Sep'22

The IUP Journal of Entrepreneurship Development

Archives

Factors Influencing Entrepreneurship Ecosystem and Economic Development: Evidence from Cross-Sectional Country-Wise Imbalanced Panel Data Analysis

Ajay K Singh

Assistant Professor, School of Liberal Arts & Management, DIT University, Dehradun, Uttarakhand, India;

and is the corresponding author. E-mail: a.k.seeku@gmail.com; kumar.ajay_3@yahoo.com

Sanjeev Kumar

Assistant Professor, School of Liberal Arts & Management, DIT University, Dehradun, Uttarakhand, India.

E-mail: vashishtsanjeev147@gmail.com

This study assessed the factors influencing economic development and entrepreneurship ecosystem using log-linear regression models. It used global entrepreneurship index score as a proxy variable for entrepreneurship ecosystem, and per capita Gross Domestic Product (GDP) as a representative variable for economic development in the regression analysis. It compiled a cross-sectional imbalanced panel data of dependent and explanatory variables for 106 countries during 2006-2019. The models showed that entrepreneurship ecosystem and economic development were positively associated with business density rate, business extent of disclosure index, exports of goods and services, Foreign Direct Investment Net Inflows (FDINI), individuals using the Internet and market exchange rate. Further, entrepreneurship ecosystem was positively associated with economic development and vice versa. Entrepreneurship ecosystem and economic development have a cause-and-effect relationship with each other. The results also show a diverse impact of economic development and entrepreneurship ecosystems in developed and developing countries.

Introduction

Entrepreneurship ecosystem is useful to increase socioeconomic, science and technological development and innovation (Fritsch and Wyrwich, 2017; Singh and Ashraf, 2020; Singh and Jyoti, 2021; Sabra and Shreteh 2021; and Singh et al., 2022). Entrepreneurship ecosystem favors creation of employment for skilled and unskilled workforce, infrastructure development, and increased production of manufacturing sector and exports of goods and services

(Chen, 2014; and Ashraf and Singh, 2019). It drives increase in per capita GDP, economic development and growth, social development, economic prosperity and living standard of people (Chen, 2014; Zaki and Rashid, 2016; Bashir and Akhtar, 2016; Erken

et al., 2018; and Dhahri and Omri, 2018). Consequently, entrepreneurship ecosystem is helpful to reduce poverty, income inequality and unemployment rate (Omoruyi et al., 2017; Dvoulety, 2017; and Dvoulety, 2018). It also helps increase science and technological advancement, innovation, transfer of technologies and knowledge transfer (Sabra and Shreteh 2021; and Singh and Kumar, 2022), leading to industrial development (Singh et al., 2022). Furthermore, entrepreneurship ecosystem is essential to increase financial stability and development, and foreign direct investment (Rusu and Roman, 2017).

Entrepreneurship ecosystem has complex association with socioeconomic development, entrepreneurial skills of people, business development capability of people, infrastructural development, government policies, banking sector, financial organizations, taxation regime, science and technological development, R&D activities, digitalization, information and communication technology, digital technology, environmental development, globalization, foreign trade, foreign direct investment, geographical location, and intellectual property rights. Thus, the measurement of entrepreneurship ecosystem is debatable in academic literature (Szerb et al., 2018; Singh and Ashraf, 2020; Sabra and Shreteh 2021; and Singh

et al., 2022). Existing researchers used different indicators or variables such as startup rate (Jyoti and Singh, 2020; and Sabra and Shreteh 2021), self-employment or business ownership rate (Wennekers et al., 2010; Box et al., 2014; and Erken et al., 2018), established business ownership and total early-stage entrepreneurial activity (MoyaClemente et al., 2020), number of companies or business formation (Chen, 2014; and Audretsch et al., 2015), credit to SMEs (Farayibi, 2016), number of new firms (Zaki and Rashid, 2016), number of new businesses registered in a year (Adusei, 2016), new business registration and business density rate (Hameli et al., 2021), annual growth in registered business activity (Dvoulety, 2017), number of startup procedures and self-employment (Dvoulety, 2018), total entrepreneurial activity (Rusu and Roman, 2017), total number of newly registered and unregistered business (Dhahri and Omri, 2018), etc. to define entrepreneurship ecosystem. Many international organizations such as the World Bank, the Organization for Economic Cooperation and Development (OECD), the International Labor Organization (ILO), Global Entrepreneurship Monitor (GEM) and Global Entrepreneurship Development Institute (GEDI) have suggested different variables to describe the performance of the entrepreneurship ecosystem across countries. The OECD proposed six indicators, GEM suggested 12 indicators and GEDI proposed 14 indicators to measure the health of the entrepreneurship ecosystem (Singh and Jyoti, 2021). The ILO focused on self-employment rate to evaluate the performance of entrepreneurship ecosystem. Most studies applied index-based techniques for measuring entrepreneurship ecosystem (Tasnim and ibne Afzal, 2018; and Singh et al., 2022). Index-based estimation seemed more consistent for measuring the performance of the entrepreneurship ecosystem (Singh et al., 2020; and Singh and Jyoti, 2021). Entrepreneurship Ecosystem Index (EEI), therefore, was developed as an integration of several associated variables which are essential to increase entrepreneurship ecosystem (Szerb et al., 2013; Ashraf and Singh, 2019; and Singh et al., 2022). The global entrepreneurship index works as crucial mechanism to measure the performance of entrepreneurship ecosystem (Tasnim and Ibne, 2018; and Singh et al., 2022). Global entrepreneurship development index was also used as proxy indicator for entrepreneurship ecosystem to assess its influence on economic development (Acs and Szerb, 2012; Acs et al., 2018; and Singh et al., 2022).

The empirical findings of previous studies provided a concrete understanding of the relationship of entrepreneurship ecosystem with economic development. Prior evidence claimed that entrepreneurship ecosystem has a positive impact on social and economic development, science and technological development, employment rate, foreign trade, livelihood security, infrastructure development, financial stability, etc. Entrepreneurship ecosystem also depends upon economic development and financial development associated indicators. Moreover, several studies have identified various determinants of entrepreneurship ecosystem and economic development in developing and developed countries. Despite that, limited studies could investigate the factors affecting entrepreneurship ecosystem in various income group countries. Hence, this study examines the factors affecting entrepreneurship ecosystem and economic development in different income group countries.

The following research questions are addressed in this study:

- Is there a diverse impact of economic development on entrepreneurship ecosystem and vice versa in different income group countries?

- Whether specific macro-level indicators have dissimilar impact on economic development and entrepreneurship ecosystem in different income group countries or not?

- Which types of macro-level indicators can be useful to increase entrepreneurship ecosystem and economic development in developing countries? This study aims to achieve the following objectives:

- To assess the factors influencing economic development and entrepreneurship ecosystem in different income group countries.

- To provide policy suggestions to increase entrepreneurship ecosystem and economic development especially for developing countries.

Data and Methodology

Study Area and Source of Data

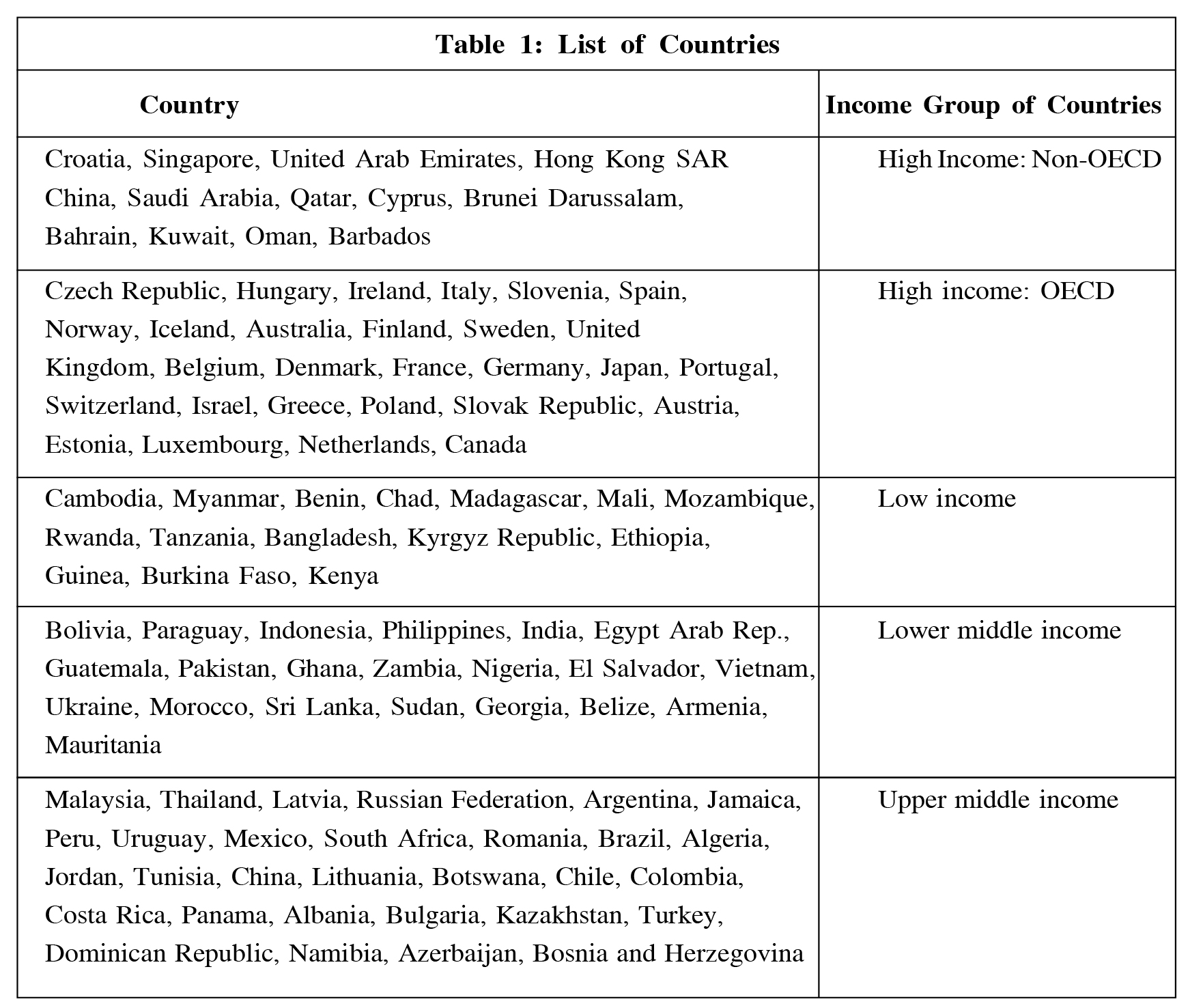

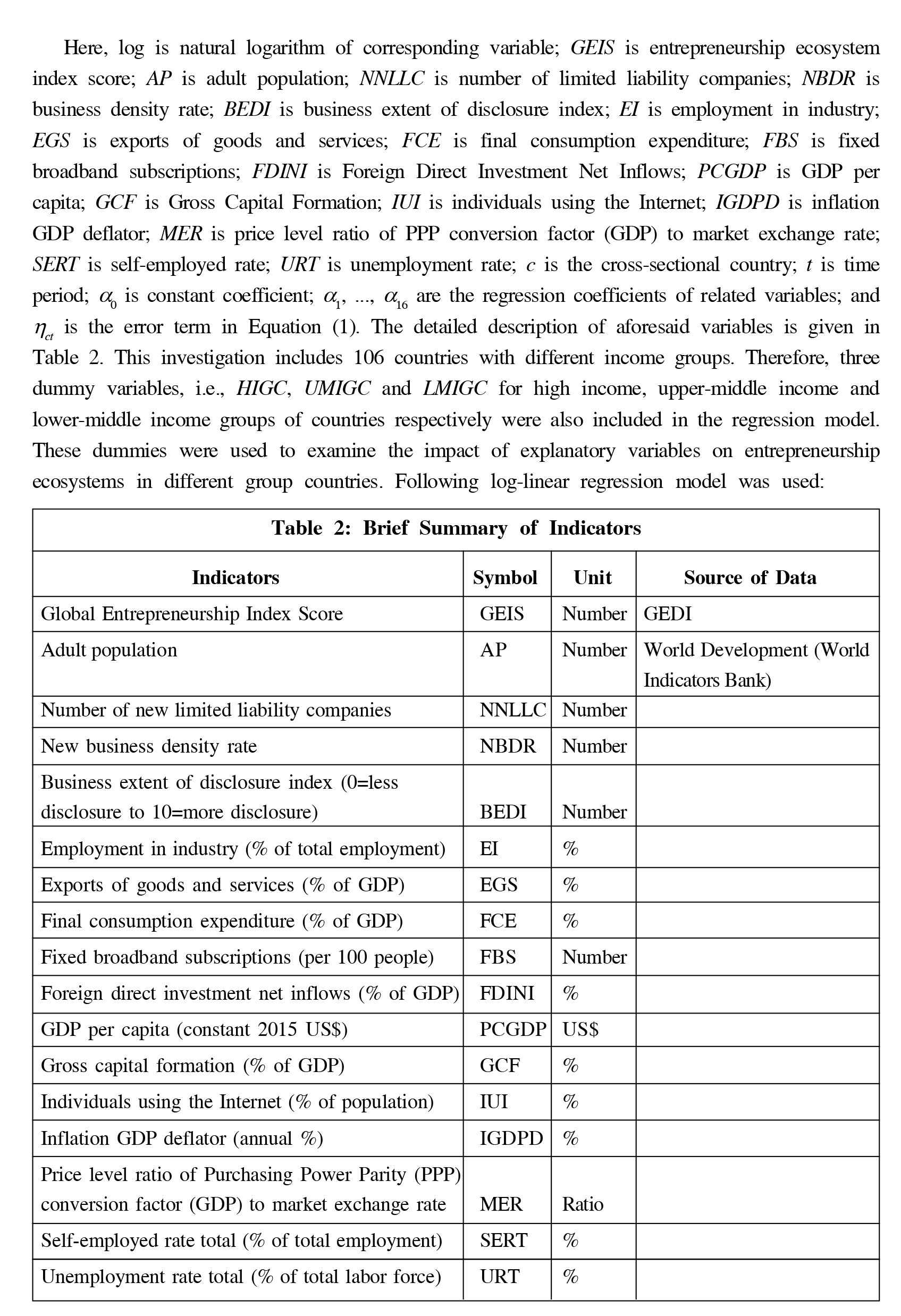

Entrepreneurship ecosystem and economic development directly and indirectly influence adult population, number of limited liability companies, business density rate, business extent of disclosure index, employment in industry, exports of goods and services, final consumption expenditure, fixed broadband subscriptions, Foreign Direct Investment Net Inflows (FDINI), GDP per capita, gross capital formation, individuals using the Internet, inflation GDP deflator, price level ratio of Purchasing Power Parity (PPP) conversion factor, self-employed total and unemployment total. Therefore, 106 countries that have the data of aforesaid variables were included in this study. 40, 30, 21 and 15 countries were from high, upper-middle, lower-middle and low-income groups, respectively (Table 1). Thereupon, the information of above-mentioned factors was not available in similar time periods for selected countries. Therefore, a cross-sectional country-wise imbalanced panel data during 2006-2019 was formulated. The statistics for selected indicators were derived from the official website of GEDI and World Development Indicators (World Bank).

Regression Analysis

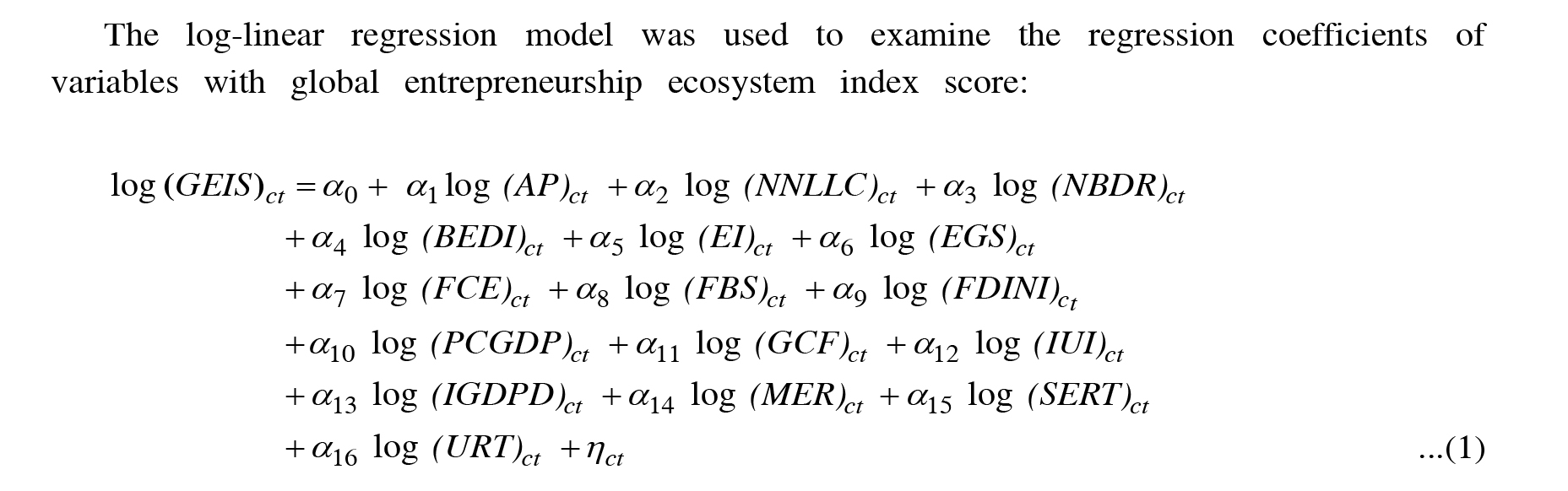

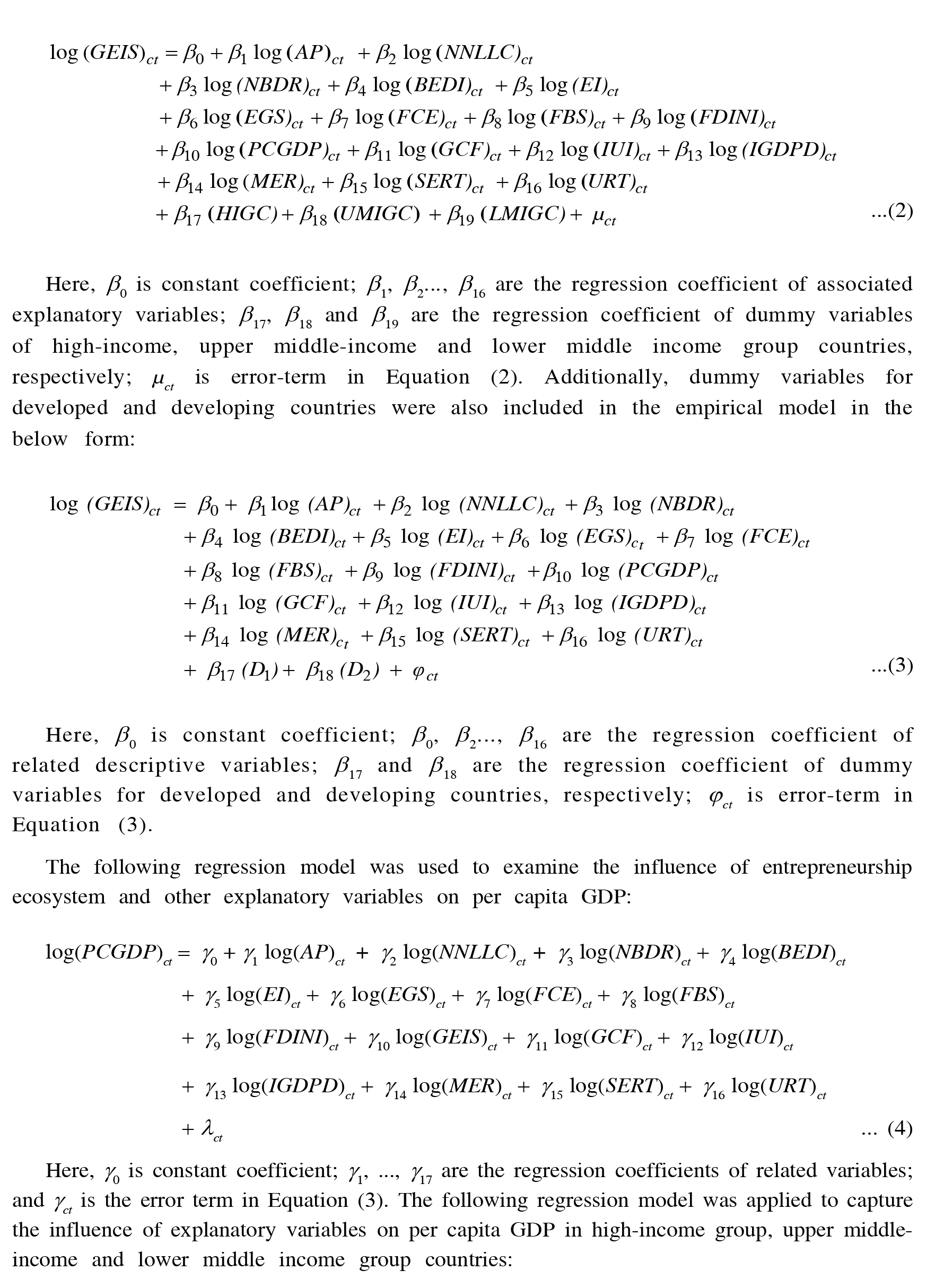

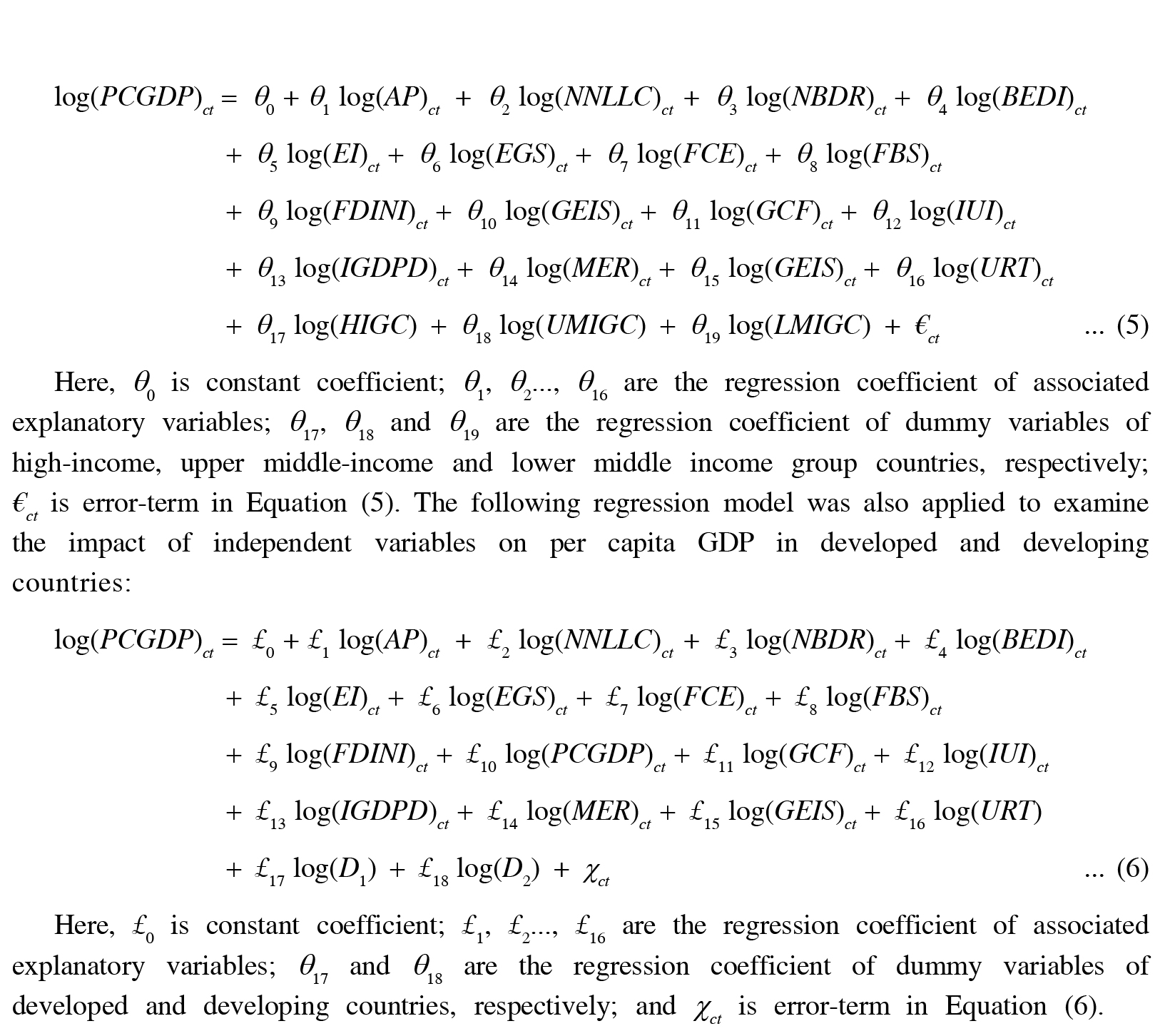

Existing studies argued that the functional form of log-linear regression model produces consistent coefficients of explanatory variables with output (Singh et al., 2021). For example, Singh and Ashraf (2020) applied a log-linear regression model to examine the determinants of the entrepreneurship ecosystem. Singh et al. (2020) explained the contribution of IPRs, S&T and socioeconomic development associated variables in the manufacturing sector using a log-linear regression model. Hence, Cobb-Douglas Production Function model was formulated to assess the factors affecting entrepreneurship ecosystem and economic development. It assumes that the entrepreneurship ecosystem has a causal relationship with per capita GDP and economic development (Singh et al., 2020 and 2022). Therefore, in the 1st empirical model, the global entrepreneurship ecosystem index score was used as a dependent variable. Wennekers et al. (2010); Box et al. (2014); Audretsch et al. (2015); Bashir and Akhtar (2016); Farayibi (2016); Omoruyi et al. (2017); Zaki and Rashid (2016); Dvoulety (2017); Erken et al. (2018); Tunali and Sener (2019); and Singh et al. (2022) also used global entrepreneurship ecosystem index as dependent variable to assess its association with explanatory variables.

In the 2nd empirical model, per capita GDP was used as a dependent variable. Earlier studies also used per capita GDP as dependent variable to examine its association with entrepreneurship ecosystem and other independent variables (e.g., Acs and Szerb, 2012; Box et al., 2014; Chen, 2014; Audretsch et al., 2015, Zaki and Rashid, 2016; Farayibi, 2016; Fritsch and Wyrwich, 2017; Tasnim and Ibne Afzal, 2018; Dhahri and Omri, 2018; Singh and Ashraf, 2020; and Sabra and Shreteh 2021). Adult population, number of limited liability companies, business density rate, business extent of disclosure index, employment in industry, exports of goods and services, final consumption expenditure, fixed broadband subscriptions, FDINI, gross capital formation, individuals using the Internet, inflation GDP deflator, price level ratio of PPP conversion factor (GDP) to market exchange rate, self-employed total and unemployment total were used as explanatory variables in the regression analysis. Adult population was used as proxy variable for human resource (Audretsch et al., 2015; Leylian et al., 2021; and Sabra and Shreteh, 2021); number of limited liability companies and business density rate were used as proxy variables for business progress (Wennekers et al., 2010; Audretsch et al., 2015; and Hameli et al., 2021); business extent of disclosure index, inflation GDP deflator and price level ratio of PPP conversion factor (GDP) to market exchange rate were used as key indicators of financial activities (Cho, 2012; Rinku, 2014; Farayibi, 2016; Adusei, 2016; Rusu and Roman, 2017; Singh et al., 2019; and Kamel et al., 2021); fixed broadband subscriptions and individuals using the Internet were used as proxy variables for digitalization (Minges, 2015; Hernandez et al., 2016; Singh et al., 2019; Afonasova et al., 2019; Kutsuri et al., 2019; Mentsiev et al., 2020; Appiah-Otoo and Song, 2021; and Singh et al., 2022); exports of goods and services, and FDINI were used as representative variables for trade openness (Rusu and Roman, 2017; Dvoulety, 2018; Singh et al., 2019; and Sabra and Shreteh, 2021); final consumption expenditure was used as representative variable for demand of goods and services (Aslan et al., 2021; and Sabra and Shreteh, 2021); employment in industry, self-employed total and unemployment total were as proxy variables for job market (Wennekers et al., 2010; Box et al., 2014; Dvoulety, 2017, 2018; Rusu and Roman, 2017; and Singh and Ashraf, 2020); gross capital formation was used as proxy variable for infrastructure development (Tasnim and Ibne, 2018; Ali et al., 2021; and Sabra and Shreteh, 2021) in the empirical model.

Process to Select a Reliable Empirical Model

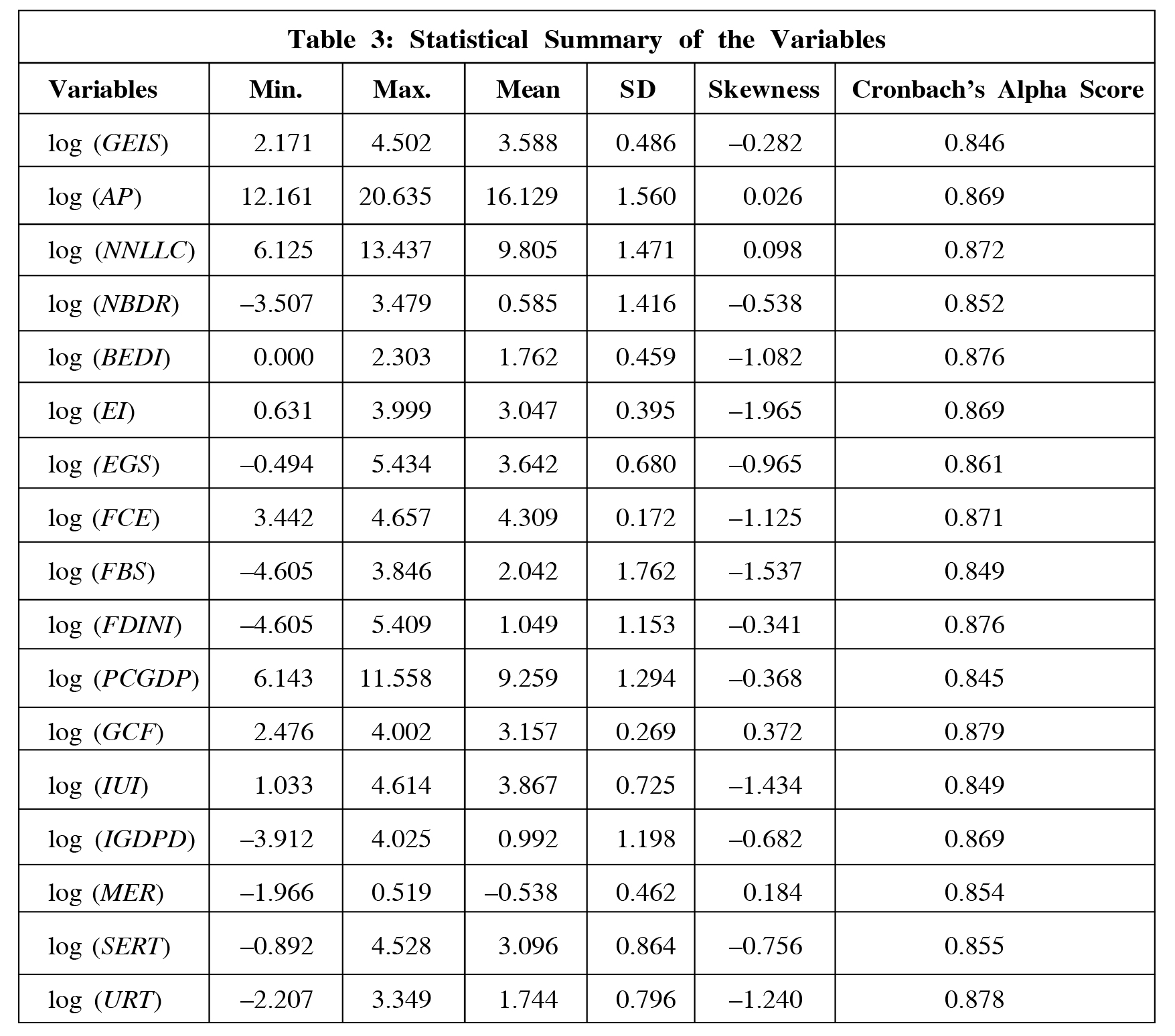

This study includes 106 countries as a cross-sectional imbalance panel data during 2006- 2019. These countries have high diversity in social-economic variables, entrepreneurship ecosystem and other variables. Therefore, abnormality of the data set may produce ambiguity in the regression coefficient. If the statistical value of skewness for a specific variable lies between -1 and +1, then it infers that this variable is in normal form (Singh et al., 2022). Scale reliability coefficients measure the validity of an individual and group of variables. Cronbach's Alpha (a) test, therefore, was used to check the scale reliability of variables. If a-value is found more than 0.7 for a variable, then it shows that this variable has reliability (Baker et al., 2021).

Ramsey RESET test was applied to identify the fitness of functional form of empirical model in output and independent variables. As multi-correlation shows the exact positive or negative relationship among the set of explanatory variables. Existence of multi-correlation among the variables may be caused due to increase in ambiguity in the regression coefficient. Variance Inflation Factor (VIF), therefore, was estimated to address the issues of multicollinearity (Singh et al., 2020). Accordingly, specific groups of explanatory variables were included in the regression analysis which had the mean value of VIF less than 10. Few variables were excluded from regression analysis due to the existence of multi-correlation among them. Statistical values of Akaike's Information Criterion (AIC) and Bayesian Information Criterion (BIC) were estimated to check the consistency of regression coefficient in the proposed models. The coefficients were assessed through Driscoll-Kraay standard errors estimation model to reduce the impact of multi-correlation, heteroskedasticity and cross-sectional dependence in the model (Singh and Ashraf, 2020). SPSS and STATA statistical software were used to examine the regression coefficients of explanatory variables with dependent variables.

Results and Discussion

Statistical Summary of Indicators

The statistical properties (i.e., minimum, maximum, mean, standard deviation, skewness and Cronbach's alpha score) of all variables are given in Table 3. The statistical values of standard deviation for most variables were nearly 1, which indicates that these variables have insignificant variance. The statistical value of skewness for most variables (except, BEDI, EI, FCE, FBS, IUI and URT) were detected between -1 and +1. The estimates reveal that most

variables were in normal form. These variables can be considered for further empirical investigations. As Cronbach's alpha score measures the scale reliability of individual variable (Baker et al., 2021), the statistical values of Cronbach's alpha score appeared more than 0.80 for respective variables. Thus, listed variables have viability to be considered in empirical investigation.

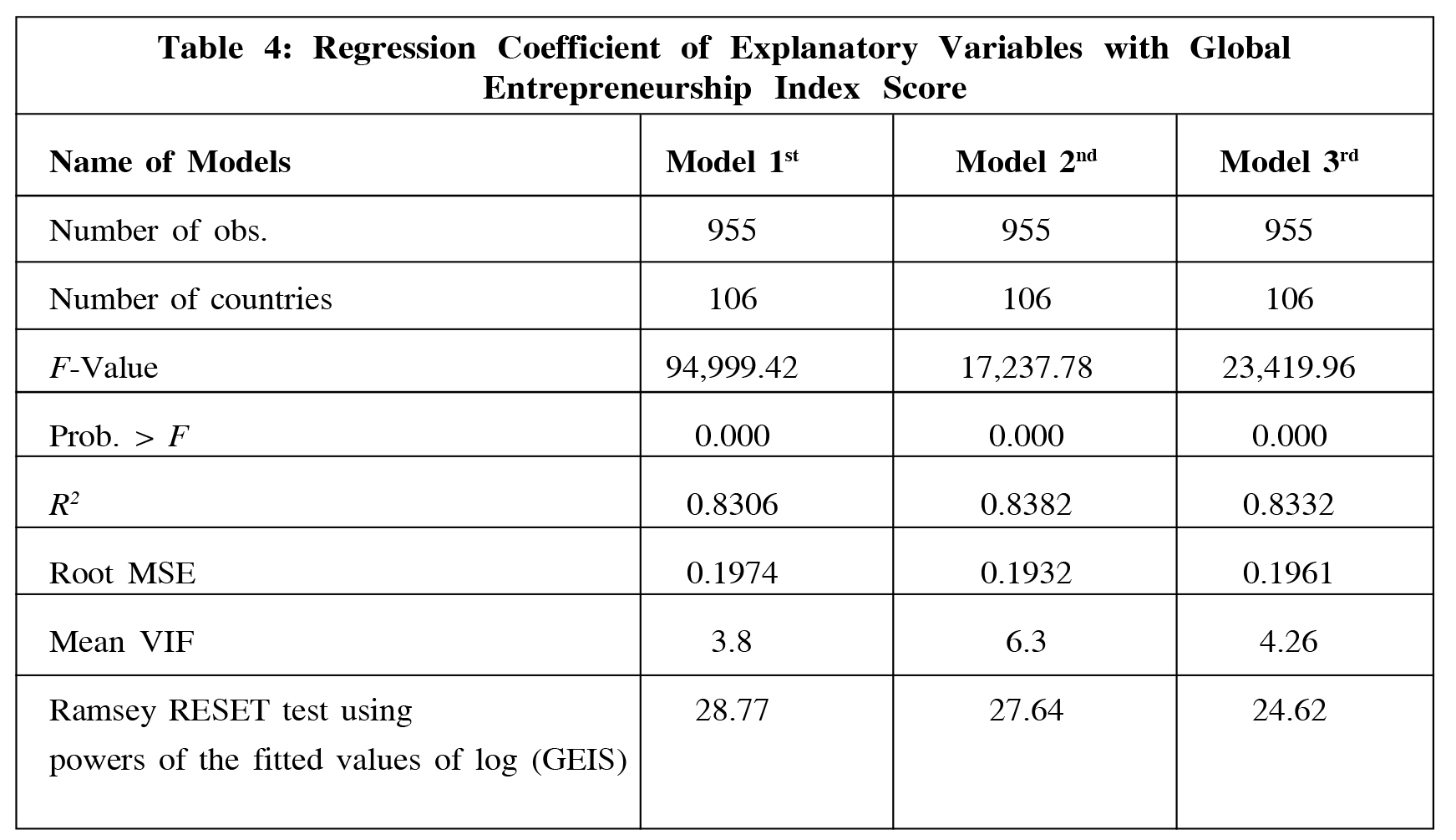

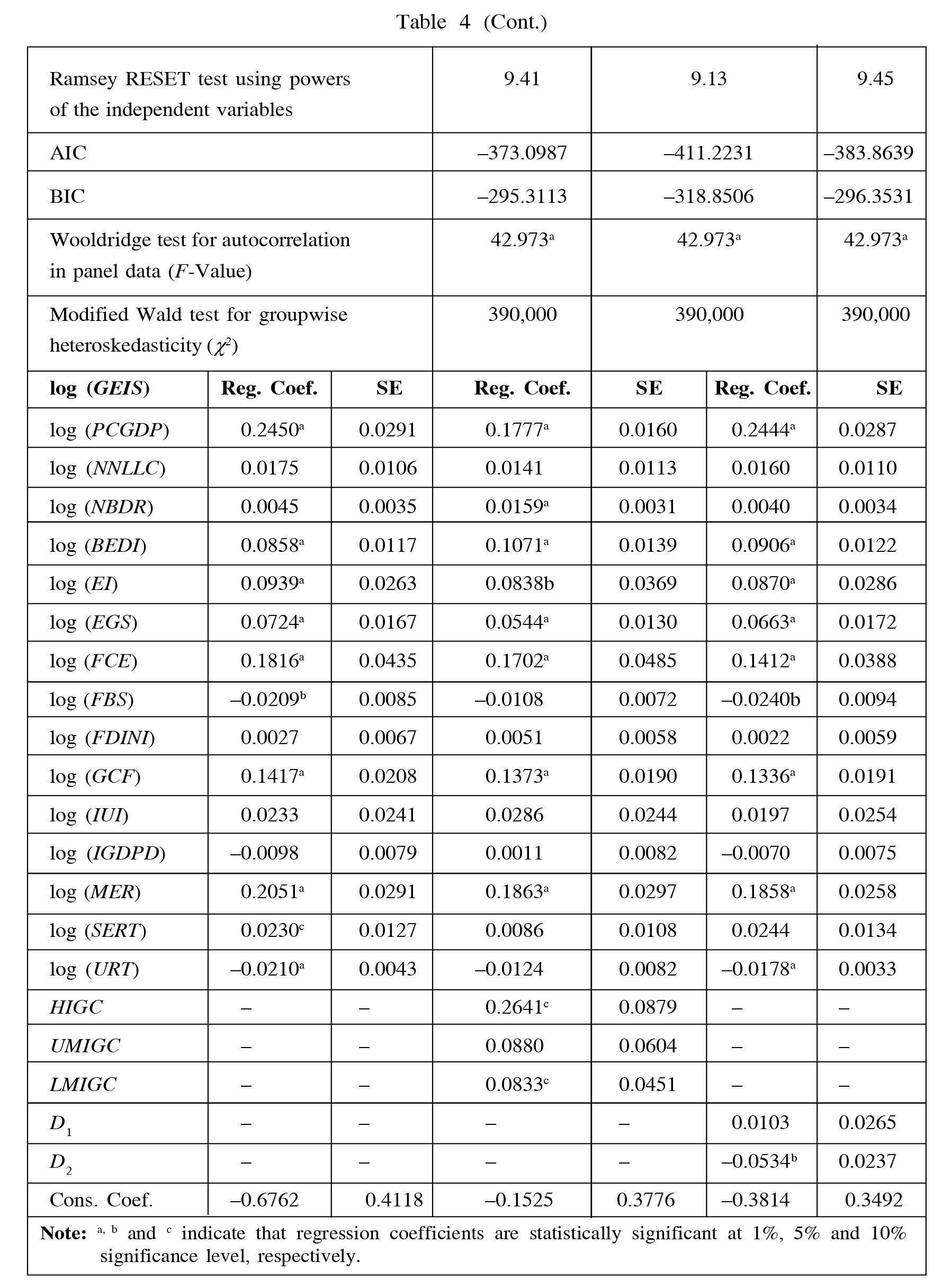

Regression Coefficients of Independent Variables with Entrepreneurship Ecosystem

The regression results for 1st, 2nd and 3rd models are given in Table 4. The F-values of these models were found statistically significant. It means that all variables have independent impact on entrepreneurship ecosystem and exhibited a goodness of fit of models as well. The R2 values were observed around 0.83 in all models which infer that 83% variation in entrepreneurship ecosystem depends upon comprised explanatory variables in the models. Also, the statistical values for Ramsey RESET test for fitted values of output and powers of the independent variables appeared statistically insignificant in all models. Hence, functional forms of proposed models were correctly specified. Moreover, the mean values of VIF appeared less than 10 in all models, which imply that independent variables do not have multi-correlation. However, F-values under Wooldridge test seemed statistically significant that indicate that there was existence of autocorrelation in panel data. Also, c2 values under Modified Wald test seemed statistically significant in the proposed models. Thus, it reveals that panel data have groupwise heteroskedasticity. Therefore, coefficients of explanatory variables with economic development were estimated using Driscoll-Kraay standard errors estimation model to reduce the presence of autocorrelation and groupwise heteroskedasticity. Furthermore, the 1st model produces lower values of AIC and BIC; thus, this model produces reliable coefficients of explanatory variables.

The regression result exhibited a positive impact of per capita GDP on global entrepreneurship index score. Entrepreneurship ecosystem is predicted to increase by 0.24% as per capita income increases by 1%. Hence, economic development is essential to nurture a favorable path of entrepreneurship ecosystem. The coefficient of number of limited liability companies with global entrepreneurship index score was found positive. The estimate infers that entrepreneurship ecosystem will improve as limited liability companies increase. The business density rate has a positive impact on global entrepreneurship index. Entrepreneurship ecosystem, therefore, is predicted to improve marginally as business density rate increases by 1%. The regression coefficient of business extent of disclosure index with global entrepreneurship index score was detected positive and statistically significant. Entrepreneurship ecosystem increases by 0.86% as business disclosure index increases by 1%.

The coefficient of employment in industry with global entrepreneurship index score was reported positive and statistically significant. Entrepreneurship ecosystem is projected to increase by 0.094% due to 1% increase in jobs in industrial sector. Exports of goods and services also showed a positive impact on global entrepreneurship index score. Entrepreneurship ecosystem is anticipated to increase by 0.07% as exports of goods and services increase by 1%. Final consumption expenditure also has a positive impact on global entrepreneurship index score. Entrepreneurship ecosystem is likely to increase by 0.18% as final consumption expenditure increases by 1%.

The coefficient of fixed broadband subscriptions with global entrepreneurship index score was seen negative and statistically significant. In modern times, people are using several online platforms for online trading of goods and services. Therefore, fixed broadband subscriptions may produce a negative impact on entrepreneurship ecosystem. Furthermore, the empirical results detect a positive impact of individuals using the Internet on global entrepreneurship index score. It provides a confirmation that entrepreneurship ecosystem increases by 0.0233% as Internet users increase by 1%, as Internet usage is a useful determinant of digitalization. Hence, it can be claimed that digitalization has a vital contribution to improving entrepreneurship ecosystem.

FDINI also showed a positive impact on the entrepreneurship ecosystem. Entrepreneurship ecosystem may improve by 0.0027% as FDINI increases by 1%. The coefficient of gross capital formation with global entrepreneurship index score was positive and statistically significant. Entrepreneurship ecosystem is likely to increase by 0.14% as gross capital formation increases by 1%. The coefficient of inflation GDP deflator with global entrepreneurship index score was observed to be negative and statistically significant. Therefore, entrepreneurial activities may decline due to marginal increase in inflation GDP deflator. The coefficient of price level ratio of PPP conversion factor (GDP) to market exchange rate with global entrepreneurship index score was observed to be positive and statistically significant. Entrepreneurship ecosystem is expected to improve by 0.20% as the market exchange rate increases by 1%.

The coefficient of self-employed rate with global entrepreneurship index score was perceived as positive. The estimate indicates that the entrepreneurship ecosystem may improve by 0.0230% as the self-employed rate increases by 1%. On the contrary, unemployment rate showed a negative impact on global entrepreneurship index score. Entrepreneurship ecosystem is likely to decline by 0.020% as the unemployment rate increases by 1%.

The coefficients of dummy variables for high-income, upper-middle income and lower-middle income group countries with global entrepreneurship index score appeared positive and statistically significant. Therefore, the impact of explanatory variables on entrepreneurship ecosystem appeared similar in different income group countries. The coefficients of dummy variables of developed countries with global entrepreneurship index score also appeared positive, while it was negative for developing countries. It implies that explanatory variables have a diverse impact on entrepreneurship ecosystems in both the countries.

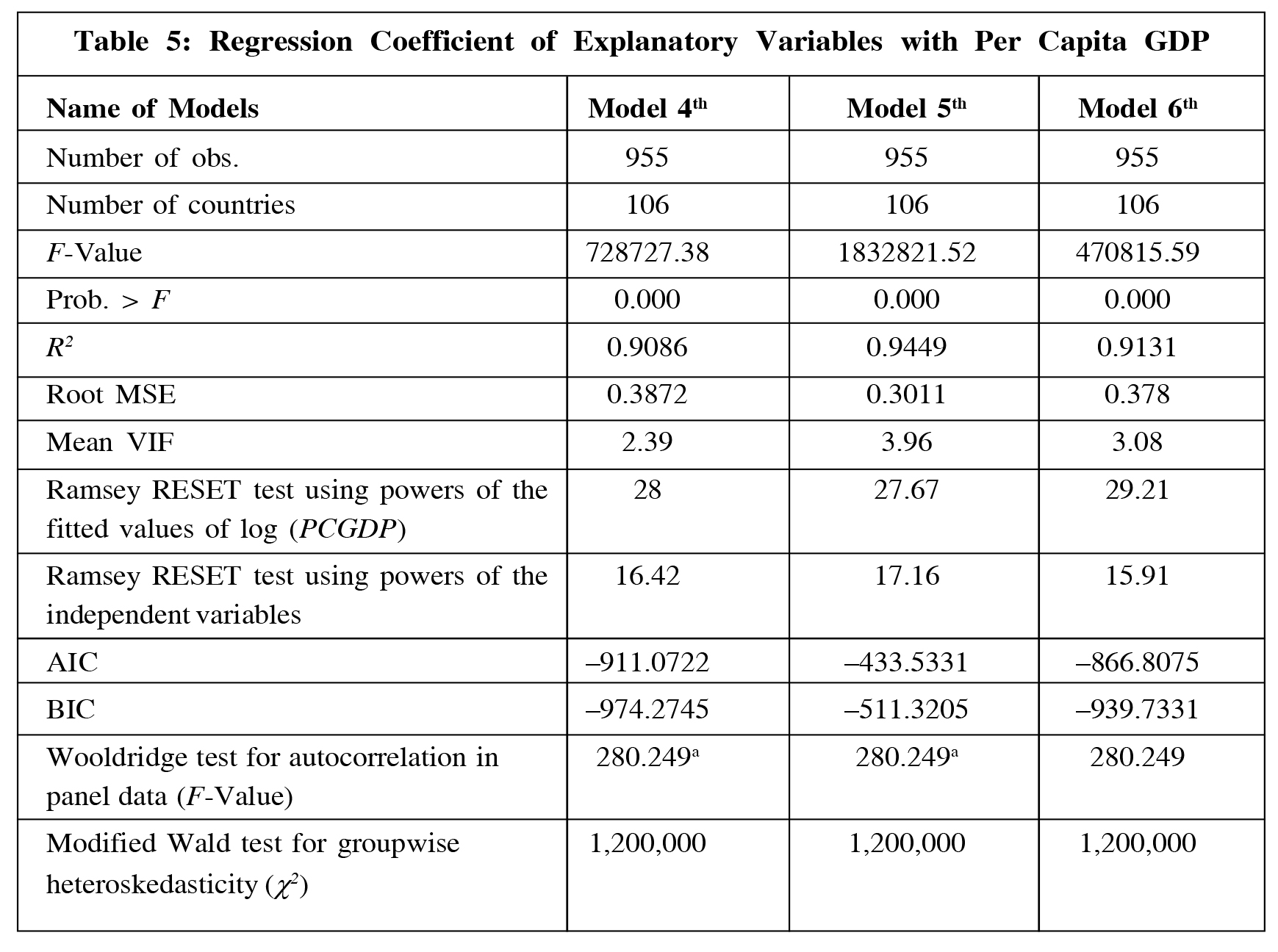

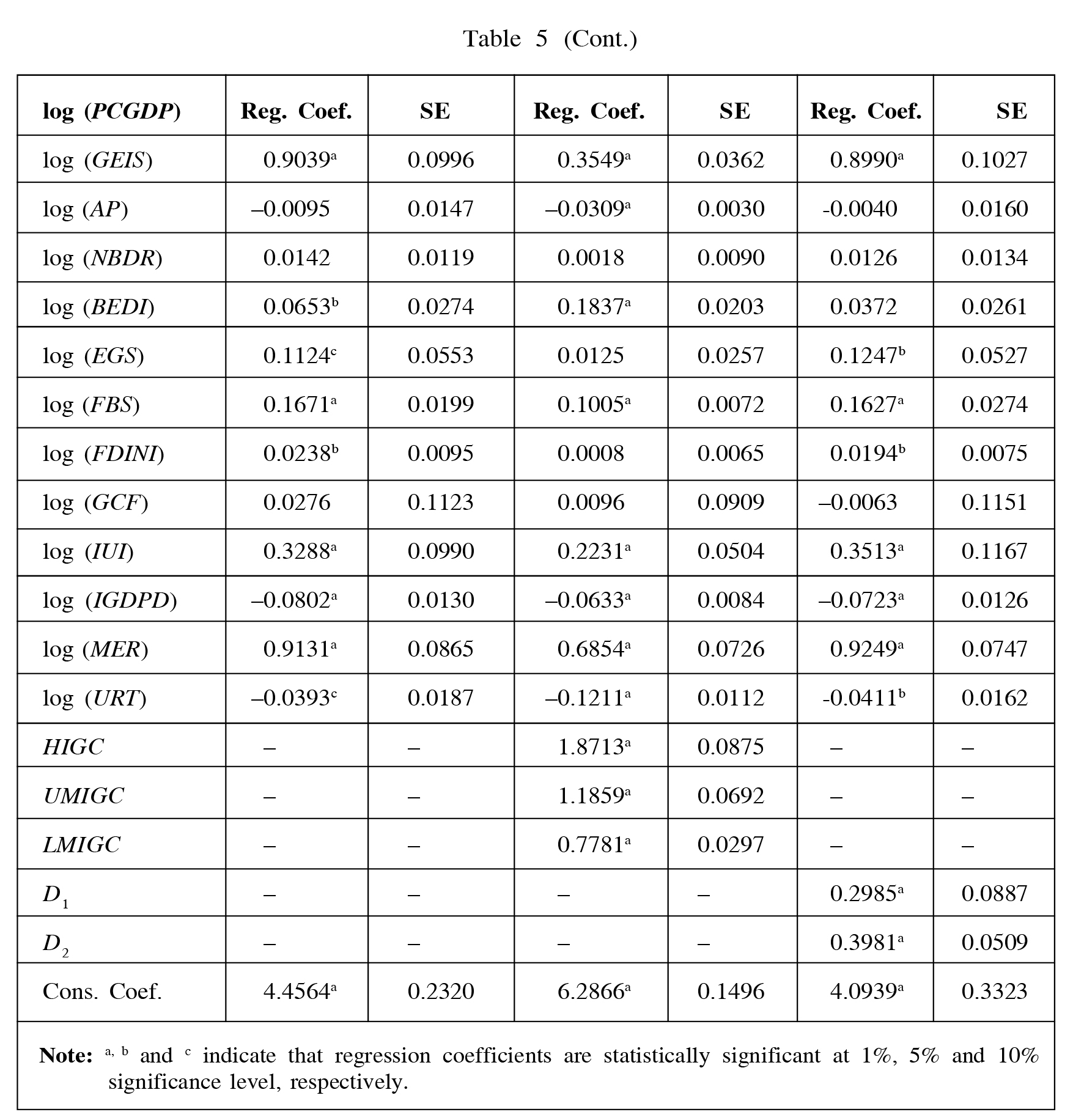

Regression Coefficient of Independent Variables with Economic Development

The regression results for 4th, 5th and 6th models are given in Table 5. As per the R2 values, around 94% variation in per capita GDP can be explained by the included variables in the 5th model. The mean value of VIF seemed less than 10 that shows that explanatory variables do not have multi-correlation. F-values under Ramsey RESET test for these models were found statistically significant, which recommended that the functional form of all regression equations was correctly defined. The F-values under Wooldridge test seemed statistically significant. It means that panel data has auto-correlation. Also, statistically significant c2 values under Modified Wald test showed that panel data has a groupwise heteroskedasticity since, the 5th model has the lowest values of AIC and BIC as compared to 4th and 6th models. Hence, this model provides rational coefficients of explanatory variables with per capita GDP.

The coefficient of global entrepreneurship index score with per capita GDP was observed to be positive and statistically significant. Per capita GDP is expected to increase by 0.35% as entrepreneurship ecosystem increases by 1%. The coefficient of adult population with per capita GDP was reported negative and statistically significant. It is obvious that rising population may be a cause for reduced per capita income. Per capita GDP may decline by 0.03% due to 1% increase in the adult population.

The coefficients of business density rate with per capita GDP were found positive and statistically significant. Per capita GDP is expected to increase marginally as the business density rate increases by 1%. The coefficient of business extent of disclosure index with per capita GDP was also detected positive and statistically significant. Per capita GDP may improve by 0.18% as the business extent of the disclosure index increases by 1%.

Exports of goods and services also have a positive impact on per capita GDP as exports of goods and services is a better indicator of trade openness. Hence, trade openness positively impacts economic development. The coefficient of fixed broadband subscriptions with per capita GDP was reported positive. It implies that fixed broadband subscriptions have a positive impact on economic development. Economic development increases by 0.10% as fixed broadband subscriptions increase by 1%.

The coefficient of FDINI with per capita GDP seemed positive and statistically significant. Per capita GDP is expected to increase due to 1% increase in FDINI. The coefficient of gross capital formation with per capita GDP was observed to be positive. Economic development is expected to increase substantially as gross capital formation increases by 1%. The coefficient of individuals using the Internet with per capita GDP appeared positive and statistically significant. Per capita GDP is projected to increase by 0.22% as Internet users increase by 1%. The coefficient of inflation GDP deflator with per capita GDP seemed negative and statistically significant. Per capita GDP is likely to decrease by 0.06% as inflation GDP deflator increases by 1%. The regression of market exchange rate with per capita GDP seemed positive and statistically significant. Per capita GDP is likely to increase by 0.68% as market exchange increases by 1%. Hence, economic development also depends upon market exchange rate. The impact of the unemployment rate on per capita GDP seemed negative and statistically significant. Per capita GDP may decline by 0.12% due to 1% increase in unemployment rate.

The coefficient of dummy variables of high-income, upper-middle income and lower-middle income group countries with per capita GDP seemed positive and statistically significant. Explanatory variables, therefore, have similar impact on per capita GDP in different income group countries. The coefficient of dummy variables of developed and developing countries with per capita GDP were found positive. Hence, it is suggested that explanatory variables can be considered in ongoing policies to increase economic development in both types of countries.

Discussion

The demand for goods and services increases as the income of people increases. Subsequently, per capita income has a larger impact on overall social welfare and livelihood security of people. Manufacturing firms increase their production scale and start new ventures to meet the rising demand for goods and services. Entrepreneurship ecosystem would improve as per capita GDP and economic development increase. Entrepreneurship ecosystem has a positive impact on economic development. Numerous studies like Wennekers et al. (2010), Naude (2013), Box et al. (2014), Audretsch et al. (2015), Bashir and Akhtar (2016), Rusu and Roman (2017), Dvoulety (2017), Erken et al. (2018), Sabra and Shreteh (2021), and Singh

et al. (2022) observed a positive impact of entrepreneurship ecosystem on economic development, economic growth and per capita GDP. Hence, entrepreneurship ecosystem and economic development have a positive causality with each other.

Number of limited liability companies is a significant determinant to create capital formation. Accordingly, it supports increased money flow, financial stability and financial development. As a result, the entrepreneurship ecosystem is expected to improve as the number of new limited liability companies increases. Fuerlinger et al. (2015) also found a positive effect of limited liability companies on the entrepreneurship ecosystem in Germany. Business density rate is the number of firms for 1000 adult people. Hence, it is noticeable that jobs for adult people increases as business density rate increases. Consequently, it would assist to increase the per capita income and gross output. Furthermore, disposable income, direct and indirect taxes for government, money flows into the market and entrepreneurial activities would increase as business density rate increases. Wennekers et al. (2010) and Audretsch

et al. (2015) also found a positive impact of new business density rate on economic growth and development. Business extent disclosure index measures the extent at which investors get protection and ownership for their financial investment. Hence, awareness of new investors towards financial activities increases as business extent disclosure index increases. Accordingly, it would help improve entrepreneurship ecosystem and economic development.

More industries need to be set up to meet demand. At the same time, industries need advanced technologies, technological processes, innovation and skilled workers to produce goods and services to meet the requirement of consumers. Subsequently, the entrepreneurship ecosystem would help create jobs for skilled and unskilled workers. The said process will enhance the income of people, production scale of industries and profits of the employers. Also, entrepreneurs will take more risk to start more ventures to earn more profit. Hence, creation of employment in the industrial sector would be beneficial to cultivate entrepreneurship ecosystem (Singh et al., 2020 and 2022).

Exports of goods and services are helpful to create jobs, increase production capability of firms, develop new ventures, create capital formation and increase profit of businessmen. It is also a better indicator of trade openness (Sabra and Shreteh, 2021). Moreover, exports of goods and services are useful to increase foreign revenue and reduce monopoly, and increase foreign trade and production scale of manufacturing firms. Subsequently, it may be positive to create extensive jobs and increase the income of the people. Existing studies also analytically and conceptually proved that exports of goods and services have a positive impact on economic development and entrepreneurship ecosystem (Sabra and Shreteh, 2021; and Singh et al., 2022). Moreover, the growth of business organizations and manufacturing sector depends upon demand for goods and services. Therefore, consumption expenditure works as a useful determinant to create new firms and business organizations. Consequently, the entrepreneurship ecosystem will improve as final consumption expenditure increases (Adusei, 2016; and Singh et al., 2022).

Fixed broadband subscriptions may be a useful driver to increase communication among the people (Appiah-Otoo and Song, 2021). It also creates an online platform for consumers and producers to increase trading of goods and services. Therefore, it may help increase economic activities of consumers and producers. Further, it would be positive to increase economic growth and development (Minges, 2015). Furthermore, Internet facilities bring several benefits to producers and consumers like the ability to search for information related to various products online (Kutsuri et al., 2019). Therefore, it creates a conducive ecosystem to increase online trading of goods and services, and a platform for digitalization (Mentsiev

et al., 2020). At present, most economies are moving towards digitalization to create more business opportunities. Digitalization develops a beneficial ecosystem for producers to produce new goods and services. Also, digitalization creates new business and jobs for skilled people. Consequently, the Internet is highly effective in increasing digital marketing that enhances economic development and entrepreneurship ecosystem (Hernandez et al., 2016; Afonasova et al., 2019; and Mentsiev et al., 2020).

FDINI creates favorable ecosystem to increase the economic development through increasing exports of goods and services, skills and knowledge of people, infrastructure development, technology transfer, investment in capital and money market, and investment in the manufacturing sector (Dritsakris and Varelas, 2006; Iqbal et al., 2017; and Singh et al., 2022). Subsequently, the entrepreneurship ecosystem will be augmented as FDINI increases. Rusu and Roman (2017) and Dvoulety (2018) also reported a positive impact of foreign direct investment on entrepreneurship ecosystem. Moreover, FDINI creates physical assets, infrastructure development and new business opportunities. Consequently, it is an essential driver to increase jobs for skilled and unskilled workforce. Singh and Ashraf (2020) also observed that FDINI has a positive impact on economic development. Leylian et al. (2021) also argued that foreign direct investment has a positive contribution to improving economic development.

Gross capital formation includes the investment on land, machinery and technologies by private and public players. It has a positive impact on jobs, infrastructural development and industrial development (Singh and Kumar, 2021). Accordingly, it assists in improving the entrepreneurship ecosystem. It also comprises gross business fixed investment, gross residential construction investment and gross public investment. Further, gross capital formation is significantly associated with change in net inventories and innovation. Also, it is an indispensable driver to increase human productivity and efficiency of resources. It also includes investment in different sectors like schools, plants, building construction, machineries, equipment, road and highway construction, construction of industrial buildings, techno parks and other physical assets. Thus, it increases the investment in the financial market which meets the financial requirements of new entrepreneurs. As a result, gross capital formation would be helpful in increasing financial stability, economic development and entrepreneurship ecosystem (Sabra and Shreteh, 2021).

Inflation has a negative impact on per capita GDP and entrepreneurship ecosystem due to various reasons as real income of people decreases and cost of living also increases due to rising inflation. Subsequently, it reduces demand for goods and services, which decreases the production competencies of manufacturing firms and business organizations. Thereupon, production, level of employment, investment, income, profit, saving, consumption, money flows, financial stability and government expenditure also decline due to increase in inflation. Hence, entrepreneurship ecosystem and economic development will be vulnerable due to increase in inflation. Rusu and Roman (2017) also reported a negative impact of inflation on demand for goods and services, production in manufacturing sector and money flows. Khalilnejad and Gharraie (2021) also observed that high inflation has a negative influence on economic growth and entrepreneurship ecosystem.

Market exchange rate maintains the imports and exports of goods and services under foreign trade. Thus, the market exchange rate directly contributes to improving entrepreneurship ecosystem. Foreign direct investment, business and employment rate increase as exchange rate increases. Market exchange rate, thus, plays a vital role in increasing bilateral agreements among countries to increase their trade relations. Cho (2012) and Rinku (2014) found a significant influence of market exchange rate on foreign trade. Foreign trade is a useful determinant of economic development. Hence, it is noticeable that entrepreneurship ecosystem and economic development will improve as market exchange rate increases.

Per capita income, living standard, purchasing power and social welfare, demand for goods and services, and infrastructure development decline due to increase in unemployment rate. High unemployment rate may also increase income inequality, poverty, black marketing, crime and other social issues, financial instability and government expenditure on non-developmental activities. Thereafter, production of manufacturing firms and business organizations declines due to high unemployment rate. Unemployment rate, therefore, has a negative impact on entrepreneurship ecosystem (Audretsch et al., 2015; Dvoulety, 2017; Dvoulety, 2018; and Singh et al., 2022). Moreover, high unemployment rate will reduce consumption pattern and demand for goods and services. As a result, economic growth and development would also decline due to increase in unemployment rate.

Adult and working population needs jobs to be economically active and to sustain their livelihood. However, most countries are unable to provide jobs to their working population. Therefore, per capita GDP declines due to increase in adult population. As a result, economic development may be adversely affected due to rising population. However, a few studies argued that human resources have a crucial contribution to improving economic development (Sabra and Shreteh, 2021; and Yoo and Yi, 2022). Moreover, self-employed workers have an ability to change and reduce monopoly in the market. It is expected that after a certain time period, a self-employed person may become an entrepreneur. Further, new entrepreneurs have the ability to make the change in the markets by introducing new goods and services with better quality, develop innovative method of production, open a new market and increase supply of new materials (Zahedi and Otterpohl, 2015). Therefore, entrepreneurship ecosystem and economic development are likely to improve as self-employed workers percentage increases.

Conclusion

This study measured the factors affecting entrepreneurship ecosystem and economic development in 106 cross-sectional countries using a Cobb-Douglas production function model. The empirical results infer that economic development, number of limited liability companies, business density rate, business extent of disclosure index, employment in industry, exports of goods and services, final consumption expenditure, individuals using the Internet, FDINI, gross capital formation, market exchange rate and self-employed have a positive impact on global entrepreneurship index score. Hence, these variables were considered useful determinants of entrepreneurship ecosystem. The coefficients of dummy variables with entrepreneurship ecosystem in high-income, upper-middle income, lower middle-income group, and developed and developing countries appeared similar. Hence, the explanatory variables do not have diverse impact on entrepreneurship ecosystem in different income group countries.

Global entrepreneurship index score, new business density rate, business extent disclosure index, exports of goods and services, foreign direct investment net inflow, gross capital formation, individuals using the internet and market exchange have a positive impact on per capita GDP. As per capita GDP reflects overall economic development, the aforesaid variables were perceived as the most influencing factors of economic development. The results also claimed that economic development and entrepreneurship ecosystems have a positive causality. It means that entrepreneurship ecosystem may be useful to improve economic development, and economic development may be helpful to improve entrepreneurship ecosystem. Furthermore, the overall impact of explanatory variables on entrepreneurship ecosystem and economic development were similar in high, upper-middle, lower-middle and low-income group countries. However, explanatory variables showed a diverse impact on economic development and entrepreneurship ecosystems in developed and developing countries. The developed and developing countries, therefore, should follow different policies to improve economic development and entrepreneurship ecosystem.

The developing countries should create jobs for the adult and working population to increase their income, purchasing power and consumption expenditure. This initiation would increase the demand for goods and services, which would further encourage manufacturing industries to increase production scale. Consequently, to meet the demand for goods and services, industries will hire more skilled and unskilled workers. The above-mentioned process would ensure equilibrium in demand and supply of goods and services in the domestic and international markets. Furthermore, it would be helpful to increase exports of goods and services, and foreign trade. In most developing countries, a large segment of the working population is engaged in the agricultural sector. Therefore, these countries should focus on industrial development to create more jobs for the surplus labor force of the agricultural sector. The developing countries should also provide training to the working population to increase their entrepreneurial skills. This policy initiative would be helpful to increase business density rate and creation of new limited liability companies in developing countries. Thereupon, business density rate and limited liability companies would nurture an appropriate entrepreneurship ecosystem. It would also increase the self-employed rate and reduce the unemployment rate in the developing countries. The developing countries should also reduce high inflation to sustain demand for goods and services, real income of people, saving and investment, consumption expenditure and production of all sectors. These countries should regularly review monetary and fiscal policies to regulate high inflation. It would increase the trust of businessmen and increase their investment in money and the capital market. Subsequently, it would also improve economic development and entrepreneurship ecosystem in developing countries.

At present, the entrepreneurship ecosystem cannot be nurtured without science and technological development, technology and knowledge transfer, strict IPRs regime and digitalization. Therefore, developing countries should increase R&D expenditure and create appropriate R&D ecosystems to develop digital technologies and ICT. These also provide high Internet facilities to their population to be involved in online activities of market. Hence, the developing countries should develop digital platforms and infrastructure to be a digital economy. Consequently, digitalization would ensure better entrepreneurship ecosystem and economic development. The developing countries should create a favorable ecosystem, follow transparent taxation policies and maintain transparency in the financial market to increase the trust of foreign investors. It would enhance the global value chain, foreign direct investment inflows and trade openness of developing countries. Further, FDI would create gross capital formation and employment in developing countries. Finally, the developing countries should also give more attention to regulating the exchange rate of their currency.

References

- Acs Z J and Szerb L (2012), Global Entrepreneurship and Development Index, Edward Elgar Publishing.

- Acs Z J, Estrin S, Mickiewicz, T and Szerb L (2018), "Entrepreneurship, Institutional Economics and Economic Growth: An Ecosystem Perspective", Small Bus. Econ., Vol. 51, No. 2, pp. 501-514.

- Adusei M (2016), "Does Entrepreneurship Promote Economic Growth in Africa?", African Development Review, Vol. 28, No. 2, pp. 201-214.

- Afonasova M A, Panfilova E E, Galichkina M A and Slusarczyk B (2019), "Digitalization in Economy and Innovation: The Effect on Social and Economic Process", Polish Journal of Management Studies, Vol. 19, No. 2, pp. 22-32.

- Ali M, Raza S A A, Puah C H and Samdani S (2021), "How Financial Development and Economic Growth Influence Human Capital on Low-Income Countries", International Journal of Social Economics, Vol. 48, No. 10, pp. 23-43.

- Appiah-Otoo I and Song N (2021), "The Impact of ICT on Economic Growth-Comparing Rich and Poor Countries", Telecommunications Policy, Vol. 45, No. 2, pp. 1-15.

- Ashraf S N and Singh A K (2019), "Does Entrepreneurship Ecosystem have a Long-Term Relationship with Economic Growth in Selected Economies? A Statistical Investigation", in S Misra, S Shukla and G Batthini (Eds.), Proceedings of the 13th Biennial Conference on Entrepreneurship Organized by EDII Ahmedabad, Bookwell Publishing House New Delhi.

- Aslan A, Gozbasi O, Altinoz B and Altuntas M (2021), "Impact of Financial Development and Economic Growth on Energy Consumption: A Panel Vector Autoregressive Analysis for the Comparison of G7 and Top 10 Emerging Market Economies", Energy and Environment, Vol. 32, No. 7, pp. 1315-1330.

- Audretsch D B, Belitski M and Desai S (2015), "Entrepreneurship and Economic Development in Cities", Annals of Regional Sciences, Vol. 55, No. 1, pp. 3360.

- Baker M, Lu P and Lamm A J (2021), "Assessing the Dimensional Validity and Reliability of the University of Florida Critical Thinking Inventory (UFCTI) in Chinese: A Confirmatory Factor Analysis", Journal of International Agricultural and Extension Education, Vol. 28, No. 3, pp. 41-56.

- Bashir H A and Akhtar A (2016), "The Role of Innovative Entrepreneurship in Economic Development: A Study of G20 Countries", Management Studies and Economic System, Vol. 2, No. 2, pp. 91-100.

- Box M, Lin X and Gratzer K (2014) "Linking Entrepreneurship and Economic Growth in Sweden, 1850-2000", PESO Working Paper 1, School of Social Sciences Södertörn University.

- Chen C C (2014), "Entrepreneurship, Economic Growth and Employment: A Case Study of Taiwan", Hitotsubashi Journal of Economics, Vol. 55, No. 1, pp. 71-88.

- Cho W J (2012), "A Study on Factors Affecting US Bilateral Trade with Her Major Trading Partners", Ph.D. Thesis, Graduate Faculty of the North Dakota State University of Agriculture and Applied Science.

- Dhahri S and Omri A (2018), "Entrepreneurship Contribution to the Three Pillars of Sustainable Development: What Does the Evidence Really Say?", MPRA Paper No. 84504.

- Dritsakris N and Varelas E (2006), "The Main Determinants of Economic Growth: An Empirical Investigation with Granger Causality Analysis for Greece", European Research Studies, Vol. 9, Nos. 3-4, pp. 47-58.

- Dvoulety O (2017), "Relationship Between Unemployment and Entrepreneurship Dynamics in the Czech Regions: A Panel Var Approach", Acta Universitatis Agriculturae Et Silviculturae Mendelianae Brunensis, Vol. 65, No. 102, pp. 987-995.

- Dvoulety O (2018), "How to Analyse Determinants of Entrepreneurship and Self-Employment at the Country Level? A Methodological Contribution", Journal of Business Venturing Insights, Vol. 9, No. 1, pp. 92-99.

- Erken H, Donselaar P and Thurik R (2018), "Total Factor Productivity and the Role of Entrepreneurship", Journal of Technology Transfer, Vol. 43, No. 1, pp. 1493-1521.

- Farayibi A (2016), "Entrepreneurship as a Driver of Economic Growth: Evidence from Enterprise Development in Nigeria", MPRA Paper No. 74591.

- Fritsch M and Wyrwich M (2017), "The Effect of Entrepreneurship on Economic Development: An Empirical Analysis using Regional Entrepreneurship Culture", Journal of Economic Geography, Vol. 17, No. 1, pp. 157-189.

- Fuerlinger G, Famdl U and Funke T (2015), "The Role of the State in the Entrepreneurship Ecosystem: Insights from Germany", Triple Helix, Vol. 2, No. 3, pp. 1-15.

- Hameli A, Kampouris I, Machaal A K and Mertzanis C (2021), "Financial Development, Institutions, Gender and Entrepreneurship in the United Arab Emirates", Asian Journal of Empirical Research, Vol. 11, No. 2, pp. 111-22.

- Hernandez K, Faith B, Martín P P and Ramalingam B (2016), "The Impact of Digital Technology on Economic Growth and Productivity and its Implications for Employment and Equality: An Evidence Review", Evidence Report No. 207, Institute of Development Studies, England.

- Iqbal B A, Turray A and Sami S (2017), "Impact of Indo-US Trade on India's Economic Growth: An Empirical Analysis", Transnational Corporation Review, Vol. 9, No. 1, pp. 8-15.

- Jyoti B and Singh A K (2020), "Characteristics and Determinants of New Start-Ups in Gujarat, India", Entrepreneurship Review, Vol. 1, No. 2, pp. 1-25.

- Kamel H, Khoutem B J and Boujelbene T D (2021), "Threshold Effects of Inflation in the Financial Development-Economic Growth Nexus in Tunisia", International Journal of Monetary Economics and Finance, Vol. 14, No. 5, pp. 438-459.

- Khalilnejad Z and Gharraie R (2021), "Financial Development and Economic Growth: The Inflation Threshold Effect", International Journal of Economic Policy in Emerging Economies, Vol. 14, No. 5-6, pp. 23-43.

- Kutsuri G N, Kamberdieva S S, Dedegkaev V K H et al. (2019), "Impact of Digitalization on Improvement of Economy, IT and Internet of Business", Journal of Physics: Conference Series, Vol. 1399, No. 2019, pp. 1-6.

- Leylian N, Ebarahimi M, Zare H and Haghighat A (2021), "Assessing the Short Run and Long Run Effects of Foreign Direct Investment, Human Capital and Financial Development on the Economic Growth of Different Income Groups in Developing Countries (Application of the Panel Cointegration Approach)", Quarterly Journal of Quantitative Economics, https://jqe.scu.ac.ir/article_16933.html?lang=en

- Mentsiev A U, Engel, M V, Tsamaev A M et al. (2020), "The Concept of Digitalization and its Impact on the Modern Economy", Advances in the Economics, Business and Management Research, Vol. 128, No. 1, pp. 2960-2964.

- Minges M (2015), "Exploring the Relationship Between Broadband and Economic Growth", Background Paper, World Development Report 2016: Digital Dividends.

- Moya-Clemente I, Ribes-Gine G and Pantoja-Dyaz O (2020), "Identifying Environmental and Economic Development Factors in Sustainable Entrepreneurship over Time by Partial Least Squares (PLS)", PLoS ONE, Vol. 15, No. 9, pp. 1-17.

- Naude W (2013), "Entrepreneurship and Economic Development: Theory, Evidence and Policy", IZA Discussion Paper No. 7507, Bonn, Germany.

- Omoruyi, E M M, Olamide K S, Gomolemo G and Donath O A (2017), "Entrepreneurship and Economic Growth: Does Entrepreneurship Bolster Economic Expansion in Africa?", Journal of Socialomics, Vol. 6, No. 4, pp. 1-11.

- Rinku A (2014), "Globalization and its Effects on India", Economic Affairs, Vol. 59, No. 1, pp. 797-803.

- Rusu V D and Roman A (2017), "Entrepreneurial Activity in the EU: An Empirical Evaluation of its Determinants", Sustainability, Vol. 9, No. 1679, pp. 1-16.

- Sabra M M and Shreteh D (2021), "The Nexus Relationship Between Entrepreneurship and Economic Growth Dynamic: Evidence from Selected MENA Countries", International Economic Policy, Vol. 2, No. 35, pp. 56-75.

- Singh A K and Ashraf S N (2020), "Association of Entrepreneurship Ecosystem with Economic Growth in Selected Countries", Journal of Entrepreneurship, Business and Economics, Vol. 8, No. 2, pp. 36-92.

- Singh A K and Jyoti B (2021), "Further Research Direction for Indicators of Technology Entrepreneurship Ecosystem Technology Start-Ups Ecosystem and Technology-Business Incubators: A Conceptual Review", Dimensions International Journal of Management, Vol. 7, No. 1, pp. 14-33, ICFAI Business School (IBS), Mumbai.

- Singh A K and Kumar S (2021), "Assessing the Performance and Factors Affecting Industrial Development in Indian States: An Empirical Analysis", Journal of Social Economic Research, Vol. 8, No. 2, pp. 135-154.

- Singh A K and Kumar S (2022), "Expert's Perception on Technology Transfer and Commercialization and Intellectual Property Rights in India: Evidence from Selected Research Organizations", Journal of Management, Economics, and Industrial Organization, Vol. 6, No. 1, pp. 1-33.

- Singh A K, Arya A and Jyoti B (2019), "A Conceptual Review on Economic, Business, Intellectual Property Rights and Science & Technology Related Activities in Asian Economies", JNNCE Journal of Engineering & Management, Vol. 3, No. 2, pp. 1-22.

- Singh A K, Singh B J and Ashraf S N (2020), "Implications of Intellectual Property Protection and Science and Technological Development in the Manufacturing Sector in Selected Economies", Journal of Advocacy, Research and Education, Vol. 7, No. 1, pp. 16-35.

- Singh A K, Jyoti B, Kumar S and Lenka S K (2021), "Assessment of Global Sustainable Development, Environmental Sustainability, Economic Development and Social Development Index in Selected Economies", International Journal of Sustainable Development and Planning, Vol. 16, No. 1, pp. 123-138.

- Singh A K, Kumar S, Sharma A K and Sinha S (2022), "Does Green Entrepreneurship have an Association with Sustainable Development and its Components? Evidence from Country-Wise Panel Data Investigation", in M Magd, D Singh, D Spicer and R T Syed (Eds.), International Perspectives on Value Creation and Sustainability Through Social Entrepreneurship, IGI Global, https://www.igi-global.com/gateway/chapter/309829

- Szerb L, Aidis R and Acs J (2013), "The Comparison of the Global Entrepreneurship Monitor and the Global Entrepreneurship and Development Index Methodologies", Foundations Trends® in Entrepreneurship, Vol. 9, No. 1, p. 142.

- Szerb L, Acs Z J, Markus G et al. (2018), "The Global Entrepreneurship Index (GEI) - European Dataset", http://www.projectfires.eu/wp-content/uploads/2018/07/d4.2-the-global-entrepreneurship-index-gei-european-dataset.pdf

- Tasnim N and Ibne Afzal M N (2018), "An Empirical Investigation of Country Level Efficiency and National Systems of Entrepreneurship Using Data Envelopment Analysis (DEA) and the Tobit Model", Journal of Global Entrepreneurship Research, Vol. 8, No. 37, pp. 1-17.

- Tunali C B and Sener S (2019), "The Determinants of Entrepreneurship in Turkey", Procedia Computer Science, Vol. 158, No. 1, pp. 648-652.

- Wennekers S, van Stel A, Carree M and Thurik R (2010), "The Relationship Between Entrepreneurship and Economic Development: Is it U-Shaped?", Foundations and Trends in Entrepreneurship, Vol. 6, No. 3, pp. 167-237.

- Yoo I and Yi C G (2022), "Economic Innovation Caused by Digital Transformation and Impact on Social Systems", Sustainability, Vol. 14, No. 2600, pp. 1-18.

- Zahedi A and Otterpohl R (2015), "Towards Sustainable Development by Creation of Green Social Entrepreneur's Communities", Procedia CIRP, Vol. 26, No. 2015, pp. 196-201.

- Zaki I M and Rashid N H (2016), "Entrepreneurship Impact on Economic Growth in Emerging Countries", The Business and Management Review, Vol. 7, No. 2, pp. 31-39.