Dec '20

The IUP Journal of Case Folio

Archives

bKash Mobile Money in Bangladesh: Promoting Financial Inclusion for the Masses

Anil Anirudhan

Senior Research Associate, IBS Case Research Center, Hyderabad, India. E-mail: anil@icmrindia.org

Sanjib Dutta

Research Lead, at IBS Case Research Center, Hyderabad, India. E-mail: sanjib@icmrindia.org

The case is about bKash, a mobile financial services company in Bangladesh that provided financial services to the underprivileged sections of society in Bangladesh. It provided millions of un-banked customers in the country access to mobile banking services such as operating savings accounts, paying for goods and services, and sending or receiving money in a reliable and efficient mode. The growth of bKash is seen through the entrepreneurial journey of Kamal Quadir, who founded the company in 2011 and was responsible for its growth and success. Various factors contributed to bKash's success and its growth as the number one provider of mobile financial services in Bangladesh. In the future, bKash is poised to utilize the latest technologies such as face recognition technology, block chain technology and IoT to enable more people to come under the ambit of financial inclusion and sustainable development. The case brings to light the role of financial inclusion as a tool in bringing economically vulnerable people into the financial main stream; how mobile banking contributes to the financial inclusion of the masses; the business model in a mobile banking organization; and the channel strategy in mobile banking. .

There are many ways to make money and I'm not a saint, but when you do something that has a social uplifting agenda, tremendous progress is possible. It is tremendously exciting that we have done something that has a profound impact on the way common people behave with their finances. And technology allows it. It was not possible earlier. Now it is.1

- Kamal Quadir, CEO and Founder, bKash, in March 2018.

We are having a Facebook experience sitting here in Bangladesh.2

- Kamal Quadir, CEO and Founder, bKash, in March 2018.

We have seen massive changes in the Readymade Garments (RMG) sector of Bangladesh. Previously, factories used to pay through cash or banks, which was troublesome and time-consuming. The wage digitization is benefitting both the workers and the factory owners. Because of the largest distribution network of bKash, Bangladeshi RMG factories are becoming more dynamic with wage digitization solutions.3- Patrizio Pagano, Executive Director, World Bank, in April 2020.

Description

On March 1, 2020, bKash, a mobile financial service company in Bangladesh, announced that seven RMG firms had agreed to use the digital salary disbursement solution to distribute salaries to their employees' bKash accounts. The number of employees covered under the new agreement was 70,000. This method would allow the organizations to disburse salaries more easily and at lower cost than using the traditional banks.4 With the latest inclusion, the number of RMG firms using the bKash service stood at 400, covering more than 400,000 employees, the majority of them is women. A statement released by bKash said, "Digital salary disbursement solution of bKash is believed to play an active role in the implementation of digital Bangladesh through the empowerment of women in larger sense, and financial inclusion of the unbanked population."5

As of April 2020, bKash had an active user base of 40 million. Around 90% of the users were those who had not interacted with the banking sector earlier and had now become part of the financial system.6 bKash gave millions of non-banking consumers' access to mobile banking services such as paying for goods and services, operating savings accounts, and sending or receiving money in a reliable and efficient way (see Figure 1 for the bKash

logo and mobile app). bKash was the biggest mobile financial services firm in Bangladesh and was ranked 23rd out of the 50 companies in the annual list of the Fortune Magazine's 'Change the World in 2017' that had made changes based on social issues.7

Background

bKash, pronounced 'bikash' which means 'prosperity' in the local language of Bangladesh, was an apt name for the financial services provider which was started by Kamal Quadir (Quadir) in 2010 as a joint venture between Money in Motion LLC8, USA and BRAC Bank Limited (BRAC)9, Bangladesh. bKash started off as a Mobile Financial Service Provider and was a subsidiary of BRAC. It focused mainly on providing affordable, reliable and convenient mobile financial services to the low-income groups in Bangladesh and ensuring broader financial inclusion for the masses.

The company, which launched its mobile financial services in the second half of 2011, had two million accounts by the end of 2012. bKash grew by leaps and bounds and by the end of 2013, it had 11 million accounts.10 In April 2013, the International Financial Corporation joined as an equity partner in bKash, while the Bill & Melinda Gates Foundation joined as minority partner in 2014. In April 2018, Ant Financial Services Group (AliPay) of the Alibaba Group11 acquired a 20% stake and became an investor in bKash.12 As of 2018, the financial inclusion achieved by bKash was 37% as against the 16%, it had reached in 2011 when it started its operations.13

Entrepreneurial Musings of Kamal Quadir

Bangladesh was a country with over 165 million people. One-third of the population lived below the poverty line and 60% of the population did not have access to banks or any form of financial services. There was thus a huge market for the provision of financial services to the masses.14

In August 2005, Quadir came back to his home country Bangladesh from the US after a stint in business with his own venture, an animation company named Globekids, which failed after a period of three years. Quadir said, "We trained 70 animators all of whom are established now but we could not meet our expectation. I tried for three years and lost all my hairs to make the business viable, and failed."15 After the failed foray into business, Quadir went on to do his MBA at Massachusetts Institute of Technology (MIT), US. With the idea of using the mobile phone as a business tool, Quadir launched an online classifieds ad platform 'CellBazaar' in Bangladesh which was a success and was eventually acquired by Telenor in 2010. CellBazaar received the 'Best Use of Mobile for Social and Economic Development Award 2008' from GSM Congress16. Quadir was given the Young Global Leader award by the World Economic forum in 2009 and was also the recipient of the MIT Ideas Award.17

The popular and widespread usage of mobile phones in Bangladesh gave Quadir the idea of using the electronic device for financial transactions. It was in 2009 that the Bangladesh Government embarked upon a project for the financial inclusion of the masses to provide a safe, secure and affordable mode of financial transaction. Most of the poor were out of the financial system due to the high cost of transactions as well as their own lack of proximity to a bank. Also, it was too expensive for the banks themselves to operate, maintain and open branches in remote locations to provide financial services to the masses. According to Quadir, the average total cost of opening, maintaining and staffing new branches was $1.50 per individual, which was quite high for attracting individuals with average transactions of just $10.18

Quadir presented his idea of utilizing the mobile phone for financial transactions to BRAC founder Sir Fazle Hasan Abed, and on his advice, he traveled around the world to gather knowledge and technology for the business model on financial inclusion for the masses. Quadir said, "I choose Brac for multiple reasons, one is that it has presence across the country. We need credibility which Brac has. Moreover, Fazle bhai has the vision to create a viable business to serve the poor. This alignment with the common philosophy and objectives gives a sense of bringing a possibility to make the idea successful."19

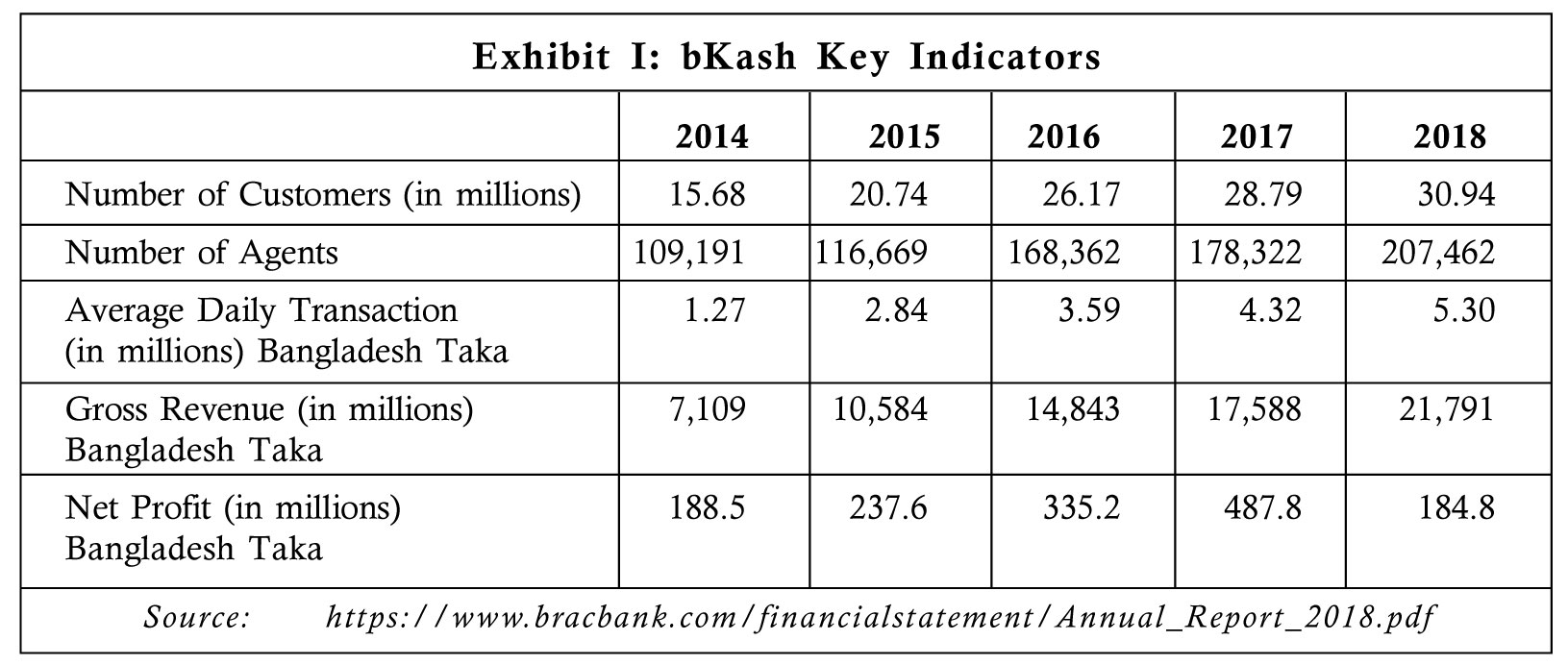

On July 21, 2011, bKash was launched with 37 employees. As of April 2020, the company had grown to have an employee base of 1800.20 The average daily transactions of bKash were $119 mn as of March 202021 (Refer to Exhibit I for the number of customers, net profit and daily transactions of bKash).

The Business Model

bKash had entered into partnerships with Mobile Network Operators (MNOs) to reach the large base of mobile customers. With a revenue sharing agreement with the big MNOs, namely, Grameenphone22, Robi23 and Banglalink24, bKash was able to access

98% of the 100 million mobile phone subscribers in Bangladesh in its first year of operations.25

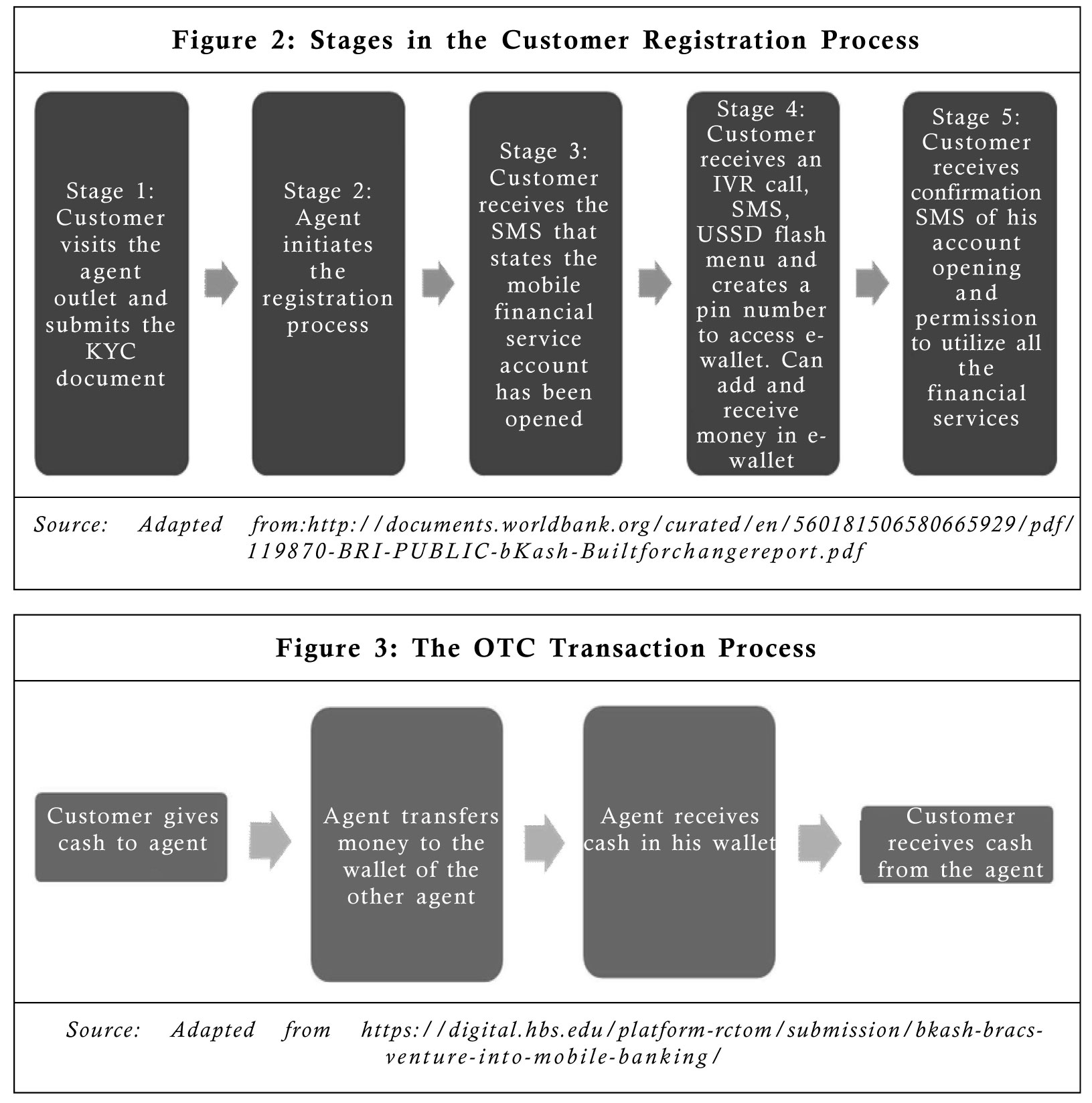

For customers, the process of registering with bKash was a simple affair. In stage one, the customer visited an agent outlet, filled out the KYC form, and submitted it along with a photograph and a copy of his/her national identity card; in the second stage, the agent initiated the registration process with his mobile phone. In the third stage, the customer received an SMS that stated that the Mobile Financial Service account had been opened. In the fourth stage, the customer received an IVR call, SMS, Unstructured Supplementary Services Data (USSD) flash menu and created a four to five-digit pin number of his/her choice. In the fifth stage, the customer received an SMS after three to five days that confirmed that the customer's account had been activated and all the services of the account could be utilized (see Figure 2 for the process of customer registration). Unlike in the case of a regular bank account at a commercial bank, the customer was not required to maintain a minimum balance in his/her account at bKash.

The wide agent network of bKash played a vital role in increasing the accessibility of the company's mobile financial services for the masses. The establishment of the initial network of agents for bKash was done by tapping grocery store owners, who were customers of BRAC. From 500 agents in 2011, the agent network grew to 135,000 by 2015.

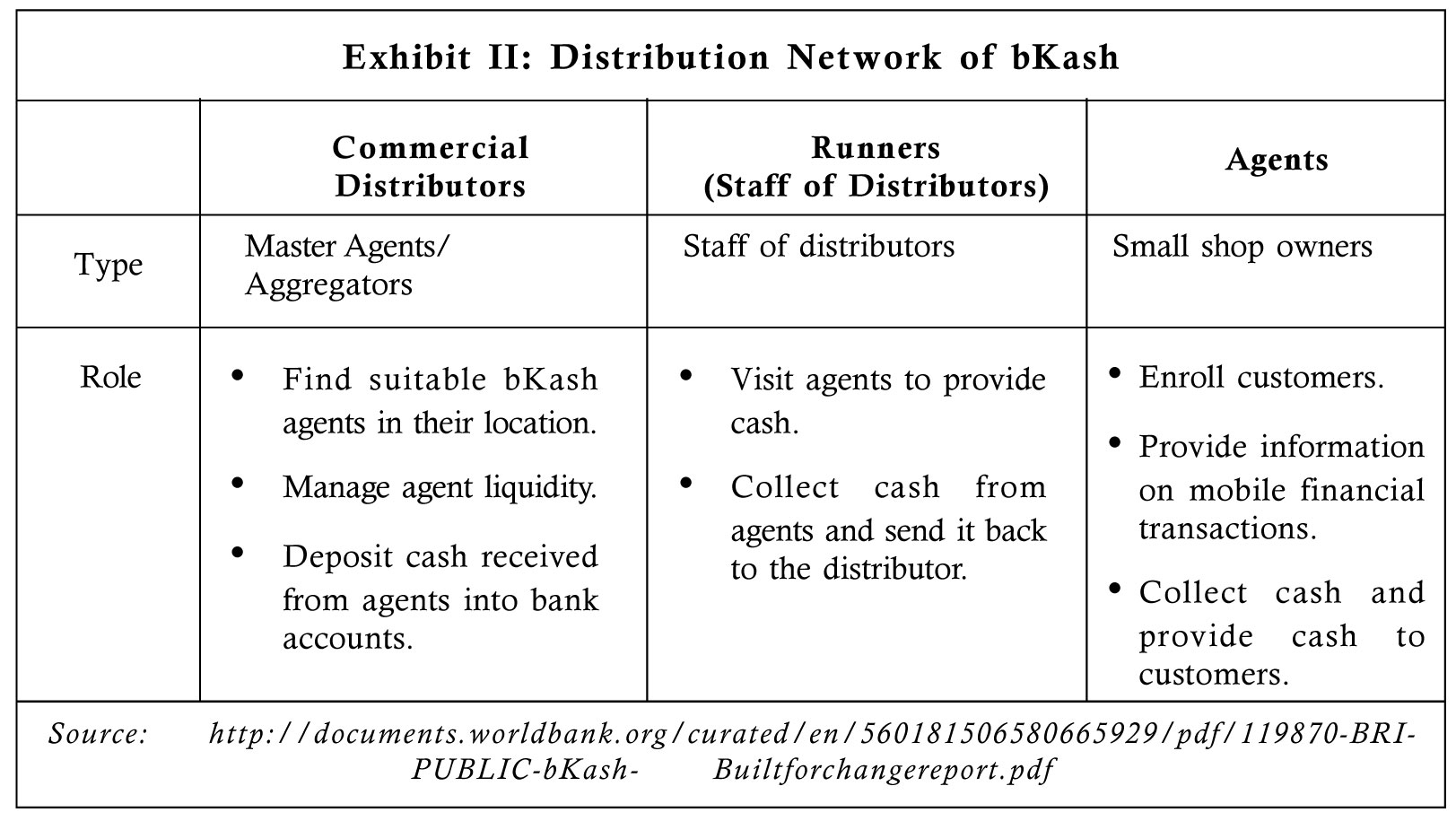

Even though the customers of bKash used their mobiles for money transfer to their kith and kin, some risk-averse customers transferred money through the Over-the-Counter (OTC) transaction mode. OTC transactions typically involved agents and the use of physical cash. The process of OTC transactions involved two agents. The customer wanting to transfer money gave physical cash to the agent at his location, who transferred the money to the wallet of another agent at the receiving location. Upon receipt of the money, the receiving agent gave physical cash to the customer at the end location (see Figure 3 for the OTC transaction process).

bKash's revenue came through services charges. It charged 2%t for cash-outs, 1.3% to 1.8% for purchases by business merchants and $0.06 for individual to individual money transactions.26

Use of Digital Technology for Financial Inclusion

AliPay, which became an investor in bKash in 2018, provided the latest technology to improve the quality of service. The new technology, biometric facial recognition technology, developed by AliPay, enabled bKash customers to self-register while opening a new account. The biometric facial recognition technology matched the photograph uploaded by the customer with information available on the government's central database within nanoseconds and helped in the account opening process.

In November 2019, bKash partnered with Ripple27 to use blockchain technology to make financial transactions faster and cheaper. The blockchain technology helped to further improve and simplify the financial transactions process and thus provide financial inclusion for the masses in Bangladesh. Quadir said, "One of the great values of leveraging block chain technology is that it allows companies to meet customer demand for immediate, transparent and low-cost global payments."28

On April 27, 2020, bKash announced a new service that enabled the American Express credit card holders of City Bank29 to pay their credit card dues through the bKash mobile app from anywhere and at any time.30 American Express credit card holders would be able to pay their dues on time and also avoid the queues at the payment counters, and thereby maintain social distance at the time of the Covid-19 crisis. The bKash mobile app made the credit card payment process simple with very few steps. The latest service was one of the several services that were launched by bKash as part of the company's endeavor to promote financial inclusion for the masses.

Coping with Frauds and Hackers

Several customers of bKash had lost money to scammers and become victims of fraud. The masked SMS was one of the ways fraudsters used to send anonymous messages to a customer's mobile phone. With a masked SMS, the recipient of the messages was able to see only the mobile number selected by the fraudster and not the original mobile number. He/she was thus tricked into transactions that ended up with money being sent to accounts other than the intended one. Mohammad Zahidul Islam, Senior Manager - Public Relations at bKash, said, "Fraudsters by impersonating the bKash short code may send masked SMS or make call to our customers, tricking them to conduct transactions. Masked call/SMS has been an issue around the telecommunication industry for long. The regulators are aware of it and are working on it to restrict it."31

bKash had a large team to fight frauds and hackers and it used the latest technology to combat them. With the fraud pattern witnessing changes every day, bKash invested more in fraud prevention technology. Quadir said, "Ours is a robust technological system and yet we face frauds. Interestingly, all the frauds occurring now are social engineering. Fraud pattern is changing day-to-day and bKash has formed a big team to keep its continuous efforts to fight with the changing fraud techniques."32

Factors Behind bKash's Success

Various factors such as the use of basic mobile phones for financial services, agreements and partnerships with multiple mobile network operators, a low cost and high-volume revenue model, and building a large pool of agents and distributors contributed to bKash's success and to its rapid growth.

Usage of Basic Mobile Phones

The target customers of bKash were the low-income masses from both the urban and rural settings. bKash used a USSD interface which was accessible through a basic mobile handset, as most of the customers came from a rural background and were not comfortable with smartphones. The affordability of the basic phones was another reason for utilizing the USSD interface to include the ever-increasing class of workers who had migrated from the rural areas to the urban areas in search of a livelihood and sent money to support their families.

Most of the poor working-class people used basic mobile phones and the company used an interface which was compatible with these phones and enabled people to carry out financial transactions. This ensured that even the poorest of the people was included in the Bangladesh government's policy of financial inclusion of the masses.

Partnership with Mobile Operators

bKash had entered into partnerships and agreements with the big mobile operators in Bangladesh to ensure that irrespective of the network, the financial transactions between people were seamless. It also entered into a revenue sharing agreement with the mobile network operators. These measures ensured that bKash was able to cover a large base of customers very quickly.

Low Cost and High-Volume Revenue Model

bKash's revenue generation model was of low cost and high-volume transactions. The company charged very low transaction fee for the services provided and this enabled a large number of people from the low-income group to avail the financial services. Customers were not charged anything for adding money to their e-wallets or for withdrawal of physical cash. Only those who received money through money transfer were charged and even that was only a nominal amount. The other source of revenue for bKash was the transaction fee charged to merchants and business institutions.

Large Pool of Agents and Distributors

bKash had a vast distribution network comprising commercial distributors, runners and agents to serve its customers who were spread across various locations—urban, semi-urban and rural. At the start of its operations, it had only agents who were small retailers and owners of small shops. The main role of the agents was to enroll new customers, convert cash into e-money and provide information on mobile financial services. The major role of the distributors was to appoint agents in their location, deposit money received from agents in the banks and maintain agent liquidity (Refer to Exhibit II for details of the distribution network of bKash).

Customer and Analysts Comments

A customer of bKash, Rehana Akhter (Akhter), expressed her gratitude toward the company and said she was happy to be part of the digital technology that enabled her to send money quickly and cheaply to her parents and son in her village. She had previously been employed in a garment factory and had lost a limb in a factory accident. The interest earned on the compensation received was the amount which she regularly sent to her parents and her son. Akhter said, "Life is tough for anyone who lost a limb. Nobody gives you a job or cares about your pain. But the pain is partly relieved when you know that there are technologies to help you."33

Analysts were of the view that in emerging markets, the growth of mobile payments was faster than that of the traditional payment methods and this had brought down the usage of physical cards. Amrish Kacker, Lead Analyst - Operator Strategy Consulting at Analysys Mason, said, "New mobile payment systems are challenging traditional approaches to physical commerce, for instance by enabling P2P payments and thus removing the need to for physical card reader."34

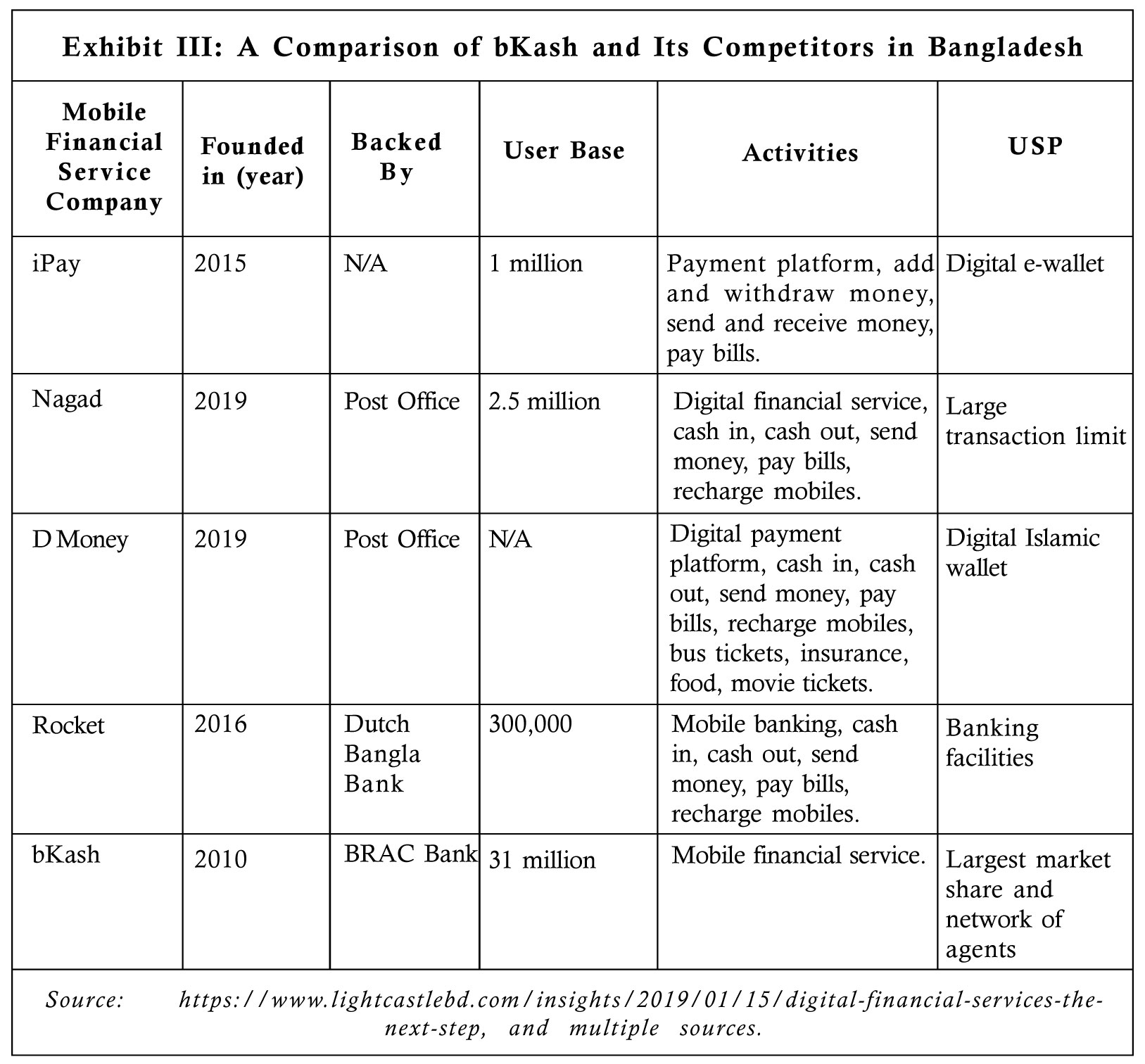

An industry analyst in Dhaka pointed out that bKash as an organization operated its business with a Bangladesh Bank license and followed the strict rules and regulations as enforced by the central bank, whereas its competitors such as the digital financial services company 'Nagad' operated without any regulatory supervision (Refer to

Exhibit III for the competitors of bKash in Bangladesh). The absence of any regulation was conducive to money laundering and other illegal activities. The analyst commented, "If you want to send money using bKash or Rocket, the maximum amount you can send in a day is Taka35 25,000. This transaction would take place under the regulatory microscope. On the other hand, with Nagad, you can send Taka 250,000 and there is no regulator looking at that transaction..." Until Nagad appeared on the scene, this used to be a very well-regulated and well-disciplined sector."36

Road Ahead

bKash planned to develop an interoperability system with all the banks to achieve deep linking with the banking system. With this new technology, customers would be able to transfer money from their bank accounts to their bKash accounts from the comfort

of their homes. Quadir said, "bKash is now working on to develop interoperability system with all banks so that clients can transfer their money to bKash account from their bank account sitting at home. We are also working with central bank to expand the inter-operability system."37

In the near future, bKash planned to use facial recognition technology to make the banking process even simpler and do away with the pin system having to be used for transactions. It had made good progress in providing unbanked people access to basic financial services and paved the way for them to climb the ladder to financial inclusion and prosperity. The future challenges for bKash would be to come up with new technology to integrate IoT with the payments system, payment integration with social media and integration with traditional banking services such as credit disbursements, insurance, investing services and saving schemes.

- Eric Ellis, "Bkash Builds a Payments System for the Future," www.euromoney.com, March 27, 2018.

- Ibid.

- William Pesek, "Fintech: Bkash Turbocharges Bangladeshi's Development," www.euromoney.com, April 9, 2020.

- Michelle Russell, "Bangladesh Grows Digital Payments for Garment Workers," www.just-style.com, March 3, 2020.

- "Over 400,000 RMG Workers Will Draw Salary Through bKash," www.bddnews24.com, March 1, 2020.

- William Pesek, "Fintech: Bkash Turbocharges Bangladeshi's Development," www.euromoney.com, April 9, 2020.

- https://www.bkash.com/about/company-profile

- Money in Motion, LLC is an investment firm based in the US and was formed by Iqbal and Kamal Quadir.

- BRAC Bank Limited is a private commercial bank in Bangladesh.

- https://www.cgap.org/sites/default/files/Brief_bKash_Bangladesh_July_2014.pdf

- Alibaba Group is a Chinese multinational company specializing in e-commerce, technology, retail, and the internet.

- Ranina Sanglap, "Alipay Acquires 20% Stake in Bangladesh's bKash," www.spglobal.com, April 26, 2018.

- Rezaul Hossain, "Fintech - in the Context of Bangladesh," www.thefinancialexpress.com, April 19, 2020.

- "Making Money Accessible by Phone in a Mostly "Unbanked" Nation," www.fortune.com, accessed on April 30, 2020.

- Inam Ahmed and Jebun Nesa Alo, "Kamal Quadir: The Artist Who Became a Fintech Guru," www.tbsnews.net, February 3, 2020.

- GSM Congress is an annual trade show organized by the GSM association for the mobile communications industry.

- https://www.weforum.org/people/kamal-quadir

- Eric Ellis, "Bkash Builds a Payments System for the Future," www.euromoney.com, March 27, 2018.

- Inam Ahmed and Jebun Nesa Alo, "Kamal Quadir: The Artist Who Became a Fintech Guru," www.tbsnews.net, February 3, 2020.

- William Pesek, "Fintech: Bkash Turbocharges Bangladesh's Development," www.euromoney.com, April 9, 2020.

- Jakirul Islam and Akhand Tiwari, "Is it the Right Time for Wallet Interoperability in Bangladesh," www.thefinancialexpress.com, May 5, 2020.

- Grameenphone is the largest and top mobile telecommunications company in Bangladesh and was founded in 1997. The company provides voice, data and other value-added services.

- Robi is the second largest mobile network operator in Bangladesh and was founded in 1997. The company provides voice and data services.

- Banglalink is the third largest mobile network provider in Bangladesh and was founded in 1996.

- http://documents.worldbank.org/curated/en/560181506580665929/pdf/119870-BRI-PUBLIC-bKash-Builtforchangereport.pdf

- https://digital.hbs.edu/platform-rctom/submission/bkash-bracs-venture-into-mobile-banking/

- Ripple is a blockchain technology company.

- "Swell 2019: How bKash Makes Banking Accessible to 36 Million in Bangladesh," www.ripple.com, November 8, 2019.

- City Bank is one of the oldest private commercial banks in Bangladesh and was started in 1983.

- "City Bank Amex Credit Card Members Can Pay Bill Through bKash," www.dhakatribune.com, April 27, 2020.

- Tareque C Moretaza, "bKash Customers at Risk," www.theindependentbd.com, September 20, 2015.

- Inam Ahmed and Jebun Nesa Alo, "Kamal Quadir: The Artist Who Became a Fintech Guru," www.tbsnews.net, February 3, 2020.

- "Bangladesh's Unbanked Poor Hail Revolutionary Service," www.business-standard.com, June 21, 2015.

- "Mobile payments in emerging markets: Beyond M-Pesa," www.mobileecosystemforum.com, May 31, 2017.

- Taka is the currency of Bangladesh.

- "Cashing in Influence," www.netra.news, March 6, 2020.