Nov '17

The IUP Journal of Marketing Management

Archives

Reducing Perceived Risk in Purchase of Uncertified Used Cars: Contributory Factors

Vivek Mishra

Assistant Professor (Marketing),

Department of Business Management,

C.V. Raman Group of Institutions,

Bhubaneswar, Odisha, India.

E-mail: viv.mishra82@gmail.com

Biswajit Das

Professor (Marketing),

KIIT School of Management,

Bhubaneswar, Odisha, India.

E-mail: biswajit@ksom.ac.in

A growing middle class, an upsurge in disposable income levels and satisfactory availability of financing options have contributed to the enormous demand for used cars in India. However, the used car market in India is highly unorganized, operating with a large number of uncertified used car dealers, which leads to a high level of perceived risk among prospects. It is an arduous task for a prospect to transmute into a customer unless he/she feels that the risk perception is low. This study tries to ascertain the various factors that are instrumental in facilitating the reduction of perceived risk while purchasing uncertified used cars. Adopting convenience sampling, data was collected from a sample of 419 respondents, using a self-administered questionnaire. The responses were analyzed using SPSS package 20.0, by adopting Principal Component Analysis, followed by Regression Analysis. The results portrayed prominent factors impacting risk perception. A significant correlation between the same and predictor variables was also revealed.

Introduction

Given the fierce competitive scenario in the market, understanding the needs and wants of the consumer has become the prime focus of existing firms. Marketers have recognized that attaining the full profit potential from each consumer is the key to outperform competition. Subsequently, developing a successful relationship with consumer is also vital which requires: consumer value creation, ensuring consumer satisfaction and creating a framework that safeguards customer retention. The concept of consumer behavior deals with the manner in which individuals or groups select, purchase, use, or dispose of products, services, ideas or experiences to satisfy needs and desires. Persistent buying decisions are made by consumers relating to what products/services to buy and where to buy from; hence, it is crucial for organizations and marketers to understand these decisions in order to develop effective marketing strategies. Consumers have an amount of persistent perceptions that are particularly catalytic in the process of consumer decision making.

As the aftermaths of such purchase decisions are uncertain, consumers face a lot of anxiety regarding the buying decision, which is otherwise known as perceived risk. This highlights the fact that uncertainty and outcomes are the two most vital and relevant aspects of perceived risk.

The extent of risk that consumers perceive and their forbearance for risk-taking are the factors that impact their purchase strategies. It should be kept in mind that consumers are prejudiced by the risks they perceive, no matter such risks actually exist or not. Risk that is not perceived, whether it is real or dangerous, will not have a bearing on the purchase decision of the consumer. The amount of perceived risk varies from one individual to another and depends on different aspects like product category, the shopping situation, level of consumers' involvement, familiarity and perceived benefits. According to Schiffman and Kanuk (2007), high risk perceivers can be termed as ŌĆśnarrow categorizersŌĆÖ and low risk perceivers can be labeled as ŌĆśbroad categorizersŌĆÖ. Narrow categorizers are individuals who restrict their choice of products to lesser and safer alternatives by eliminating good alternatives rather than chance upon a meager selection. On the other hand, broad categorizers make their product selection based on a much varied range of alternatives.

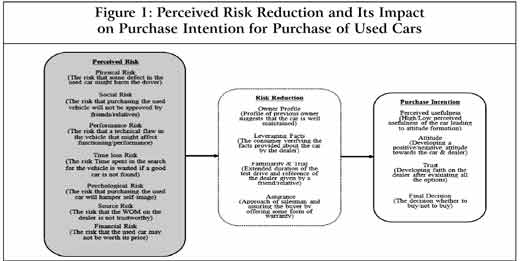

Schiffman and Kanuk (2007) have also identified six generic risk categories. The first type of risk is known as ŌĆśfunctional riskŌĆÖ, which revolves around the risk that the product will not perform as expected. It is followed by ŌĆśphysical riskŌĆÖŌĆöthe risk the product may pose to the individual and others. Also discussed is the concept of ŌĆśfinancial riskŌĆÖ, which is the risk that the product will not be worth its price. They also throw light upon ŌĆśsocial riskŌĆÖ, stressing that a poor choice of a product might lead to social embarrassment. ŌĆśPsychological riskŌĆÖ is the risk that a poor product selection might hurt the buyerŌĆÖs ego. Finally, the risk that the amount of time spent in searching for the product might go waste if the product performance does not match the expectations of the consumer is referred to as ŌĆśtime riskŌĆÖ. The illustration has been provided in Figure 1.

In order to reduce perceived risk, consumers devise their own strategies which enhance their confidence levels while making product choices in spite of the uncertain consequences. Consumers often engage in information search regarding the different product alternatives when they link a high degree of risk with the purchase of the product. They often relate product quality with price and as a result, the consumers end up buying the most expensive model of the product in order to reduce risk. Another strategy to handle risk is to remain brand loyal and avoid experimenting new brands. Sometimes, consumers also bank on store image when they have insufficient information about a particular product as they believe this involves lesser amount of risk. Individuals who are ambiguous about the sense of a product choice pursue reassurance through money back guarantees, warranties and trials before purchase.

A pre-owned/second hand car/used car is a vehicle that has previously had one or more owners. In an organized market, they are sold through company franchise (certified used car); and in an unorganized market they are sold via independent car dealers (uncertified used car), auctions, etc. The used car market in India is still budding, with immense scope for growth. According to the report by Indian Blue Book (2016), the used car market in India has an overall sale of around 3.3 million units annually and it is growing at a rate of 15%. Approximately, 30,000 dealers are involved in the pre-owned car sales and almost half (50%) of the sales are owed to metro cities.

The report also reveals that the north of India accounts for nearly 36% of the total sales, followed by the west zone at 27%, southern India at 26% and 11% by the east zone. In India, a dealersŌĆÖ license is not necessary to retail used cars as compared to China and the US. The unorganized/uncertified sector accounts for around 58% of the dealer population, whereas the Customer-to-Customer (C2C) segment stands at 34% of market share, trailed at a meager 12% by the organized/certified sector. The report highlights that the unorganized sector also dominates the ancillary services like paper transfer, finance and insurance. It also points out a very important aspect of used car purchase that Indian consumers who browse online always prefer to buy offline. Affordability and value for money are major reasons for used car purchase and statistics reveal that 55% of the pre-owned car is the first in the family and more than 50% of the buyers belong to the age group of 25-34 years. According to Prasad (2016), the buyer always looks for a trusted source and quality to complete his/her used car purchase. Conversely, the scenario in India is catchy as the trust factor between the buyer and the seller is alarmingly low, leading to declining levels of consumer protection. As a result, the consumer is highly chaotic and anxious when it comes to buying a used car, especially from an uncertified dealer, attributing to a high level of perceived risk.

Relating to the critical state of mind of the consumer, this study attempts to identify the detailed factors and relevant aspects that aid in impacting as well as reducing the levels of perceived risk in case of an uncertified used car purchase. It also aims at assisting the consumers to reach a final purchase decision and aid the dealer to bridge the trust-gap with the consumer.

Literature Review

Perceived Risk

During the process of buying, individuals come across various kinds of risks, some of these risks can be perceived by them, some cannot be perceived, some of them can be extravagated, and some can be diminished. So the perceived risk may differ from the actual risk because the risk cannot impact the purchase decision without knowing it (Bauer, 1964). According to Hermann et al. (2007), self-confidence and self-esteem play a very vital role in the purchase decisions of the buyer and a lack of both can lead to high levels of perceived risk. Even though various models have been suggested to theorize the risk concepts, there is no conceptual definition that is universally accepted. Perceived risk is an influential and illustrative factor in consumer behavior, as individuals happen to be more motivated to avoid mistakes than to exploit purchasing benefits (Mitchell, 1999). As investigated by Ritchie (2007), trust plays a crucial role in reducing consumer perceived risk. Mayer et al. (1995) have defined perceived risk as a blend of relative benefits and negative outcomes. In the words of Cox (1967), perceived risk is a function of: the sum that would be lost if the outcomes of the action were unfavorable and the buyer's individual sense of certainty that the outcomes will be opposed.

Dimensions of Perceived Risk

Reviews of past studies reveal that researchers have discovered various dimensions of perceived risk. According to Jacoby and Kaplan (1972), perceived performance risk is the likelihood that the purchased product will not function properly or can be used for a very short duration. They have explained perceived social risk as the likelihood that the buying behavior of the individual will be disapproved by members of the society. The researchers were of the view that perceived psychological risk is the mental stress experienced by the individuals as a result of their purchase decision. As studied by Simpson and Lakner (1993), perceived physical risk is the risk that the product may be harmful to the buyerŌĆÖs health and not match his/her levels of expectation. Perceived time-loss risk as examined by Roselius (1971) is the probability that buyer might waste a lot of time searching for the desired product. Perceived source risk is the chance that the individuals might agonize, as the sources of business from where the product is purchased are not dependable (McCorkle, 1990).

Risk Reduction

As introspected by Srinivasan and Ratchford (1991), the aggregate of purchases and the overall positive buying experience decrease the total perceived risk while purchasing automobiles but the two variables may not necessarily have a positive correlation in the purchasing situation. Strategies for reducing the amount of perceived risk focus on reducing the aspect of uncertainty in risk instead of neglecting the opposing outcome that would surface. Generally, consumers are unable to alter unfavorable outcomes of product purchase, whereas they can modify the degree of uncertainty by buying established brands (Sheth and Venkatesan, 1968).

Levitt (1967) discovered that even though a high credibility company played a vital role in risk reduction both in high and low risk condition, credibility was more crucial in the high risk scenario. The study by Lutz and Reilly (1973) reveals that the consumer decided to buy a product when the performance was low and declined the purchase in the case of a higher amount of performance risk. In the research conducted by Perry and Hamm (1969) on the impact of social and financial risk on individuals, it was observed that personal influence had a substantial impact in case of a higher perceived risk associated with the buying decision. Kim and Prabhakar (2000) recommend that if the degree of trust surpasses the level of perceived risk, the consumer will perform the purchase action.

Purchase Intention

According to the Theory of Reasoned Action propounded by Fishbein and Ajzen (1975), intentions consist of two theoretically varied factors. The first forecaster of intention is the consumersŌĆÖ attitude towards the behavior, the second predictor of intention is a social component called subjective norm. They refer to the buyersŌĆÖ perception of conditional social pressures to perform the behavior in question. Purchase intention is a type of decision that examines the purpose to purchase a specific brand by the consumer (Shah et al., 2012).

According to Khraim (2011), the price of the product has a noteworthy influence on brand loyalty which consequentially impacts the purchase intention of consumers. Outcomes of the study by Hern├Īndez and K├╝ster (2012) imply that a consumerŌĆÖs attitude towards a product has a significant impact on their intention to buy. Specifically Wood and Scheer (1996) have efficaciously demonstrated that the intention to purchase is negatively motivated by the perceived risk associated with the purchase of a product. According to the research analysis by Spence et al. (1970), a highly positive previous shopping experience reduces the degree of the consumersŌĆÖ perceived risk and ultimately increases the probability of purchase. Perceived risk is a prime source of perceived uncertainty; it also has a powerful impact on the formation of the consumersŌĆÖ attitude toward purchasing and in turn governs the buyersŌĆÖ final intention to purchase or not to purchase (Yang et al., 2016). Another factor moderating purchase intention is product involvement; it is indicated by the research that high product involvement has a profound effect on purchase intention and often predicts buyer behavior (Clarke and Belk, 1979).

Used Cars and Buyer's Perception

In their research, Ealey and Lius (1996) suggested that an increase in the perceived value of a car would facilitate both the initial sale of the car as well as the resale value of the used car, thus making the car a better investment. The paper also suggested that perceived value can be enhanced by optimizing performance, quality and price. According to Ramachandran et al. (2008), traditional dealers selling non-certified used cars benefit when buyers acquire information related to transaction and alternatives. Hermann et al. (2007) focus on examining specific factors that affect fairness perceptions, including perception of prices and consumer susceptibility, in the context of car purchases in major used car dealerships. Key factors like quality assurances, warranty and after-sales service will aid in changing buyer perceptions and also bridge the gap between individual aspirations and affordability, helping consumers progressively overcome their previously unfavorable sentiment against ŌĆśsecond-handŌĆÖ cars (Koparkar, 2015). Generally, the consumer preferences and requirements in the new-car market are identical to the used-car buyer trends. Conversely, a used-car buyer is ready to experiment as he/she is not as brand conscious as compared to a new car buyer. Brands that are usually ignored but are available at attractive prices with all the bells and whistles get instant attention from buyers of used cars (Baggonkar, 2016). According to Goyal (2016), the growth in the used car segment is propelled by many factors. The span of ownership is starting to shorten, from 6-7 years earlier, it drifts at four years currently and this has facilitated the increase in the available pool of used vehicles. Improved car quality has led to elevated reliability and has also reformed the societal perception towards used cars.

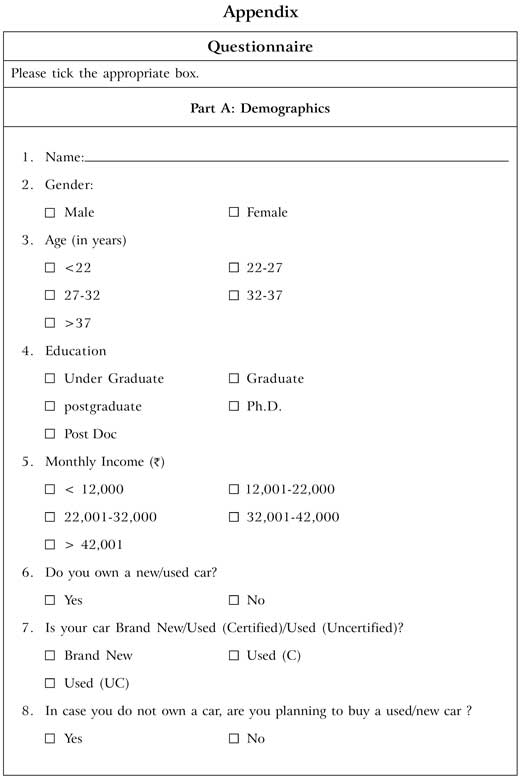

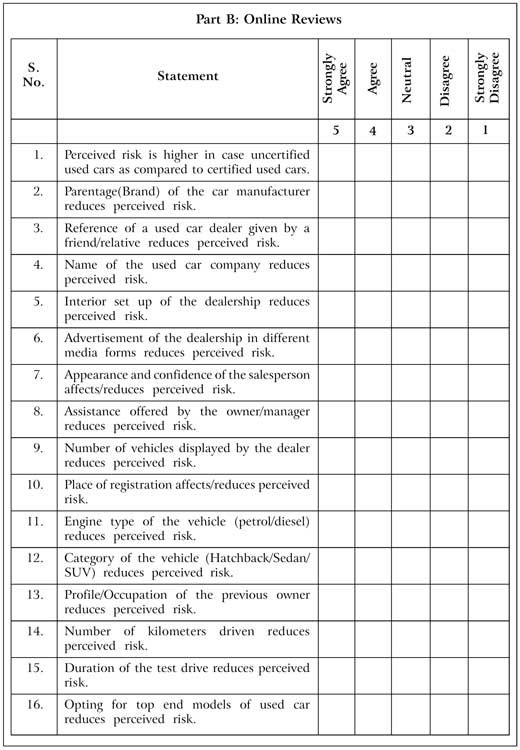

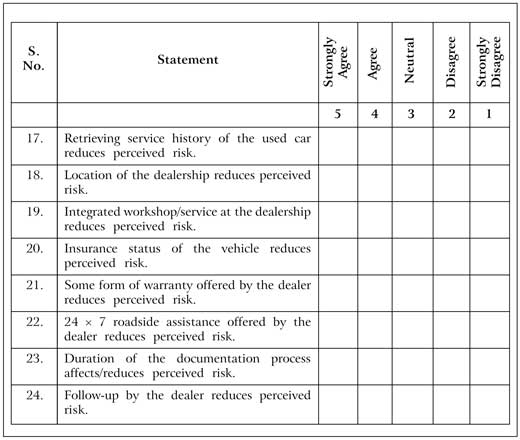

Data and Methodology

Quantitative research is fixated on objectivity. In this study, quantitative research was carried out by using a questionnaire survey comprising closed questions on a five-point Likert scale. The data was collected within a time span of six months, ranging from September 2016 to February 2017. Within the scope of the study, the respondents were asked to indicate the factors that spearhead the process of risk reduction on the five-point scale. It can be inferred that this type of study is swayed by positivism, which states that reality can only be understood based on the analysis of raw data, acquired with the help of standardized and neutral instruments. A convenience non-random sampling method was adopted for this paper, which decreases the possibility of generalization from drawn conclusions. For collecting data, a structured self-applied questionnaire was designed using Google Docs. The questionnaire was mailed to a sample totaling 432 respondents based out of different parts of the country; however, 13(3.009%) responses were rejected as the information was inconsistent, so the final sample size selected for the study was 419. The questionnaire comprised two sections; in part one, the demographic and personal information from interviewees was collected. In part two, statements were put forth relevant to the topic of study (perceived risk reduction), which were answered according to a five-level Likert scale, in which 1 means strongly disagree and 5 means strongly agree. Also included in part two are questions based on vehicle ownership status of the respondents, which is crucial to the topic of study. These questions are directed to determine whether the individual is well versed with the concept of pre-owned vehicles or not and if he/she plans to own or already owns a new/used car. The demographic profile of the 419 respondents is represented in Table 1.

As depicted in Table 1, the total sample size for the study was 419 individuals, out of which 354 (84.5%) were male and 65 (15.5%) were female. A majority of the respondents belonged to the age group of 32-37 years, which forms 39.1% of the total sample. As observed, a majority of respondents had completed their postgraduate degrees (N = 283, 67.5%). The number of individuals having a monthly income of more than 42,000 was 167 (39.9%), followed by 119 (28.4%) in the income slab of 32,001- 42000. The vehicle ownership status is also portrayed in the table; it illustrates that a large number of individuals already own a new/used car 45.6% (N = 191), 44% of respondents (N = 184) are planning to buy a used/new car and 10.4% (N = 44) of the surveyed sample currently do not own a used/new car and neither have plans of buying one. A brand new car is owned by 25.5% (N = 107), 29 people own an uncertified used car, whereas the percentage of individuals owning a certified used car is 13.1% (N = 55).

Results and Discussion

Factor Analysis

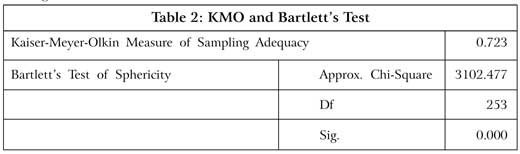

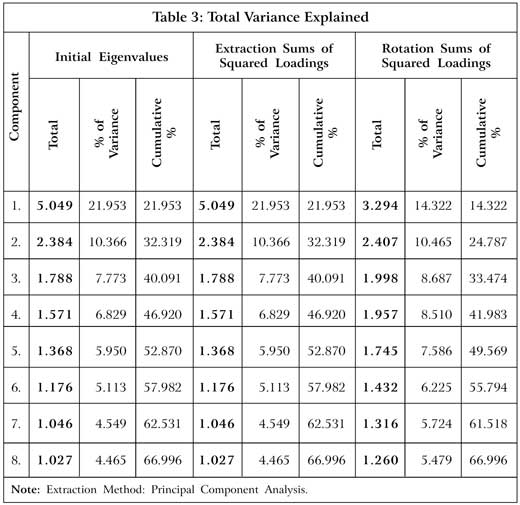

The data analysis was done using SPSS package 20.0. In the present study, the factor analysis is used to eliminate the redundant (highly correlated) variables from the data and to shrink the number of variables into definite number of dimensions or factors associated with perceived risk reduction. In order to determine whether the dataset was fit for factor analysis, Kaiser-Meyer-Olkin (KMO) and BartlettŌĆÖs test were conducted. The KMO test result was 0.723, which shows that factor analysis was applicable to the dataset. As the p value for BartlettŌĆÖs test was 0.00 or p< 0.05, the relationship between the variables was sufficient to conduct the factor analysis, the results are shown in Table 2. Responses were further treated with factor analysis using principal component analysis to spot the closely related variables. Out of a total of 23 variables, eight factors were extracted on rotation of the variables; they are shown in Table 3 with their respective factor loadings. The result of the factor analysis using principal component method depicts that 66.996% of the total variance is explained by classifying these 23 variables into eight factors.

In Table 3, components having eigenvalues below 1.0 have been removed and from the above analysis it is observed that the first factor component accounts for 21.953% of the variance, the second factor component accounts for 10.366%, the third factor component accounts for 7.773%, the fourth factor component accounts

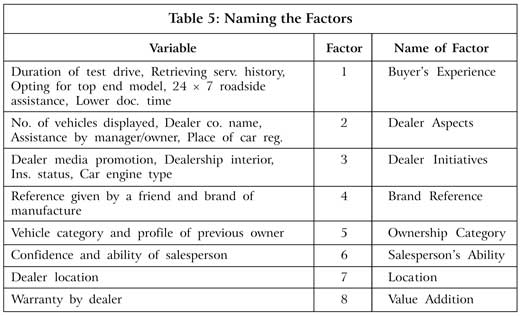

The above Table 5 depicts those eight factors which can be considered to represent the core. The factors have been named as the following: Factor 1 - BuyerŌĆÖs Experience, Factor 2 - Dealer Aspects, Factor 5 - Ownership Category and Factor 7 - SalespersonŌĆÖs Ability and Factor 8 - Value Addition, to name a few. These factors are considered to be highly pivotal in bridging the trust gap between the buyer and the used car dealer.

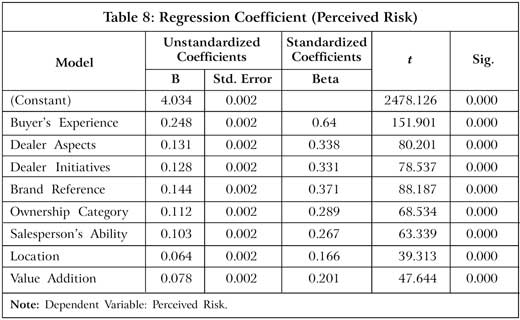

Regression Analysis

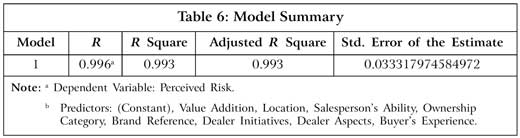

Further, regression analysis was used to test the significance of the factors. This model summary (Table 6) provides the R and R-square values. The R value is 0.996, which indicates a high degree of correlation. The R-square value is 0.993 which indicates that the dependent variable, "Perceived RiskŌĆØ, can be explained by the independent variables, i. e., "Buyer's Experience, Dealer Aspects, Dealer Initiatives, Brand Reference, Ownership Category, SalespersonŌĆÖs Ability, Location and Value Addition" by 99.3%, which is a very good indicator.

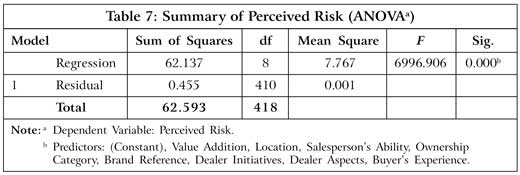

The F-test (ANOVA) Table 7 indicates that the regression model predicts the outcome variable significantly well. The significance of F-statistics is 0.000 (p< 0.05) which indicates that overall this model can statistically significantly predict the outcome variable.

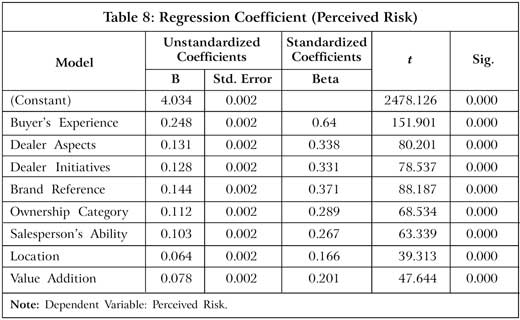

From the Regression coefficient (Table 8), we found that all the eight independent variables (BuyerŌĆÖs Experience, Dealer Aspects, Dealer Initiatives, Brand Reference, Ownership Category, SalespersonŌĆÖs Ability, Location and Value Addition) contribute significantly to the dependent variable i.e., Perceived Risk.

Conclusion

The consumer will encounter some form of risk during the entire process of product purchase. To a certain degree, the purchasing behavior is actually a risk reducing endeavor. In this context, the purchase decision is a phenomenon of acceptance of the product. Whereas substituting, postponing or canceling the purchase decision is a pointer towards the existence of perceived risk. Directorially, this paper provides marketers and dealers the significance of the consumers' risk perception and associated risk-reduction strategies in the purchase of uncertified used cars. Dealers must observe and understand the behavior of buyers and must find out which risk-reduction strategy is important to consumers in used car purchase to reduce their apprehensions more specifically. The findings indicate that the entire purchasing experience, encompassing extended duration of test drive, dealer initiatives/aspects, profile of the previous vehicle owner, some form of warranty offered by the dealer, etc. decrease consumersŌĆÖ perceived risk and increase their probability of buying a pre-owned car from an uncertified dealer. It has also been found that a trusted source of word-of-mouth reduces perceived source risk and an array of used cars displayed by the dealer diminishes perceived time-loss risk.

Positive word-of-mouth is often a result of high satisfaction level of existing users. Hence, apart from increasing new customer base, the dealer should also focus on the satisfaction level of previous buyers. This can be achieved by adopting a sound customer feedback mechanism. It is also extremely crucial for the dealer to establish some form of trust with the prospect and avoid exaggeration regarding the vehicle. For prospective buyers, the first point of contact at dealerships is the sales executives who play a pivotal role in reducing the perceived risk levels of the buyer. It is highly recommended that the sales and marketing executives at the dealer end should be well trained to handle all customer queries and not try to mislead them. The dealers should ensure that the information mentioned in their advertisements should match the actuals, and in spite of being a part of the unorganized sector, they can always ensure that the entire shopping experience is well organized.

Limitations and Scope for Future Research: There are certain limitations to the study. We are studying perceived risk as a factor affecting the consumers' decision making process in case of uncertified used car purchase; however, we do not discuss used car choice. The study does not emphasize on the different levels of the perceived risks among different categories of buyers, and we do not discuss how strongly perceived risk affects the consumersŌĆÖ decision making. Lastly, due to time constraints, resources and scope of our study, we did not carry out a study to prove the relationship between the influential factors and the perceived risk.

Future studies can concentrate on how an interaction between pre-purchase exposure and post-purchase experience influences consumer purchase decisions and perceived risk. Owing to the differences between pre and post-purchase information processing phases, this provides an incentive to explore more detailed changes in risk perception and reduction throughout the whole consumer decision process.

References

- Baggonkar S (2016), "Automobile Makers Stumped by Used-Car BoomŌĆØ, Business Standard. Retrieved on May 6, 2017 from http://www.businessstandard.com/article/companies/automobile-makers-stumped-by-used-car-boom-116032600725_1.html

- Bauer R A (1964), "Consumer Behavior as Risk Taking: Dynamic Marketing for a Changing WorldŌĆØ, pp. 389-398, American Marketing Association, Proceedings of the 43rd Conference of the American Marketing, Chicago.

- Clarke K and Belk R W (1979), "The Effects of Product Involvement and Task Definition on Anticipated Consumer EffortŌĆØ, Advances in Consumer Research, Vol. 6, pp. 313-318.

- Cox D F (1967), "Risk Handling in Consumer Behavior: An Intensive Study of Two CasesŌĆØ, in D F Cox (Ed.), Risk-Taking and Information-Handling in Consumer Behavior, pp. 34-81, Harvard University Press, Boston.

- Ealey L A and Luis T B (1996), "The Automotive Industry: A 30,000-Mile CheckupŌĆØ, The McKinsey Quarterly, No. 1, pp. 72-79.

- Fishbein M and Ajzen I (1975), Belief, Attitude, Intention, and Behaviour: An Introduction to Theory and Research, Addison-Wesley, Reading, MA.

- Goyal M (2016), "Used Car Market Witnesses Steady Growth as New Car Sales Hit a Speed BumpŌĆØ, The Economic Times. Retrieved on May 1, 2017 from http://economictimes.indiatimes.com/articleshow 54382047.cms?utm_source= contentofinterest &utm_medium= text &utm_campaign = cppst

- Hermann A, Xia L, Monroe K B and Huber F (2007), "The Influence of Price Fairness on Customer Satisfaction: An Empirical Test in the Context of Automobile PurchasesŌĆØ, Journal of Product & Brand Management, Vol. 16, No. 1, pp. 49-58.

- Hern├Īndez A and K├╝ster I (2012), "Brand Impact on Purchasing Intention: An Approach in Virtual Social Networks ChannelsŌĆØ, Economics and Business Letters, Vol. 1, No. 2, pp. 1-9.

- Indian Blue Book (2016), "India Pre-Owned Car Market ReportŌĆØ, 1. Retrieved on April 2, 2017 from http://www.indianbluebook.com/storage/app/Insights/India-Pre-Owned-Car-Market-Report-2016.pdf

- Jacoby J and Kaplan L B (1972), "The Components of Perceived RiskŌĆØ, Advances in Consumer Research, Vol. 1, pp. 382-392, M Venkatesan (Ed.), Association for Consumer Research, Urbana, IL.

- Khraim H S (2011), "The Influence of Brand Loyalty on Cosmetics Buying Behavior of UAE Female ConsumersŌĆØ, International Journal of Marketing Studies, Vol. 3, No. 2, pp. 123-133.

- Kim K and Prabhakar B (2000), "Initial Trust, Perceived Risk, and the Adoption of Internet BankingŌĆØ, Proceedings of the 21st International Conference on Information Systems, pp. 537-543.

- Koparkar P (2015), "Seeking Gold in Old CarsŌĆØ, The Economic Times. Retrieved on May 1, 2017 from http:// auto.economictimes.indiatimes.com /autologue /seeking-gold-in-old-cars /439

- Levitt T (1967), "Persuasibility of Purchasing Agents and Chemists: Effects of Source, Presentation, Risk, Audience Competence, and TimeŌĆØ, pp. 541-558, in D F Cox (Ed.), Risk-Taking and Information-Handling in Consumer Behavior, Harvard University Press, Boston.

- Lutz R J and Reilly P J (1973), "An Exploration of the Effects of Perceived Social and Performance Risk on Consumer Information AcquisitionŌĆØ, in S Ward and P Wright (Eds.), Advances in Consumer Research, Vol. 1, pp. 393-405, Proceedings of the Fourth Annual Convention of the Association for Consumer Research.

- Mayer R C, Davis J H and Schoorman F D (1995), "An Integrative Model of Organizational TrustŌĆØ, Acad. Manage. Rev., Vol. 20, No. 3, pp. 709-734.

- McCorkle D E (1990), "The Role of Perceived Risk in Mail Order Catalog ShoppingŌĆØ, J. Direct Market., Vol. 4, pp. 26-35.

- Mitchell V (1999), "Consumer Perceived Risk: Conceptualizations and ModelsŌĆØ, European Journal of Marketing, Vol. 33, Nos. 1/2, pp. 163-195.

- Perry M and Hamm B C (1969), "Canonical Analysis of Relations Between Socioeconomic Risk and Personal Influence in Purchase DecisionsŌĆØ, Journal of Marketing Research, Vol. 6, pp. 351-354.

- Prasad K (2016), "Seeking Gold in Old CarsŌĆØ, The Economic Times. Retrieved on May 5, 2017 from http:// auto.economictimes .indiatimes.com /autologue/ seeking-gold -in-old- cars/439

- Ramachandran V, Viswanathan S and Gosain S (2008), "The Impact of Online Information on the Purchase of Certified Used CarsŌĆØ, Advances in Consumer Research, Vol. 35, p. 743.

- Ritchie C (2007), "Beyond Drinking: The Role of Wine in the Life of the UK ConsumerŌĆØ, International Journal of Consumer Studies, Vol. 31, No. 5, pp. 534-540.

- Roselius T (1971), "Consumer Rankings of Risk Reduction MethodsŌĆØ, J. Market., Vol. 35, pp. 56-61.

- Schiffman L G and Kanuk L L (2007), "Perceived RiskŌĆØ, in Consumer Behavior, Vol. 9, pp. 187-188, Prentice-Hall of India, Delhi, India.

- Shah H, Aziz A, Jaffari A R et al. (2012), "The Impact of Brands on Consumer Purchase IntentionsŌĆØ, Asian Journal of Business Management, Vol. 4, No. 2, pp. 105-110.

- Sheth J N and Venkatesan M (1968), "Risk-Reduction Process in Repetitive Consumer BehaviorŌĆØ, Journal of Marketing Research, Vol. 5, No. 3, pp. 307-310.

- Simpson L and Lakner H B (1993), "Perceived Risk and Mail Order Shopping for ApparelŌĆØ, Journal of Consumer Studies Home Economy, Vol. 17, pp. 377-398.

- Spence H F, Engel J F and Blackwell R D (1970), "Perceived Risk in Mail-Order and Retail Store BuyingŌĆØ, Journal of Marketing Research, Vol. 7, No. 3, pp. 364-369.

- Srinivasan N and Ratchford B T (1991), "An Empirical Test Model of External Search for AutomobilesŌĆØ, Journal of Consumer Research, Vol. 18, No. 2, pp. 233-242.

- Wood C M and Scheer L K (1996), "Incorporating Perceived Risk into Models of Consumer Deal Assessment and Purchase IntentŌĆØ, Advances in Consumer Research, Vol. 23, pp. 399-406.

- Yang J, Sarathy R and Lee J (2016). "The Effect of Product Review Balance and Volume on Online ShoppersŌĆÖ Risk Perception and Purchase IntentionŌĆØ, Decision Support Systems, Vol. 89, pp. 66-76.