November' 21

The IUP Journal of Marketing Management

Archives

Unibic India: From Fastest Growing Niche Cookie Brand to a Challenger? in the Indian Context

Mohandas J Menon

Associate Professor, Department of Marketing and Strategy, IBS Hyderabad (Under IFHE-

A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India.

E-mail: mjmenon@ibsindia.org

Namratha V Prasad

Faculty Associate, IBS Hyderabad (Under IFHE-A Deemed to be University u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: namrathap@ibsindia.org

The case describes the various strategies undertaken by UNIBIC Foods India Pvt. Ltd. (Unibic) to create and consolidate its position in the highly competitive Indian biscuit industry. The case takes an in-depth look into the early history of the company and the differentiation strategy it used to make a market impact in the niche cookie segment. Later, it discusses in detail Unibic's marketing mix and media mix strategy. Information about Unibic's product development strategy, retail strategy, and advertising strategy is provided. The efforts of the company to grow beyond its niche segment and enter other sub-segments in the Indian biscuit industry are described. The case also provides an insight into the challenges plaguing the company. Can Unibic grow from a niche brand to a challenger brand?

Introduction

In August 2020, UNIBIC Foods India Pvt. Ltd. (Unibic), India's fastest growing company in the cookie3 segment, said it had experienced a huge demand for healthy cookies during the intermittent lockdowns enforced due to the outbreak of the Covid-194 pandemic. The company further claimed that it had seen an overall rise in demand during that year compared to previous years, despite it being a time of economic uncertainty. Sreenivasulu Vudayagiri (Vudayagiri), CEO of Unibic, said, "We have seen very good growth in our health segment. People are sitting at home generally; they want to have some snacks but at the same time they are cautious about health."5

In 2004, the newly established Unibic began operating in the cookie segment, a niche and premium segment in the Indian biscuit6 market with very few organized players. It sought to differentiate itself in the cookie market by adopting a unique cookie production process that gave its cookies a distinctive texture, along with a packaging style that was different from the market norm for cookies.

Despite struggling financially in its initial years, Unibic gradually became a player to contend with in the Indian cookie market on the back of its product, marketing, and retail strategies. The company adopted innovation and quality as its key focal points. Arti Iyer (Iyer), Marketing Head, Unibic, said, "Unibic's USP7 has always been to bring something new to the table and with it the quality that will never be compromised. We ensure that we offer more with our cookies by adding more ingredients and hence making it richer and tastier. Nicheness comes with some of the firsts we have introduced in the market..."8

The company, which primarily operated in the premium segment of the Indian biscuit market, gradually introduced products at lower price points to increase its distribution network, especially in rural areas, and to gain a foothold in the mass market. To promote its products, it adopted marketing strategies such as celebrity endorsements and sports sponsorship. To build a connection with its consumers, it introduced a lively mascot called UBU that was featured in all its ads. Unibic also adopted the strategy of reaching out to its consumers through a media mix that included TV, OOH9 and digital and social media.

The Indian cookie segment grew enormously over the years to constitute almost 25% of the entire biscuit market-the largest and fastest growing segment. Unibic emerged as the fastest growing player in the cookie segment. However, the company still had a long way to go before it became a serious contender for market leadership in the highly competitive Indian biscuit industry. Unibic was already diversifying by entering new market segments in order to create a stronger position for itself in the biscuit market. It remained to be seen whether a strong niche player could grow to become a serious challenger to the well-established market leaders.

Starting the Journey

In July 2004, in association with Michael Quinn - founder of Unibic Australia Pty Ltd. (Unibic Australia)10 - and Australia-based entrepreneur Dhruv Deepak Saxena, Nikhil Sen (Sen) founded Unibic. With an initial investment of 150 mn, Unibic was incorporated as the Indian subsidiary of Unibic Australia. Sen was an industry veteran with almost 20 years of experience in the FMCG11 industry. He had joined leading food and beverage company Britannia Industries Limited (Britannia)12 as a management trainee in the late 1980s and had risen through the ranks to the position of Chief Operating Officer, before resigning in the early 2000s.

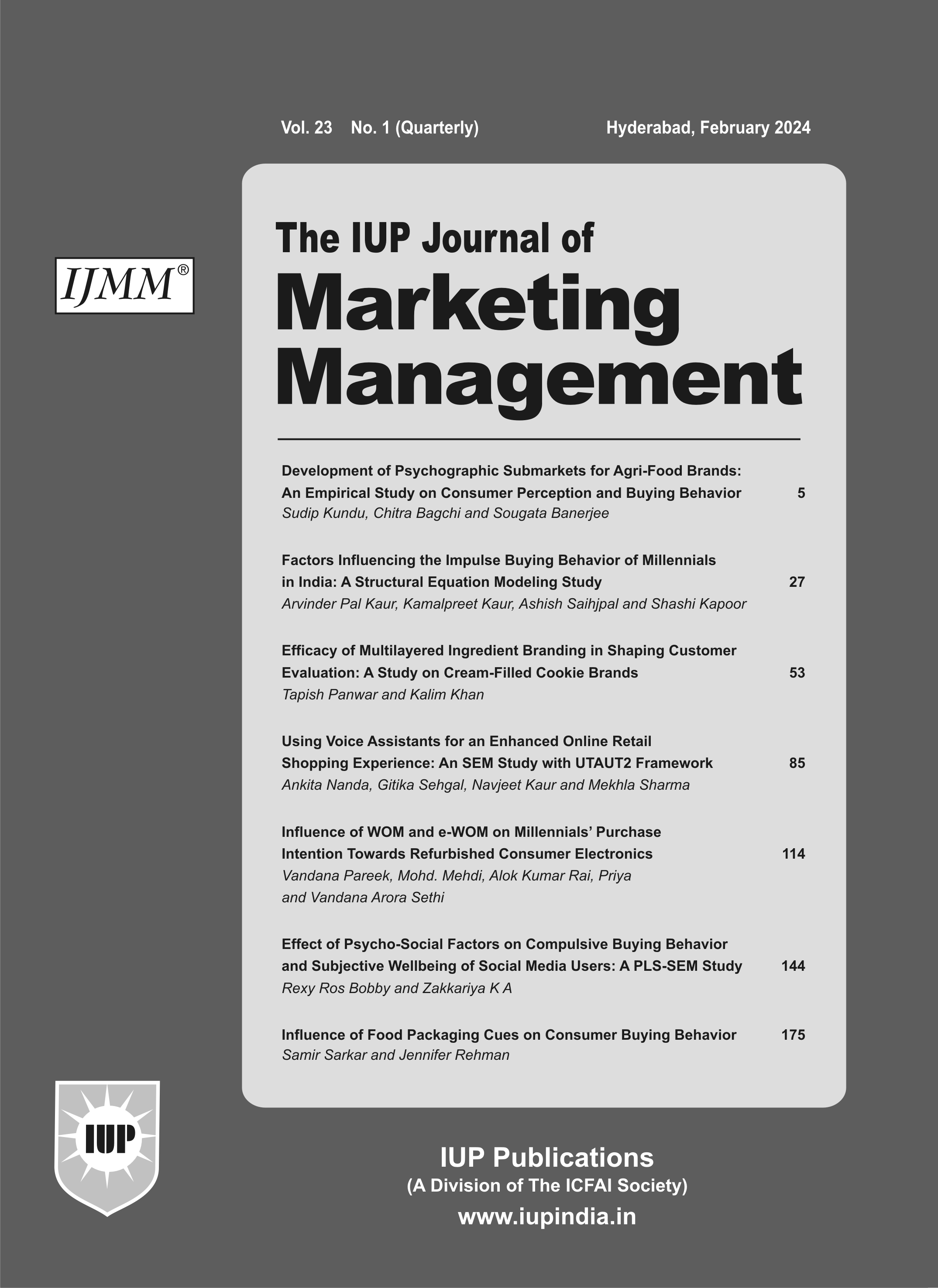

Unibic was set up to tap into the cookie segment in the Indian biscuit industry. This was a niche and premium segment with few organized players. The biscuit industry at that time was dominated by the glucose biscuit13 segment, with other segments also growing fast (See Exhibit I for Break-up of the Indian Biscuit Industry in the Early 2000s).

Unibic imported cookies from Unibic Australia's plants in Australia and sold them under the brands ANZAC and Bradman in India. Its first products were ANZAC Oatmeal Cookies and Bradman Chocochip Cookies. The products were priced fairly high and were targeted at the premium cookie market. D. Saxena, Managing Director of Unibic, said, "...pricing is a sensitive issue with the biscuit industry but we are not aiming at the mass market. Our target market is the 500 cr (5 bn) niche premium segment, where the consumer looks for quality and doesn't mind paying the price

for it."14

At the end of 2005, Unibic set up its own manufacturing facility in Tumakuru near Bengaluru. This was the first overseas production unit of Unibic Australia and was built using Australian technology. At the beginning, Unibic imported raw materials such as chocolate chips and oatmeal into India for its production. Later, it began sourcing its high quality raw materials from India itself. Speaking about the role played by a production process that focused on quality in the success of the products, Sen said, "...most factories concentrated on the front end of the business such as advertising and having brand icons... (we) work from the back end of the business and invest in different machinery, importing machines from abroad and to enhance taste and quality for consumers."15

One of the most critical factors that helped differentiate Unibic in the Indian market was the adoption of the unique wire-cut technology in its cookie manufacturing process that gave each of its cookies a unique shape and the appearance of homemade cookies. At that time, molded cookies16 were available in India, but wire-cut biscuits were virtually unknown. The wire cut technology and the associated baking on a solid steel band was not common in India. One of the reasons for its uncommonness was the high cost of the technology. It cost a company 3-4 times more to produce cookies using the wire-cut technology, than molded cookies.

In the wire-cut technology process, the cookie dough was made extra-soft in consistency for ease of processing. As the dough, on extrusion, passed through the dies, a reciprocating wire cut it and the dough pieces fell on a chain conveyor. That enabled the cookies to freely spread, allowing each one to look different. Sen added, "The wire-cut technology produces a molded product with a more open texture, almost like a handmade cookie mould. This way, no two cookies are ever the same. The formation and what happens inside the oven is unique for each cookie."17 Furthermore, the wire cut technology enabled the inclusion of fruit pieces, nuts, chocolate chips, and oats, among other things, in the cookie, without the fear that they would be crushed or smashed when the dough piece was being formed.

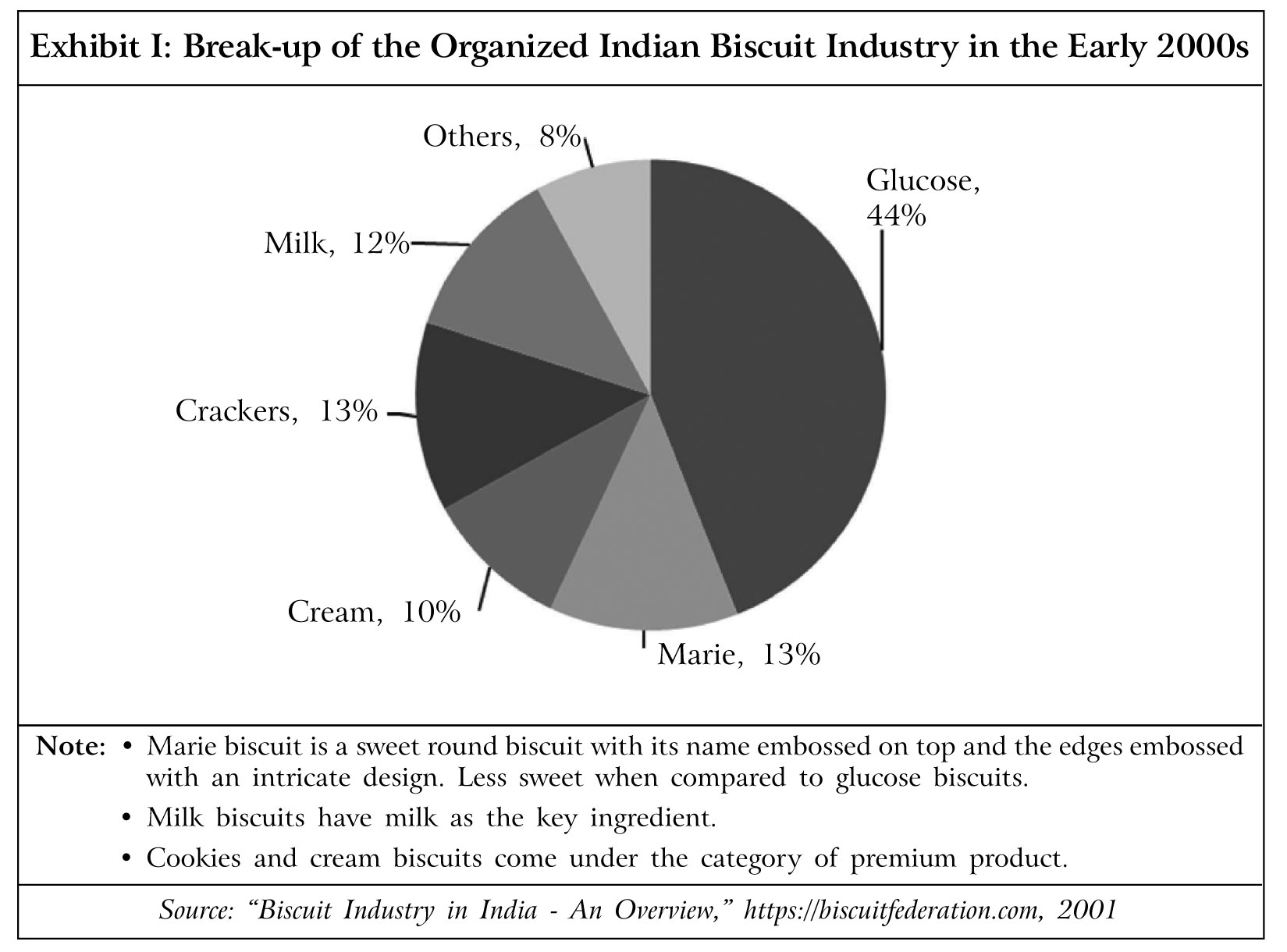

In addition, Unibic adopted a packaging style for its biscuits that was different from the industry norm for cookies at that time. While, the usual packaging style was 'biscuits on edge', Unibic took up the 'biscuits on pile' style of packaging, as it believed that the former made the pack look small (See Exhibit II for Information on the Two Packaging Styles). The company believed that the 'biscuits on pile' style made the packs look comparatively bigger and also reduced the chances of the cookie breaking inadvertently.

The company designed its initial marketing strategy around the ability of its packaging style to keep its cookies unbroken till they reached the final customer. Its first marketing campaign was launched with the slogan 'Australia's favorite cookie, too good to be served broken'. In the early days, the company undertook sports sponsorship of cricket to gain visibility, considering the fact that Indians were crazy about cricket. In 2005, it held the first T2018 cricket tournament recognized by the BCCI19, called the 'Unibic Twenty 20 Bradman Cup'. Sen added, "It cost us a lot of money and resources, but it turned out to be a fantastic opportunity for us to gain greater visibility and an experience to see notable cricketers at their game."20

Considering that it was yet to create a position for itself in the market, the company did not have much money to spare for advertising in later days. However, it wanted to create a buzz around its cookies in the biscuit industry. Consequently, it resorted to comparative advertising. It chose to position its products against Britannia's popular 'Good Day' range of cookies which had the advertising tagline "Have a Good Day". At that time, 'Good Day' was a popular cookie brand and was considered to be synonymous with cookies.

Unibic then advertised its products in the print media and through a TVC21 with the tagline 'Why have a 'Good Day' when you can have a great day - Introducing Australia's favorite cookie'. The ad copy further stated that one shouldn't settle for anything less than great, and claimed that Unibic's cookies, made from the finest ingredients, were far better than 'any other mere biscuit'. The campaign raised brand awareness for Unibic and led to a sales spike. However, Britannia objected to it and subsequently Unibic signed a compromise saying it would not use the line anymore. Later, Unibic mostly did below-the-line advertising22. Through the next few years, Unibic introduced cookies under its brand name.

The Troubled Days

In 2007, Lighthouse Funds23 acquired a 25% stake in Unibic from Unibic Australia for 200 mn. In 2010, Unibic Australia started making losses and wanted to withdraw from the Indian market. At that time, Unibic operated solely in the premium, high-margin cookies segment in India, with a share of around 8%. It had a market presence primarily in south India and was exporting to the Middle East and Hong Kong. It had strategic alliances to make cookies for various private players. However, it was not yet making profits and was cash-strapped.

In 2011, Lazard, a US-based private equity firm, acquired a major stake in Unibic Australia, thereby gaining the majority stake in Unibic also. However, Lazard did not want to retain the Indian operations and began searching for an Asian company to which it could sell its stake. The uncertainty around the ownership lasted for around two years.

In 2013-14, Unibic recorded revenue of 75 cr (750 mn).24 But it was yet to make profits and was struggling with cash problems. However, there was a general belief in the industry that the company had good growth prospects. In 2013, Peepul Capital (PC)25 acquired a majority stake of 90% in Unibic for almost 1 bn from the company's various investors. The rest of the stake in the company was held by Sen's family. With that, the Australian company no longer held any stake in Unibic, leaving the latter to function more independently. Vudayagiri, who was the then Investment Director at PC, said, "We have consolidated our position. We are the only institutional investor in the company right now."26

Over the years, PC invested almost $11 mn in Unibic. Speaking about the role played by the new investments in fueling the company's growth, Sen said, "Luckily, we were able to convince a few market players to invest, who came in and funded us. We stepped up and sustained our growth from that point."27

Unibic began to advertise more after receiving investments from PC. The company redesigned its logo, stating that the new logo made it more modern, and spruced up its packaging. Speaking about the ad campaigns that the company subsequently launched, Sen said, "We then decided to communicate about how we use the best ingredients which make our products the best. We wanted to stand for something that could really relate to taste. We came up with 'Delight in every bite' which graduated to 'Bicalicious'."28

Unibic's Retail Strategy

Over the next few years, Unibic grew rapidly. Its growth was primarily fueled by the changes sweeping through the Indian biscuit industry, wherein glucose biscuits that had dominated the market, gradually lost out to cream biscuits29 and cookies. The reasons for the shift included rising disposable incomes leading to an increase in consumption of premium biscuits; a larger number of manufacturing facilities of premium biscuits; growing health awareness; innovation bringing in attractive new products; rising affordability of cookies; and increase in eye-catching packaging.

From 2013 onward, Unibic strove to increase its presence in other parts of India, primarily the western and northern regions. The western region and metro cities were the largest markets for biscuits in India. Unibic not only recruited local regional managers in the new areas, but also began foraying into micro markets by working with distributors who could bring in more retailers. Unibic's marketing head Iyer said, "The northern market is a heavy cookie consumption market and we see huge potential there. Although there are local players who are pretty strong in those markets, our focus will be to make sure all our variants are available in the North and not just selective products."30

For many years, Unibic's key price point was 25 for a 75 g pack of its cookies, which meant that it was operating in the premium market. In 2015, in order to tap the lower end of the cookie market along with the rural market, the company launched 10 packs with a weight of 37.5 g. In addition, it introduced milk biscuits priced at 5. The company was attracted to the lower end of the market, as the bulk of sales (70%) happened in it. Thus, Unibic's products were available in Trial packs, Regular packs, and Family packs ranging from 5 to 25, and also in Gift tins ranging from 100 to 150, in all leading retail outlets.

Moreover, the company planned to expand its distribution reach by making several new retail outlets carry its products and thought that a low price point would help in that endeavor. Sen said, "We haven't been attentive to the 10 price point because we continue to be a premium biscuit company. But when you want to go from 100,000 to half-a-million outlets gradually, value pricing is conducive."31 The company's strategy paid off, when it managed to get its products carried by 1,000 distributors and 0.3 million retailers across India spanning traditional trade and modern trade32, by the late 2010s. The company did a lot of in-store branding and in-store communication at the retail outlets.

The company claimed that it maintained the efficiency of its distribution systems by ensuring an effective inventory system. Even though it had only one production unit, it ensured freshness of stocks by maintaining an optimum inventory level, which also kept the cost of capital low. Talking about the company's rising production and supply chain capabilities, Vudayagiri said, "Cookies have a shelf life of six months and I can take the product to stores in ten days from production. This is because of our supply chain efficiency and the capability of our team. We adopted a lot of new technologies early on and have focused on quality. That's why we have been able to scale ten times in eight years."33

Through the years, Unibic made significant inroads with the institution channels34, which also played a crucial role in its growth. It gained several institution buyers including the Indian Railways, the hospitality industry, armed forces, police personnel, educational institutions, financial institutions, leading food caterers, and corporates.

The company also focused on promoting cookies as a gifting option during festive occasions. Gradually, people started gifting cookies as they began to be considered a rich and attractive snack during festivals and occasions. Touting the suitability of cookies as a gifting option, Unibic claimed that its cookies were hygienically packed, had less sugar content, and a longer shelf life than traditional Indian sweets. In addition, consumers had a fear of adulteration in sweets, which made them shift to buying premium cookies.

As of the mid-2010s, online biscuit consumption in India was low at just 2-3% of the entire market. However, Unibic ensured that its products were available on leading online platforms. It also intended to set up its own online retail platform in the future.

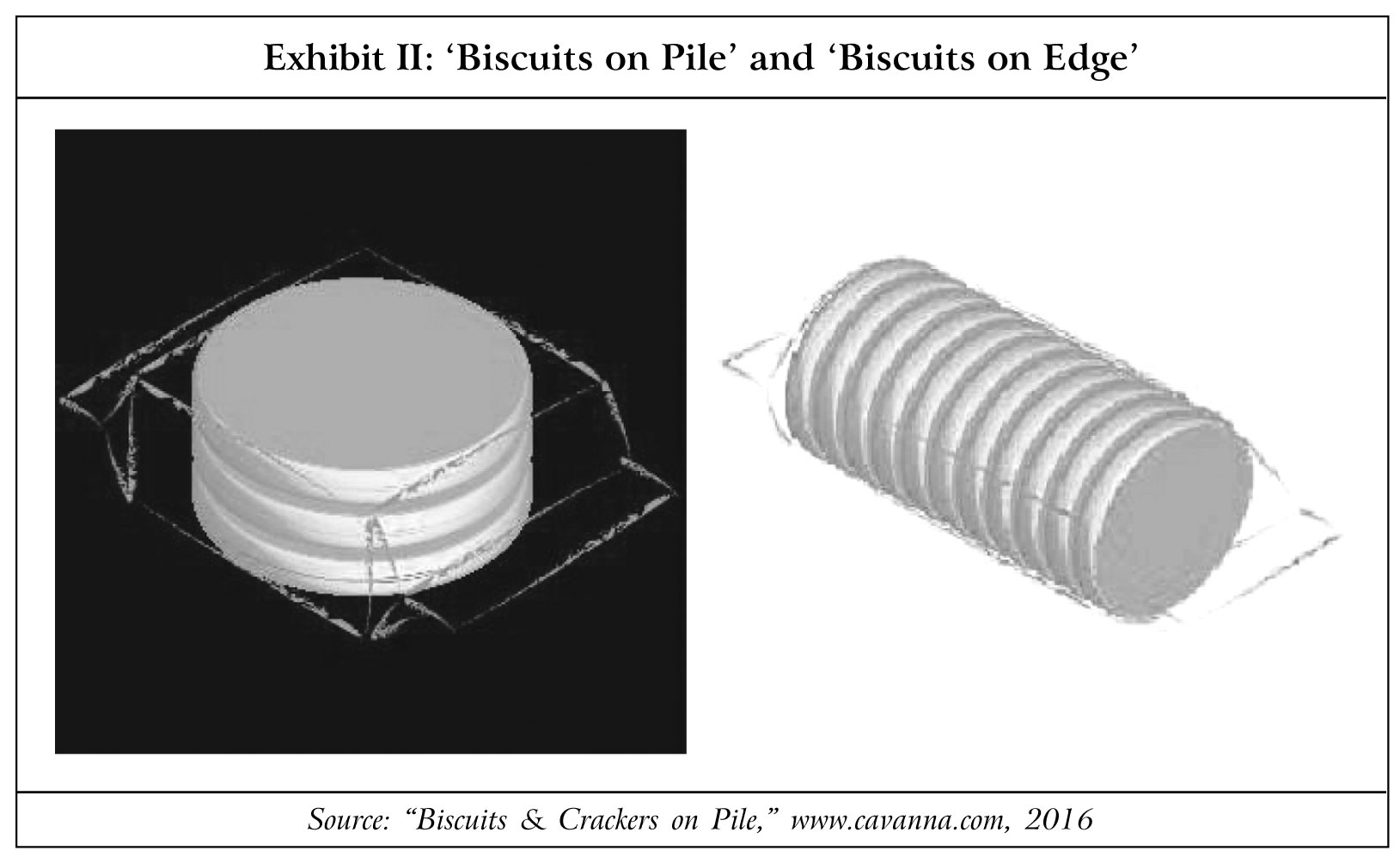

As of 2017, the cookie segment was growing 2.5-3 times faster than the biscuit segment. In 2017, Unibic claimed that it had grown almost 4.5 times more than the market in the previous five years.35 (See Exhibit III for Market Share of Unibic in the Cookie Segment)

Unibic's Keen Eye on Quality and Product Innovation

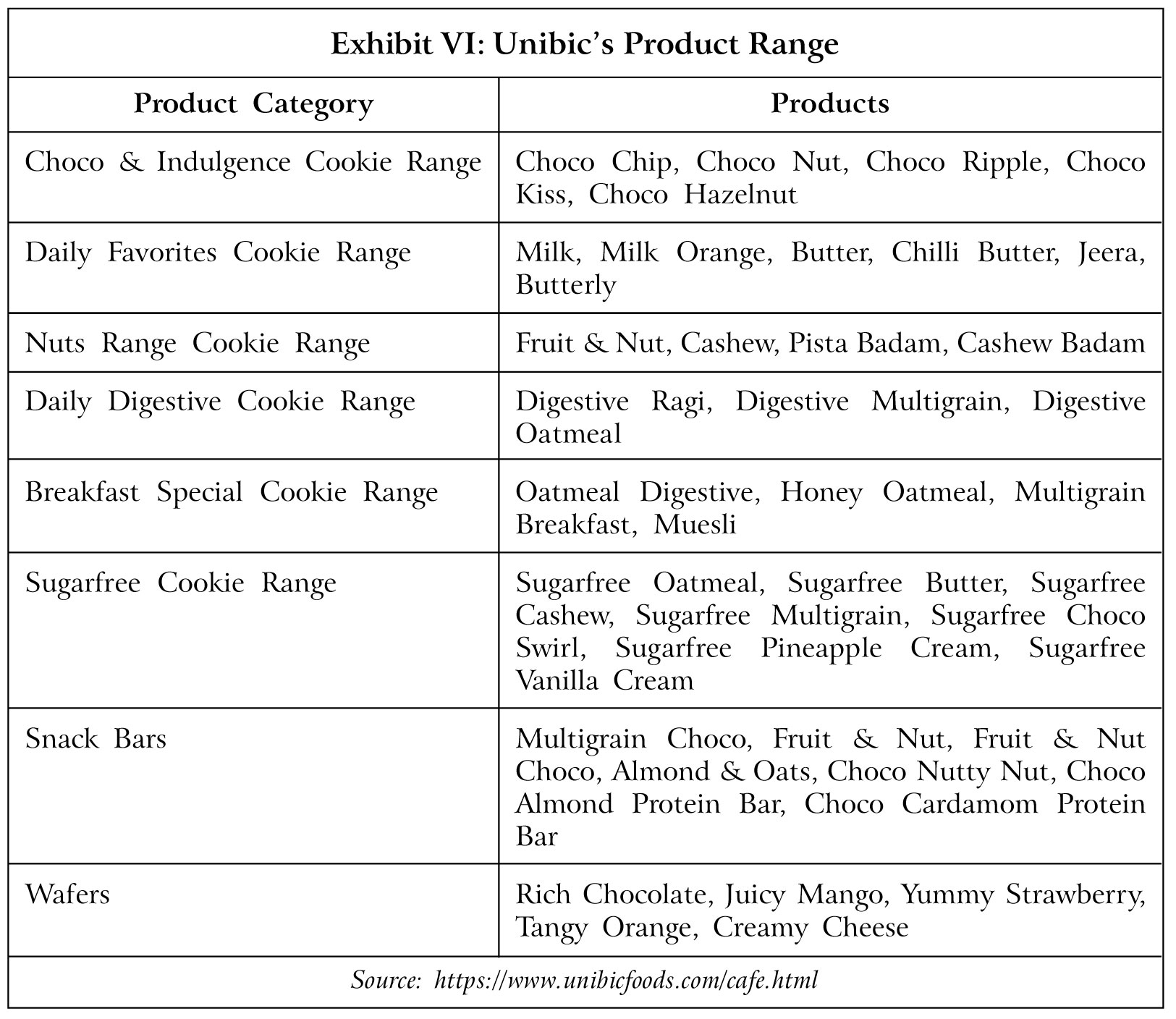

Over the years, Unibic regularly introduced fresh and unique flavors, ultimately producing over 30 variants of cookies. Its products could be broadly categorized into chocolate, butter, milk, savory, and health. The company considered its target market to be between the ages of 14 and 40. It continued its efforts at innovation and produced new products which would appeal to its target market.

Unibic had a keen eye on quality, with its cookies having a higher proportion of key ingredients, than those of its competitors. While its Choco Chip Cookies contained 21% chocolate, which was one of the highest in the market, its Cashew Cookies had 8% cashew compared to 4% in other brands; its Milk Cookies were richer in milk solids than any other cookie in India and its Butter Cookies had 9.4% real butter, which was almost double of what its nearest competitor put in their cookies.36 Later, Unibic began to use the marketing tagline 'Wow, too much' to emphasize how it put in much more ingredients into its products than its competitors. Iyer said, "Our communication strategy is to bring out the brand's intrinsic value proposition which is about giving consumers more - more of ingredients, more of richness and more of taste."37

Unibic had a robust product development process with the involvement of senior management, marketing, and sales along with the Research and Development team. The company claimed it had an out-of-the-box approach to creating new products, several of which were firsts in the industry. The company's firsts included the first liquid chocolate center cookies of India - Choco Kiss; the first Oatmeal Digestive Cookie in India; the first Indian brand to bring out Scotch Finger38; the first savory cookies in India called Chilli Butter Cookies, and the uniquely flavored Meetha Paan39 snackbar.

Unibic claimed that its focus on R&D meant that it came up with 100 products in a year, of which it chose a select few that it believed held market appeal. While creating new variants, the company stated it used consumer insights and innovative thinking in order to offer new experiences to its consumers. Its unique variants included Fruit & Nut, Milk Orange, Chilli Butter, and Honey Oatmeal.

The company was conscious of the fact that there was a rise in health-consciousness among Indians, prompting them to increasingly consume cookies that were considered to be healthy. As of the late 2010s, out of the 300 bn domestic biscuit market, the health category was estimated to be about 40 bn.40 Consequently, Unibic launched several new products in that category. In the health category, Unibic's products that were first in the market were Ragi Cookies (with pure ghee), Gluten-free Cookies, and Oats Cookies with 40% oats. The company mostly did umbrella branding and positioning for its health range. Over a period of time, its healthy range began to account for 20% of its revenues.

In 2018, Unibic was on the lookout for growth and entered the 10-bn snack bar/protein bar41 category. In a short period of time, it claimed to have become the number three player in that segment. Sen added, "We will look at bordering categories which are exciting. As a first step, we have launched the snack bar category, which is doing very well, and we hope to drive our volumes over there. It is a very nascent category and within the short span of time that we have launched, we must be among the top three players in the category. We will look at more specific health offering there to see how we can expand our market share there."42

In November 2019, it entered the wafers category with products priced at 5, 10, and 20. Through wafers, the company wanted to target children between the ages of five and eight. In 2020, the company's focus was on developing variants of sugar free and healthier cookies. This resulted in the launch of the chyawanprash43 cookie.

Laying Out the Marketing Strategy

In 2015, Unibic had used celebrity endorsement by signing on south Indian actor Shruti Hassan, for over a year. It stated that it wanted someone who was relevant and would give the brand a boost to get to the numbers it wanted in the South.

In September 2016, Unibic launched a new mascot called UBU, which was derived from "U (ni) B (ic) (and you) U". UBU appeared to have the texture of a cookie and was fashioned to be an affable character. UBU's catchphrase was "Wow! Too Much!" to represent the essence of "more" that a customer was said to derive while consuming the company's cookies. Sen added, "We are excited about the pan India launch of our mascot UBU. The multi-faceted character will allow us visible differentiation on every kind of medium: from in-store displays to television and digital media. It is friendly, fun, peppy and ensures it drives our message "more in every cookie" to our consumers."44

UBU was launched as part of a multimedia campaign that included electronic, static, and digital platforms in English and five languages. To create deeper engagement with the brand, the campaign was backed by outdoor, print, store, and unique on-ground events, apart from social media campaigns. UBU was shown sharing interesting nuggets on various aspects that included recipe tips on TV and quirky messages in the form of 'UBUISMs' on social media. On the various media channels, UBU was shown making famous cartoon characters yearn for Unibic cookies, apart from donning various avatars to have fun interactions with consumers.

UBU also strove to have unique interactions with viewers on TV by popping in to congratulate the players for the goal of the day during football matches, urging viewers to cheer loudly during cricket matches, and making cookies along with other cartoon characters.

The company's outdoor events centered on UBU included visiting schools to conduct games and contests where kids had to draw their interpretations of UBU and cookies. Iyer said, "Having created our own mascot, we want UBU, to be a lively, friendly personality who likes to interact and engage with the consumers in many ways. We are looking forward to bringing in more such interesting activations that will help us connect with our consumers at the right time in a fun manner. We will be looking at expanding this integration with other channels across sectors in the coming months."45

Unibic's Media Mix

Unibic didn't advertise much in print media; TV remained the company's core focus and got the largest chunk of its advertising spend, followed by digital and OOH. Instead of following the traditional strategy of having a similar marketing campaign across markets, Unibic employed a unique strategy in each market, thereby playing to its strengths in each market while keeping in mind the market conditions and consumption patterns. Iyer said, "Our marketing varies region to region. On one hand, for a cosmopolitan city like Bangalore, it is a blend of TV, outdoor and digital because the consumption of media here is very different from other smaller areas. On the other hand, Tamil Nadu has a high consumption of TV content so it makes more sense to invest in it there rather than on digital and OOH. Similarly, in the Northeast, the local channels are big and so we invest there."46

The company believed that modernizing the brand would enable it to get customer attention. For that purpose, it decided that digital was the best platform as it was assured of a larger audience and engagement, especially for new product launches. Iyer said, "People are not going to do a digital search for the best type of cookie or biscuit, as opposed to purchasing a car. In the FMCG sector, you need to create affinity and trust with your consumers, which is possible through creating fun aspects around the brand. We started off with social media engagement to showcase our presence, and are now using product engagement platforms, other digital integrations during cricket matches, and social platforms..."47

As of 2019, it spent 10% of its budget on digital, of which half went to digital video. It used digital as a brand advertising medium and followed its audiences' preference for video content. Iyer added, "We are not a million-dollar company but we are growing. However, that means we have to do things in media in a smarter way. Considering this, we look into OTT platforms48 as well, where we have the opportunity to connect with the buyer that matches the mindset we are looking for. YouTube49 is like an ocean and a brand could get lost there. We do spend on Facebook50 though."51

The company also used social media for brand promotion. To promote its cookies and snack bars on Instagram52 and other social media, the company teamed up with influencers53. It partnered with leading Hindi film actor Shilpa Shetty Kundra - considered to be a fitness icon - to promote its digestive cookie offering on her YouTube channel.

Unibic's OOH options included hoarding, bus shelters, and transit media. The company believed that anything large or static in the right location or where the traffic was slow would most definitely capture people's attention. On the other hand, it thought that advertising on buses helped too as the buses were constantly moving without leaving a blind spot. Speaking about Unibic's OOH strategy, Iyer said, "Outdoor is a great medium to get people's attention, retain brand recall and prompt them to make a purchase decision. To garner eyeballs, you need to find where your consumers are most of the time, when and where they make the decision and their preferred purchase destination. Each brand has its own parameters. Being an FMCG brand, outdoor is best near residential, entertainment zones and shopping areas as that is when people buy your product most of the time. This is what we looked at as well - be it hoardings, median signages or buses."54

The Testing Economic Environment

From 2019 onward, Unibic started feeling the heat of the economic slowdown in India. The Indian economic slowdown of 2019 led to a serious and continuing decline in the country's real estate, automobile and construction sectors and in overall consumption demand. The second quarter (July-September) of the financial year (April 2019-March 2020) witnessed a drastic fall in the Gross Domestic Product (GDP) growth rate to 4.5%. The main reasons attributed to the fall in the GDP growth rate were - contraction in manufacturing activity, weakened investments, and lower consumption demand.55 Vudayagiri added, "It is an established fact that there is a slowdown in the market and some of the discretionary spends have come down. Volume and value growths of the overall biscuit industry has reduced."56

The company also claimed to be suffering the ill-effects of inflation because the prices of its raw materials had increased tremendously, thereby resulting in high manufacturing costs. Besides, there was a significant rise in packaging costs. Together, the increased costs made it difficult for the company to price-correct, thereby leading to margin pressure.

The company usually priced its products over 20, so as to position them as a planned purchase at modern retail57. In order to boost sales during the economic slump, the company decided to boost its impulse offering. Therefore, it doubled its offerings in the price range of 5 to 10. The company believed that this particular price range would have a larger distribution reach.

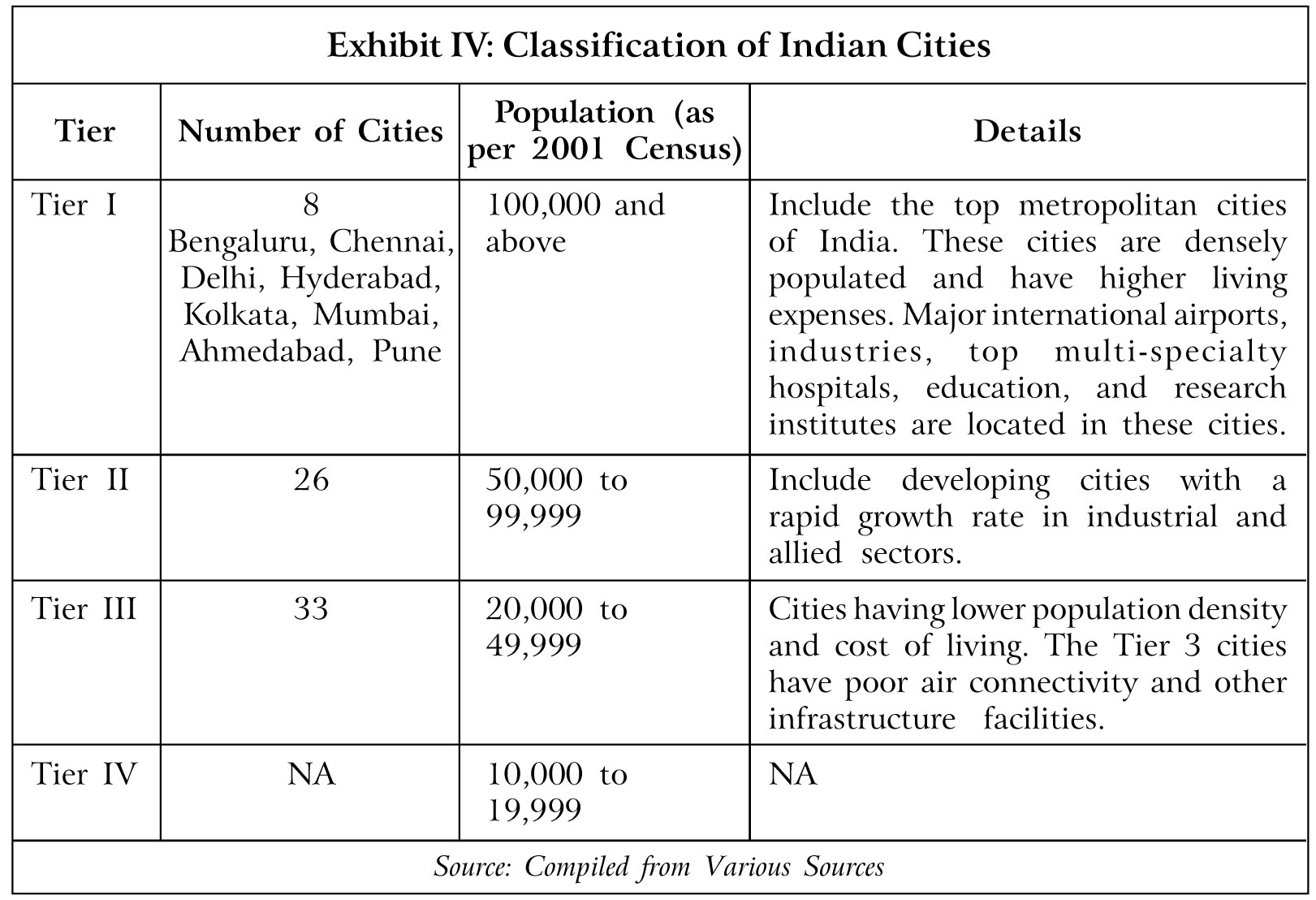

In January 2020, Unibic launched chocolate cookies in a new package format called 'ladi' or string package format, priced at 10 that could be carried by small retail stores. Vudayagiri added, "'Ladi' is a fantastic vehicle to get to markets that we couldn't reach earlier like Tier 3 and 4 towns for that audience without putting pressure on their pockets. Even within metros, we now reach small shops on the city's periphery."58 (See Exhibit IV for Information on Classification of Indian Cities)

From March 2020, the entire Indian economy was left reeling under the impact of the Covid-19 pandemic, due to which there were nationwide lockdowns, which impacted various businesses adversely. Unibic, however, continued its operations and kept its supply chains open. It proactively worked with distributors and logistics companies to ensure product distribution was done on time. It used technology to provide items to small stores, apart from working with tech B2B59 players. Vudayagiri added, "We worked with logistics tech companies to reach out to our ecosystem. Smaller truck owners were hit so we had to work with the larger companies to take our product to distributors and then to retailers. This helped us not lose sight on how to reach our end customer."60

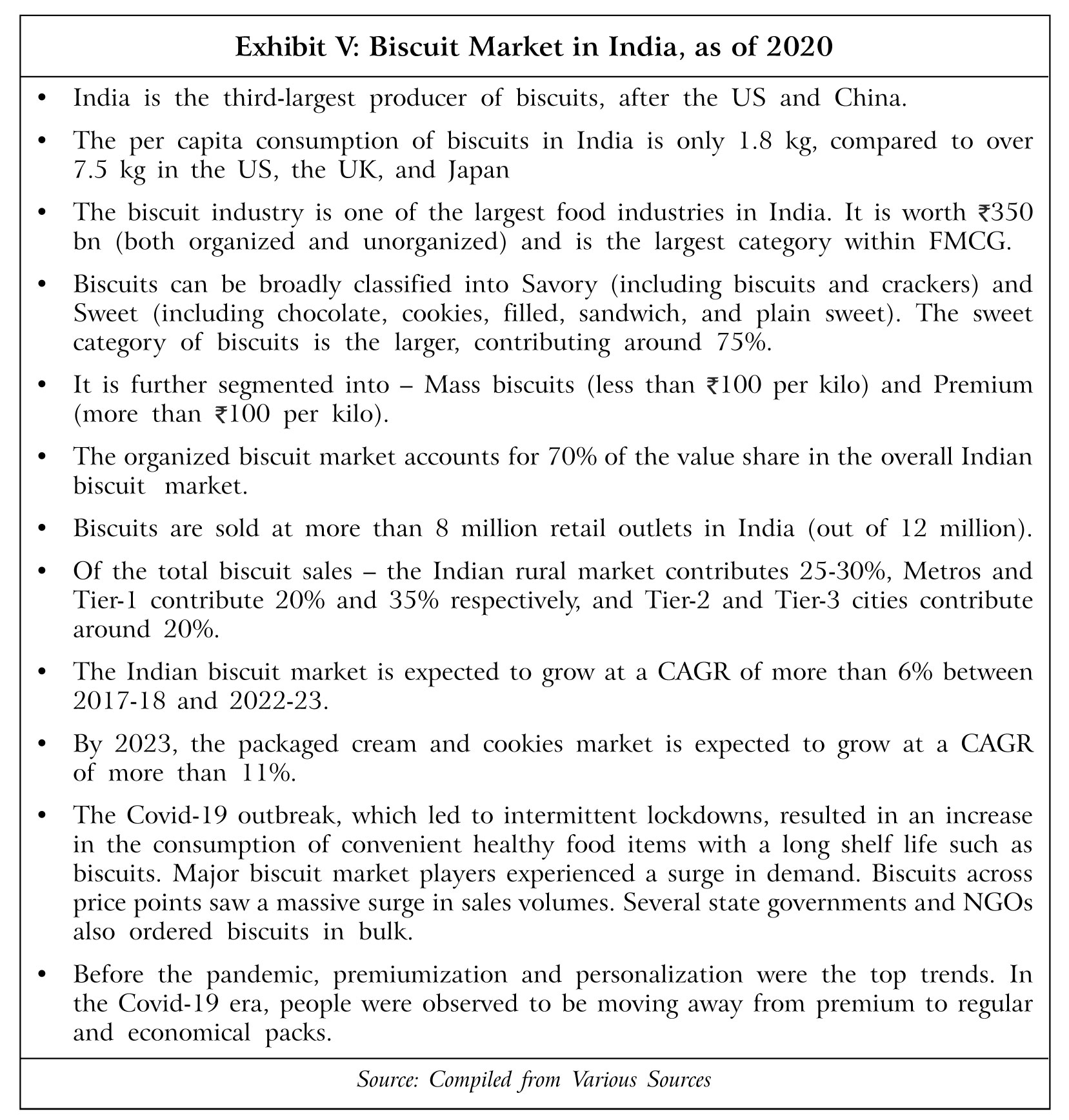

In the ensuing months, it was observed that the food industry was not adversely impacted during the Covid-19 crisis. During the lockdown, most snacks became unavailable to consumers, leading to biscuits becoming the preferred snacking choice of consumers. The organized biscuit market in India grew at double the rate of growth in April-May (12-15%) against pre-Covid-19 levels (7-8%) as people stocked up during the lockdown.61

Unibic also experienced an increase in demand and Vudayagiri attributed the surge in growth rate in April-May to pantry loading, as well as increase in in-home consumption (See Exhibit V for Information on the Indian Biscuit Industry). Speaking on the issue, Harish Bijoor, founder of private-label consulting firm, Harish Bijoor Consults, said, "Unibic is a niche segmented biscuit company. It is bound to do better than the mass market offerings. In many ways, this space is insulated for the moment as price and affordability elasticity is higher out here."62

The Road Ahead

As of 2020, Unibic had the largest wire cut cookie manufacturing plant in India. The plant had the capability to manufacture 100 tonnes of cookies each day, with five production lines. While it used 98% of its production capability to produce its own brand, the rest was used to manufacture for private label brands - six in India and 10 across the world. It had annual revenues of 5 bn.63 It also exported its products to more than 21 countries including across Australia, North America, the UK, and Europe, Asia, the Middle East, and New Zealand. It derived 45% of its earnings from the south of India.

Unibic believed that there was vast scope for growth in the Indian biscuit industry. Moreover, the Indian cookie per capita consumption was still far lower than in the European, American, and Far Eastern markets. The cookie segment constituted 25% of the Indian biscuit industry - the largest share in the biscuits market - and was closely followed by plain biscuits and cream biscuits. It was also the fastest growing segment - growing at twice the rate of the biscuit industry.64 The cookies segment was expected to grow with a CAGR of more than 11% during the period 2018-23. The Indian biscuit market was also observed to be moving toward the premium segment, as demand for low-priced biscuits had been declining even in rural markets. Anuj Sethi, Senior Director of rating agency, Crisil Ratings, said, "Premiumisation in biscuits needs to be seen in comparison with other categories within food - such as chips, chocolates and soft drinks; most of these are more expensive than biscuits. So consumers make these trade-offs in the overall food category - rather than within biscuits. That has led to rise in premium biscuits consumption."65

The biscuits market was 80% organized with Unibic facing severe competition from the top three market players in the biscuit segment dominated by Britannia, Parle Products Private Limited66, and ITC Foods67, all three with immense ability to spend. Speaking about the competition, Sen said, "When you are up against them, you need to decide on how to tackle them and at what level you should engage with them. If you try and get them head on, you are going to get hurt. We therefore decided to make sure that our products were relevant and would make consumers choose us and make us a part of their daily lives."68

Several other players had forayed into the cookie segment enticed by the space and the opportunity it offered. Unibic faced competition from localized players who dominated the regional markets. It was estimated that 3,500-4,000 smaller and loose biscuit firms operated in just one region or district of India. In addition, the cookie segment faced pressure due to the rising number of people preparing cookies at home or buying fresh cookies from specialty and in-store bakeries (bakeries in supermarkets).

Despite facing stiff competition, Unibic continued to remain the fastest-growing cookie brand in the country. Vudayagiri claimed that while the biscuit industry grew between 8 to 10% each year, Unibic had consistently seen 2.5 to 3 times the industry growth over the years.69

Vudayagiri stated that Unibic operated in a market segment that constituted just 35% of the biscuit market. This meant that it did not have an active presence in almost 55-58% of the market (See Exhibit VI for Unibic's Product Range). Crackers70 comprised another area which had huge scope and which Unibic was yet to tap to its full potential. The company intended to launch new products in that segment. Vudayagiri added, "We have been a non-cracker and a low-cream player in the market. So, crackers and creams are on our drawing board now. Products in this category may be introduced only after the next quarter (late 2020). They are not category extensions but will help us play a larger role within the biscuit market."71

The company believed that it was still largely a Tier 1 and 2 player in terms of product positioning and distribution reach. It was observed that the company had yet to crack the rural market. In the future, it intended to increase its focus on the rural market, which it thought had high growth potential. The rural markets were considered to be impulse markets, where biscuits replaced a quick meal, whether it was for nutritional purposes or for convenience.

The size of the premium category in which Unibic operated was between 16 and 17 bn in India, with an annual growth rate of 10%.72 In the post Covid-19 era, the company expected to experience multi-fold growth due to heightened health awareness among consumers, which prompted them to consume more products that they perceived as healthy and of high quality.

Unibic had a target of doubling its revenue to 10 bn by 2023, primarily by diversifying into newer categories such as crackers and through new product launches. Speaking about the company's future plans, Vudayagiri said, "Our CAGR will be about 15% and if we continue to grow at this rate, we can double our revenue in three years. We are thinking of capacity expansion too and will be setting up a factory in Hyderabad."73 The company intended to set up the new plant at an investment of around $12 mn. In March 2020, Vudayagiri said, "The new facility will be operational in the next 14-18 months, and have the capacity to produce 100 tonnes of cookies per day. Additionally, it will also have (production) lines for snack bars and crackers."74J

Suggested Readings and References

- Karan Chechi, "Impact of Covid-19 Pandemic Outbreak on Biscuits Industry," http://www.fnbnews.com, June 25, 2020.

- "Be More Available. Coexist Smarter," https://blog.bizom.in, April 24, 2020.

- Smita Balram, "Unibic Hires for Key Leadership Roles to Grow In 2020," https://economic times.indiatimes.com, March 4, 2020.

- "Unibic Biscuits in Expansion Mode, To Spend Rs 7.5 Crore In Ad Campaigns For 2006," www.exchange4media.com, August 8, 2019.

- "UNIBIC goes Paan India," http://marketingg-brains.blogspot.com, July 8, 2019.

- Steena Joy, "Cookies Constitute 25 Per Cent of the Total Biscuit Market: Unibic," www.foodhospitality.in, January 15, 2019.

- "Cookie Maker UNIBIC Eyes At Least 10% Share in Premium Market In 12-18 Months," www.newindianexpress.com, October 7, 2018.

- "Options Many and Varied with Attractive Price Points," www.fnbnews.com, August 6, 2018.

- "How Unibic's Cheerful Cookie Mascot 'UBU' Is Popularizing the Brand," https://brand equity.economictimes.indiatimes.com, March 22, 2018.

- "Top 5 Challenges Biscuit Manufacturers Will Face In 2018," www.techsciresearch.com, March 2018.

- Sangeetha Chengappa, "Unibic Foods Ramps up Production Capacity to 100 Tonnes a Day," www.thehindubusinessline.com, January 8, 2018.

- "Mascot 'Ubu' Vouches For Unibic Cookies," www.mxmindia.com, August 7, 2017.

- "Meet UBU - Unibic's New Mascot," www.adgully.com, July 31, 2017.

- Ankush Chibber, "Search on for an Asian partner for Unibic," www.foodnavigator-asia.com, March 15, 2017.

- "Delight in Every Bite," http://unibics.blogspot.com, October 9, 2016.

- "Integrated OOH Plan Is Critical," www.media4growth.com, January 15, 2014.

- "Unibic : You Deserve a Great Day," http://marstrategiesworld.blogspot.com, January 13, 2014.

- "How The Anzac Bikkie Was Saved - New Investors Bullish after Biscuit Maker Unibic Rescued from Administration," www.smartcompany.com.au, March 14, 2012.

- Ratna Bhushan and Sarah Jacob, "Unibic Sale Won't Impact India Operations: Nikhil Sen, Managing Director, Unibic Biscuits India," https://economictimes.indiatimes.com, March 6, 2012.

- Anjali Prayag, "Unibic Looks to Build Biscuit Brand in Niche Segments," www.thehindu businessline.com, August 9, 2011.

- "Lazard's Aussie Biscuit Firm Seeking Asian Partner," www.moneycontrol.com, June 14, 2011.

- "Marico Ends Talks to Buy Unibic Biscuits' India Arm; Stock Up," https://economictimes. indiatimes.com, May 11, 2011.

- Sarah Jacob, "Our biggest hurdle is brand salience: Nikhil Sen, MD, Unibic Biscuits India," https://economictimes.indiatimes.com, March 14, 2011.

- "Unibic Airs New Production Line," www.foodprocessing.com.au, December 6, 2010.

- Devina Joshi, "Unibic Cookies Press Ad in Trouble Following Court Order," www.afaqs. com, December 19, 2007.

- Boby Kurian and Sushmita Mohapatra, "Lighthouse Picks Up 20% Stake In Unibic," https://economictimes.indiatimes.com, April 27, 2007.

- Boby Kurian, "Britannia Old-Hand to Help Steer Australian Cookie Major's Ops Here," https://economictimes.indiatimes.com, December 18, 2006.

- Nandita Vijay, "UNIBIC, Australia's Finest Cookies, Come to India," www.fnbnews.com, April 1, 2005.

- https://biscuitfederation.com

- www.indianretailer.com

- www.magazinebbm.com

- http://www.ibmabiscuits.org