October'23

The IUP Journal of Organizational Behavior

Archives

Impact of Green HRM Practices on Environmental CSR of Indian Banks: A Comparative Analysis of a Public and Private Bank

Sarthak Mishra

Research Scholar, Faculty of Management Studies, Sri Sri University, Odisha, India; and is the corresponding

author. E-mail: sarthak.m2018ds@srisriuniversity.edu.in

Namita Rath

Associate Professor, Faculty of Management Studies, Sri Sri University, Odisha, India.

E-mail: namita.r@srisriuniversity.edu.in

Considering the current global concerns over environmental degradation, environmental corporate social responsibility (CSR) and green human resource management (GHRM) practices need additional attention from all organizations, including the banking sector which plays a vital role in a nation's development process. The present study focuses on environmental CSR in two leading Indian banks, namely, State Bank of India (SBI) and HDFC Bank. An analysis of available CSR data for six years from FY2016-17 to FY2021-22 reveals that in both the banks, CSR spending on environment-related activities was significantly lower as compared to other CSR activities. The study provides theoretical insights on GHRM practices as strategic resource with attributes of resource-based view (RBV) Theory, to achieve sustained competitive advantage and better environmental CSR. Strategic implementation measures to improve environmental CSR have also been highlighted. An empirical study of both the banks regarding the effect of GHRM practices on improving environmental CSR has been carried out. The data analysis, using the Smart PLS4, shows that GHRM practices have a significant effect on environmental CSR through the mediating support of organizational citizenship behavior for environment (OCBE).

Introduction

In view of the worsening trend of environmental degradation, the United Nations Industrial Development Organization (UNIDO) has added an environment angle to the concept of corporate social responsibility (CSR) and expects companies to integrate social and environmental concerns in their business operations. This will ensure achieving balance of economic, environmental and social imperatives, i.e., Profit, Planet and People, the Triple Bottom Line approach as mentioned in the Handbook on Corporate Social Responsibility in India. The traditional approach of achieving economic goals alone is no longer compatible with society's changing demands for a more sustainable approach encompassing reduced impact on the environment (Freitas et al., 2020). In India, the evolution of CSR transformed from pure philanthropy and charity during 1850-1914 to social development during 1914-1960 (Mitra and Schmidpeter, 2017). There has been a significant transition of CSR from a voluntary welfare activity to a mandatory requirement for certain class of companies in the Companies Act, 2013, which will bring about a positive social change not only in India but in other emerging economies globally. Environment and Sustainable Development received particular focus after the United Nations initiated millennium development goals (MDGs) in 2000 and sustainable development goals (SDGs) in 2015, which made CSR a strategic necessity for organizations.

The present study focuses on the Indian banking sector which plays an important role in all-round economic and inclusive development of the nation. Unlike the manufacturing sector, banks do not directly contribute to environmental pollution, but considering the vast branch network and large customer base, they do have a major share in use of resources and energy. Banks' lending and investment decisions also impact the environment. Therefore, banks owe an obligation to the community for environmental welfare, and the platform of CSR offers good opportunity to banks to discharge this responsibility. However, success of banks in environmental CSR depends upon the extent to which the staff are pro-environment with required knowledge, skill and aptitude, which the green human resource Management (GHRM) practices can nurture.

Sayad and Diab (2022) commenting on bank employees' perceptions on CSR practices, report awareness issue among employees on environment matters and bring out the fact of less interest on environment-related CSR activities. The study recommends that this aspect needs to be investigated further to find out the role of work culture and to reprioritize the CSR aspect in it. Even though there are studies on CSR initiatives and GHRM practices in the Indian banking sector, very few have focused on environmental CSR and the supporting role of GHRM in it. There is also hardly any empirical study concerning the impact of GHRM practices as a strategic resource to improve environmental CSR. Thus, a research gap in this area is felt, and the present study is an attempt to bridge the gap.

In this context, the status of environmental CSR of two leading Indian banks, namely, State Bank of India (SBI) and HDFC Bank, has been analyzed, representing the Indian banking sector for the following reasons: SBI is the largest public sector bank in India with a branch network of 22,266, number of customers at 46.77 crores, number of employees at 2,44,250 and 227 foreign branches/offices across all time zones as on March 31, 2022 (SBI Annual Report, 2021-22). HDFC Bank is the largest private sector bank in India with a balance sheet size of 20,68,535 cr, 6,342 branches, 7.1 crore customers and 1,41,579 employees as on March 31, 2022, with a few foreign branches/representative offices at Manama (Bahrain), Hong Kong, Dubai, Abu Dhabi and Nairobi (Kenya) (HDFC Bank Annual Report, 2021-22). Among all the Indian banks, HDFC Bank spent maximum amount of 736.01 cr under CSR during 2021-22.

Objective: The objective of the present study is threefold: (1) To find out the trend of environmental CSR spend of SBI and HDFC Bank during the last six years; (2) To explore the significance of Green HRM practices as a strategic resource in accelerating environmental CSR; and (3) To examine empirically the impact of GHRM practices on environmental CSR through the mediating effect of Organizational Citizenship Behavior for Environment (OCBE). The methodology adopted in the study was both secondary data collection from sustainability and annual reports of SBI and HDFC Bank, as well as primary data through a structured questionnaire (see Appendix) for necessary analysis.

In the next section, the existing studies on Green HRM practices for promoting CSR activities have been reviewed to get an insight. This is followed by the guidelines for CSR in the Indian banking sector and quantitative data regarding the trend of CSR spend in SBI and HDFC Bank. Next, the paper focuses on the theoretical framework, highlighting how GHRM practices can be a strategic resource based on resource-based view (RBV) theory. The paper also presents an empirical study of both the banks regarding the effect of GHRM practices on improving environmental CSR. and highlights a strategic framework for effective implementation of environmental CSR. Lastly, the paper presents a discussion on the findings, along with the theoretical and practical implications of the study, focusing on its contributions to the body of literature.

Literature Review

CSR in Banking Sector

Bihari and Pradhan (2011) explored different CSR practices in the Indian banking sector and its overall impact on the performance and the brand image of the respective banks. They concluded that when Indian banks contribute to social welfare, the overall advantage is passed on to the organization, and the brand value is enhanced. Based on a study of 19 public and private sector banks in India, Kulkarni (2014) recommended that the banks should have a well-documented CSR policy, incorporating environmental protection and eco-friendly practices in order to discharge their CSR responsibilities in a meaningful manner. CSR initiatives of banks with long-term social engagement would facilitate customer retention and business penetration. Dhingra and Mittal (2014) assessed the different steps undertaken by the banks in India to integrate CSR in their business strategy and also examined the challenges regarding its implementation. They concluded that most of the Indian banks have used CSR as a marketing tool by way of giving donations, sponsoring events, etc. In many cases, banks do not reveal the details of CSR spend, and reporting of CSR practices is also not satisfactory. While exploring CSR in the Indian banking sector, Hill (2014) added that the general public are now more concerned about environment, and also an increasing number of NGOs are actively watching corporate behavior. Financial institutions, therefore, need to be more cautious on environment dimensions while funding projects as well as adopting CSR practices. The study also revealed that knowledge and skills relating to environment were lacking among bank executives and that banks adopting participatory approach with local community in CSR activities make positive contributions.

Eyasin and Arefayne (2020), in their empirical analysis of Lion International Bank, Ethiopia, observed that environmental CSR received less attention from banks. Bank managers need to give more thrust to environmental CSR and integrate it in business operations so as to have higher competitive advantage and sustainability. In a recent study of CSR data for the period 2014-15 to 2018-19 of 20 Indian banks (10 public sector and 10 private sector), Gaba and Madhumathi (2022) concluded that CSR creates various value functions for banks like Market Value (increases share price, liquidity and reduces business risk), Sustenance Value (improves operating performance, earnings, stability and resilience) and Social Value (improving image with consumers, government and other stakeholders). The study by Sayad and Diab (2022) added that while CSR-related research has increased, it is much less in developing markets more particularly in the banking sector.

Green HRM, Environmental CSR and OCBE

Babiak and Trendafilova (2011) noted that environmentally focused CSR is viewed as a value driver that can be a source of opportunity, innovation, and competitive advantage. In today's competitive business environment, Green CSR activities can play a positive role by improving the brand image of an organization and also achieving a marketing advantage by fulfilling the needs of the community and the key stakeholders. Green HRM practices and their role in CSR promotion are focused on in some of the recent studies. Freitas et al. (2020) showed the association between Green HRM and CSR with empirical evidence from Brazilian companies. They identified the GHRM practices of performance evaluation, teamwork, recruitment and selection to be the most important factors for better CSR performance. These practices can set up effective managerial systems for better utilization of employee skills for promoting economic, social and environmental sustainability of the company.

Malik et al. (2021) linked the concept of GHRM practices, CSR and sustainability based on a survey in various manufacturing firms in Pakistan. They concluded that GHRM practices help firms to attract talented workforce who have a drive towards solving environmental problems, whereas CSR improves the brand image of the firm as a socially responsible employer. Using ability, motivation and opportunity (AMO) and Stakeholder Theory, the authors also established that OCBE, GHRM and CSR significantly contribute to the sustainable performance of the organization. The concept of OCBE was proposed by Boiral (2009) as individual discretionary social behavior, not coming under the formal reward system but helping in improving environmental performance. Further, Boiral and Paille (2012) mentioned a few examples of such behavior like knowledge sharing for pollution prevention at workplace, offering solution for waste reduction, and supporting the organization in implementing green technology. The study also segregated OCBE under three categories-eco-helping, eco-civic engagement and eco-initiatives. In order to improve environmental CSR, organizations need to strategically nurture pro-environmental behavior among employees. Green HRM practices strongly influence voluntary pro-environmental behavior (PEB) of employees across organizations, which become an asset in promoting social and environmental responsibility (Saifulina et al., 2020). GHRM practices also help develop an urge among employees to find solutions to environmental problems by adopting eco-friendly ways of working.

Quantitative Data and Trend of CSR Spend

CSR Guidelines for Indian Banking Sector

Reserve Bank of India (RBI), being the banking regulator in India, had issued directives to all Scheduled Commercial Banks in India in 2005 (RBI Circular dated 21.12.2005) advising the principles for giving donations, without any specific reference to CSR. As per the above notification, profit-making banks may give donations up to 1% of their published profit in the previous year and loss-making banks can make donations totaling 5 lakh in a financial year. These guidelines are voluntary without any obligation imposed on banks. Further, in view of rising concerns over global warming and climate change, RBI issued directives in 2007 on CSR, Sustainable Development and Non-Financial Reporting-Role of Banks (RBI Circular dated 20.12.2007). In the above circular, banks were informed of various international initiatives in the matter and urged to act as responsible citizens by showing concern for human rights and environment in their functioning. Banks were required to give due attention to environmental and social impact of projects while taking lending decisions keeping in mind International Finance Corporation (IFC) principles (known as Equator Principles-to denote global applicability). The directives also stressed upon the relationship among environment management, worker relations and social responsibility. It is obvious from RBI directives that Indian banks need to give more focus to environment-related CSR activities, though on a voluntary basis.

A major shift in CSR policy in India took place with the amendments to the Companies Act in the year 2013. Section 135 of Companies Act, 2013 made it mandatory for companies having net worth of 500 cr or more, or annual turnover of 1,000 cr or more, or net profit of 5 cr or more during the immediately preceding financial year to spend in every financial year a minimum of 2% of its average net profit during the three immediately preceding financial years in CSR activities. Schedule VII of the Act contains the list of permitted CSR activities. Some of the activities listed under environment category are: environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, conservation of natural resources.

However, the mandatory CSR guidelines under the Companies Act, 2013 are not applicable to public sector banks in India as these banks have been incorporated under separate statutes like State Bank of India Act (in case of SBI) and Banking Companies Act (Acquisition and Transfer of Undertakings) (in case of other nationalized banks). Therefore, CSR remains a voluntary activity for Indian public sector banks. SBI and other public sector/nationalized banks adhere to RBI's above guidelines on donation and allocate 1% of previous year's profit as CSR budget. HDFC Bank, being a private sector bank, is complying with mandatory CSR guidelines under the Companies Act, 2013.

In view of the above, CSR guidelines are not uniform across all categories of banks in India. In the following section, we focus on State Bank of India, the largest Indian public sector bank, and HDFC Bank, the leading Indian private sector bank, for a detailed analysis.

CSR Trend in SBI and HDFC Bank

The data was collected from the sustainability reports and annual reports of both SBI and HDFC Bank available in the public domain. The data for the preceding six years (2016-2022) was analyzed to ascertain the CSR spend under different activities. Financial Year (FY)- wise data is presented in tabular format, after calculating the related percentages of total CSR spend and environmental CSR spend. The latest CSR policies (April, 2021) of both the banks were also taken into consideration for the analysis. Bank-wise findings are given below.

State Bank of India

SBI introduced CSR in 1973 under the name of "Innovative Banking" with special focus on the economic development of weaker sections of society. After increase in scope of activities, the bank renamed it to "Community Services Banking". In addition to various offices/branches of SBI implementing CSR activities, SBI Foundation was set up by the bank in 2015 as Section 8 under Companies Act, 2013 to implement CSR activities in project mode. The bank has formed CSR committee at apex level, which gives directions for effective implementation of CSR and reviews the activities at quarterly intervals. Budget for CSR expenditure is allocated every year to the extent of 1% of bank's previous year net profit. According to SBI CSR Policy (April, 2021), key thematic areas of CSR activities are education, healthcare and sanitation, skill development and livelihood creation, environmental protection and culture and sports.

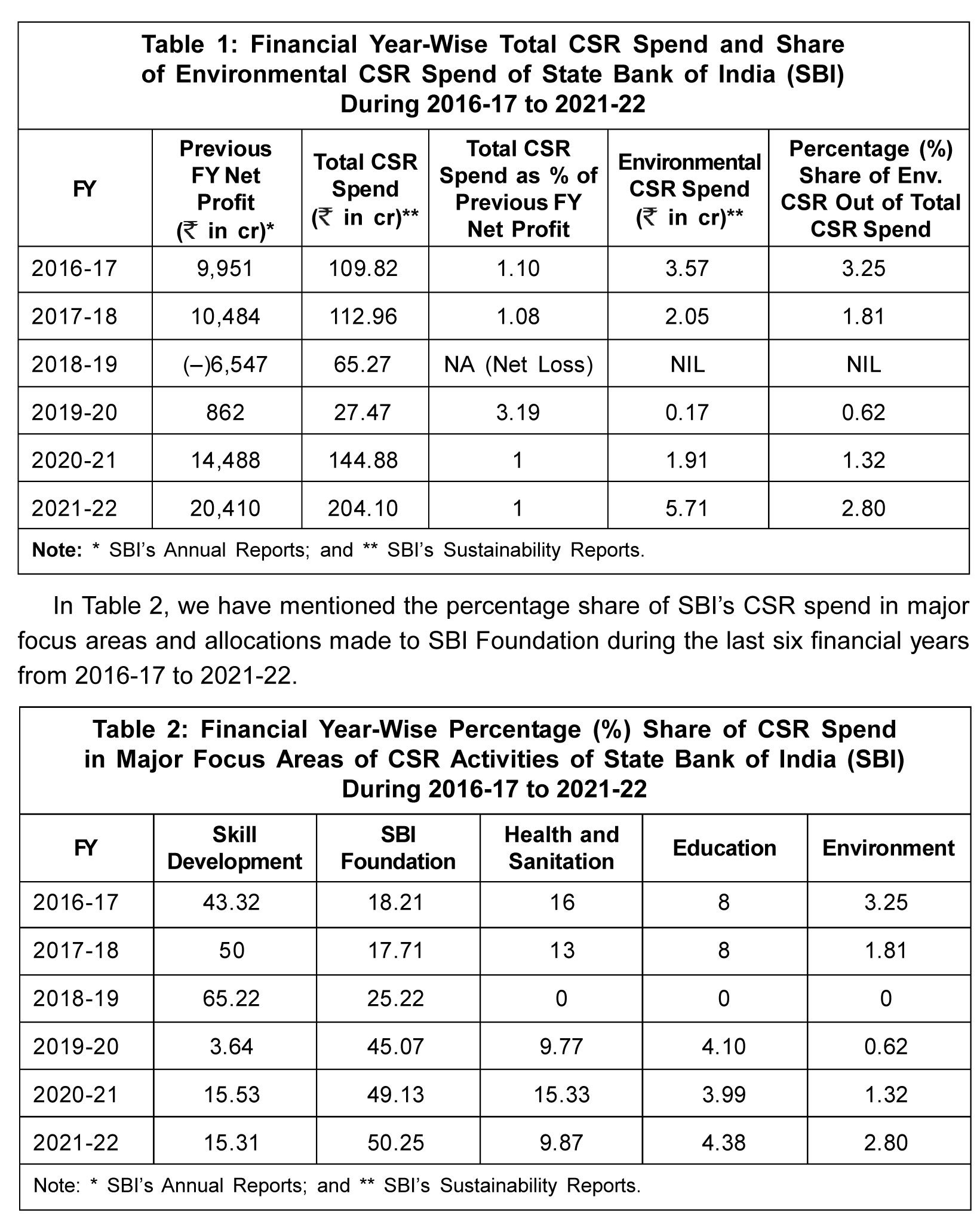

Data concerning net profit, total CSR spend and environment-related CSR expenditure during preceding six years (FY2016-17 to FY2021-22) are shown in Table 1.

Out of the total CSR spend, share of environmental CSR was significantly low in all the preceding six years ranging from 0.62% to 3.25%. In FY2018-19, despite sustaining loss in the previous FY, the bank spent 65.27 cr under CSR, but nil under environmental CSR.

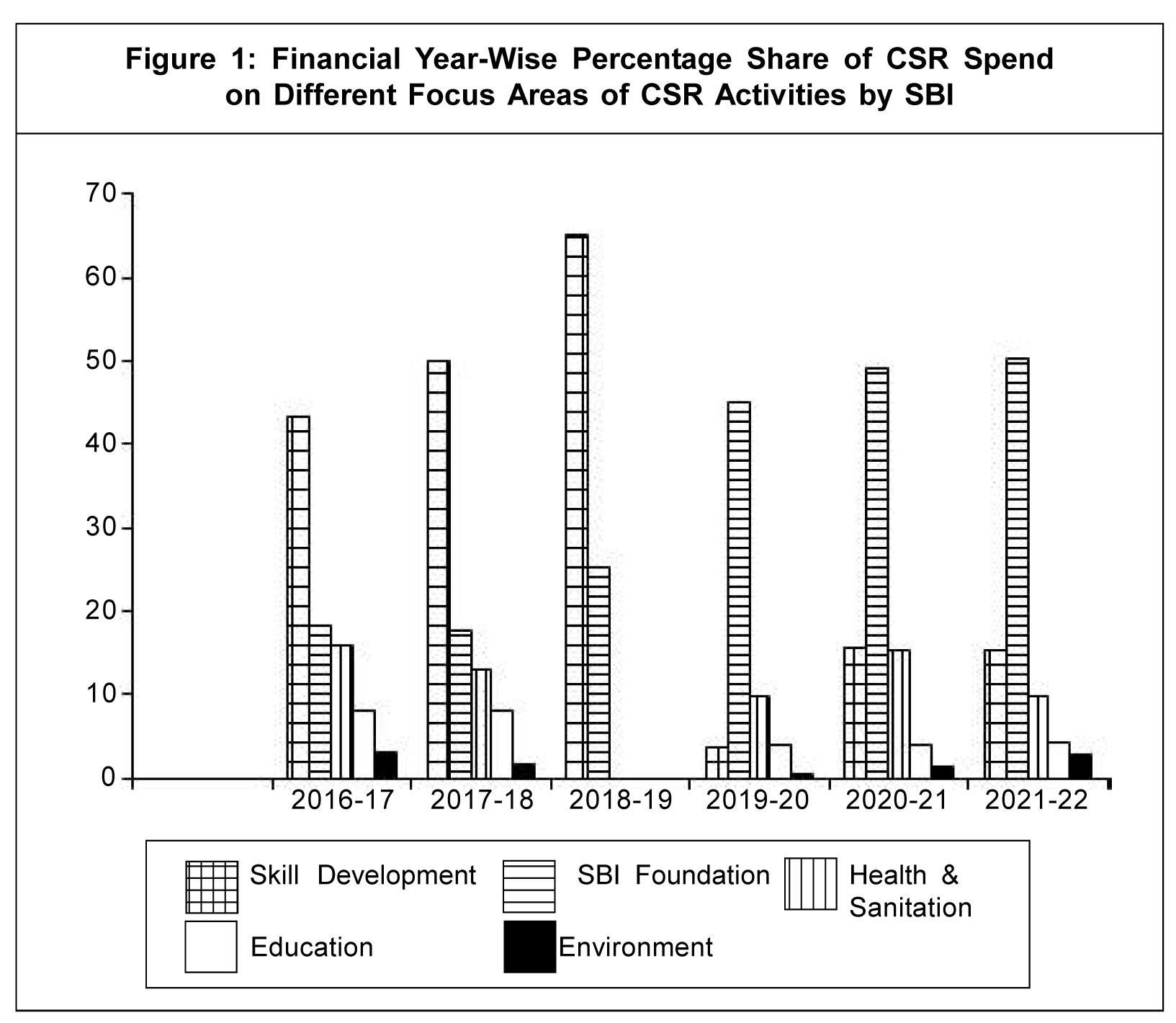

Even though environment was one of the focus areas of CSR activity of SBI, the CSR spend under environment is much lower in comparison to that under other focus areas. The comparative position is shown in Figure 1.

As mentioned before, SBI has been allocating substantial amount of its CSR budget to SBI Foundation. Therefore, to make a proper assessment of SBI's environmental CSR spend, we analyzed annual reports

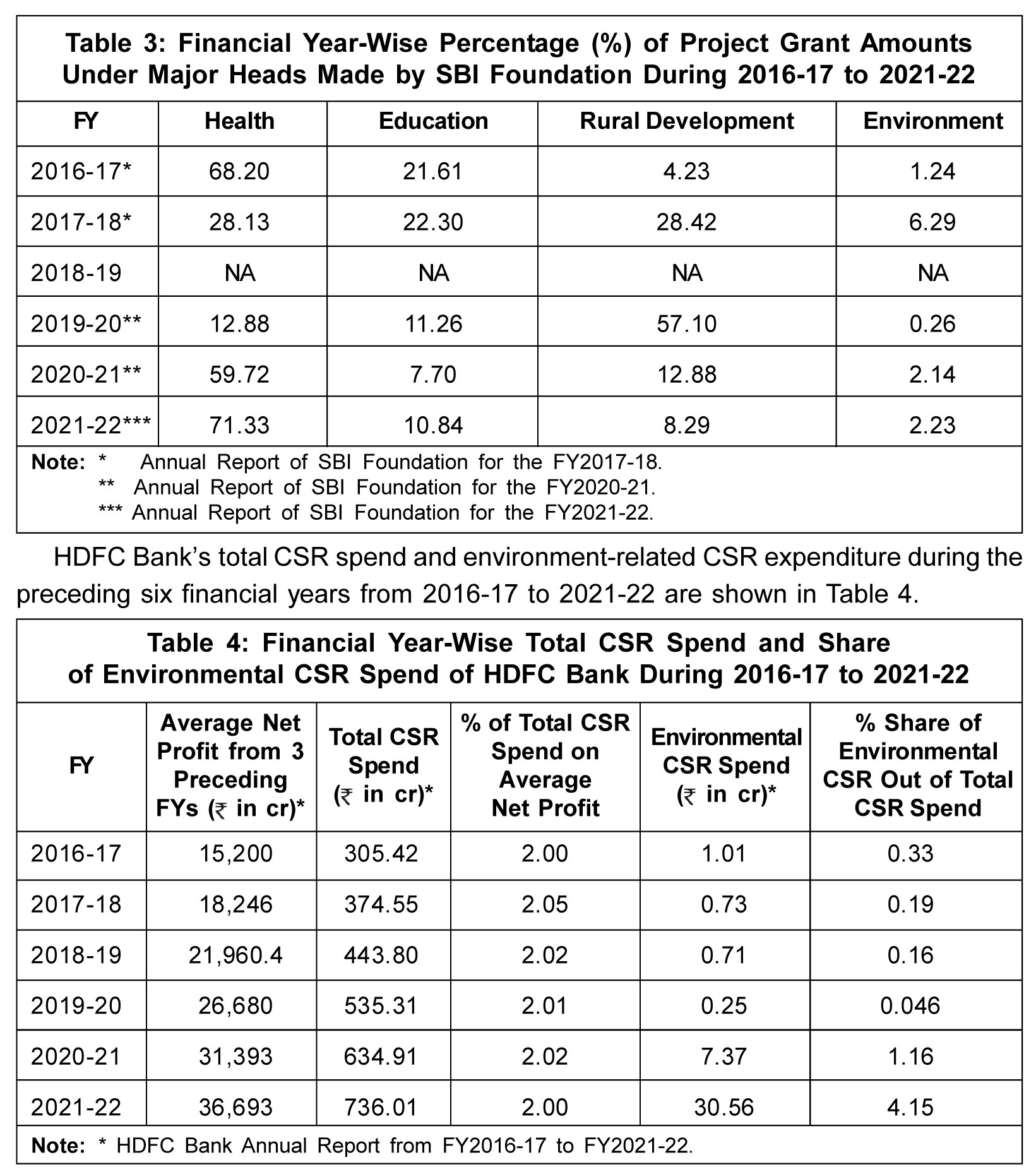

of SBI Foundation. In the public domain, annual report of SBI Foundation for FY2018-19 is not available. Accordingly, in Table 3, FY-wise percentage share of the amount of donations/grants of SBI Foundation in different focus areas are detailed (except for the FY2018-19) for comparison purpose.

It can be seen from Table 3 that the share of environment-related project donations/grants of SBI Foundation is significantly low as compared to that in other focus areas.

HDFC Bank

In compliance with Section 135 of Companies Act, 2013, HDFC Bank fixes its annual CSR budget (prescribed CSR expenditure) at 2% of average net profits from the immediately preceding three FYs. As per the CSR policy of HDFC Bank (April 2021), CSR activities are driven by a dedicated CSR team under the guidance and support of senior functionaries. Holistic Rural Development Program (HRDP) is the bank's flagship CSR initiative. Besides rural development, other focus areas of CSR are education, skill training and livelihood enhancement, eradicating poverty and environment sustainability. These activities are undertaken by the bank itself (Direct Projects) with the involvement of various bank employees/units or indirectly through implementing agencies like NGOs, trusts and societies.

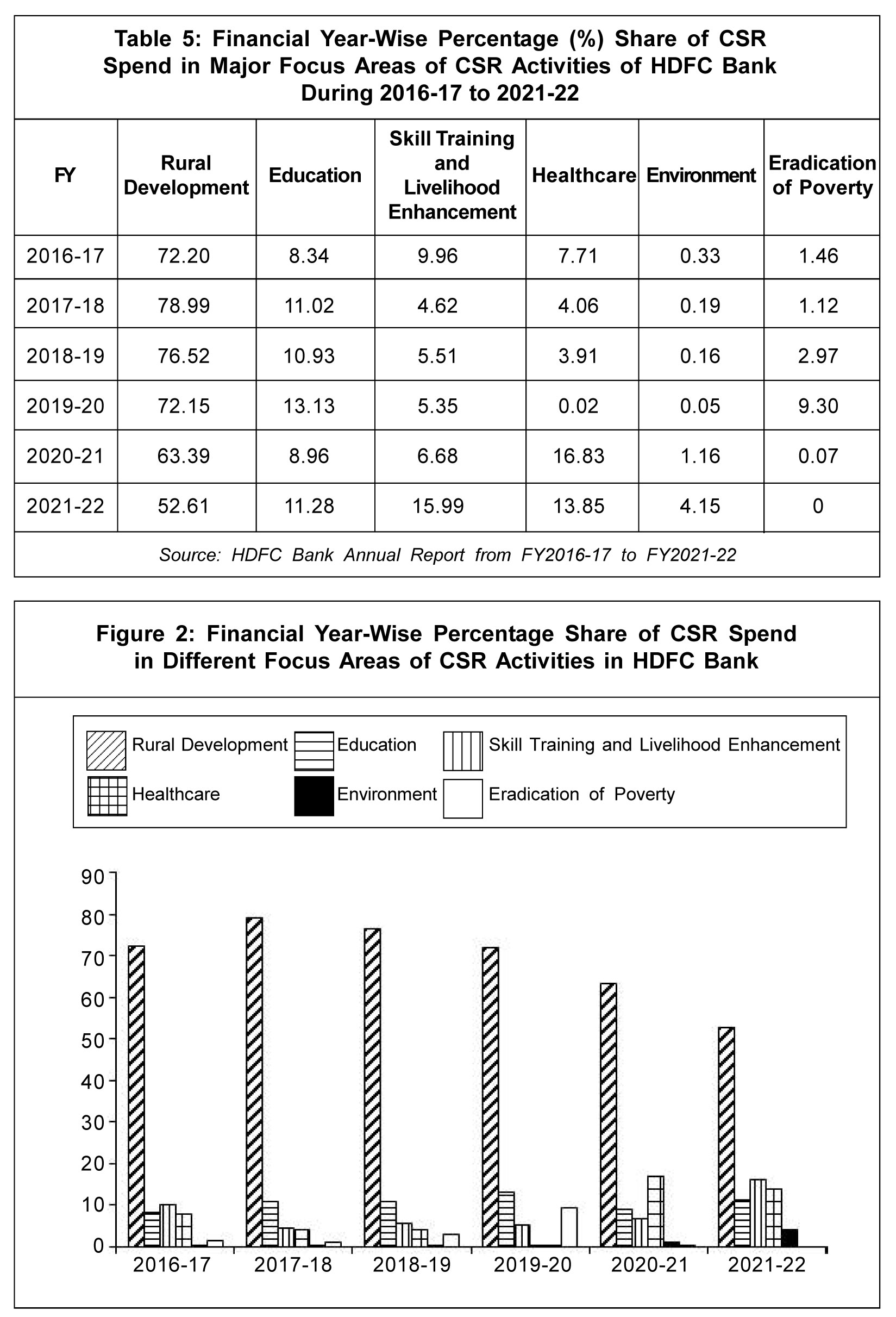

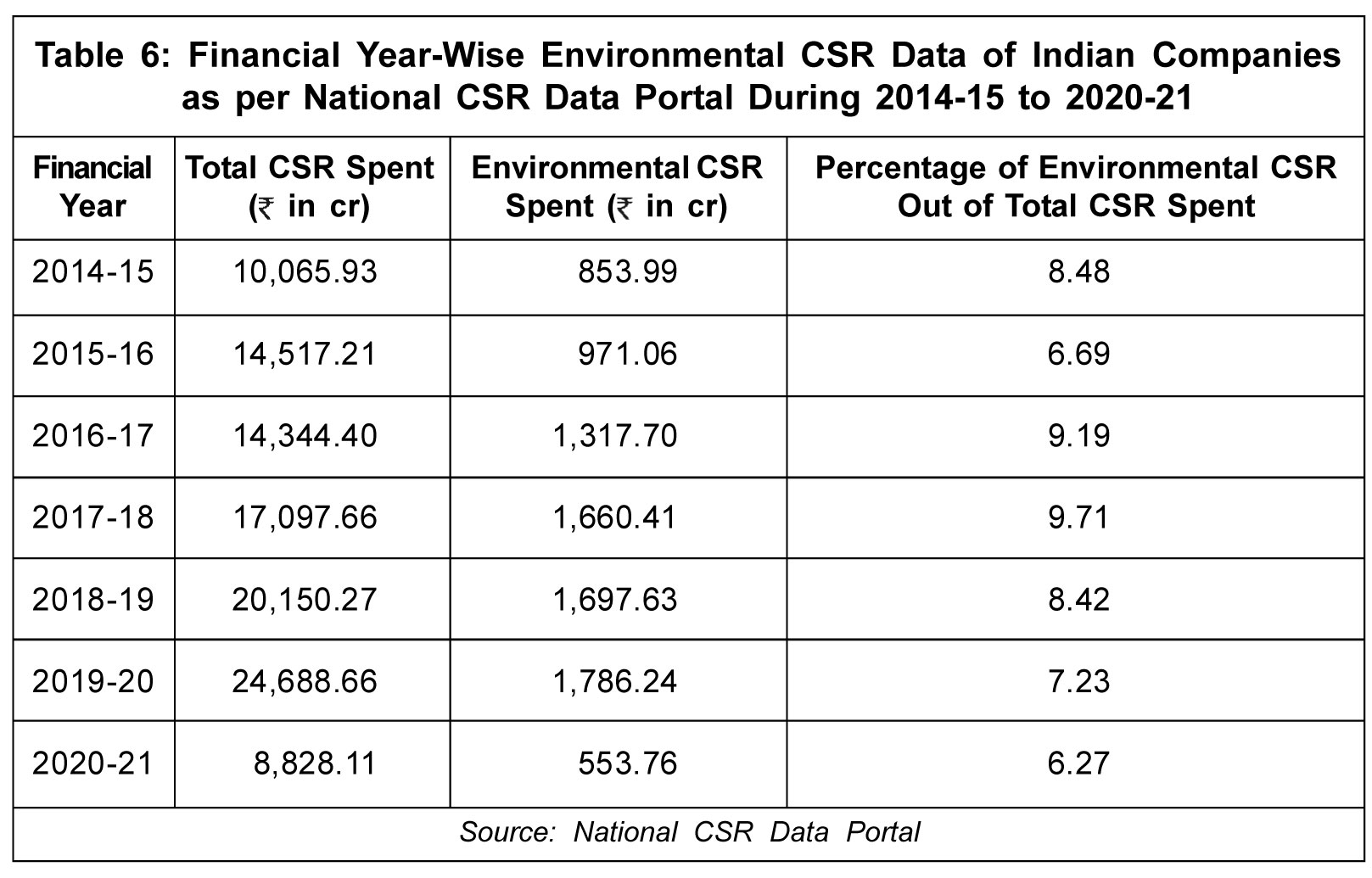

Despite increasing trend of total CSR expenditure year after year, share of environment- related CSR expenditure remained very low and its percentage continuously declined from 0.33% in FY2016-17 to 0.046% in FY2019-20. However, it is heartening to observe an increasing trend with 1.16% in FY2020-21 and 4.15% in FY2021-22 but it is still much less in comparison to other focus areas as detailed in Table 5, which shows percentage share of CSR spend under major focus areas during the preceding six financial years from 2016-17 to 2021-22.

Even though environmental sustainability is one of the focus areas of bank's CSR activities, it can be observed from Table 5 and Figure 2 that the expenditure under this activity is very low as compared to other focus areas.

Findings of Quantitative Analysis

After a comparative analysis of adoption of CSR activities in SBI and HDFC Banks, the following points emerge:

- In view of mandatory stipulation under Companies Act, 2013 and higher profits, HDFC Bank's CSR spend is higher than SBI's.

- SBI's top focus area is Skill Development, and in the case of HDFC Bank, it is Rural Development.

- Education and healthcare have received almost equal attention from both the banks.

- Environmental CSR has not received due attention in case of both SBI (ranges from 0.62% to 3.25%) and HDFC Bank (ranges from 0.046% to 4.15%).

To serve as a comparison, we furnish CSR data of Indian companies from FY2014-15 to FY2020-21, available on the National CSR data portal of the Ministry of Corporate Affairs, Government of India.

The data in Table 6 shows that much higher percentage has been spent by Indian companies on environmental CSR as compared to such spend of leading Indian banks. In view of such findings, there is scope for improving environmental CSR in Indian banking sector. There is a need to identify right environmental CSR activities/projects with suitable financial allocation. In the following section, we explore how Green HR practices can play a significant role in better environmental CSR in the light of theoretical framework of RBV theory.

Theoretical Framework

Financial sector reforms in 1991 brought many structural changes in the Indian banking sector, which include inter alia deregulation of interest rates, prudential norms on asset classification, capital adequacy, increased adoption of technology, allowing entry of new private sector and foreign banks, etc. These measures contributed to enhanced competition and operational efficiency among Indian banks. In fact, the banking regulator, Reserve Bank of India, encourages competition among banks for improving service delivery to bank customers (Sengupta and De, 2018). Indian banks, therefore, need competitive strength and sustainable practices to stay in the race and to march ahead. Malik et al. (2021) showed that organizations can achieve competitive advantage and sustainability by adopting GHRM and CSR. We explain here how GHRM practices in the Indian banking sector can facilitate sustained competitive advantage as well as environmental CSR through the lens of RBV theory.

Resource-Based View (RBV) Theory

Barney (1991) reported that an organization can achieve sustained competitive advantage, if its resources possess the following four attributes-Valuable, Rare, Inimitable and Non-substitutable. GHRM practices in the Indian banking sector can be reinforced with all the four attributes of RBV theory.

Valuable: Resources are treated as valuable when they enable an organization to implement strategies that improve its efficiency and effectiveness and also help in exploiting opportunities and neutralizing threats. Banking sector may adopt such GHRM practices that help in improving efficiency by reducing cost in several ways like less paper use, better recycling and waste management, reducing transaction cost through increased digitization, efficient resource/energy use, etc. Hence, various opportunities available for reducing cost, protecting the environment and attracting talent can be exploited through GHRM practices. Threats from environmental degradation, community resistance and customer dissatisfaction can be addressed through strategic adoption of GHRM practices. Thus, strategic GHRM can add value to the human resources of a banking organization.

Rare: HRM practice aligned with environment perspective through GHRM is a rare resource. However, to make it unique in the banking sector for sustained competitive advantage, GHRM practices need to be blended with environment-related physical capital (green workplace setup, energy saving devices, etc.), human capital (effective green training, acquiring green talent, etc.), and organization capital (environment policy, CSR policy giving adequate thrust to environment, designing effective structure for better environment management, etc). Above strategic interventions promote employee engagement and the staff become more creative and innovative, which is very essential in service sector organizations like banks to beat the competition.

Inimitable: Technology and products can be imitated by competitors as they are tangible. However, pro-environment qualities of human resources reinforced through strategic GHRM practices are difficult to imitate as they are more cognitive in nature. Indian banks adopting strategic GHRM will over a period of time develop different organizational values and beliefs, and a green work culture sets in, which will further generate inimitable socially complex resources for banks like reputation among customers and all other stakeholders.

Non-Substitutable: The pro-environment capability of HR is tuned according to specific GHRM policies and practices of the individual organization through appropriate green learning and development exercise. Such HR becomes non-substitutable as competitors will not be able to exploit their full potential.

GHRM Practices Act as an Enabler for Better Environmental CSR

We explain below how strategic GHRM practices as a part of HR strategy will lead to better environmental CSR activities in the banking sector:

Green recruitment and selection (GRS): GRS involves attracting and recruiting candidates having basic environmental knowledge and aptitude as per the environment management system (EMS) of the organization. Indian banks need to include a test of environmental awareness in their recruitment process with stipulation of minimum qualifying marks so that new recruits will have required aptitude towards environment. Malik et al. (2021, p. 15) stated, "Green recruitment has a positive and significant impact on OCBE among employees". This will facilitate implementing EMS in banks towards sustainable use of resources. Environmentally-conscious staff can better identify the environmental needs of the community, thereby helping in adoption of proper area-specific environment-related CSR projects. As regards the recruitment and selection process in Indian banks, all banks, including both State Bank of India and HDFC Bank are conducting tests in online mode, which tests the candidates' general awareness, quantitative aptitude, reasoning and language skills, without any focus on environmental knowledge.

Green Training: "Environmental programs, initiatives and goals of an organization must be communicated frequently so that the employees know what needs to be done to accomplish the goals", as pointed out by Govindarajulu and Daily (2004, p. 366). Green training of bank employees is, therefore, very essential for successful EMS. Green training module of Indian banks may focus on integrating Green HRM with Green CSR. Well-trained employees can disseminate environment-related awareness in the community like proper use of natural resources, preservation of water bodies, more tree plantation, avoidance of burning of fuel wood, proper disposal and recycling of waste, soil conservation, avoiding single-use plastic, etc. in a more effective manner. Green training also improves the capability of employees to identify environmental issues, leading to a more focused environmental CSR. They can convince the local people about the benefits of environment-related CSR projects, which will help in getting their support and participation.

Green Performance Management: GPM involves assessing the environmental performance of employees and giving due benefit to them in career advancement according to their level of performance. This motivates employees to improve their environment-related performance which will ultimately reflect in better organizational performance. In order to have proper green performance assessment, bank employees may be given specific environment-related goals, including environmental CSR activities. According to Malik et al. (2021, p. 14), "Green performance evaluation has positive and significant role in sustainable performance and OCBE". Timely recognition will lead to higher motivation and involvement of employees, facilitating better formulation and execution of environment- related CSR projects.

Green Reward: "Reward will motivate the employees continuously and will enhance their commitment towards environment", as explained by Govindarajulu and Daily (2004,

p. 368). Rewards can be monetary (cash reward) or non-monetary recognition (letter of appreciation, mementos/prizes, publishing photo in in-house journal, merit certificate, etc). In order to promote environmental CSR, Indian banks need to integrate the green reward system to the employee suggestions on innovative green solutions. Reward to employees for good environment CSR activities will also improve the employer's reputation with all stakeholders like the community, customers, investors, suppliers and the government.

In order to test the theoretical framework, we have formulated suitable hypotheses and verified the same through empirical analysis, the details of which are elaborated in the following section.

Empirical Study

The target respondents of the empirical study cover senior level executives working in various offices and branches of both SBI and HDFC Bank in the State of Odisha, India. Around 315 questionnaires were distributed among the senior executives of SBI and 200 questionnaires among the executives of HDFC Bank via Google Forms, e-mail, WhatsApp and offline mode. For SBI, 200 valid responses were chosen for final analysis. Similarly, for HDFC Bank, 127 responses were selected for data analysis. A majority of the respondents have work experience of more than 15 years, and have handled various assignments, including human resource departments. Thus, the sample fits our study well.

Data and Methodology

A total 25 structured questions were set for data collection, which were categorized under four different groups: green recruitment and training (GRT): (GRT1-GRT8), green performance and reward (GPR): (GPR1-GPR7), organizational citizenship behavior for environment (OCBE): (OCBE1-OCBE5) and environmental corporate social responsibility (ECSR): (ECSR1-ECSR5). The related questions are designed in line with previous studies by Boiral and Paille (2012), Tang et al. (2018) and Malik et al. (2021). The questionnaire is given in the Appendix. For greater credibility and validity, we employed a 5-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree) to measure the variables. The four categories of questions correspond to four constructs (variables) GRT, GPR, OCBE and ECSR, which we use for structural equation modeling (SEM) analysis with Smart PLS-4 statistical tool. Here, we note that GRT and GPR represent the independent constructs, whereas OCBE and ECSR represent the dependent variables. The concept of the two independent variables of GRT and GPR represent green ability and competence-building practices (Teixeira et al., 2012) and green-motivation enhancing practices (Harvey et al., 2013), respectively, in the lens of ability-motivation-opportunity (AMO) theory. The empirical survey was conducted during December 2022 to February 2023.

Hypothesis Development

On the basis of the AMO theory and RBV theory, hypotheses (H1-H7) of the present research study were designed as follows:

- H1: GRT has a direct significant impact on OCBE.

- H2: GPR has a direct significant impact on OCBE.

- H3: GRT has a direct significant impact on ECSR.

- H4: GPR has a direct significant impact on ECSR.

- H5: OCBE has a direct significant impact on ECSR.

- H6: OCBE mediates the relationship between GRT and ECSR.

- H7: OCBE mediates the relationship between GPR and ECSR.

Data Analysis

Data analysis is done to prove the hypothesized relationships of GRT and GPR with ECSR, where OCBE acts as the mediator. We apply SEM using the statistical tool Smart PLS 4. The analysis procedure involves two stages, i.e., measurement model assessment and structural model assessment. In the measurement model, consistent check of the measured parameters through convergent reliability and discriminant validity testing is done. The second stage involves the assessment of the structural model to test the hypothesized relationships involving GHRM practices and ECSR.

Measurement Model Assessment

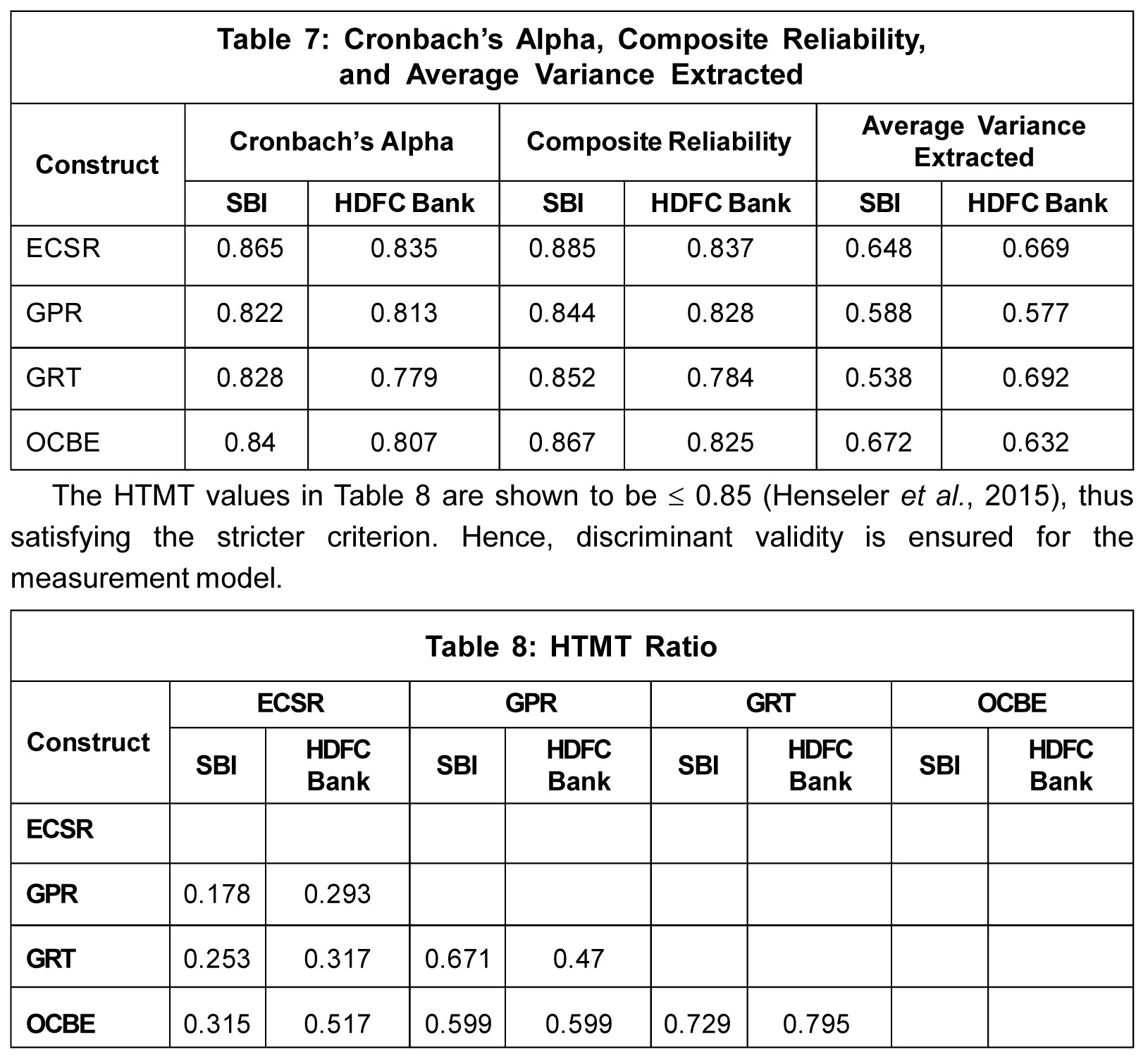

In the measurement model, we follow the conventional method for examining the construct reliability and validity, followed by discriminant validity (Hair et al., 2019).

Table 7 shows that the respective loadings of the model meet the check point values, i.e., Cronbach's alpha coefficients and the composite reliability (CR) ⋝ 0.7 and average variance extracted (AVE) ⋝ 0.5 (Bagozzi and Yi,1988). In the next step, the discriminant validity is checked for consistency using HTMT ratio criteria.

Structural Model

As proposed by Hair et al. (2013, 2019 and 2022), the structural model assessment is done by assessing the respective path coefficients (beta coefficient), the standard errors,

t-values and p-values for the individual structural model using bootstrapping procedure (Ramayah et al., 2018) to ensure acceptance or rejection of the proposed hypotheses.

State Bank of India

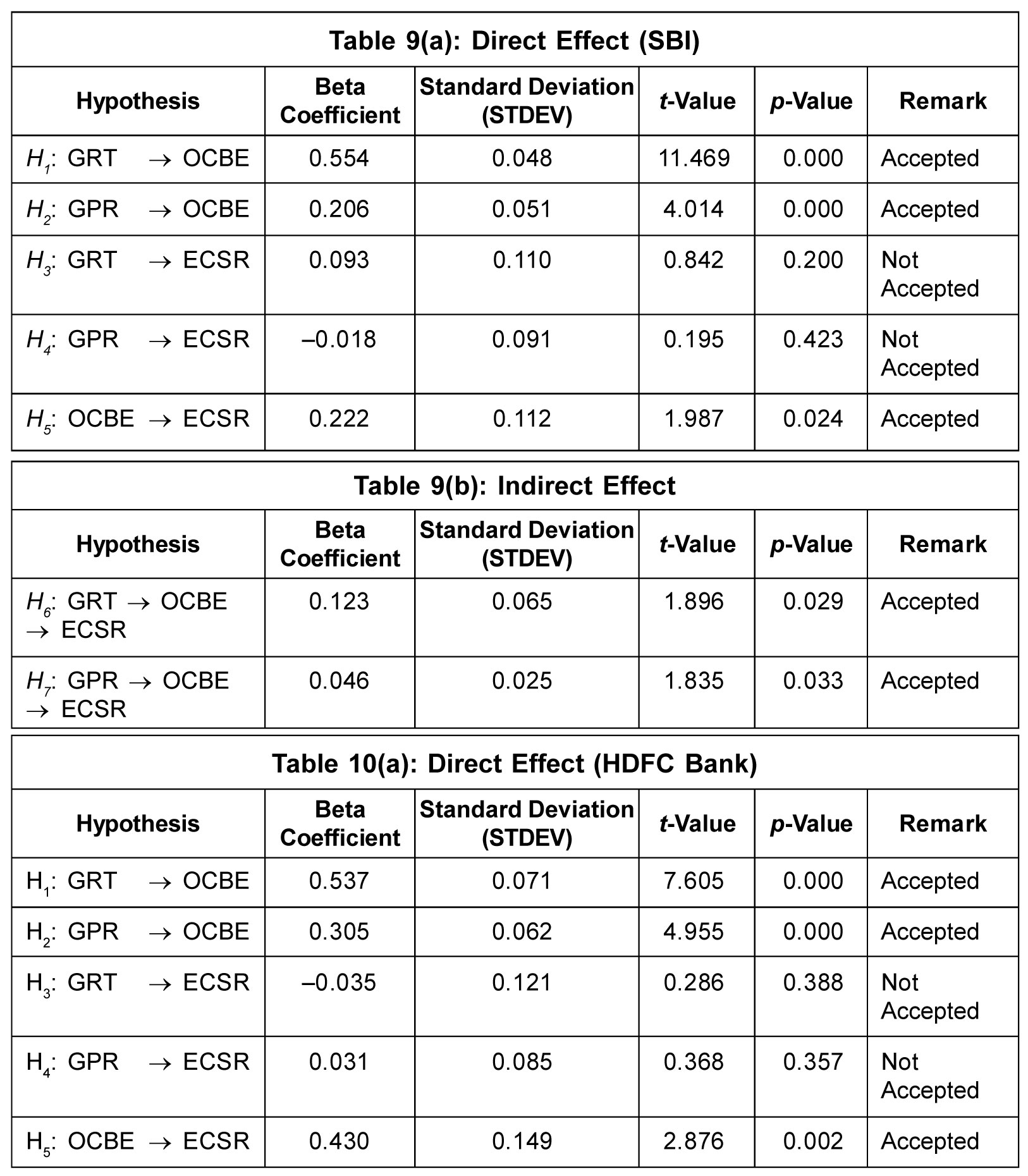

Beta coefficient, standard deviation, p-values: and t-values are noted in Tables 9a and 9b.

HDFC Bank

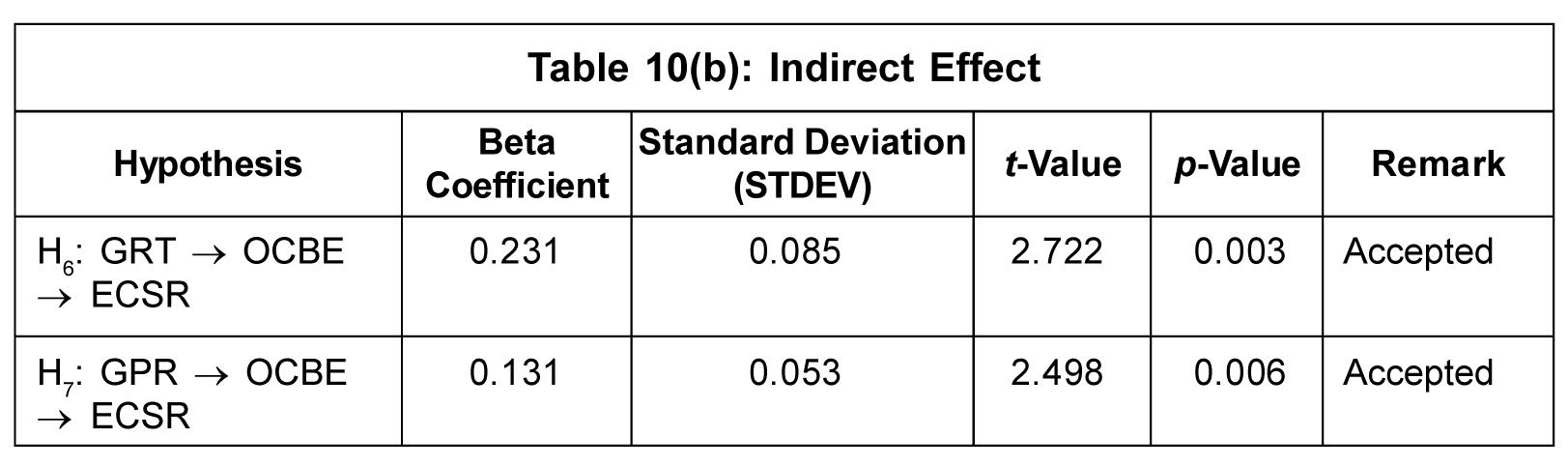

Beta coefficient, standard deviation, t-values and p-values for both direct and indirect effects in HDFC Bank are given in Tables 10a and 10b.

The results for direct effect of GRT on OCBE and GPR on OCBE, are shown in Tables 9(a) and 10(a). We find that for GRT, t-value is 11.469 for SBI and 7.605 for HDFC Bank and p-value is 0 for both the banks. As regards GPR, t-value is 4.014 for SBI and 4.955 for HDFC Bank and p-value is 0 (< 0.05) for both the banks. Thus, GRT and GPR have a direct significant impact on OCBE, confirming H1 and H2 for both the banks. Similarly, as regards direct effect of OCBE on ECSR, t-value is 1.987 for SBI and 2.8761 for HDFC Bank. Further, p-value is 0.024 (< 0.05) for SBI and 0.002 (< 0.05) for HDFC Bank, thus showing a significant impact of OCBE on ECSR in case of both the banks, thereby confirming H5. In respect of indirect effect results shown in Tables 9(b) and 10(b), OCBE as a mediator has a significant impact in facilitating the influence of both GRT and GPR practices on ECSR in both the banks, thus confirming H6 and H7. On the other hand, as per the t-value and p-value criterion, the direct effect of GRT and GPR on environmental

CSR was found to be insignificant in case of both the banks, and therefore, H3 and H4 stand rejected.

The above empirical analysis clearly shows the importance of OCBE, which acts as a mediator to influence ECSR significantly in both SBI and HDFC Bank. Coupled with this, the strategic implementation of the programs will hold the key to the success, which is detailed in the following section.

Environmental CSR Strategy

Organizations can become responsible corporate citizens by adopting appropriate CSR strategy to bring about social and environmental welfare of the community without losing focus on their long-term profitability. In the following paragraphs, we highlight some of the strategic measures which Indian banks may adopt to improve environmental CSR.

Focus on Environment in CSR Policy: Banks may give due priority to environment in their CSR policy document by carving out separate budget allocation for environment- related activities out of the total CSR budget after taking board approval. This will send a clear message down the line.

CSR Committee Formation: In accordance with guidelines under Section 135 of Companies Act, 2013, both SBI and HDFC Bank have formed CSR committees at the bank level. Committees at State and Local/Unit levels may be formed to facilitate effective implementation of CSR activities. Suitable personnel having environment-related knowledge and experience may be identified and nominated as members of CSR committees by HR departments. Committees may meet and coordinate with different developmental experts in government and NGOs to obtain area-wise needs and potential for CSR intervention, including environment-related areas. The projects can be categorized in a manner in which bigger projects may be handled by state/apex committees and small projects by local committees.

Skill and Knowledge Building: Success of CSR projects depends upon proper identification of projects by need-gap analysis, effective implementation and active engagement of staff. In regard to environment-related CSR activities like waste disposal, energy and water conservation, etc. through reduce, reuse and recycle principle, the staff need to be equipped with adequate knowledge in related areas. Green training will play an important role here. Environment experts and CSR committee members may participate in green training programs to share their knowledge/experience.

Selection of Implementation Partners: Successful execution of environmental CSR projects will depend on competence of implementation partners having necessary capability and good track record in successfully implementing environment projects. Banks need to carry out necessary due diligence while selecting them. Following important areas need to be verified: Identity, Management, Competence, Financial Strength, Transparency and Integrity and Track Record.

Periodic Review and Monitoring: CSR committees will meet at periodical intervals to review and monitor the progress towards effective and timely execution of CSR projects. Performance evaluation of CSR activities will be included in this exercise. Units doing better performance in environmental CSR may be encouraged with timely recognition. This will be a part of green performance evaluation (GPE).

Impact Assessment: Impact assessment provides necessary feedback and helps in future project design. It is absolutely necessary in environment-related projects. This will be driven by CSR committees with the help of an independent team with specific skills related to environment projects. SBI has made provisions in CSR policy for impact assessment of projects with outlay 1 cr or more.

Success Stories: Successful CSR projects relating to environment may be highlighted and their success stories need to be published in bank's annual/sustainability reports. Teams involved in such projects may be rewarded under a suitably designed Green Reward Scheme.

Discussion

In the present study, we have made a comparative analysis of CSR spend under different activities during the preceding six financial years (2016-17 to 2021-22) of State Bank of India and HDFC Bank, the two leading Indian banks in public and private sector, respectively. It is observed that their environmental CSR spend was significantly low all through in comparison to CSR spend under other focus areas. Through empirical analysis, it is noted that adoption of GHRM practices in the bank has no direct impact on ECSR. However, these practices have significant impact on OCBE, and OCBE in turn has significant impact on ECSR, as is evident from the confirmation of the proposed hypotheses H1, H2 and H5. Further, the confirmation of H6 and H7 shows that OCBE has a relevant mediating role in effectively influencing GHRM practices towards better environmental CSR in the Indian banking sector.

It is noteworthy to mention that the study has highlighted how GHRM practices can be a strategic resource possessing all the four attributes of RBV theory and can be used as a vital resource to improve environmental CSR and achieve sustained competitive advantage in the banking sector with appropriate interventions. The study has also various practical implications for bank managements to introspect their environmental CSR status, to take suitable steps in amending the CSR policy/priorities, and to keep the CSR committees and mechanisms in place. HR managers can take every possible step at the workplace to ensure green work culture and higher OCBE so as to get active participation and initiatives of staff in environmental CSR activities.

The study has contributed to the body of literature by laying emphasis on environmental CSR in the Indian banking sector with quantitative analysis of SBI and HDFC Bank, two leading Indian banks. It has focused on how GHRM practices can be a strategic resource with appropriate interventions for improving the already low environmental CSR, taking inputs from the RBV theory. Further, this is the first empirical study to establish that GHRM practices can significantly impact environmental CSR in the Indian banking sector through mediation of OCBE.

Conclusion

Indian banking sector has made good progress in internalizing sustainable practices like digital banking, eco-friendly products and services, and efficient energy and resource utilization to face the environmental challenges. Under the CSR platform, banks are also undertaking various community welfare projects, including environment-related programs. However, considering the serious state of environmental degradation, Indian banks need to pay more attention to environmental CSR by giving its due share, which will hold hope for long-term sustainability. It will also serve the interests of banks as they will win the loyalty and patronage of customers and satisfaction of their own employees as well, who will take pride in identifying themselves with an environment-friendly organization. Further, as the CSR guidelines are not uniform across the entire Indian banking sector, it needs intervention of the government and the Reserve Bank of India. Allocating a separate budget for environmental CSR out of total CSR budget, adopting suitable strategy and ushering a green work culture through appropriate GHRM practices should receive attention of the bank managements and HR managers, which will certainly give a boost to environmental CSR. The study has dealt with how various factors can make GHRM practices in banks more supportive so as to contribute towards environmental welfare through the CSR platform. This will lead to satisfaction of all stakeholders, including the society at large.

Limitations and Future Scope: The study is confined to only two Indian banks, though they are the leading ones. Responses were obtained only from senior executives of the concerned two banks operating in Odisha state. More insights can be obtained by making the study broad-based by covering more banks, including Regional Rural Banks and Cooperative Banks, and with inclusion of junior officers and other employees, and increasing the geographical spread. These limitations offer scope to future researchers for further study, including measuring the environmental performance through other mediators like green work culture, green employee empowerment and pro-environment behavior. Future researchers also may conduct a deeper probe to identify the underlying reasons for low environmental CSR in the Indian banking sector as well as the status of environmental CSR in other sectors.

References

- Babiak K and Trendafilova S (2011), "CSR and Environmental Responsibility: Motives and Pressures to Adopt Green Management Practices", Corporate Social Responsibility and Environmental Management, Vol. 18, No. 1, pp. 11-24. https://doi.org/10.1002/csr.229

- Bagozzi R P and Yi Y (1988), "On the Evaluation of Structural Equation Models", Journal of the Academy of Marketing Science, Vol. 16, No. 1, pp. 74-94.

- Barney J (1991), "Firm Resources and Sustained Competitive Advantage", Journal of Management, Vol. 17, No. 1, pp. 99-120. https://doi.org/10.1177/014920639 101700108

- Bihari S C and Pradhan S (2011), "CSR and Performance: The Story of Banks in India", Journal of Transnational Management, Vol. 16, No. 1, pp. 20-35. https://doi:10.1080/15475778.2011.549807

- Boiral O (2009), "Greening the Corporation Through Organizational Citizenship Behaviours", Journal of Business Ethics, Vol. 87, No. 2, pp. 221-236. https://doi:10.1007/s10551-008-9881-2

- Boiral O and Paille P (2012), "Organizational Citizenship Behaviour for the Environment: Measurement and Validation", Journal of Business Ethics, Vol. 109, No. 4, pp. 431-445.

- Dhingra D and Mittal R (2014), "CSR Practices in Indian Banking Sector", Global Journal of Finance and Management, Vol. 6, No. 9, pp. 853-862.

- Eyasu A M and Arefayne D (2020), "The Effect of Corporate Social Responsibility on Banks' Competitive Advantage: Evidence from Ethiopian Lion International Bank SC", Cogent Business and Management, Vol. 7, No. 1, pp. 1-23. https://doi:10.1080/23311975.2020.1830473

- Freitas W, Oliveria J, Teixeira A, Stefanelli N and Teixeira T (2020), "Green Human Resource Management and Corporate Social Responsibility: Evidence from Brazilian Firms", Benchmarking: An International Journal, Vol. 27, No. 4, pp. 1551-1569. https://doi:10.1108/BIJ-12-2019-0543

- Gaba N and Madhumathi R (2022), "Does Corporate Social Responsibility Add Value to the Indian Banking Sector?", Indian Journal of Finance and Banking, Vol. 9, No. 1, pp.140-158. https://doi.org/10.46281/ijfb.v9i1.1612

- Govindarajulu N and Daily B F (2004), "Motivating Employees for Environmental Improvement", Industrial Management and Data Systems, Vol. 10, No. 4, pp. 364-372. https://doi.org/10.1108/02635570410530775

- Hair J F, Ringle C M and Sarstedt M (2013), "Editorial Partial Least Squares Structural Equation Modelling: Rigorous Applications, Better Results and Higher Acceptance", Long Range Planning, Vol. 46, Nos. 1-2, pp. 1-12.

- Hair J F, Risher J, Sarstedt M and Ringle C M (2019), "When to Use and How to Report the Results of PLS-SEM", European Business Review, Vol. 31, No. 1, pp. 2-24.

- Hair J F, Hult G T M, Ringle C M and Sarstedt M (2022), A Primer on Partial Least Squares Structural Equation Modelling (PLS-SEM), Sage, Thousand Oaks, CA.

- Hand Book on Corporate Social Responsibility in India (2013), Confederation of Indian Industry, https://www.pwc.in

- Harvey G, Williams K and Probert J (2013), "Greening the Airline Pilot: HRM and the Green Performance of Airlines in the UK", International Journal of Human Resource Management, Vol. 24, No. 1, pp. 152-166.

- HDFC Bank Annual Report (2016-17), (2017-18), (2018-19) and (2019-20), https://www.hdfcbank.com

- HDFC Bank Business Responsibility Report (2016-17), https://www.hdfcbank.com

- HDFC Bank CSR Policy (April 2021), https://www.hdfcbank.com

- HDFC Bank Integrated Annual Report (2020-21) and (2021-22), https://www. hdfcbank.com

- HDFC Bank Sustainability Report (2017-18), (2018-19) and (2019-20), https://www.hdfcbank.com

- Henseler J, Ringle C and Sarstedt M (2015), "A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modelling", Journal of Academic Market Science, Vol. 43, No. 1, pp.115-135.

- Hill H S (2014), "CSR in India: Reflections from the Banking Sector", Social Responsibility Journal, Vol.10, No.1, pp. 21-37.

- Kulkarni A (2014), "Corporate Social Responsibility in Indian Banking Sector: A Critical Analysis", in Subhasis Ray and S Siva Raju (Eds.), Implementing Corporate Social Responsibility, Chapter- 8, pp. 111-127, Springer.

- Malik S Y, Hayat M Y, Azam T et al. (2021), "Corporate Social Responsibility, Green Human Resources Management and Sustainable Performance: Is Organizational Citizenship Behaviour Towards Environment the Missing Link", Sustainability, Vol. 13, No. 1044, pp. 1-24. https://doi.org/10.3390/su13031044

- Mitra N and Schmidpeter R (2017), "The Why, What and How of the CSR Mandate: The India Story",in CSR, Sustainability, Ethics & Governance, Book Series, Springer Publication, pp.1-8. https://doi/10.1007/978-3-319-41781-3_1

- National CSR Data Portal of the Ministry of Corporate Affairs, Government of India, https://csr.gov.in

- Ramayah T, Cheah J, Chuah F, Ting H and Memon M A (2018), "Partial Least Squares Structural Equation Modelling (PLS-SEM) Using Smart PLS 3.0", An Updated Guide and Practical Guide to Statistical Analysis, First Edition, Pearson Malaysia.

- RBI Circular (2005), "Donations by Banks", Vide DBOD. No. Dir.BC.50/13.01.01/ 2005-06, dated 21-12-2005, https://www.rbi.org.in

- RBI Circular (2007), "Corporate Social Responsibility, Sustainable Development and Non-Financial Reporting-Role of Banks", Vide DBOD. No. Dir.BC.58/ 13.27.00/2007-08, dated 20-12-2007, https://www.rbi.org.in

- Saifulina N, Carballo-Penela A and Ruzo-Sanmartin E (2020), "Sustainable HRM and Green HRM: The Role of Green HRM in Influencing Employee Pro-Environmental Behaviour at Work", Journal of Sustainable Research, Vol. 2, No. 3, pp.1-25. e200026. https://doi.org/10.20900/jsr20200026

- Sayad S E and Diab A (2022), "Bank Employee Perceptions of Corporate Social Responsibility Practices: Evidence from Egypt", Sustainability, Vol. 14, No. 3, 1862, pp. 1-32 https://doi.org/10.3390/su14031862

- SBI Annual Report (2016-17), (2017-18), (2018-19), (2019-20), (2020-21) and (2021-22), https://www.sbi.co.in

- SBI CSR Policy (April 2021), https://www.sbi.co.in

- SBI Sustainability Report (2016-17), (2017-18), (2018-19), (2019-20), (2020-21) and (2021-22) https://www.sbi.co.in

- SBI Foundation Annual Report (2017-18), (2019-20), (2020-21) and (2021-22), https://www.sbifoundation.in/reports

- Sengupta A and De S (2018), "Competition in Indian Banking Sector since 1990s: An Empirical Study", The Indian Economic Journal, Vol. 65, Nos.1-4, pp. 67-75 https://doi:10.1177/0019466217727845

- Tang G, Chen Y, Jiang Y, Paille P and Jia J (2018), "Green Human Resource Management Practices: Scale Development and Validity", Asia Pacific Journal of Human Resource, Vol. 56, No. 1, pp. 31-55.

- Teixeira A A, Jabbour C J C and Jabbour A B S (2012), "Relationship Between Green Management and Environmental Training in Companies Located in Brazil: A Theoretical Framework and Case Studies", International Journal of Production Economics, Vol. 140, No. 1, pp. 318-329.