June'21

The IUP Journal of Entrepreneurship Development

Archives

Case Study

VG Siddhartha of Cafe Coffee Day: A 'Failed'

Entrepreneur?

Nagendra Kumar M V

Senior Research Associate, Case Research Center, IBS Hyderabad (Under IFHE - A Deemed to be University

u/s 3 of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: nagendra.ncr@icmrindia.org

The case study is about the entrepreneurial journey of VG Siddhartha (VGS), Chairman and Managing Director, Coffee Day Enterprises Limited (CDEL). The case study describes the various dimensions of VGS as an entrepreneur, the causes of the 'self-doubt' in his entrepreneurial journey, the role of financial management and diversification strategy in his entrepreneurial development, and his dramatic fall. VGS was acknowledged as the Coffee King of India. He was responsible for creating India's popular coffee hangout place called Cafe Coffee Day (CCD). CCD gained immense popularity among the young and urban population. VGS was also acknowledged for the strategic investment decisions he took as an investment banker and as an investment analyst. VGS was enthusiastic and energetic, and was considered a visionary entrepreneur in India. His suicide in July, 2019 brought his entrepreneurial journey to an abrupt end and left the entire business world and the entrepreneurial ecosystem in India in a state of shock. In a note, VGS stated pressure from income tax department and private equity investors as a cause of his death. The incident raised several questions with respect to the challenges being faced by entrepreneurs in India.

If you are chasing your dream to make money alone, don't be an entrepreneur ... Chase your dream, and money will be on your way ... use it for the right causes ... Entrepreneurship is like an ultra-marathon ... there will be ups and downs ... Gains and losses ... It's a journey, gives a lot of personal satisfaction than earning and saving billions of dollars ... it cannot be without risk ... don't let yourself go down ... believe yourself ...

- V G Siddhartha, Chairman and Managing Director, Coffee Day Enterprises Limited

(CDEL) at eSummit'16, IIT Kanpur, India1

I would like to say I gave it my all. I am sorry to let down all the people that put their trust in me. I fought for a long time but today, I gave up as I could not take any more pressure from one of the private equity partners forcing me to buy back shares, a transaction I had partially completed six months ago by borrowing a large sum of money from a friend.

- Excerpts from the letter written by V G Siddhartha to Board of Directors

of CDEL and CDEL Family on July 27, 20192

Introduction

On July 29, 2019, family members, employees, friends, and well-wishers of V G Siddhartha

(VGS), Chairman and Managing Director of Coffee Day Enterprises Limited (CDEL), were

shocked to hear the disappearance of their beloved VGS. He had last been seen by his driver

near the Netravati River (Netravati).3 Massive search operations went on for two days in the

heavily flooded Netravati. Speculation abounded on the coffee baron's whereabouts. On

August 1, 2019, a body was found washed up on the banks of the river. It was identified as

that of VGS.

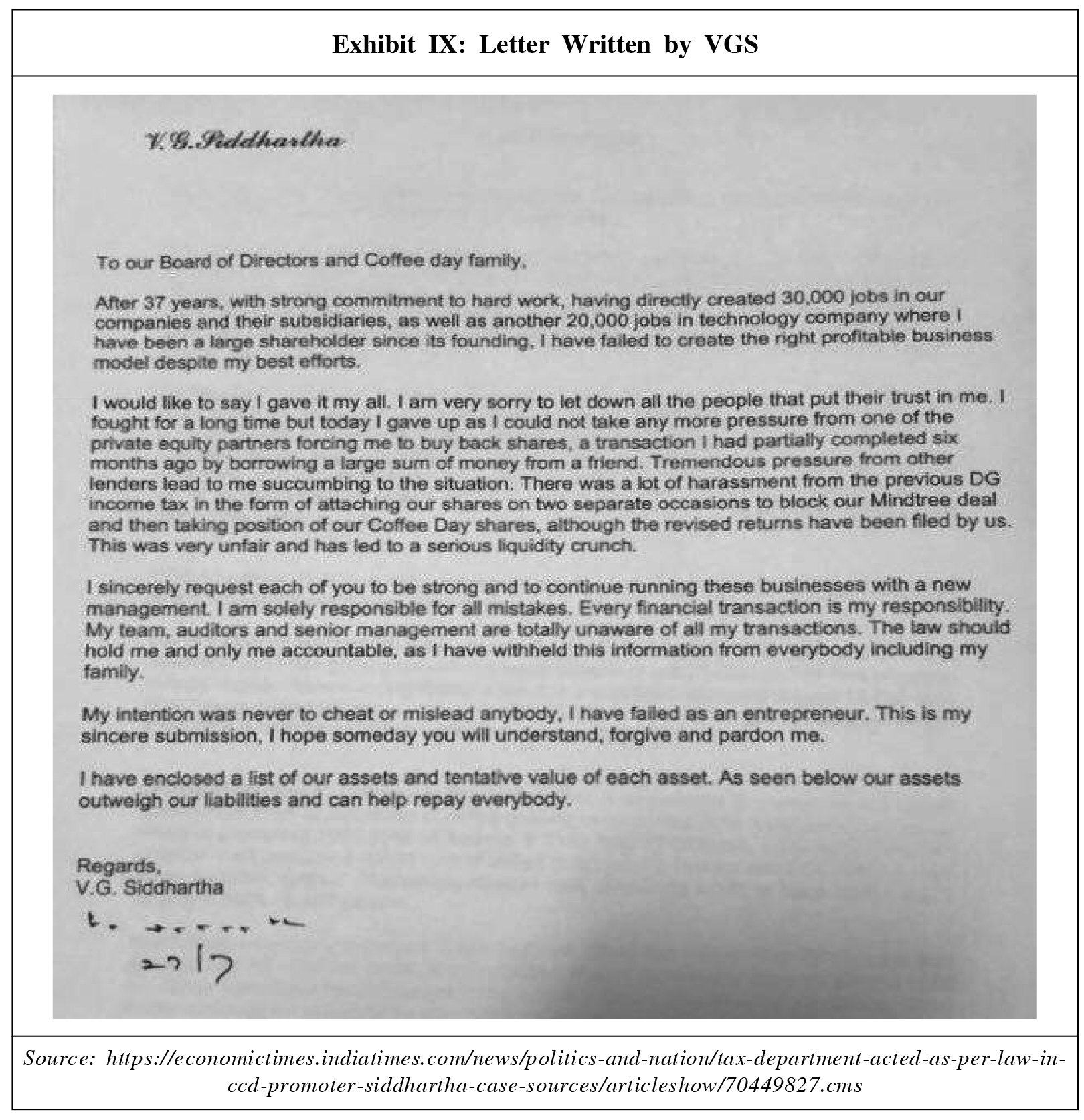

After his disappearance, a letter purportedly written by VGS was found in his house. In

the letter, VGS mentioned that he had failed as an entrepreneur. "...I have failed to create the

right profitable business model despite my best efforts. I would like to say I gave it my all.

I am very sorry to let down all the people that put their trust in me", he wrote in the letter.4

He added that he was under pressure from the Income Tax Department (IT department),

Government of India (GoI), and from some private equity investors. He also mentioned that

he alone was responsible for the financial condition prevailing at CDEL, and its holding

companies. He claimed that no one could be held responsible for the financial dealings he

had done without the knowledge of the board members and other stakeholders.

CDEL and various other companies promoted by VGS had been struggling with mounting

debts since 2015. The mounting debts and thinner margins forced VGS to go in for an IPO

in the year 2015. VGS put in considerable effort to come out of the mounting debt burden

but to no avail.

VGS had been named 'Entrepreneur of the Year' in 2002-03 by The Economic Times, a

leading financial daily in India. In the year 2015, Forbes estimated his net worth at $1.2 bn

( 82,000 mn). His alleged suicide shattered the confidence of the corporate world and that

of many young and emerging entrepreneurs, and also raised questions over the prevailing

economic and political scenario in the country.

Early Days of VGS

VGS was born in the year 1959 in the Chikmagalur district of Karnataka (India) in a

well-off business family that had been in the coffee growing business since 1870. VGS had a happy childhood; he studied in a boarding school but was always delighted to come back

home for the holidays to the sumptuous homemade food cooked by his mother. He also

enjoyed playing cricket with his friends.

VGS was inspired by the writings of Karl Marx.5 At the age of 18, he developed a deep

desire to serve the country (he was also in the National Cadet Corps). He appeared for the

National Defence Academy (NDA) examination,6 but failed to clear the exam. This turned out

to be a life-long regret for him. However, he set his disappointment aside and found

inspiration in the true stories of rich people around Chikmagalur region helping the poor and

the needy during the colonial era.

Early Career: Stock Trading

By the time Siddhartha completed his graduation in the year 1983, he had developed an

interest in stock trading. Later, he wanted to start his own business in stock trading. VGS

convinced his father and went to Bombay (now Mumbai) in 1983 to start a career in stock

trading.

VGS was inspired by Mahendra Kampani (Kampani), a senior stock trader and also a

partner in India's oldest stock trading firm Jamnadas Morarjee and Co. Kampani had also

worked in various capacities in the Bombay Stock Exchange (BSE) since 1982. He was a

sitting member of the governing board and vice president and also served as president for one

term (1987-88).7 He was one of the pioneers in introducing stock market reforms.

VGS worked with Kampani for two years and understood the nuances of stock market

trading. In 1985, he decided to quit the job and start his own stock trading business in

Bangalore (now Bengaluru). He came back to Chikmagalur and asked his father to lend him

the initial capital to start his own venture. Though VGS's father was not too happy with his

son's decision to start a new business, he gave him 0.75 mn and told him that he could come

back to him any time for any kind of support.

VGS decided to have a back-up plan in case his venture did not succeed. He purchased

a piece of land worth 0.50 mn, and also set for himself a time limit of two years to test his

idea of running a stock trading business.

With the remaining amount (i.e., 0.25 mn), VGS rented a room for his office ( 0.05 mn)

and acquired the needed infrastructure at a cost of 0.115 mn (office furniture and computers)

and a telephone connection at a cost of 0.035 mn to start a stock trading firm Sivan Securities

in the year 1985. He was left with only 0.05 mn to invest in stocks.

VGS was successful in the stock trading business and his systematic investment strategies

earned him millions of rupees. VGS attributed the success of Sivan Securities not to his own

knowledge or skill, but to the dynamics of the stock market conditions prevailing during the

mid-80s. There were quick gains and quick losses, but there was never a dull day in stock

trading, he said. In the early 1990s, VGS invested in 60,000 Infosys shares as an underwriter

for its public issue. But within six months of buying the stock, he sold it at six times the offer

price, thus making a handsome sum of money.

The Journey from Coffee Trading to Cafe Coffee Day

Along with the stock trading business, VGS started showing a keen interest in coffee

plantations. He had inherited 300 acres of coffee plantations from his father and forefathers.

He also started purchasing coffee plantations in 1985.

In the year 1991-92, VGS took the initiative to meet the then Indian Finance Minister,

Dr. Manmohan Singh (Dr. Singh), along with the Coffee Growers delegation to request him

to liberalize the export business of coffee trading. Dr. Singh was convinced with the request

of the team lead by VGS. "He was young, determined, sharp and also an influential man. He

knew what potential coffee had," said Bopanna, Member of the Coffee Growers Delegation

led by VGS.8 The GoI liberalized the export norms for coffee in 1992. This provided VGS a

great business opportunity as he had already started purchasing coffee plantations in 1985.

By the time the norms were liberalized, he had more than 3,000 acres of coffee plantation in

his possession. This gave him enough opportunity to penetrate the coffee trading business

quickly and easily.

In 1993, the coffee trading business, Amalgamated Bean Coffee Trading Company Limited

(ABCTCL), was born. In addition to exporting the coffee grown in the plantations acquired

by VGS, ABCTCL also associated itself with small growers and started selling their produce

in the global markets. While the total produce from VGS's plantations was considered to be

3,000 tons, it increased to 20,000 after sourcing the produce from the other plantations.

Within two years, ABCTCL had become the largest exporter of coffee from India. Besides

trading in coffee (sale of coffee seeds), VGS also entered into the coffee processing business.

He acquired some sick coffee processing units and also started new coffee processing units.

By the year 2019, VGS owned more than 12,000 acres (4,047 ha) of coffee plantation.9

Cafe Coffee Day Is Born

The liberalization of trade policies and a change in the investment scenario in the country

in the early 1990s was expected to open the market to international players in India. Hence,

VGS turned his focus onto creating a brand for his coffee business rather than being in a

commodity business. In the year 1995, he met the representative of Tchibo, Germany's second

largest coffee trading company, which was one of ABCTCL's customers. After an informal discussion with him, VGS realized that creating a coffee brand may not take as much time

as he had earlier thought.

Though VGS wanted to sell branded coffee to retail customers, the demand for branded

coffee was not really encouraging in India. Preliminary research conducted by a team of

market researchers revealed that retail consumers were not interested in purchasing branded

coffee powder. "Are you sure you want to put up these shops? I met people who have been

in this business for 20-30 years and everyone said this business is so tough you won't be able

to sell even 5 kg of branded coffee through retail outlets. Don't waste your time and money,"10

said one of the analysts appointed by VGS. However, VGS believed strongly in launching a

branded retail coffee store and sought to sell at least 500 tons of coffee a year in India and

in the global markets. He assigned the job of identifying a brand name to his team. The team

came up with the name "Coffee Day". VGS liked the idea and named his brand "Coffee Day".

In 1994, VGS started his first retail coffee trading business under the brand name Coffee Day

in Bangalore.

With the growing trend of coffee consumption across the world, VGS believed that coffee

consumption in India too would pick up. He expected this to happen mostly in the urban areas

and thought it would provide him with the opportunity to enter the cafe business, catering

to the segment of the urban population. VGS planned to invest 15 mn in the cafe business.

But the market was not as encouraging as VGS thought it would be, mainly due to the fact

that Indians mostly consumed tea and consumption of coffee was mostly limited to the

southern part of the country. VGS wanted to sell a cup of branded coffee for 25. This was

way above the price of a cup of coffee in the local markets, which was 5. He did not receive

positive feedback from his research team and would have dropped the idea of starting a coffee

cafe but for an official trip to Singapore. During a casual walk along a marketplace prominent

for restaurants, he came across a store selling beer and providing Internet access free of cost.

He liked the idea of customers enjoying their beer while surfing the Internet and

socializing with others in a friendly ambience. This triggered the idea of launching a coffee

cafe where people could socialize while enjoying a cup of coffee. VGS believed that younger

generation in India would buy this concept, especially at a time when India was becoming

more integrated with the rest of the world due to the on-going wave of globalization. He went

ahead with testing his idea. He branded his cafe business Cafe Coffee Day (CCD). The first

outlet was started in July 1996 on Brigade Road in Bangalore. The concept immediately

gained wide acceptance among the urban population, especially the youth. This marked a new

beginning in the entrepreneurial journey of VGS.

Blue Oceans: Creating a New Market

By the year 2000, CCD had opened 1,700 cafes in different parts of the country and was

focusing primarily on creating an environment where people could leisurely spend time on

enjoying a cup of coffee. In the early days, CCD offered a cup of coffee at 100. This included an hour of browsing the Internet. The initial plan was to offer a cup of coffee for 25, but

this was later changed to a bundled offer which included a cup of coffee and Internet surfing

for 100. CCD primarily targeted young urban consumers. The growing IT sector boom in

Bangalore provided the impetus to the young urban crowd to throng CCD outlets for a cup

of coffee in their leisure time rather than go for a cup of coffee to the traditional Darshini and

Udupi restaurants (known for serving vegetarian food and a cup of hot filter coffee).

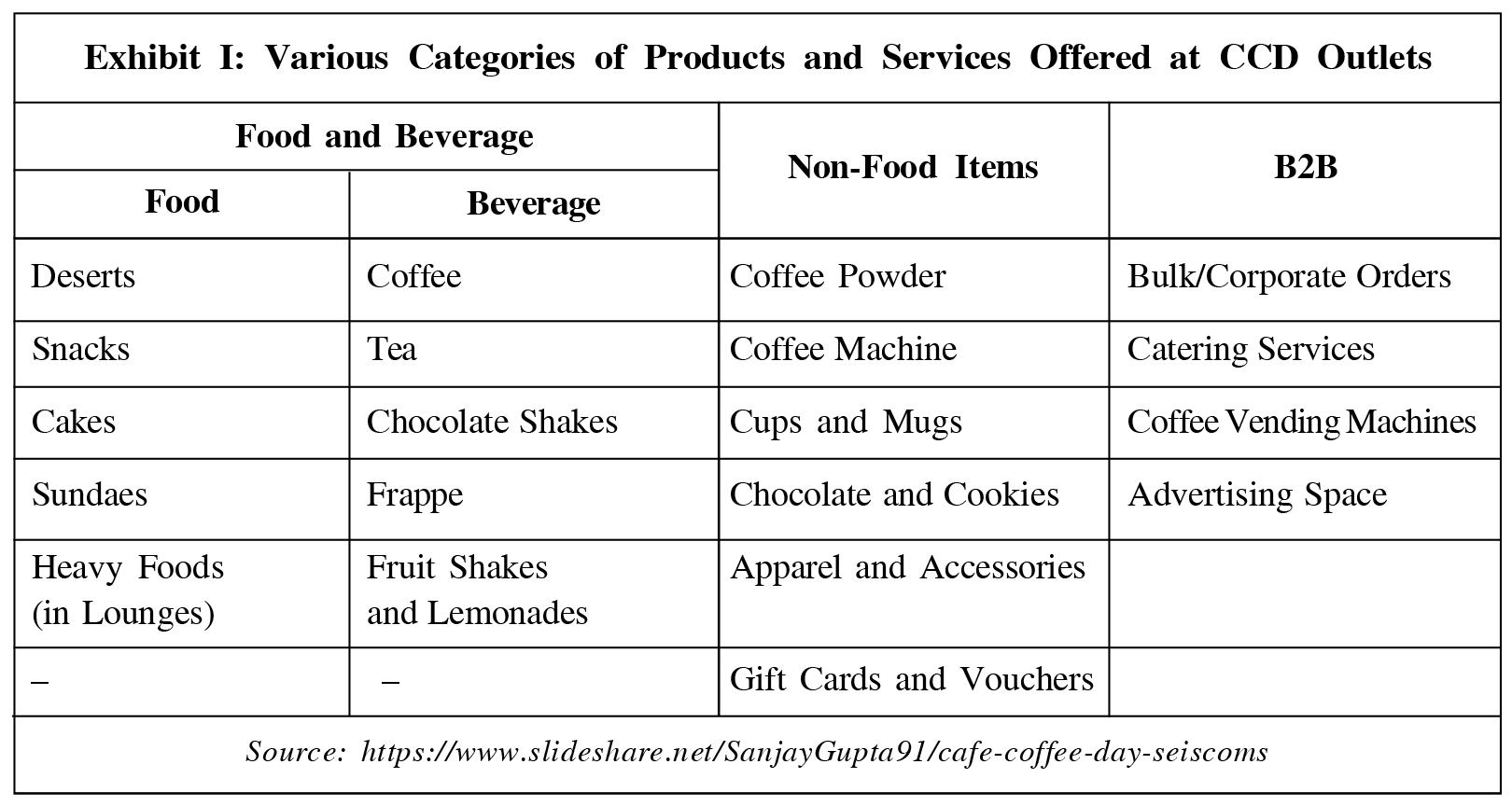

In addition to serving coffee, CCD introduced various other products and services

(see Exhibit I). Within a short span of time, CCDs became a hot spot for business meetings,

friends hanging out, and couples looking for a decent and convenient location to spend time

together. "CCD outlets have also been a favorite spot for many tech start-ups for a variety of

reasons, primarily because of their inability to rent office space" said Kumar Rangarajan,

Founder of Little Eye Labs.11

CCD introduced various formats like Cafes, Garden Cafes, Lounge Cafes, Xpress Cafes,

etc.12 It targeted different locations to attract more of the urban population; the outlets were

started in high level streets, malls, multiplexes, offices, educational institutions, railway

stations, etc. The level of disposal incomes in the hands of urban consumers was increasing

and this also raised the expectations of consumers for different types of services. CCD created

a unique in-store experience for the customers like having book cafes, movie cafes, sports

cafes, etc.

CCD also tied up with Bharat Petroleum Corporation Limited (BPCL) to launch its outlets

on their premises at select locations. It adopted different formats for educational institutions

and offices, providing them with the choice of either opting for detailed stores or for

economical stores based on the profile of the staff and students working or studying in the offices and institutions. CCD adopted a strategy of being accessible at different points in the

same location, with the outlets within a short distance of each other. It launched a store within

a range of 0.50 km to 1 km of another, thus ensuring that customers became more habituated

to its products and services.

All the CCD outlets were equipped with a coffee roasting unit that catered to the specific

requirements of the consumers. Also, they aimed to provide better quality coffee by adopting

innovative and up-to-date coffee making techniques delivered through trained professionals.

CCD not only created an experience through its coffee but also through its branded merchandise

like caps, T-shirts, bags, mugs, coffee filters, coffee powders, coffee mints and pens.

According to a study conducted in the early 2000s, around 37% of the CCD customers

were aged between 20 and 24 while 27% were aged between 25 and 29. Of the total number

of customers, 60% were male and 40% were female, while the majority of them-around

52%-were students. By 2019, CCD was operating 1,700 cafes, 48,000 vending machines,

532 kiosks, and 403 ground coffee selling outlets across India. All the coffee-related

businesses were promoted under Coffee Day Enterprises (CDE) and CCD was owned by Coffee

Day Global (CDG), a subsidiary of CDE.13

Competition

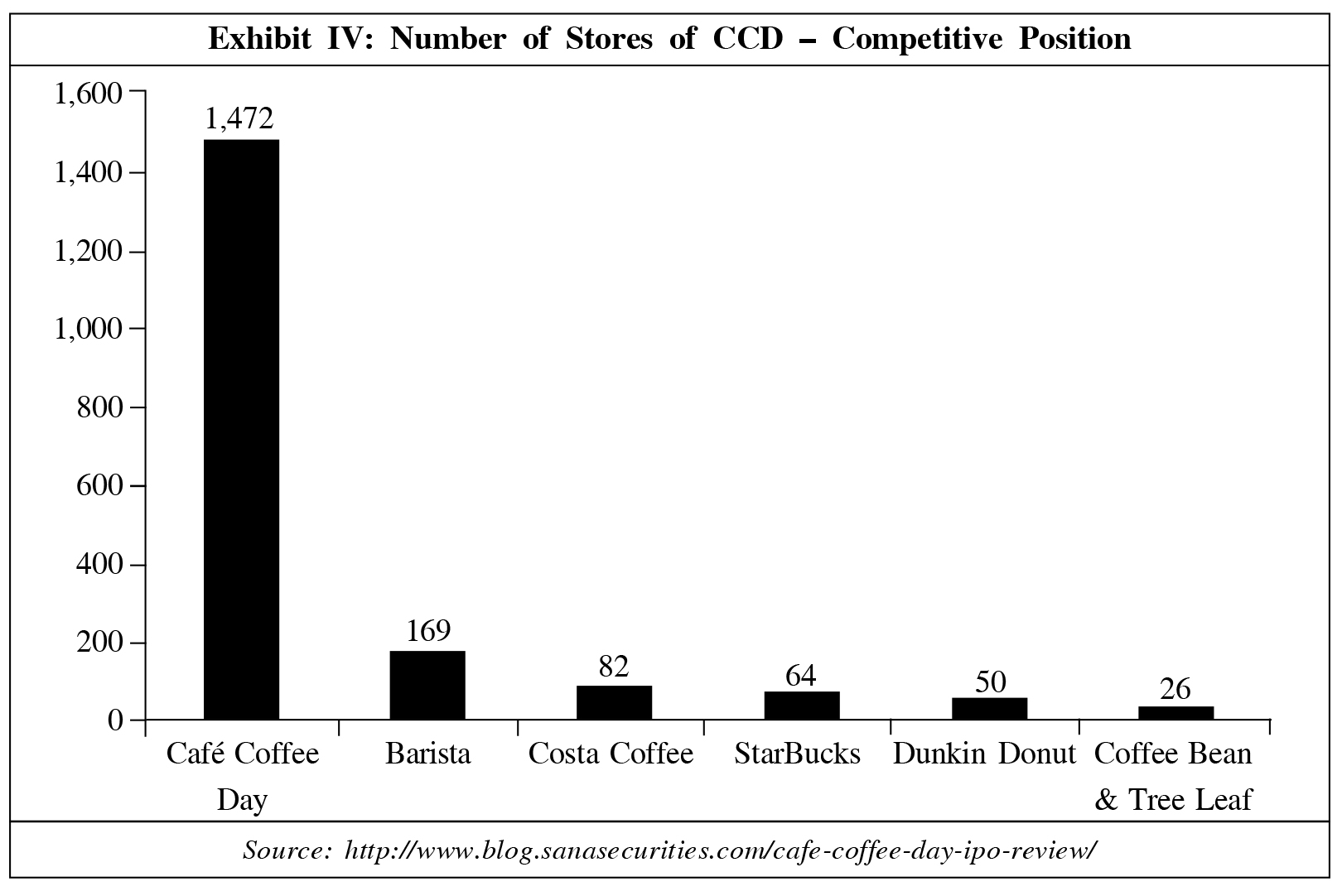

VGS expected competition to CCD from international players, but much to his surprise, he

faced unexpected competition from a domestic company, Barista Coffee Company Limited

(Barista). Barista, launched in early 2000, opened 20 stores in Mumbai and 20 stores in Delhi

in the year 2000 itself, while CCD was operating only 20 stores in all. However, CCD had

a rent to revenue ratio14 of 20-25% while for Barista it was 50%.15 CCD then went on an

expansion spree, increasing the number of its stores to 200 by the year 2004. By the end of

December 2014, the number of stores operated by CCD was 1,472, whereas Barista had just

169 stores.

Starbucks, the world's largest coffee brand, entered the Indian market in the year 2012

through a 50-50 joint venture with Tata Global Beverages Limited. Starbucks was quick to

expand into the market, targeting a specific category of customers. Within 20 months of its

launching operations, Starbucks opened around 20 outlets across the county. In spite of the

presence of various players, VGS continued his plan of opening more stores. During

2014-15, VGS launched around 150 stores and planned to launch more in the following years.

Also, VGS launched different format stores for malls and highways, high-end stores called

Lounges, and a single-origin coffee destination called "The Square". Said VGS, "We want to

have around 2,500 Cafe and Express outlets in three years... we will set them up wherever there

are opportunities, including at educational institutions, hospitals, expressways and high streets."

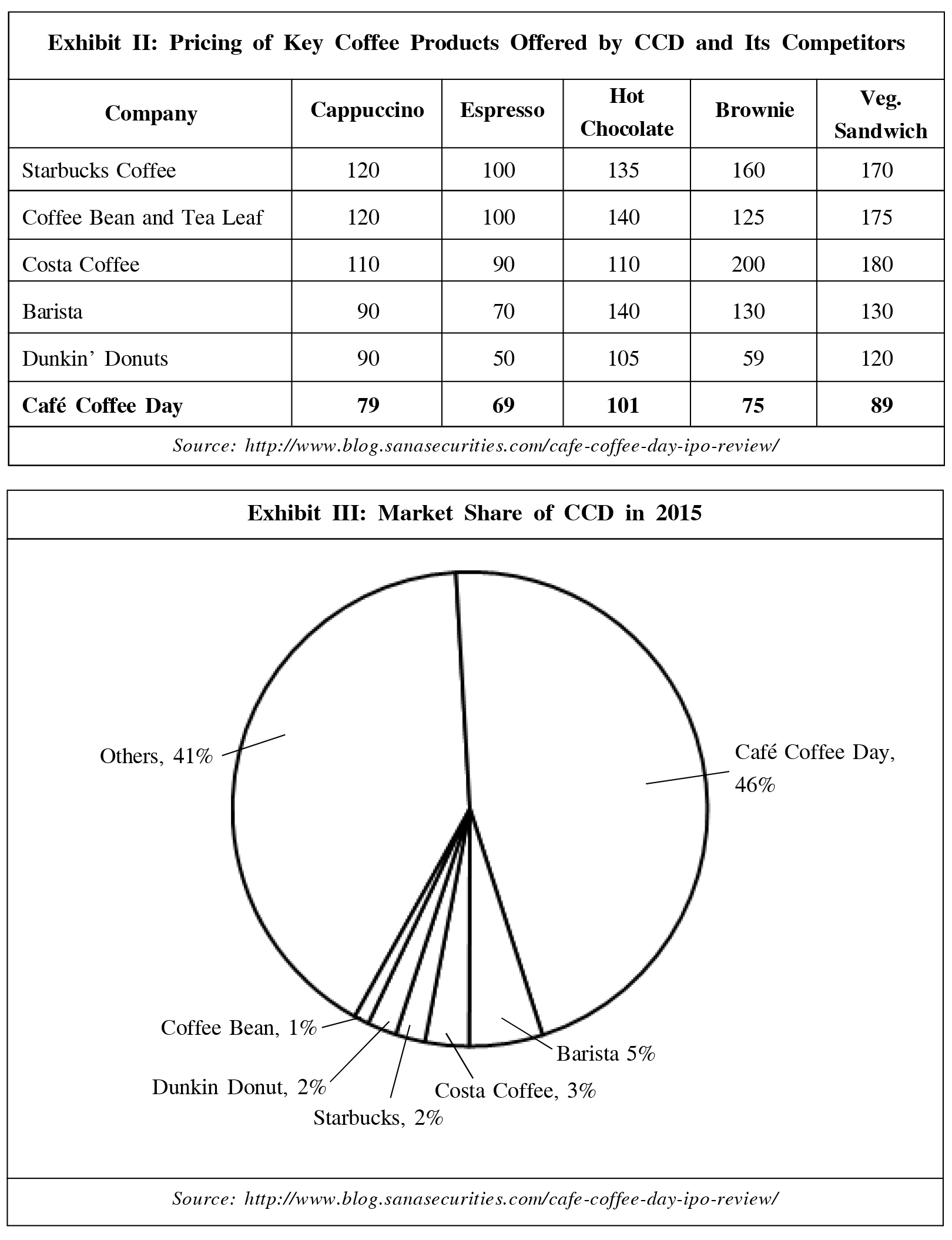

CCD had an advantage over other players not only where number of stores opened

was concerned, but also in terms of the pricing of its products and services. Its primary

coffee products were cheaper than those offered by the other cafes (see Exhibit II). By

2015, CCD was the leader in market share and number of stores (see Exhibits III

and IV).

Diversification

While focusing on creating a sustainable coffee brand, VGS also concentrated on diversifying

his investment portfolio. His first business, Sivan Securities, was successful in providing stock

broking and investment advisory services. He owned a share of 85.53% in that business. In

2000, VGS acquired another stock broking firm, Way2Wealth Securities Limited, and merged

it with Sivan Securities. In 2006, he entered the hospitality sector, launching Coffee Day

Hotels and Resorts, which operated the Serai and Cicada resorts in Chikmagalur and Bandipur

regions of Karnataka.

In 2007, VGS entered the real estate business through Tanglin Retail Limited. Under the

brand, he invested in the development of technology parks and special economic zones,

providing infrastructural facilities to technology giants to start their businesses in Bangalore

city. In the year 2010, VGS ventured into logistics by acquiring a 52.83% stake in Sigal

logistics that specialized in providing integrated logistics services. In addition to making

direct investments in various businesses, he also invested in the shares of technology

companies and was also a board member in companies like Mindtree Limited, Ittiam Systems,

Global Edge Software Limited, and Magna Soft. VGS had bought a stake of 6.6% in a

technology start-up Mindtree for a value of 440 mn in the year 2000. His technology

portfolio (investment in technology-based companies) was valued at 4.150 bn during the

year 2000. Said Ashok Soota, Co-founder and former CEO of Mindtree, "We were really, really

lucky with our first two VCs. He (VGS) was a superb investor and he gave us all the freedom,

he (VGS) clearly saw the upside to his investment but at the same time, he wanted to be a

'White Knight.'"16

Until 2008, VGS carried out all his businesses as a private sole trading concern. In the year

2008, he converted them into a partnership firm in the name of Coffee Day Holding Company.

Later, this was converted into a private limited company Coffee Day Holdings and eventually

into CDEL after the company went in for an IPO in the year 2015. The period 2000-2010

remained crucial for VGS as he had been diversifying his investments into various businesses

and at the same been focusing on expanding his coffee business, especially CCD. During the

year 2011, VGS bought 1.85 million hectares of Amazon forestland in South America on lease

to source timber to start a furniture business.

The Debt Trap

The growing competition from domestic and international players and the massive expansion

of CCDs stores posed various challenges for VGS, including thin margins. To manage the

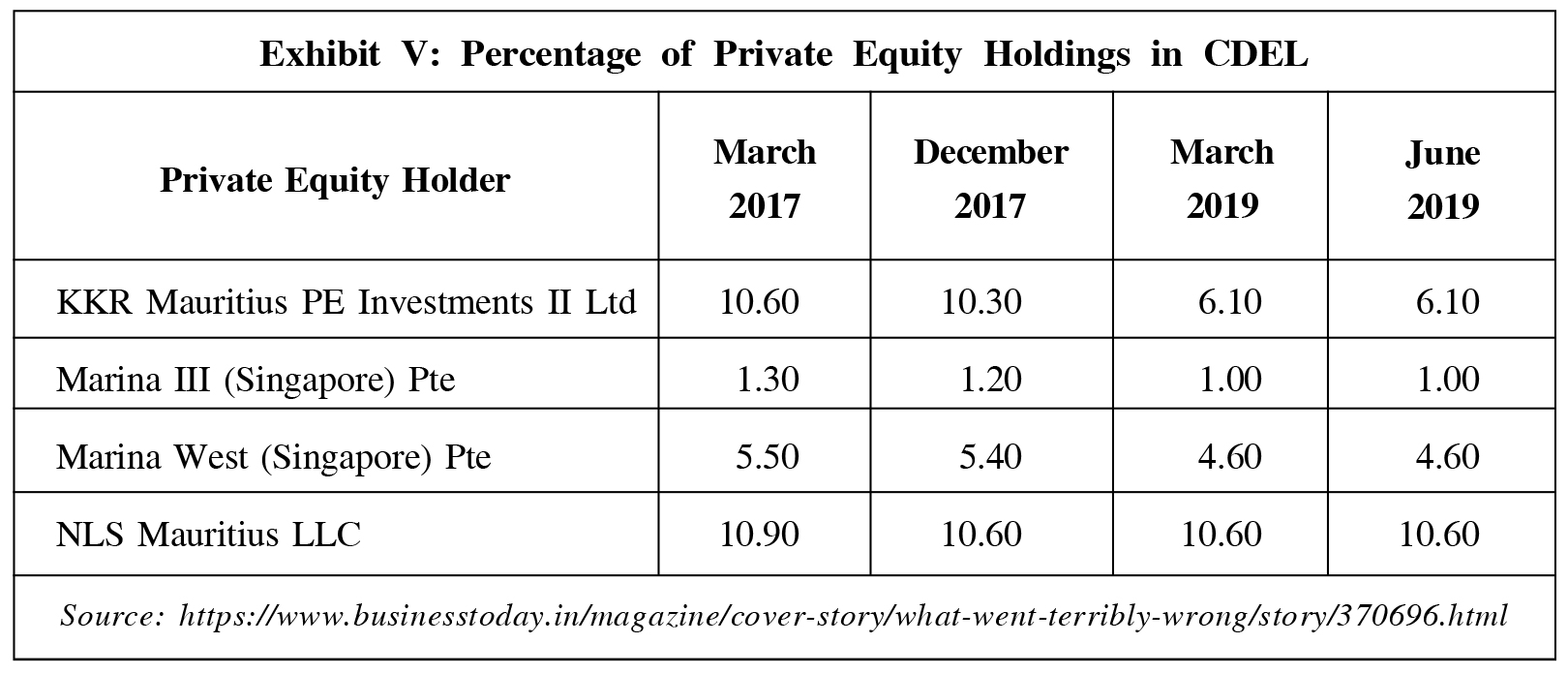

capital expenditures and the operating costs, VGS raised debt from private equity players. In

the year 2010, VGS raised $149 mn from Standard Chartered Private Equity (Mauritius) II Ltd,

KKR Mauritius PE Investments II Ltd, and Arduino Holdings Ltd. Arduino Holdings Limited

transferred its Debentures to NLS Mauritius LLC.17 As part of the agreement, the preference

shares held by Standard Chartered Private Equity (Mauritius) II Ltd and the debentures held

by KKR Mauritius PE Investments II Ltd and NLS Mauritius LLC had to be compulsorily

converted into equity. Hence, they were converted into equity in the year 2015 after VGS went

in for an IPO (see Exhibit V).

Analysts opined that the prevailing financial condition during the years 2010-2015 with

respect to the coffee business had prompted VGS and his partners to convert the business into

a Public Limited company. After making adjustments for the private equity players, the debt

remained at 27 bn in June 2015. The CCD business had reportedly incurred losses for the

fiscal year 2008-09 that amounted to 77.20 mn. This reached 1.55 bn in the fiscal year

2014-15 and 1.50 bn in the fiscal year 2015-16.18

One of the major objectives of going in for an IPO was to reduce the debt burden. However,

the IPO did not evoke the kind of response from the public that VGS expected. "It was not

really the response Siddhartha was expecting. He was quite disheartened that the market could

not see his vision," said a former investment banker associated with VGS. VGS raised just

11.50 bn. Prior to the launch of the IPO, VGS had brought 3.34 bn from anchor investors

and 1 bn from other private parties associated with him.19 With an increase in the number

of stores, the revenue margins improved for the years 2016-17, 2017-18 and 2018-19.

However, the debt component increased to 29.72 bn as on March 31, 2017.

Of the total debt, 5.41 bn was related to the short-term borrowings of the company. It was

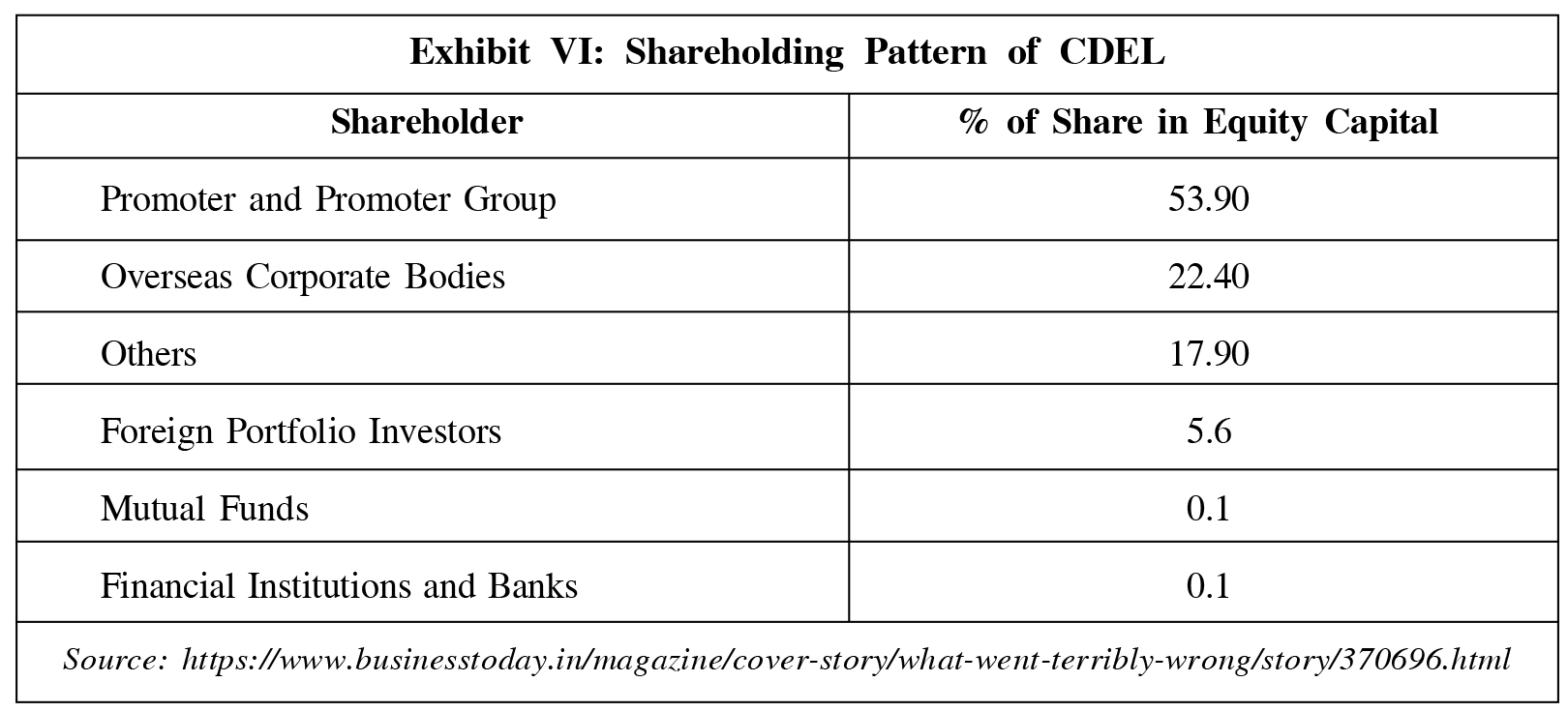

also observed that in the month of December 2016, a large part of the promoter holdings (around

54%) in CDEL has been pledged to raise money for investment in the construction and hospitality

businesses (see Exhibit VI). Many private investors and VGS's close associates warned him about

an impending liquidity crisis and the problem of higher leverage, but VGS remained optimistic.

By the end of March 31, 2018, the debt crisis had worsened with banks facing a liquidity problem

and being unable to provide the refinancing facility. At the same time, the increase in interest rates

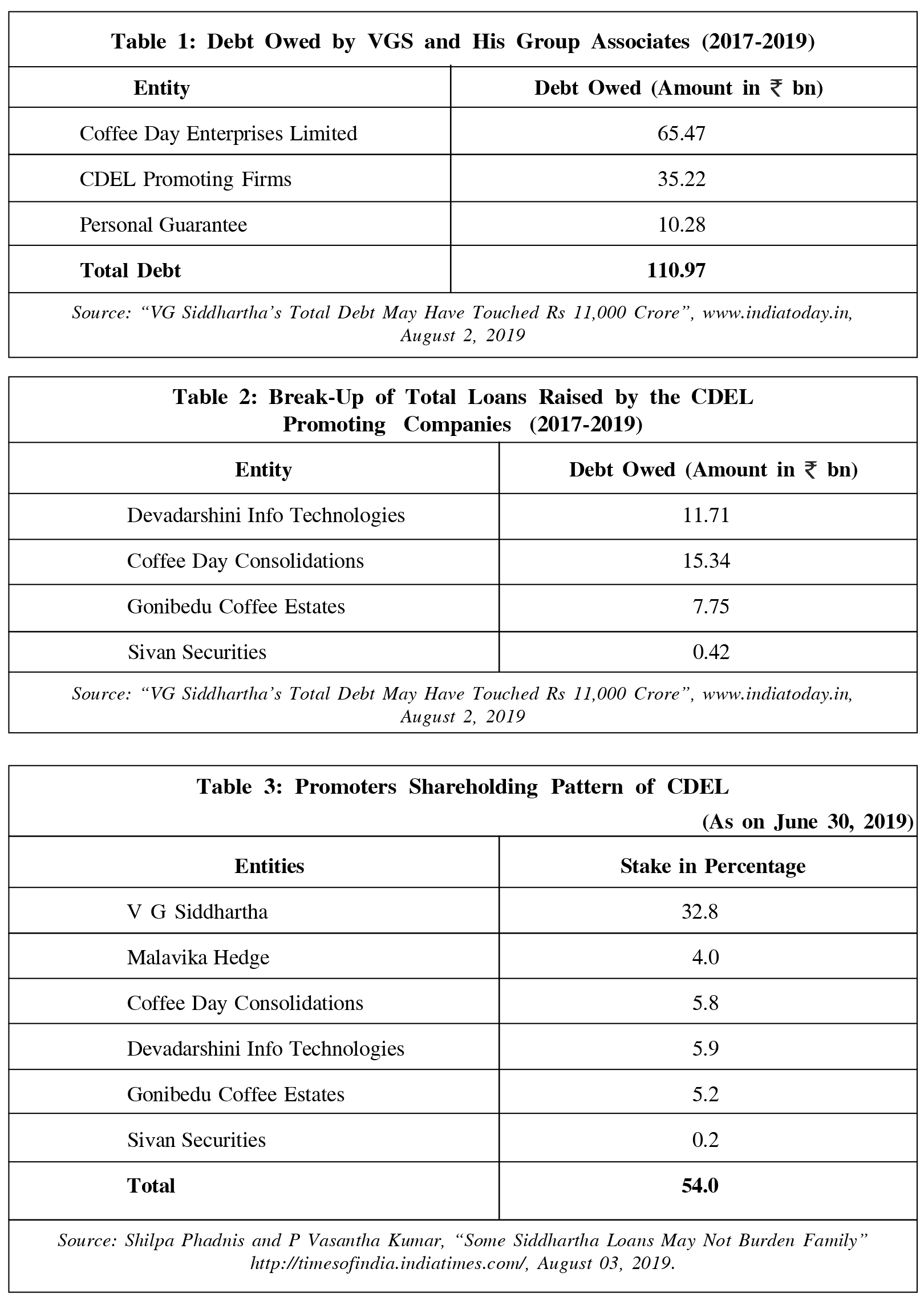

on existing loans put a burden on VGS in managing the liquidity of debt. As per the available

records from the stock exchanges and the Ministry of Corporate Affairs, GoI, VGS, CDEL, and its

promoting companies owed a debt of around 110.97 bn to different lenders between 2017 and

2019 (see Table 1). The promoting companies of CDEL raised the loans against the mortgage of

shares to various lenders since 2014 (see Table 2).20

Since 2017, VGS had been struggling to manage the investors and the tax authorities. In March 2018, CDEL mentioned in its financial reports that VGS had given a personal guarantee for loans worth 10.28 bn. Also, VGS and his wife Malavika Hegde had not taken any compensation since 2016 (see Table 3). In the month of November 2018, VGS held a meeting with the board of directors to take a decision on the restructuring of CDEL-owned businesses.

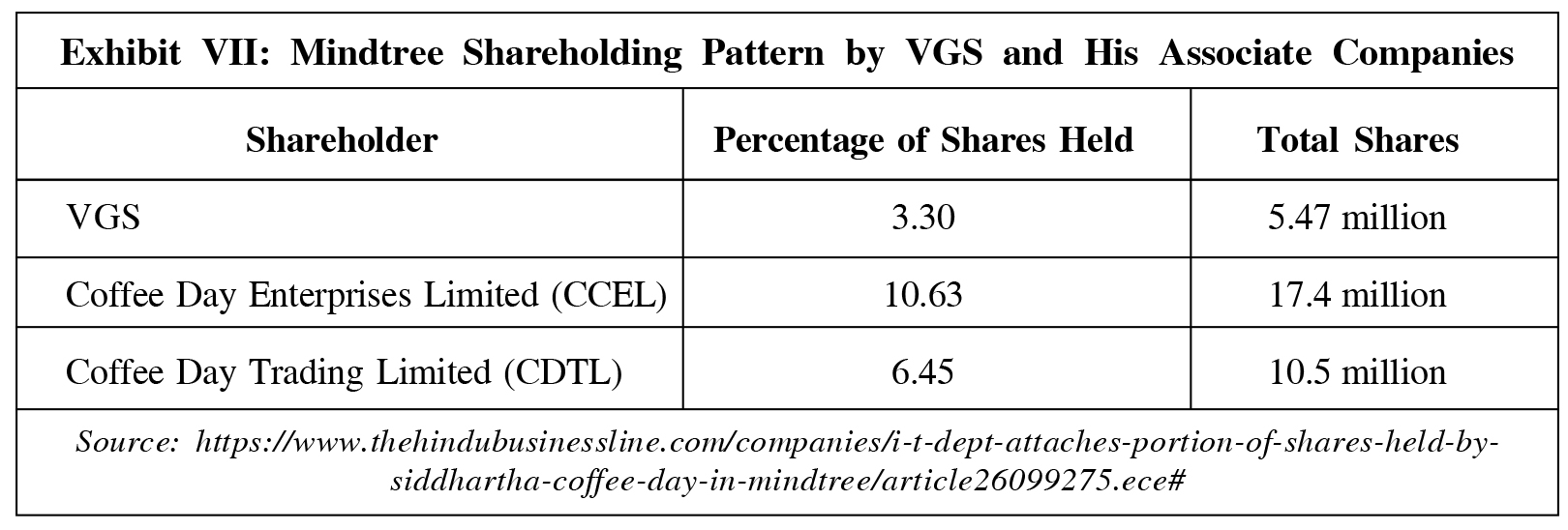

Though what was discussed at the meeting about the debt settlement was not known, VGS initiated the process of selling his stake in Mindtree to settle dues for which he had given the personal guarantee. The IT department of the GoI after getting to know that VGS was selling his stake of 21%21 in Mindtree, attached 7.49 million of his shares in Mindtree as a precautionary measure to recover the dues from VGS (around 6 bn of unaccounted incomes and 3 bn in the form of fines and penalties). So, in the process of recovering the dues, the IT department attached the shares of CDEL in Mindtree (see Exhibit VII).

The board of directors of CCD also approved the sale of securities held by the

company in Mindtree. VGS therefore requested the IT department to release the Mindtree

shares attached to the IT evasion case and in lieu attach the CDEL shares. Hence, the IT

department attached 25.04 million worth of CDEL shares in the case in the month of

February 2019.

In March 2019, VGS reached an agreement with L&T 22 on the sale of stake in Mindtree

for a value of 32.69 bn. As per CDEL records, the total outstanding debt of CDEL by the

end of March 31, 2019, was 65.47 bn.23 The company reported a revenue of 42.64 bn and

a net profit after tax of 1.28 bn (the company had incurred a profit for three successive years),

and the coffee business had generated a profit of 0.41 bn on revenues of 14.68 bn. CDEL

was able to clear debts amounting to 21 bn from the sale proceeds of Mindtree dealings, after

the payment of taxes and other expenses during the fiscal year 2018-19. As per the

information available with CDEL, after the settlement of dues, the total outstanding debt of

CDEL stood at 44.47 bn.24

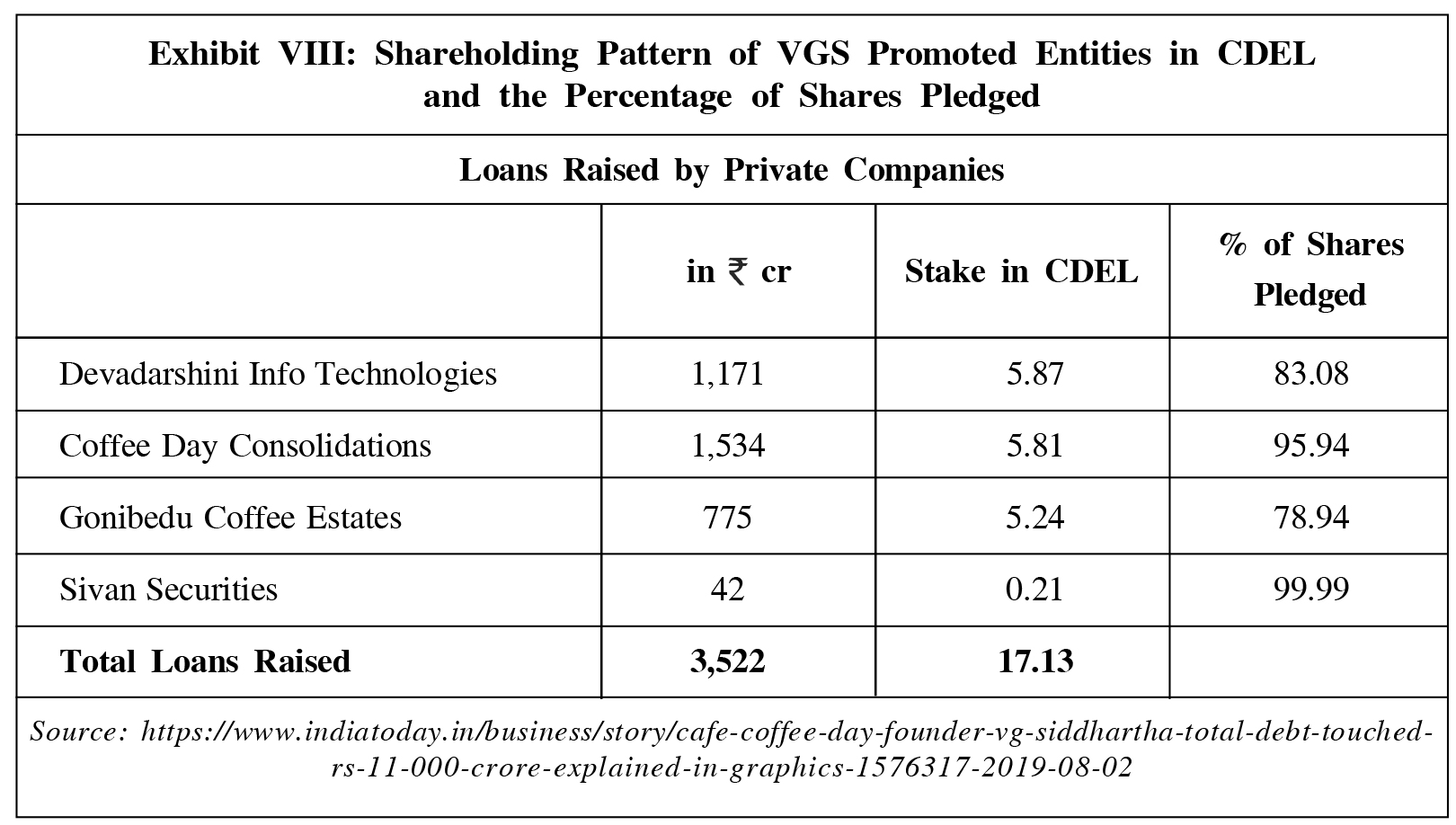

In June 2019, the management of CDEL declared that around 75.70% of the promoting

shareholding had been pledged with respect to the debt obligations.25 It was also observed

that the other entities promoted by VGS had raised loans by pledging the shares held by them

in CDEL (see Exhibit VIII). The other entities had a stake of 17.13% in CDEL against which

they had raised a debt of 35.22 bn by pledging the shares to different private investors

(see Table 4).

All the entities had pledged a majority of their shareholding in CDEL to raise loans from

various sources. Sivan Securities stood at the top, pledging almost 99% of the shares held by the

company in CDEL. All the dealings related to raising the loans had happened between 2014 and

2019. The frequency of debts being raised by the entities had been increasing since 2014. It was

estimated to be four times in 2014, once in 2016, four times in 2017, 17 times in 2018, and three

times in 2019. In April 2019, Sivan Securities raised 150 mn from IDBI Trusteeship Services

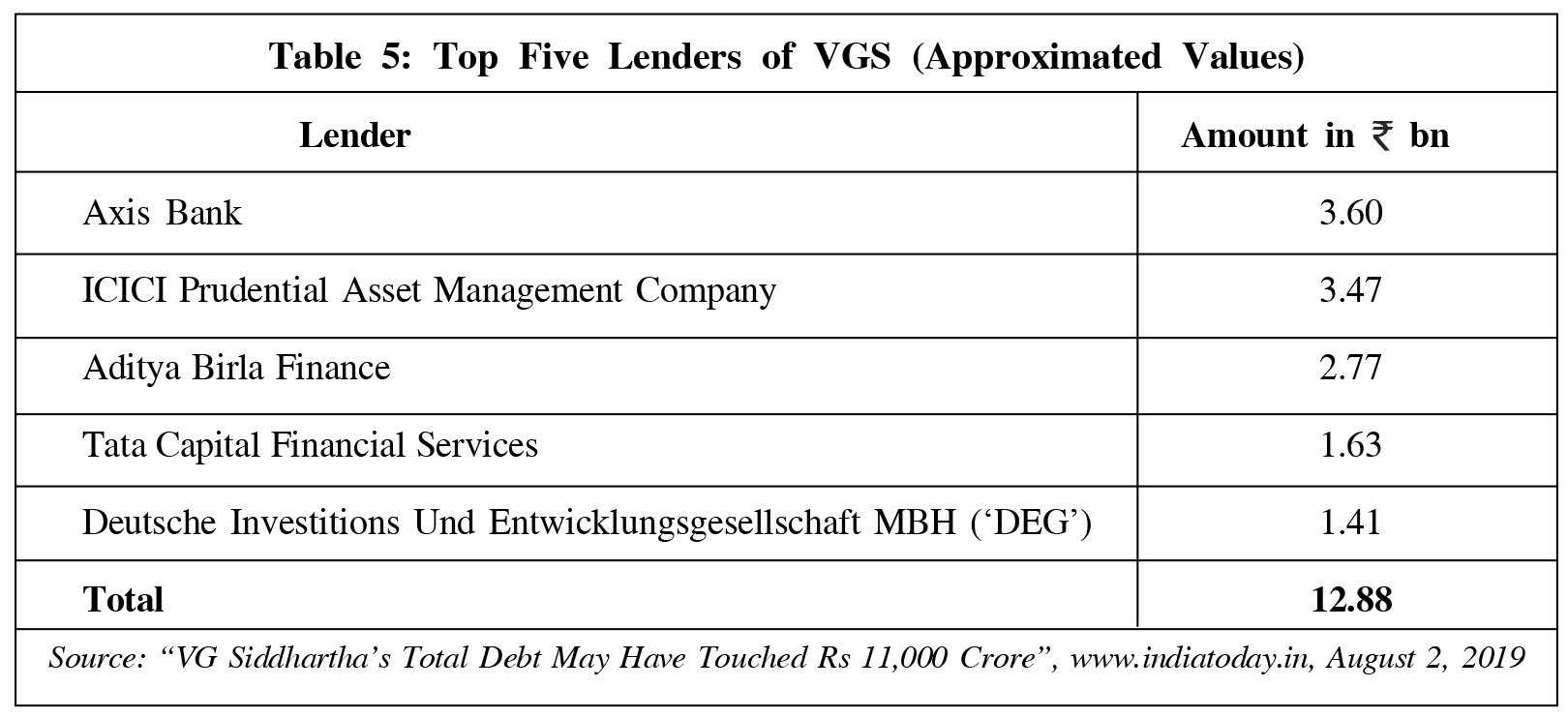

Limited by pledging the shares. Other than this, VGS alone raised around 26.03 bn in loans from

different sources (see Table 5).

Questionable Financial Reporting Structure

Many analysts and the auditors were not convinced with the financial reporting structure of

CDEL, as they were unable to take a decision based on the information provided in the annual

reports. Since 2017-18, the company had been in the process of streamlining its financial

reporting processes. The auditors from BSR and Associates in their audit report for the year

ended on March 31, 2018, mentioned that they did not audit information pertaining to

40-odd subsidiary companies of CDEL.

The financial reporting structure of CDEL comprised a holding company, four major

subsidiaries, more than 40 step-down subsidiaries, and more than 12 associate and joint

venture companies. The structure was a complicated one for a normal stakeholder to interpret

any kind of financial information from the financial statements. It was believed that such a

complicated structure would have a ripple effect on the business performance of the group

companies if even one business did not perform well at any level.

Some analysts opined that such a reporting structure was convenient for VGS as he was

able to raise a large amount of funds through various entities. However, the structure created

serious asset-liability management issues for CDEL, making it complicated to manage the

increasing risk component. It was observed that a two-member board level risk committee

constituted in the year 2015, consisting of VGS and his wife, had never been found to discuss

any risk management issues since its formation.

The Death of an Entrepreneur

The news that VGS had been reported missing by his driver near the Netravati River made

headlines in the media and business circles on the evening of July 29, 2019. A massive hunt

was mounted for the coffee baron and speculation of various kinds began doing the rounds

in media and business circles. A letter supposedly written by VGS was found in his house after

his disappearance, addressed to the Board of Directors of CDEL and the CDEL family

(see Exhibit IX). In the letter, he mentioned that the total assets held by CDEL and its

promoting entities were sufficient to meet all his financial obligations. The value of assets

would be around 180 bn, sufficient to clear any pending dues without the company going

bankrupt. After rigorous search operations that went on for more than a day, on August 1,

2019, VGS was found dead on the shores of the Netravati River. It was believed that his

political connections and the stringent tax norms implemented by the GoI had played a role

in his taking this extreme step.

Two major issues cropped up after his death. One was that VGS had raised lot of money

from various lenders and PE investors in his private capacity to invest in real estate businesses

and other long-term projects. It was thought that he had likely faced pressure from the lenders

to return the money. The other issue was political. VGS was the son-in-law of a former Chief

Minister of Karnataka and a former Central Minister in the Congress26 regime, S M Krishna,

who had joined the BJP27 after quitting the Congress party in March 2017. However, VGS had

never maintained any open political relations with his father-in-law. He did maintain close relations though with DK Shiva Kumar (DKS), a strong and influential politician belonging

to the Congress party. It was believed that a political fight between the Congress party and

BJP had also led to the indirect targeting of VGS. The IT department had reportedly found

evidence of financial transactions between DKS and VGS with respect to money laundering

dealings in the month of August 2017. The IT department, which raided the residential

locations and office locations of VGS, had reportedly found evidence against him with respect

to unaccounted financial dealings. The IT department claimed that VGS had given a

self-declaration accepting the financial dealings. Analysts believed that though it might not

be easy to establish a direct relationship between his political connections and his alleged

suicide, a failure on his part to manage the issues with some of the private equity investors

and lenders could be possible reasons for his death.

According to a banker associated with VGS, VGS had no collateral left to raise any

additional amount. He had not only pledged his personal share holdings in CDEL and in his

group companies, but had also pledged the assets of the companies, investments in other

companies, corporate guarantees of his group companies, and the personal guarantee on

various group companies, loans, and fixed deposits. It was also observed that the lenders had

a charge against the cash deposits given by VGS to the land owners of current and future CCD

outlets "The company often talked about net debt (gross debt minus cash deposits, etc.), but

the fact was that all the cash and deposits were under the charge of lenders," said the banker.28

It was observed that VGS had funded subsidiary Tanglin Developments and its step-down

subsidiaries Tanglin Retail Reality Development, logistics businesses like Sical, and

hospitality businesses like resorts and hotels through various related party transactions and

by providing loans. But the revenue generation from these investments was considered to be

negligible considering the substantial flow of investments.

The complicated financial structure also paved the way for money to be drained out into

different entities or businesses through transfer from one business to another, raising issues

about the corporate governance structure at CDEL. For instance, during the fiscal year 2017-

18, many cross transactions were observed within CDEL; a loan of 3.56 bn was provided

to Coffee Day Hotels and Resorts Limited at zero interest. This type of allotment was not

normally permitted under the Companies Act. However, the management got an exemption

under the category that any loans provided to the hospitality industry could be exempt from

payment of the interest amount.

Similarly, there were some related party transactions. CDEL purchased raw coffee worth

0.39 bn from one of its subsidiaries, Mysore Amalgamated Coffee & Estates and sold it to

another subsidiary, Kathlekhan Estate Pvt. Ltd for 0.35 bn. In another instance, CDEL

provided a long-term loan worth 0.41 bn to its related company, Dark Forest Furniture (DFF),

and also purchased furniture from DFF as fixed assets worth 0.20 bn. These subsidiaries were

spread across different locations on the globe like Denver, Cyprus, Austria, the Czech

Republic, and others. Many stakeholders doubted their very existence.

Recovery Measures

Amid the speculations doing the rounds in media, political, and business circles, the

management of CDEL came forward to state the debt position of the company. As per the

information provided by it, as on August 17, 2019, the total debt outstanding with CDEL was

49.70 bn. Further, the management stated in a public statement that divestment in other

group companies had been initiated and based on the returns from the divestments, the

amount would be settled. CDEL had initiated divestment of its stake in Global Village Tech

Park (Global Village), a subsidiary of one of the CDEL promoting companies Tanglin

Developments Limited. The deal was expected to fetch around 26 bn to 30 bn, bringing

down the debt burden of the company to around 25 bn. Of this, around 15 bn had to be

paid to Sical and Magnasoft Consulting, the promoting entities of CDEL. After excluding this

amount, the total debt of CDEL would come down to 10 bn. Sical and Magnasoft would

recoup their debt dues by selling the assets of CDEL that were related to the company.

The management of CDEL requested all the stakeholders to be patient and said all the

obligations would be honored. "We request all the lenders and creditors to give sufficient time

to honor the commitments and to unlock the true potential value of the assets. We thank on

behalf of 50,000 employees, for whom the group has provided employment," said the

management of the firm in a public statement.29

- "E-Cell IIT Kanpur", https://www.youtube.com/watch?v=hXfVVT_ETGc, posted on October 25, 2016, actual speech delivered on August 26, 2016.

- "Cafe Coffee Day Founder VG Siddhartha Had Repaid All Pending Loans, Says Tata Capital", www.news18.com, August 4, 2019.

- Considered to be one of the holy rivers of India, had its origin in Bangrabalige valley, Yelaneeru Ghat in Kudremukh in Chikmagalur district of Karnataka, India. It passes through famous pilgrimage places like Dharmasthala and had a length of around 103 Kilometres.

- "I Gave it My All, Sorry to Let Down People: CCD Owner's Letter to Board", https://www.businessstandard. com/, July 30, 2019.

- Karl Marx was a German philosopher, economist, politician, and a social revolutionary, born on May 5, 1818, in Trier, Germany.

- It is a national level examination conducted by Union Public Service Commission (UPSC) of India for the recruitment of personnel in Indian Navy, Army and Air Force. It is a two level examination, the first level is written exam; and the second level is interview.

- "Kampani: A Visionary Who Lived Ahead of the Times", www.business-standard.com, updated on February 26, 2013.

- Rukmini Rao, "Cafe Coffee Day's VG Siddhartha's Death: What Went Terribly Wrong?", www.businesstoday.in, August 25, 2019.

- India Today Web Desk, "How CCD Owner VG Siddhartha Created the Largest Coffee Empire in India", www.indiatoday.in, July 30, 2019.

- "V.G. Siddhartha: Everybody Said It Wouldn't Work", www.forbesindia.com, updated on November 1, 2017.

- Apoorva Puranik, "A Lot Still Happening Over Coffee: How VG Siddhartha's Cafe Coffee Day Transformed the Simple Brew into a Lifestyle", https://economictimes.indiatimes.com, August 2, 2019.

- Ibid.

- India Today Web Desk, "How CCD Owner VG Siddhartha Created the Largest Coffee Empire in India", www.indiatoday.in, July 30, 2019.

- Calculated as rent expense divided by total revenues. The lower the ratio, the higher is the efficiency of operating an outlet.

- Ashis Mishra, "Business Model for Indian Retail Sector: The Cafe Coffee Day Case: In Conversation with V.G.Siddhartha, Chairman, Coffee Day", www.sciencedirect.com, September 2013.

- Rukmini Rao, op. cit.

- Ibid.

- Chitresh Sehgal, "The Dark Reality: Having it All vs Dying for It", www.dkoding.in, July, 30, 2019.

- Rukmini Rao, op. cit.

- "VG Siddhartha's Total Debt May Have Touched Rs 11,000 Crore", www.indiatoday.in, August 2, 2019.

- Over the years since 2000, VGS and his promoting entities had increased the stake in Mindtree Limited to 21%.

- Larson and Turbo (L&T), a leading engineering conglomerate was one of the serious contenders for acquiring a stake in the Mindtree Technologies. L&T managed to improve its share in Mindtree to 28.9% acquiring VGS' stake of 20.32% at around 980 per share. L&T acquired Mindtree in July 2019.

- "VG Siddhartha's Total Debt May Have Touched Rs 11,000 Crore", www.indiatoday.in, August 2, 2019.

- Ibid.

- Ibid.

- Congress, the short form of Indian National Congress (INC) is the oldest political party in India founded in the year 1885.

- Bharatiya Janata Party (BJP), founded in 1980, is one of the two major political parties in India along with INC. In 2019, BJP was the largest political party in India in terms of representation in the Indian Parliament.

- Rukmini Rao, op. cit.

- "After VG Siddhartha's Death, CCD Clarifies on Firm's Debt; Says All Obligations Will be Honoured", www.financialexpress.com, August 17, 2019