December'20

The IUP Journal of Entrepreneurship Development

Archives

Venture Capital and Entrepreneurship: The Cost and Resolution of Investment Readiness

Danai Zana

MBA Student, WITS Business School, University of the Witwatersrand, Johannesburg, South Africa.

Brian Barnard

Researcher, WITS Business School, University of the Witwatersrand, Johannesburg, South Africa; and is the

corresponding author. E-mail: barnard.b@polka.co.za

The study examines Investment Readiness (IR) within Venture Capital (VC) markets and the cost and resolution thereof. IR impacts VC markets, and the efficiency thereof, in a number of ways. The factors and issues that are raised and considered as part of IR include entrepreneurs' experience and business acumen, the quality of opportunities, the perspective of VC firms, the perspective of entrepreneurs, the quality of IR content and services, IR assistance, moderation and accreditation and awareness. In general, IR solutions need to consider cost, quality, coverage or pervasiveness, awareness and assistance. The matter of IR assistance to improve IR requires an in-depth cost-benefit analysis. IR assistance raises the issue of the seriousness of entrepreneurs. The method and technique available to improve IR at no negative impact, typically implies running additional pipelines on the side. There is definitely room and place for technology, also IR metrics as technology, to assist with IR. IR metrics can be further integrated with technology and professional assistance to offer a comprehensive IR tool and solution. This may also be the beginning of turning IR into a competitive advantage. IR metrics should be considered and regarded against their accompanying and corresponding accuracy and success rates, also when considering subsequent and successive IR assessment. IR metrics or IR metric systems can further be secured through moderation. The industry can consider working towards an industry-accepted IR standard. Cost estimates to improve IR equally reveals whether the system is not overextended, requiring rather a focus on quality.

Introduction

Investment Readiness (IR) comprises a significant burden to Venture Capital (VC) markets and

forms a principal factor of VC market efficiency. VC bankers frequently refer to IR when

explaining the high proposal rejection ratios typical of VC (Mason, 2009; and Mason and

Kwok, 2010). VC bankers also spend-and given the approval/rejection ratios, consequently

waste-a lot of time on screening opportunities presented to them (Dietz, 2003). The level

of IR in a VC market should equally be proportional to the level of entrepreneurship quality

in the market.

IR typically spans three dimensions: financial literacy or equity aversion, investability,

and presentational failings (Mason and Kwok, 2010). Opportunities are predominantly

rejected because of shortcomings of the entrepreneur or because of shortcomings of the

business (Mason and Kwok, 2010; and Hazenberg et al., 2015). Shortcomings with regard to

the attributes of entrepreneurs include lack of knowledge and expertise to turn the idea into

a viable business, unrealistic expectations (e.g., overly optimistic and unsubstantiated), and

personal qualities (lack of integrity, vision or commitment; and high need for control of the

business) (Feeney et al., 1999; Mason and Kwok, 2010; and Silver et al., 2010). Shortcomings

of the business include poor management team (e.g., balance, experience, discipline, and

teamwork), poor profit potential for the level of risk, under-capitalized, and insufficient

information provided (Mason and Harrison, 2004; and Vasilescu, 2009). The remedies

correspondingly are information provision and support, and include business development

and expert input (Mason and Harrison, 2004; Mason and Kwok, 2010; and McAdam and

Marlow, 2011).

The purpose of the study is to further investigate IR within VC markets and its resolution.

A principal question relates to the most optimal method to address, deal with, and resolve IR.

Is IR resolution optimal? It involves understanding the actual cost of IR, also to the industry,

the allocation of IR as task and the optimization of IR as process. Understanding the actual

cost of IR, and how it affects the industry, considering the ways in which IR can be addressed

and to whom it can and should be assigned and evaluating methods to improve, optimize and

standardize its processes and handling, should help to better understand how to deal with it

and thus improve IR in the market.

The study addresses the following research question: What are the premises of optimal IR

resolution? In this regard, it covers the following sub-questions:

What is the cost of IR to the VC market?

How should IR as task be allocated and resolved? Of the market participants and

stakeholders, who is in the best position to deal with IR?

How can IR be optimized and standardized?

The study contributes to both VC and entrepreneurship literature. It reflects on the quality

of VC and entrepreneurship resident in the market. The study mainly focuses on the

perceptions of experienced venture capitalists and angel investors regarding investment

resolution and its resolution. The study assumes experienced venture capitalists and angel

investors are in the best position to reflect on IR and its resolution. Although relevant and

important, the views of other stakeholders of IR are not considered as crucial for the study.

Literature Review

Interventions into the VC market have historically focused on supply-side weaknesses.

Government intervention programs have focused more on improving business access to

finance, through stimulating business angel investment activity and creating new investment

vehicles (Mason and Kwok, 2010), thereby implying that the inefficiencies in the market arise due to the unavailability of sufficient sources of capital for growing businesses. However,

recent indicators have shown that demand-side weaknesses also adversely affect access to

finance. Investors and business angel investors in particular, often find that they cannot invest

in as many businesses as they are prepared to invest in, due to the low quality of potential

investees that they are presented with (Mason and Harrison, 2002; and Mason and Kwok,

2010). Many of the opportunities that are presented to investors are not investment ready,

resulting in investors deeming the opportunities unworthy of funding.

Definition of Investment Readiness

There is no set definition for IR, but the term is generally used in the context of raising

external equity finance (Mason and Kwok, 2010) and is typically used with reference to an

inability by potential investees to meet the minimum requirements for investment, as sought

by investors. Silver et al. (2010) define IR as a set of processes carried out in efforts to make

businesses viable prospects for investors. A potential investee is considered to be

investment ready, when investors perceive that the company has the appropriate attributes

that make it an investible proposition for the type of funding being sought (Gregory et al.,

2012). IR is not only an assessment of how investors perceive the business to be but is also

based on the entrepreneur's understanding of the finance market and its mechanisms

(Hazenberg et al., 2015). Entrepreneurs are often unwilling to seek equity finance for fear

of losing control of their business, a mindset often referred to as 'equity aversion'.

Entrepreneurs would rather impede their business growth than lose control to external actors

(Silver et al., 2010).

IR is neither one-dimensional nor resolved through the improvement of only one attribute

of a business but may involve the improvement of various elements of a business. IR covers

all aspects of a business, as they relate to the business's perceived investability and include

such factors as management team skills, the clarity with which the opportunity is defined, the

business model, route to market, governance arrangements and presentation (Mason and

Harrison, 2004). Mason and Kwok (2010) state that IR comprises of three parts, namely, equity

aversion, investability and presentational failings. Failure by entrepreneurs and their

businesses to meet any of these parts, or a combination of them, may be taken as evidence

that the business is not yet investment ready.

Equity aversion is consistent with the 'Pecking order' theory, which states that

entrepreneurs often prefer debt as a form of financing, relative to equity (Mason and Kwok,

2010; and Silver et al., 2010), as they are unwilling to cede ownership and control of their

businesses in exchange for financing. Equity aversion also arises from a lack of understanding

by entrepreneurs of the various sources of finance that are available to growing businesses,

and their respective advantages and disadvantages (Van Auken, 2001; and Mason and

Harrison, 2004). Mason and Kwok (2010) argue that more entrepreneurs would choose equity

finance, if they had greater knowledge of the role of different types of financing in business

development, thereby providing investors with a larger pool of potentially investable

opportunities to assess for investment viability.

The concept of investability relates to those companies that do choose to seek equity

finance and must thus meet the specific investment criteria of the investors from whom they

seek financing. The high rejection rates of investors definitively show that most businesses

do not meet these requirements (Mason and Kwok, 2010). This rejection partially arises from

information asymmetry, as businesses are usually assessed on whether they fit individual

investor's unique investment criteria, based on such features as sector, business stage,

investment size and location (Mason and Kwok, 2010). However, many business angel

investors choose to remain anonymous and entrepreneurs are thus unable to determine

whether an investor is appropriate for their business pitch or not, prior to their presentation.

Potentially investable companies may thus be rejected on this basis, but it will not necessarily

be as a result of the business not being investment ready. Subsequent to screening businesses

for fit with their criteria, investors further assess potential investees on various elements of

the business, such as marketing, finance, and the skills and structure of its management team,

as well as on the characteristics and personal qualities of the entrepreneurs themselves, such

as their knowledge and expertise regarding the viability of the business, any unrealistic

expectations, and their integrity or commitment (Feeney et al., 1999; Vasilescu, 2009; and

Mason and Kwok, 2010). Shortcomings at this stage of the business assessment process may

be considered as indications that the business is not investment ready.

Presentational failings concern the presentation of the overall written business plan as well

as the oral presentation by the entrepreneur. Deficiencies in the information provided in

business proposals and in any other written documents aimed at investors as well as poor

verbal presentations by business owners are unlikely to be met with favorable reactions from

investors (Mason and Harrison, 2003; and Mason and Kwok, 2010). Mason and Kwok (2010)

further stated that investors are frustrated by business plans that lack the generic information

expected to be found in any investment proposal. As regards the verbal presentation, Mason

and Harrison (2003) stated that entrepreneurs need to focus on making the business case rather

than focusing on the product or technology, as well as ensuring that they impart all the

information that investors want to know. Impression management is also important, as failure

by an entrepreneur to sell their opportunity convincingly, leaves investors with the perception

that the entrepreneur is incompetent (Mason and Harrison, 2003), thereby compromising what

may otherwise be a viable business idea.

In summary, IR encompasses both a business's attributes and the entrepreneur's

knowledge, characteristics and qualities, including presentational skills. IR is a combination

of factors, all of which must be addressed to resolve the demand-side inefficiencies present

in the VC market. Any interventions aimed at improving IR should thus be designed to cover

all these elements.

Developing Investment Readiness

IR enables investors to avoid wasting resources on unviable business ventures (Silver et al.,

2010). Therefore, demand-side initiatives aimed at increasing the availability of investable

opportunities should be designed around what investors find to be the typical shortcomings

of the opportunities they are presented with. IR programs should be designed to raise the quality of potential investees and address the issues of equity aversion, investability and

presentational shortcomings (Mason and Kwok, 2010). Mason and Kwok (2010) further

proposed that IR programs should comprise of two parts: information provision and support,

which are further broken down into five more specific elements. It has been ascertained that

entrepreneurs are not well-versed on the different forms of financing, on investors'

requirements and criteria when assessing investment opportunities, nor on how to present their

business proposals convincingly. Any program aimed at resolving IR should thus involve

knowledge-sharing, and the promulgation of information regarding financing options

(Vasilescu, 2009), satisfying investor requirements, and conducting presentations that are both

informative and captivating. Subsequent to receiving the aforementioned information,

entrepreneurs then need to be provided with assistance in meeting these standards.

Mason and Kwok (2010) proposed that IR programs should comprise five elements,

namely, an information session to fill the knowledge gap on equity as a form of financing,

an investment-ready review, an investment-ready development program, an investment-ready

presentation review and investment networking. Such a program would serve to impart

knowledge to entrepreneurs, support business venture development to a level that renders

them strong contenders for equity financing, and then ultimately connect investment-ready

opportunities with appropriate investors.

The VC market is characterized by information asymmetry, as investors lack information

regarding the venture's potential for success, and the entrepreneur's commitment, while the

entrepreneur risks losing control of their business, and cannot be certain as to the security of

the investment (McAdam and Marlow, 2011). McAdam and Marlow (2011) further stated that

the technical and entrepreneurial skills of business owners often are not matched by the

managerial and presentation skills required to convince investors that their businesses are

viable and investment ready, and that this information gap can be overcome by the creation

of a business plan through which investors can perceive the IR of a business. In their study

on what investors look for in a business plan, Mason and Stark (2004) found that the

information presented in the business plan plays a pivotal role in whether entrepreneurs will

be successful in their pursuit for financing, regardless of the form of financing. It thus follows

that IR programs should include support regarding the generation of articulate business plans

which contain credible information.

A proportion of businesses that are rejected on the basis of not being investment ready,

have the potential to become viable investment opportunities, if they receive appropriate

support. However, this support comes with associated costs that entrepreneurs may not be

able to afford, and that investors may be unwilling to cover. Investors are thus more likely

to reject investment proposals that are not deemed to be investment-ready at first glance,

and focus on those that require less investigation and support. Mason and Harrison (2004)

further stated that business plans that either fail to provide the requisite information, or are

poorly presented, will only serve to increase investors' skepticism in an already imperfectlyinformed

market. This serves to further solidify the notion that IR programs must include

business plan support.

Mason and Kwok (2010) concluded by recommending that IR programs should ideally be

delivered by consultants and experienced practitioners who are familiar with the requirements

and expectations of investors. IR is a long-term process and IR programs will not only be

expensive but will also require commitment from both the program practitioners and the

program beneficiaries (Mason and Kwok, 2010).

Investment Readiness Mediums

The VC industry plays a significant role in innovation, the creation of new industries,

products and services, the subsequent creation of new jobs, and ultimately facilitates

economic growth and development (Mason and Harrison, 2004; and Proimos and Murray,

2006). It follows then that IR programs should be a concern not only in the private sector

but also at a governmental level. Government intervention to improve efficiency in the VC

market is typically focused on the supply of finance to business ventures (Mason and Kwok,

2010), rather than on assisting firms to ensure that they are investable. Demand-side

deficiencies compromise supply-side interventions' potential for success. Therefore, demandside

initiatives aimed at improving the quality of deal flow should accompany supply-side

interventions (Mason and Kwok, 2010). Following the recognition of demand-side

inefficiencies in the VC market, various programs and initiatives have been introduced in an

attempt to render the market more efficient. These initiatives include government programs,

business incubators, and Business Angel Networks (BANs).

Government Programs

The general consensus amongst policy makers is that VC is a matter for the private sector,

therefore the key objective of public policy is to facilitate and encourage the development

of private sector activity in the VC market (McGlue, 2002). Government intervention into the

VC industry has predominantly been supply-side, such as tax incentives for investors, changes

to legislation to remove constraints on the advertisement of investment opportunities, and

coinvestment schemes with private sector investors (Mason, 2009). However, a number of

governments have recognized the importance of IR as a tool for rectifying some of the failures

in the VC market, and have embarked on the implementation of IR programs aimed at

addressing demand-side inefficiencies. Mason and Harrison (2004) listed the United Kingdom

(UK), Australia and New Zealand as some of the jurisdictions where governments have

implemented investment-ready programs. Mason and Harrison (2004) further provided a review

of LINC Scotland's 'trial marriage' scheme which operated under the Scottish Office and which

the authors believe was able to provide efficient business development support at low cost.

The LINC Scotland trial marriage scheme was created in response to the identification by

investors of business opportunities that had investment potential but required significant

support to enable them to be at a level where they could attract equity funding (Mason and

Harrison, 2004). The need for support arose from the companies either being unable to afford

the cost of fixing a problem and investors being unwilling to cover the cost, or from

companies requiring an overhaul of certain elements such as their financial systems or

management teams. The scheme provided each company with a small grant to cover the cost

of rectifying the problem hindering its potential as an investable business venture. If an investor subsequently invested in the business, the company paid back the grant to LINC

Scotland. The trial marriage scheme supported six companies, which resulted in five

investments, and the development of one licensing agreement (Mason and Harrison, 2004).

One criticism of government intervention in the VC industry has been that public sector

funding is too small, and suffers from constraints due to having a ceiling on how much can

be invested in any business (Mason, 2009). As the grants provided in this initiative were

provided to resolve specific problems, there was no need for follow-on funding, therefore the

criticism of government intervention did not apply, and a case could thus be made for the

appropriateness of government intervention. The case of LINC Scotland's trial marriage

scheme thus provides some evidence that government intervention in the demand-side of the

VC market has the potential to yield success in narrowing the investment-ready gap.

Business Angel Networks

BANs act as a bridge between entrepreneurs in need of financing and angel investors in need

of investment opportunities, while maintaining the investors' desire for anonymity (Mason,

2009). Business angels are more 'hands-on' than other investors, typically conducting their

own due diligence of potential investment opportunities, negotiating investment terms

directly with the entrepreneur, and devoting some of their own time to the daily business

operations. BANs therefore serve to connect entrepreneurs with knowledgeable participants

in the VC market, who are able to assist them to achieve investment-ready status. BANs also

enable entrepreneurs to benefit from advice, and directing to more appropriate sources of

assistance and feedback, from investors who did not invest (Mason, 2009). A significant

benefit of BANs is thus their ability to facilitate the education of entrepreneurs. Mason (2009)

noted that an additional benefit of BANs is that they operate on a local or regional scale. This

serves to lower the barrier to financing that is often created by location, as the majority of

investors prefer to invest locally. Through connecting entrepreneurs with investors who are able

to impart advice and potential funding, BANs indirectly assist entrepreneurs with a channel

through which they can discover resources and tools, to aid them in improving their IR.

Business Incubators

The information asymmetry that characterizes the VC market means that investors need a

significant amount of convincing to persuade them to invest in businesses without track

records and whose future profitability is uncertain. Tenancy in a business incubator can be

seen as a signal of a business's potential for long-term existence (McAdam and Marlow, 2011).

Business incubators advance entrepreneurs and early stage start-up companies, through

providing financial and managerial support, and through providing entrepreneurs with access

to a network of professional client advisors (CAs) and potential investors (Carayannis and von

Zedtwitz, 2005; and McAdam and Marlow, 2011). Carayannis and von Zedtwitz also noted

that business incubators differentiate themselves from business angels through the

institutionalization of their services.

In their study of the role of business incubators in assisting entrepreneurs to make sense

of IR status, McAdam and Marlow (2011) found that the placement of entrepreneurs within

a business incubator reduced the information asymmetry between entrepreneurs and appropriate investors, as CAs, due to their networks and more intimate knowledge of specific

investors' requirements, were able to match entrepreneurs with investors that had some

knowledge of the product area, and/or a history of similar or related investments. The study

also found that CAs assisted entrepreneurs with drafting investor-appropriate business plans,

and acted as impression managers, coaching entrepreneurs on how to deliver convincing

verbal presentations for specific investors. Business incubators thus enable entrepreneurs to

improve the quality of some of their business-specific attributes, as they relate to IR.

Investment Readiness Appraisal

Research has shown that the IR gap has hindered the ability of the VC market to function

as designed and various interventions are needed to correct the demand-side failures plaguing

the industry. Improved IR status places a company in a position where investors are more

confident about its potential for success and deem it to be a viable investment opportunity.

However, studies have shown that individual investors' perceptions of what constitutes IR are

different and are reflective of intuitive assessments (Fellnhofer, 2015). Fellnhofer (2015)

further stated that entrepreneurs and investors also tend to differ in their awareness of IR. This

lack of consensus raises questions around how IR can be evaluated formally, thereby

satisfying all parties involved in potential investment transactions.

In their study on Accreditation in the Context and Framework of Evaluation Activities

within the European Higher Education, Schwarz and Westerheijden (2004) found that

accreditation as an evaluation tool carries most credibility in society due to its attributes of

independent, non-political, academic and expert opinion. Accreditation is defined as a

process, based on professional judgment, for evaluating whether an institution or program

meets specified standards of quality (Prados et al., 2005). Prados et al. (2005) further stated

that accreditation signals that the accredited institution or program meets a minimum level

of competence in its chosen field, thereby serving to protect the consumers of the institution

or program's products or services. Institutions providing IR programs and initiatives can thus

serve as accreditation agencies of sort, with graduation from the programs and initiatives

serving as a trustworthy indicator of the quality of the investment opportunities.

Charities strongly depend on the public's trust, as donors cannot be completely sure of

how their donations will be used (Bekkers, 2003). Bekkers (2003) further stated that a system

of accreditation can be an instrument for signaling a charity's trustworthiness to the public.

Although the VC industry cannot be described as charitable, the information asymmetry

inherent in the industry means that a high level of credibility and trust often underlies

investors' decisions to finance companies (Fellnhofer, 2015). A system of IR accreditation

could thus ease some of the wariness that investors may have regarding new ventures and their

lack of credible track record.

An accreditation system requires a means of measuring and evaluating both qualitative

and quantitative elements, expert knowledge, independent evaluation, and comprehensive

assessment (Balci, 1998)-all attributes which can be found in well-designed IR programs. An

accreditation system also incurs costs, and a means of covering such costs needs to be determined. There are various ways of covering accreditation costs, such as the government

covering all costs, or institutions covering marginal costs and the government covering fixed

costs (Schwarz and Westerheijden, 2004). Therefore, a system of IR accreditation needs to be

carefully designed to ensure that both investors and entrepreneurs can derive maximum

benefit from the system and at a reasonable cost.

IR has specific areas of focus that can be targeted and improved. Common areas of IR

revolve around shortcomings on the part of the entrepreneur, or the business. To a large extent,

IR is also systematic in nature. If certain aspects of an opportunity are secured, the opportunity

has high likelihood of being seen as investment ready. IR relates to the experience or

development of the entrepreneur-more experienced entrepreneurs are likely to be more

knowledgeable with regard to the requirements of investors, and are bound to struggle less

with ensuring opportunity IR. IR also relates to entrepreneurship and market culture-

perceptions of VC and entrepreneurship culture are likely to affect general IR levels. There

are a number of IR stakeholders in the entrepreneurship and VC marketplace, including

government, angel networks and business incubators. VC constitutes a prominent arbiter of

IR because it forms a significant first point of contact to the market for many entrepreneurs.

The cost of IR likely has a fundamental indirect component and is bound to affect the

entrepreneurship and VC industry and the market as a whole. Methods like accreditation may

raise the IR quality bar within the industry. Policy and culture should shape perceptions

regarding IR and impact the accepted method of resolve of IR.

The literature review concludes with the following research question: What are the

premises of optimal IR resolution? In this regard, it covers the following sub-questions:

What is the cost of IR to the VC market?

How should IR as task be allocated and resolved? Of the market participants and

stakeholders, who is in the best position to deal with IR?

How can IR be optimized and standardized?

Data and Methodology

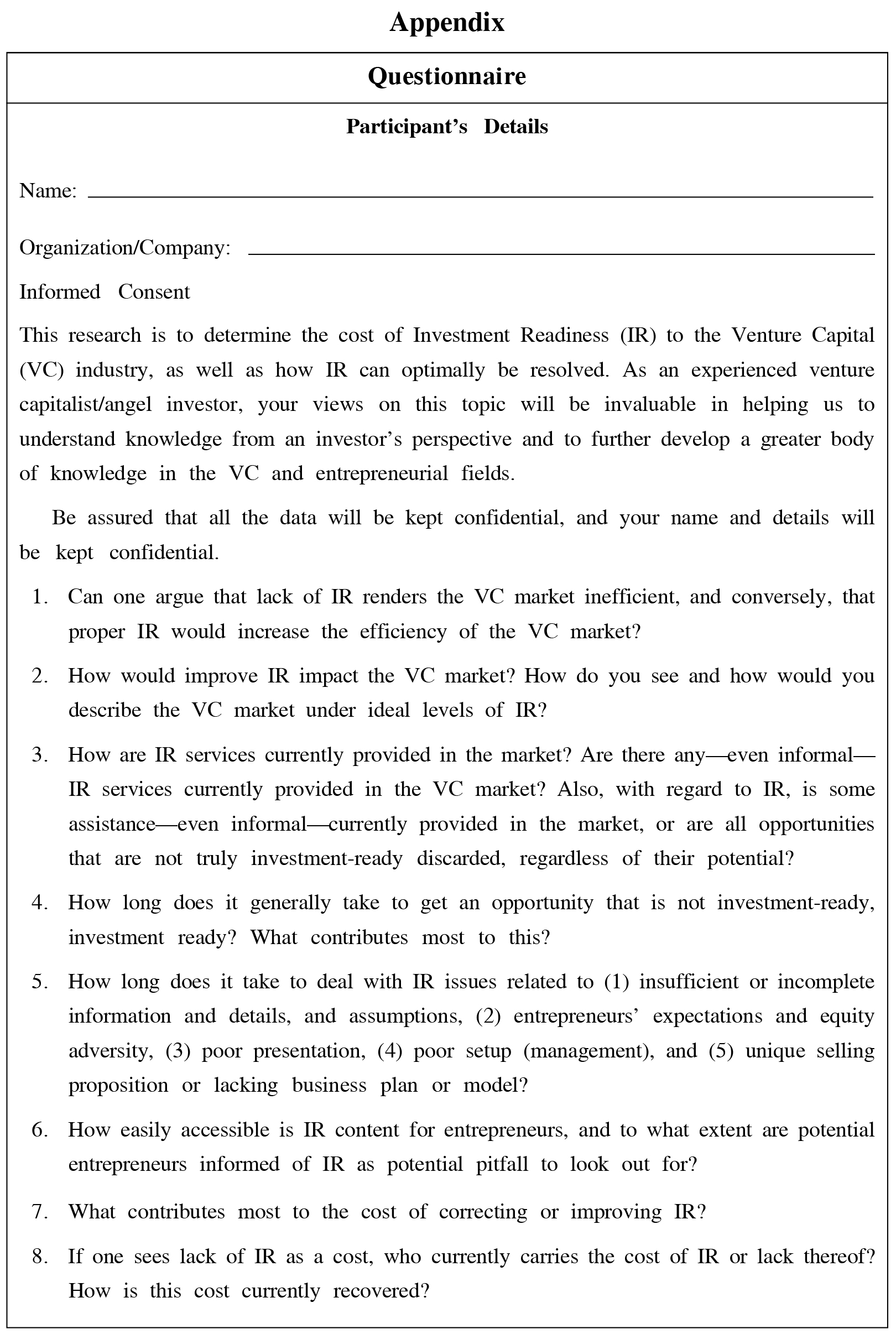

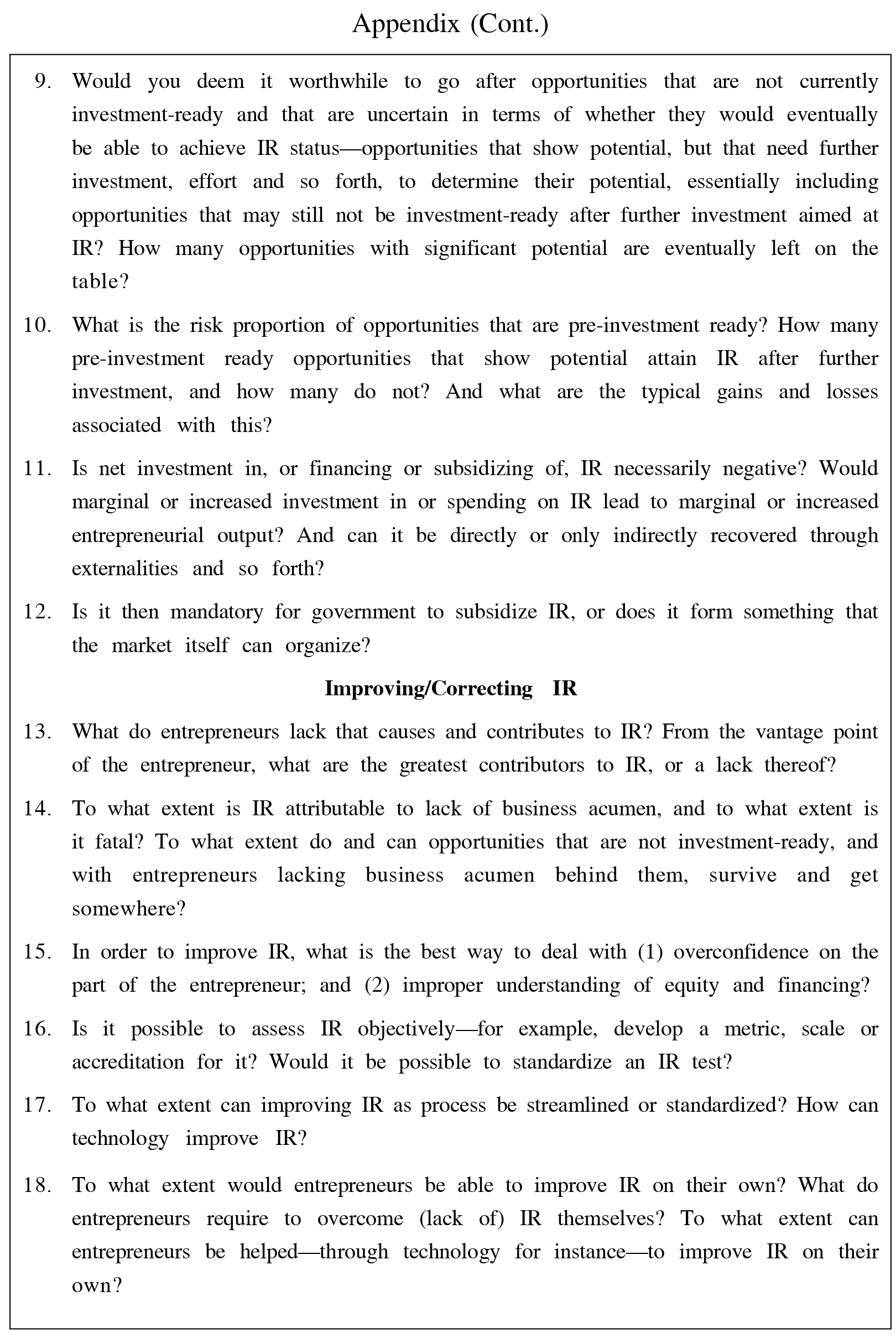

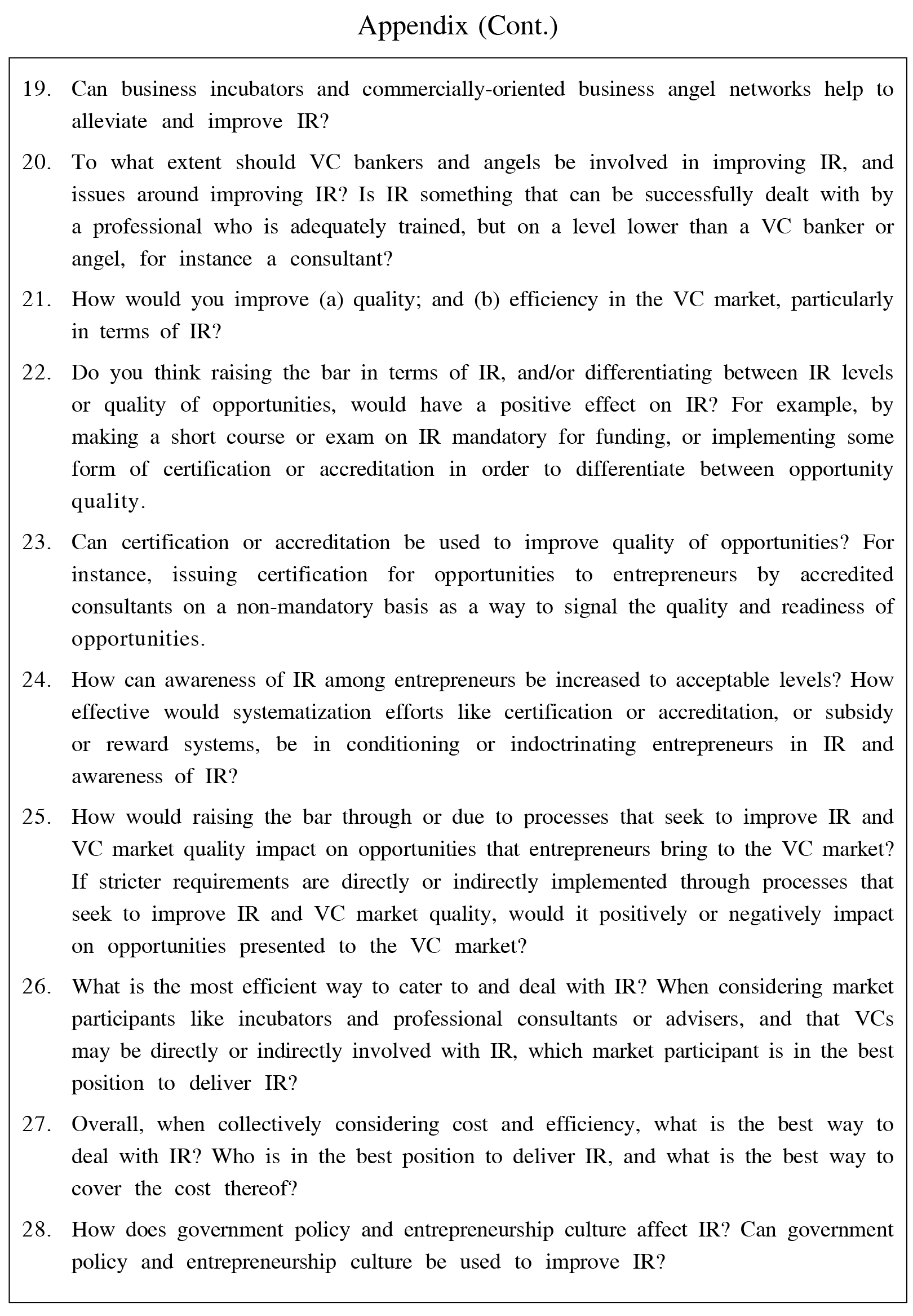

In order to further study IR, semi-structured interviews (see Appendix) were carried out with

experienced venture capitalists, angels, and professional consultants, and purposive sampling

was used. 10 experienced said professionals were interviewed, all with experience

(significantly) in excess of three years. Sampling was not constrained according to industry

or particular focus, as the impact thereof on the study was deemed negligible. Participants

were identified through professional and business networks. Interviews on average lasted one

hour. Interviews were recorded, transcribed, coded, and further analyzed.

Results

What is the Cost of Investment Readiness to the Venture Capital Market?

The Impact of IR on the VC Market

IR is a major problem of the VC market and has a marked impact on the market's effectiveness.

A lack of IR is a huge obstacle to investing as it leads to a reduction in the volume of good opportunities available for investment thereby reducing the amount of investment that takes

place in the market and rendering the market inefficient. One of the frustrations of venture

capitalists is that most of the entrepreneurs that approach them for funding are not investmentready.

Entrepreneurs may feel that they are investment-ready, but they often are not. There

are a number of reasons why entrepreneurs may not be investment-ready, including not having

full knowledge of what they are doing, over or underestimating certain aspects of the funding

required, and not understanding who or what is in the VC market, and what each option offers.

Lack of IR makes the VC market weary, as investors typically do not know what they are

dealing with, and have to spend time trying to figure potential opportunities out. This lack

of preparedness creates unease amongst investors which results in the entire investment

process stalling.

The South African VC market itself is not well developed or defined. Some VC firms are

closer to private equity while the true venture capitalists are really angels with access to

formalized funds. The South African VC market is also somewhat isolated, hence there is a

lack of competition among entrepreneurs looking for VC money. This forms a negative cycle

as there are not enough good entrepreneurs, so there is not enough investment, which adds

to the level of difficulty for entrepreneurs to become investment ready.

Improving IR would thus increase the efficiency of the VC market and the entrepreneurial

ecosystem as a whole. The more prepared (investment-ready) entrepreneurs are, the less time

it will take to exchange information and establish relationships with investors.

VC money is fundamentally managed by people who are under pressure to deliver returns,

and who are evaluated based on these returns. Venture capitalists thus look for high-risk, highreturn

opportunities. However, when entrepreneurs present half-baked opportunities, investors

struggle to adapt to the nature of the risk and the reality of the VC market. Investing in the

opportunities thus becomes too much of a leap of faith, thereby restricting the VC market.

Improved IR would speed up the investment process and improve the scope of the VC

market's pipeline. Currently, 90% of the VC market's pipeline is not investment-ready, so

improving IR would increase this figure. Improved IR would also lead to entrepreneurs having

all the right investment requirements in place, which in turn would attract further investment

into the VC market, by reducing risk-adversity in the market. The more and better the number

of opportunities that are investment-ready, the better for the VC market-the greater the

transaction rate will be, the greater the volume of the market will be, and the more efficient

the market will be. The higher the transaction rate, the more cash will flow into the VC market,

to take advantage of the fact that the market is efficient. Improved IR will thus allow the VC

market to grow naturally.

Ideal Conditions: Under ideal IR, there would be more VC firms, and the South African VC

market would approximate and operate more like the mature VC markets in Europe or the US.

The VC market would move from more of an angel type of market to more of a true VC market,

with more high-volume and low touch investments. Investment would be more free and less

risk adverse, and more opportunities or investments would succeed.

The VC process is currently a shotgun approach, as entrepreneurs, unclear on VC firms'

investment mandates, send their opportunities to every single VC firm they can locate-

regardless of the firm's focus. VC firms need to clearly define their focus so that when

entrepreneurs do their research, they can understand which firms to approach. VC firms also

do not provide clear documentation on IR. IR documentation must be more clearly defined,

and must be adapted for every opportunity stage. In addition to the provision of IR

documentation, there should be an arbitrator, regulator, broker or go-between, to help

entrepreneurs prepare and find the most suitable VC firm(s). An ideal VC market would be

able to mentor and assist entrepreneurs on the holistic aspects of IR and opportunities, giving

entrepreneurs advice and drawing their attention to the points that they may be missing.

An ideal VC market consists of VC teams made up of people that are experienced in

starting and running businesses-people that are able to evaluate opportunities based on

experience. Experienced executives in the market should be deeply involved in the VC

market. The experience of the investor-together with his background-determines how

accommodating he is, and how much he expects with regard to IR. The investor may relate

to the entrepreneur and understand where he is coming from, particularly if he (the investor)

is, or has been, an entrepreneur himself. The investor will be more accommodating, in not

expecting perfect answers.

Existing IR Services

There is a significant number of IR services and programs available in the VC market, and

the support structures are growing. (1) There are incubators, accelerators, business schools, and

business and support services and programs for Small and Medium-sized Enterprises (SME).

(2) There are brokers and consultants that do pre-due-diligence, and that help with IR.

(3) An abundance of IR content exists online, as well as online processes to test IR. (4) There

are also books available for entrepreneurs to read. (5) There are hybrid VC firms that tend to

both investment and IR or advisory services, as well as selection programs that screen and

take in candidates looking for VC funding. (6) Some major companies and banks are also

involved in providing IR services. (7) More informally, there are consultants and angels who

can offer advice-whether solicited or unsolicited, paid or unpaid. Entrepreneurs can also help

themselves by identifying mentors who would be able to offer guidance.

Although IR services are provided in the VC market, few of these services approach IR

from the mindset of venture capitalists, particularly in certain areas of VC, such as early stage.

The focus tends to be on entrepreneurs that are further down the line, than those that are just

starting out with their ideas. The quality of IR programs and services is also an issue, with

the issue exacerbated by the fact that there is no real standard for IR. Business and start-up

experience is needed, to assist entrepreneurs get their opportunities off the ground, and this

experience is often lacking.

Pre-IR Opportunities: Venture capitalists generally do not give hard "no's," because they do

not want to lose the potential deal or pipeline. The VC firm may be willing to back the

entrepreneur and/or his team under certain circumstances and conditions, even if the opportunity is not really investment ready. Venture capitalists normally provide entrepreneurs

with advice and point them in the right direction-either other VC firms or angel investors-

if they cannot help the entrepreneurs themselves. Depending on the type of investor, the

investor themselves and the opportunity, VC firms may be more reluctant and angel investors

may be more willing, to take a chance on opportunities that are not investment ready.

Despite all this, a significant number of opportunities that are not investment-ready are

discarded because VC firms are not willing to take the high risk. VC firms prefer to look at

opportunities that are investment ready. Whether an idea or opportunity gets discarded also

depends on the entrepreneur. The entrepreneur's idea may be great, but the entrepreneur

themselves may not be able to run with, implement, and make the idea a success. If the

investor does not have confidence in the entrepreneur, he will not invest. The ability and

willingness of the entrepreneur to work with the investor, can also affect IR and perceptions

of IR: Whether the entrepreneur is open to the criticism and suggestions of the investor,

whether the entrepreneur can establish a working relationship with the investor, and whether

the entrepreneur can align with the investor. VC firms and angel investors may be willing to

invest in and work on opportunities that are not investment-ready, if they see potential. Thus,

having a good idea may be more important than IR per se, as the investor will look past the

pre-IR, and focus more on the opportunity and its potential. In this sense, IR is also much

about the quality of opportunities. It is the quality of opportunities that gets them through,

regardless of their IR. An investor may go with a high-quality, poor-IR opportunity, and

discard a low-quality, moderate-IR opportunity.

IR Timelines

The length of time taken to get an opportunity investment-ready is largely dependent on the

opportunity itself and the entrepreneur(s) behind it. It depends on how much is wrong with

the opportunity-how many (poor or unsubstantiated) assumptions are embedded in it. It also

depends on how advanced and developed the idea or concept is and how far the idea is from

a product prototype. Some opportunities cannot be recovered because there is no product or

market or the entrepreneur is already insolvent. If there are not too many issues with an

opportunity, it can be ready for investment in a few weeks. If it involves management,

leadership, business development and growth, understanding of the market, or soft skills

development, IR can take much longer.

An IR professional needs to determine what is missing and what is still required regarding

the IR of an opportunity as well as what factors the entrepreneur does not know or does not

have ready that would contribute to IR. The time that it takes to get an opportunity IR is thus

greatly dependent on the entrepreneur, how open he or she is to input, and how willing he

or she is to cooperate and incorporate suggestions. Attaining IR thus becomes an iterative

process of giving feedback and tasks to the entrepreneur and reviewing the tasks once

completed. Consequently, IR can take anywhere between one month to three years to achieve.

Insufficient or Incomplete Information and Details and Assumptions: Insufficient or

incomplete information, details and assumptions constitute the bulk of the time to attain IR.

The length of time taken varies from case to case and depends on what is in place and what

is missing: a good product and competitive advantage, a good sales strategy, environmental

and competitor analyses, a good company structure, a good exit plan, financial models, a

marketing plan, etc. The length of time to resolve these issues is further dependent on how

long it takes the entrepreneur to respond to the requests and recommendations of the investor.

Entrepreneurs' Expectations and Equity Adversity: The issues mentioned stem from a

disconnect between the entrepreneurs' valuations of their businesses and those performed by

investors as well as ignorance on the entrepreneurs' part regarding equity and financing.

Entrepreneurs' expectations are often ungrounded and unrealistic and their valuations are

based on exceptional cases or success stories. Correcting entrepreneurs' expectations and

equity adversity depends on the maturity of the entrepreneurs and their knowledge, awareness

or exposure-whether they have been exposed to the VC process or have heard about it and

thus have some insight and more realistic expectations. These issues can thus be resolved in

as little as one meeting, through a plain, straightforward and upfront discussion that spells

out the rules and conditions and that constitutes a case of "take it, or leave it".

Poor Presentation: Presentation forms part of first impressions and is equally seen by

investors as a filter or check. Poor presentation can be fatal for entrepreneurs and their

opportunities and can mean termination, i.e., no further discussions or meetings. Presentation

issues mainly stem from a lack of understanding by entrepreneurs of the nature of their

business and their Unique Value Proposition (UVP). In order to resolve presentation issues,

these underlying issues must thus be addressed. Assuming these underlying issues are in place,

presentation issues can take as little as a week to resolve through coaching the entrepreneur

on how to present, or simply getting someone else with better presentation skills to lead the

presentation. Presentation issues related to a lack of understanding, however, will take a much

longer time to resolve.

Poor Setup (Management): Few opportunities have perfect management teams. Management

is generally poor and entrepreneurs typically do not have all the structures in place. The

entrepreneur as the central point of contact and the person investors' deal with is far more

important than the set up of the management team. However, management is still an important

requirement for VC firms and where venture capitalists feel there is potential for the

management team to grow, they will assist the entrepreneur, by helping to put the right

management structures in place. Identifying issues of poor management setup is easy and can

be fixed by a conversation. Putting the management team together, however, will take longer,

as it will not only be a matter of sourcing appropriately skilled people but also dealing with

the entrepreneur's mindset regarding any fear, hesitation, or pride he or she may have.

Unique Value Proposition or Lacking Business Plan or Model: The UVP is the foundation

of an opportunity and a fundamental component of IR. However, the UVP is also often a

weakness for entrepreneurs. VC firms may be unwilling to further work with an entrepreneur

and help them reach IR, if the UVP is lacking. Venture capitalists can act as a guide for

entrepreneurs but they cannot discover the business opportunity for them. The requirements

do differ between consultants and venture capitalists. Venture capitalists will turn away or turn down opportunities without UVPs whereas consultants are more willing to assist and

help work on certain aspects (thereof). It is difficult to correct the UVP as it either does or

does not exist. Where the UVP exists but is not properly articulated, it is easier to fix.

However, because the UVP is such a fundamental component, it can take as much as six

months to three years to crystallize an opportunity well.

Availability of IR Content and IR Awareness of Entrepreneurs

IR content and templates are readily available on the Internet. There are specific platforms,

like Finfind, that connect entrepreneurs and investors, and VC firms' websites, where they

provide guidelines specific to their unique requirements. Social media platforms such as

Twitter, also serve as online sources for information. In addition to online resources,

entrepreneurs can attend seminars through institutions and universities, complete courses and

attend industry conferences and talks.

There is a major gap in terms of entrepreneurs' awareness of IR and the perception among

entrepreneurs is that IR is easy. Early stage entrepreneurs in particular are not investmentready

and often have not received advice on IR and how to ensure that they are investment

ready. Entrepreneurs know and are aware of the basic requirements and components of IR,

such as a business plan, the target market, a marketing plan, financial reports, etc. Yet, they

still fail to put forth and present a UVP. Based on this, it can be said that IR guidelines are

inadequate and are failing.

The Cost of IR

Correcting or improving IR involves a lot of time and people's time is scarcer than money.

A lot of time is spent on getting the UVP right and in place and understanding what the core

business is about. The venture capitalist, consultant or adviser spends the majority of their

time checking all of the entrepreneur's assumptions regarding the market and the UVP. After

that the business plan and presentation then become easier to perfect. Based on this, the more

articulate and accurate the entrepreneur is in terms of UVP, the less time will be wasted trying

to resolve its issues.

The time taken to correct or improve IR is also dependent on the entrepreneur's

background and mindset. The more commercially-or business-oriented the entrepreneur is,

and the more receptive he or she is to the advice and recommendations made to him (her),

the shorter the time taken to correct or improve his (her) IR, and the lower the cost.

How the Cost of IR Is Currently Recovered: The cost of IR is shared between the

entrepreneur and the investor. The required investment typically involves time and money.

The entrepreneur carries most of the cost of IR as readiness is seen as a pre-investment issue.

However, investors incur IR costs through performing due diligence, as well as through the

opportunity cost associated with the other opportunities that they may forgo while focusing

on assisting an entrepreneur to become investment ready.

If there is significant work that needs to be done to get an opportunity investment-ready,

e.g., to gain a better understanding of the business concept, or to conduct some market research, the investor may request that the entrepreneur do the work, and may be willing

to fund it, in exchange for rights to the opportunity. The cost to the investor is often written

off as the cost of seeking opportunities. The harder the investor has to work to understand

the opportunity, the higher the return he or she expects, and the more equity the

entrepreneur has to give up. The cost of IR is thus often only recovered when the

opportunity succeeds.

IR and Potential of Opportunities

Investors are typically reluctant to pursue opportunities that are not investment-ready,

choosing instead to give advice to these entrepreneurs and instructing them to come back

when they have implemented the necessary changes or improvements. This cycle is often repeated,

until the opportunity is investment ready. Investors will, however, work on an opportunity that

is not investment ready, if the opportunity shows significant potential with a road-map to

successful product development within a reasonable time-frame. The investor will consider the

risk-return ratio of the opportunity and will expect higher returns than usual, as the opportunity

will take more time and effort. Given the high number of opportunities that are not investment

ready and that lack significant potential, few opportunities are ultimately advanced.

Risk Proportion of Opportunities That Are Pre-Investment-Ready: Opportunities that are

pre-IR are considered high risk, given the fact that very few of them eventually attain IR or

show progress. Angel investors are more willing than VC firms to work with opportunities that

are pre-IR although it must be noted that the opportunity's success in becoming investmentready,

is dependent on how much effort the entrepreneur himself puts in as well as the quality

of the opportunity. The number of opportunities that eventually attain IR, is in the region of

10 to 20%. At the same time, it is becoming easier to attain IR, due to all the online resources

and IR professionals available.

Investment in IR comes with both gains and losses. On the downside, investors run the

risk of getting involved in and tied down by an opportunity that struggles to make progress,

thus wasting their time, while the entrepreneur may bear significant monetary costs. However,

on the upside, entrepreneurs will benefit through saving time on trying to become investmentready

by themselves, as well as through receiving funding quicker.

Impact of Investment in IR

Expenditure on IR is risky as it is incurred in the hope of earning a positive return in the

future. Investment in and subsidizing of IR are a necessary cost of start-ups. The investment

and subsidization should, however, be targeted and selective-rather than follow a blanket

approach-to be effective. The focus should be on opportunities with potential. Investment

in IR leads to an increase in entrepreneurial output and investment, and subsidization of IR

is not necessarily negative: value is derived from various activities. There is value in

interrogating ideas and opportunities to ensure they are viable. There is value in mentors,

universities, departments, and institutions helping entrepreneurs to crystallize their ideas and

thinking and verify, validate and substantiate their ideas. The experience that entrepreneurs

gain through the process is an indirect benefit. From the investor's perspective, not all expenditure on IR leads to investment-ready opportunities and thus carries no financial

benefit. However, the investor still learns and gains experience from this.

Government Versus Private Sector

Government does have a major role to play in terms of IR and can subsidize and support

private sector IR work and initiatives. The private sector is unwilling to provide IR services

out of its own pocket due to the risk profile that implies that it is unlikely that the costs will

be recovered. Government subsidization can thus assist with the payment of IR experts and

consultants, for example. Programs and initiatives provided by government tend to have

quality issues. Government itself tends not to be very productive, efficient, or motivated, and

will unlikely be able to maximize output. Thus, IR should ideally be spearheaded by the

private sector with financial support from the government.

How Should Investment Readiness as Task Be Allocated and Resolved? Of

the Market Participants and Stakeholders, Who Is in the Best Position to

Deal with Investment Readiness?

Entrepreneurs Improving IR on Their Own

Entrepreneurs can improve IR on their own to the extent that they know what information

to look for, but they will still require advice from experienced professionals to fully resolve

a lack of IR. Entrepreneurs can educate themselves on IR through consulting online resources,

attending workshops and seminars, and speaking to industry incumbents and people who are,

or have been, entrepreneurs before. Entrepreneurs can always ask for advice and assistance, but

they must drive the process of becoming investment-ready by themselves. An online IR

assessment or test would assist entrepreneurs to gauge their IR and point out to them where they

are lacking and what they need to correct, but they will still require assistance with the finer

details and points. Essentially, to resolve a lack of IR, entrepreneurs need to understand what

investors require and thus how to convince and attract them. By ensuring that they offer

investors an attractive opportunity with a UVP, a clear business concept and a clear market as

well as addressing any potential risks the investors may identify, entrepreneurs can improve their

IR on their own. Entrepreneurs can thus improve their IR through a lot of general education.

IR and Market Participants

Incubators and Business Angel Networks: Incubators and BANs can be a good source of

support for entrepreneurs although their usefulness in this regard is dependent on the quality

of the professionals working within the institutions as well as their motivation for providing

assistance. Incubators and BANs can convert unconscious incompetence to conscious

incompetence through making entrepreneurs aware of where their knowledge is lacking and

what they can do to remedy their individual situations thus assisting them to improve their

IR. Incubators and BANs assist entrepreneurs to verify and validate their business concept

premises and assumptions and get them up to standard. Even if they do not incubate the

entrepreneurs themselves, incubators can offer IR services, such as formal courses and events

aimed at improving the education and knowledge base of the entrepreneurs. Angels are also

able to provide coaching and mentoring, although on a more informal basis.

IR Professionals: There is a vested interest for VC bankers and angel investors to ensure that

more entrepreneurs become investment-ready, as increased IR will result in a larger pool of

viable investments-both in quality and quantity-and lead to significant growth in the VC

market. However, VC bankers in particular are in short supply and have a lot of demand on

their time and would therefore want (to show) returns on time invested. VC bankers will thus

only (want to) be involved with entrepreneurs that are sure to show results and from whom

income or equity will virtually be guaranteed. VC firms can, however, provide specific

guidelines that set out exactly what entrepreneurs need to do to increase their chances of

investment.

While VC bankers may be unwilling to assist entrepreneurs with IR, if there is no

significant potential for success, angel investors tend to be more willing to interface with

young and unsophisticated entrepreneurs and guide them towards IR. Angel investors can

provide advice which raises entrepreneurs' awareness and consciousness. As angel investors

are more involved with entrepreneurs prior to IR, they may be better positioned to assist them

to become investment ready.

There is a role for consultants to play in terms of improving IR. It is naive to expect

entrepreneurs to know the entire IR process without training and with the short supply of VC

bankers and angel investors available to assist with IR, consultants have a crucial role to play.

Consultants can increase the level and quality of IR, through advice, experience, and access

to resources. The fact that consultants are more knowledgeable and experienced than the

entrepreneurs themselves, already serves as an indication of their potential to assist

entrepreneurs in improving their IR. The issue with consultants, however, is that they will

require payment for their services and this affects the number of entrepreneurs that they are

able to assist. Entrepreneurs are generally unable to pay for consultants themselves and this

suggests a role that government can step into and subsidize the payment of consultancy fees.

Consultants do, however, need to have proven investment, management and/or entrepreneurship

experience, in order to be truly useful to entrepreneurs.

Most Suitable Participant: IR is best dealt with through providing and making available to

entrepreneurs, educational resources, forums, advice, support and mentoring. The Internet is

possibly the best medium through which IR services can be provided as it allows for the widescale

provision and dissemination of information. Ultimately, however, it is the responsibility

of the entrepreneur to ensure that he attains an acceptable level of IR.

The best market participants to deliver IR are incubators, accelerators and angel investors

who act as mentors. A VC firm with an advisory arm can also deliver IR. Still, a VC firm's

main role is to evaluate and consider opportunities. Accelerators and incubators already have

a framework designed to assist with IR and the provision of their services is institutionalized.

Consultants also have a role to play in delivering IR, although, unless subsidized, their

approach may be more profit-driven-their approach may be more focused on potential

returns to keep the lights on, rather than on "free" or "unbiased" consultation (what is best

for the entrepreneur; what the entrepreneur truly needs; meeting the entrepreneur where he is currently at). Incubators and accelerators are set up to get entrepreneurs through an incubation

and development process and are more likely to be agnostic to the outcome. To maximize

their usefulness, the incubators and accelerators must have the necessary skills and experience,

as well as credibility and a good reputation, and it should be ensured that they (incubators

and accelerators) are accessible to all. Good quality incubators will have the necessary skills,

experience and consultants.

Aside from mentoring, angel investors may also assist stronger entrepreneurs that are able to

more quickly get ahead on their own in terms of IR. This raises the point that there are different

calibers of entrepreneurs that require different levels or forms of assistance when it comes to IR.

How Can Investment Readiness Be Optimized and Standardized?

Factors of IR

Most entrepreneurs find themselves lacking knowledge and certain skills and attributes that

contribute towards IR when they initially seek out funding. Entrepreneurs tend to be too

technically-oriented and not business-orientated enough. They overly focus on their product,

and not enough on the commercial metrics: the UVP, competitive advantage, sustainability,

competition, and protection of their concept. They lack understanding of their market, their

customers, and why their customers would be interested in their product. On the other end

of the spectrum, some entrepreneurs are not innovative enough and they lack a good business

idea, model or strategy, and thus propose low-quality products. Entrepreneurs also tend to be

unrealistic and lack reasonable expectations regarding the validity and value of their

businesses, and the potential for success-they are not critical enough of themselves and their

products. Entrepreneurs fail to think like investors and do not consider the factors that

investors look at, such as investment risk and return, and the entrepreneur's own attributes,

such as commitment, enthusiasm and unique thinking. Entrepreneurs fail to communicate and

articulate their concepts and are unable to prove their concept and reason(s) for seeking

funding.

IR and Business Acumen

Business acumen is generally lacking among entrepreneurs. They lack a certain basic

understanding of business and management concepts and they do not necessarily know how

to run a business. IR is heavily dependent on business acumen and entrepreneurs that lack

business acumen are more likely to have their opportunities turned down: With cases where

there is a lack of business acumen, it is almost always fatal. The business acumen that

entrepreneurs should possess, cannot only be academic, but must also be experiential, gained

either through running a business or working in industry.

Whether opportunities with entrepreneurs that lack business acumen can survive depends on

the entrepreneur's personality (how teachable and open the entrepreneur is to input), and the

investor's response: whether the entrepreneur can somehow circumvent his lack of business

acumen and the investor responds positively to this. Some opportunities survive because the

entrepreneur is persistent and his opportunity does not require a significant amount of funding.

Other opportunities survive because the idea is good and the product is strong. However, the

idea may still require that someone else, other than the entrepreneur, implement it.

Assessing IR

It is possible to assess (aspects of) IR objectively and there are standard metrics that an IR

test can incorporate and be based on. There are already some forms of IR assessment tools

available in the market. An IR test would involve both quantitative and qualitative aspects

and measures. Quantitative measures can be judged objectively, however, qualitative

measures such as psychometrics and the behavioral traits of the entrepreneur are more

subjective. Also, investors may still want to do their own due diligence. The fact that

opportunities, industries and investors are diverse and differ in their requirements also renders

it more difficult to create a generic IR metric. It may only be possible to standardize the

questions of an IR test to a certain extent.

An IR assessment would also improve an entrepreneur's chances of securing investment

as investors may be more willing to invest or engage with an entrepreneur if they knew that

the opportunity has been pre-qualified to some extent. The assessment can be in the form of

an initial online IR assessment and subsequently a team of professionals that take

entrepreneurs through a formal and detailed assessment. If it is made mandatory to go through

such a process, access must be reasonable. To be successful, multiple parties of investors need

to come together and develop an IR standard that they are willing to subscribe to and that

can then be championed, acclaimed and accredited. Some basic measure or level of IR can

then at least be assessed or evaluated.

IR, Quality and Efficiency in the VC Market

VC firms in particular may lack the skills and resources needed to filter and search for opportunities

and may be interested in something that can improve the quality of their pipeline. VC firms have

limited resources, therefore, having a middleman or a broker that can match entrepreneurs with

the right investors would improve the efficiency of the VC market. It is important for VC firms

to invest in IR programs as the more they invest in incubators, tools and guidelines for

entrepreneurs to become investment-ready, the better for the VC market in general.

Because most entrepreneurs go through or can access incubators, it should be ensured that

all incubators adequately cover IR.

VC market efficiency can be improved by increasing and enhancing interaction and

interaction spaces: building on the analogy of speed dating, having entrepreneurs and angel

investors meet and have a discussion, to see if they fit together. If they do not fit, the

entrepreneur simply moves on to the next investor. Similarly, the quality of angel investors

can also be enhanced by more effort and focus on bringing them together and having more

inter-activity between them. The quality of entrepreneurs can be improved through the

compilation of concise and accessible guidelines which highlight all the concepts that

entrepreneurs must understand, as well as through forums to assist with IR. The provision of

online IR tests to help filter and pre-screen opportunities, will assist in streamlining the

process and provide for a more efficient use of investors' time.

Government can assist with improving the VC market by ensuring quality Internet access

to all. Government can also subsidize IR services but without getting directly involved in the

process. The revision of small business taxation law would also aid in improving the VC

market by ensuring that small businesses are not treated as mature businesses, simply because

they attain a certain level of investment.

Streamlining and Standardizing IR Processes

Various measures can be taken to streamline the IR process. These measures include making

crowd-funding and pitching solutions and platforms such as Kickstarter, more accessible and

inclusive. IR can also be streamlined through education or systemization and assistance, i.e.,

providing certain guidelines to follow and helping entrepreneurs to meet those guidelines.

Other measures include involving VC firms in the improvement of IR. IR can be broken up

based on the industry and stage of the opportunity and different investors and specialists can

get involved based on their preferences.

Having online IR content aids in the streamlining process as technology can then be used

to help collect better responses to IR questions, explain IR questions and guide responses to

IR questions. An online forum with mentors that entrepreneurs can interact with can be

created, coupled with online references and IR examples that entrepreneurs can access.

Technology can further impact IR by allowing rapid prototyping and increasingly permitting

agility in product designs and products.

It was noted that some of the more successful VC markets have very stringent requirements

and filters, whether formal or informal, and entrepreneurs do not make it through the door,

if they cannot prove that they are investment ready. Entrepreneurs in those markets are aware

that it may be a risk to their reputation to present an underdeveloped opportunity and that

they may not get a chance to present their opportunity again. The success of these markets

can be used as an argument in favor of introducing more stringent requirements in the South

African VC market.

Views on systemization efforts, such as certification, accreditation, and subsidy or reward

systems, were generally divided. Certification and accreditation would be useful in that they

can save investors time on filtering opportunities. However, such processes would only be

useful to the point that commonality among investors' requirements can be found. The

subjective aspects of IR interfere with standardization efforts. The hurdles that entrepreneurs

must scale as part of a standardized process may remove the entrepreneurial spirit to some

extent. Certification and accreditation can be offered as options and optional, providing the

entrepreneur with credits to be considered in his favor. However, to make certification and

accreditation mandatory, would result in some VC firms dominating and ultimately bypassing

the process. Mandatory certification and accreditation may also over-regulate the VC market

and bury the VC process in administration and administrative processes.

Raising the bar would eliminate the time wasted evaluating opportunities as investors will

be able to easily assess where exactly the entrepreneur is in terms of IR and filter the results accordingly. Despite its advantages, raising the bar does present some hurdles, the highest of

which will most likely be enforcement. Raising the bar may render the IR process too

stringent. Introducing a mandatory IR exam or some other form of assessment may be met with

resistance from entrepreneurs and may deter some entrepreneurs from the entire investment

process. Additionally, because entrepreneurs are often unable to pay for services, they would

not be interested in such an assessment, unless it was free and would rather refer and revert

to free online IR resources. Again, more subjective aspects of IR may be more difficult to

assess and making such an assessment mandatory may not provide all the answers that

investors seek, thus the assessment's effect may not have as positive an effect on IR as

envisioned.

While one cannot deny the benefits of government support aimed at assisting

entrepreneurs with covering the actual costs associated with entrepreneurship, some investors,

etc. are against subsidies or reward systems (for both entrepreneurs and investors), as such

systems may encourage the pursuit of entrepreneurship and investment for the wrong reasons.

The belief is that entrepreneurs and VC firms should be naturally motivated and incentivized

by the natural VC process, so that it is not necessary to introduce subsidies and/or reward

systems.

Also, as a way of dealing with potential abuse of a subsidy system, one suggestion is to

permit each entrepreneur at least one meeting with an IR professional, after which a detailed

report on the entrepreneur's IR and IR progress is compiled. Based on their findings, the IR

professional can then decide whether or not to recommend further subsidized meetings for the

entrepreneur. Such a process would have the added benefit of acting as a filter and signaling

the seriousness of the entrepreneur.

Certification and Accreditation

(Very formal) certification and accreditation (of entrepreneurs' IR directly) would add to the

compliance requirements that entrepreneurs have to meet as well as increase the time to raise

funding thereby rendering it more difficult to do business. Entrepreneurs may also be reluctant

to share all their information for someone to certify, as they are extremely protective of their

intellectual property.

A standard due diligence test can be used for certification and accreditation and the closer

the test can be brought to the due diligence process that investors follow-and mimic its

outcome-the more useful it will be. Again, investors would be more willing to look at

opportunities that have been approved by an accredited consultant as this can act and serve

as a form of pre-qualification and they would benefit from the time saved in filtering

opportunities. The issue with this process, however, is that there is no standard against which

consultants can be measured in terms of IR accreditation. Therefore, they may not be deemed

credible. There may also be an aspect of subjectivity, as the consultant may not look at

opportunities through the same lens as an investor. The role, duties and contribution of the

consultant would thus need to be explicitly set out and resolved. Incubators may have this credibility and investment experience which may constitute and serve as a form of (informal)

accreditation due to the internal processes that they put down and in place.

It is stressed that this process must not be made mandatory and certification should not

get in the way of entrepreneurs approaching investors, especially those entrepreneurs who are

able to articulate themselves well. The process should be treated as an option that will count

in favor of entrepreneurs but that does not over-regulate them. The process should also allow

for investors to access all screened opportunities that were rejected to counter the possibility

of differences in their assessment and that of the accredited consultant(s). Again, the issue of

cost exists. With entrepreneurs generally unable to pay and VC firms unwilling to pay for the

service upfront, unless the opportunity has a high likelihood of being successful, the role that

government can play in subsidizing these costs remains.

Impact of Quality Standards

The effectiveness of processes that seek to raise the bar in terms of IR will depend on the

particular processes being used. Any IR process that helps with and contributes to the maturity

of entrepreneurs will have a positive impact. Raising the bar relays a message to entrepreneurs

that there are requirements that must be met before investment can be attained and there may

be a need for the entrepreneur to put in more effort to ensure his opportunity meets these

requirements. Raising the bar also creates opportunities for the entrepreneur to collaborate and

improve his idea (increase its quality) through meeting with and receiving constructive

criticism, advice and support from IR professionals and mentors. Raising the bar through

formal assessment should not, however, be mandatory for investment as it may reduce the

innovative and entrepreneurial flair of opportunities. Formal assessment should be a means

to improve entrepreneurs' chances at investment not a potential hindrance. Stricter

requirements coupled with detailed and clear feedback should benefit entrepreneurs and

improve the quality of their opportunities. An administration and governing body that is

supported by government, and that looks to manage and maintain IR guidelines,

documentation, a forum, mentors, contact details of consultants and that may offer IR

assistance itself would also have a positive impact on entrepreneurs and the opportunities they

present.

Stricter requirements would be beneficial to the VC market, if they result in more

entrepreneurs and opportunities being further down the line in terms of IR. The more concrete

the proposals and the better opportunities are defined, the less time investors waste and the

better for the VC market in general. However, the general consensus is that stricter

requirements in terms of IR may negatively impact the VC market as it may render the process

more onerous for VC firms and may increase their duties and responsibilities. Stricter

requirements may also render entrepreneurs more apprehensive to present their opportunities

and the VC market may miss out on opportunities that have potential and that may not

actually have been that lacking in terms of IR. While stricter requirements may increase the

quality of opportunities, any corresponding increase in regulation may result in a reduction

in the number of opportunities that are presented to the market thereby hindering the market's

growth.

Increasing Entrepreneurs' Awareness of IR

Awareness of IR among entrepreneurs can be increased in a number of ways, the most

predominant of which is through education. IR awareness can be increased through the use

of consultants that provide entrepreneurs with advice, feedback and support. Entrepreneurs

may also learn from the experiences and advice of role models, mentors and other acclaimed

people in the industry, as well as through the success stories of entrepreneurs that have gone

through an IR process. Educational material, such as booklets and other guidelines prepared

by experts, can also contribute to raising entrepreneurs' IR awareness levels together with the

provision of IR workshops and other forums. Entrepreneurs should also have a natural

curiosity and should demonstrate effort, commitment and initiative when it comes to IR and

working towards learning about and improving their IR.

Improving Additional Aspects of IR

Overconfidence on the Side of the Entrepreneur: Overconfidence is not necessarily a

problem and entrepreneurs that are slightly more overconfident are generally more successful.

Overconfidence is only a problem when it leads to ignorance. Overconfidence is generally