Dec'19

The IUP Journal of Entrepreneurship Development

Archives

The Impact of Training on Small and Growing Businesses

Suncan Pavlovic

Visiting Professor, Strathmore Institute for Mathematical Sciences, Strathmore University, Ole Sangale

Road, Madaraka, Nairobi, Kenya. E-mail: spavlovic@strathmore.edu

Jermaine Coelho

Project Manager, Institute for Small Business Initiatives, Strathmore University, Ole Sangale Road, Madaraka,

Nairobi, Kenya; and is the corresponding author. E-mail: jermaine.coelho@strathmore.edu

John Olukuru

Head of Data Science and Analytics, Strathmore University, Ole Sangale Road, Madaraka, Nairobi, Kenya.

E-mail: jolukuru@strathmore.edu

It is widely believed that Small and Growing Businesses (SGBs) have the potential to be global engines of shared prosperity: to drive growth, promote sustainability, and support equality around the world. This study looks at the effect of providing training to SGBs on their growth, profitability and employment creation. Data was collected from participants of the advanced entrepreneurship program at the Institute for Small Business Initiatives in Kenya. The study features the introduction of a new metric?Effective Cash at Owner?s Disposal (ECOD)?which is critical in evaluating SGBs, especially in developing economies. The data was then compared as at the intake date, 1 year and 2 years after. The findings of the study show that the program has a significant positive effect on the businesses that went through it with average revenue increasing by 63%, average EBITDA increasing by 106% and 2.2 net new jobs created by each enterprise within a year of enrolment. The study also finds that the program year is characterized by strong revenue and profit margin growth, as well as relatively moderate employment growth due to the optimization effect. In the year after the program year, the positive trend continues (at a notably lower rate), but once the streamlining process is completed, the employment growth booms (doubling the growth rate from the first year). The study also reveals that remarkable improvement in understanding of finance is not matched by an equivalent improvement in cost optimization and record keeping. The introduction of a userfriendly IT tool for financial analysis and cost optimization is likely to greatly increase the effectiveness of such entrepreneurship programs and create longer lasting impact.

Introduction

The Micro, Small and Medium Enterprises (MSME) sector has garnered increasing attention

from across the globe due to its contribution to the economy and society as a whole, often

being cited as the ?backbone of the economy? (Robu, 2013). This holds true in various parts

of the world from regions such as across Europe, where they represent 99% of all businesses; they have created over 85% of jobs (Commission, 2019) in Southeast Asia, where they again

represent over 90% of enterprises, and generate a majority of the employment (Pratama, 2019) in

China, Japan and the USA (Robu, 2013). It is the same case in Kenya, with over 80% contribution

to employment creation and contributing one-third to the economy?s GDP (KNBS, 2016). Given

the critical role they evidently play in the economy, the high rate of business failure is alarming

with over 60% of businesses closing within the first two years (KNBS, 2016). A study carried out

by Njoroge and Gathungu (2013) on Small and Medium Enterprises (SMEs) in a Kenyan district

revealed the urgent need for training on financial and strategic management for SMEs to grow

beyond the first stage of enterprise development and survive beyond five years.

Small and Growing Businesses (SGBs) differ from the more traditional characterization of

SMEs in two fundamental ways. Firstly, SGBs differ from livelihood-sustaining small

businesses, which start small and are destined to stay that way. Secondly, unlike many

medium-sized companies, SGBs often lack access to the financial and knowledge resources

required for growth (ANDE, 2019). SGBs have the potential to be global engines of shared

prosperity: to drive growth, promote sustainability, and support equality around the world

(ANDE, 2016). The Institute for Small Business Initiatives (ISBI) was founded by an Austrian

NGO ICEP and Strathmore Educational Trust (SET) with the goal to promote business and

financial skills amongst these SGBs in Kenya.

ISBI offers comprehensive innovative business programs for entrepreneurs who wish to

streamline their business operations, expand their business and graduate from micro stage to formal

or higher levels of scale enterprises. The focus of the programs is on the immediate practical value

for entrepreneurs and best practices from each industry involved. All business cases were

developed based on real-life Kenyan examples. Furthermore, the class framework also provides an

excellent opportunity to network and exchange ideas with the like-minded entrepreneurs.

The Advanced Entrepreneurship Program (AEP) is ISBI?s flagship program; it is composed

of 13 half-day sessions held once a week over 3 months. Contrary to most training programs

where participants are either fully sponsored or pay only a small symbolic fee, AEP

participants pay on average US$1,000 which cater for all the direct costs associated with

running the program. This ensures sustainability of the program independent of future

donations, since clients are willing to pay the full cost of the program. This serves as a doubleedged

sword as it forms part of the selection criteria in filtering the entrepreneurs who are

serious and dedicated to improving their businesses while, on the other hand, it ensures that

the program is constantly improving in attempt to deliver value for money to the clients.

Comparing the performance of these entrepreneurs who pay for training to those who take part

in sponsored programs will reveal critical insights which can be used by other training

institutions and NGOs as well as contribute to policy making regarding SGB training.

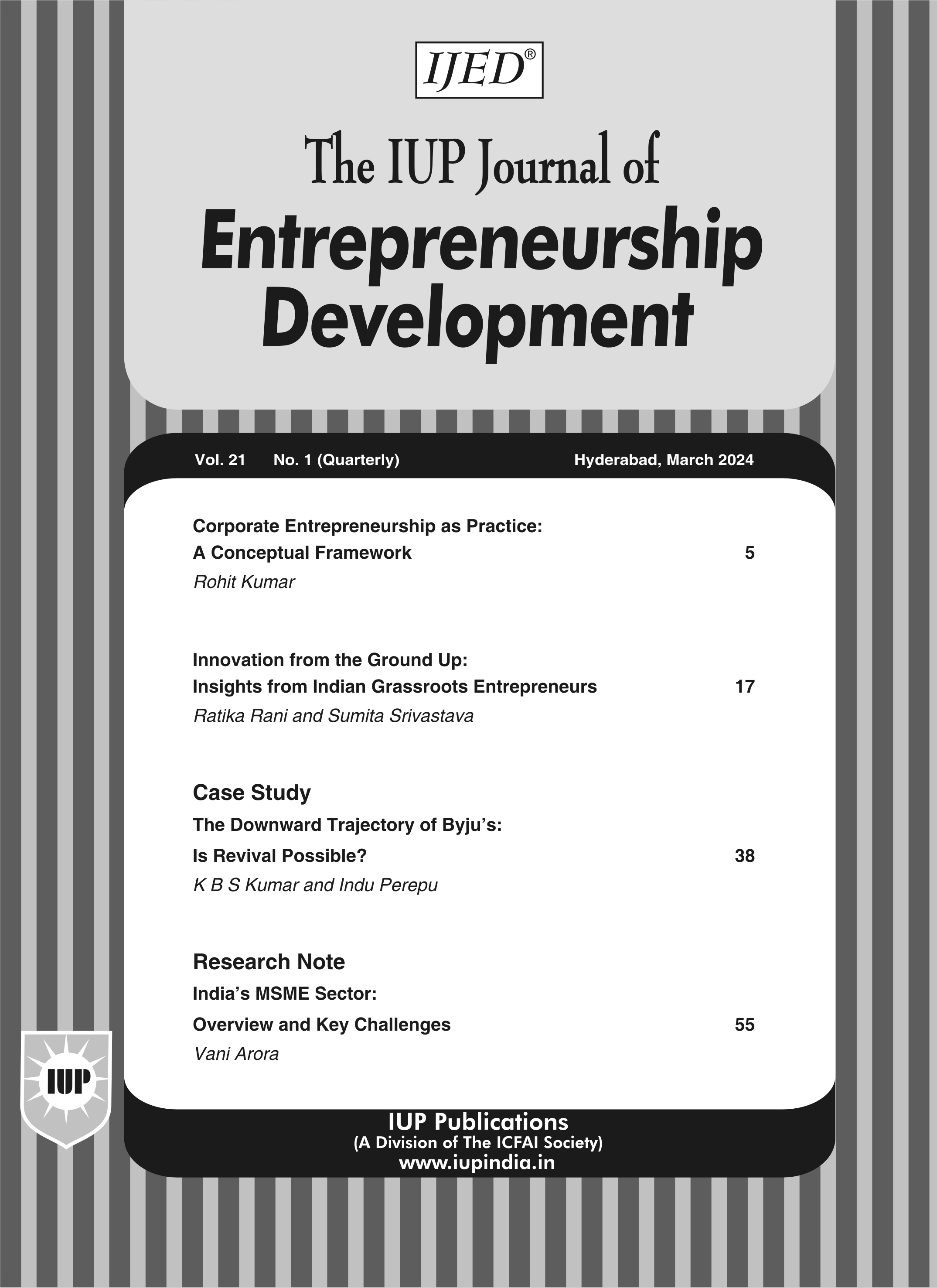

AEP focuses on five main areas: strategy and marketing, finance and cost management,

leadership and organization, tax and law, and personal development. As a value add-on,

participants enjoy the benefit of a choice (depending on their individual priorities) of one of

the following individual services: consulting, coaching or business plan mentoring, typically

between 1-3 months after completion of the class sessions. As shown in Figure 1, these modules form the foundation of the business and when this

foundation is strong, it transforms into the pillars of growth of the business. After the

entrepreneurs gain personal skills that help them develop personally, they gain business skills,

what together results in effective and transformative change within the businesses.

- Annual turnover of US$100,000 (KES10 mn) or more

- Credit capacity of US$50,000 (KES5 mn) or more

- Two years at the least in the same business

- Five full-time employees or more

- Undergraduate degree or higher of the participant entrepreneur

By using this selection process, ISBI is able to select businesses that meet ANDE?s

definition of SGBs of having between 5-250 employees and significant potential, and

ambition for growth (ANDE, 2019). The existing research shows that there is a gap in the efficiency of providing support when

it comes to selecting which firms to support (Woodruff, 2018). Differences in firm performance

after going through training based on ISBI?s selection criteria will provide valuable insights

into developing an optimal selection process for other similar programs.

This paper, in form of a benchmarking report aims to estimate the impact, both financially

and qualitatively, of the program by comparing performance data for the year before the

participant joined the program, one year after and, where applicable, two years after intake

in the program.

Literature Review

Studies reveal that education and training rank highly among the critical factors leading to

the success of entrepreneurs and their businesses (Mehralizadeh and Sajady, 2006). It is also

widely regarded amongst practitioners, researchers and policy makers that entrepreneurship

education results in measurable outcomes (Kozlinska, 2012). There is the increased need and

desire amongst both business schools and firms in measuring the impact of executive and

entrepreneurial education, though it is often difficult to accurately measure due to lack of

baseline data as well as inaccurate or misleading data (Murray, 2019). The diverse content

of various programs combined with differences in duration and intensity makes it difficult to

determine the extent to which such programs can be compared (Ismail, 2018). Generally, the

impact of entrepreneurial education can be measured across two spheres: educational and

socioeconomic (Kozlinska, 2012) where educational learning outcomes are put forward as

knowledge, attitude and skills (Heinonen and Poikkijoki, 2006; and Batarelo et al., 2013).

Other sources refer to the ?impact? of entrepreneurial education moving from the purely

educational dimension to the socioeconomic level which includes increased income, growth

and job creation (Blenker et al., 2006).

Studies throughout the literature reveal conflicting results with some scholars discovering

that there is little to no significant effect on businesses in terms of revenue, profits and

employment amongst Peruvian female entrepreneurs who received training (Karlan and

Valdivia, 2011). Most studies find that business owners implement some of the practices

taught during training, though the magnitude of improvement to practices is often modest at

best (McKenzie and Woodruff, 2013). Despite one of the main aims of entrepreneurship

training programs being the promotion of self-employment through business creation,

evidence from programs in Sri Lanka and Chile find that in the long term (2 years), selfemployment

declined significantly (Mel et al., 2014; and Mart?nez et al., 2016). Another

meta-analysis of 37 programs also found that there was no impact on income after training

(Cho and Honorati, 2014).

There are some studies that reveal some positive effects of business training albeit under

certain conditions. For instance, there is a statistically significant positive effect on

entrepreneurs who had access to higher education (Cho and Honorati, 2014). In Chile, the

Micro-Enterprise Support Program (MESP) resulted in an increase in total income of US$70

which decreased to US$34 over the long term (Mart?nez et al., 2016). A study in Pakistan finds

that entrepreneurship training reduced the rate of business failure among men by 6.1% though

there was no effect on women (Gin? and Mansuri, 2014). Another study using data from seven

countries shows that standard training programs with focus on business practices are highly

correlated with differences in firm performance both in the cross section and panel data

(McKenzie and Woodruff, 2017).

The discovery that standard mass-delivered trainings are mostly ineffective led to the

experimentation of new approaches, for instance, an initiative in Togo providing ?personal

initiative? psychological training to small business owners is more effective in improving sales

and profitability than standard training programs (Campos et al., 2017). Anderson et al. (2018)

find that connecting small-scale entrepreneurs in Uganda with mentors across the world

through online meetings over Skype has little impact on business practices, highlighting the

importance of local knowledge or personal contact.

There are also a number of self-published reports from various organizations involved in

business training that show improvements after participation, for instance, Goldman Sachs?

10,000 small businesses program in the US where 68% of participants increased revenue after

six months (Sachs, 2016) and in the UK where one year after the program, average revenue

increased by 45% (Sachs, 2018). Technoserve has recently launched a program for training

micro-retailers in Kenya and the results of the program indicate that average revenue increased

by 44% and average profits increased by 56% (Waweru, 2019). A study done on female

entrepreneurs in Kenya who underwent business training shows that they increased revenues,

profits and the owners? well-being without any negative effects on non-treated businesses,

meaning that business growth in underdeveloped markets is possible without taking sales

away from non-treated businesses (McKenzie and Puerto, 2017).

While there is very limited evidence on the effectiveness of business training for SMEs,

the available evidence suggests that individualized consulting programs for bigger entities,

though largely more expensive, has significant effects on performance with costs being

recouped in less than a year (Bloom et al., 2012). ISBI?s unique approach of blending in-class

training with individual consulting sessions after they learn the core concepts significantly

reduces the traditionally large cost of individualized consulting services. There is an

increasing number of incubators and accelerators in lower-income countries, however, there

is limited evidence of their effectiveness (Woodruff, 2018). A majority of the studies focus

on either programs that provide technical skills through lectures in a classroom setting, or

mentoring projects or individualized consulting. ISBI provides services to its clients mainly

through lectures but also offers additional value-add on services of consulting, mentoring or

business plan development depending on the entrepreneur?s concrete needs and priorities.

Studying the differences between entrepreneurs? performance based on their choice of valueadded

will provide key insights into the most effective method of support for SGBs. The study

will also contribute significantly towards understanding more about which specific

components of accelerators are the most important in the context of the Kenyan SME sector.

Research shows that some interventions have different effects on males and females

(Woodruff, 2018). ISBI has approximately 50% male and 50% female alumni entrepreneurs

across various sectors, thereby providing the opportunity to discern differences in effects of

training on these businesses. This will greatly contribute to the much-needed body of

literature to assist in development of the most effective interventions for both female and male

owners.

Data and Methodology

Population and Sampling

The entire population under study includes 163 entrepreneurs who undertook the AEP from the

commencement of this study in May 2019. For the purpose of this study, it was determined that

32 of the entrepreneurs who had gone through the program not long before would be unable to

provide sufficient data at that point, leaving a net population of 131 entrepreneurs. According to

Krejcie and Morgan (1970), a population of 131 corresponds to a sample size of 98. From this

target sample size, there was a response rate of 80% (number of usable responses/target sample

size) (Fincham, 2008) which is significantly above the generally accepted minimum response rate

of 60% and in some cases even 50% (Draugalis et al., 2008).

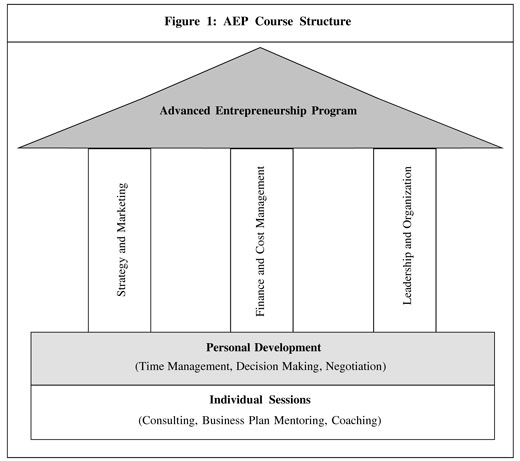

As shown in Figure 2, 47 participants were able to provide all the required data for 2 years.

31 participants were able to provide all the required data for 3 years. 32 participants took part

in the program during 2019 and it was determined that it was too early for conclusive

information at the time of data collection. 23 participants cancelled set appointments on more

than one occasion. 11 participants were uncomfortable sharing financial information.

8 participants refused to take part in the impact assessment. 7 participants responded to only

a part of the questionnaire. 4 participants could not be reached after calling on 5 separate

occasions as well as sending 2 emails with no response.

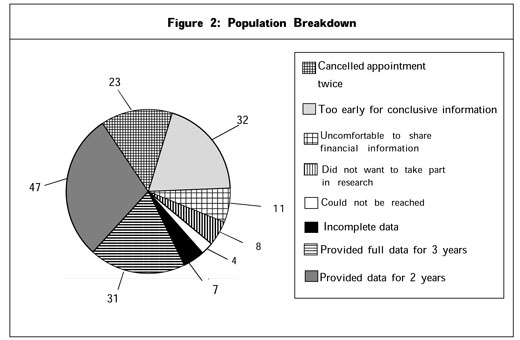

Complete datasets were obtained from 78 entrepreneurs: 43 were recorded at the clients? sites, 22 were recorded in ISBI premises and 13 were recorded over the phone. As shown in Figure 3, 50% of participants are female and 50% are male. 50% held an undergraduate degree, while 26% held a higher degree and 24% had a lower qualification than an undergraduate degree. Regarding how long the participants have been in the same business, 32% had over 10 years of experience, 36% had 6-10 years experience, 10% had 3-5 years experience and 22% had less than 2 years of experience. 61% were in the service sector, 24% in production and 15% in retail. In terms of industry, 19% were in professional services, 19% in building technologies, 13% in food and beverages, 12% in ICT, 9% in tourism and leisure, 8% in environmental technologies, 8% in education, and 12% in others. In terms of size 17% had revenues below US$20K, 10% had revenues between US$20-50K, 14% between US$50- 100K, 13% between US$100-200K, 22% between US$200-500K, 13% between US$500K to 1 mn and 12% had revenues greater than US$1 mn.

Data Collection

Since the data to be collected is of complex nature and can be interpreted in various ways,

it was necessary to train the data collectors beforehand in how to collect the data to ensure

accuracy and uniformity (Schindler, 2019). The data collected is both quantitative and qualitative.1 The quantitative data collected

relates to three distinct periods: the year before the program?12 months before the intake

date, the year during the program?12 months after intake date, and the year after the

program?13 to 24 months after intake date (where applicable).

The qualitative data was collected by asking participants to rate various characteristics of

the program and their experiences on a scale of 1-5 where 1 = No impact and 5 = Major

Transformation.

Data was collected through three main ways: interview in person at the clients? sites (in

55% cases), interview in person at ISBI offices in Strathmore University Business School (in

28% cases) and phone interview (in 17% cases).

Companies were categorized by industry sector according to the 10 clusters used by the

UK Department of Trade and Investment since 2001 (Midlands, 2012).

Data collected and used in evaluating impact include:

Employment

As employees are recognized as all people who work full-time for a concrete SGB and it

represents their main source of income, irrespective of legal status and formality of

employment. In some cases, especially in construction and agriculture sectors, the SGBs

employ quite a few seasonal workers. In such cases, the number of workers and working

months are annualized. For instance, six full-time workers engaged for four months are

reported as two full-time employees.

Revenue

Reported revenue represents total revenue from all business activities of an entrepreneur,

irrespective of formal, semi-formal or even completely informal nature of a concrete business

activity.

EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization)

EBITDA is used as a measure of profitability increase because of lack of proper accounting

records and unfeasibility to collect precise data, especially on depreciation and total credit

costs. The change in EBITDA is used as the most relevant benchmark for measuring

increased market value of the SGBs (Damodaran, 2012). The measurement of this aspect is

very important as many SGBs strive for external equity capital, and the higher the initial

value of the enterprise, the stronger the entrepreneur?s negotiation position, i.e., they

sacrifice a smaller percentage of ownership for the same amount of investment.

EBITDA = Revenue ? COGS ? SGA

ECOD (Effective Cash at Owner?s Disposal)

For the purpose of this study we introduced a new metric: ECOD, i.e., Effective Cash at

Owner?s Disposal. It is similar to Owner?s Discretionary Cash Flow (ODCF), but net of credit

installments and effectively paid tax in the concrete year.

ECOD = EBITDA + Owners Salary + Owner?s Drawings ? Interest Expense ? Credit

Principal Repayment ? Tax Paid

ODCF (Kenton, 2018) is commonly used as one of the most important multiples for estimating

SME value in case of merger and/or acquisition of small businesses (Schmerler, 2016). Since ODCF

is used mainly for the purpose of valuation, current capital structure is irrelevant to the new owners.

Therefore, ODCF gives valuable information to the acquirers about the cash SMEs can generate,

irrespective of decision on how they are going to finance the acquired company.

The relevance of measuring the effective cash the owners have at their disposal is

extremely important for MSMEs in emerging countries being an indicator of their

sustainability (i.e., ability to generate cash from operation over and above credit and tax

obligations) as well as of the potential to sustainably grow their business (i.e., without

increasing leverage).

In Kenya, many MSMEs, especially the micro- and very small enterprises, rely on different

kinds of MFIs, less-regulated SACCOs and even informal Chamas. Moreover, even the

licensed banks often provide their financing products in a less transparent way as compared

to the common practice in developed countries. For instance, overdraft is typically given at

a fixed rate for three months, but the interest rate is applied flat to the highest amount exposed

during this period and not calculated per day pro rata. Such practices are combined with high

flat fees and other upfront charges, which (due to the short crediting period) have serious

effects on the actual costs of borrowing.

A majority of credits provided by MFIs and other, less regulated institutions are for very

short periods, typically up to one year. It makes the servicing monthly (or often weekly)

installments a real challenge and a serious threat to the MSME survival.

Due to all this and our primary interest lies not in enterprise valuation for the purpose of

sale, but in the increase of its sustainability, and we found that measuring ECOD is much more

suitable for our purpose. Additionally, by measuring changes in CROE (Cash Return on

Equity) we used changes in ECOD/Equity as significantly more informative in our case.

Finally, in our measurement of the Gross Value Added (GVA) we use the change in ECOD

in combination with the change in total amount of salaries paid.

After collection, the data was then entered into the database by the researchers. The data

was then prepared for analysis by ensuring that it was complete, accurate and appropriately

coded (Schindler, 2019).

Data Analysis

The report seeks to estimate the GVA to the participants? businesses using methodology

borrowed from similar impact assessments carried out by Aston Business School (Butler and

Wilson, 2015) and Advantage West Midlands (Midlands, 2012).

This study measures GVA using three of the recognized approaches which center on

business (turnover), employment (change in number of employees), and business (salaries and

profits). The above approaches were calculated for the sample size and then extrapolated over

the entire population in order to estimate the total impact of the program.

Results

Business (Turnover)

After participation in the program, average revenue increased by 63% (US$285,000) from

US$437,000 to US$733,000. There was a total increase in revenue across all participants by

US$48.3 mn from US$73.9 to 120.3 mn, thereby contributing to the growth of the economy.

This growth was fueled by 71% of participants who increased their revenue, while 25%

reduced their revenue and 4% did not experience any change. The increase in revenue among

the smaller-sized entrepreneurs who fall within the first quartile (Q1), was 56% which is similar

to the average revenue increase of 63%. This implies that the average is not skewed upwards

by some big companies and growth is similar across all sizes of businesses. This average

increase in revenue one year after the intake is roughly 1.5 times higher than similar, fully

sponsored programs in developed economies such as the UK (Sachs, 2018). Furthermore, when

looking at growth, 40% of participants were able to grow into the next category, testifying

to the effectiveness of the program.

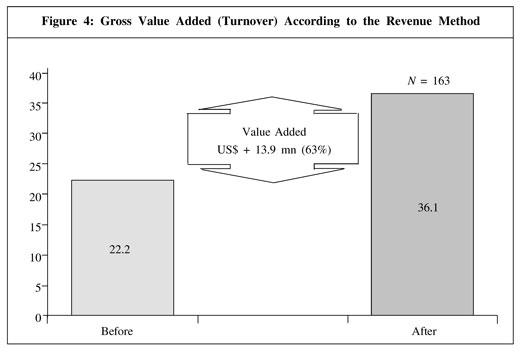

The GVA is US$13.9 mn as shown in the Figure 4 and is calculated as 30% of the total

increase in revenue for all participants translating to a 63% increase (Midlands, 2012; and

Butler and Wilson, 2015).

Job Creation

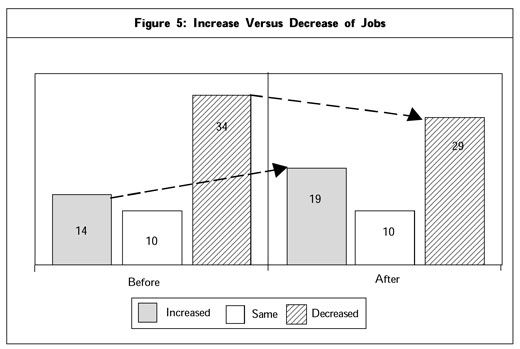

After participation in the program, there were on average 3 new jobs created per SGB,

especially among the smaller businesses. As shown in Figure 5, 42 SGBs (54%) with 14

employees on average increased their staff by 5, creating 235 jobs. There was no reported

difference in the number of employees for 22 SGBs (28%). There was also a reduction in the

number of employees, particularly in the larger companies that were overstaffed and

underwent optimization processes. 14 SGBs (18%) with 34 employees on average reduced

their staff by 5, i.e., 64 in total. In combination, these two effects (growth of the smaller and

optimization of the larger SGBs) resulted in a net creation of 2.2 jobs per SGB which translates

to 357 net new jobs.

Business (Salaries and Profits)

Within a year of participating in the program, average EBITDA increased by 106%

(US$72,000) from US$67,000 to US$139,000. There was a total increase in EBITDA by

US$12 mn from US$11 mn to US$23 mn. This growth was fuelled by 81% of participants who

increased their EBITDA, while 13% reduced their EBITDA and 6% did not experience any

change. Increase in EBITDA after going through the program is remarkably strong in the lower

segment (Q1) with EBITDA increasing by 320% (US$14,000). Specifically of interest is the

fact that 8% of businesses reduced their turnover by 20% on average, but tripled their EBITDA

(increased by 193%), which is one of the AEP?s key messages: ?optimization before growth?.

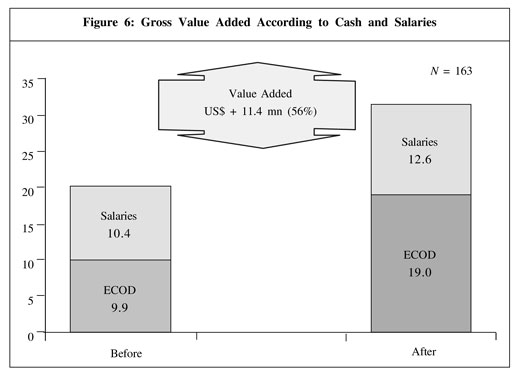

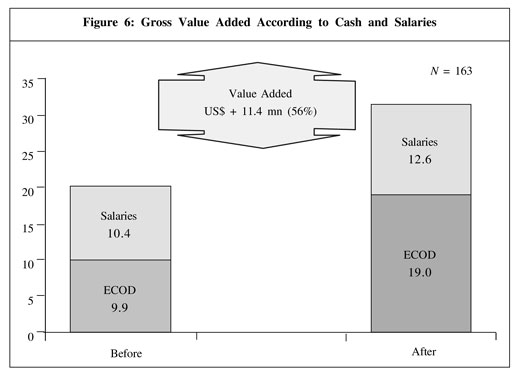

Within 1 year of participating in the program, average ECOD increased by 92%

(US$56,000) from US$60,000 to US$116,000. There was total increase in ECOD by

US$9.1 mn from US$9.9 mn to US$19 mn as shown in Figure 6. This growth was fuelled by 81% of participants who increased their ECOD, while 17% reduced ECOD and 2% did not

experience any change. The average increase in ECOD is equally strong in the lower segment

with increase in ECOD of 94% (US$10,000).

Net employment increased by 357 (491 gross) and in combination with average salary

increase of +US$287 per employee per annum amounts to US$2.26 mn increase in salaries.

Total amount of salaries and profits changed from US$20.22 mn to 31.57 mn, i.e., increase

of US$11.35 mn.

Statistical Significance

Two-sample t-tests were carried out on the samples for each category of revenue, EBITDA,

ECOD and employment to determine the statistical significance of the changes attributed to

going through the program on these variables, at 5% significant level. The results reveal that

the changes in the businesses can indeed be attributed to their participation in the program

as shown in Table 1.

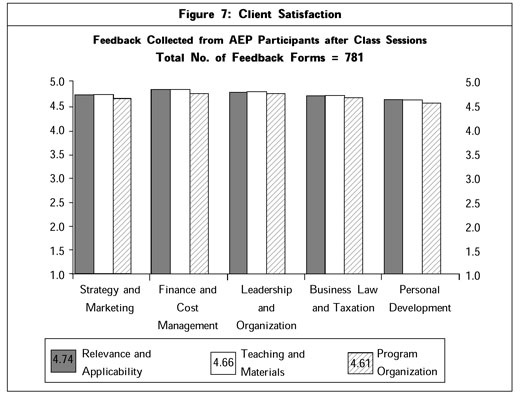

Client Satisfaction

After each class session, participants fill in a feedback form where they rate the session

and provide suggestions for improvement. The ratings are made on a scale of 1 to 5, where

the answers are summarized in three thematic groups and represented as average for each

group:

- Relevance and applicability, ranging from (1) Not at all ? to (5) Very much.

- Teaching method and provided materials, ranging from (1) Poor ? to (5) Excellent

- Program organization, venue, etc. in the range from (1) Poor ? to (5) Excellent

Continuous and meticulous study of clients? feedbacks for each subject and lecturer is the

only way to keep quality at the desired level and to improve instead to degrade the

effectiveness of the program with the time.

The soaring reviews received from AEP participants of over 90% rating across all modules

and aspects, shown in Figure 7, testify to the quality of the program and the value that they

derive from it.

Personal Development

Over 80% of alumni reported significant positive impact on their leadership confidence and

capability, what translates into concrete organizational improvements. About 75% of

participants reported improvements in delegation of duties, thus freeing up time for strategic

thinking and planning.

Over 75% of participants reported major transformation or significant improvement in their

understanding of finance, especially in relation to their business. However, this improved

understanding of finance by the entrepreneurs is not matched by an equivalent improvement

in record keeping and cost optimization where only about half of the participants reported

major transformation or significant improvement.

Discussion

Investor Desirability

Analysis of the data collected shows that Return on Assets as a measurement of management

efficiency increased by 81% within a year of participating in the program [Due to lack of

precise information about interest costs explained above, (EBITDA/Assets) is used as much

more reliable metrics for comparison over time than typically calculated (Net Income/Assets)]

This can be attributed to participants? better understanding of finance and how thereby to

better utilize the assets at their disposal to generate greater returns.

Cash return on equity (ECOD/Equity) as a measure of SGB attractiveness for investors

went up by 62%. As a result of the participants? increased understanding and awareness

regarding their business, they are able to generate greater returns on their investments

through a combination of deleveraging, streamlining operations and precisely focused

investing.

These significantly higher ratios make SGBs more attractive to potential investors as it is

an indication of the effectiveness of the management as well as the ability of the company

to generate cash. This makes it easier for the SGB owners to raise capital, if they decide to

seek investment for further growth and expansion.

Risk Reduction

Debt coverage ratio as an indication of SGB?s ability to service its credit obligations

increased by 55%. This is brought about by the improved profitability and cash generation

of the firm and represents one of the most important achievements of the AEP: reduction

of risk of falling into illiquidity (most common bankruptcy cause, especially among very

small SGBs). Furthermore, lending institutions are more willing to extend additional credit

to these SGBs.

These findings are in line with earlier studies carried out by Karlan and Valdivia (2006),

who found that through entrepreneur training, microfinance institutions also had direct

benefits in terms of higher repayment and client retention rates.

Debt/Equity (D/E) ratio, as a measure of financial risk SGBs are exposed to, was reduced

by 19% within one year. This is also an extremely important achievement of AEP as it makes

SGBs much more robust against changes in their very volatile market conditions?resulting

in significantly reduced likelihood of falling into insolvency.

Insights

Gender

We have not identified any statistically relevant differences between men- and women-owned

SGBs. This implies that both men and women benefit similarly from the training provided.

Experience

We attribute the differences based on the entrepreneurial experience much more to the

difference in the SGB size than to the actual owner?s experience. Profit has more than doubled

in each segment, but the profit drivers are different:

- Improvement in SGBs with owners having fewer than 10 years of experience (actually smaller SGBs with revenue of US$300K on average) was driven mainly by increased turnover (87%) and less by profit-margin increase (15%).

- On the contrary, in SGBs with more experienced owners (in fact, bigger SGBs with revenue of US$779K on average) the change was achieved by the turnover increase of 43% (half the rate of smaller SGBs) and profit-margin increase of 34% (double the rate compared to smaller SGBs). Education

- The participants with a degree above undergraduate ? tripled EBITDA (+221%)

- The participants with undergraduate degree ? doubled EBITDA (+108%)

- The participants with educational level below undergraduate ? increased EBITDA ?only? by half (+49%)

Differences based on educational background support the assumption that better educated participants benefit much more from the program:

Cost Recovery

A majority of participants recovered the cost of the program already during the program itself

through increased profits and operations, with 80% recovering their costs within three months.

Only 10% of participants required more than 6 months to recover their costs. Next to ensuring

sustainability of entrepreneurship programs, this finding reinforces ISBI?s founding

presumption that such training must be perceived by MSMEs not as a personal owner?s

expense, but as investment into their business and as such must bear return.

Comparative Impact

Comparing the performance of the AEP alumni to the performance of participants in other

programs as well as the larger economy as a whole helps to put things into perspective. The

Global Accelerator Learning Initiative (GALI), which draws data from the Entrepreneur

Database Program at Emory University, provides a benchmark using 12 acceleration programs

in developing countries with the focus on creating impact on for-profit micro and small

enterprises across all sectors (ANDE, 2019), similarly to AEP. This benchmark compares the

78 AEP alumni to 86 accelerated ventures with the following results:

Conclusion

Leadership affects the potential of the entrepreneur. There are also a number of practical issues

related to leadership that affect entrepreneurship and the success of the entrepreneur.

The entrepreneur naturally and essentially becomes a leader the moment he sets out to be

an entrepreneur.

The impact of leadership on entrepreneurship is strongly dependent on the definition of

leadership and the measure used to assess leadership.

There are strong similarities between entrepreneurs and leaders. Entrepreneurs and leaders

have a number of skills and competencies in common. When the entrepreneur develops and

matures, he is naturally and inadvertently developing leadership skills and competencies.

Conversely, the entrepreneur can further develop and can accelerate his development by

developing leadership skills and competencies (Lord and Hall, 2005).

Strategic leadership forms an important aspect of entrepreneurship. Although not limited

to them, novice entrepreneurs in particular can further develop in this area.

A number of factors like culture and the market impair the power and influence of the

entrepreneur. It is the entrepreneur as strong leader that is able to rise above this. Leadership as a concept is not always fully understood by entrepreneurs, and it impacts the performance

and success of entrepreneurs. Entrepreneurs do not always associate strategic leadership and

exerting influence over contexts with leadership. Entrepreneurs can further develop in terms

of leadership skill and competency. Recognition of leadership and fear of failure are

prominent factors that impair leadership, and consequently entrepreneurship success.

Leadership is not really recognized and regarded in social and other contexts.

Innovation can be seen as exerting influence over a context, etc. in order to shape it.

Leadership similarly impacts the potential of the (entrepreneur as) innovator. The leader and

innovator equally share a number of common skills and competencies.

Leadership and leadership process form part of innovation method and thereby affect the

sustainability of innovation and innovativeness. Leadership equally affects the effectiveness

and accuracy of innovation, and leadership helps to manage and direct the uncertainty

associated with the innovation process. When considering this, it is possible to talk of and

refer to innovation leadership.

Limitations:

- For practical reasons, only entrepreneurs from South Africa were interviewed. This could skew the results in that entrepreneurs from other countries, especially first world countries, might have had different perceptions.

- According to Willig and Stainton-Rogers (2008, p. 158), "Qualitative research does not always provide the researcher with certainty."

- Since the researcher becomes immersed in the research, "alternative interpretations are always possible" (p. 158).

- One of the selection criteria suggested that entrepreneurs had to have a business for a minimum of three years. We assumed that three years was an adequate period to develop leadership perceptions. Scope for Future Studies: Future studies can further examine the following: The practical impact of leadership on entrepreneurship can be further examined to a greater depth. An intervention study can train and develop the leadership skills and competencies of a group of entrepreneurs, and the impact on their entrepreneurial thought and output, and their innovativeness can be compared to that of a group of entrepreneurs who did not receive such training and development.

- The relative success of a leadership training and development program for entrepreneurs can also be monitored.

- Strategic leadership in the context of entrepreneurship, and the strategic leadership skill and competency of entrepreneurs.

- The recognition and regard of leadership in social and other contexts: whether leadership is truly celebrated and regarded in social and other contexts, and the potential reasons why not.

- An in-depth comparison of leaders and entrepreneurs to highlight both the similarities and differences.

- The comprehension of leadership by entrepreneurs.

- The ways in which leaders shape and influence contexts, and the ability of leaders to shape and influence contexts

References

- Avolio B J and Gardner W L (2005), Authentic Leadership Development: Getting to the Root of Positive Forms of Leadership, pp. 315-338.

- Barriball K L and While A (1994), "Collecting Data Using a Semi-Structured Interview: A Discussion Paper", Journal of Advanced Nursing, Vol. 19, No. 2, pp. 328-335. Retrieved on July 2018.

- Bass B M, Avolio B J, Jung D I and Berson Y (2003), "Predicting Unit Performance by Assessing Transformational and Transactional Leadership", Journal of Applied Psychology, Vol. 88, No. 2, pp. 207-218.

- Bell J (2010), Doing Your Research Project: A Guide for First-Time Researchers in Education, Health and Social Science, 5th Edition, Open University Press.

- Bolden R (2016), Leadership, Management and Organisational Development, Routledge.

- Braun V, Clark V and Terry G (2014), "Thematic Analysis", in P Rohleder and A Lyons (Eds.), Qualitative Research in Clinical and Health Psychology, Palgrave MacMillan, Basingstoke.

- Collins D B and Holton III E F (2004), "The Effectiveness of Managerial Leadership Development Programs: A Metaanalysis of Studies from 1982 to 2001", Human Resource Development Quarterly, Vol. 15, No. 2, pp. 217-248.

- Darlington Y and Scott D (2002), Qualitative Research in Practice: Stories from the Field, Open University Press, Buckingham.

- Dawson T L (2008), "Metacognition and Learning in Adulthood", Prepared in Response to Tasking from ODNI/CHCO/IC Leadership Development Office, Developmental Testing Service, LLC.

- Day D V (2000), "Leadership Development: A Review in Context", The Leadership Quarterly, Vol. 11, No. 4, pp. 581-613.

- Day D V, Fleenor J W, Atwater L E et al. (2014), "Advances in Leader and Leadership Development: A Review of 25 Years of Research and Theory", The Leadership Quarterly, Vol. 25, No. 1, pp. 63-82.

- Densten I L and Gray J H (2001), "Leadership Development and Reflection: What is the Connection?", International Journal of Educational Management, Vol. 15, No. 3, pp. 119-124.

- Dugan J P (2006), "Explorations Using the Social Change Model: Leadership Development Among College Men and Women", Journal of College Student Development, Vol. 47, No. 2, pp. 217-225.

- Golafshani N (2003), "Understanding Reliability and Validity in Qualitative Research", The Qualitative Report, Vol. 8, No. 4, pp. 597-606.

- Hogan R, Curphy G J and Hogan J (1994), "What We Know About Leadership: Effectiveness and Personality", American Psychologist, Vol. 49, No. 6, pp. 493-504.

- Komives S R and Dugan J P (2007), "Developing Leadership Capacity in College Students", National Clearinghouse for Leadership Programs, College Park, MD.

- Komives S R, Lucas N and McMahon T R (2009), Exploring Leadership: For College Students Who Want to Make a Difference, John Wiley & Sons.

- Komives S R, Owen J E, Longerbeam S D et al. (2005), "Developing a Leadership Identity: A Grounded Theory", Journal of College Student Development, Vol. 46, No. 6, pp. 593-611.

- Kothari C (2004), Research Methodology, Methods and Techniques, New Age International (P) Limited, Publishers, Jaipur, India.

- Longhurst R (2003), "Semi-Structured Interviews and Focus Groups", Key Methods in Geography.

- Lord R G and Hall R J (2005), "Identity, Deep Structure and the Development of Leadership Skill", The Leadership Quarterly, Vol. 16, No. 4, pp. 591-615.

- Mayer J D and Geher G (1996), "Emotional Intelligence and the Identification of Emotion", Intelligence, Vol. 22, No. 2, pp. 89-113.

- McCleskey J A (2014), "Situational, Transformational, and Transactional Leadership and Leadership Development", Journal of Business Studies Quarterly, Vol. 5, No. 4, pp. 117-130.

- McDermott R (2011), "Internal and External Validity", Cambridge Handbook of Experimental Political Science, Cambridge University Press, pp. 27-40.

- Mumford M D, Friedrich T L, Caughron J J and Byrne C L (2007), "Leader Cognition in Real-World Settings: How do Leaders Think About Crises?", The Leadership Quarterly, Vol. 18, No. 6, pp. 515-543.

- Odom S F, Boyd B L and Williams J (2012), "Impact of Personal Growth Projects on Leadership Identity Development", Journal of Leadership Education, Vol. 11, No. 1, pp. 49-63.

- Pearce C L (2007), "The Future of Leadership Development: The Importance of Identity, Multi-Level Approaches, Self-Leadership, Physical Fitness, Shared Leadership, Networking, Creativity, Emotions, Spirituality and On-Boarding Processes", Human Resource Management Review, Vol. 17, No. 4, pp. 355-359.

- Ready D A and Conger J A (2003), "Why Leadership-Development Efforts Fail", MITs Loan Management Review, Vol. 44, No. 3, pp. 83-88.

- Shamir B and Eilam G (2005), "What's your Story?", A Life-Stories Approach to Authentic Leadership Development, Vol. 16, No. 3, pp. 395-417.

- Uhl-Bien M, Marion R and McKelvey B (2007), "Complexity Leadership Theory: Shifting Leadership from the Industrial Age to the Knowledge Era", The Leadership Quarterly, Vol. 18, No. 4, pp. 298-263.

- Vroom V H and Jago A G (2007), "The Role of the Situation in Leadership", American Psychologist, Vol. 62, No. 1, pp. 17-24.

- Willig C and Stainton-Rogers W (2008), Qualitative Research in Psychology, Open University Press, Google Scholar, Maidenhead.

- Zohar D (2005), "Spiritually Intelligent Leadership", Leader to Leader, Vol. 2005, No. 38, pp. 45-51.