Dec'22

The IUP Journal of Entrepreneurship Development

Archives

Case Study

Interswitch Drives Financial Inclusion: Can Africa's Fintech Unicorn Sustain the Momentum?

Shwetha Kumari

Senior Research Associate, Case Research Center, IBS Hyderabad (Under IFHE-A Deemed to be University of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: shwetha.kumar@ibsindia.org

Jitesh Nair

Research Faculty, Case Research Center, IBS Hyderabad (Under IFHE-A Deemed to be University of the UGC Act, 1956), Hyderabad, Telangana, India. E-mail: jiteshnair@ibsindia.org

Interswitch Group (Interswitch), an Africa-focused integrated digital payments and commerce company, was founded in December 2002 in Nigeria by Mitchell Elegbe. Interswitch was launched as a transaction switching and electronic payments processing company that built and managed payment infrastructure and soon grew to deliver innovative payment products and transactional services throughout the African continent. Over the years, Interswitch had grown through funding and partnerships. By mid-2020, Interswitch was present in Nigeria, Uganda, Kenya, and Gambia, and its services and payment tokens were being used in 25 African markets. However, it was facing increasing competition from fintech startups in Nigeria and across Africa. Startups such as Flutterwave and TeamAPT had already entered some of Interswitch's product territory. Amidst these developments, industry experts wondered whether Interswitch would be able to broaden access to financial services for Africans, driving greater financial inclusion across the continent.

So you have somebody who invested N=10 mn in this business going away with N=2.6 bn after eight years. That to me was real value, When you help solve big problems, you're bound to be well rewarded.i

- Mitchell Elegbe, Group MD & CEO,

Interswitch Group, in March 2021.

Interswitch has been at the forefront of digital payment innovation across the continent, enabling individuals, businesses, and governments to transact more efficiently over the last 17 years. The evolution of our payment and ecommerce offerings into Quickteller Business, represents a significant long-term shift in both our business and merchant operating model."ii

- Akeem Lawal, Divisional Chief Executive Officer,

Payments Processing, Interswitch Group, in February 2021.

For TA Associates to have partnered with us on Interswitch as their first investment into Africa, given the current market context, is a testament to Interswitch's successful growth trajectory to date, and the quality and resilience of its brand and business model.iii

- Babatunde Soyoye, Co-founder and Managing Partner,

Helios Investment Partners, in 2017.

Introduction

In September, 2021, Interswitch Group (Interswitch), an Africa-focused integrated digital payments and commerce company, announced a new strategic partnership with Codebase Technologies (CBT) to accelerate the digital banking transformation across the African Continent. Digibanc SaaS, hosted by Interswitch, would offer full front-to-back SaaS capabilities to financial institutions in West and East Africa through a rapid and cost-effective deployment model that would allow for economies of scale. Working with CBT was expected to help Interswitch broaden its current digital offering while leveraging Interswitch's brand recognition to increase the reach and visibility of Digibanc SaaS.iv On September 10, 2021, Jonah Adams, Interswitch, Divisional CEO, Digital Infrastructure and Managed Services, stated, "Africa is at the forefront of digitization, with the fintech market across the continent rapidly evolving. There is also an increasing consumer demand for new, more accessible products and services, and for Interswitch, continuing to innovate and enhance our product propositions is critical. We are excited to partner with Codebase Technologies, bringing with them next-generation technological capabilities and expertise, as we continue our mission to increase access to financial services and drive financial inclusion across Africa."

Interswitch was founded in 2002 in Nigeria by Mitchell Elegbe (Mitchell) after he saw the dire need for an easy digital payment system that would help make Nigeria a less cash- dependent economy. The company was launched as a transaction switching and electronic payments processing company that built and managed payment infrastructure as well as delivered innovative payment products and transactional services throughout the African continent.

Over the years, Interswitch had grown through funding and partnerships. In the year 2010, with the company valued at over $170 mn, a private equity deal was structured and two-thirds of the company was sold to a consortium called Helios Investment Partners. In 2013, Interswitch entered into an agreement for payment processing with Discover Financial Services.vi In September 2014, the company acquired a majority shareholding in Paynet Group, an East-African payments provider.vii However, Interswitch faced increasing competition beginning 2015 from fintech startups in Nigeria and across Africa such as Flutterwave, Paystack, and TeamAPT. In 2019, Visa took a 20 percent stake in Interswitch at a valuation of $1bn, which made Interswitch Africa's first fintech unicorn. By mid-2020, Interswitch was present in Nigeria, Uganda, Kenya, and Gambia and its services and payment tokens were being used in 25 African markets. By March 2021, the company's network had grown from 7 banks to almost all Nigerian banks with 11,000 ATMs on its network.viii As of October 2021, Interswitch's business footprint covered more than 26 countries in Africa.

Foundation Years - Setting the Stage for Building Financial Inclusion in Africa

The Idea

Mitchell Elegbe (Mitchell) founded Interswitch in December 2002. After graduating from the University of Benin (UNIBEN), Nigeria, Mitchell did his national service1 at Computer Systems Associates (CSA)-a software implementation company connecting banks to the Society for Worldwide Interbank Financial Telecommunications (SWIFT). After his service year, he got a job as a business developer at Telnet, an ICT engineering and consulting firm operating in Nigeria. Eventually, he moved to Scotland after landing a job with Schlumberger Wireline & Testing as a Field Engineer. While there, Mitchell had an unpleasant experience with an ATM machine seizing his card. That singular experience set the ball rolling for what later turned into Interswitch (Refer to Exhibit I).

The Initial Challenges

Mitchell soon left Scotland and returned to Nigeria with the sole objective of helping Nigeria 'go cashless'. Prior to 2002, Nigerians hauled cash around to pay for everything from groceries to houses and cars. In those days, debit and credit cards were almost non-existent and Point-of-Sale (POS) machines were simply alien. Though there were a handful of ATMs, they only served customers who had an account in the bank to which the ATM belonged. Nigeria simply lacked the infrastructure for interbank connectivity back then. This resulted in endless queues of people waiting to withdraw cash for the weekend. Mitchell spotted the need for an easy digital payment system and meeting that need became his dream.

Mitchell was rehired by Telnet Communications after he returned to Nigeria in 2001. He soon pitched his 'Switch' idea of electronic payments to his boss who liked it and gave him the go-ahead. Mitchell began selling the software for the switching technology but most of the existing players were not that big and were not willing to support his idea.

Mitchell soon realized that promoting electronic payments in Nigeria required overcoming a strong cultural bias in favor of cash. Nigerians used cash in almost any situation, including for giving as gifts at weddings, at burials, at childbirth, and other occasions. Mitchell decided that the best approach was not to eliminate cash but to preach a message that it would be more efficient to use electronic payments. Mitchell also had to overcome skepticism from potential customers and investors through questions such as: 'How do you run a 24/7 business in a country where power is not constant or where telecom is still very unreliable?' and 'How would you get the human resources needed to start a company in an entirely new space like electronic payments?'.

Inception of Interswitch

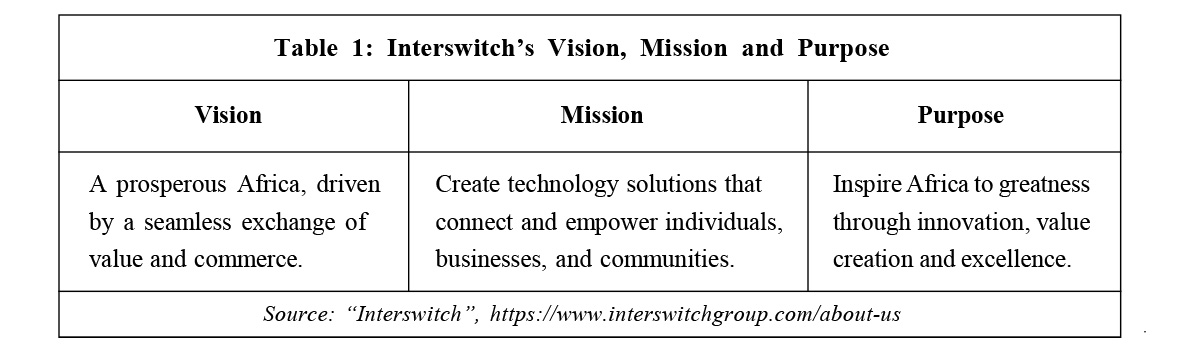

Mitchell knew that electronic payments could be appealing to banks as well as the Nigerian people because transactions were a significant source of banking revenues. Finally, in 2002 Mitchell founded Interswitch with support from Accenture. Mitchell partnered with Accenture to develop a business case2 and a business plan3 where ownership was given to institutions to scale up the business. A few banks also helped raise capital and he partnered with a couple of IT companies too, including Telnet. He did not look to retain control and ownership of the new entity and raised capital by relinquishing nearly 85% ownership of the company. Even though the company was built on his idea, he began life at Interswitch as an employee with no shareholding. He said his priority was not ownership of the company, but rather to see out the execution of what he believed was a brilliant idea (Refer to Table 1).

Mitchell was soon entrusted with the task of leading the company after the company faced the challenge of finding a CEO to run Interswitch because of financial limitations. His outstanding leadership at the company earned him and his team stakes in the enterprise and by 2004, Interswitch was also bestowed with a gold medal for innovation at the Computerworld Honors, an international award program which recognized individuals and organizations whose achievements in ICT had impacted society.

Early Initiatives

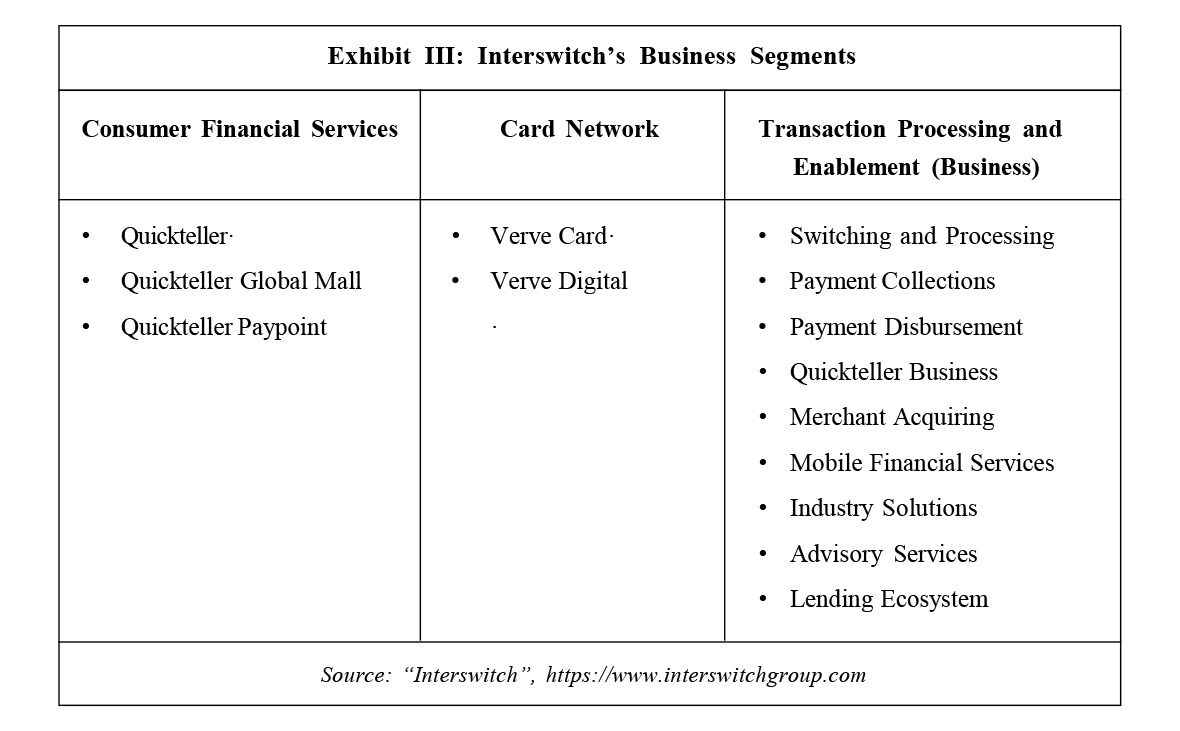

Interswitch initially focused on the consumer financial services and card payment segments and built its brands Verve and Quickteller in Nigeria. It also entered into a series of partnerships followed by acquisitions for overseas expansion in other African markets as a result of timely investments from various private equity investments.

Products and Services for Consumer Segment

The year 2008 was a landmark one for Interswitch as it launched Verve, a payment card, in Nigeria. Within a year, Interswitch introduced Quickteller, an online payments platform that could be accessed through a wide array of digital and physical channels.x By 2010, a consortium led by Helios Investment Partners4 (Helios) had acquired two-thirds of the company through a private equity deal that valued the company at over $170 mn.

In 2017, the company also launched Quickteller Paypoint5, a service under Interswitch Financial Inclusion Services (IFIS).xi Olawale Akanbi, Group Head, Growth Marketing, Merchant and Ecosystem at Interswitch, stated, Quickteller Paypoint is designed to empower Nigerians by creating income-generating opportunities for unemployed Nigerians and increase streams of income for employed Nigerians thereby facilitating business in both the rural and urban parts of Nigeria. "......we are not only empowering Nigerians to earn income, we are also providing them a platform with which they are able to provide meaningful services to their communities and eventually grow to employ and empower others."xii Quickteller was processing over 42 million transactions monthly by July 2019-the equivalent of more than $1.82 bn.

Focus on Business Segment and Entrepreneurship

In October 2014, Interswitch launched Retailpay, a mobile business management platform. Retailpay aimed to provide growing businesses with the technology to remotely manage and monitor their operations via mobile devices, irrespective of location. It was an application that allowed retailers access to their business records from any smart device. Retailpay's key features included sales and inventory management, intelligent business reporting, online store front, records access, staff monitoring, electronic receipts, and the ability to accept card payments from customers. This new sales and inventory management solution enabled the monitoring and control of stock movements, thereby preventing revenue leakages and increasing business profitability. Available via web and mobile, Retailpay was compatible with Windows, Android, and Blackberry and Apple iOS devices using Chrome, Firefox, and Opera web browsers. With Retailpay, small and medium-sized businesses (SMEs) were equipped with the technology they needed to be completely efficient. This enabled them to manage their daily business operations end-to-end. Mitchell stated "Retailpay is a revolution in retail business management designed in response to identified gaps within the SME space in Nigeria. Retailers consistently require reliable and effective end-to-end management of their daily business operations in the most cost-effective way possible. Emerging technologies, such as Retailpay Mobile, will help SMEs drive considerable economic growth."xiii

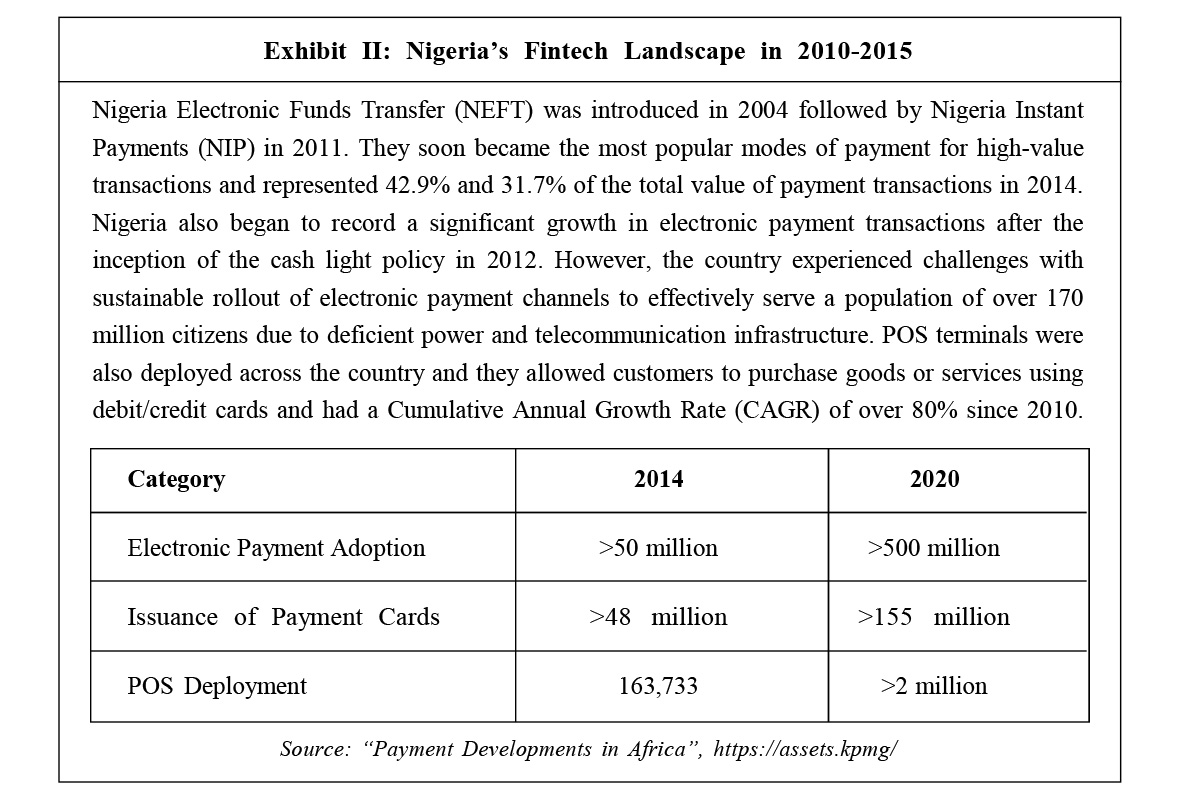

Thereafter, in 2015, Interswitch launched a $10 mn e-payment fund for startups which aimed to serve as a catalyst for funding innovation and disruptive business concepts within the payment industry across Africa. Interswitch sought to collaborate with African entrepreneurs and startup businesses developing innovative products and services that empowered Africans to participate in the emerging payment ecosystems that were transforming business on the continent. Speaking about the funds, Mitchell stated, "Interswitch is committed to encouraging innovative ideas and developing startups across Africa. We created the $10 mn e-payment growth fund to do just that."xiv (Refer to Exhibit II).

In September 2020, Mitchell announced that Interswitch was planning to restart its corporate venturing-the practice of using corporate funds to directly invest in external startups-after a four-year hiatus. Speaking to TechCrunch (an American online newspaper focusing on high tech and startup companies) on Interswitch's plan to resume startup acquisitions, Mitchell said, "We've just certified a team and the plan is to begin to make those kinds of investments again. This time around we want to make financial investments and also leverage the network that Interswitch has and put that at the disposal of these companies."xv

Acquisition and Partnerships for Overseas Expansion

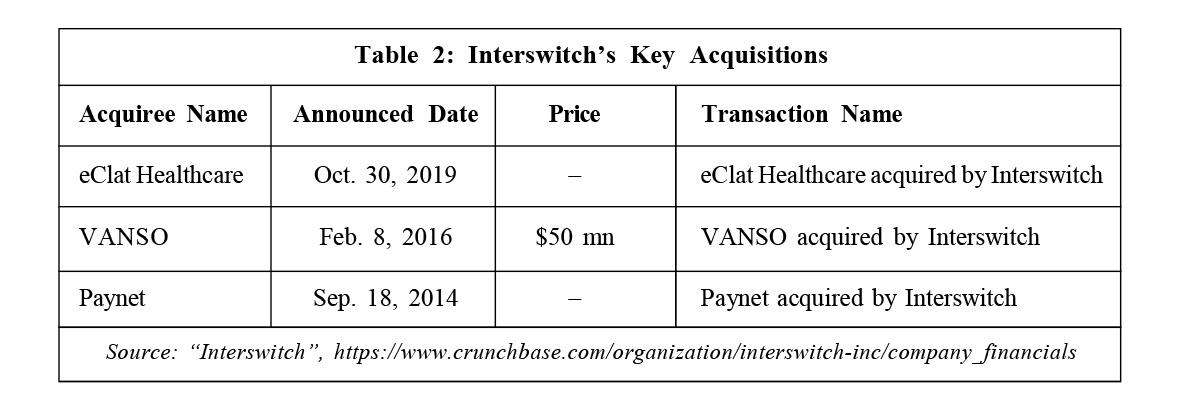

In 2011, the cash rich Interswitch took a 60% stake in Bankom Uganda Limited in Uganda, its first major overseas acquisition.xvi In September 2014, it signed an agreement with the Paynet Group, a leading multi-institutional payments provider of East Africa, to combine their businesses. While Interswitch acquired a majority shareholding in Paynet Group under the agreement, Paynet's existing shareholders became shareholders of Interswitch. Speaking about the deal, Bernard Matthewman (Bernard), CEO of Paynet stated, "Paynet have done a great job at building an innovative and trusted payments company in East Africa and we are confident that between us we can drive growth by continuing to provide payment solutions that are highly tailored to the African market."xvii In a statement, Interswitch noted, "The transaction creates an unrivalled payment infrastructure across East and West Africa." It emphasized that the new combined network connected over 100 financial institutions.xviii

In October 2016, Interswitch acquired 100% of the equity in Value Added Network Solutions (VANSO), a market leading mobile and security-focused financial technology provider. VANSO provided highly secure messaging, payments, and banking solutions for a wide range of telecommunications and financial services clients in Nigeria, Ghana, Rwanda, Kenya, and a number of other territories across Sub-Saharan Africa. The combination of Interswitch and VANSO created an unrivaled African solution across switching, billing, cards, mobile money, and mobile commerce, while integrating an end-to-end value chain play through the combination of VANSO's front-end solutions and Interswitch's back-end infrastructure.

As part of the acquisition, VANSO's non-executive vice chairman, Constantine Labi Ogunbiyi, joined the board of the Interswitch Group. His two decades of strategy, corporate finance, and legal experience in Africa served to strengthen the board's existing capabilities. VANSO co-founder and CEO, Denis O'Brien, assumed a new role as the CEO for Interswitch's Digital Payments business, and the broader VANSO senior management team took up senior positions within the Interswitch system. Commenting on the transaction, VANSO executive co-founders, Denis O'Brien and Idris Saliu, noted, "VANSO's mobile banking platform and payments solutions are already integrated with the Interswitch system, and this transaction provides a broad and established platform from which we can grow into the continent's leading mobile messaging, payments and banking provider. In Interswitch, we have found a partner with ambitions aligned to our own, and the institutional backing and scale to rapidly accelerate their attainment."xix

By 2017, Interswitch was active across the entire payments value chain. It not only owned and operated Nigeria's principal domestic debit card scheme Verve, but served as a third-

party transaction processor for many of Nigeria's largest banks. It also offered a number of electronic payment services to public and private sector organizations and businesses, including government entities, hospitals, telecommunications companies, and utilities (Refer to Exhibit III).

Positive Sentiment in the Market

In 2017, TA Associates, a leading global growth private equity firm, acquired a minority interest in Interswitch. Naveen Wadhera (Naveen), Managing Director of TA Associates, joined the Interswitch board. Naveen stated, "Interswitch is a unique and high quality asset located in one of Africa's leading economies. We are delighted to expand upon our longstanding presence within the global payments. By strategically partnering and aligning its interests with key banks, merchants and other institutions, Interswitch has become a leading provider for payments solutions in an emerging and rapidly growing market in Nigeria." Helios's co-founder and Managing Partner, Babatunde Soyoye, stated, "For TA Associates to have partnered with us on Interswitch as their first investment into Africa, given the current market context, is a testament to Interswitch's successful growth trajectory to date, and the quality and resilience of its brand and business model."xx

Rating agency Moody's in September 2019 assigned Interswitch a B2 corporate family rating, owing to the fact that it processed some 90% of total electronic transactions in Nigeria and the electronic payments segment had risen by 32% in 2018 and was expected to maintain double digit growth rates. According to industry group GSMA, the value of mobile money payments in Sub-Saharan Africa had grown by more than 15% from 2017 to 2018 to

$26.8 bn.xxi Moody's also mentioned that Interswitch had posted an average net revenue growth of 17% from 2017-2019 and an average EBITDA margin of 40% over the same period.

In October the same year, Interswitch raised $55.72 mn through the issuance of a

$55.72 mn Series 1 Fixed Rate Senior Unsecured Callable 7-year Bond via a Special Purpose Vehicle, Interswitch Africa One PLC. This was part of a $72.68 mn debt issuance program registered with the Nigerian Stock Exchange. The Series 1 Issue priced at 15% was 2.6x subscribed.

The strong level of oversubscription demonstrated investor confidence in the Interswitch brand, business model, and long-term strategy. Mitchell commented, "We are delighted to report the success of the first series of Bonds issued under our Program, especially with the level of interest shown by investors. Diversifying our funding sources through the inclusion of these Bonds will enable us achieve our strategic objectives and vision."xxii

In November 2019, Visa paid $200 mn for a 20% stake in Interswitch that valued the firm over a billion, resulting in its unicorn status.xxiii Visa's investment in Interswitch changed the fintech landscape considerably and confirmed the strategic interest of global payment giants in Africa's financial services industry, said Victor Asemota (Asemota), a veteran tech investor. He added, "Interswitch will be also wise to do the same ecosystem play Visa has made. We need that big company which will become an exit path for others. Interswitch has now been positioned to do it."xxiv

Owing to the positive sentiments, Interswitch planned for an IPO via a dual listing on the Nigerian Stock Exchange (NSE) and the London Stock Exchange (LSE) in July 2019. However, this was delayed due to the Covid-19 pandemic.

The Next Phase of Growth

After the postponement of the IPO, Interswitch decided to further improve its offerings in the African market. The company entered into strategic partnerships with American Express and Codebase Technologies (CBT). Interswitch also introduced Quickteller Business to complement its existing Quickteller platform and broaden payment management capabilities to businesses and merchants of all sizes.

Partnership with American Express

In February 2020, Interswitch partnered with American Express to broaden acceptance of Amex Cards in Nigeria. As part of the agreement, Interswitch assumed responsibility for managing American Express (AmEx) merchants in Nigeria, while bringing new merchants onto its platform. Previously, American Express Card members could only use their cards at select locations across the country. This new partnership broadened that acceptance to Interswitch merchants, ATMs, and websites nationwide. Akeem Lawal, Divisional Chief Executive Officer for Payment Processing at Interswitch, stated, "AmEx and Interswitch are aligned in our desire to provide fast and secure payment solutions and transactions across Nigeria. With this new partnership, we are improving AmEx Cardmember access to a convenient and secure network, which also benefits our merchants who will gain new opportunities presented by an expanded user base. By remaining card scheme neutral, Interswitch will continue to explore innovative partnerships that will benefit consumers and retailers alike"xxv (Refer to Table 2).

Launch of Quickteller Business

In February 2021, Interswitch planned to roll out the business payments solution it had launched in Nigeria, Kenya, and Uganda to other countries in West Africa.xxvi Interswitch launched Quickteller Business, a new comprehensive corporate solution focused on empowering businesses of all sizes by facilitating payments and managing transactions from anywhere in the world through one, simple integrated platform. Complementing Interswitch's existing Quickteller platform, Quickteller Business aimed to broaden its payment management capabilities to businesses and merchants of all sizes, allowing them to access a wide range of integrated payment offerings ranging from disbursements to value financing.

The launch of Quickteller Business further expanded the reach of Interswitch's popular ecommerce solution to a broader audience of business users, helping to facilitate growth in the burgeoning SME sector across Africa. On the launch of the new platform, Akeem Lawal, Divisional Chief Executive Officer, Payments Processing at Interswitch Group, stated "Through the integrated platform, SMEs, financial services agents, and large corporates, can better navigate the challenges around payments collections, allowing them to focus on their core business, with their diverse transaction needs taken care of through the versatility of the new Quickteller Business offering". Lawal further added that the platform offered a comprehensive, integrated, payment solution that allowed businesses to receive and track payments, generate e-invoices, and also dispute management. It was an innovative and exciting payment solution that was expected to benefit all business owners. Through this new offering, Interswitch continued its mission to make payments a seamless part of people's lives every day.xxvii With the Covid-19 pandemic causing major disruptions to businesses across the world, the new platform was expected to support the growth of African business owners by facilitating access to effective and easy digital payment and transaction solutions and technologies. Quickteller Business also offered a three-month zero transaction fee incentive for SMEs that signed up, as part of its launch offer.

Strategic Partnership with Codebase Technologies

Interswitch announced a new strategic partnership with Codebase Technologies (CBT), a leading global open API banking solution provider in September 2021. It aimed to accelerate the digital banking transformation across the African continent for Africa's financial institutions and customers. Codebase Technologies' award-winning Digibanc SaaS platform complemented Interswitch's existing payments and digital banking offering. The partnership was projected to help Interswitch broaden its current digital offering, whilst leveraging its brand recognition to upsurge the reach and visibility of Digibanc SaaS in Africa. CBT's Commercial Director and Africa MD, Paul Nilsen, stated: "This partnership will capitalize on the Interswitch Group's in-depth knowledge of the current needs and direction of financial institutions across the Continent, as well as the progress they have made in the banking and financial services space."xviii The partnership was projected to enable banks, fintechs, and other corporates to get the benefit of new technologies that would help them meet evolving market and customer demand. In turn, customers would be able to access an array of innovative banking and payment products that met their existing and future needs.xxix

The same month, SOLAD Power Group6 (SOLAD) partnered with Quickteller Paypoint as a sub-agent. The partnership was expected to enable SOLAD to digitize collections and provide existing energy customers with a broader range of financial services. SOLAD was expected to integrate its sites into the agent network, beginning with its operations in Ogun State, Nigeria. "SOLAD has connected more than 10,000 small businesses with reliable, affordable power and we can now begin to supplement the customer relationship by providing additional value-added services in some of our locations," stated Yewande Olagbende (Olagbende), CEO, SOLAD Power Group, Nigeria. According to Olagbende, the services included cash-in cash-out, bill payments, and other agent network-related activities. She stated further that as more SOLAD sites went live, they would be added to the Quickteller Paypoint network ensuring that these services were available to all SOLAD customers.xxx

Partnership with Interstellar

In October 2021, Interswitch partnered with Interstellar, Africa's first Enterprise Blockchain Infrastructure Services organization, to develop Blockchain-powered Infrastructure Services and Solutions. As part of the partnership, Interstellar's Blockchain technology stack called STARGATE would be integrated with Interswitch's industry-leading payments and digital commerce technology. This was expected to advance the shared vision of the businesses to drive greater financial inclusion and prosperity across the continent.

Both companies had been preparing for the Blockchain revolution in the African market with several ongoing initiatives including a Pan African Payment Ecosystem (PAPE) powered by a 'private permissioned'7 Blockchain network, which included a consortium of banks and fintech players. Ernest Mbenkum, Founder and CEO at Interstellar commented, "This marks the genesis of an innovative and collaborative partnership aimed at delivering impact-focused and enterprise grade Blockchain-powered services across the African continent."xxxi Akeem Lawal, Divisional Chief Executive Officer for Transaction Switching and Payment Processing at Interswitch, said, "This new alliance underscores the directional evolution of our Blockchain innovation strategy which is premised on 3 core pillars: (i) Strategically developing a native, proprietary enterprise-grade distributed ledger technology stack that is practically tailored to the African context; (ii) Progressively digitizing multiple industry value-chains across African markets; and (iii) Supporting the actualization of the Pan African Payment Ecosystem (PAPE), riding the wave of opportunities created by such initiatives as the AFCFTA (African Continental Free Trade Area)."xxxii

Changing Scenario?

Despite the launch of various products under consumer financial services and payment cards and its recent focus on institutional markets, the company experienced a few setbacks.

Downgrade by Moody's

In June 2021, Moody's relegated Interswitch Corporate Family Rating (CFR) to B3 from B2. It also downgraded the senior unsecured medium-term note program ratings of Interswitch Africa One Plc, a special purpose vehicle owned by Interswitch, to (P)B3 from (P)B2 and its national scale senior unsecured medium-term note program ratings to A3.ng from Aa3.ng. The June 2021 rating action was on account of increasing industry risks that exposed Interswitch to operational and cyber risks and concerns about corporate behavior and risk management due to the limited and delayed public disclosures of its performance and financial accounts, and future prospects amidst ongoing macro-economic challenges and evolving regulation.

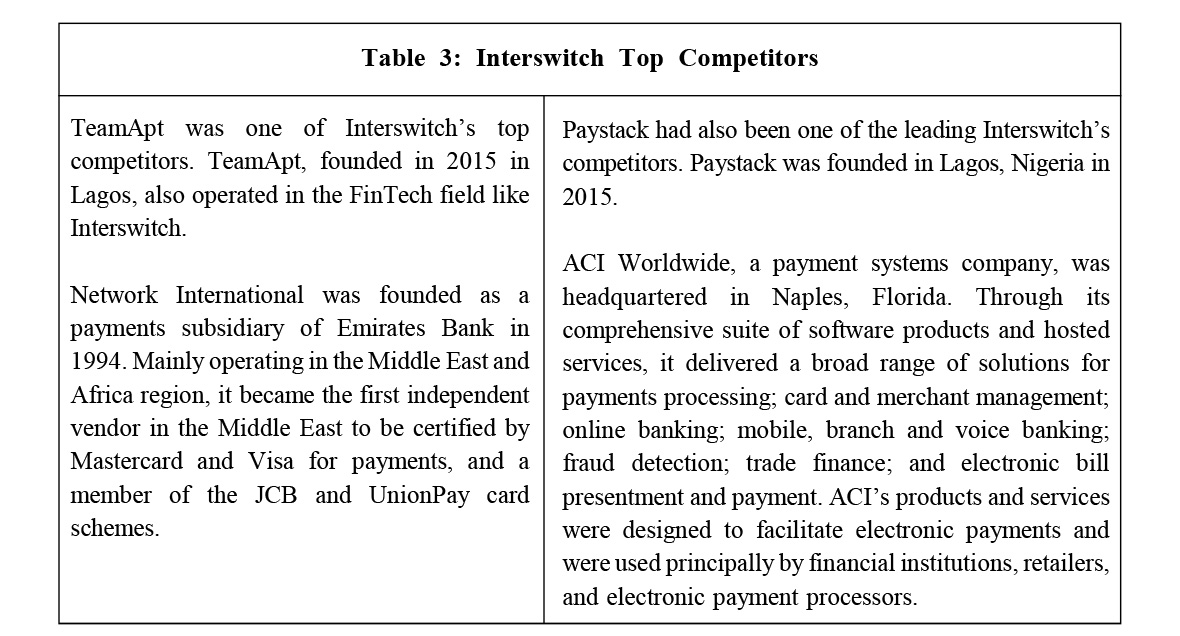

Competition had increased as both new fintech companies and some of Nigeria's leading banking groups were also investing in their own capabilities to handle and process electronic transactions and payments (Refer to Table 3).

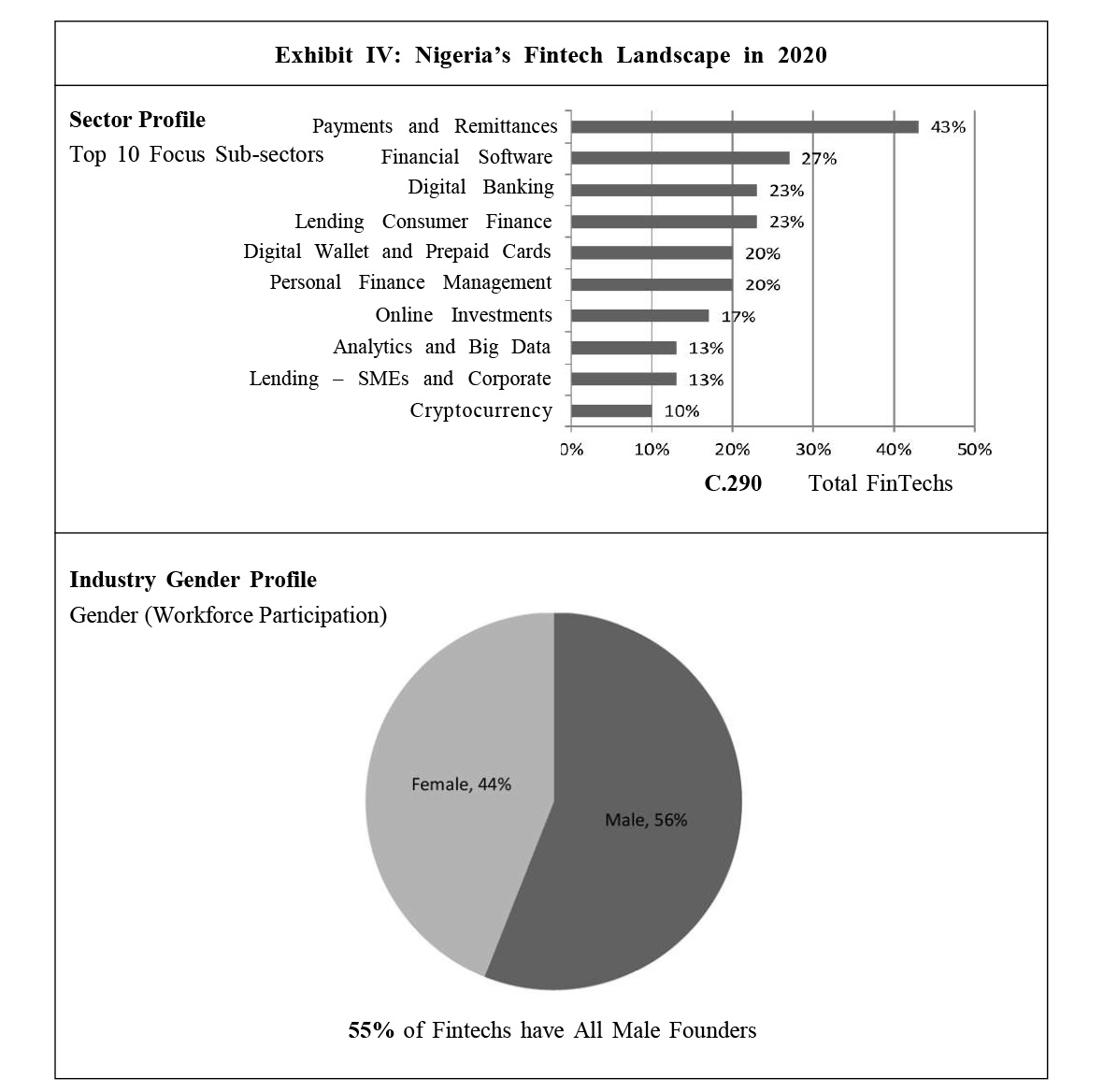

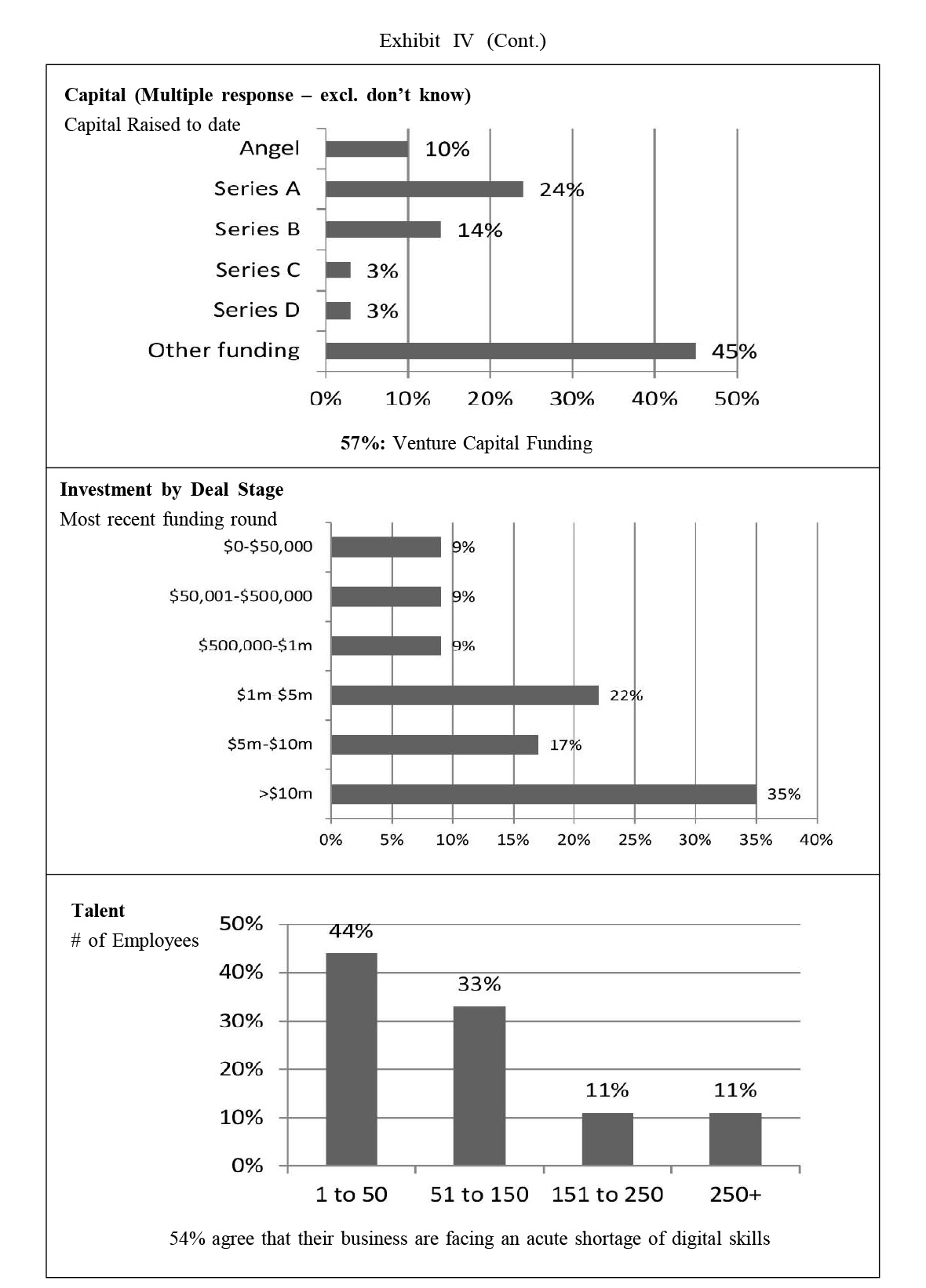

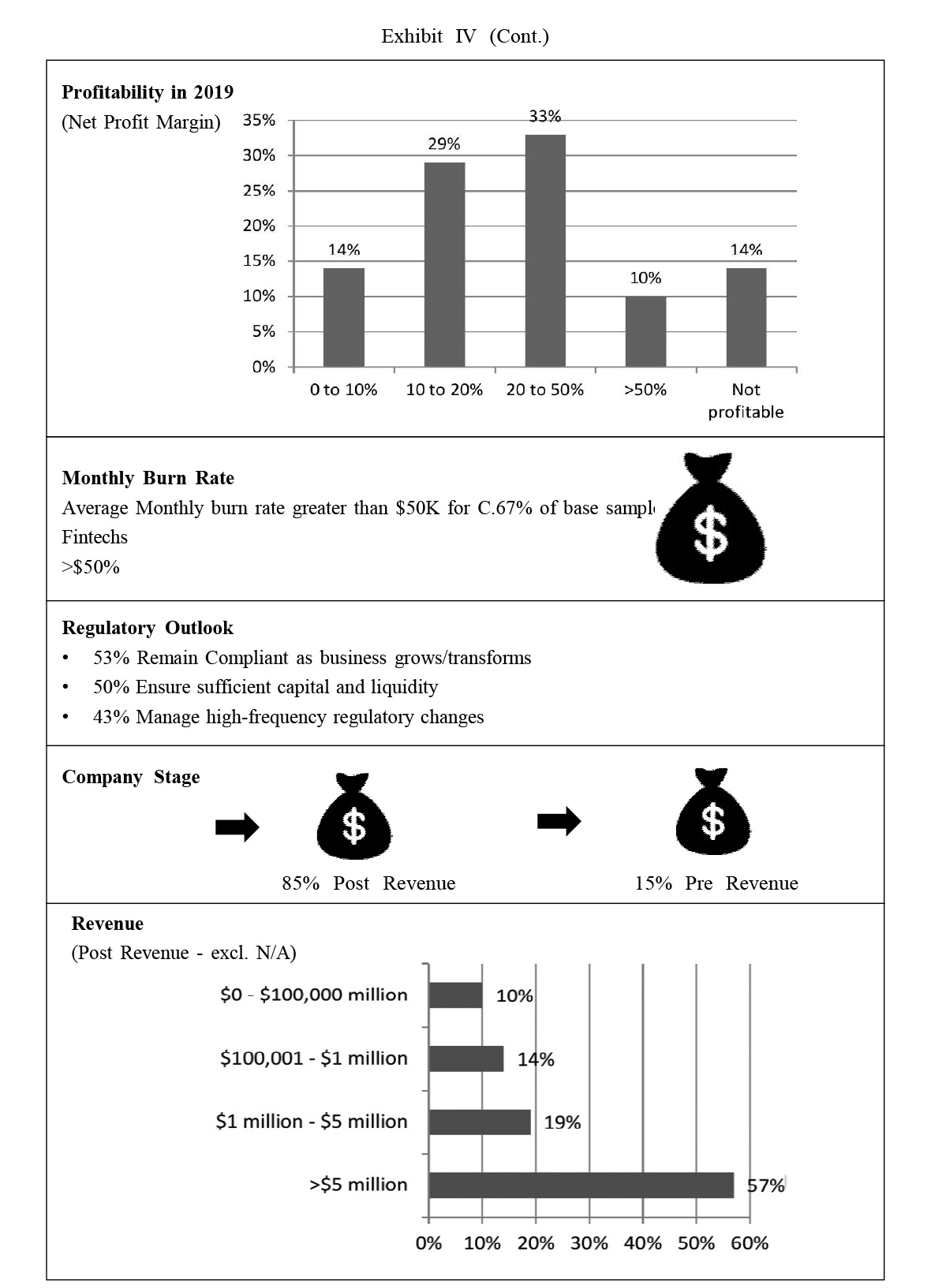

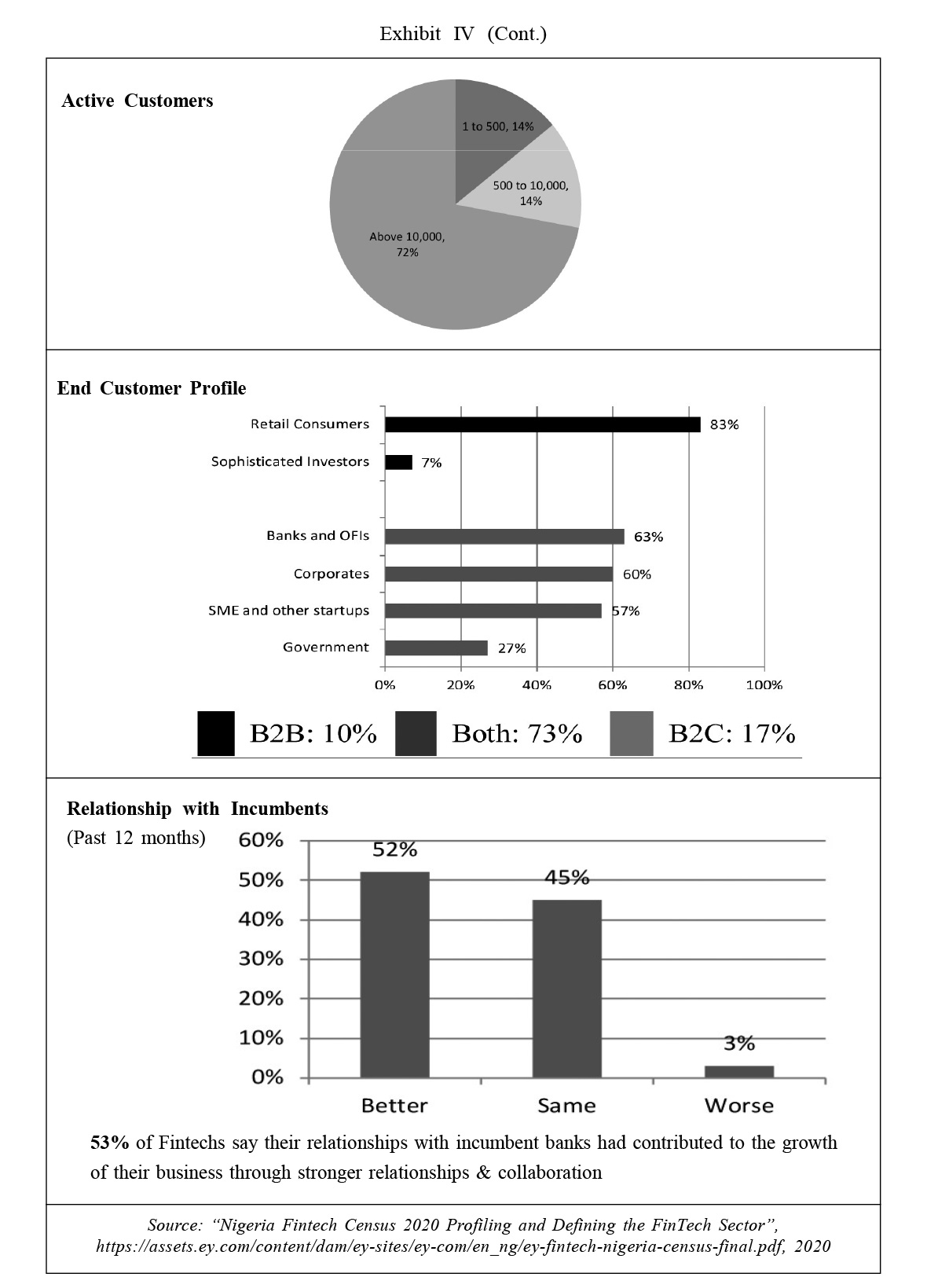

Interswitch's rating also captured Moody's concerns around corporate behavior, risk management, and the limited financial and operational information that was available in the public domain. More specifically, Interswitch released its March 2020 accounts with a significant delay while additional business updates were scarce and not in the public domain, given that Interswitch was a private company, making it difficult for the general investing public to assess its financial performance. The rating agency also noted that the recent strong growth of Interswitch's balance sheet, which expanded 2.1x in the 2016-20 period, had heightened the company's operational risks and could lead to unexpected losses in the future.xxxiii Furthermore, competition from agile Nigerian startups such as Union Pay, and pan-African platform EMPH had added pricing pressure to Interswitch's payments processing business.xxxiv (Refer to Exhibit IV).

Future Outlook

According to a PwC survey, Nigeria's vast SME sector had contributed as much as 48% to the national GDP, on an average from 2015-19 and accounted for about 50% of industrial jobs and almost 90% of activities in the manufacturing sector.xxxv With one of the fastest growing emerging middle classes in the world, Nigeria represented a significant growth opportunity. However, almost 40% of the population still remained financially excluded. Furthering access to electronic payment systems for businesses had the potential to increase the contribution of SME commercial activity in economies across the continent.

Compared to its competition, Interswitch was a more mature business and the next phase of its growth would likely involve a long rumored Initial Public Offering (IPO) that was initially planned in 2016. TechCrunch initially reported that Interswitch was set to launch its IPO in 2020 on the London and Nigerian stock exchanges for about $1 bn, or 2x its revenues at the time. This was said to be a very conservative valuation given the spate of tech IPOs in 2020. Further, through an IPO, Interswitch would be able to raise fresh financing to further fuel its growth and lower its cost of capital compared to its remaining a private company. It was likely to reinvest this money into further geographic expansion. Interswitch was heavily concentrated in the Nigerian market where it generated about 90% of its revenue.

Its consumer-facing app was slowly evolving toward looking more and more like a SuperApp, putting it in direct competition with JumiaPay. Interswitch unlike Jumia, a Nigeria-based online marketplace for electronics and fashion, was not an ecommerce company and could work with a range of third-party ecommerce platforms and delivery providers and integrate them into Quickteller to quickly create a robust SuperApp without having to make expensive capital investments in building its own supply chain and delivery capacity. The opportunity for Interswitch's Quickteller was equally promising on the business side. African small and medium-sized enterprises needed access to capital, investment, and more financial services to continue to grow their businesses. The traditional banking sector remained very conservative and the SMB segment was heavily underserved. Furthermore, Interswitch's dominance in the Nigerian market, its control over the largest card network in Africa, and prominence in Nigeria made it a compelling business to keep an eye on in the years to come. Despite rising competition, Interswitch was well placed to compete against fintech competitors thanks to its maturity as a company and strong ecosystem of consumers and businesses actively transacting on the platform.xxxvi

Commenting about the expansion plan of Interswitch, Mitchell stated, "There are enough opportunities for Interswitch on the continent. We'd like to be in as many African countries as possible...and position Interswitch as the (financial) gateway to the continent."xxvii Mitchell reiterated that Interswitch would continue to work through alliances with major financial services firms to open up global financial access for its African client base. He added, "Nigeria has a very large population and a very large market. We have lots of challenges that need to be solved, but it makes sense to me that lots of money is finding its way to Nigeria because the opportunity is there".

End Notes

- Ruth Okwumbu-Imafidon, "Interswitch: The Story of One of Africa's Earliest Unicorn Companies", https://nairametrics.com/, March 21, 2021.

- Interswitch launches Quickteller Business to Support the Growth of the SME Sector Across Africa", https://www.kapitalafrik.com/, February 15, 2021.

- Nelson, Chijioke, "TA Associate's Stake Acquisition in Interswitch to Boost Payment", https://guardian. ng/, March 10, 2017.

- "Interstellar Partners Interswitch Group to Develop Blockchain Solutions", https://www.thisdaylive.com/, October 07, 2021.

- "Interswitch Partners Codebase on African Digital Financial Services", https://www.finextra.com/, September 2021.

- Mantas Peter, "Yours To Discover: How Discover Financial Services Is A Direct Play on the U.S. Recovery", https://seekingalpha.com/, October 13, 2014.

- Afrique Jeune, "E-payment: Interswitch Nigeria launches a Specialized Investment Fund", http://economie.jeuneafrique.com/, February 26, 2015.

- Nosike Moses, "Mitchell Elegbe: A Giant Stride of a Visionary who Transformed Electronic Payments in Nigeria", https://www.vanguardngr.com/, November 14, 2020.

- Henry, Nzekwe, "Unpacking The Untold Story Behind The Company That Is Set To Become Nigeria's First Billion-Dollar Tech Firm", https://weetracker.com/, 2019.

- Henry, Nzekwe, "Second-Time Unlucky: Interswitch Forced To Further Delay IPO Until 2021", https://weetracker.com/, April 28, 2020.

- "Quickteller Paypoint Empowers Nigerians, Recruits More Agents", https://pmnewsnigeria.com/, September, 2021.

- Nweze Collins, "Quickteller Paypoint Recruits Agents", https://thenationonlineng.net/, September 22, 2021.

- "Interswitch Retailpay To Drive SMEs' Economic Growth", https://www.brandcrunch.com.ng/, October16, 2014.

- "Interswitch Launches $10 million e-Payment Growth Fund", https://dailypost.ng/, February 16, 2015.

- "Interswitch to Restart Investments in African Startups, says GMD", http://www.financialnigeria.com/, September 17, 2020.

- Okwumbu-Imafidon, Ruth, "Interswitch: The Story of One of Africa's Earliest Unicorn Companies", https://nairametrics.com/, March 21, 2021.

- "Interswitch Forms Business Combination With Paynet Group", https://www.heliosinvestment.com/, September 17, 2014.

- "Interswitch, Paynet Sign Business Combination Deal", https://www.thecable.ng/, September 18, 2014.

- "Interswitch buys Nigeria's Vanso", https://www.finextra.com/, October 6, 2019.

- Nelson Chijioke, "TA Associate's Stake Acquisition in Interswitch to Boost Payment", https://guardian. ng/, March 10, 2017.

- George Libby and Akwagyiram Alexis, "Nigerian 'Unicorn' Interswitch Sells Stake to Visa", https://www.reuters.com/, November 12, 2019.

- "Interswitch Raises 23 Billion Naira For Business Growth", https://innovation-village.com/, October 24, 2019.

- "Visa to Pay $200 million for 20% Stake in Interswitch", https://www.marketdigestng.com/, November 12, 2019.

- Kazeem Yomi, "Nigeria's Top Fintech Company is Set to be Africa's First Home-Grown Unicorn with Visa Investment", https://qz.com/, November 11, 2019.

- "Interswitch partners with American Express to Broaden Acceptance of Amex Cards in Nigeria", https://www.interswitchgroup.com/, February 20, 2020.

- Whitehouse David, "Nigeria's Interswitch Eyes Kenya and Uganda to Extend its Payments Services", https://www.theafricareport.com/, February 16, 2021.

- "Interswitch launches Quickteller Business to support the growth of the SME sector across Africa", https://www.kapitalafrik.com/, February 15, 2021.

- "Interswitch partners Codebase on African digital financial services", https://www.finextra.com/, September 10, 2021.

- "Interswitch partners Codebase Technologies on digital financial services", https://thenationonlineng.net/, September 12, 2021.

- Salau S J, "SOLAD, Quickteller Paypoint partner to expand digital power-as-a-service offering", https://businessday.ng/, September 28, 2021.

- "Interswitch partners with Interstellar to develop Blockchain-powered Infrastructure Services and Solutions", https://www.globenewswire.com/, October 04, 2021.

- "Interswitch partners with Interstellar to develop Blockchain-powered Infrastructure Services and Solutions", https://finance.yahoo.com/, October 4, 2021.

- "Moody's Downgrades Interswitch's Ratings to B3 from B2; Stable Outlook", https://www.proshareng. com/, June 04, 2021.

- "Payments in Africa's Largest Market", https://digital.hbs.edu/, November 18, 2016.

- Uyi Akpata and Taiwo Oyedele, "PwC's MSME Survey 2020", https://www.pwc.com/, June 2020.

- Khoso Mikal, "Interswitch: An African Fintech Powerhouse", https://mikalkhoso.medium.com/, May 17, 2021.

- Bright Jake, "Interswitch to Revive its Africa Venture Fund, CEO Confirms", https://techcrunch.com/, September 17, 2020.