Sept '20

The IUP Journal of Case Folio

Archives

JPMorgan Chase & Co. - Creating a Next-Gen Banking Experience Powered by Digital Technology

Anil Anirudhan

Senior Research Associate, IBS Case Research Center, IBS Hyderabad, Telangana, India.

E-mail: anil@idmrindia.org

Sanjib Dutta

Research Lead, IBS Case Research Center, IBS Hyderabad, Telangana, India.

E-mail: sanjibdutta@idmrindia.org

The case discusses the digital initiatives taken by JPMorgan Chase (JPMC). To stay relevant amidst changing customer expectations and the increasing trend of digital banking, JPMC employed a team of 50,000 technologists worldwide and had a technology budget of $11.5 bn in 2019. The initiative to have digital technologies play a pivotal role in banking operations was taken up in 2006 under the leadership of Jamie Dimon, CEO of JPMC. The case deals with the growth of JPMC over the years and its digital initiatives, which included the "mobile first, digital everything" strategy. The use of new technologies such as Big Data, Artificial Intelligence, Cloud Computing, Mobile and Electronic Payments, Machine Learning, Blockchain, Robotics and Cyber Security by JPMC is discussed in detail. JPMC had tied up with several fintech companies to develop new technologies for its banking operations and to preempt competition in future, both from banking and non-banking entities. Even though JPMC had emerged as a disrupter in the banking industry with its innovative technologies, it faced an ever-growing threat from banking organizations aligned with technological companies. It therefore sought to take the competition head on with the use of digital technology.

While other tech companies have a narrower scope of things they do very well, what differentiates JPMorgan Chase is our ability to invest $11 bn in a broad number of technologies simultaneously. Our size and scale are simply unparalleled.1

- Larry Feinsmith, MD and Head of Global Tech Strategy, JPMorgan Chase

The business case for digital everything is compelling. It's a generational shift. Think streaming films versus DVDs. Banking is no exception, and as such, they (millennials) are choosing a provider based upon their digital capabilities.2

- Marianne Lake, Former Chief Financial Officer, JPMorgan Chase

I have always told people: "You have to use tech to do a better job for your client." That's a sine qua non. So, in our reviews-and this has been true my whole life-we ask: "What are you building, what are other people building, how do you make it better, faster, quicker, cheaper?" And tech is the big part of that.3

- Jamie Dimon, Chief Executive Officer, JPMorgan Chase

Introduction

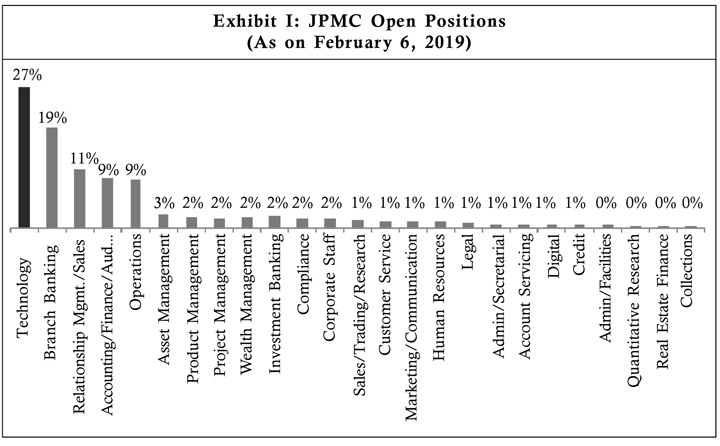

In early 2019, the career website of JPMorgan Chase & Co. (JPMC), the largest bank in the US4 and the third largest in the world,5 had 2102 open technology jobs (27%), the highest among all the categories, followed by openings in core banking areas such as Branch Banking (1496, 19%), Relationship Management (857, 11%) and Accounting/ Finance/Audit/Risk (731, 9%) (Refer Exhibit I for details of open positions in all categories). The fact that the number of openings for technologists was the highest was no surprise, given the bank's relentless focus on technology over the years. In 2018, the bank had a team of 50,000 technologists worldwide (around two-third of them software engineers), which it claimed was more than the number of technologists Facebook and Twitter together employed.

JPMC had been hiring more than 1,000 entry level engineers every year across the world. They included cyber security, cloud technology and data science engineers. In 2018, one-third of JPMC's analysts and associates were trained in programming language Python and it was made mandatory for all analysts joining its asset management division to be trained in Python.6 Data science and Machine Learning (ML) were to be included in the mandatory technology training program. In 2018, JPMC's technology budget amounted to a whopping $10.8 bn, a 15% increase over the previous year.7 Most of the technology spend was earmarked for improving mobile and web-based services across the bank's various business segments. For 2019, JPMC had a technology budget of $11.5 bn, around a 6% increase over the 2018 budget. While half of this would go toward IT maintenance, the other half would be spent on innovation.8

JPMC was transforming itself into a digital bank given that customers' dependence on banks for financial products and services was going down. Research showed that 60% of bank customers in the US were open to trying financial products offered by tech firms and this number went up to 73% in the case of millennials.9 Digital capabilities were critical to JPMC's business as, according to research by Deloitte, 57% of millennials would change their bank for a better tech platform.10

JPMC was leading among the major banks in the US in the number of digital banking customers. With new features in its digital channels, particularly digital account opening, JPMC had opened two million digital accounts as of July 2019. In fact, digital account opening constituted about 25% of the new account opening activity at JPMC.11 Mobile banking was one of the primary features which had attracted the millennials to JPMC, and the bank was poised to invest more on developing its mobile banking app.

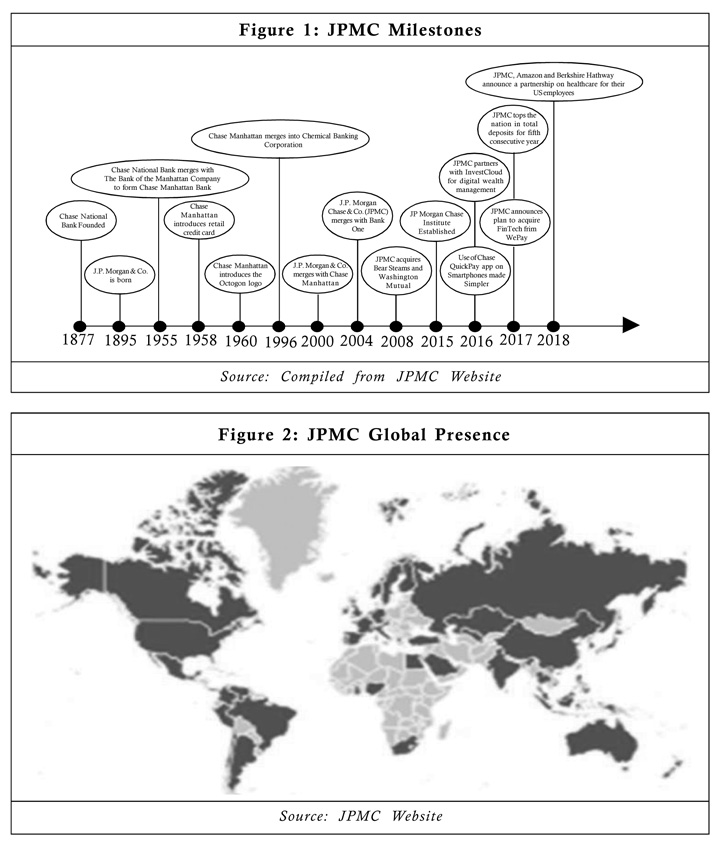

A Note on JPMC

The foundation of JPMC rested on several companies that had come together over the years to establish JPMC as it is known today. These included JP Morgan & Co., Chase National Bank, The Chase Manhattan Bank, Chemical Banking Corporation, Bank One, The First National Bank of Chicago and the National Bank of Detroit

(Refer Figure 1 for an indicative timeline of JPMC).

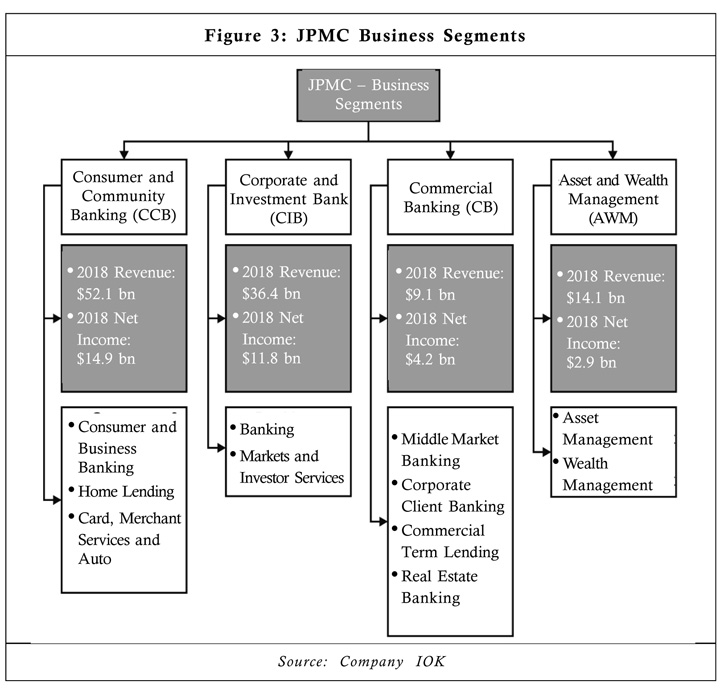

In 2018, JPMC was a leading financial services company and one of the leading banking institutions in the world. Headquartered in the US, it had operations in more than 60 countries (Refer Figure 2 for JPMC's global presence). As of December 2018, JPMC had $111.5 bn in revenue and $32.5 bn in net income and managed $2.7 tn in assets.12 JPMC's business segments comprised Consumer and Community Banking (CCB), Corporate and Investment Bank (CIB), Commercial Banking (CB) and Asset and Wealth Management (AWM) (Refer Figure 3 for details of JPMC's business segments).

Technology at the Core of Banking

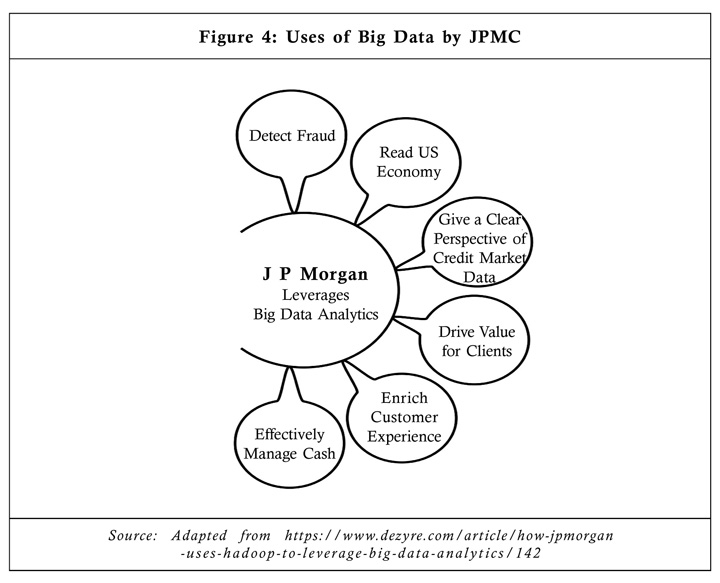

JPMC used the latest technologies such as Big Data, Cloud Computing, Artificial Intelligence (AI), ML, Blockchain, Robotics, Mobile and Electronic Payments and Cyber Security to develop and improve its banking operations. Larry Feinsmith (Feinsmith), MD and Head of Global Tech Strategy, Innovations and Partnerships at JPMC, said, "We are an unexpected disruptor in banking and in the technology industry. Because technology changes so quickly we are not only developing technology for today, but we

Cloud Computing

In 2016, JPMC created its own private cloud16 to study and develop its applications in banking such as storing information in dozens of data centers rather than a few data centers with tightly controlled norms. After a year of development, the organization moved a few of its applications to a public cloud17 in May 2017.18 The move made JPMC one of the pioneers in using the cloud for its applications.

Initially, JPMC faced a challenge in recruiting the best talent for developing its cloud platform. Most of the talented engineers in cloud security were based in Seattle, US, and worked for the largest cloud providers such as Google Cloud, Amazon Web Services, and Microsoft Azure. To overcome the challenge, JPMC started a cloud cyber security office at Seattle and started hiring from the pool of talented cloud security engineers available locally. Todd Hrycenko (Hrycenko), Head of Cloud, Platform and Application Security at JPMC said, "All of the large cloud providers have made Seattle their home base in North America. In fact, the density of this sort of talent does not exist outside of a couple other cloud pockets around the world."19

Cloud computing helped JPMC save on costs as it used the low cost cloud infrastructure and platform. Another reason for JPMC to adopt the cloud computing technology was that most of the fintech companies with which it was working to develop applications to improve customer service worked directly on the public cloud. Dana Deasy, Chief Information Officer at JPMC, said, "Fintech companies are no longer building their own infrastructure and standing up their own data centers. They are building their companies directly on the public cloud. If we want to use these young companies in some sort of business process inside the firm, we are going to have to be able to demonstrate to ourselves and to regulators that these applications have the right quality and security."20

Artificial Intelligence (AI) and ML

JPMC brought into the market an AI-powered virtual assistant that helped corporate customers move money across the globe easily. The virtual assistant helped the customers and answered their queries relating to balance available and with information on other transactions. Eventually with the help of ML, the virtual assistants were able to analyze the customers' behavior and provide suitable recommendations.

In JPMC's consumer banking division, AI-enabled the bank to approve car and home loans speedily by improving banking tasks such as underwriting. The securities trading division had JPMC's DeepX ML,21 which aided the bank in its trading algorithms, which helped avoid costly errors. Due to the ability of the AI and ML applications of the bank to distinguish genuine from fraudulent points of sale transactions, JPMC saved an estimated $100 mn per year.22

Blockchain

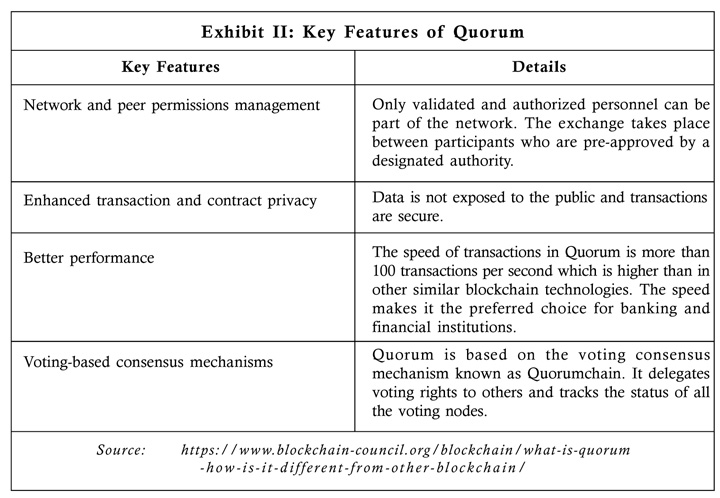

JPMC in partnership with Enterprise Ethereum Alliance23 came up with a blockchain platform 'Quorum' (Refer Exhibit II for key features of Quorum). The development of 'Quorum' was intended to remove apprehensions regarding the use of blockchain technology in the mainstream financial transaction system. Feinsmith said, "We are actively exploring applications of blockchain technology across all of our lines of business. We believe blockchain technology can be a game changer in terms of process optimization".24

As an extension of the blockchain project, JPMC in April 2019 planned to include settlement features in Quorum. The Interbank Information Network, built on the blockchain network Quorum in 2016, had 220 banking partners as of April 2019 and enabled the banking members to quickly solve payment errors, which otherwise took several weeks to sort out.25

In May 2019, JPMC and Microsoft entered into an agreement to use Microsoft's cloud-based services to help other organizations make blockchain applications easily, fast and cheaply. Umar Farooq (Farooq), Head of the Blockchain Initiatives at JPMC, opined that the 'Quorum' platform, powered by Microsoft's Azure, enabled enterprises to create new blockchain applications in a couple of weeks, which was much less than the time it normally took and that too without the requirement of significant expertise. Farooq said, "We are incredibly proud of the success Quorum has had over the last four years, as organizations around the world use Quorum to solve complex business and societal problems via blockchain solutions."26

As of 2019, JPMC was working toward developing its digital currency the 'JPM Coin' for its big corporate customers. As JPMC was providing banking services to 80% of the Fortune 500 companies, the 'JPM Coin' would enable its big customers to transfer huge amounts quickly and securely. The process flow of money transfer using the 'JPM Coin' involved the conversion of money in JPMC accounts into JPM Coins, with each coin being valued at one dollar. The money transfer was to be done using JPMC's Quorum blockchain with the coins being converted into dollars after the completion of such transfers.

To begin with, JPMC planned to use the JPM Coin only for institutional clients on the blockchain; it was not meant for investment purposes of the public. There were further plans at JPMC to later make the 'JPM Coin' versatile and compatible with other currencies across the world. The organization was also working with regulators to obtain permission for other multiple uses of the 'JPM Coin'. Farooq said, "Clients engaged us, saying they need a way to move money onto the blockchain. This is designed specifically for institutional use cases on blockchain. It is not created to be for public investment."27

"Mobile First, Digital Everything"

The "Mobile First, Digital Everything" term was coined by Dimon when he became the CEO of JPMC in 2006.28 While most of the banks at that time were outsourcing their technology requirements to third parties, Dimon emphasized that JPMC should build its own technology rather than outsource it as other banks had done. As of 2018, JPMC had spent more than 10% of its revenues on technology and digitization.29 And JPMC's digital focus seemed to be paying off, judging by the steady growth in its active digital and active mobile customers over the years. JPMC's active digital customers had increased from 43.8 million in 2016 to 51 million till the second quarter of 2019, a Year-on-Year (YoY) growth of 6%, while the number of active mobile customers had gone up from 26.5 million in 2016 to 35.4 million till the second quarter of 2019, a YoY growth of 12 %30 (Refer Exhibit III for growth in JPMC's active digital and active mobile customers).

The benefits of digital technology were reflected in the different services provided by JPMC. A new wealth management customer was able to open an investment account at JPMC within three minutes using a mobile phone instead of wasting time at a physical branch in a process which involved signing of various documents. Digital account opening attracted millennials and had gained more customers for JPMC. Even though the millennials were first time customers, there was the possibility of them turning into high net worth customers in future. Marianne Lake (Lake), In-Charge of Consumer Lending Business at JPMC, said, "Digital account opening…is a pretty good success story. And we are seeing a lot more accounts opened digitally across the channels, and we are seeing, of those, a decent chunk of net new to bank."31

One of the unique features of JPMC's corporate and investment bank was that it did not have physical branches. The institutional investor customers of JPMC at the corporate and investment bank were able to utilize AI-driven software that scanned numerous financial reports and put forth names of companies which were expected to issue extra debt or equity financing. Daniel Pinto, Co-President and Co-COO - Wholesale Banking at JPMC, said, "They want access to our analytics, and they want to receive the solutions on their mobiles phones and iPads."32

Shaping the Future of Banking

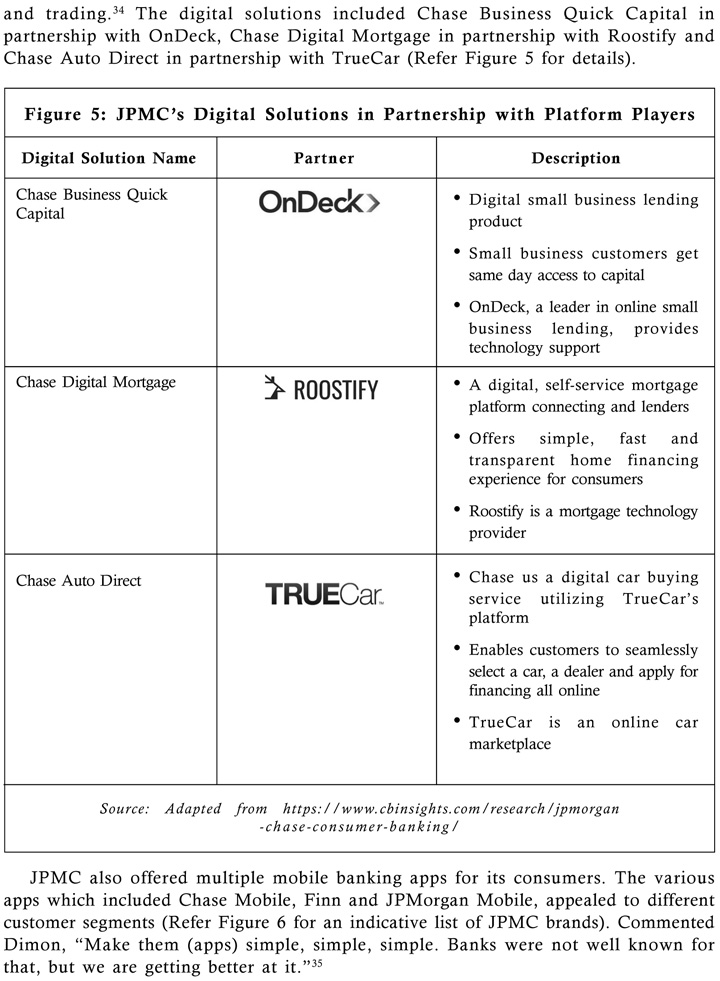

JPMC was focusing on creating a digital banking ecosystem that would include all its products and services as well as partners' products and service offerings. This was expected to position it more comfortably in the future against the competition. It partnered with platform players33 in areas such as online mortgages, auto financing, peer-to-peer consumer payments and small business loans. JPMC had invested in more than 100 platform companies working in these areas. In addition to the traditional banking products, JPMC also partnered with platform players to offer digital solutions in nontraditional product categories. During 2017-18, JPMC had invested more than $20 bn in developing new products for investment advice, digital banking, cyber security,

Even though JPMC was gung-ho over digital/mobile banking, analysts believed that the importance of physical branches in the current financial services ecosystem would remain. The younger generation was more inclined toward digital banking, whereas high net worth customers preferred a personal banking experience and advisory services. Thus, JPMC embarked on a strategy to close its branches with less customer footfall and open more branches in locations nearer its high net-worth clients. Lake said, "People still want to stare into your eyes when they are making the most significant financial investments of their lives".36 As of June 2019, JPMC had 5,04137 retail branches in the US and it planned to open 400 more branches by 2022.38 The growth plans and branch expansion would enable JPMC to provide services to 93% of the US population by 2022.39

Big Tech Threat to JPMC

By 2019, JPMC had emerged as a disrupter in the banking/financial services industry with breakthrough innovations in financial products and services. But there was an ever-growing threat to it from technology/platform players. Apple had forayed into the payments business with its mobile payment and digital wallet service 'Apple Pay' with a presence in over 40 countries across the globe in Latin America, Europe, Canada, the US, the Middle East and Asia-Pacific.40 Amazon's 'Amazon Cash' enabled customers to load money into their accounts and shop at participating stores. Another product from Amazon, 'Amazon Lending', offered loans to small business owners. As of June 2018, Amazon had provided loans to more than 20,000 Amazon sellers amounting to $3 bn.41

Google was already into the payments business with its innovative product 'Google Pay' whereon its customers were able to transfer money and make payments to service providers. Facebook was also scouting across the world to promote its cryptocurrency project 'Libra'. Facebook had also partnered with financial players such as Visa, Stripe, MasterCard, American Express and PayPal to enable its customers to transfer money with its Facebook messenger payment.

There was an ever-increasing possibility of a tech company aligned with a bank posing a threat to JPMC. Analysts also opined that a Google Bank or an Amazon Bank could not be ruled out and these would disrupt traditional banking. JPMC's technology push powered by digital technology was aimed at preempting competition from such disruptive forces. Said Dimon, "Of course. You will always have competition, and I expected [new competition to come] one day somewhere in the world. We have been very aggressive players trying to compete in our business. And we will always compete very aggressively".42 It remained to be seen whether JPMC would continue to create next-gen banking experiences powered by digital technology and be at the forefront of technology-led banking.

Suggested Readings and References

- Andy Peters (2019), "JP Morgan's Dimon: Square Innovated Where We Should Have", www.americanbanker.com, February 26.

- Anna Irrera (2018), "JPMorgan Chase Invests in Artificial Intelligence Startup Volley", www.thestar.com, July 18.

- Arif Bacchus (2019), "Think Crypto's Dead? JPMorgan to Offer First Cryptocurrency Backed by a US Bank", www.digitaltrends.com, February 14.

- Ben Norman (2019), "Chase Banks Go Digital", www.chamberbusinessnews.com, February 7.

- Dan Biewener (2018), "Banking on Digital Transformation: How JPMorgan Chase & Co. is Winning by Committing to Digital", www.simplilearn.com, October 11.

- Deepika Asthana (2019), "The Dealmaker", www.businesstoday.in, March 24.

- "Digital Transformation and Fintech Strategies of JPMorgan Chase 2018: Focus on Blockchain, Cloud, Big Data, Robotics, Initiatives & Branch Transformation," www.prnewswire.com, October 2, 2018.

- Isabel Woodford (2019), "JPMorgan Launches Its Own Cryptocurrency: The First for a Major US Bank", www.theblockcrypto.com, February 14.

- Jason Amunwa (2019), "Millennials are Changing the User Experience of Finance", www.dtelepathy.com. Accessed on October 10.

- Jim Marous, "Chase Commits to Long-Term 'Digital Everything' Strategy", www.thefinancialbrand.com

- Julia Horowitz (2019), "JPMorgan's Move into Crypto Puts the Rest of the Industry on Notice", www.edition.cnn.com, February 19.

- Justin Cash (2019), "JP Morgan Takes Stake in Pensions Technology Company," www.moneymarketing.co.uk, February 4.

- Marie Huillet (2018), "JPMorgan's Focus on Blockchain Is Part of Digital Transformation Roadmap, New Study Reveals", www.cointelegraph.com, October 3.

- Marie Huillet (2018), "JPMorgan's Focus on Blockchain is Part of Digital Transformation Roadmap, New Study Reveals", www.cointelegraph.com, October 3.

- Tanaya Macheel (2018), "'We're Living in the Golden Age of Payments': How JPMorgan Chase is Integrating Payments into Banking", www.tearsheet.co, February 27.

- Tristan Navera (2018), "For JPMorgan Chase, A New Mission in Digital," www.bizjournals.com, October 2.

- Will Stablecoin Ever Become a Reality?" www.theeconreview.com, September 15, 2019.

- www.jpmorganchase.com.

- https://www.jpmorganchase.com/corporate/news/stories/tech-investment-could-disrupt-banking.htm

- James Langford, "Going 'Digital Everything,' JPMorgan Ramps Up Tech Spend by $1.4 Billion," www.washingtonexaminer.com, March 6, 2018.

- Clive Horwood and Peter Lee, "The Banks That Define the Decades: Jamie Dimon, JPMorgan Chase," www.euromoney.com, June 10, 2019.

- Kurt Badenhausen, "Full List: Ranking America's 100 Largest Banks 2018," www.forbes.com, January 10, 2018.

- Kristin Stoller, "Global 2000: The World's Largest Public Companies 2018," www.forbes.com, June 6, 2018.

- Tom Loftus, "The Morning Download: JPMorgan Chase Makes Coding Literacy a Requirement," www.blogs.wsj.com, October 8, 2018.

- James Langford, "Going 'Digital Everything,' JPMorgan Ramps Up Tech Spend by $1.4 Billion," www.washingtonexaminer.com, March 6, 2018.

- Samantha Ann Schwartz, "JPMorgan Chase Splits Tech Spend Between Maintenance, Innovation," www.ciodive.com, April 23, 2019.

- "How JPMorgan is Preparing for the Next Generation of Consumer Banking," www.cbinsights.com, August 23, 2018.

- Franklin Tsung, "Generation Next: Tailoring Financial Advice for Millennials and Beyond," www.forbes.com, April 17, 2019.

- Rachael Green, "JPMorgan Chase is Maintaining Its Lead in Digital Banking," www.businessinsider.com, July 17, 2019.

- "JPMorgan Chase Firm Overview Presentation", February 26, 2019.

- "This $11 Billion Tech Investment Could Disrupt Banking," www.jpmorganchase.com, accessed on September 25, 2019.

- "How JPMorgan Uses Hadoop to Leverage Big Data Analytics?" www.dezyre.com, July 13, 2015.

- https://www.51zero.com/blog/jpmorgan-unveils-big-data-strategy

- Private cloud is a model of cloud computing where IT services are provisioned over private IT infrastructure for the dedicated use of a single organization.

- Public cloud refers to a computing service model used for the provisioning of storage and IT services to the general public over the internet. The access to the IT services is through a pay per use billing model. The infrastructure, backend and software are maintained by a third-party provider.

- Dakin Campbell, "JPMorgan is Building a Cloud Engineering Hub in Seattle Minutes Away from Amazon and Microsoft, and it's Planning to Hire 50 Staffers this Year," www.businessinsider.com, accessed on September 27, 2019.

- Dakin Campbell, "JPMorgan is Building a Cloud Engineering Hub in Seattle Minutes Away from Amazon and Microsoft, and it is Planning to Hire 50 Staffers this Year," www.businessinsider.com, accessed on September 27, 2019.

- Penny Crosman, "Unexpected Champion of Public Clouds: JPMorgan CIO Dana Deasy," www.americanbanker.com, September 22, 2016.

- DeepX is a software accelerator for deep learning execution. DeepX helps lower the device resources (Memory, Computation, Energy) required by deep learning for extracting high level information.

- Ron Williams, "How JPMorgan Chase Climbed to a Record High," www.fool.com, October 6, 2019.

- Enterprise Ethereum Alliance is an organization based in Massachusetts, US. The organization works toward developing open, blockchain specifications to drive harmonization and interoperability for businesses and consumers worldwide.

- "This $11 Billion Tech Investment Could Disrupt Banking," www.jpmorganchase.com, accessed on September 25, 2019.

- Daniel Palmer, "JP Morgan Expanding Blockchain Project with 220 Banks to Include Payments," www.coindesk.com, April 22, 2019.

- Michael del Castillo, "JPMorgan Says New Blockchain Partnership with Microsoft Will Solve Business and Social Problems," www.forbes.com, May 2, 2019.

- Michael J de la Merced and Nathaniel Popper, "JPMorgan Chase Moves to be First Big U S Bank with Its Own Cryptocurrency," www.nytimes.com, February 14, 2019.

- Jonathan Kandell, "Jamie Dimon is Not Messing Around," www.institutionalinvestor.com, May 21, 2018.

- Ibid.

- Rachael Green, "JPMorgan Chase is Maintaining Its Lead in Digital Banking," www.businessinsider.com, July 17, 2019.

- "How JPMorgan is Preparing for the Next Generation of Consumer Banking," www.cbinsights.com, August 23, 2018.

- Jonathan Kandell, "Jamie Dimon is Not Messing Around," www.institutionalinvestor.com, May 21, 2018.

- A platform is any hardware or software used to host an application or service. It is a group of technologies that are used as a base upon which other applications, processes or technologies are developed.

- Jonathan Kandell, "Jamie Dimon is Not Messing Around," www.institutionalinvestor.com, May 21, 2018.

- Ibid.

- Jonathan Kandell, "Jamie Dimon is Not Messing Around," www.institutionalinvestor.com, May 21, 2018.

- Jose Miguel Fidel and Javier Usman Pirzada, "JPMorgan Leads Bank Branch Closures in June," www.spglobal.com, July 16, 2019.

- "How JPMorgan is Preparing for the Next Generation of Consumer Banking," www.cbinsights.com, August 23, 2018.

- Hugh Son, "JP Morgan Chase Says It's in Growth Mode, Expects Branches to Reach Nearly All Americans by 2022," www.cnbc.com, February 26, 2019.

- Maggie Tillman and Britta O'Boyle, "What is Apple Pay, How Does It Work, and How Do You Set It Up?" www.pocket-lint.com, June 5, 2019.

- "How Open Banking Can Save Banking from Threat of Tech Giants," www.thefinancialbrand.com, June 11,2018.

- Sissi Cao, "JPMorgan Chase CEO Jamie Dimon Responds to Banking's Potential Big Tech Threat," www.observer.com, September 25, 2019.