December'20

The IUP Journal of Entrepreneurship Development

Archives

Moderating Effect of Environmental Uncertainties on Entrepreneurial Orientation and Business Performance Relationship in SMEs in Kurunegala District, Sri Lanka

P Venkateswarlu

Professor, ICFAI University, Dehradun, Uttarakhand, India. E-mail: venkat@ibsindia.org

Deepal N Perera

Ph.D. Scholar, ICFAI University Tripura, Agartala, India. E-mail: deepal@expack.lk

Vivek Ranga

Director, ICFAI Business School, Ahmedabad, Gujarat, India; and is the corresponding author.

E-mail: vivekr@ibsindia.org

This paper underscores the importance of policy formulation in entrepreneurship development in Nigeria as well as the importance of entrepreneurship in reducing the ever-growing rate of unemployment in Nigeria. The methodology adopted for this paper is the Narrative-Textual Case Study (NTCS); it is a social science research method that relies on information and data from several sources for problem identification and problem solving. The paper opines that entrepreneurship is lacking in Nigeria due to certain challenges such as epileptic power supply, lack of genuine support for those intending to start up a business, lack of strong will power to take risks; all these and more inhibit entrepreneurship development and create unemployment. The paper concludes that government policy on entrepreneurship should be more robust and that the government should create a conducive business environment to enhance entrepreneurship development and reduction in youth unemployment.

Introduction

In the era of globalization, with the advent of technology, competitive and explosive growth, the world has become a global village. Organizations and industries are facing challenges throughout the world to be part of the global economy. In order to survive, one has to keep pace with the swift advancements in technology; to lead is very hard on the one hand and at the same time, it opens up opportunities which were never explored. Entrepreneurship is one of the powerful factors for the economic development of the countries, which has become a symbol of business tenacity.

Entrepreneurship perhaps is one term that invariably features high when it comes to the socioeconomic agenda of any country. The whole idea of entrepreneurship is fundamentally driven by individual's business astuteness essentially coupled with risk-taking propensity. Entrepreneurship involves taking cognizance of business prospects, capitalizing upon ideas and innovation, mobilizing essential resources to establish and operate a business venture, driven by the intellect and readiness to anticipate and address the risks and liabilities that accompany the rewards and possibilities.

The pursuit of success an entrepreneur takes is with immense passion and perseverance. Individuals in the quest of becoming entrepreneurs face and encounter challenges and adversities. The major bottlenecks to combat and survive through myriads of challenges include market-related contingencies, regulatory obligations twice as complicated by bureaucratic glitches, financing quandaries and multitudes of risks and liabilities. The unrestrained dynamics of global business environment intensifies the tests and trials for entrepreneurs. It is not just the ambition and risk-taking ability that an individual needs to be fortified with, but high level of resilience, self-efficacy and endurance are also imperative.

When asked about entrepreneurs in India, the examples of Dirubhai Ambani, Narayana Murthy, Adanis and Azim Premji, etc. come to one's mind, although there are so many people who have struggled to attain success and created a lasting impact on the society. Entrepreneurial Orientation (EO) is a concept where executives craft strategies with a hope to exploit opportunities for business, which others cannot do. EO concept embraces five dimensions, viz., innovativeness, risk-taking propensity, proactiveness, competitive aggressiveness and autonomy.

The present study is aimed at investigating the moderating effect of Environmental Uncertainties (EU) on the relationship of EO dimensions and Business Performance (BP). EU are: product obsolescence in the firm is very high; the environment in which firms operate are challenging, stressful, hostile and difficult to keep oneself afloat; the actions of competitors are unpredictable; demand and tastes of the consumers are unpredictable; and the models of production change very frequently in a big way.

Literature Review

Business prosperity is defined as an opportunity development which involves creativity by the entrepreneurs rather than opportunity recognition. The need or resources 'identified' or 'perceived' will only become viable with 'development'. Opportunity development comprises recognizing the opportunity, evaluation and adoption. These opportunities are evaluated at every stage of development which may be informal or unarticulated (Tang and Tang, 2012). The word 'evaluation' determines whether or not developing the opportunity will be able to gather resources to mature it to the next stage.

Innovativeness: Innovativeness represents the tendency for any enterprise to support creativity, new products, novelty and experimentation, which results in new technological processes, new products and services. It is an important means of exploring opportunities and hence is an important component of entrepreneurship (Lumpkin and Dess, 1996). Schumpeter (1934) referred to innovativeness as the heart of entrepreneurship. He defined entrepreneur as a financial person who always tries to maximize his profits through innovations in his field of specialization such as new products, new markets, new production techniques, new source of supply and new form of the firm. According to Schumpeter, all these initiatives are very important for a business activity, but he feels that 'introduction of new products' is more important and more influential than all these as it has direct impact on increasing the human welfare. All other factors could contribute when 'introduction of new products' is present.

Drucker (1985) imitated Schumpeter by saying that innovativeness is the important factor for competitive advantage, growth, development and profitability. There is no business in the world without innovation (Wiklund and Shepherd, 2003; and Edmondson and Nembhard, 2009). Lumpkin and Dess (1996) defined innovativeness as the firms' propensity to engage their staffs' creativity and come out with new ideas as experimentation will always result in developing new products and services. They also stated that Schumpeter was the first one to emphasize the role of innovation in entrepreneurial process.

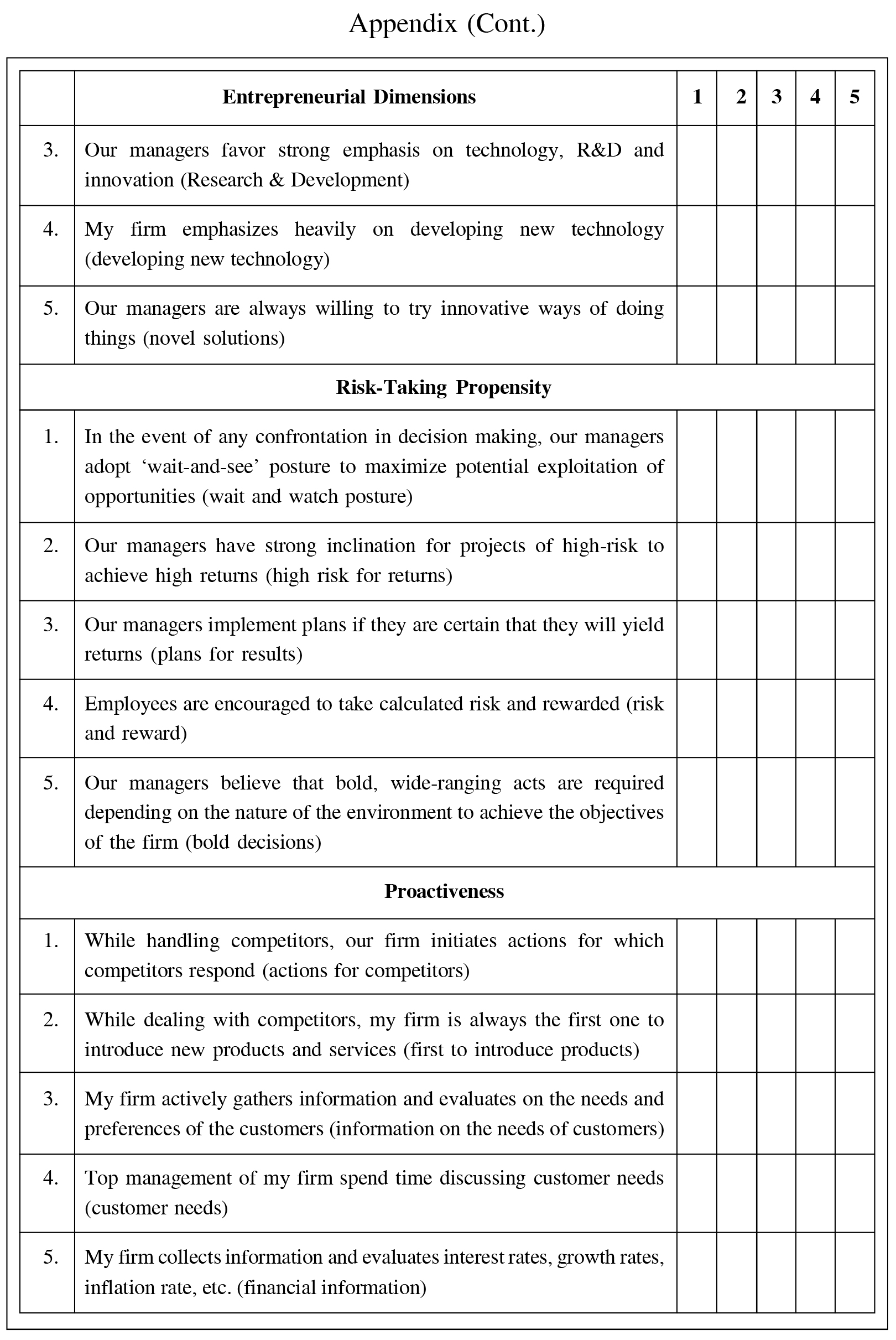

Risk Taking: Risk-taking ability is represented as the bold and courageous decisions to venture into unknown markets and allocating large amounts of resources without knowing the outcomes. It is described by Wiklund and Shephered (2003) as willingness to spare huge resources which involve probability of high failures. The literature pertaining to entrepreneurship, strategic management and risk taking has come out as one of the factors affecting the posture of the firm. It shows the firms' propensity to allocate sizable resources to the projects which have probability of failure along with getting chance of high returns (Swierczek and Ha, 2003; and Feifei, 2012). Risk discloses the firm's propensity to act aggressively on the upcoming market opportunities and taking bold decisions (Fiegenbaum and Thomas, 1988; and Lumpkin and Dess, 1996)

.

Baird and Thomas (1985) posited that risk-taking propensity of the firm can be measured through its actions such as (1) committing or allocating large portions of assets and resources in the name of uncertainty; (2) venturing into unknown business activities; and (3) heavy borrowings. It not only depicts the willingness of the firm to allocate resources to opportunities where outcomes are unclear, but also reflects the culture (McGrath, 1999).

Risk taking should always have a support culture wherein success should be rewarded and failure should not be penalized. Management's willingness to accept occasional failures actually motivates others to come out with unique and novel solutions. Any organization that supports integration, dissemination of knowledge and sharing of knowledge across all channels encourages the members to go beyond the tried and tested model (Hornsby et al., 1999; and Zahra et al., 1999).

Proactiveness: Proactiveness is seeking opportunities and a perspective of anticipating the demand to innovate, create and change the business environment and also looking forward to beating the competitors in introducing new services or products ahead of them (Lumpkin and Dess, 1996). A proactive organization is the one which adopts an opportunity-seeking perspective. Such organizations anticipate the market demand in advance and act and are the first ones to enter new markets or 'fast followers'.

Oni (2012) defined proactiveness as the state of mind driven by individual consciousness to achieve the vision, fulfill the mission, and the goals. Yener and Aykol (2008) described proactiveness as opportunistic behavior and the entrepreneurs view these environmental changes as opportunities instead of troubles.

Tang and Tang (2012) defined proactiveness that reflects the firm's strategic posture which is aimed at future requirements of the firm by seeking opportunities whether they are relevant or irrelevant to their current operations, introduction of new products much before their competitors.

Lumpkin and Dess (1996) opined that proactiveness depicts the firm that is fast to innovate and introduce products or services ahead of its competitors. Senge (1990) stated that proactiveness is the capacity to take initiative by exhibiting behavior that is goal-directed. Miller and Friesen (1982) used the term proactiveness as the capacity of the firm to innovate and present new products and services in the market ahead of their competitors to mold the environment of the firm in its favor.

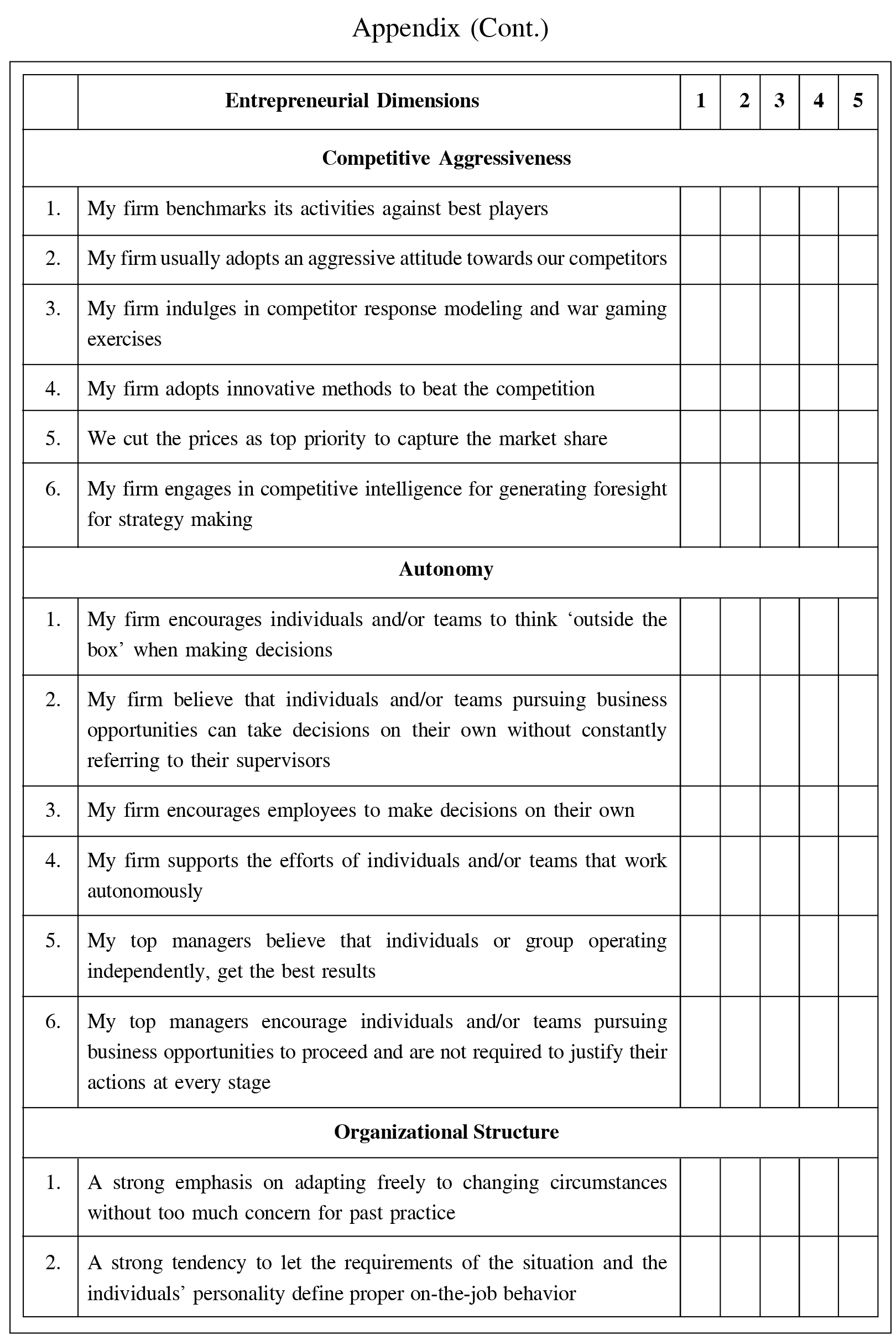

Competitive Aggressiveness: Competitive aggressiveness refers to the firm's inclination to beat the challenge of the competitors in the market directly and intensely for achieving an entry into the market and improve the position and outperform the competitors in the market place (Kraus et al., 2005). It is also referred to as a firm's willingness to be unconventional to gain the markets to face the competition. The literature says often proactiveness and competitive aggressiveness are used interchangeably, but there is a difference between these two dimensions. Competitive aggressiveness is in contrast to proactiveness and refers to how firms respond to demand in the market. Establishing a reputation for competitive aggressiveness can damage a firm's chances of being invited to join collaborative efforts such as joint ventures and alliances.

Lumpkin and Dess (1996) and other researchers have defined competitive aggressiveness as the firm's propensity to challenge the competitors directly or indirectly and outperform them in the marketplace. It shows the firm's disposition to fight with the competitors. Frese et al. (2002) stated that competitive aggressiveness shows the firm's responsiveness towards their competitors and indicates how the firm handles the threats.

According to Covin and Covin (1990), competitive aggressiveness is the firm's propensity to dominate competitors by various innovative and proactive measures, by being the first firm to introduce new products and services, techniques, and through actions that the competitors have to respond to and by exhibiting extremely competitive posture. Miller (1983) opined that competitive aggressiveness reveals the firm's assertiveness towards competitive challenges and reflects a firm's posture directed towards beating the competitors.

Stone and Brush (1996) gave a different definition of competitive aggressiveness: it involves protecting the firm's existing share and targeting the customer base of competitors. In the course of attaining the attributes, the firms, instead of relying on traditional methods of competing, tend to go for unconventional methods of competing such as getting into the competitors' market by offering low prices, monitoring the strengths and weakness of the competitors, aggressive spending on branding, etc.

Autonomy: Autonomy is the firm's ability to identify and look for opportunities by itself. It also refers to individuals or teams within the organization to have freedom to innovate and develop an idea and see through its completion. It is also the actions taken freely irrespective of the constraints in the organization for the establishment and smooth running of the business venture (Lumpkin and Dess, 1996).

Lumpkin and Dess (1996) defined autonomy as action by individuals or team to come out with a new idea or vision and carry it forward for completion. It is the will and ability of the individuals or teams to be independent in the pursuit of opportunities (Krauss et al., 2005). It refers to the extent that employees feel empowered to take decision on their own without having to seek any approvals and permissions and also should have discretion to identify the ways and means to implement their ideas (Frese et al., 2002). Hackman (1980) also feels that autonomy is the extent up to which any individual has independence, freedom and discretion in developing and implementing ideas.

Autonomy, in other words, is described in the organizational context as actions taken freely, irrespective of organizational constraints, for the establishment of business and smooth running of the business venture (Shrivastava and Grant, 1985). The very concept of entrepreneurship requires some autonomy and freedom, paving the way free of structural constraints that stifle risk taking, exploration and out-of-the-box thinking to foster creativity and the discovery of new ideas (Merlo and Auh, 2009). It represents the ability of the organization towards self-direction in ideas and action and encourages such behavior among their employees or teams in the organization (Burgelman, 1983; and Brock, 2003).

Environmental Uncertainties

Environmental uncertainty, often caused by changes in markets or technologies, can be regarded as both a constraint and an opportunity that influences the internal structures and processes (Lawrence and Lorsch, 1967). Christensen (1997) suggests that innovating companies follow an approach very different from what they would take towards an established technology when they are concerned with new products in emerging or highly unpredictable markets. In particular, in cases where initial market applications are uncertain, a discovery-driven learning process as compared to a formal development process might work better.

Hypotheses Formulation

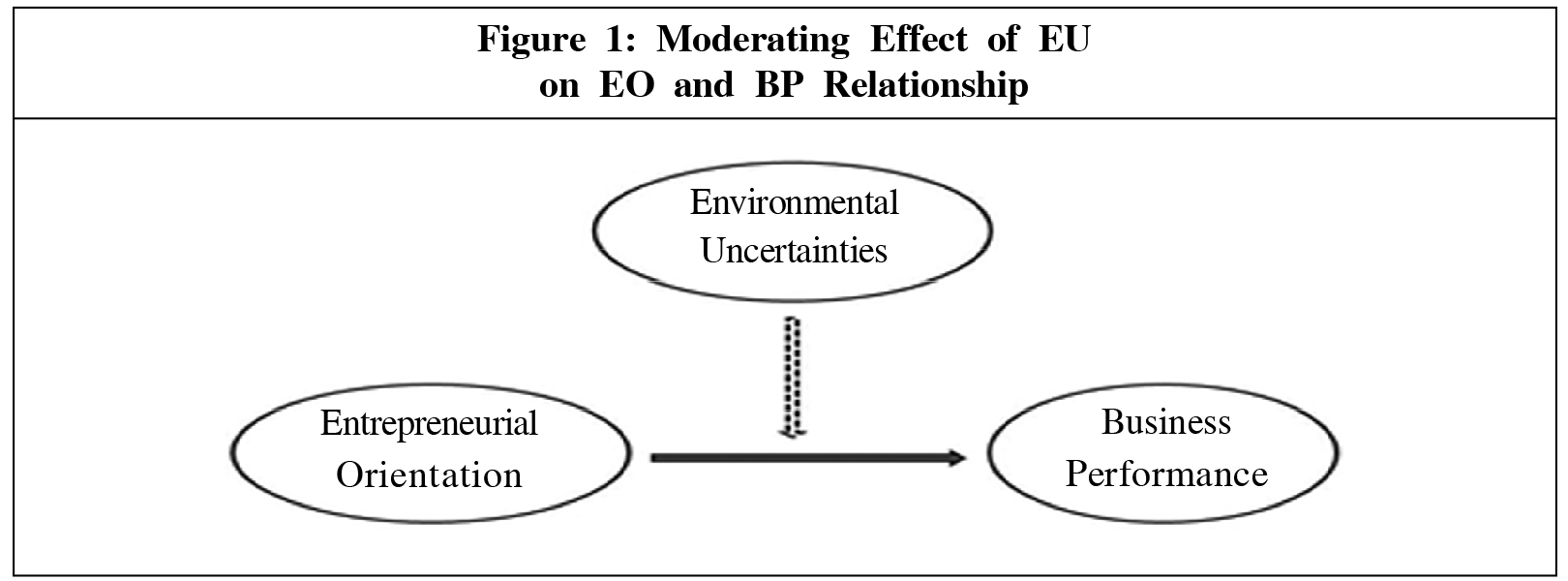

The study came up with the research question: Does EU moderate the relationship of EO and BP? (Figure 1). Therefore, the hypothesis is proposed as under:

H1: Environmental uncertainties moderate the relationship between entrepreneurial orientation and business performance.

Data and Methodology

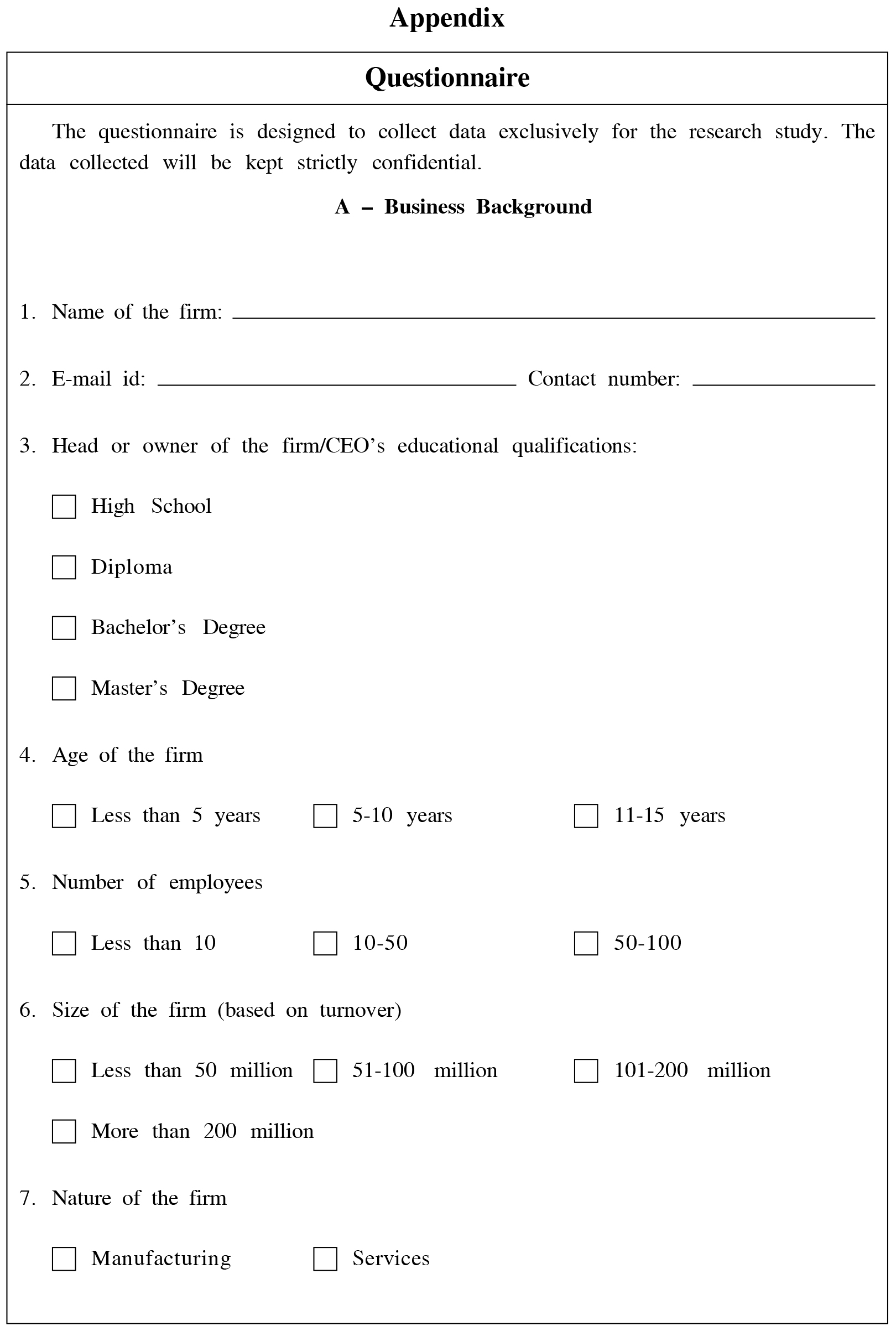

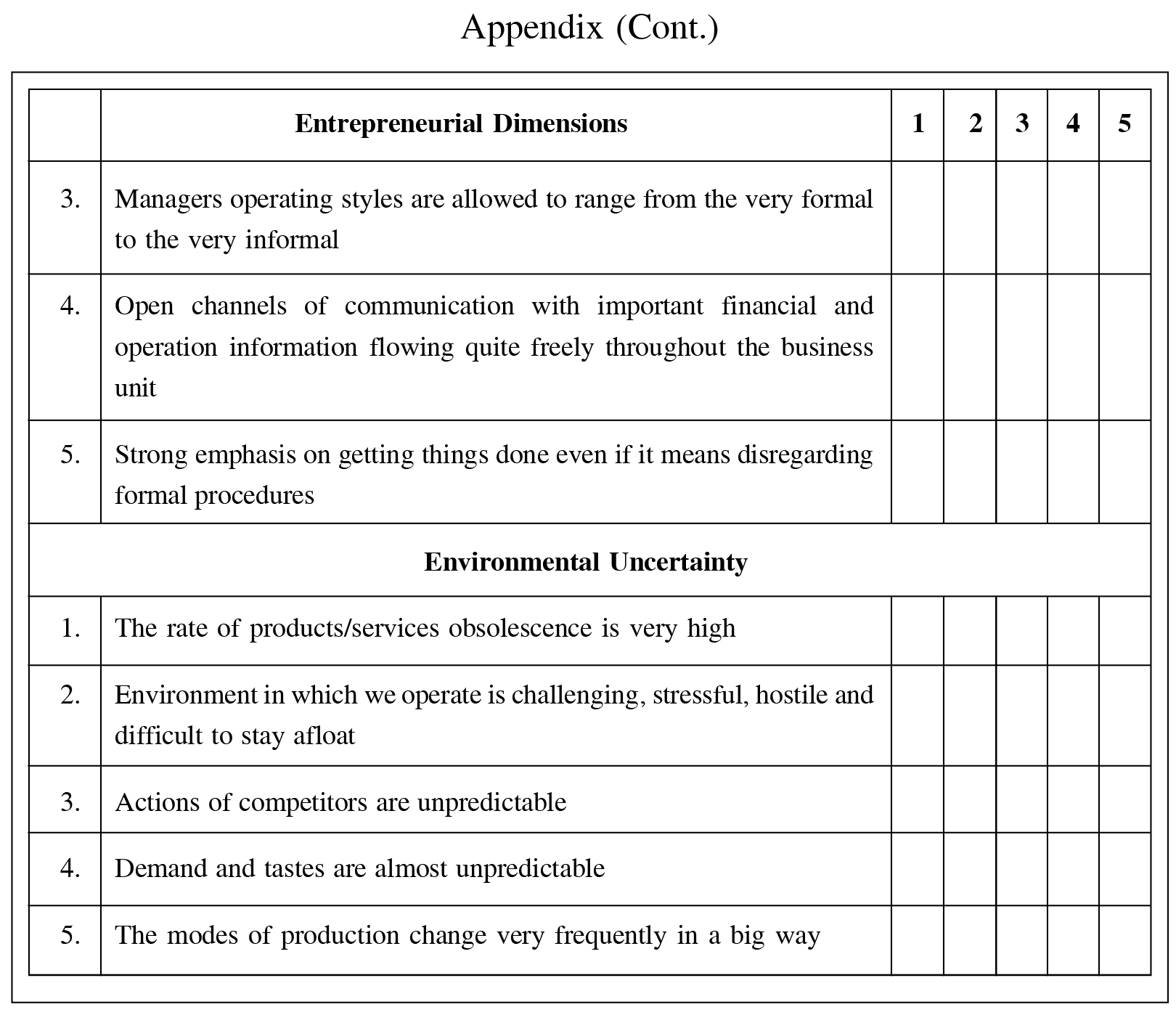

The study was conducted on 275 product-oriented and service-oriented Small and Medium Enterprises (SMEs) in Kurunegala, Sri Lanka. The questionnaires (see Appendix) were distributed to the owners or managers in the firms. 72% respondents (n = 198) were owners and 28% (n = 77) were managers working in the firm. 47% of the firms (n = 130) were less than 10 years old and only 5% of firms (n = 14) were more than 15 years old. 52% firms (n = 143) have less than 10 employees. 54% of the respondents (n = 149) are from service-oriented and 45.8% of the respondents (n = 126) are from product-oriented sector. 50% of the firms' turnover is less than 50 million SLR (Sri Lankan Rupee) and 6% of the firms' turnover is more than 200 million SLR. It indicates that there are few firms with higher investments in Kurunegala district.

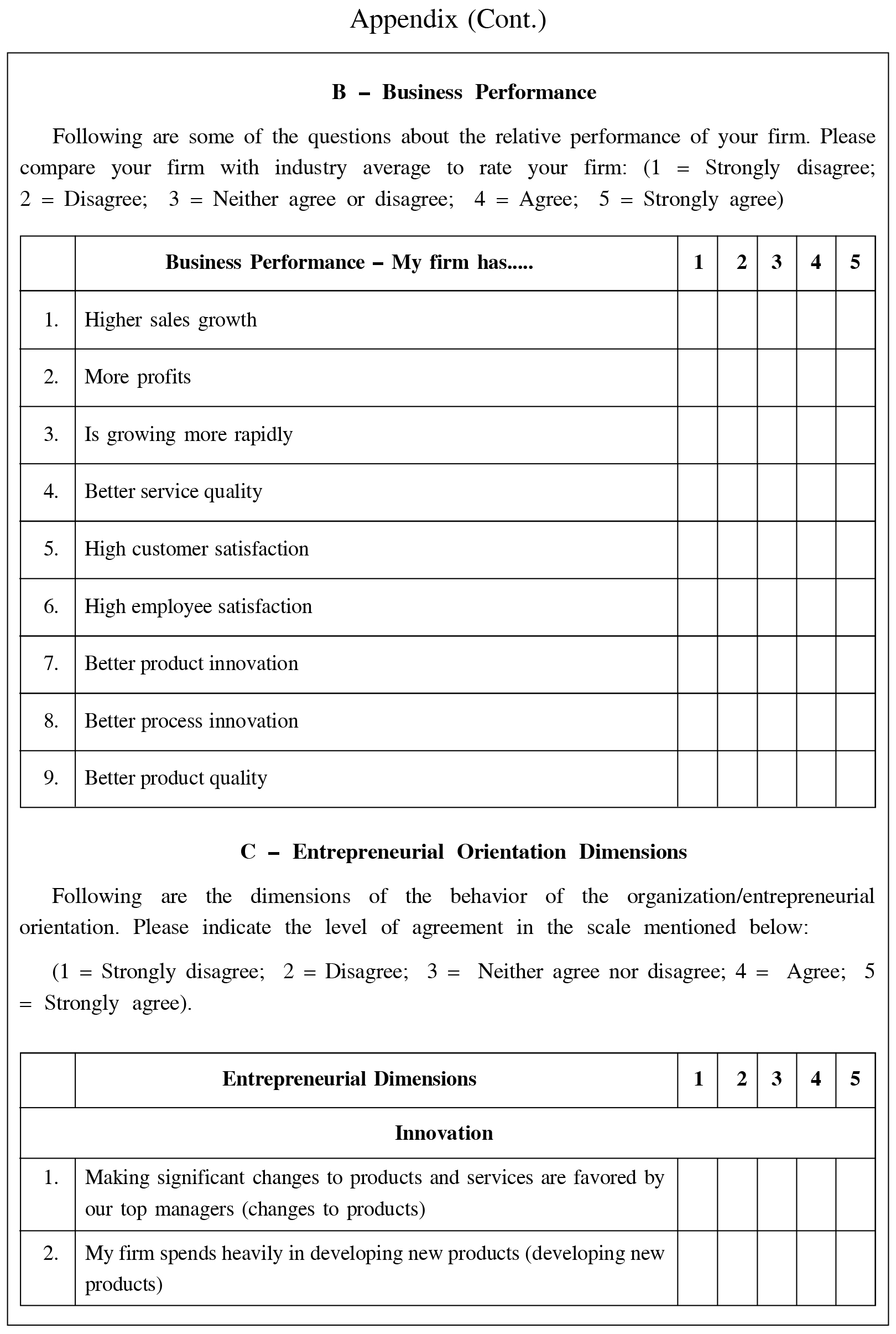

To capture different aspects of BP, characteristics such as sales growth, employment growth, market share growth, employees and owner's satisfaction, product innovation and process quality were used to evaluate BP. The internal consistency was tested using Cronbach's alpha coefficient. Overall for the dimensions of EO, BP and EU, the alpha value obtained was 0.757 (alpha > 0.7), which validated the use of these measures for further analysis.

Results and Discussion

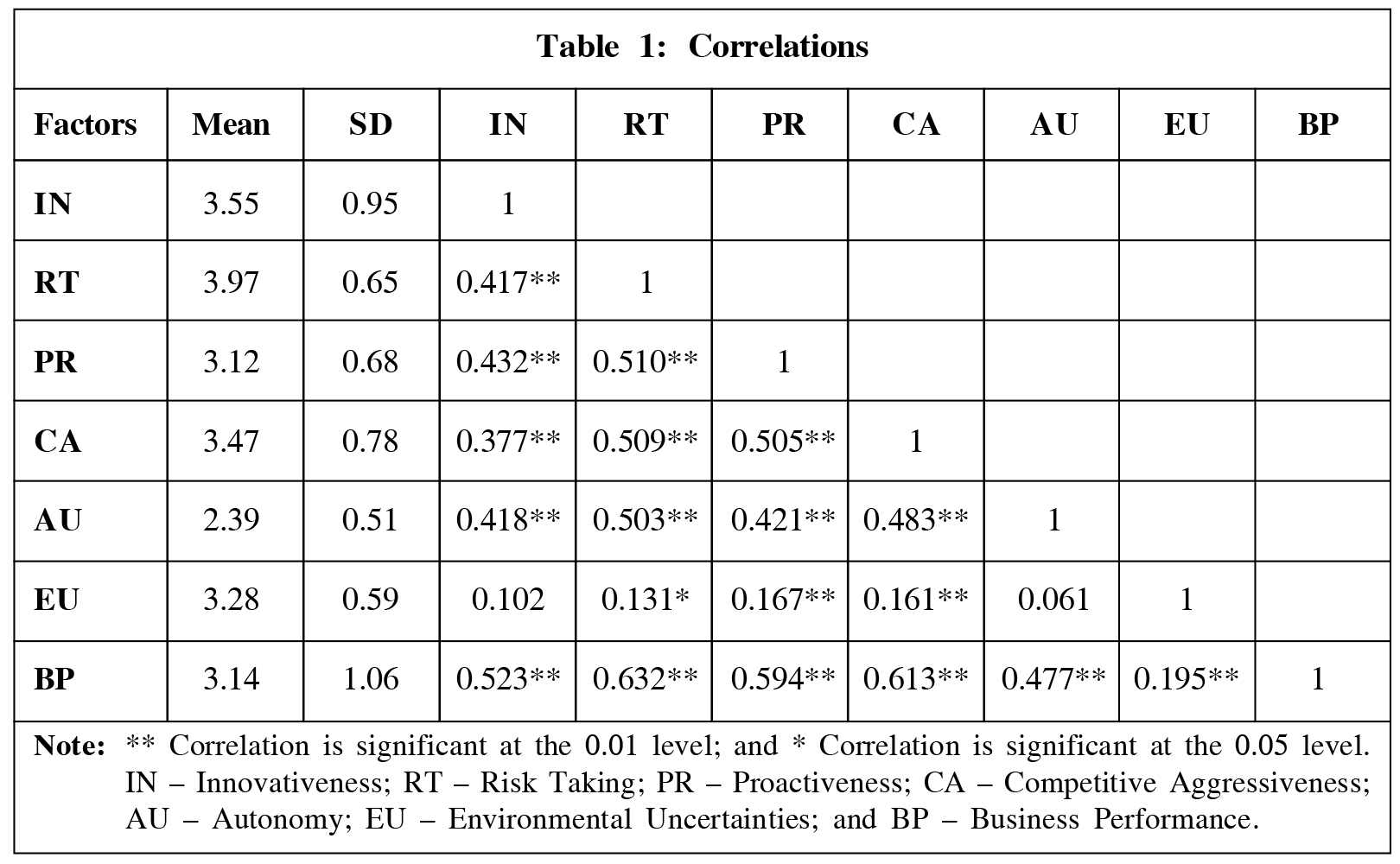

Table 1 shows the descriptive statistics and correlation matrix for the dimensions of EO, EU and BP. It is observed that the SMEs have moderate to high levels of risk-taking propensity (mean = 3.97) and moderate level of innovation (mean = 3.55), competitive aggressiveness (mean = 3.47) and but low levels of proactiveness (mean = 3.12) and autonomy (mean = 2.39). The mean score for EU is 3.28. The results indicate that the correlation among the dimensions of EO, EU and BP is positive and significant, except for the correlation between EU and innovativeness and EU and autonomy.

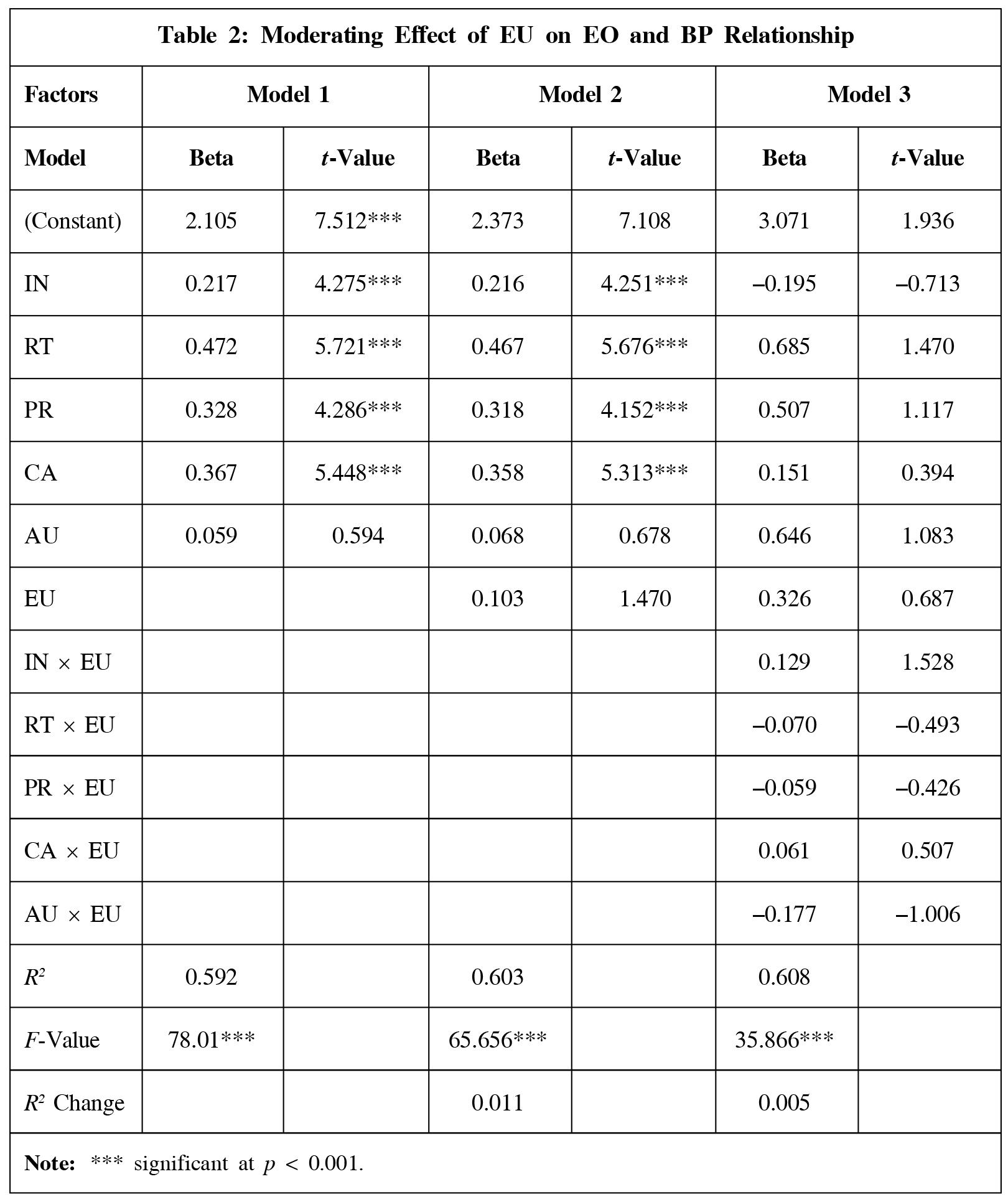

Regression analysis was done to hypothesize whether EU affects the relationship of EO and BP. The dependent variable is BP and the independent variables are EO, EU and the interaction of EO x EU as the moderating variable. The results are presented in Table 2.

The probability of the F-value 78.01 (p < 0.001) indicates that the model is significant and thus valuable in predicting the firm's performance. Model 1 indicates that innovativeness, risk-taking propensity, proactiveness and competitive aggressiveness had significant positive influence on BP of the SMEs, except autonomy.

In Model 2, all the EO dimensions and the moderating factor (EU) were included as independent variables and the BP as dependent variable. The results showed that overall significance of the model with the probability of F-value is significant (F-value = 65.656, p < 0.001). The addition of EU to the model had very little or no effect as its prediction power had no significant increase (R2 change = 1.1%), however the relationship between EU and BP was positive and significant.

In Model 3, entrepreneurial dimensions, EU and all interactions of entrepreneurial dimensions with EU were included against BP as dependent variable. The probability of

F-value indicates that the model is significant (F = 35.866, p < 0.001), thus making it a good EO predictor of firms' performance. The inclusion of the interaction variables had no change in the variance explained by the model by 0.5% (R2 change). It indicates that EU does not moderate the relationship between EO dimensions and BP. Hence, the hypothesis that EO and BP relationship is moderated by EU is rejected. It indicates that the moderating effect of EU does not explain that BP is determined by the predictor variable.

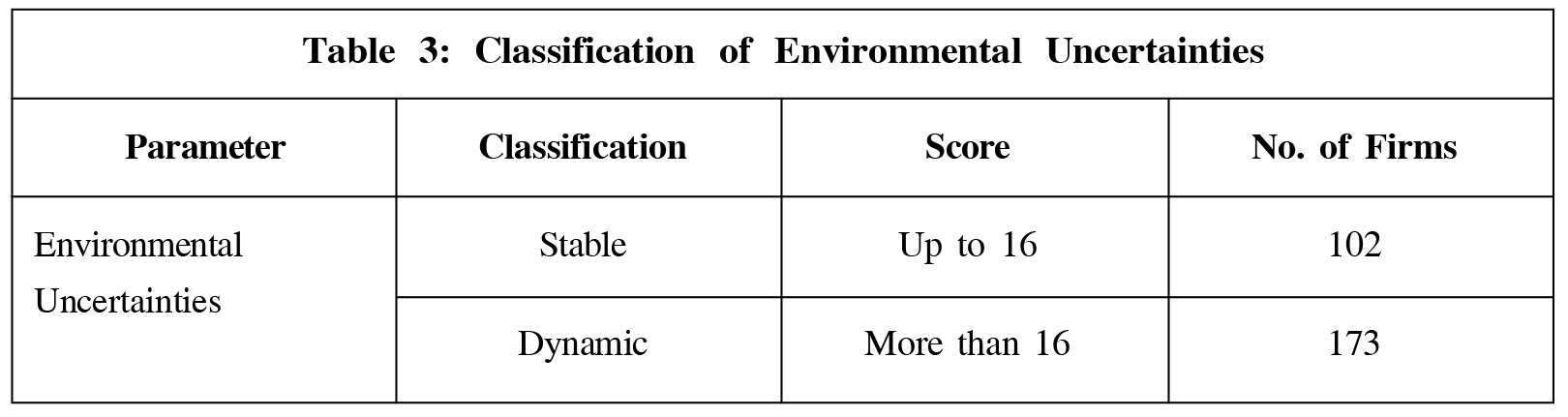

The summated measure of five dimensions of environment uncertainties is grouped into two categories, namely, dynamic environment and stable environment. The average of the summated environment uncertainty is 16. The firms with less than the average EU are categorized as stable environment and more than the average EU are categorized as dynamic environment (Table 3).

The firms which come under stable environment show a slow pace of advancement in terms of technology and process and are very stable in predicting the tastes and preferences of the customers and predicting and forecasting the actions of the competitors. It is a safer environment. On the contrary, in the dynamic environment, there is high pace of change in the advancement of technology, and it is a stressful environment.

The results indicate that out of the 275 SMEs that participated in the survey, 173 firms have come under the dynamic environment. The firms operating in the dynamic environment will certainly benefit more from the entrepreneurial behavior than the firms operating in the stable environment, as dynamic environment is conducive to the firms because of the rapid changes in the conditions and environment, continuous emergence of opportunities, seeking new opportunities actively and employees think out-of-box and encourage application of research and development for new products and services. EO helps the firms with capabilities to better monitor and scan the environment and adjusts the degree of EO dimensions based on the needs and complexities of the environment. Monitoring and disseminating information around the environment in the firm helps them in the adoption of suitable strategic posture which will not only ensure the survival of the firm but also help in the improvement of market share and better BP.

Conclusion

The study was conducted to investigate the moderating role of EU in EO and BP relationship. The results revealed that the relationship between EO and BP is positive and significant. This result is in conformity with the research by Lumpkin and Dess (1996) that positive EO will lead to good BP. Further, the results reveal that the interaction effect of EO x EU on the BP is not significant, which indicates that the relationship of EO dimensions is not moderated by EU. It means that the change of environment and technology and other external factors do not seem to change the performance of the firm.

173 firms were under the dynamic environment and others were stable environment. The firms operating in the dynamic environment will certainly benefit more from the entrepreneurial behavior because these firms are amenable to rapid changes in the business environment in terms of technology, freedom to employees in taking decisions, and adopting aggressive posture to face the competitors, which is more likely to gain an edge over the competitors.

References

- Baird I S and Thomas H (1985), "Toward a Contingency Model of Strategic Risk Taking", Academy of Management Review, Vol. 10, No. 2, pp. 230-243.

- Brock D M (2003), "Autonomy of Individuals and Organizations: Towards a Strategy Research Agenda", International Journal of Business and Economics, Vol. 2, No. 1, pp. 57-73.

- Burgelman R A (1983), "Corporate Entrepreneurship and Strategic Management: Insights from a Process Study", Manag. Sci., Vol. 29, No. 12, pp. 1349-1364.

- Christensen C M (1997), The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail, Harvard Business School Press, Boston.

- Covin J G and Covin T J (1990), "Competitive Aggressiveness, Environmental Context, and Firm Performance", Entrepreneurship Theory and Practice, Vol. 14, No. 4, pp. 35-50.

- Drucker P F (1985), Innovation and Entrepreneurship, Harper Trade, NY.

- Edmondson A C and Nembhard I M (2009), "Product Development and Learning in Project Teams: The Challenges are the Benefits", Journal of Product Innovation Management, Vol. 26, No. 2, pp. 123-138.

- Feifei Y U (2012), "Strategic Flexibility, Entrepreneurial Orientation and Firm Performance: Evidence from Small and Medium-Sized Business (SMB) in China", African Journal of Business Management, Vol. 6, No. 4, pp. 1711-1720.

- Fiegenbaum A and Thomas H (1988), "Attitudes Toward Risk and the Risk-Return Paradox: Prospect Theory Explanations", Academy of Management Journal, Vol. 31, No. 1, pp. 85-106.

- Frese M, Brantjes A and Hoorn R (2002), "Psychological Success Factors of Small Scale Businesses in Namibia: The Roles of Strategy Process, Entrepreneurial Orientation and the Environment", Journal of Developmental Entrepreneurship, Vol. 7, No. 3, pp. 259-282.

- Hackman J R (1980), "Work Redesign and Motivation", Professional Psychology, Vol. 11, No. 3, pp. 445-455.

- Hornsby J S, Kuratko D F and Montagno R V (1999), "Perception of Internal Factors for Corporate Entrepreneurship: A Comparison of Canadian and US Managers", Entrepreneurship Theory and Practice, Vol. 24, No. 2, pp. 9-24.

- Krauss S I, Frees M Friedrich C and Unger J M (2005), "Entrepreneurial Orientation: A Psychological Model of Success Among Southern African Small Business Owners", European Journal of Work and Organizational Psychology, Vol. 14, No. 3, pp. 315-344.

- Lawrence P R and Lorsch J W (1967), Organization and Environment: Managing Differentiation and Integration, Division of Research, Graduate School of Business Administration, Harvard University, Boston.

- Lumpkin G T and Dess G G (1966), "Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance", Academy of Management Review, Vol. 21, No. 1, pp. 135-172.

- McGrath R G (1999), "Falling Forward: Real Options Reasoning and Entrepreneurial Failure", Academy of Management Review, Vol. 24, No. 1, pp. 13-30.

- Merlo O and Auh S (2009), "The Effects of Entrepreneurial Orientation, Market Orientation, and Marketing Subunit Influence on Firm Performance", Marketing Letters, Vol. 20, No. 3, pp. 295-311.

- Miller D (1983), "The Correlates of Entrepreneurship in Three Types of Firms", Management Science, Vol. 29, No. 7, pp. 770-791.

- Miller D and Friesen P H (1982), "Innovation in Conservative and Entrepreneurial Firms: Two Models of Strategic Momentum", Strategic Management Journal, Vol. 3, No. 1, pp. 1-25.

- Oni E O (2012), "Relevance of Entrepreneurial Proactiveness on Business Performance: Nigerian Companies Experience", Kuwait Chapter of Arabian Journal of Business and Management Review, Vol. 1, No. 6, pp. 92-108.

- Schumpeter J A (1934), The Theory of Economic Development, Harvard University Press, Cambridge, MA.

- Senge P M (1990), "The Leader's New Work: Building Learning Organizations", Sloan Management Review, Vol. 24, No. 1, pp. 7-23.

- Shrivastava P and Grant J H (1985), "Empirically Derived Models of Strategic Decision Making Processes", Strategic Management Journal, Vol. 6, No. 2, pp. 97-113.

- Stone M M and Brush C G (1996), "Planning in Ambiguous Contexts: The Dilemma of Meeting Needs for Commitment and Demands for Legitimacy", Strategic Management Journal, Vol. 17, No. 8, pp. 633-652.

- Swierczek F W and Ha T T (2003), "Entrepreneurial Orientation, Uncertainty Avoidance and Firm Performance: An Analysis of Thai and Vietnamese SMEs", International Journal of Entrepreneurship and Innovation, Vol. 4, No. 1, pp. 46-58.

- 26. Tang Z and Tang J (2012), "Entrepreneurial Orientation and SME Performance in China's Changing Environment: The Moderating Effects of Strategies", Asia Pacific Journal of Management, Vol. 29, No. 2, pp. 409-431.

- Wiklund J and Shepherd D (2003), "Knowledge-Based Resources, Entrepreneurial Orientation and the Performance of Small and Medium-Sized Businesses", Strategic Management Journal, Vol. 24, No. 12, pp. 1307-1314.

- Yener M and Aykol S (2008), "Entrepreneurial Orientation in Small Family Firms in Istanbul", The Business Review, Vol. 11, No. 1, pp. 231-239.

- Zahra S A, Jennings D and Kuratko D (1999), "The Antecedents and Consequences of Firm-Level Entrepreneurship: The State of the Field", Entrepreneurship Theory and Practice, Vol. 24, No. 2, pp. 45-65.