Dec'23

The IUP Journal of Entrepreneurship Development

Archives

Impact of Entrepreneurial Innovation on Firm Performance: An Empirical Investigation with Emphasis on Women Entrepreneurs

Sania Sami

Ph D Scholar, Indian Institute of Social Welfare and Business Management, Kolkata, West Bengal, India; and

is the corresponding author. E-mail: saniasharique656@gmail.com

Roychowdhury S

Professor, Indian Institute of Social Welfare and Business Management, Kolkata, West Bengal, India.

E-mail: srcdb@rediffmail.com

Innovativeness has been recognized as a crucial driver for a firm's success and survival. Innovation creates and builds value for the organization. This study examines the effect of different factors of innovation on firm performance. Data was collected from 250 women entrepreneurs across West Bengal based on random sampling. Exploratory factor analysis, multiple regression, analysis of variance, and correlation statistical techniques were used to analyze the data. The findings reveal that there exists a positive and strong relationship between many factors of innovation and firm performance. It was also found that all the factors of innovation are major and crucial predictors of firm performance. The amount of investment and business type are the only two socioeconomic variables that contribute significantly to predicting business performance. Further, the study found that there exists a significant difference between process and market innovation across different business types. The findings also suggest that choosing relevant innovation type can optimize firm performance.

Introduction

In today's dynamic business landscape, innovation stands as a pivotal source of competitive advantage. It is widely acknowledged that innovation plays an indispensable role in corporate strategies, contributing to market expansion, brand development, sustainability, and attainment of competitive edge (Gunday et al., 2011). Notably, innovation has been a central focus of research over the past two decades. Maritz and Brown (2013) revealed that entrepreneurs in entrepreneurship development programs need specific skills tailored to particular markets. Tyler (2001) supported this notion, confirming that innovation involves specific technical expertise to enhance existing practices. Drucker (1954) famously asserted that the primary purpose of a business is to "create a customer", and identified marketing and innovation as its two essential functions.

Traditionally, research and development (R&D) were considered "closed innovation." However, with the advent of the Internet, the concept of "open innovation" emerged (Simmie, 2005; and Gunday et al., 2011). Innovation has consistently been a driving force behind global economic growth, with past research underscoring the connection between technological innovation and economic development.

This empirical research focuses on women's entrepreneurship and its link to innovation, shedding light on the limited information available about innovation in this context. While many studies have explored innovation in high technology sectors typically led by male entrepreneurs, there is a scarcity of research addressing service and trading industries primarily driven by women entrepreneurs. This study aims to bridge this research gap by conducting empirical research on innovation factors in women's entrepreneurship, encompassing product, process, organizational, and marketing innovation.

Literature Review

A comprehensive literature review has been conducted to gain a deeper understanding of innovation and its various facets. This study encompasses a literature review that addresses the following dimensions of innovation:

- Organizational innovation

- Product innovation

- Process innovation

- Market innovation

According to Hansen and Wakonen (1997), innovation encompasses any alteration or enhancement in the way tasks are executed or in the creation of new products. It is closely tied to the development of new products and the adoption of contemporary management practices and approaches, functioning as both a process and an outcome. Bolton and Thompson (2004) defined an entrepreneur as an individual entrusted with the role of creating or innovating, thereby adding value by recognizing opportunities.

Consequently, entrepreneurial innovation involves the acquisition, exploitation, or implementation of new techniques and technologies to invent new products or services or enhance existing ones. The literature review underscores that innovation is a multifaceted concept with numerous contributing factors. Furthermore, it reveals a strong and positive correlation between innovation and business performance, as highlighted by Yavarzadeh et al. (2015).

According to Abidin et al. (2011), organizational innovation is characterized by a deliberate approach to effecting change within an organization, with a specific focus on transforming both its technological and social aspects. Several studies have consistently indicated a positive correlation between organizational innovation and performance of firms, as demonstrated by Reed et al. (2012) and Rajapathirana and Hui (2018).

It is noteworthy that the term "organizational change" can be used interchangeably with "organizational innovation," as suggested by Tether and Tajar (2008). The expectation is that organizational innovation will play a crucial role in understanding and harnessing change within an organization, ultimately enabling the exploration of opportunities for innovation and fostering unrestricted growth in the market, as emphasized by Hamdouch and Samuelides (2001).

The survival and competence of any firm depend on its ability to strive in global competition, maintain its position, bear uncertainties, exploit the opportunities and technologies, and be able to generate new products and demands. Thus, there is a need for product innovation. Multitudinous research has given paramount importance to product innovation over marketing and organizational innovation (Rajapathirana and Hui, 2018).

Abidin et al. (2011) argued that owing to cost-efficiency, it is expected that process innovation will positively affect the performance of the firm. Expediencies stemming from process innovation encompass time efficiency, increased output, and cost-efficiency. Further, product efficiency led to generating quality products (European Commission, 2013).

Marketing innovation is the implementation of new marketing techniques or methods that yield major changes in designing, packaging, placement, promotion, and pricing of the product (OECD, 2005). Drucker (2015) revealed that marketing innovation plays a crucial role in the success of innovation. Marketing innovation is grounded on product innovation, promotion, positioning, distribution, and pricing.

Previous studies have consistently demonstrated that innovation plays a significant role in driving variations in firm performance and influencing the economic landscapes of different countries. Fagerberg et al. (2004) found that countries that prioritize innovation tend to experience higher levels of productivity and income in comparison to those that do not emphasize innovation. It is thus anticipated that the adoption of innovation by businesses will undoubtedly impact their overall organizational performance.

On reviewing the existing literature, it becomes evident that firm performance can broadly be categorized into four main aspects: financial performance, innovative performance, market performance, and production performance.

Drawing from this existing body of research, this framework explores the relationship between innovation and firm performance and develops hypotheses related to these variables. In summary, the framework posits that the implementation of the four distinct types of innovation within firms based in West Bengal will enhance their innovative performance, subsequently leading to improvements in production, process and marketing.

Hypotheses

- H1: Organizational innovation positively affects firm performance

- H2: Product innovation positively affects firm performance

- H3: Process innovation positively affects firm performance

- H4: Marketing innovation positively affects firm performance

A descriptive research design was employed to report the findings, as recommended by Mugenda and Mugenda (2003). The study used various statistical techniques, including factor analysis, correlation analysis, and multiple regression.

The study involved 250 women entrepreneurs to assess the impact of innovation on firm performance within the State of West Bengal. Data was collected through structured questionnaires administered to small and medium-sized businesses, which were randomly selected. These firms represented various sectors, including manufacturing, trading, and service enterprises. IBM SPSS v.26 software was used for statistical analysis. This study was conducted during the academic year 2022-2023.

The data collection process relied on self-administered questionnaires, a key instrument for gathering primary data from 250 women entrepreneurs. The questionnaire (see Appendix) was divided into three segments: the first segment gathered demographic information, the second focused on assessing the impact of innovation within the firms, and the final segment examined the innovativeness of the respondents/entrepreneurs.

To ensure data reliability and validity, the study conducted measures for the overall consistency and accuracy of the items. Cronbach's alpha coefficient was employed to measure internal consistency, with values ranging from 0 to 1.

In this study, the firm performance is the dependent variable and independent variables are organizational innovation, market innovation, product innovation, amount invested, and business type. Each of these factors consisted of specific items and criteria.

Firm performance was evaluated based on four factors: marketing performance, production performance, financial performance, and innovative performance. Innovative performance was particularly crucial in measuring overall firm performance. Marketing performance was assessed through various metrics to evaluate market productivity. Financial and nonfinancial performance was measured, including factors such as profitability, return on investment (ROI), growth, competitiveness, customer satisfaction, and employee loyalty. Production performance was evaluated based on product reliability, design quality, conformance, and pre- and post-sale customer service.

Both innovativeness measures and firm performance were measured using a five-point Likert scale, with a range from 1 (strongly disagree) to 5 (strongly agree), while firm performance was assessed on a continuous scale.

Data Analysis Exploratory Factor Analysis for Identifying Major Factors of Entrepreneurial Innovation

In this study, exploratory factor analysis (EFA) has a crucial statistical role to examine the interrelationship between items of entrepreneurial innovation. Multivariate factor analysis has been performed to extract the same. Principal component analysis (PCA) has been applied to extract a few significant factors from a large set of variables. Further, varimax rotation is used to identify the underlying factors of innovation and firm performance. Only those factors whose eigen values were 1 or greater than 1 were retained. Eigen values explained the amount of variance accounted for by a factor (Kim and Mueller, 1978). Content validity is measured using Cronbach's alpha to ascertain internal consistency and reliability, and it was found to be 0.782. The label of each factor is selected to typify the included variables in the study as closely as possible.

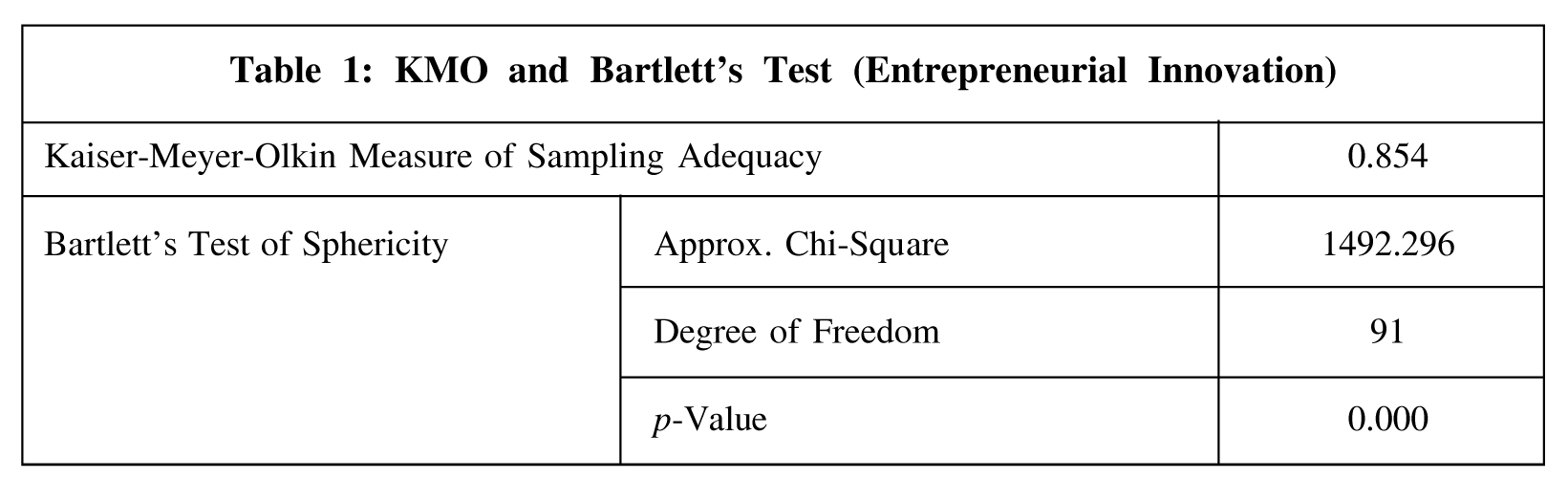

Kaiser-Meyer Olkin (KMO) measures the sampling adequacy, and in the output table, the overall KMO value is 0.854, which ensures consistency with the assertion that the data is appropriate to carry out PCA. Bartlett's test measures the strength of the relationship among the variables. Since Bartlett's test is significant, it is inferred that the correlation matrix is not an identity matrix, and thus it indicates that it is appropriate to carry PCA on the sample correlation matrix (Table 1).

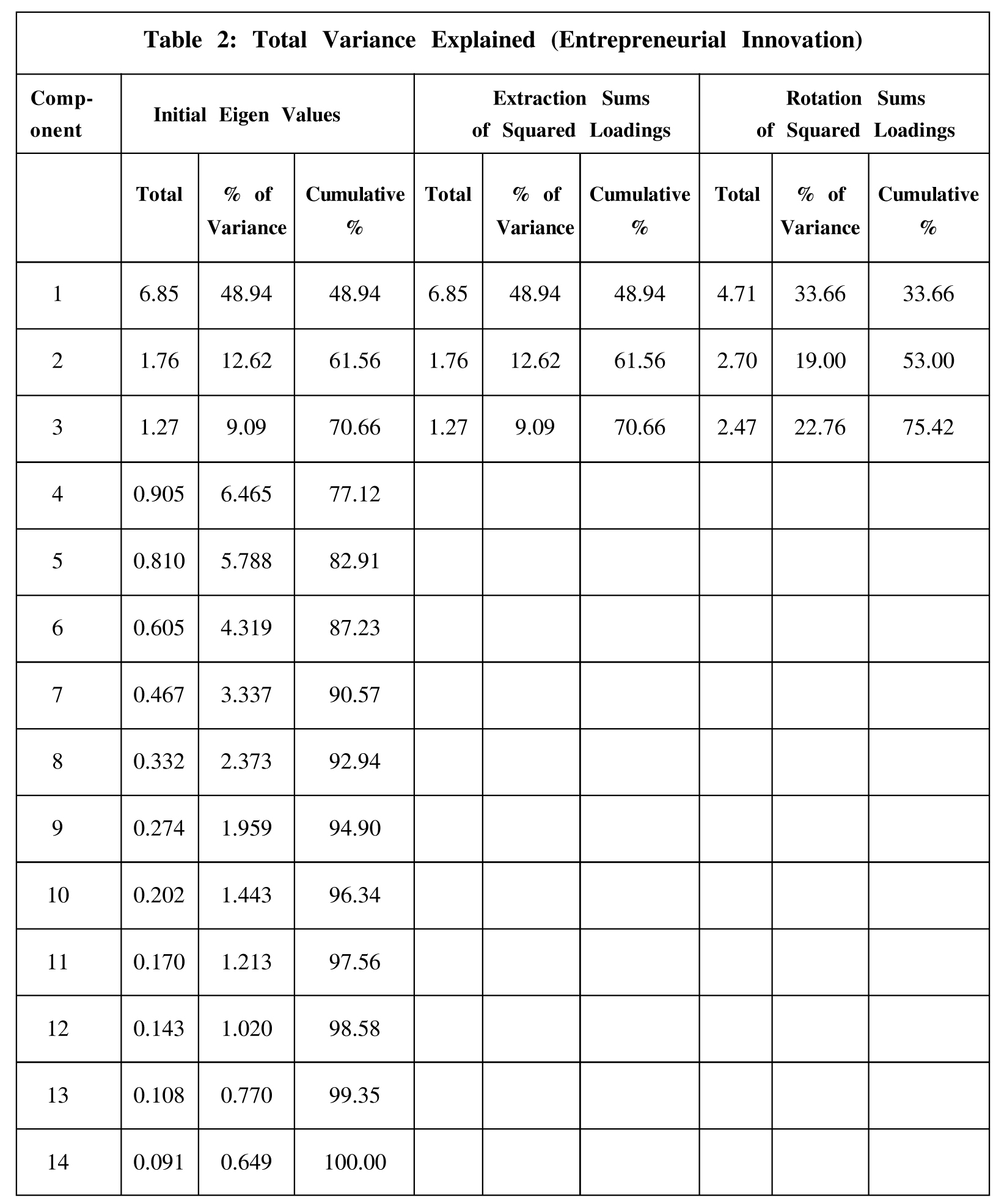

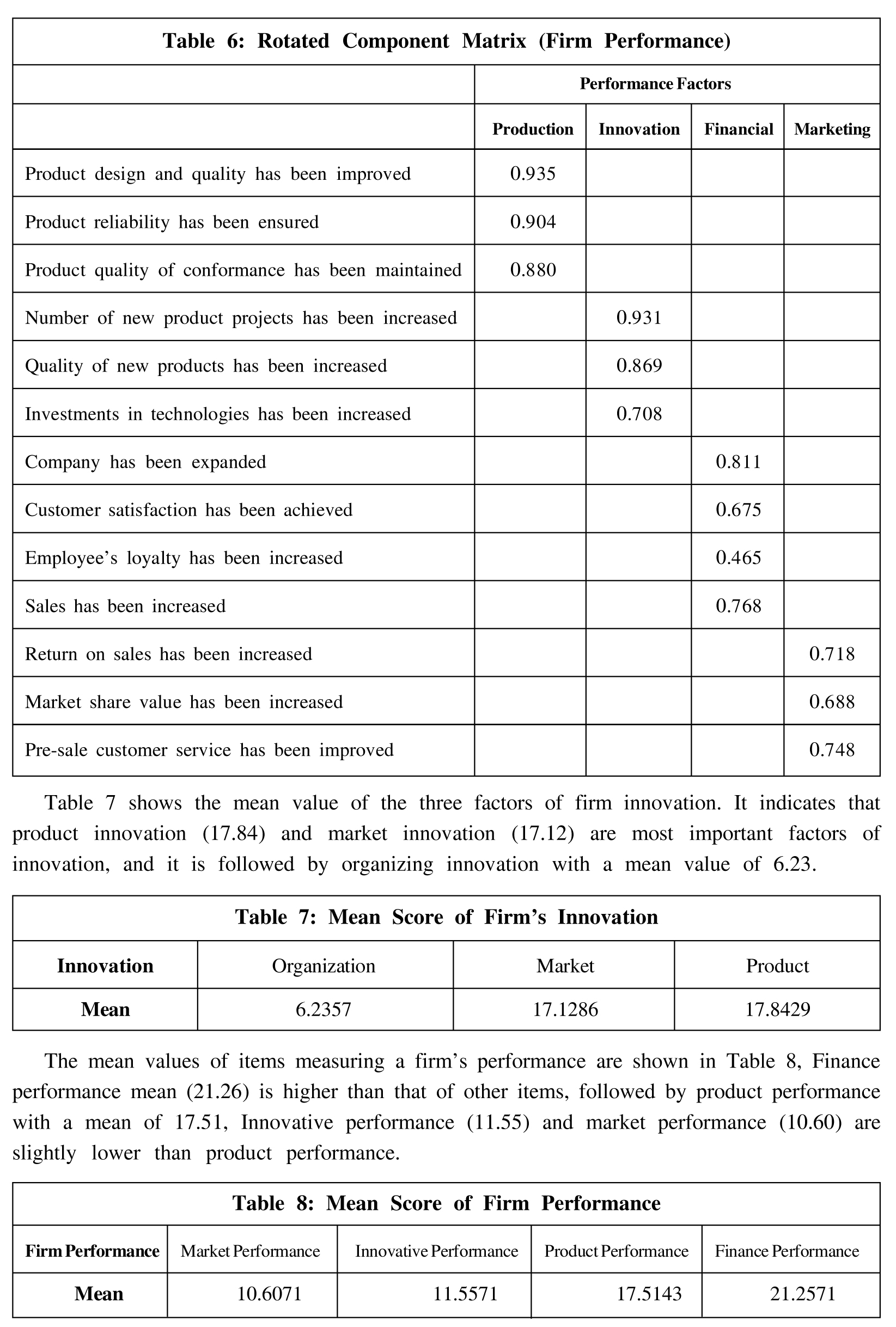

Total variance explains the extent of variability in data that has been modeled by extracted factors. It exhibits all the factors extractable from the analysis against their eigen values-the percentage of variables attributable to each factor, the cumulative variance of the factor, and the previous factor. Table 2 shows that around 75.42% of the variation in the measured variable is explained by the extracted factors.

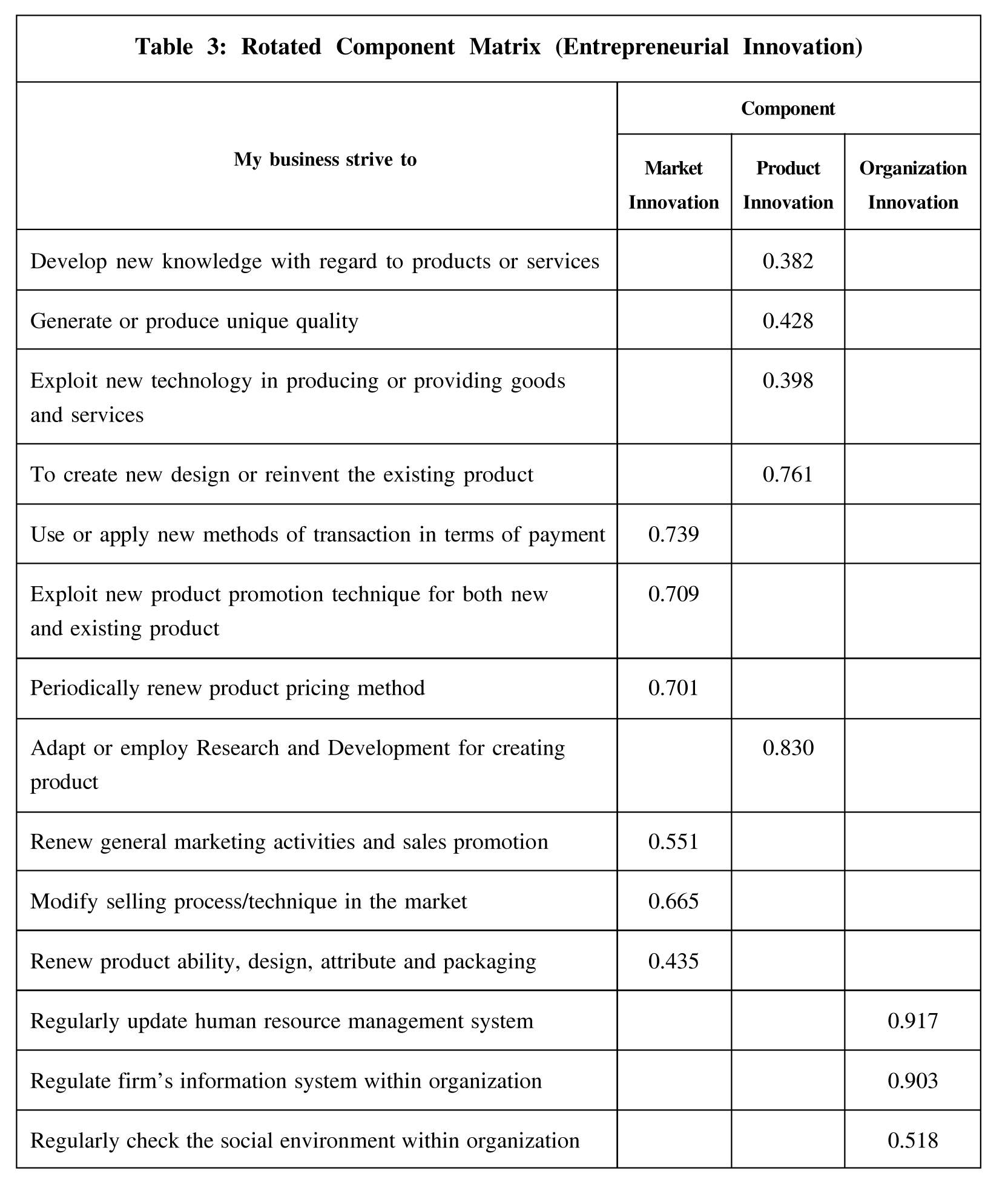

Table 3 shows that there are six items in market innovation, five in product innovation, and three in organizational innovation.

Exploratory Factor Analysis1 for Identifying Major Factors of Firm Performance

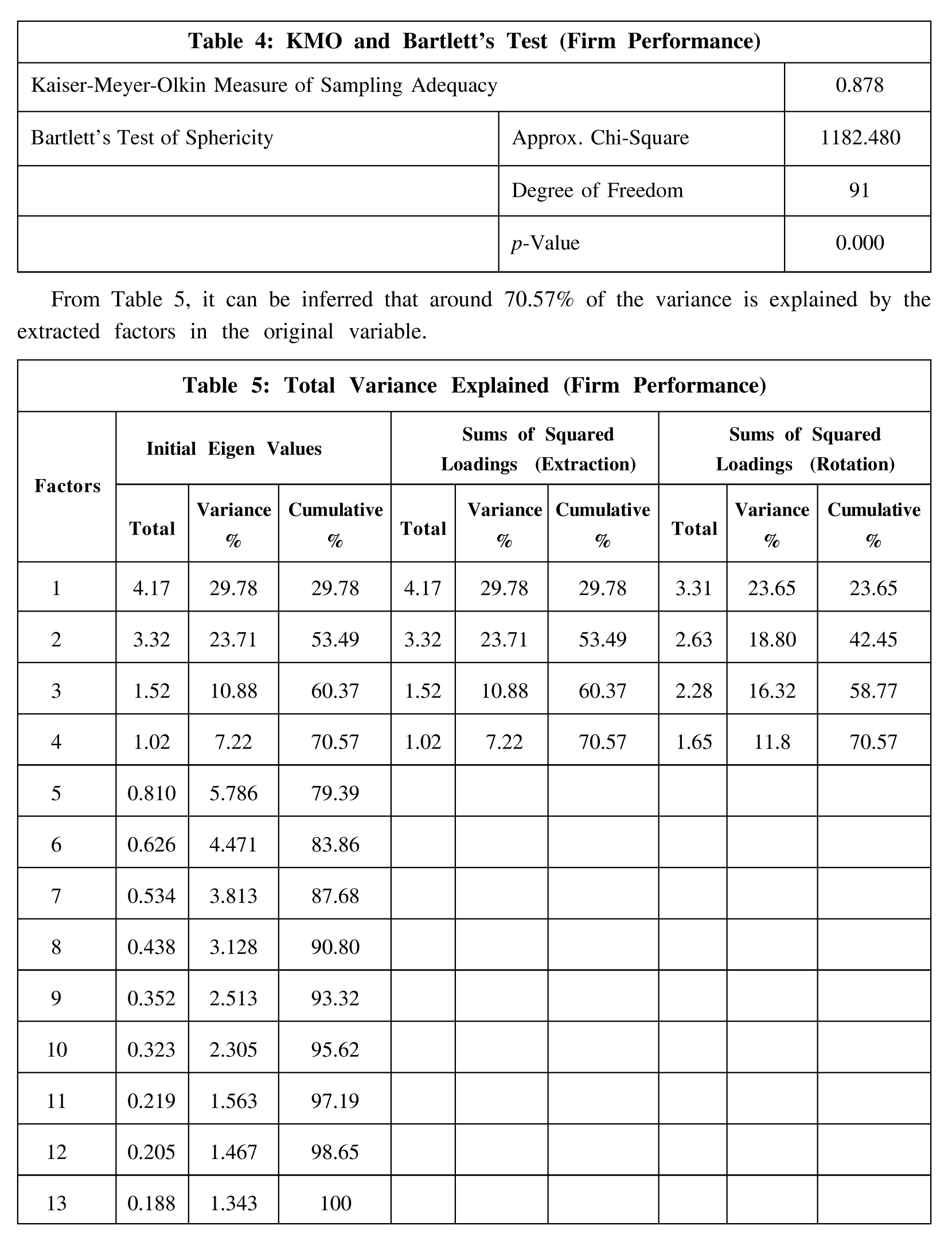

Table 4 represents the KMO and Bartlett's test. The KMO value is 0.878 which is closer to 1; and since the p-value in Bartlett's test is lower than 0.05, it can be inferred that data is adequate to conduct a factor analysis test.

From the rotated component matrix (Table 6), it was found that factor 1 has three items mainly related to the performance of production and hence labeled as production performance. Factor 2 has three items and is labeled as innovative performance and factor 3 and factor 4 have possessed four and three items each and are labeled as financial performance and marketing performance.

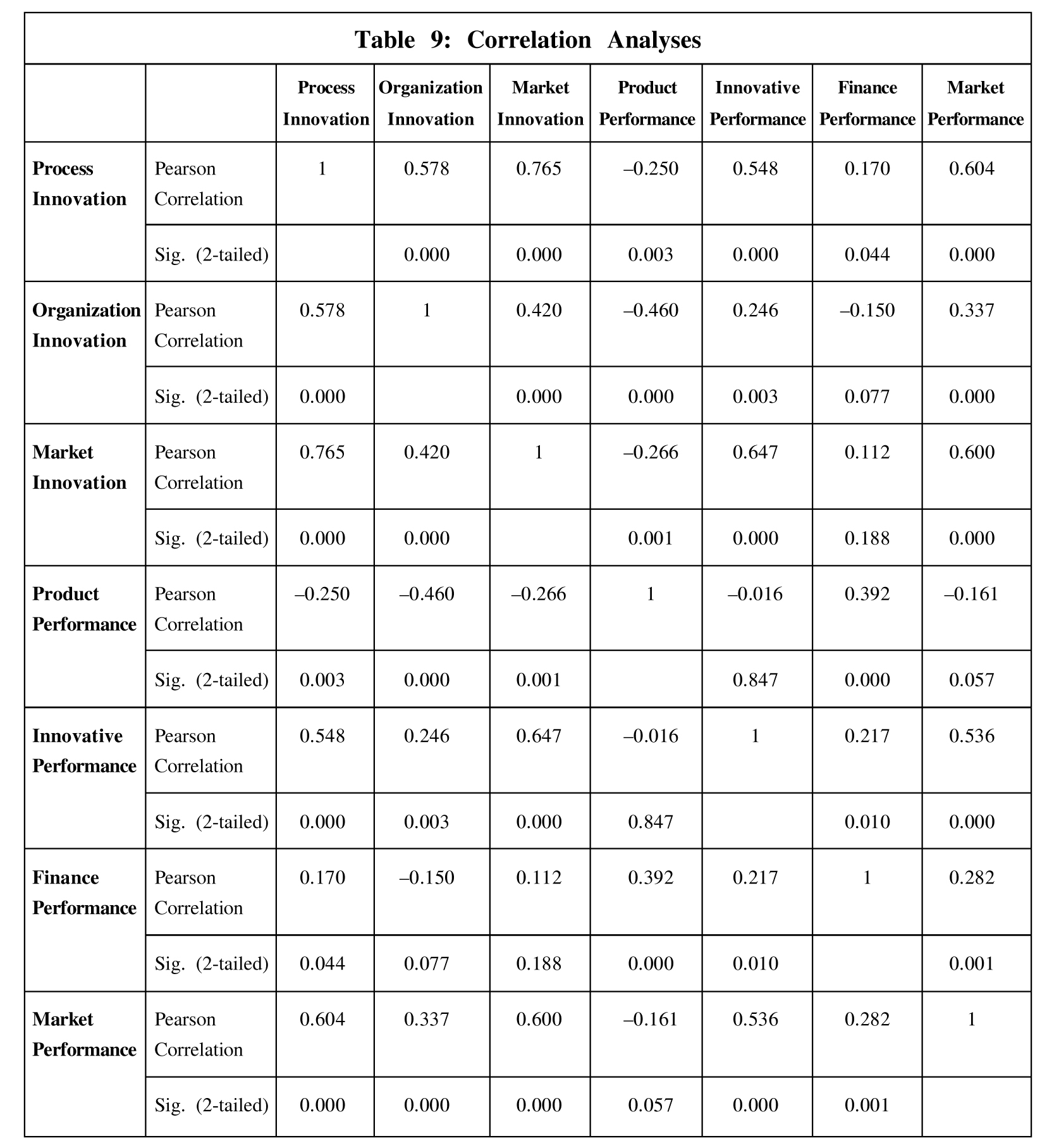

Table 9 shows that there exists a strong and positive relationship between process innovation and organizational innovation (0.578) and market innovation (0.765). Further, there also exists a strong and positive relation between process innovation and a firm's innovative performance (0.548) and also a firm's market performance (0.604).

Organization performance also has a moderate positive relationship with market innovation (0.42) and negative moderate relation with product performance. Additionally, it has moderate relation with the market performance (0.337) of the firm.

Market innovation has a strong and positive relationship with a firm's innovative performance (0.647) as well as with market performance (0.600).

Product performance has a moderate positive relationship with a firm's finance performance (0.392), inferring as product performance increases finance performance also increases. Further, it was found that innovative performance has a strong and positive relationship with market performance (0.536). Finance performance had a moderate relationship with product (0.392), innovative (0.217), and market performance (0.282), indicating that as the firm's product, innovation and market performance increase, the firm's financial growth also increases, leading to expansion and earning of more profit.

Multiple Regression Techniques: Analyzing the Relationship Between Firm Performance and Entrepreneurs' Innovation

A multiple regression model is used to analyze the relationship between independent and dependent variables. Dimensions of entrepreneurs' innovations are the predictors or independent variables and firms' performance is the outcome or dependent variable. The assumptions of multiple regression were checked.

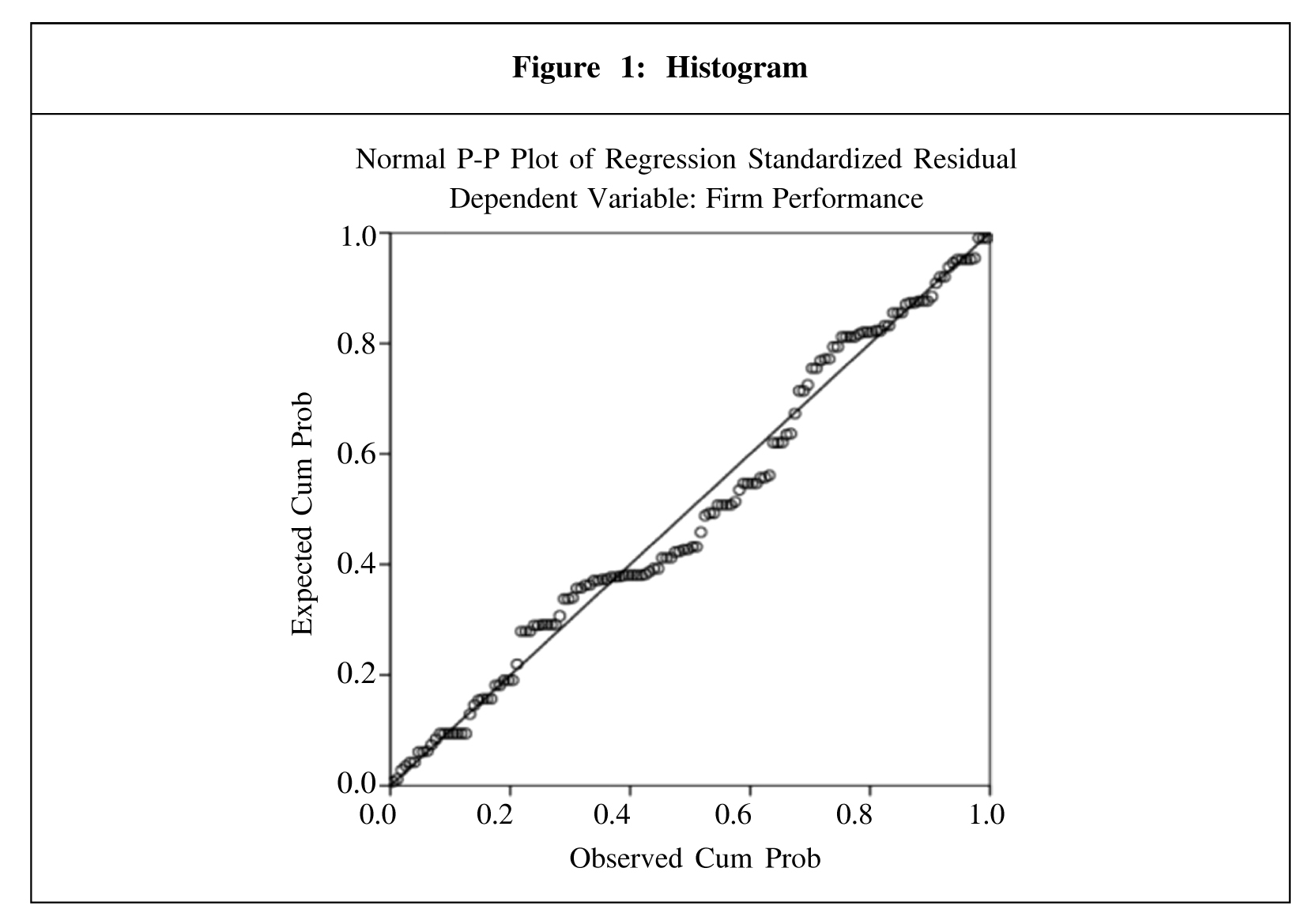

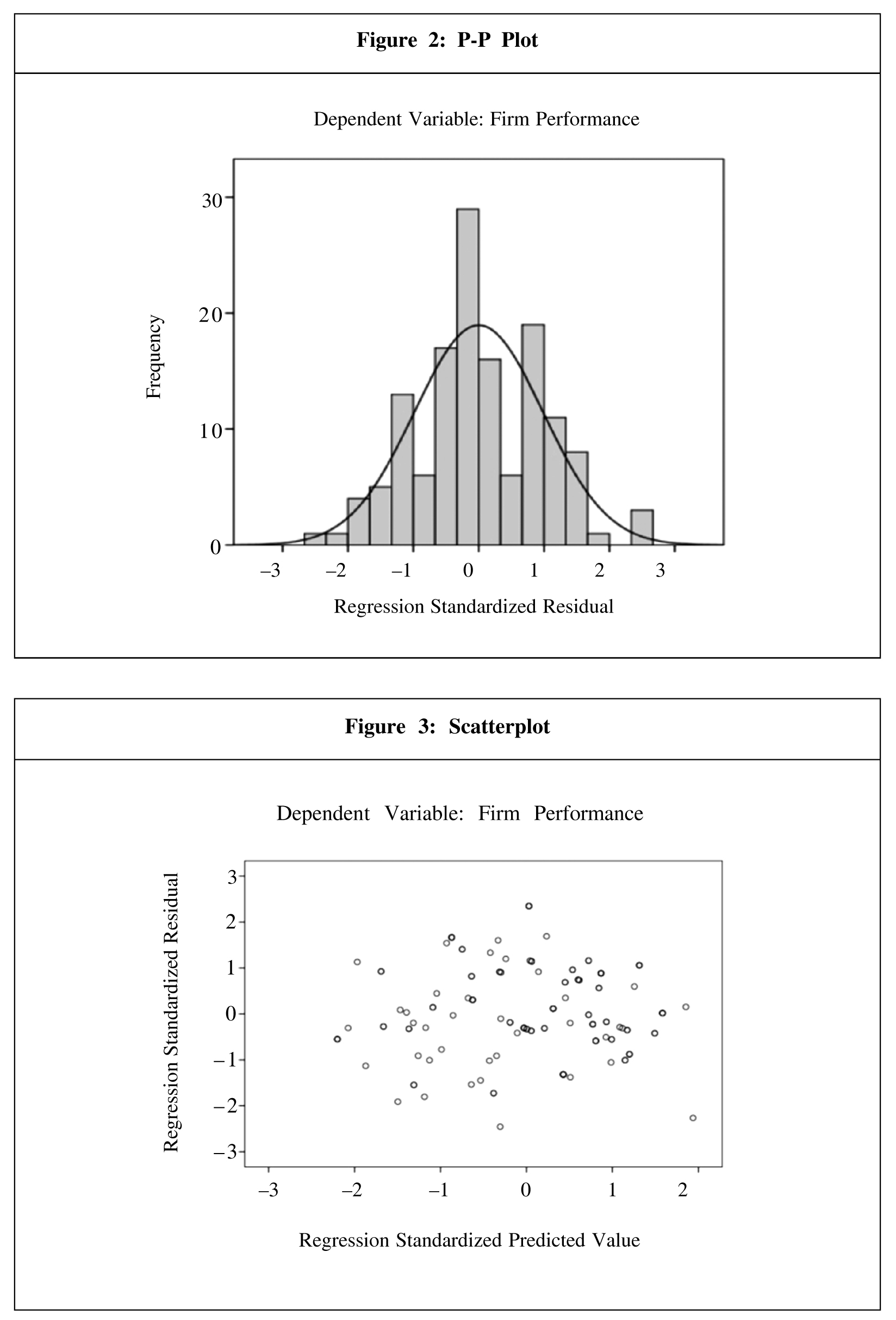

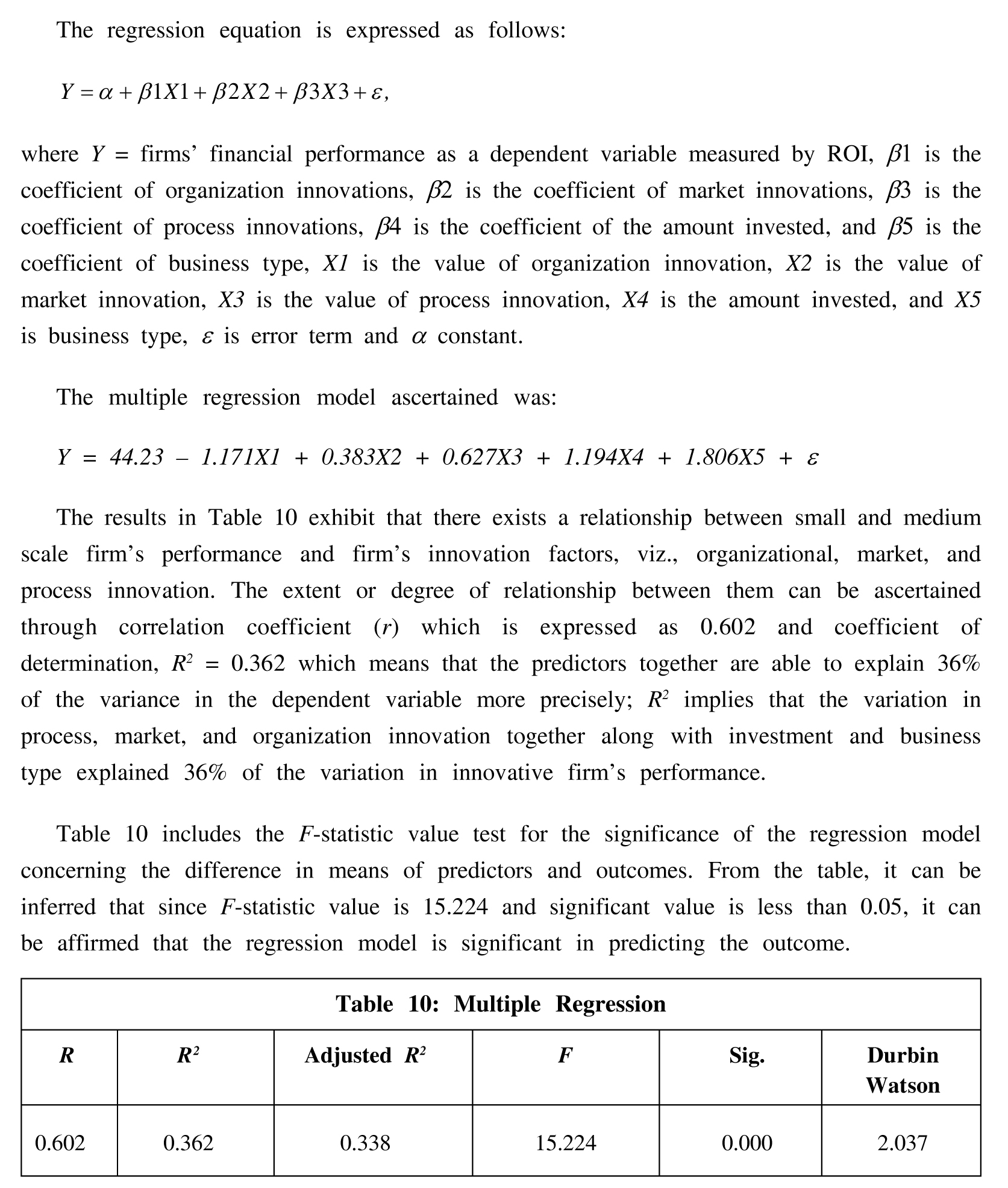

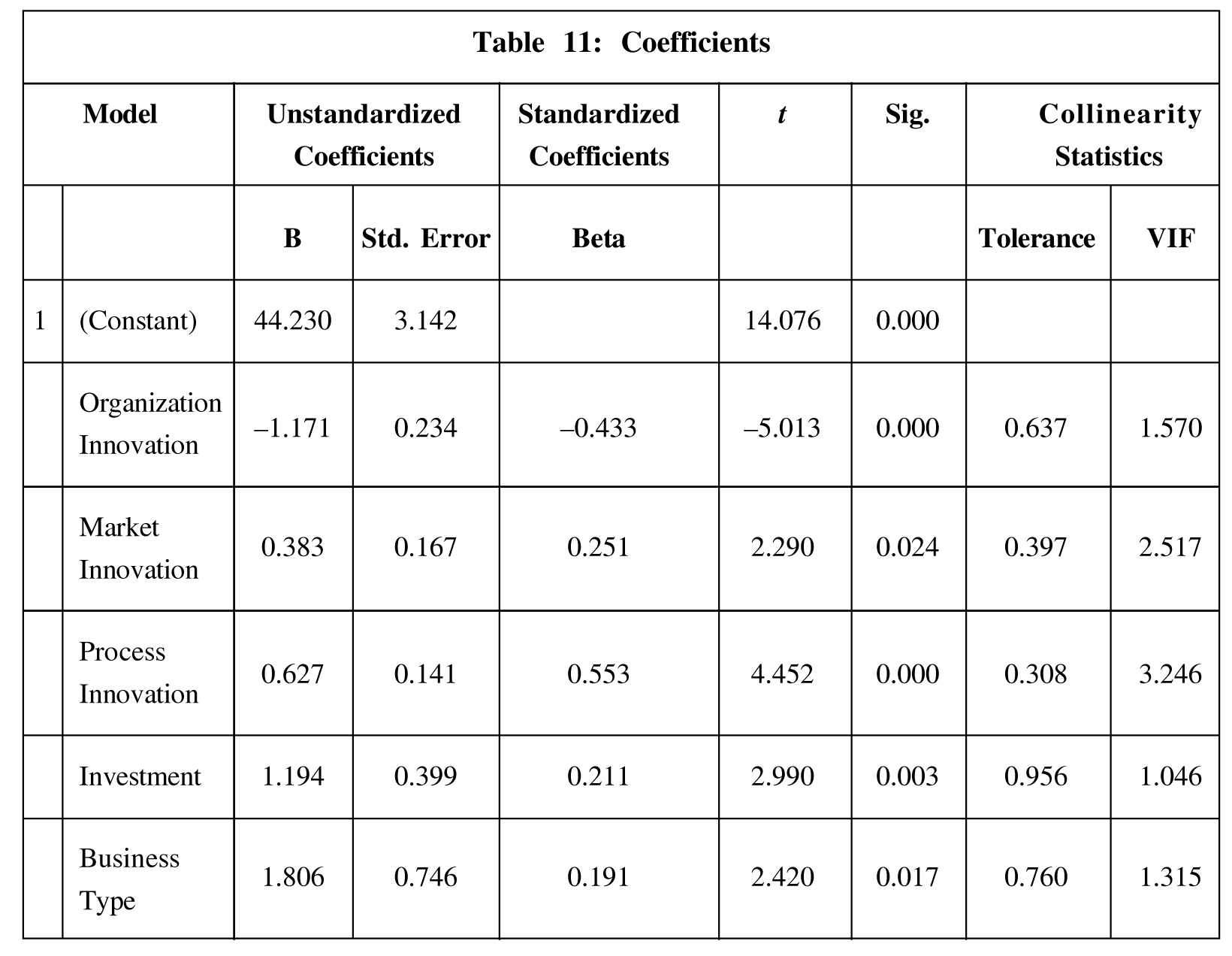

The histogram (Figure 1) and p-p plot (Figure 2) exhibit that most of the observations are substantially closer to the straight line, indicating that they are closer to a normal distribution. From Figure 3, scatter plot represents the constant of residuals across all the independent variables and thus the assumptions of homoscedasticity were also met. Table 10 shows the Durbin-Watson test that measures autocorrelation in residuals from regression analysis. The Durbin-Watson value is 2.037, which signifies that the residuals from a linear regression or multiple regression are independent.

Table 11 presents the results of two multicollinearity tests for the predictive variables, namely, tolerance levels and variance inflation factor (VIF). These tests are essential to examine whether the predictive variables excessively influence each other. It is noteworthy that all the tolerance levels are above 0.1, and the VIF scores are well below 5, indicating that there is no significant concern regarding multicollinearity among the variables.

Upon analyzing Table 11, it becomes evident that the variables related to "process," "market," "amount invested," and "business type" exhibit positive coefficients. This suggests that these predictors positively contribute to predicting a firm's performance. In other words, an increase in these variables corresponds to an increase in a firm's performance, with specific unit changes mentioned.

Conversely, the data in Table 11 reveals that "organizational innovation" is negatively associated with a firm's performance. An increase in organizational innovation is shown to reduce a firm's performance. This negative relationship may be attributed to the fact that many firms in the study are family-owned or small-scale businesses, and they might not have a significant need for organizational innovation, as suggested by Kuo and Wu (2006).

Further examination of Table 11 indicates that the p-values for all the predictors are below 0.05, implying that each of these predictors significantly contributes to predicting the model. Additionally, the t-values suggest that among all the predictors, "process innovation" and "organizational innovation" emerge as crucial predictors for predicting firm performance.

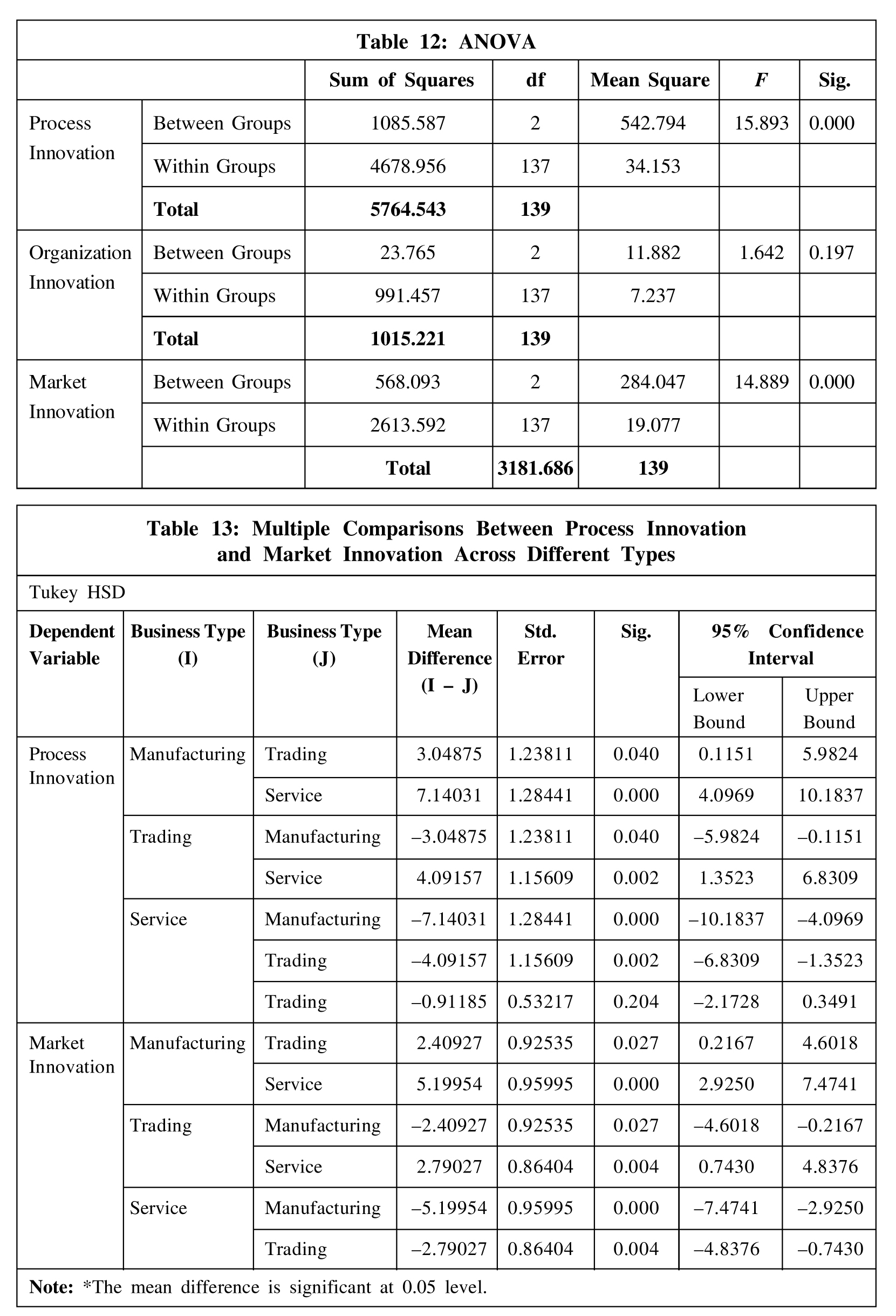

To assess the significant differences between business types and various innovation factors, an analysis of variance test was conducted (Table 12). The table indicates a significant difference in "process innovation" and "market innovation" across different business types. Table 13, which presents the results of the Tukey HSD post hoc analysis suggest that there are statistically significant differences in both process innovation and market innovation between the different types of businesses (manufacturing, trading, and service). The specific mean differences and confidence intervals provide additional context regarding the magnitude of these differences.

Conclusion

The study used various analytical methods to explore the connection between entrepreneurial innovation and firm performance. Through exploratory factor analysis (EFA), we identified key factors of innovation, such as organization, market, and product innovation. The analysis revealed strong positive relationships between these dimensions of innovation and various aspects of firm performance. Subsequent multiple regression analysis demonstrated the significance of product innovation, market innovation, and business type as positive predictors of firm performance. Additionally, ANOVA tests highlighted significant differences in innovation across different business types. The study's comprehensive approach, including factor analysis, regression, and ANOVA, contributes valuable insights. Small and medium-sized businesses stand to improve their performance by strategically focusing on process and market innovation while considering their specific business types. Overall, the findings emphasize the importance of innovation in shaping and enhancing firm performance.

Future Scope: Furthermore, it is noted that there is a scarcity of extensive empirical studies in India concerning innovative performance and firm performance. To gain a deeper and more comprehensive understanding of this subject, it is imperative for future researchers to undertake initiatives aimed at expanding research in this area, particularly within the Indian context. Additionally, there is potential for state-wise comparisons regarding innovation and sustainability, and the scope for exploring sustainable entrepreneurship in relation to innovativeness in business remains largely untapped.

References

- Abidin Z S B, Mokhtar S S and Yusoff R Z (2011), "A Systematic Analysis of Innovation Studies: A Proposed Framework on Relationship Between Innovation Process and Firm's Performance", The Asian Journal of Technology Management, Vol. 4, No. 2, pp. 65-83.

- Bolton B and Thompson J (2004), Entrepreneurs: Talent, Temperament, Technique, 2nd Edition, Butterworth-Heinemann.

- Drucker P (1954), The Practice of Management, Harper and Row Publishers, New York.

- Drucker P F (2015), Innovation and Entrepreneurship, Routledge.

- European Commission (2013), "Measuring Innovation Output in Europe: Towards a New Indicator", SWD 325 final.

- Fagerberg J, Mowery D C and Nelson R R (2004) (eds), Oxford Handbook of Innovation, Oxford University Press, Oxford.

- Gunday G, Ulusoy G, Kilic K and Alpkan L (2011), "Effects of Innovation Types on Firm Performance", International Journal of Production Economics, Vol. 133, No. 2, pp. 662-676. https://doi.org/10.1016/j.ijpe.2011.05.014

- Hamdouch A and Samuelides E (2001), "Innovation's Dynamics in Mobile Phone Services in France", European Journal of Innovation Management, Vol. 4, No. 3, pp. 153-163. https://doi.org/10.1108/eum0000000005670

- Hansen S O and Wakonen J (1997), "Innovation, A Winning Solution?", International Journal of Technology Management, Vol. 13, No. 4, p. 345.

- Kim J O and Mueller C W (1978), Introduction to Factor Analysis, Sage, Newbury Park, CA. https://doi.org/10.1504/ijtm.1997.001668

- Kuo T and Wu A (2006), "The Determinants of Organizational Innovation and Performance: An Examination of Taiwanese Electronics Industry", SSRN Electronic Journal. https://doi.org/10.2139/ssrn.921324

- Maritz A and Brown C R (2013), "Illuminating the Black Box of Entrepreneurship Education Programs", Education and Training, Vol. 55, No. 3, pp. 234-252. https://doi.org/10.1108/00400911311309305

- Mugenda O and Mugenda A (2003), Research Methods: Quantity and Quality Approaches, Oxford University Press, London, UK.

- Organisation for Economic Co-Operation and Development (2005), Oslo Manual: Guidelines for Collecting and Interpreting Innovation data, 3rd Edition.

- Rajapathirana R J and Hui Y (2018), "Relationship Between Innovation Capability, Innovation Type, and Firm Performance", Journal of Innovation & Knowledge, Vol. 3, No. 1, pp. 44-55. https://doi.org/10.1016/j.jik.2017.06.002

- Reed R, Storrud-Barnes S and Jessup L (2012), "How Open Innovation Affects the Drivers of Competitive Advantage", Management Decision, Vol. 50, No. 1, pp. 58-73. https://doi.org/10.1108/00251741211194877

- Simmie J (2005), "Critical Surveys Edited by Stephen Roper Innovation and Space: A Critical Review of the Literature", Regional Studies, Vol. 39, No. 6, pp. 789-804. https://doi.org/10.1080/00343400500213671

- Tether B S and Tajar A (2008), "Beyond Industry-University Links: Sourcing Knowledge for Innovation from Consultants, Private Research Organisations and the Public Science-Base", Research Policy, Vol. 37, Nos. 6-7, pp. 1079-1095. https://doi.org/10.1016/j.respol.2008.04.003

- Tyler B B (2001), "The Complementarity of Cooperative and Technological Competencies: A Resource-Based Perspective", Journal of Engineering and Technology Management, Vol. 18, No. 1, pp. 1-27. https://doi.org/10.1016/s0923-4748(00)00031-x

- Yavarzadeh, Mohammad Reza, Yashar Salamzadeh, and Mahmood Dashtbozorg (2015), "Measurement of Organizational Maturity in Knowledge Management Implementation", International Journal of Economic, Commerce and Management, Vol. 3, No. 10, pp. 318-344.