 4, and 5 were cancelled;

the flights were later suspended for a few

more days, before extending to May 30 (there were

no further announcements by the airline at the

time of going to press). The Mumbai-headquartered

air carrier, which began its journey as GoAir

in November 2005, some six months before its

bete noire and the current market leader IndiGo,

promoted by industry stalwarts Rahul Bhatia and

Rakesh Gangwal (the latter has now

parted ways with the air carrier after

a bitter legal battle with his friend

turned foe early last year), was

among only a handful of the so-called

ultra-low-cost air carriers to dot

Indian skies until it announced its

bankruptcy proceedings early this

May; the other ultra-low-cost-carrier

(ULCCs) include SpiceJet and the newbie Akasa

Air (of Jhunjhunwala fame). With no visible signs

yet about whether it has on-boarded investors so

as to raise fresh capital and restart operations,

concern grows, concern grows if the Mumbaiheadquartered

air carrier too is headed for the

similar fate met by the likes

M&A

Microsoft's Activision Acquisition

A Potential Game Changer

- By Rob Enderle,President and Principal Analyst, The Enderle Group, Bend, Oregon, USA

The European Union recently approved Microsoft's acquisition of Activision, making the merger far more likely; however, the United States and the UK are opposing the deal, and their opposition needs to be overcome before it can go through. Let's talk about why this deal is important to both Activision and Microsoft, why the merger will be successful, and what the ultimate result will likely be.

MARKET MONITOR

Over half of NSE500 stocks delivered multibagger returns in 20

years, says a new study from Goldman Sachs

According to a new study, India has delivered the most number of multibaggers in the last two decades. The study

by investment banking biggie Goldman Sachs noted that more than half (54%) of the NSE500, or 269 stocks,

have generated multibagger returns over the past 20 years-the largest proportion of multibaggers among the 10

markets versus 30% and 20% averages for EM and DM, respectively.

The study, as per a Mint report, comprised 10 major markets across emerging and developed markets and covered 6,700

stocks to identify multibagger stocks-those which generated at least 10x total returns within a rolling 5-year period over the

past two decades.

VIEWPOINT

Another Airline Goes Bankrupt

Can Go First make a comeback?

Chances look slim going by the ever-growing list of

bankrupt domestic air carriers and the likelihood of a

prolonged legal battle with creditors and lessors.

To a certain extent, the Go First bankruptcy filing sounds interesting. For, the

bankruptcy was filed voluntarily by the airlines under Section 10 of IBC 2016 for

the Corporate Insolvency Resolution Process (CIRP) instead of Financial Creditors

(FC) filling it under Section 7 of IBC for CIRP or operational creditors filing it under Section

9 of IBC for CIRP, which took its lessors and creditors by surprise (as they stand to lose).

The CIRP process can be initiated by an FC, OC (operational creditors), or CD (corporate

debtor). In most cases, which we have seen in the Indian context, FC or OC has filed for CIRP, but here the management

of the CD itself has filed for bankruptcy and sought protection for payment of overdue amounts to the different creditors.

PERSPECTIVE

Go First's Bankruptcy

Why are some air carriers struggling even as the industry is flying high?

- By Shail Apte, Founder & CEO, Airtham, Ahmedabad

Founded in 2005 by Jeh Wadia,

son of Nusli Wadia, Chairman

of the Wadia Group, Go

First, formerly known as GoAir operated

a fleet of Airbus A320 aircraft in

an all-economy configuration. The company

prioritized profitability over market

share expansion, earning recognition

as the "Best Performing Airline" by

Airbus in 2011.

US Banking Crisis

Is Shadow Banking on a Comeback Trail?

The recent crisis at US regional banks has highlighted the importance of a strong and resilient banking system.

The Federal Reserve is taking steps to support the banking system, but regulators need to continue to monitor

the situation closely.

- By Surbhi Singhal, Senior Research Analyst, Advance ThinkTank, New Delhi

In any major economy of the world,

there's mainstream banking at the

top-rung, regional and cooperative

banks in the middle, and shadow banks

at the bottom. What happens when

there's a major disturbance in any of

these layers? Naturally, some other

layer expands to fill in the void.

MACRO MATTERS

JP Morgan Raises India's

Outlook for 2024

JPMorgan recently increased its

2024 economic forecast for India

-although only marginally-

saying the country's growth will be

affected by a slowdown in global

growth momentum. The world's leading investment bank expects

Asia's third-largest economy to grow

5.5%-instead of 5% it had forecast

earlier-in 2024. The revision follows

the Q4 and FY23 gross domestic

product data which the government

released recently. As per the official

statistics, the Indian economy grew at

a much healthier 6.1% in the January

to March quarter, compared to 4.5%

the previous quarter.

LEADERSHIP

Organizational Metaphors and Leadership BehaviorThe Good, Bad, and Ugly!

Metaphors reveal new ways of seeing and thinking about organizations, about people, about situations, and

about the nature of the work itself. However, on the flip side, using metaphors to simplify such complex entities

as commercial organizations and people has dangers if too simplistic perspectives are adopted.

- By Michael Walton,Business Psychologist and Visiting Professor, UK

The purpose of this article is to

illustrate how metaphors can

enrich and enhance understandings

about the nature of organizations

as institutional entities succinctly and

'capture' the individual behavioral

characteristics and conduct of leaders.

Such understandings provide insights

about the type of organization in which

a person may be working and about the

type of leadership under which they are

expected to be successful and thrive.

STARTUP XPRESS

Shilpa Shetty Invests in Agritech Startup KisanKonnect

Bollywood Diva Shilpa Shetty Kundra recently made an investment in the Mumbai-based startup Kisankonnect. The actress has invested an undisclosed amount in the company. She has been contributing to the startup by providing essential fitness elements, particularly focusing on "Fresh Food." Kisankonnect, founded in 2020, stands out in the agricultural ecommerce industry due to its unique approach. The company operates through a vast network of 5,000 members and village-level collection centers, directly sourcing agricultural produce from farmers.